444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US pressure sensitive adhesives market represents a dynamic and rapidly evolving sector within the broader adhesives industry, characterized by exceptional growth potential and technological innovation. Pressure sensitive adhesives (PSAs) have become indispensable components across numerous industries, from packaging and automotive to healthcare and electronics. The market demonstrates remarkable resilience and adaptability, driven by increasing demand for sustainable solutions and advanced bonding technologies.

Market dynamics indicate substantial expansion opportunities, with the sector experiencing robust growth at a CAGR of 5.8% over the forecast period. This growth trajectory reflects the increasing adoption of PSA technologies across diverse applications, particularly in e-commerce packaging, medical devices, and automotive manufacturing. The market’s strength lies in its ability to provide immediate adhesion without requiring heat, water, or solvents for activation.

Regional distribution shows concentrated activity across major industrial hubs, with significant market presence in the Midwest, Southeast, and West Coast regions. The market benefits from strong manufacturing infrastructure, established supply chains, and proximity to key end-user industries. Technology penetration rates continue to accelerate, with water-based and hot-melt PSAs gaining 65% market share due to environmental considerations and performance advantages.

The US pressure sensitive adhesives market refers to the comprehensive ecosystem encompassing the production, distribution, and application of adhesive materials that form bonds when pressure is applied at room temperature. These specialized adhesives maintain their tackiness in dry form and adhere instantly to various substrates without requiring additional activation mechanisms such as heat, water, or chemical catalysts.

Pressure sensitive adhesives are characterized by their unique viscoelastic properties, combining the flow characteristics of liquids with the elastic properties of solids. This distinctive behavior enables them to wet surfaces quickly under light pressure while maintaining sufficient cohesive strength to resist removal. The technology encompasses various formulations including acrylics, rubber-based systems, silicones, and hybrid compositions, each designed for specific performance requirements and application conditions.

Strategic market analysis reveals the US pressure sensitive adhesives market as a cornerstone of modern manufacturing and packaging operations. The sector demonstrates exceptional resilience and growth potential, driven by evolving consumer preferences, technological advancements, and increasing emphasis on sustainable solutions. Market penetration continues to expand across traditional and emerging applications, with notable growth in healthcare, electronics, and automotive sectors.

Key performance indicators highlight the market’s robust fundamentals, with water-based PSAs capturing 42% adoption rate among environmentally conscious manufacturers. The competitive landscape features established players alongside innovative startups, creating a dynamic environment that fosters technological advancement and market expansion. Supply chain optimization remains a critical success factor, with companies investing heavily in production capacity and distribution networks.

Future projections indicate sustained growth momentum, supported by increasing demand for flexible packaging solutions, medical device applications, and automotive lightweighting initiatives. The market’s evolution toward sustainable formulations and enhanced performance characteristics positions it favorably for long-term expansion and value creation across multiple industry verticals.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the US pressure sensitive adhesives sector:

Primary growth drivers propelling the US pressure sensitive adhesives market forward encompass both traditional demand factors and emerging technological trends. The e-commerce revolution continues to generate substantial demand for packaging solutions, with online retail growth directly correlating to increased PSA consumption across various packaging applications.

Healthcare sector expansion represents another significant driver, as medical device manufacturers increasingly rely on specialized PSAs for wound care, diagnostic equipment, and wearable health monitors. The aging population and growing focus on home healthcare solutions create sustained demand for medical-grade adhesive products with biocompatible properties and skin-friendly characteristics.

Automotive industry transformation toward electric vehicles and lightweight construction drives demand for advanced PSAs that enable weight reduction while maintaining structural integrity. These applications require adhesives with enhanced temperature resistance, durability, and bonding strength to meet stringent automotive performance standards.

Sustainability initiatives across industries fuel demand for environmentally friendly PSA formulations. Companies seeking to reduce their carbon footprint and meet regulatory requirements increasingly specify water-based, solvent-free, and bio-based adhesive solutions, creating opportunities for innovative product development.

Market challenges facing the US pressure sensitive adhesives sector include raw material price volatility, which significantly impacts production costs and profit margins. Petroleum-based feedstocks used in traditional PSA formulations experience price fluctuations that create uncertainty for manufacturers and end-users alike, necessitating careful supply chain management and pricing strategies.

Regulatory compliance costs present ongoing challenges as environmental regulations become increasingly stringent. Manufacturers must invest substantially in research and development to create compliant formulations while maintaining performance characteristics, often resulting in higher product costs and extended development timelines.

Technical limitations in certain applications constrain market expansion, particularly where extreme temperature resistance, chemical compatibility, or specialized performance characteristics are required. Developing PSAs that meet these demanding requirements while remaining cost-effective represents a significant technical and commercial challenge.

Competition from alternative technologies such as mechanical fasteners, structural adhesives, and emerging bonding methods creates pressure on PSA market share in specific applications. Companies must continuously innovate to maintain competitive advantages and defend market positions against these alternative solutions.

Emerging opportunities within the US pressure sensitive adhesives market span multiple high-growth sectors and technological frontiers. The rapid expansion of flexible electronics and wearable technology creates demand for specialized PSAs with unique properties including transparency, conductivity, and ultra-thin profiles that enable next-generation device designs.

Sustainable packaging initiatives present substantial growth opportunities as companies seek alternatives to traditional packaging materials. PSAs that enable recyclable packaging designs, facilitate easy label removal, and support circular economy principles align with evolving market demands and regulatory requirements.

Healthcare innovation continues to generate new application areas, particularly in telemedicine, remote patient monitoring, and advanced wound care. These applications require PSAs with specialized properties including biocompatibility, breathability, and extended wear capabilities that command premium pricing.

Infrastructure modernization projects across the United States create opportunities for construction-grade PSAs used in building materials, insulation systems, and architectural applications. The focus on energy efficiency and sustainable construction practices drives demand for high-performance adhesive solutions.

Market dynamics within the US pressure sensitive adhesives sector reflect a complex interplay of supply and demand factors, technological evolution, and competitive pressures. MarkWide Research analysis indicates that market equilibrium continues to shift toward value-added products and specialized applications, with commodity PSAs facing increased price pressure and margin compression.

Supply chain dynamics have evolved significantly, with manufacturers implementing strategies to reduce dependency on single-source suppliers and geographic concentration risks. Diversification of raw material sources and production locations helps mitigate supply disruptions while maintaining cost competitiveness and quality standards.

Demand patterns show increasing sophistication, with end-users requiring more specialized products tailored to specific applications. This trend drives market fragmentation and creates opportunities for niche players while challenging large manufacturers to maintain broad product portfolios and technical expertise.

Innovation cycles continue to accelerate, with new product introductions occurring more frequently as companies respond to evolving market needs. The integration of digital technologies into manufacturing processes enables more rapid product development and customization capabilities, improving market responsiveness and customer satisfaction.

Comprehensive research methodology employed in analyzing the US pressure sensitive adhesives market encompasses multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves extensive interviews with industry executives, technical specialists, and end-user representatives across key market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry publications, company financial reports, patent filings, and regulatory documents to develop a comprehensive understanding of market structure and competitive dynamics. This approach provides historical context and identifies emerging trends that may impact future market development.

Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and regional distribution patterns. These models incorporate multiple variables including economic indicators, industry growth rates, and technological adoption patterns to generate reliable forecasts.

Qualitative assessment focuses on understanding market drivers, restraints, and opportunities through expert interviews and industry observation. This approach provides context for quantitative findings and helps identify factors that may not be apparent through numerical analysis alone.

Regional market distribution across the United States reveals distinct patterns of concentration and growth, with the Midwest region maintaining 35% market share due to its strong manufacturing base and proximity to automotive and packaging industries. States like Ohio, Michigan, and Illinois serve as major production and consumption centers, benefiting from established industrial infrastructure and skilled workforce availability.

Southeast region demonstrates rapid growth momentum, capturing 28% market share through expansion of manufacturing facilities and favorable business conditions. States including North Carolina, South Carolina, and Georgia attract PSA manufacturers with competitive operating costs, strategic transportation access, and supportive regulatory environments.

West Coast markets represent 22% market share, driven primarily by technology sector demand and innovative applications in electronics, aerospace, and healthcare industries. California’s concentration of high-tech companies creates demand for specialized PSAs with unique performance characteristics and stringent quality requirements.

Northeast corridor maintains 15% market share, supported by pharmaceutical, medical device, and specialty packaging industries. The region’s focus on high-value applications and technical innovation creates opportunities for premium PSA products despite higher operating costs and regulatory complexity.

Competitive dynamics within the US pressure sensitive adhesives market feature a diverse mix of multinational corporations, regional specialists, and innovative technology companies. The landscape continues to evolve through mergers, acquisitions, and strategic partnerships that reshape market structure and competitive positioning.

Market leaders maintain competitive advantages through comprehensive product portfolios, extensive distribution networks, and substantial research and development capabilities:

Market segmentation analysis reveals the US pressure sensitive adhesives market’s complexity and diversity across multiple dimensions. Technology-based segmentation shows water-based PSAs leading with 45% market share, followed by hot-melt formulations and solvent-based systems, reflecting the industry’s shift toward environmentally friendly solutions.

By Technology:

By Application:

Packaging applications continue to dominate the US pressure sensitive adhesives market, representing the largest consumption category with diverse sub-segments including labels, tapes, and flexible packaging materials. This category benefits from e-commerce growth, consumer goods expansion, and increasing demand for sustainable packaging solutions that enable recycling and reuse.

Automotive applications demonstrate exceptional growth potential, driven by industry transformation toward electric vehicles and lightweight construction. PSAs enable weight reduction while maintaining structural integrity, supporting fuel efficiency goals and performance requirements. Advanced formulations provide temperature resistance, durability, and bonding strength essential for automotive applications.

Healthcare applications represent a high-value segment with specialized requirements including biocompatibility, skin-friendliness, and regulatory compliance. Medical device manufacturers increasingly rely on PSAs for wound care products, diagnostic equipment, and wearable health monitors, creating opportunities for premium-priced specialized formulations.

Electronics applications encompass both traditional and emerging technologies, from consumer electronics to flexible displays and wearable devices. This category requires PSAs with unique properties including transparency, conductivity, and ultra-thin profiles that enable next-generation device designs and manufacturing processes.

Manufacturing benefits for PSA producers include opportunities for product differentiation, premium pricing, and market expansion through technological innovation. Companies investing in sustainable formulations and advanced performance characteristics can capture market share while commanding higher margins in specialized applications.

End-user advantages encompass improved product performance, cost optimization, and sustainability benefits. PSAs enable design flexibility, manufacturing efficiency, and end-product functionality that traditional bonding methods cannot achieve, creating value throughout the supply chain.

Supply chain benefits include reduced inventory requirements, simplified logistics, and improved quality control through standardized PSA products. Distributors and converters benefit from product consistency, technical support, and market development assistance provided by PSA manufacturers.

Environmental benefits result from the industry’s transition toward sustainable formulations, reduced VOC emissions, and recyclable product designs. These advantages align with corporate sustainability goals and regulatory requirements while creating competitive differentiation opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the US pressure sensitive adhesives market, with manufacturers investing heavily in bio-based raw materials, water-based formulations, and recyclable product designs. This trend reflects growing environmental consciousness among end-users and increasingly stringent regulatory requirements.

Digital integration continues to revolutionize manufacturing processes, with smart sensors, automation systems, and data analytics improving production efficiency and product quality. These technologies enable real-time monitoring, predictive maintenance, and customized production capabilities that enhance competitiveness.

Application diversification expands beyond traditional markets into emerging sectors including flexible electronics, wearable technology, and advanced healthcare devices. These applications require specialized PSA properties and create opportunities for premium-priced products with unique performance characteristics.

Supply chain localization gains momentum as companies seek to reduce dependency on global supply chains and improve responsiveness to customer needs. This trend drives investment in domestic production capacity and regional distribution networks, creating opportunities for local suppliers and service providers.

Recent industry developments highlight the dynamic nature of the US pressure sensitive adhesives market and the continuous evolution of technologies, applications, and business models. MWR analysis indicates accelerating innovation cycles and increasing collaboration between PSA manufacturers and end-users to develop customized solutions.

Technology breakthroughs in bio-based formulations have enabled PSA manufacturers to reduce petroleum dependency while maintaining performance characteristics. These developments support sustainability goals and create differentiation opportunities in environmentally conscious market segments.

Strategic partnerships between PSA manufacturers and technology companies facilitate development of next-generation applications in electronics, healthcare, and automotive sectors. These collaborations combine adhesive expertise with application knowledge to create innovative solutions.

Capacity expansion projects across multiple regions reflect growing market confidence and demand projections. Companies are investing in new production facilities and upgrading existing operations to meet increasing demand while improving efficiency and sustainability performance.

Strategic recommendations for market participants emphasize the importance of sustainable innovation, customer collaboration, and operational excellence in maintaining competitive advantages. Companies should prioritize development of environmentally friendly formulations while ensuring performance characteristics meet evolving application requirements.

Investment priorities should focus on research and development capabilities, manufacturing flexibility, and supply chain resilience. These investments enable companies to respond quickly to market changes while maintaining quality standards and cost competitiveness across diverse applications.

Market positioning strategies should emphasize technical expertise, customer service, and solution development capabilities rather than competing solely on price. Value-added services including technical support, application development, and supply chain optimization create sustainable competitive advantages.

Partnership opportunities with end-users, technology companies, and research institutions can accelerate innovation and market development. These collaborations provide access to new applications, technologies, and markets while sharing development costs and risks.

Future projections for the US pressure sensitive adhesives market indicate sustained growth momentum driven by technological advancement, application diversification, and sustainability initiatives. MarkWide Research forecasts continued expansion across traditional and emerging market segments, with particular strength in healthcare, electronics, and sustainable packaging applications.

Technology evolution will continue toward more sustainable formulations, enhanced performance characteristics, and specialized applications. Bio-based materials, smart adhesives, and recyclable formulations represent key development areas that will shape future market dynamics and competitive positioning.

Market structure is expected to become increasingly specialized, with companies focusing on specific applications or technologies rather than broad commodity markets. This trend creates opportunities for niche players while challenging large manufacturers to maintain comprehensive capabilities.

Growth acceleration is anticipated in emerging applications including flexible electronics, advanced healthcare devices, and sustainable packaging solutions. These high-value segments offer attractive margins and growth potential for companies with appropriate technical capabilities and market positioning.

The US pressure sensitive adhesives market represents a dynamic and evolving sector with substantial growth potential across multiple industries and applications. Market fundamentals remain strong, supported by technological innovation, application diversification, and increasing demand for sustainable solutions. The sector’s ability to adapt to changing market requirements while maintaining performance standards positions it favorably for continued expansion.

Strategic success factors include investment in sustainable technologies, customer collaboration, and operational excellence. Companies that prioritize these areas while maintaining technical expertise and market responsiveness will be best positioned to capitalize on emerging opportunities and navigate market challenges.

Future market development will be shaped by sustainability initiatives, technological advancement, and application innovation. The transition toward environmentally friendly formulations, coupled with growing demand in healthcare, electronics, and automotive sectors, creates a favorable environment for sustained growth and value creation throughout the US pressure sensitive adhesives market ecosystem.

What is Pressure Sensitive Adhesives?

Pressure sensitive adhesives (PSAs) are adhesive substances that bond to surfaces when pressure is applied, without the need for heat or solvents. They are widely used in applications such as labels, tapes, and medical devices.

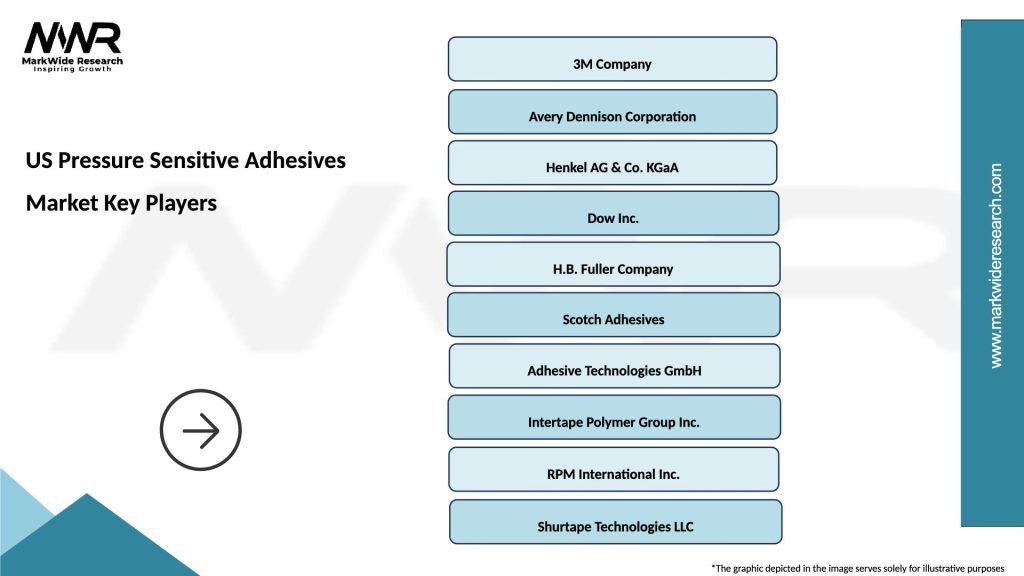

What are the key players in the US Pressure Sensitive Adhesives Market?

Key players in the US Pressure Sensitive Adhesives Market include companies like Avery Dennison Corporation, 3M Company, Henkel AG, and Sika AG, among others.

What are the main drivers of the US Pressure Sensitive Adhesives Market?

The main drivers of the US Pressure Sensitive Adhesives Market include the growing demand for packaging solutions, the rise in automotive applications, and the increasing use of PSAs in electronics and medical sectors.

What challenges does the US Pressure Sensitive Adhesives Market face?

Challenges in the US Pressure Sensitive Adhesives Market include fluctuating raw material prices, environmental regulations regarding solvent-based adhesives, and competition from alternative bonding technologies.

What opportunities exist in the US Pressure Sensitive Adhesives Market?

Opportunities in the US Pressure Sensitive Adhesives Market include the development of eco-friendly adhesives, advancements in adhesive technology, and the growing trend of automation in manufacturing processes.

What trends are shaping the US Pressure Sensitive Adhesives Market?

Trends shaping the US Pressure Sensitive Adhesives Market include the increasing demand for sustainable products, innovations in adhesive formulations, and the expansion of applications in the automotive and healthcare industries.

US Pressure Sensitive Adhesives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Water-Based, Solvent-Based, Hot Melt, Reactive |

| End Use Industry | Automotive, Electronics, Packaging, Healthcare |

| Form | Rolls, Sheets, Tapes, Dots |

| Technology | Pressure Sensitive, Thermosetting, Thermoplastic, Biodegradable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Pressure Sensitive Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at