444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Property and Casualty (P&C) Insurance Market represents one of the most dynamic and essential sectors within the American financial services industry. This comprehensive market encompasses a wide range of insurance products designed to protect individuals and businesses against property damage and liability risks. Market dynamics indicate robust growth driven by increasing awareness of risk management, regulatory changes, and evolving consumer needs across residential and commercial segments.

Current market conditions reflect a period of significant transformation, with the industry experiencing growth rates of approximately 4.2% annually. The market demonstrates remarkable resilience despite challenges from natural disasters, economic fluctuations, and changing regulatory landscapes. Digital transformation initiatives have accelerated adoption of innovative technologies, including artificial intelligence, telematics, and blockchain solutions that enhance underwriting accuracy and customer experience.

Regional distribution shows concentrated activity in major metropolitan areas, with California, Texas, Florida, and New York representing approximately 45% of total market activity. The market structure includes diverse participants ranging from large national carriers to specialized regional insurers, creating a competitive environment that benefits consumers through improved products and pricing strategies.

The US Property and Casualty Insurance Market refers to the comprehensive sector that provides financial protection against property damage and liability risks for individuals, businesses, and organizations across the United States. This market encompasses various insurance products including auto insurance, homeowners insurance, commercial property insurance, general liability coverage, and specialty lines that address specific industry risks.

Property insurance components protect against physical damage to buildings, equipment, inventory, and personal belongings caused by covered perils such as fire, theft, vandalism, and natural disasters. Casualty insurance elements provide liability protection when policyholders are legally responsible for bodily injury or property damage to third parties, including legal defense costs and settlement payments.

Market participants include insurance carriers that underwrite risks, independent agents and brokers who distribute products, reinsurance companies that provide risk transfer mechanisms, and various service providers supporting claims processing, risk assessment, and regulatory compliance activities throughout the insurance value chain.

Strategic analysis reveals the US Property and Casualty Insurance Market maintains strong fundamentals supported by mandatory coverage requirements, economic growth, and increasing risk awareness among consumers and businesses. The market benefits from diverse revenue streams across personal and commercial lines, with auto insurance representing the largest segment followed by homeowners and commercial property coverage.

Technology adoption has accelerated significantly, with approximately 68% of insurers implementing advanced analytics and digital platforms to improve operational efficiency and customer engagement. InsurTech innovations continue reshaping traditional business models through usage-based insurance, parametric products, and automated claims processing solutions that reduce costs while enhancing service quality.

Regulatory environment remains supportive yet challenging, with state-level oversight creating opportunities for market expansion while requiring compliance with varying requirements across jurisdictions. Climate change impacts increasingly influence underwriting practices and pricing strategies, particularly for property coverage in catastrophe-prone regions where insurers adapt risk models to address evolving exposure patterns.

Competitive landscape features established market leaders alongside emerging digital-native insurers that leverage technology advantages to capture market share. Consolidation trends continue as companies seek scale advantages and operational efficiencies through strategic acquisitions and partnerships that expand geographic reach and product capabilities.

Market intelligence indicates several critical trends shaping the US Property and Casualty Insurance landscape. Customer expectations have evolved significantly, with policyholders demanding seamless digital experiences, transparent pricing, and rapid claims resolution that matches service standards established by leading technology companies.

Primary growth drivers propelling the US Property and Casualty Insurance Market include mandatory coverage requirements, economic expansion, and increasing risk awareness across consumer and business segments. Regulatory mandates for auto insurance and mortgage-related property coverage create stable demand foundations that support consistent market growth regardless of economic cycles.

Economic prosperity drives increased property values and business investments, expanding the total insurable value base and creating opportunities for coverage expansion. Urbanization trends concentrate higher-value properties in metropolitan areas, increasing demand for comprehensive protection against various perils including theft, liability, and natural disasters.

Technology advancement enables more accurate risk assessment and pricing, allowing insurers to expand coverage to previously underserved markets while maintaining profitability. Telematics adoption in auto insurance has reached approximately 32% market penetration, enabling usage-based pricing models that attract safety-conscious consumers seeking premium discounts.

Climate change awareness paradoxically drives market growth as property owners recognize increased exposure to severe weather events and seek enhanced protection. Business continuity concerns following recent disruptions have elevated commercial insurance demand, particularly for coverage addressing operational interruptions and supply chain risks.

Significant challenges facing the US Property and Casualty Insurance Market include increasing catastrophe losses, regulatory complexity, and competitive pricing pressures that compress profit margins. Natural disaster frequency and severity have intensified, creating substantial claims costs that strain insurer profitability and force premium increases that may reduce affordability for some consumers.

Regulatory fragmentation across 50 state jurisdictions creates compliance complexity and operational inefficiencies that increase administrative costs. Rate approval processes in some states limit insurers’ ability to adjust pricing promptly in response to changing risk conditions, potentially creating market distortions and capacity constraints.

Fraud activities continue imposing significant costs on the industry, with estimated annual fraud losses representing approximately 10-15% of total claims payments. Legal system trends including social inflation and litigation financing have increased settlement costs and legal expenses, particularly affecting commercial liability and auto insurance segments.

Technology implementation costs require substantial capital investments that may strain smaller insurers’ resources while creating competitive disadvantages. Cybersecurity risks pose increasing threats to insurers’ operations and customer data, necessitating ongoing investments in security infrastructure and risk management capabilities.

Emerging opportunities within the US Property and Casualty Insurance Market include untapped customer segments, innovative product development, and technology-enabled service enhancements. Underserved demographics including millennials and gig economy workers represent significant growth potential as these groups establish households and require comprehensive insurance protection.

Product innovation opportunities exist in addressing emerging risks such as cyber liability, climate change impacts, and sharing economy exposures that traditional coverage may not adequately address. Parametric insurance products utilizing satellite data and weather indices offer potential for rapid claims settlement and reduced administrative costs.

Distribution channel expansion through digital platforms and strategic partnerships with non-traditional entities creates opportunities to reach new customer segments. Embedded insurance integrated into purchase processes for vehicles, homes, and business services represents a growing market opportunity with projected adoption rates of 25-30% over the next five years.

Data monetization opportunities allow insurers to leverage vast information repositories for risk assessment, product development, and customer insights that create additional revenue streams. International expansion and specialty line development offer diversification benefits and access to higher-growth market segments with favorable risk-return profiles.

Complex interactions between supply and demand factors create dynamic market conditions that influence pricing, capacity, and product availability across the US Property and Casualty Insurance Market. Underwriting cycles continue affecting market conditions, with current trends indicating a gradual transition toward more disciplined pricing following several years of competitive pressure.

Capacity management remains critical as insurers balance growth objectives with risk management requirements. Reinsurance market conditions significantly influence primary insurers’ capacity and pricing strategies, particularly for catastrophe-exposed lines where reinsurance costs have increased substantially in recent years.

Customer behavior evolution drives market adaptation as policyholders increasingly expect digital-first experiences and personalized products. Price sensitivity varies significantly across market segments, with commercial buyers often prioritizing coverage breadth and service quality over premium costs, while personal lines customers frequently focus on price competitiveness.

Competitive intensity varies by line of business and geographic region, with some markets experiencing significant price competition while others maintain more disciplined pricing approaches. Market concentration shows the top 10 insurers controlling approximately 55% of total market share, creating both competitive challenges and opportunities for smaller specialized carriers.

Comprehensive research approach utilized multiple data sources and analytical methodologies to ensure accurate and reliable insights into the US Property and Casualty Insurance Market. Primary research included extensive interviews with industry executives, regulatory officials, and market participants across various segments and geographic regions to capture diverse perspectives and emerging trends.

Secondary research encompassed analysis of regulatory filings, industry reports, academic studies, and public company disclosures to establish quantitative baselines and validate qualitative findings. Data triangulation techniques ensured consistency and accuracy across multiple information sources while identifying potential discrepancies requiring additional investigation.

Market modeling incorporated statistical analysis of historical trends, regulatory changes, and economic indicators to project future market conditions and growth patterns. Scenario analysis evaluated potential impacts of various external factors including regulatory changes, economic conditions, and catastrophic events on market dynamics and competitive positioning.

Expert validation processes included review by industry specialists and academic researchers to ensure analytical rigor and practical relevance. Continuous monitoring of market developments and regulatory changes ensures research findings remain current and actionable for stakeholders across the insurance value chain.

Geographic distribution across the US Property and Casualty Insurance Market reveals significant regional variations in market size, growth rates, and competitive dynamics. California represents the largest single state market, accounting for approximately 12% of national premium volume, driven by high property values, large population, and diverse economic activity requiring comprehensive insurance protection.

Texas market demonstrates robust growth potential supported by population expansion, economic diversification, and increasing property values across major metropolitan areas. Florida’s unique characteristics include high catastrophe exposure and regulatory challenges that create both opportunities and risks for insurers operating in this dynamic market environment.

Northeast corridor including New York, New Jersey, and Pennsylvania features mature markets with established competitive structures and sophisticated regulatory frameworks. Market penetration rates in these regions typically exceed national averages, reflecting higher income levels and greater risk awareness among consumers and businesses.

Midwest markets offer stable growth opportunities with lower catastrophe exposure and favorable regulatory environments that attract insurer investment. Western states beyond California present emerging opportunities driven by population growth and economic development, though wildfire risks create underwriting challenges requiring specialized expertise and risk management capabilities.

Market leadership in the US Property and Casualty Insurance sector features a diverse mix of large national carriers, regional specialists, and emerging digital-native insurers. Competitive positioning varies significantly across product lines and geographic markets, with different companies maintaining advantages in specific segments based on operational capabilities, distribution networks, and risk management expertise.

Competitive strategies increasingly focus on technology adoption, customer experience enhancement, and operational efficiency improvements. Market share dynamics show gradual shifts as digital-native insurers gain traction while traditional carriers invest heavily in modernization efforts to maintain competitive positioning.

Market segmentation within the US Property and Casualty Insurance Market reflects diverse customer needs, risk profiles, and distribution preferences across multiple dimensions. Product-based segmentation reveals distinct characteristics and growth patterns across major coverage categories that require specialized underwriting expertise and risk management approaches.

By Coverage Type:

By Customer Segment:

Personal Auto Insurance continues dominating the US Property and Casualty market with stable demand driven by vehicle ownership requirements and regulatory mandates. Technology integration through telematics and mobile applications has transformed this segment, enabling usage-based pricing models that reward safe driving behaviors while providing insurers with enhanced risk assessment capabilities.

Homeowners Insurance demonstrates strong correlation with housing market conditions and mortgage lending activity. Climate change impacts increasingly influence underwriting practices and pricing strategies, particularly in catastrophe-prone regions where insurers implement sophisticated risk modeling and mitigation requirements to manage exposure concentrations.

Commercial Lines Insurance exhibits greater complexity and customization requirements compared to personal lines coverage. Risk management services have become increasingly important differentiators as businesses seek comprehensive solutions addressing operational risks, regulatory compliance, and business continuity concerns beyond traditional property and liability protection.

Specialty Lines Coverage including cyber liability, environmental liability, and professional indemnity represents the fastest-growing segment with adoption rates increasing approximately 15-20% annually. Emerging risks from technology adoption, regulatory changes, and evolving business models create ongoing opportunities for product innovation and market expansion.

Insurance Carriers benefit from diversified revenue streams, regulatory protection, and opportunities for operational efficiency improvements through technology adoption. Risk pooling mechanisms enable insurers to manage large exposures while generating consistent cash flows that support investment activities and capital growth strategies.

Policyholders receive financial protection against catastrophic losses that could otherwise threaten personal wealth or business continuity. Risk management services provided by insurers help customers identify and mitigate exposures while potentially reducing insurance costs through improved loss experience and safety programs.

Distribution Partners including agents and brokers benefit from recurring commission income and opportunities to build long-term client relationships through comprehensive risk management advisory services. Technology platforms provided by insurers enhance agent productivity and customer service capabilities while reducing administrative burdens.

Economic Benefits extend throughout the broader economy as insurance facilitates commerce, supports lending activities, and provides stability during crisis periods. Employment opportunities across underwriting, claims, sales, and support functions contribute to economic growth while developing specialized expertise that benefits the broader financial services sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the US Property and Casualty Insurance Market, with insurers investing heavily in artificial intelligence, machine learning, and automation technologies. Customer experience enhancement through mobile applications, chatbots, and self-service portals has become essential for competitive positioning and customer retention.

Usage-based insurance adoption continues accelerating, particularly in auto insurance where telematics programs now serve approximately 35% of eligible customers. Personalization trends extend beyond pricing to include customized coverage options, risk management recommendations, and communication preferences that reflect individual customer needs and behaviors.

Climate adaptation strategies increasingly influence business operations as insurers develop sophisticated catastrophe modeling capabilities and implement risk-based pricing that reflects evolving exposure patterns. Sustainability initiatives include green building discounts, renewable energy coverage, and environmental risk assessment that align with broader corporate responsibility objectives.

Partnership ecosystems expand as insurers collaborate with technology companies, data providers, and service vendors to enhance capabilities and market reach. InsurTech integration accelerates through strategic investments, acquisitions, and joint ventures that combine traditional insurance expertise with innovative technology solutions.

Recent developments within the US Property and Casualty Insurance Market reflect ongoing transformation driven by technology adoption, regulatory changes, and evolving customer expectations. Regulatory modernization efforts in several states have streamlined approval processes while maintaining consumer protection standards, enabling faster product innovation and market responsiveness.

Technology partnerships between established insurers and InsurTech companies have accelerated, with traditional carriers acquiring or investing in innovative startups to access advanced capabilities in artificial intelligence, blockchain, and data analytics. Digital-native insurers continue gaining market share through superior customer experiences and operational efficiency advantages.

Climate risk management has evolved significantly with insurers implementing advanced catastrophe modeling, parametric products, and risk mitigation requirements that address increasing severe weather exposure. Regulatory responses to climate change include updated building codes, disclosure requirements, and resilience standards that influence underwriting practices and pricing strategies.

Market consolidation continues through strategic acquisitions and mergers that create scale advantages and operational synergies. Distribution evolution includes expansion of direct-to-consumer channels, embedded insurance partnerships, and digital agency platforms that enhance market access and customer convenience.

Strategic recommendations for US Property and Casualty Insurance Market participants emphasize technology investment, customer experience enhancement, and risk management sophistication. MarkWide Research analysis indicates successful companies will prioritize digital transformation initiatives that improve operational efficiency while delivering superior customer value propositions.

Technology adoption should focus on artificial intelligence applications for underwriting, claims processing, and fraud detection that provide measurable returns on investment. Data strategy development requires comprehensive approaches to information collection, analysis, and application that enhance risk assessment accuracy and customer insights while ensuring privacy compliance.

Market positioning strategies should emphasize differentiation through specialized expertise, superior service delivery, or innovative product offerings rather than competing solely on price. Partnership development with technology providers, distribution channels, and service vendors can accelerate capability development while reducing implementation costs and risks.

Risk management enhancement requires sophisticated catastrophe modeling, diversification strategies, and capital management approaches that balance growth objectives with financial stability requirements. Regulatory engagement through industry associations and direct communication with regulators helps shape favorable policy environments while ensuring compliance readiness.

Long-term prospects for the US Property and Casualty Insurance Market remain positive despite near-term challenges from catastrophe losses, regulatory complexity, and competitive pressures. Market growth is projected to continue at approximately 3-5% annually over the next decade, driven by economic expansion, population growth, and increasing risk awareness across consumer and business segments.

Technology transformation will accelerate with artificial intelligence, machine learning, and automation becoming standard capabilities rather than competitive advantages. Customer expectations will continue evolving toward digital-first experiences, personalized products, and seamless service delivery that matches standards established by leading technology companies.

Climate change impacts will intensify, requiring sophisticated risk management approaches and potentially reshaping market dynamics in catastrophe-prone regions. MWR projections indicate successful insurers will develop advanced modeling capabilities and risk transfer mechanisms that enable continued coverage availability while maintaining profitability.

Regulatory evolution will likely include modernization efforts that balance innovation enablement with consumer protection, potentially creating opportunities for market expansion and product development. Market structure may experience continued consolidation as companies seek scale advantages, though regulatory oversight will likely prevent excessive concentration that could harm competition or consumer choice.

The US Property and Casualty Insurance Market stands at a critical juncture where traditional business models intersect with transformative technology capabilities and evolving customer expectations. Market fundamentals remain strong, supported by regulatory requirements, economic growth, and increasing risk awareness that drive consistent demand for comprehensive insurance protection across personal and commercial segments.

Technology adoption will continue reshaping competitive dynamics as insurers leverage artificial intelligence, data analytics, and digital platforms to enhance operational efficiency and customer experience. Successful market participants will balance innovation investments with risk management discipline while maintaining focus on core underwriting principles and customer value creation.

Future success in this dynamic market requires strategic vision, operational excellence, and adaptive capabilities that enable response to changing conditions while capitalizing on emerging opportunities. The US Property and Casualty Insurance Market will continue serving as a critical foundation for economic stability and growth, providing essential risk management solutions that protect individuals, businesses, and communities across the nation.

What is Property and Casualty (P&C) Insurance?

Property and Casualty (P&C) Insurance refers to a type of insurance that provides coverage for property loss and liability for damages to others. It encompasses various policies, including auto, home, and commercial insurance, protecting individuals and businesses from financial losses due to unforeseen events.

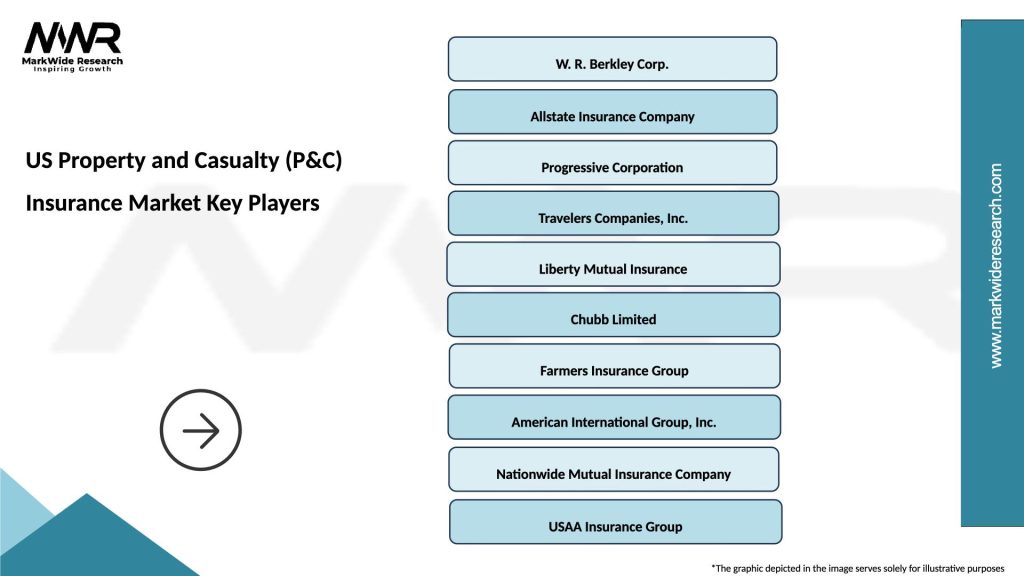

Who are the key players in the US Property and Casualty (P&C) Insurance Market?

Key players in the US Property and Casualty (P&C) Insurance Market include State Farm, Allstate, and Berkshire Hathaway, among others. These companies offer a range of insurance products and services to meet the diverse needs of consumers and businesses.

What are the main drivers of growth in the US Property and Casualty (P&C) Insurance Market?

The main drivers of growth in the US Property and Casualty (P&C) Insurance Market include increasing consumer awareness of insurance products, the rise in natural disasters leading to higher demand for coverage, and the growth of the real estate market, which boosts property insurance needs.

What challenges does the US Property and Casualty (P&C) Insurance Market face?

The US Property and Casualty (P&C) Insurance Market faces challenges such as regulatory changes, rising claims costs due to climate change, and increased competition from insurtech companies that are disrupting traditional business models.

What opportunities exist in the US Property and Casualty (P&C) Insurance Market?

Opportunities in the US Property and Casualty (P&C) Insurance Market include the adoption of technology for better customer service, the development of personalized insurance products, and the expansion into underserved markets, which can enhance growth potential.

What trends are shaping the US Property and Casualty (P&C) Insurance Market?

Trends shaping the US Property and Casualty (P&C) Insurance Market include the increasing use of artificial intelligence for underwriting and claims processing, the rise of usage-based insurance models, and a growing focus on sustainability and environmental considerations in policy offerings.

US Property and Casualty (P&C) Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Auto Insurance, Homeowners Insurance, Commercial Property Insurance, Liability Insurance |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Coverage Type | Comprehensive, Collision, Personal Injury Protection, Uninsured Motorist |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Property and Casualty (P&C) Insurance Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at