444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US small home appliances market represents a dynamic and rapidly evolving sector that encompasses a wide range of compact, portable, and countertop appliances designed to enhance convenience and efficiency in American households. This market includes coffee makers, blenders, toasters, food processors, air fryers, vacuum cleaners, and numerous other essential household devices that have become integral to modern living.

Market dynamics indicate robust growth driven by changing consumer lifestyles, technological innovations, and increasing emphasis on convenience and time-saving solutions. The sector demonstrates remarkable resilience and adaptability, with manufacturers continuously introducing smart features, energy-efficient designs, and multifunctional capabilities to meet evolving consumer demands.

Consumer preferences are shifting toward premium, feature-rich appliances that offer enhanced functionality and connectivity. The market experiences significant growth in categories such as kitchen appliances, cleaning equipment, and personal care devices, with adoption rates reaching 78% of American households for essential small appliances.

Regional distribution shows strong performance across all major metropolitan areas, with particularly robust demand in urban centers where space optimization and convenience are paramount. The market benefits from established retail infrastructure, strong e-commerce penetration, and sophisticated supply chain networks that ensure widespread product availability.

The US small home appliances market refers to the comprehensive ecosystem of compact, portable, and countertop electrical devices designed for residential use, typically weighing less than 50 pounds and serving specific household functions ranging from food preparation and cleaning to personal care and comfort enhancement.

This market encompasses a diverse range of product categories including kitchen appliances such as coffee makers, blenders, and food processors, cleaning appliances like vacuum cleaners and steam cleaners, and personal care devices including hair dryers and electric shavers. These appliances are characterized by their portability, ease of use, and ability to perform specialized tasks that enhance daily living convenience.

Market participants include established manufacturers, emerging technology companies, retailers, distributors, and service providers who collectively contribute to product development, manufacturing, marketing, and after-sales support. The ecosystem also encompasses component suppliers, design firms, and technology partners who enable continuous innovation and improvement in appliance functionality.

Value proposition centers on providing consumers with time-saving, efficient, and reliable solutions that simplify household tasks while offering enhanced performance, durability, and user experience compared to manual alternatives or larger appliance counterparts.

The US small home appliances market demonstrates exceptional growth momentum driven by technological advancement, changing consumer lifestyles, and increasing demand for convenience-oriented solutions. Market expansion is supported by continuous product innovation, smart technology integration, and evolving retail channels that enhance consumer accessibility and engagement.

Key growth drivers include rising disposable income, urbanization trends, smaller living spaces requiring compact solutions, and growing awareness of energy efficiency and sustainability. The market benefits from strong brand loyalty, established distribution networks, and increasing consumer willingness to invest in premium, feature-rich appliances.

Technology integration plays a crucial role in market evolution, with smart connectivity, IoT capabilities, and artificial intelligence features becoming increasingly prevalent across product categories. Consumer adoption of connected appliances shows growth rates of 23% annually, indicating strong market acceptance of technological enhancements.

Competitive landscape features both established multinational corporations and innovative startups, creating a dynamic environment that fosters continuous improvement and competitive pricing. Market leaders maintain strong positions through brand recognition, quality assurance, and comprehensive product portfolios that address diverse consumer needs.

Future outlook remains highly positive, with sustained growth expected across all major product categories, driven by ongoing innovation, expanding consumer base, and increasing integration of advanced technologies that enhance appliance functionality and user experience.

Market analysis reveals several critical insights that shape the US small home appliances landscape and influence strategic decision-making for industry participants:

The US small home appliances market benefits from multiple powerful drivers that sustain growth momentum and create opportunities for market expansion across diverse product categories and consumer segments.

Lifestyle transformation represents a primary growth driver as American consumers increasingly embrace convenience-oriented solutions that save time and effort in daily household tasks. Busy lifestyles, dual-income households, and changing work patterns create strong demand for appliances that streamline cooking, cleaning, and personal care activities.

Technological advancement drives market growth through continuous innovation in product functionality, energy efficiency, and user experience. Smart connectivity, voice control, mobile app integration, and artificial intelligence features enhance appliance capabilities and appeal to tech-savvy consumers seeking modern solutions.

Urbanization trends contribute significantly to market expansion as more Americans live in apartments, condominiums, and smaller homes where compact, multifunctional appliances provide essential functionality without consuming excessive space. Urban consumers particularly value appliances that maximize utility while minimizing footprint.

Rising disposable income enables consumers to invest in premium appliances with advanced features, superior build quality, and enhanced performance. Economic prosperity supports market premiumization and encourages replacement of older appliances with newer, more efficient models.

Health and wellness awareness drives demand for appliances that support healthy lifestyle choices, including air fryers, juicers, food processors, and other devices that enable home preparation of nutritious meals and beverages.

Despite strong growth prospects, the US small home appliances market faces several challenges that may limit expansion potential and create obstacles for industry participants seeking to maximize market penetration and profitability.

Market saturation in certain product categories presents challenges for sustained growth as many American households already own essential appliances such as coffee makers, toasters, and vacuum cleaners. High penetration rates in mature categories require manufacturers to focus on replacement cycles and product differentiation.

Economic sensitivity affects consumer purchasing decisions during periods of economic uncertainty or recession, as small appliances are often considered discretionary purchases that can be delayed or avoided when household budgets are constrained.

Intense competition creates pricing pressure and margin compression as numerous manufacturers compete for market share across similar product categories. Price competition can limit profitability and reduce resources available for research and development investments.

Supply chain disruptions periodically impact product availability and manufacturing costs, particularly for appliances dependent on global component sourcing and international manufacturing operations. Geopolitical tensions and trade policies can exacerbate supply chain challenges.

Regulatory compliance requirements related to energy efficiency, safety standards, and environmental regulations increase development costs and complexity while potentially limiting design flexibility and innovation speed.

Consumer durability expectations create challenges as buyers expect appliances to function reliably for extended periods, potentially reducing replacement frequency and limiting repeat purchase opportunities for manufacturers.

The US small home appliances market presents numerous compelling opportunities for growth, innovation, and market expansion that industry participants can leverage to enhance competitive positioning and capture additional market share.

Smart home integration offers significant opportunities as consumers increasingly adopt connected home ecosystems that enable seamless appliance control, monitoring, and automation. Integration with popular smart home platforms creates new value propositions and differentiation opportunities.

Sustainability initiatives present opportunities for manufacturers to develop energy-efficient, environmentally friendly appliances that appeal to environmentally conscious consumers while potentially qualifying for government incentives and rebates.

Demographic shifts create opportunities to address specific needs of growing market segments, including millennials entering homeownership, aging baby boomers seeking convenience solutions, and Gen Z consumers prioritizing technology integration and social responsibility.

E-commerce expansion enables manufacturers to reach consumers directly, improve profit margins, gather valuable customer data, and provide enhanced customer service experiences that build brand loyalty and encourage repeat purchases.

Product innovation opportunities exist in developing multifunctional appliances that combine multiple capabilities in single devices, addressing space constraints while providing enhanced value propositions for consumers seeking versatile solutions.

International expansion potential exists for successful US brands to leverage their market expertise and product development capabilities in international markets with growing middle-class populations and increasing appliance adoption rates.

The US small home appliances market operates within a complex ecosystem of interconnected forces that influence supply and demand patterns, competitive dynamics, and long-term growth trajectories across diverse product categories and consumer segments.

Supply-side dynamics are characterized by continuous technological innovation, manufacturing efficiency improvements, and global supply chain optimization that enable cost reduction and product enhancement. Manufacturers invest heavily in research and development to maintain competitive advantages and meet evolving consumer expectations.

Demand-side factors include changing consumer preferences, lifestyle evolution, demographic shifts, and economic conditions that influence purchasing decisions and product adoption rates. Consumer willingness to pay premium prices for advanced features drives market premiumization trends.

Competitive dynamics feature intense rivalry among established players and emerging brands, with competition based on product quality, innovation, pricing, brand reputation, and customer service. Market leaders maintain positions through continuous innovation and strategic marketing investments.

Technology disruption creates both opportunities and challenges as new technologies enable enhanced functionality while potentially obsoleting existing products. Artificial intelligence, IoT connectivity, and advanced materials drive innovation cycles and reshape consumer expectations.

Regulatory environment influences product development through safety standards, energy efficiency requirements, and environmental regulations that shape design parameters and manufacturing processes. Compliance costs and complexity vary across product categories and jurisdictions.

Distribution evolution reflects changing retail landscapes with growing e-commerce penetration, direct-to-consumer sales models, and omnichannel strategies that provide consumers with multiple purchasing options and enhanced shopping experiences.

Comprehensive market analysis employs rigorous research methodologies that combine quantitative data collection, qualitative insights, and expert analysis to provide accurate, reliable, and actionable intelligence for industry stakeholders and decision-makers.

Primary research involves extensive surveys, interviews, and focus groups with consumers, retailers, manufacturers, and industry experts to gather firsthand insights into market trends, consumer preferences, competitive dynamics, and growth opportunities. Data collection encompasses diverse demographic segments and geographic regions to ensure representative sampling.

Secondary research utilizes published industry reports, government statistics, trade association data, company financial statements, and academic studies to validate primary findings and provide historical context for market analysis. Multiple data sources ensure comprehensive coverage and cross-validation of key findings.

Market modeling employs statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify potential growth trajectories under various economic and competitive conditions. Advanced analytics enable identification of key drivers and their relative impact on market performance.

Expert validation involves consultation with industry veterans, technology specialists, and market analysts to verify research findings, validate assumptions, and ensure accuracy of conclusions and recommendations. Expert insights provide valuable context and perspective on market dynamics.

Data quality assurance includes multiple verification steps, cross-referencing of sources, and statistical validation to ensure accuracy, reliability, and consistency of research findings. Quality control processes minimize errors and enhance confidence in research conclusions.

The US small home appliances market exhibits distinct regional characteristics and variations that reflect local economic conditions, demographic patterns, lifestyle preferences, and retail infrastructure across different geographic areas.

Northeast region demonstrates strong market performance driven by high population density, elevated income levels, and urban lifestyle patterns that favor compact, efficient appliances. The region shows 32% market share with particular strength in premium product categories and smart appliance adoption.

Southeast region experiences robust growth supported by population expansion, economic development, and increasing urbanization. Consumer preferences lean toward value-oriented products with strong brand recognition, while climate conditions drive demand for specific appliance categories.

Midwest region maintains steady market performance with emphasis on durability, reliability, and practical functionality. Traditional consumer preferences coexist with growing interest in energy-efficient and technologically advanced appliances among younger demographics.

West Coast region leads in innovation adoption and premium product penetration, with consumers showing strong preference for environmentally friendly, technologically advanced appliances. The region demonstrates 28% adoption rate for smart-connected appliances, significantly above national averages.

Southwest region shows accelerating growth driven by population migration, economic expansion, and changing demographic composition. Market development benefits from increasing disposable income and evolving lifestyle patterns that support appliance adoption.

Mountain region exhibits unique market characteristics influenced by outdoor lifestyle preferences, energy consciousness, and space optimization needs. Consumer demand focuses on versatile, durable appliances that support active lifestyles and efficient home management.

The US small home appliances market features a diverse competitive landscape with established multinational corporations, specialized manufacturers, and innovative startups competing across multiple product categories and price segments.

Market leaders maintain competitive advantages through comprehensive product portfolios, strong brand recognition, extensive distribution networks, and significant research and development investments that enable continuous innovation and market responsiveness.

Competitive strategies vary across market participants, with some focusing on cost leadership and mass market appeal while others emphasize premium positioning, technological innovation, and niche market specialization.

Innovation competition drives continuous product development as companies invest in smart technology integration, energy efficiency improvements, and enhanced user experience features to differentiate their offerings and maintain market relevance.

The US small home appliances market can be segmented across multiple dimensions that provide insights into consumer preferences, market opportunities, and competitive dynamics within specific product categories and consumer segments.

By Product Category:

By Price Range:

By Distribution Channel:

Kitchen appliances dominate the small home appliances market with the highest revenue contribution and broadest consumer adoption. This category benefits from frequent usage, replacement cycles, and continuous innovation in cooking technology, smart connectivity, and energy efficiency.

Coffee makers represent a particularly strong subcategory with high household penetration and regular replacement patterns. Premium single-serve systems and smart-connected brewers drive category growth, with 43% of households owning multiple coffee-making devices.

Air fryers emerge as a rapidly growing segment driven by health consciousness and convenience trends. Consumer adoption accelerates as manufacturers introduce larger capacity models, enhanced features, and competitive pricing that broadens market appeal.

Cleaning appliances maintain steady growth supported by increasing awareness of hygiene, allergen control, and home cleanliness. Cordless vacuum cleaners and robotic cleaning devices gain market share through technological advancement and improved performance.

Personal care appliances benefit from grooming trends, professional styling preferences, and technological innovations that enhance performance and user experience. Premium hair styling tools and advanced grooming devices drive category premiumization.

Heating and cooling appliances experience seasonal demand patterns with strong growth in energy-efficient models that provide cost savings and environmental benefits. Smart thermostatic controls and air quality monitoring features enhance product appeal.

According to MarkWide Research analysis, kitchen appliances maintain the largest market share at approximately 45% of total market volume, followed by cleaning appliances and personal care devices as significant contributors to overall market performance.

Industry participants in the US small home appliances market enjoy numerous advantages and opportunities that support business growth, profitability, and long-term sustainability across diverse market segments and operational areas.

Manufacturers benefit from strong consumer demand, established distribution channels, and opportunities for product differentiation through innovation and brand building. The market provides stable revenue streams with predictable replacement cycles and seasonal demand patterns that enable effective production planning.

Retailers enjoy attractive profit margins, high inventory turnover, and strong consumer traffic generation from small appliance categories. These products serve as traffic drivers that encourage additional purchases and build customer loyalty through quality and service excellence.

Technology providers find significant opportunities in supplying smart connectivity solutions, energy-efficient components, and advanced materials that enhance appliance performance and functionality. Partnership opportunities with manufacturers enable technology integration and market expansion.

Consumers benefit from continuous product innovation, competitive pricing, enhanced convenience, and improved quality of life through time-saving and efficiency-enhancing appliances. Market competition ensures access to diverse options that meet varying needs and budgets.

Distributors capitalize on strong market demand, established supply chains, and opportunities for value-added services including installation, maintenance, and customer support that enhance profitability and customer relationships.

Service providers benefit from growing installed base of appliances requiring maintenance, repair, and replacement services. Extended warranty programs and service contracts provide recurring revenue opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

The US small home appliances market experiences several transformative trends that reshape consumer expectations, competitive dynamics, and industry development patterns across all major product categories and market segments.

Smart connectivity emerges as a dominant trend with consumers increasingly seeking appliances that integrate with smart home ecosystems, offer mobile app control, and provide advanced monitoring and automation capabilities. Connected appliance adoption shows 35% annual growth as technology becomes more accessible and user-friendly.

Sustainability focus drives demand for energy-efficient appliances that reduce environmental impact and operating costs. Consumers prioritize products with eco-friendly materials, recyclable components, and energy star certifications that align with environmental values and cost-saving objectives.

Multifunctionality gains importance as consumers seek appliances that combine multiple capabilities in single devices, addressing space constraints while providing enhanced value propositions. Combination appliances and modular systems appeal to urban consumers and small-space living situations.

Premium positioning accelerates as consumers demonstrate willingness to invest in higher-quality appliances with superior performance, durability, and advanced features. Premium segment growth outpaces overall market expansion as brand differentiation becomes increasingly important.

Health and wellness integration influences product development with appliances designed to support healthy lifestyle choices, including air purification, water filtration, and food preparation devices that promote nutritious eating habits.

Personalization trends drive demand for customizable appliances that adapt to individual preferences, usage patterns, and aesthetic requirements. Modular designs and programmable features enable personalized user experiences.

Recent industry developments demonstrate the dynamic nature of the US small home appliances market with significant innovations, strategic partnerships, and market expansion initiatives that shape competitive positioning and growth trajectories.

Technology partnerships between appliance manufacturers and technology companies accelerate smart appliance development and market adoption. Collaborations with voice assistant providers, smart home platforms, and mobile app developers enhance product functionality and user experience.

Sustainability initiatives gain momentum as manufacturers invest in eco-friendly materials, energy-efficient designs, and circular economy principles that reduce environmental impact while appealing to environmentally conscious consumers.

Direct-to-consumer strategies expand as manufacturers establish online sales channels, subscription services, and customer relationship management systems that improve profit margins and provide valuable consumer insights for product development.

Acquisition activity continues as larger companies acquire innovative startups and specialized brands to expand product portfolios, access new technologies, and enter emerging market segments with growth potential.

Manufacturing automation investments improve production efficiency, quality consistency, and cost competitiveness while enabling rapid response to market demand fluctuations and customization requirements.

Retail partnerships evolve with new collaboration models between manufacturers and retailers that enhance product presentation, customer education, and after-sales support to improve consumer satisfaction and brand loyalty.

Industry analysts recommend strategic approaches that enable market participants to capitalize on growth opportunities while addressing competitive challenges and market dynamics in the evolving US small home appliances landscape.

Innovation investment should focus on smart technology integration, energy efficiency improvements, and user experience enhancements that differentiate products and justify premium pricing. Companies should prioritize research and development spending to maintain competitive advantages.

Brand building efforts should emphasize quality, reliability, and customer service excellence to build consumer trust and loyalty in increasingly competitive markets. Strong brand positioning enables pricing power and market share protection.

Distribution diversification across multiple channels including e-commerce, traditional retail, and direct sales reduces dependency risks while maximizing market reach and consumer accessibility. Omnichannel strategies provide competitive advantages.

Supply chain optimization should focus on resilience, flexibility, and cost efficiency to manage global sourcing challenges and maintain competitive pricing. Regional sourcing strategies may reduce vulnerability to international disruptions.

Consumer segmentation strategies should address specific needs of different demographic groups, income levels, and lifestyle preferences through targeted product development and marketing approaches that maximize market penetration.

Sustainability integration should become a core business strategy rather than peripheral consideration, as environmental consciousness continues growing among consumers and regulatory requirements become more stringent.

The future outlook for the US small home appliances market remains highly positive with sustained growth expected across all major product categories, driven by technological innovation, changing consumer lifestyles, and expanding market opportunities.

Market expansion will continue benefiting from demographic trends including household formation, urbanization, and income growth that support appliance adoption and replacement cycles. MWR projections indicate sustained growth momentum with particularly strong performance in smart-connected and premium product segments.

Technology evolution will accelerate with artificial intelligence, machine learning, and advanced connectivity features becoming standard across product categories. Voice control, predictive maintenance, and automated optimization will enhance user experience and product value propositions.

Sustainability requirements will intensify as environmental regulations become more stringent and consumer environmental consciousness continues growing. Energy efficiency, recyclable materials, and circular economy principles will become competitive necessities rather than differentiators.

Market consolidation may accelerate as larger companies acquire innovative brands and technologies to maintain competitive positions and access emerging market segments. Strategic partnerships and joint ventures will enable technology sharing and market expansion.

Consumer expectations will continue evolving toward higher quality, enhanced functionality, and superior user experience, requiring continuous innovation and improvement from manufacturers seeking to maintain market relevance and competitive positioning.

Growth projections indicate robust expansion potential with smart appliance penetration expected to reach 52% of households within the next five years, driven by improving technology accessibility and increasing consumer acceptance of connected home solutions.

The US small home appliances market represents a dynamic, resilient, and continuously evolving sector that provides essential solutions for American households while offering significant opportunities for industry participants across the value chain. Market fundamentals remain strong with sustained growth driven by technological innovation, changing consumer lifestyles, and expanding product categories that address diverse household needs.

Key success factors for market participants include continuous innovation, brand building, distribution excellence, and customer-centric approaches that deliver superior value propositions and user experiences. Companies that effectively integrate smart technology, sustainability principles, and consumer insights will be best positioned to capture growth opportunities and maintain competitive advantages.

Market outlook remains highly favorable with multiple growth drivers supporting expansion across product categories, price segments, and consumer demographics. The convergence of technology advancement, lifestyle evolution, and economic prosperity creates a supportive environment for sustained market development and industry profitability.

Strategic priorities should focus on innovation leadership, operational excellence, and customer relationship building that enable long-term success in an increasingly competitive and sophisticated market environment. Industry participants who adapt to changing market dynamics while maintaining focus on quality and customer satisfaction will achieve sustainable growth and market leadership positions.

What is Small Home Appliances?

Small home appliances refer to portable or semi-portable machines that assist in household tasks. These include items like toasters, blenders, and vacuum cleaners, which are designed to enhance convenience and efficiency in daily living.

What are the key players in the US Small Home Appliances Market?

Key players in the US Small Home Appliances Market include companies like Whirlpool Corporation, Philips, and Black+Decker, which are known for their innovative products and strong market presence, among others.

What are the growth factors driving the US Small Home Appliances Market?

The US Small Home Appliances Market is driven by factors such as increasing consumer demand for convenience, advancements in technology, and a growing trend towards smart home integration. Additionally, the rise in urbanization and smaller living spaces has led to a higher demand for compact appliances.

What challenges does the US Small Home Appliances Market face?

Challenges in the US Small Home Appliances Market include intense competition among manufacturers, fluctuating raw material prices, and changing consumer preferences. Additionally, the market must navigate issues related to sustainability and energy efficiency.

What opportunities exist in the US Small Home Appliances Market?

The US Small Home Appliances Market presents opportunities for growth through the development of energy-efficient products and smart appliances that cater to tech-savvy consumers. There is also potential in expanding e-commerce channels to reach a broader audience.

What trends are shaping the US Small Home Appliances Market?

Trends in the US Small Home Appliances Market include the increasing popularity of multifunctional devices, the rise of eco-friendly products, and the integration of IoT technology. Consumers are increasingly looking for appliances that offer both convenience and sustainability.

US Small Home Appliances Market

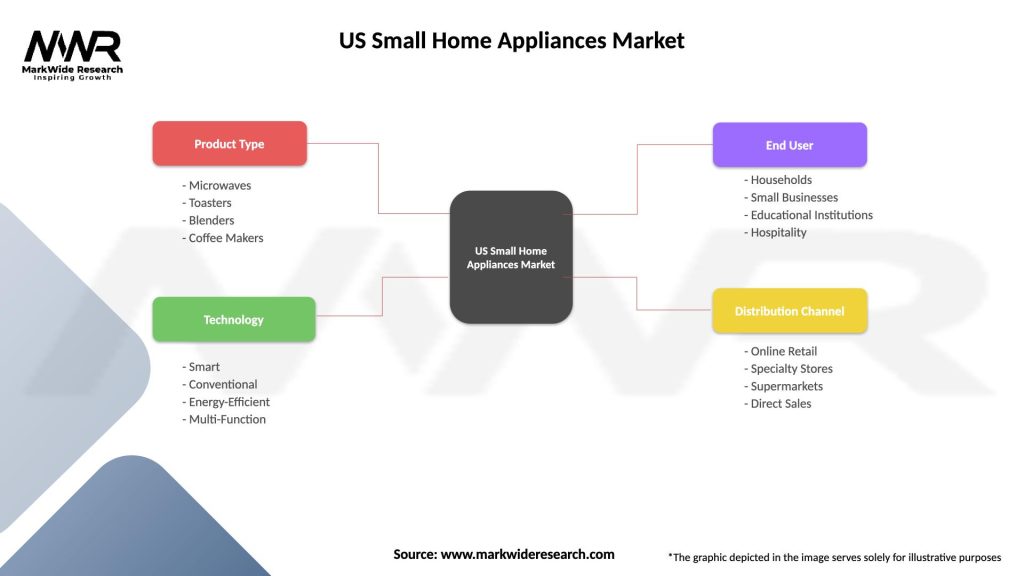

| Segmentation Details | Description |

|---|---|

| Product Type | Microwaves, Toasters, Blenders, Coffee Makers |

| Technology | Smart, Conventional, Energy-Efficient, Multi-Function |

| End User | Households, Small Businesses, Educational Institutions, Hospitality |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Small Home Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at