444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US single use packaging market represents a dynamic and rapidly evolving sector that has become integral to modern consumer lifestyles and business operations. This market encompasses a comprehensive range of disposable packaging solutions including plastic containers, paper bags, foam packaging, aluminum foil products, and biodegradable alternatives designed for one-time use across multiple industries. Market dynamics indicate robust growth driven by increasing consumer demand for convenience, food safety requirements, and the expansion of e-commerce platforms.

Industry transformation is occurring as manufacturers adapt to changing regulatory landscapes and consumer preferences for sustainable packaging solutions. The market experiences significant demand from food service establishments, retail operations, healthcare facilities, and direct-to-consumer businesses. Growth projections suggest the sector will maintain a steady expansion rate of 4.2% CAGR through the forecast period, supported by innovation in materials technology and increasing adoption of eco-friendly alternatives.

Regional distribution shows concentrated activity in major metropolitan areas and industrial centers, with California and Texas leading in both production capacity and consumption volumes. The market benefits from established supply chains, advanced manufacturing capabilities, and strong consumer acceptance of single-use packaging solutions across diverse applications.

The US single use packaging market refers to the comprehensive ecosystem of disposable packaging products designed for one-time use applications, encompassing materials, manufacturing processes, distribution networks, and end-user consumption patterns across various industry sectors throughout the United States.

Single use packaging includes any packaging material or container intended for immediate disposal after serving its primary function of protecting, containing, or presenting products to consumers. This definition encompasses traditional materials like plastic, paper, and aluminum, as well as emerging biodegradable and compostable alternatives that address environmental sustainability concerns.

Market scope extends beyond simple containment solutions to include sophisticated packaging systems that provide barrier protection, extend shelf life, ensure product integrity, and enhance consumer convenience. The sector serves critical functions in food safety, pharmaceutical protection, retail presentation, and logistics efficiency across the American economy.

Strategic analysis reveals the US single use packaging market as a resilient and adaptable sector experiencing transformation driven by sustainability initiatives, regulatory changes, and evolving consumer preferences. The market demonstrates strong fundamentals with consistent demand from essential industries including food service, healthcare, retail, and e-commerce sectors.

Key performance indicators show the market maintaining steady growth momentum despite facing challenges from environmental regulations and shifting consumer attitudes toward sustainability. Innovation acceleration in biodegradable materials and recyclable alternatives has created new market segments while traditional packaging materials continue to dominate volume consumption.

Competitive dynamics feature a mix of large multinational corporations and specialized regional manufacturers, with increasing focus on sustainable product development and circular economy principles. Market consolidation trends indicate strategic acquisitions and partnerships aimed at expanding product portfolios and geographic reach while building capabilities in sustainable packaging technologies.

Future trajectory points toward continued market expansion supported by demographic trends, urbanization patterns, and the growing preference for convenient packaging solutions, balanced against increasing pressure for environmental responsibility and regulatory compliance.

Market intelligence reveals several critical insights shaping the US single use packaging landscape:

Primary growth drivers propelling the US single use packaging market include fundamental shifts in consumer behavior, regulatory requirements, and technological capabilities that create sustained demand across multiple industry sectors.

Consumer lifestyle changes represent the most significant driver, with increasing urbanization, dual-income households, and time-constrained lifestyles creating strong preference for convenient packaging solutions. The rise of food delivery services, takeout dining, and grab-and-go retail formats has fundamentally altered packaging requirements, driving demand for functional single-use containers that maintain product quality during transport and storage.

Food safety regulations and health consciousness have elevated the importance of hygienic packaging solutions, particularly in healthcare, food service, and retail environments. Single-use packaging provides critical contamination prevention capabilities that multi-use alternatives cannot match, making it essential for maintaining public health standards and regulatory compliance.

E-commerce expansion continues to drive packaging innovation and volume growth as online retailers require specialized protective packaging to ensure product integrity during shipping. The growth of direct-to-consumer business models has created new packaging requirements for products previously sold only through traditional retail channels.

Technological advancement in materials science enables the development of high-performance packaging solutions that offer superior barrier properties, extended shelf life, and enhanced functionality while addressing environmental concerns through improved recyclability and biodegradability.

Environmental concerns constitute the primary restraint facing the US single use packaging market, with growing public awareness of plastic pollution, landfill accumulation, and ocean contamination creating significant pressure for industry transformation. Consumer advocacy groups and environmental organizations actively campaign against single-use packaging, influencing purchasing decisions and corporate policies.

Regulatory challenges present increasing complexity as state and local governments implement plastic reduction mandates, packaging taxes, and extended producer responsibility programs. These regulations create compliance costs, limit material choices, and require significant investment in alternative packaging development, potentially constraining market growth in certain segments.

Raw material volatility affects market stability as packaging manufacturers face fluctuating costs for petroleum-based plastics, paper pulp, and aluminum. Supply chain disruptions and commodity price swings create uncertainty in production planning and pricing strategies, impacting profitability and market predictability.

Competition from reusable alternatives intensifies as consumers and businesses explore sustainable packaging options. Reusable containers, refillable systems, and bulk purchasing models present viable alternatives for certain applications, potentially reducing demand for single-use solutions in specific market segments.

Economic sensitivity influences market performance during economic downturns when businesses and consumers seek cost reduction opportunities. Single-use packaging may face scrutiny as a discretionary expense, particularly in non-essential applications where alternatives exist.

Sustainable packaging innovation presents the most significant opportunity for market expansion, with growing demand for biodegradable, compostable, and recyclable alternatives creating new product categories and market segments. Companies investing in plant-based materials, advanced recycling technologies, and circular economy solutions position themselves for long-term growth as environmental regulations tighten and consumer preferences evolve.

Smart packaging integration offers opportunities to enhance functionality through embedded sensors, QR codes, and interactive features that provide product information, track freshness, and enable consumer engagement. These technologies add value beyond basic containment, justifying premium pricing and creating competitive differentiation.

Healthcare sector expansion provides substantial growth potential as aging demographics increase demand for medical packaging, pharmaceutical containers, and healthcare facility supplies. The emphasis on infection control and patient safety creates sustained demand for sterile single-use packaging solutions.

E-commerce specialization enables companies to develop packaging solutions specifically designed for online retail requirements, including enhanced protection, space optimization, and brand presentation capabilities. The continued growth of direct-to-consumer sales creates expanding market opportunities for specialized packaging providers.

Regional market development offers expansion opportunities in underserved geographic areas and emerging market segments. Companies can leverage distribution networks and manufacturing capabilities to capture market share in growing regions and industry verticals.

Market dynamics in the US single use packaging sector reflect complex interactions between environmental pressures, technological innovation, regulatory requirements, and consumer behavior patterns that collectively shape industry evolution and competitive positioning.

Supply chain transformation is occurring as manufacturers adapt to sustainability requirements while maintaining cost competitiveness and operational efficiency. Companies are investing in domestic production capabilities to reduce transportation costs and improve supply security, while simultaneously developing partnerships with recycling facilities and waste management companies to create circular economy solutions.

Innovation cycles are accelerating as companies compete to develop next-generation packaging materials that balance performance, cost, and environmental impact. Research and development investments focus on bio-based materials, improved barrier properties, and end-of-life solutions that address regulatory requirements and consumer preferences.

Competitive intensity increases as traditional packaging companies face competition from startups specializing in sustainable alternatives, technology companies developing smart packaging solutions, and international manufacturers expanding into the US market. This competition drives innovation, improves product quality, and creates pricing pressure across market segments.

Consumer education initiatives by industry associations and individual companies aim to improve understanding of packaging benefits, proper disposal methods, and recycling opportunities. These efforts help maintain market acceptance while addressing environmental concerns through responsible use and waste management practices.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US single use packaging market dynamics, competitive landscape, and growth prospects.

Primary research activities include structured interviews with industry executives, packaging manufacturers, end-users, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities. Survey research among consumers and business customers provides quantitative data on usage patterns, preferences, and purchasing decisions.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and academic studies to establish market context and validate primary research findings. Patent analysis and technology assessments provide insights into innovation trends and competitive positioning.

Market modeling utilizes statistical analysis and forecasting techniques to project market growth, segment performance, and regional trends. Economic indicators, demographic data, and industry-specific metrics inform quantitative projections and scenario analysis.

Expert consultation with industry specialists, technology developers, and regulatory experts provides additional validation and context for research findings. MarkWide Research methodology ensures comprehensive coverage of market dynamics while maintaining analytical rigor and objectivity.

Geographic distribution of the US single use packaging market reveals significant regional variations in consumption patterns, manufacturing capacity, and regulatory environments that influence market dynamics and growth opportunities.

West Coast markets lead in sustainable packaging adoption, with California accounting for 23% of national consumption while implementing the most stringent environmental regulations. The region’s technology sector, food service industry, and environmental consciousness drive demand for innovative packaging solutions and sustainable alternatives.

Southeast region demonstrates strong growth in manufacturing capacity and consumption, supported by favorable business climates, logistics infrastructure, and expanding population centers. Texas and Florida represent major market centers with diverse industrial bases and growing consumer markets.

Northeast corridor maintains significant market presence through dense population centers, established food service industries, and proximity to major ports for international trade. The region’s focus on urban sustainability initiatives influences packaging preferences and regulatory development.

Midwest manufacturing centers provide production capabilities for traditional packaging materials while adapting to changing market requirements. The region’s agricultural base supports paper and bio-based packaging production, while industrial centers drive demand for protective packaging solutions.

Regional specialization emerges as different areas develop expertise in specific packaging types, materials, or applications. This geographic diversity provides market resilience and enables specialized supply chains that serve national and international customers.

Market leadership in the US single use packaging sector features a diverse competitive landscape combining multinational corporations, regional specialists, and innovative startups that collectively serve various market segments and customer requirements.

Competitive strategies emphasize sustainability innovation, operational efficiency, and customer service excellence as companies differentiate their offerings in increasingly competitive markets. Strategic acquisitions and partnerships enable market expansion and technology development while building scale advantages.

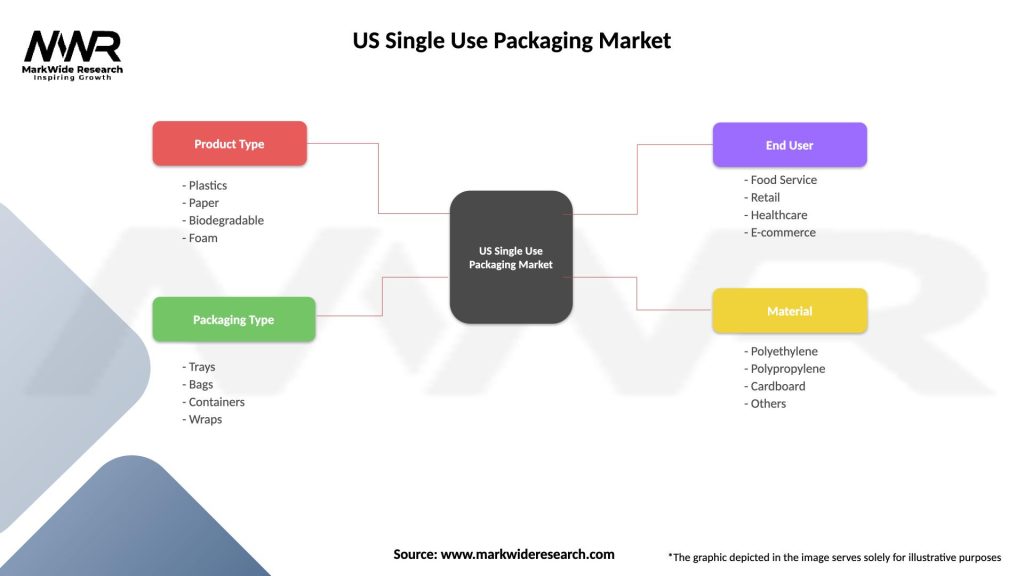

Market segmentation analysis reveals distinct categories within the US single use packaging market, each characterized by specific applications, material requirements, and growth dynamics.

By Material Type:

By Application:

By End-User:

Food service packaging represents the largest and most dynamic category, driven by the expansion of quick-service restaurants, food delivery services, and takeout dining. This segment demonstrates consistent growth of 5.1% annually as consumer dining habits shift toward convenience and mobility. Innovation focuses on temperature retention, leak resistance, and sustainable materials that maintain food safety while addressing environmental concerns.

E-commerce packaging emerges as a high-growth category with specialized requirements for product protection during shipping and handling. The segment benefits from online retail expansion and direct-to-consumer business models that require packaging solutions optimized for automated fulfillment and customer experience. Protective packaging demand increases as fragile and high-value products require enhanced security during transportation.

Healthcare packaging maintains steady growth driven by aging demographics, pharmaceutical innovation, and infection control requirements. This category demands the highest quality standards and regulatory compliance, creating opportunities for specialized manufacturers with expertise in sterile packaging and medical device protection.

Sustainable packaging categories experience the fastest growth as companies respond to environmental regulations and consumer preferences. Bio-based materials, compostable alternatives, and recyclable designs gain market share despite higher costs, supported by corporate sustainability commitments and regulatory incentives.

Industrial packaging serves manufacturing and logistics applications with emphasis on durability, cost-effectiveness, and supply chain efficiency. This category remains stable with growth tied to manufacturing activity and international trade volumes.

Manufacturers benefit from diverse market opportunities across multiple industry sectors, enabling revenue diversification and risk mitigation through portfolio balance. The market provides opportunities for innovation leadership, sustainable product development, and operational efficiency improvements that create competitive advantages and customer loyalty.

Retailers gain access to packaging solutions that enhance product presentation, extend shelf life, and improve customer convenience while supporting brand differentiation and marketing objectives. Single-use packaging enables efficient inventory management, reduces contamination risks, and supports food safety compliance.

Consumers receive convenient, hygienic, and functional packaging that supports busy lifestyles while ensuring product quality and safety. Modern packaging innovations provide improved usability, portion control, and product information access that enhance the overall consumption experience.

Food service operators achieve operational efficiency through standardized packaging solutions that reduce labor costs, improve food safety compliance, and enable consistent service delivery. Single-use packaging eliminates washing and sanitization requirements while supporting takeout and delivery business models.

Healthcare providers ensure patient safety and regulatory compliance through sterile packaging solutions that prevent contamination and maintain product integrity. Single-use medical packaging reduces infection risks and supports efficient clinical workflows.

Environmental stakeholders benefit from industry innovation in sustainable materials and circular economy solutions that reduce environmental impact while maintaining packaging functionality and safety requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation dominates market trends as companies invest heavily in biodegradable materials, recyclable designs, and circular economy solutions. Consumer pressure and regulatory requirements drive innovation in plant-based packaging, compostable alternatives, and reduced material usage while maintaining functionality and safety standards.

Smart packaging integration introduces digital capabilities including QR codes, NFC tags, and embedded sensors that provide product information, track freshness, and enable consumer interaction. These technologies create new value propositions and differentiation opportunities while supporting supply chain transparency and consumer engagement.

Customization and personalization trends enable brands to create unique packaging experiences through digital printing, variable designs, and limited edition packaging that supports marketing campaigns and brand building initiatives. Advanced manufacturing capabilities make small-batch customization economically viable.

Supply chain localization accelerates as companies seek to reduce transportation costs, improve supply security, and support sustainability objectives through regional manufacturing and sourcing strategies. Domestic production capacity expansion addresses supply chain resilience concerns while reducing carbon footprint.

Regulatory harmonization efforts aim to create consistent standards across states and municipalities, reducing compliance complexity while maintaining environmental protection objectives. Industry collaboration with regulators supports balanced approaches that address environmental concerns while preserving packaging functionality.

Technology breakthroughs in materials science have enabled the development of high-performance biodegradable packaging that matches traditional plastic properties while offering end-of-life advantages. Recent innovations include plant-based barrier coatings, compostable films, and recyclable multi-layer structures that maintain product protection capabilities.

Strategic partnerships between packaging manufacturers and technology companies accelerate smart packaging development and market adoption. Collaborations focus on integrating digital capabilities, improving supply chain visibility, and creating consumer engagement opportunities through connected packaging solutions.

Regulatory developments include expanded producer responsibility programs, plastic reduction mandates, and packaging tax implementations across multiple states. MarkWide Research analysis indicates these regulations will drive significant market transformation over the next five years as companies adapt product portfolios and business models.

Investment activity in sustainable packaging startups and technology development reaches record levels as venture capital and corporate investors support innovation in bio-based materials, recycling technologies, and circular economy solutions. This funding accelerates product development and market commercialization timelines.

Market consolidation continues through strategic acquisitions that combine complementary capabilities, expand geographic reach, and build scale advantages in competitive markets. Large corporations acquire innovative startups to access new technologies and sustainable packaging expertise.

Strategic recommendations for market participants emphasize the critical importance of sustainability integration, innovation investment, and regulatory compliance preparation to ensure long-term competitive positioning and market success.

Sustainability leadership should become a core strategic priority with significant investment in bio-based materials, recyclable designs, and circular economy solutions. Companies that establish early leadership in sustainable packaging will benefit from competitive advantages as regulations tighten and consumer preferences evolve toward environmental responsibility.

Technology adoption in smart packaging capabilities offers differentiation opportunities and premium pricing potential. Investment in digital integration, sensor technology, and consumer engagement features creates value-added solutions that justify higher margins while building customer loyalty and brand recognition.

Supply chain optimization through regional manufacturing, strategic partnerships, and vertical integration improves cost competitiveness while enhancing supply security and sustainability credentials. Companies should evaluate domestic production opportunities and local sourcing strategies to reduce transportation costs and environmental impact.

Market diversification across industry sectors and geographic regions provides risk mitigation and growth opportunities. Companies should develop expertise in high-growth segments like healthcare packaging, e-commerce solutions, and sustainable alternatives while maintaining strength in core markets.

Regulatory preparation requires proactive engagement with policy development, compliance planning, and product portfolio adaptation. Companies should monitor regulatory trends, participate in industry advocacy, and develop transition strategies for restricted materials and new requirements.

Market trajectory for the US single use packaging sector points toward continued growth driven by fundamental demographic and lifestyle trends, balanced against increasing pressure for environmental responsibility and sustainable practices. Long-term projections indicate the market will maintain expansion momentum while undergoing significant transformation in materials, technologies, and business models.

Sustainability integration will accelerate as regulatory requirements tighten and consumer preferences shift toward environmentally responsible packaging solutions. Bio-based materials are expected to capture 35% market share within the next decade as technology improvements reduce costs and enhance performance characteristics.

Technology advancement will create new market categories through smart packaging capabilities, digital integration, and enhanced functionality that provides value beyond basic containment. These innovations will support premium pricing and create competitive differentiation opportunities for early adopters.

Regional market development will continue as population growth, urbanization, and economic expansion create new consumption centers and manufacturing opportunities. MWR analysis suggests emerging markets within the US will drive incremental growth while established regions focus on sustainability and innovation.

Industry consolidation will accelerate as companies seek scale advantages, technology capabilities, and market access through strategic acquisitions and partnerships. This consolidation will create larger, more capable organizations while maintaining innovation through startup ecosystem development.

Regulatory evolution will shape market dynamics through environmental standards, extended producer responsibility, and circular economy requirements that drive innovation while creating compliance challenges and opportunities for differentiation.

The US single use packaging market stands at a critical juncture where traditional growth drivers intersect with transformative forces including sustainability requirements, technological innovation, and evolving consumer expectations. Market fundamentals remain strong with consistent demand from essential industries, while the sector adapts to environmental challenges through materials innovation and circular economy solutions.

Strategic success in this evolving market requires balanced approaches that maintain packaging functionality and safety while addressing environmental concerns through sustainable materials and responsible business practices. Companies that invest in innovation, embrace sustainability leadership, and adapt to regulatory requirements will capture the greatest opportunities in this dynamic market environment.

The future of the US single use packaging market will be defined by the industry’s ability to transform traditional business models while serving essential functions in food safety, healthcare protection, and consumer convenience. This transformation presents both challenges and opportunities for market participants committed to sustainable growth and innovation excellence.

What is Single Use Packaging?

Single Use Packaging refers to packaging materials designed to be used once and then discarded. This type of packaging is commonly found in food service, retail, and consumer goods, providing convenience and efficiency for both manufacturers and consumers.

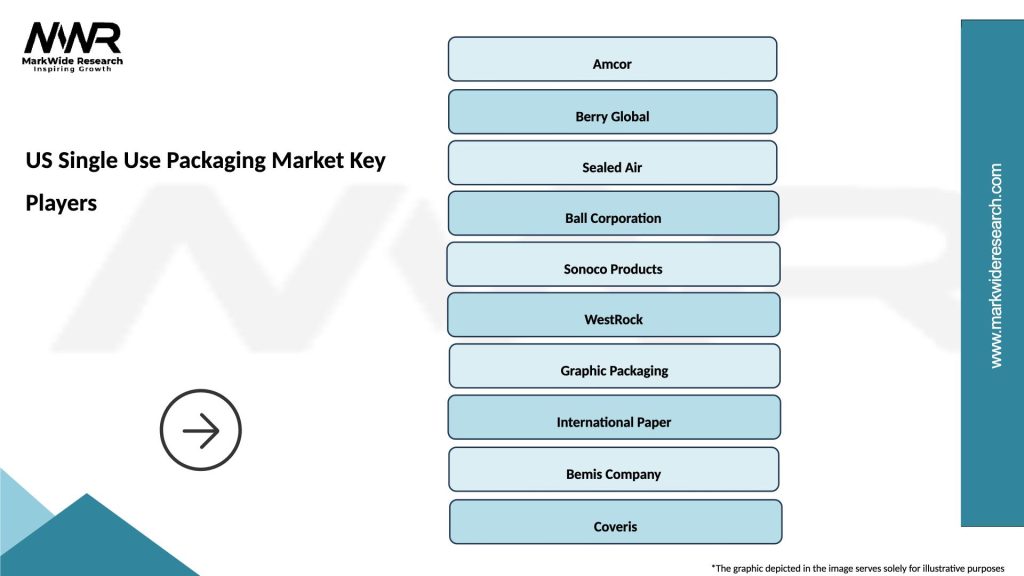

What are the key players in the US Single Use Packaging Market?

Key players in the US Single Use Packaging Market include companies like Amcor, Sealed Air Corporation, and Berry Global. These companies are known for their innovative packaging solutions and extensive product offerings, among others.

What are the main drivers of growth in the US Single Use Packaging Market?

The main drivers of growth in the US Single Use Packaging Market include the increasing demand for convenience in food and beverage sectors, the rise of e-commerce, and consumer preferences for ready-to-eat products. Additionally, sustainability trends are influencing packaging innovations.

What challenges does the US Single Use Packaging Market face?

The US Single Use Packaging Market faces challenges such as increasing regulatory pressures regarding waste management and environmental impact. Additionally, there is growing consumer awareness and demand for sustainable alternatives, which can complicate production processes.

What opportunities exist in the US Single Use Packaging Market?

Opportunities in the US Single Use Packaging Market include the development of biodegradable and compostable packaging materials. Companies are also exploring smart packaging technologies that enhance user experience and product safety.

What trends are shaping the US Single Use Packaging Market?

Trends shaping the US Single Use Packaging Market include a shift towards eco-friendly materials, increased automation in packaging processes, and the integration of technology for enhanced functionality. These trends reflect changing consumer preferences and regulatory landscapes.

US Single Use Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plastics, Paper, Biodegradable, Foam |

| Packaging Type | Trays, Bags, Containers, Wraps |

| End User | Food Service, Retail, Healthcare, E-commerce |

| Material | Polyethylene, Polypropylene, Cardboard, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Single Use Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at