444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US prefabricated building market represents a transformative sector within the construction industry, characterized by the manufacturing of building components in controlled factory environments before assembly at construction sites. This innovative approach to construction has gained substantial momentum across residential, commercial, and industrial applications, driven by increasing demand for cost-effective, time-efficient, and sustainable building solutions. The market encompasses various prefabrication methods including modular construction, panelized systems, and manufactured housing, each offering distinct advantages in terms of quality control, reduced waste, and accelerated project timelines.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% over the forecast period. This expansion is fueled by technological advancements in manufacturing processes, growing awareness of environmental benefits, and increasing adoption by both residential and commercial developers. The integration of advanced materials, digital design tools, and automated manufacturing systems has significantly enhanced the quality and customization capabilities of prefabricated buildings, making them increasingly competitive with traditional construction methods.

Regional distribution shows concentrated activity in states with high construction demand and favorable regulatory environments, with California, Texas, and Florida leading market adoption. The sector benefits from strong support across diverse applications, from affordable housing initiatives to large-scale commercial developments, positioning prefabricated construction as a viable solution for addressing the nation’s growing infrastructure needs.

The US prefabricated building market refers to the comprehensive ecosystem of companies, technologies, and processes involved in the design, manufacture, and assembly of building components or complete structures in controlled factory environments before transportation and installation at final construction sites. This market encompasses the entire value chain from raw material suppliers and component manufacturers to design firms, logistics providers, and installation contractors who collectively deliver prefabricated building solutions across residential, commercial, and industrial sectors.

Prefabricated construction fundamentally differs from traditional on-site building methods by leveraging factory-controlled environments to achieve superior quality control, reduced material waste, and accelerated construction timelines. The market includes various prefabrication approaches such as modular construction, where complete room-sized sections are manufactured off-site, panelized systems that involve pre-assembled wall and floor panels, and manufactured housing that produces complete residential units in factory settings.

Key characteristics of this market include standardized manufacturing processes, advanced quality control systems, integrated supply chain management, and sophisticated logistics networks that enable efficient transportation and assembly of prefabricated components. The sector serves diverse customer segments ranging from individual homeowners and small developers to large-scale commercial enterprises and government agencies seeking efficient, cost-effective building solutions.

The US prefabricated building market stands at the forefront of construction industry transformation, offering compelling advantages in cost efficiency, construction speed, and environmental sustainability. The sector has evolved from traditional manufactured housing to encompass sophisticated modular construction systems, advanced panelized building solutions, and innovative hybrid approaches that combine multiple prefabrication technologies. This evolution reflects growing market maturity and increasing acceptance among mainstream construction stakeholders.

Market penetration has reached approximately 15% of total construction activity in key segments, with particularly strong adoption in residential construction where time-to-market advantages and cost predictability drive demand. The commercial sector shows increasing interest in prefabricated solutions for office buildings, retail facilities, and educational institutions, while industrial applications benefit from the scalability and customization capabilities of modern prefabrication systems.

Technological advancement serves as a primary market driver, with manufacturers investing heavily in automated production systems, digital design platforms, and advanced materials that enhance both product quality and manufacturing efficiency. The integration of Building Information Modeling (BIM), robotics, and sustainable materials has positioned prefabricated construction as a technologically advanced alternative to traditional building methods, attracting forward-thinking developers and construction professionals.

Regulatory support continues to strengthen, with building codes increasingly accommodating prefabricated construction methods and government initiatives promoting affordable housing solutions that leverage prefabrication technologies. This regulatory evolution, combined with growing environmental consciousness and labor shortage concerns in traditional construction, creates favorable conditions for sustained market expansion.

Market segmentation reveals distinct growth patterns across different prefabrication categories, with modular construction leading in terms of technological sophistication and commercial adoption. The residential segment accounts for the largest market share, driven by housing affordability challenges and the need for rapid deployment of quality housing solutions. Commercial applications show the highest growth rates, reflecting increasing acceptance of prefabricated solutions in office, retail, and institutional construction projects.

Geographic concentration shows strong market development in regions with high construction demand, supportive regulatory frameworks, and established manufacturing infrastructure. The West Coast leads in innovation and adoption, while the Southeast demonstrates rapid growth in manufacturing capacity and market penetration.

Housing affordability crisis represents the most significant driver propelling prefabricated building market growth, as traditional construction costs continue to escalate beyond the reach of many potential homeowners. Prefabricated construction offers a viable solution by reducing both material costs and labor expenses through efficient factory-based manufacturing processes. The ability to achieve economies of scale in controlled environments enables manufacturers to deliver quality housing at more accessible price points, addressing critical affordability gaps in markets across the United States.

Construction labor shortages create compelling demand for prefabricated solutions that require fewer on-site workers and can leverage skilled factory-based labor more efficiently. The construction industry faces persistent challenges in recruiting and retaining qualified workers, particularly in skilled trades essential for traditional building methods. Prefabricated construction addresses these challenges by concentrating skilled work in factory environments where productivity can be optimized and working conditions are more controlled and predictable.

Environmental sustainability concerns drive increasing adoption of prefabricated building methods that demonstrate superior environmental performance compared to traditional construction. Factory-controlled manufacturing processes enable precise material utilization, reducing waste generation and improving resource efficiency. Additionally, the ability to integrate advanced insulation systems and energy-efficient components during factory assembly results in buildings with enhanced environmental performance throughout their operational lifecycle.

Technological advancement in manufacturing systems, design software, and materials science continues to expand the capabilities and applications of prefabricated construction. Advanced computer-aided design tools enable complex architectural configurations while automated manufacturing systems ensure precision and consistency. The integration of smart building technologies and sustainable materials during the factory assembly process creates opportunities for enhanced building performance that would be difficult to achieve through traditional construction methods.

Regulatory barriers continue to pose significant challenges for prefabricated building market expansion, as building codes and zoning regulations in many jurisdictions remain oriented toward traditional construction methods. Local building departments may lack familiarity with prefabricated construction techniques, leading to extended approval processes and additional compliance requirements. These regulatory hurdles can offset some of the time and cost advantages that prefabricated construction typically offers, particularly in markets where local officials are conservative about approving innovative building methods.

Transportation limitations constrain the size and configuration of prefabricated building components, potentially limiting architectural flexibility and increasing project complexity. Highway weight restrictions, bridge clearances, and route accessibility requirements impose practical constraints on the dimensions of prefabricated modules and panels. These transportation challenges can necessitate additional on-site assembly work or require specialized transportation equipment, potentially reducing the cost and time advantages of prefabricated construction.

Market perception challenges persist among some consumers and construction professionals who associate prefabricated construction with lower quality or limited design options. Historical associations with basic manufactured housing or temporary structures can create resistance to modern prefabricated building solutions, despite significant improvements in quality, design flexibility, and performance. Overcoming these perceptions requires ongoing education and demonstration of successful prefabricated projects across diverse applications and market segments.

Initial capital requirements for establishing prefabricated manufacturing facilities represent substantial barriers to entry for new market participants. The investment required for factory facilities, specialized equipment, and skilled workforce development can be prohibitive for smaller companies seeking to enter the prefabricated building market. These capital intensity requirements tend to favor larger, established manufacturers while limiting market competition and innovation from smaller, more agile companies.

Government housing initiatives present substantial opportunities for prefabricated building market expansion, as federal, state, and local agencies seek efficient solutions for affordable housing development. Public sector projects often prioritize cost effectiveness, construction speed, and quality consistency—all areas where prefabricated construction demonstrates clear advantages. The growing recognition of prefabricated construction’s potential to address housing shortages creates opportunities for manufacturers to participate in large-scale public housing programs and disaster relief efforts.

Commercial construction adoption offers significant growth potential as businesses recognize the advantages of prefabricated construction for office buildings, retail facilities, and industrial structures. The ability to maintain business operations while construction occurs off-site, combined with predictable timelines and costs, makes prefabricated construction attractive for commercial developers. Growing acceptance of modular office buildings and retail structures demonstrates expanding market opportunities beyond traditional residential applications.

Sustainable building demand creates opportunities for prefabricated manufacturers to differentiate their offerings through enhanced environmental performance and green building certifications. The controlled factory environment enables integration of advanced sustainable materials and energy-efficient systems that can be difficult to implement consistently in traditional construction. As environmental regulations become more stringent and green building standards gain importance, prefabricated construction’s sustainability advantages become increasingly valuable market differentiators.

Technology integration opportunities enable prefabricated building manufacturers to incorporate smart building systems, advanced materials, and innovative construction techniques that enhance building performance and user experience. The factory environment provides ideal conditions for integrating complex building systems and testing their performance before delivery to construction sites. These technological capabilities position prefabricated construction as a platform for building innovation rather than simply a cost-reduction strategy.

Supply chain evolution within the prefabricated building market reflects increasing vertical integration as manufacturers seek greater control over quality, costs, and delivery schedules. Leading companies are expanding their capabilities to include raw material processing, component manufacturing, logistics, and installation services. This integration enables better coordination across the entire project lifecycle while providing opportunities for margin improvement and quality enhancement throughout the value chain.

Competitive landscape dynamics show traditional construction companies increasingly partnering with or acquiring prefabricated building manufacturers to expand their service capabilities and market reach. These strategic relationships combine the manufacturing expertise of prefabricated specialists with the project management and customer relationships of established construction firms. The resulting partnerships create more comprehensive service offerings while accelerating market adoption of prefabricated construction methods.

Customer segment evolution demonstrates expanding acceptance of prefabricated construction across diverse market segments, from individual homeowners to large-scale commercial developers. Early adopters in affordable housing and disaster relief applications have provided proof-of-concept demonstrations that attract mainstream construction stakeholders. This market maturation process creates opportunities for manufacturers to develop specialized solutions for specific customer segments while building broader market credibility.

Innovation cycles in the prefabricated building market are accelerating as manufacturers invest in research and development to differentiate their offerings and expand market applications. Advanced materials, automated manufacturing systems, and digital design tools enable continuous improvement in product quality, customization capabilities, and cost effectiveness. These innovation investments position leading manufacturers to capture market share while establishing barriers to entry for potential competitors.

Primary research activities encompassed comprehensive interviews with key stakeholders across the prefabricated building value chain, including manufacturers, developers, contractors, and end-users. These interviews provided insights into market trends, competitive dynamics, and customer preferences that inform strategic market analysis. The research methodology incorporated both quantitative surveys and qualitative discussions to capture diverse perspectives on market opportunities and challenges.

Secondary research analysis involved extensive review of industry publications, government statistics, trade association reports, and company financial disclosures to establish market baseline data and identify emerging trends. This research foundation enabled comprehensive analysis of market size, growth patterns, and competitive positioning across different prefabricated building segments and geographic regions.

Market modeling techniques utilized statistical analysis and forecasting methodologies to project future market development scenarios based on historical trends, current market conditions, and identified growth drivers. The modeling approach incorporated multiple variables including economic indicators, regulatory changes, and technological advancement patterns to develop robust market projections and scenario analyses.

Data validation processes ensured research accuracy through triangulation of multiple data sources, expert review panels, and cross-verification of key findings with industry participants. This validation methodology provides confidence in research conclusions while identifying areas where market conditions may be evolving rapidly or where additional investigation may be warranted for comprehensive market understanding.

West Coast markets lead the US prefabricated building sector in terms of innovation, adoption rates, and regulatory support, with California accounting for approximately 28% of national market activity. The region benefits from strong environmental consciousness, supportive building codes, and established manufacturing infrastructure that facilitates prefabricated construction adoption. High construction costs and housing affordability challenges create compelling demand for prefabricated solutions, while technology-forward developers and architects drive innovation in design and application.

Southeast region demonstrates the highest growth rates in prefabricated building market development, driven by population growth, business expansion, and increasing manufacturing capacity. States including Florida, Georgia, and North Carolina show particularly strong adoption patterns, benefiting from favorable regulatory environments and growing recognition of prefabricated construction advantages. The region’s lower labor costs and available industrial sites support manufacturing facility development while proximity to major population centers enables efficient distribution.

Northeast markets show steady growth in prefabricated building adoption, particularly in urban areas where construction costs and space constraints favor efficient building methods. The region’s emphasis on energy efficiency and sustainable construction aligns well with prefabricated construction capabilities, while established construction industries provide experienced partners for market development. However, regulatory complexity and transportation challenges in dense urban areas can limit some applications.

Midwest and Mountain regions present emerging opportunities for prefabricated building market expansion, driven by growing awareness of construction efficiency benefits and increasing manufacturing capacity. These regions offer advantages in terms of transportation accessibility and lower operating costs, while growing populations in key metropolitan areas create demand for efficient construction solutions. The presence of established manufacturing industries provides potential synergies for prefabricated building development.

Market leadership in the US prefabricated building sector is distributed among several categories of companies, each bringing distinct capabilities and market approaches. The competitive landscape includes traditional manufactured housing companies expanding into modular construction, construction firms developing prefabrication capabilities, and specialized modular building manufacturers focusing on commercial and institutional applications.

Competitive strategies vary significantly across market participants, with some companies focusing on cost leadership through manufacturing efficiency while others emphasize design innovation and customization capabilities. Vertical integration strategies enable some manufacturers to control quality and costs throughout the value chain, while partnership approaches allow companies to leverage specialized expertise in different market segments.

Market consolidation trends show increasing merger and acquisition activity as companies seek to expand geographic reach, enhance manufacturing capabilities, and access new customer segments. These consolidation activities create opportunities for operational synergies while potentially reducing competitive intensity in some market segments.

By Construction Type:

By Application:

By Material Type:

Modular construction represents the fastest-growing segment within the prefabricated building market, driven by increasing acceptance in commercial applications and growing sophistication in design capabilities. This category benefits from maximum factory control over construction quality while enabling complex architectural configurations through advanced engineering and design systems. The segment shows particular strength in multi-family residential projects and commercial office buildings where standardization advantages can be leveraged effectively.

Panelized systems demonstrate strong growth in custom residential construction where design flexibility requirements exceed the capabilities of traditional modular approaches. This category enables architects and builders to maintain design control while capturing manufacturing efficiencies in structural components. The segment benefits from lower transportation costs compared to complete modular units while providing significant time savings compared to traditional stick-built construction methods.

Manufactured housing continues to serve as the foundation of the prefabricated building market, providing affordable housing solutions for cost-conscious consumers. Recent innovations in design, materials, and manufacturing processes have enhanced the quality and aesthetic appeal of manufactured homes while maintaining cost advantages. The segment shows increasing integration with site-built construction techniques to expand market acceptance and regulatory approval.

Commercial applications represent the highest growth potential within the prefabricated building market, as businesses recognize the advantages of predictable construction timelines and costs. Office buildings, retail facilities, and institutional structures increasingly utilize prefabricated construction methods to minimize business disruption while achieving quality and performance objectives. The segment benefits from growing acceptance among commercial developers and architects who appreciate the design flexibility and construction efficiency of modern prefabricated systems.

Manufacturers benefit from the prefabricated building market through opportunities to achieve economies of scale, optimize production processes, and develop specialized expertise in efficient construction methods. Factory-based manufacturing enables consistent quality control, reduced material waste, and improved worker productivity compared to traditional construction approaches. The controlled environment allows for continuous process improvement and integration of advanced manufacturing technologies that enhance both efficiency and product quality.

Developers and contractors gain significant advantages through reduced construction timelines, more predictable project costs, and enhanced quality control that minimizes callbacks and warranty issues. The ability to begin site preparation while building components are manufactured in parallel reduces overall project duration and enables faster return on investment. Additionally, the reduced weather dependency of factory-based manufacturing provides greater schedule reliability and risk mitigation.

End users and building owners benefit from improved building quality, enhanced energy efficiency, and reduced long-term maintenance requirements that result from controlled manufacturing processes. The precision achievable in factory environments enables better integration of insulation, air sealing, and building systems that improve comfort and reduce operating costs. Additionally, the speed of construction reduces financing costs and enables earlier occupancy or revenue generation.

Communities and government agencies benefit from prefabricated construction’s ability to address housing shortages, disaster recovery needs, and infrastructure development requirements more efficiently than traditional construction methods. The reduced construction timelines and predictable costs make prefabricated construction particularly valuable for public sector projects where budget certainty and rapid deployment are priorities. Environmental benefits including reduced construction waste and improved energy efficiency align with sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration represents a transformative trend within the prefabricated building market, as manufacturers increasingly adopt Building Information Modeling (BIM), computer-aided design systems, and automated manufacturing technologies. These digital tools enable precise design coordination, efficient material utilization, and seamless integration between design and manufacturing processes. The trend toward digitalization also facilitates better communication between stakeholders and enables real-time project tracking and quality control throughout the manufacturing and assembly process.

Sustainability emphasis continues to drive innovation in materials, manufacturing processes, and building performance within the prefabricated construction sector. Manufacturers are increasingly incorporating recycled materials, renewable resources, and energy-efficient components into their products while optimizing manufacturing processes to minimize environmental impact. This trend aligns with growing regulatory requirements and consumer preferences for environmentally responsible construction methods, creating competitive advantages for companies that successfully integrate sustainability into their operations.

Customization capabilities are expanding rapidly as manufacturers develop flexible manufacturing systems that accommodate diverse design requirements while maintaining production efficiency. Advanced manufacturing technologies enable mass customization approaches that provide architectural flexibility without sacrificing the cost and time advantages of prefabricated construction. This trend addresses historical limitations of prefabricated construction while expanding market applications across diverse customer segments and project types.

Urban applications show increasing adoption of prefabricated construction methods as cities seek efficient solutions for housing shortages and infrastructure development. Modular construction techniques are particularly well-suited for urban environments where space constraints, noise restrictions, and construction timeline pressures favor factory-based manufacturing approaches. The trend toward urban densification creates opportunities for prefabricated construction to address complex logistical and regulatory challenges while delivering quality building solutions.

Manufacturing capacity expansion across the prefabricated building industry reflects growing market confidence and increasing demand across multiple segments. Leading manufacturers are investing in new production facilities, advanced manufacturing equipment, and expanded geographic coverage to serve growing customer bases. These capacity investments enable companies to capture market share while improving operational efficiency through economies of scale and technological advancement.

Strategic partnerships between prefabricated building manufacturers and traditional construction companies are creating new market opportunities and service capabilities. These collaborations combine manufacturing expertise with project management capabilities, enabling comprehensive solutions that address diverse customer requirements. Partnership strategies also facilitate market entry into new geographic regions and customer segments while sharing risks and investment requirements.

Regulatory advancement in building codes and approval processes increasingly accommodates prefabricated construction methods, reducing barriers to market adoption. State and local governments are updating regulations to recognize the quality and safety capabilities of modern prefabricated construction while streamlining approval processes. These regulatory improvements reduce project timelines and compliance costs while expanding market opportunities for prefabricated building applications.

Technology integration initiatives are transforming manufacturing processes, design capabilities, and project management systems within the prefabricated building industry. Companies are investing in robotics, artificial intelligence, and advanced materials to enhance product quality while reducing manufacturing costs. These technological advancements position prefabricated construction as a high-tech alternative to traditional building methods while enabling new applications and market segments.

Market positioning strategies should emphasize the quality, efficiency, and sustainability advantages of prefabricated construction while addressing persistent market perceptions about limitations and aesthetic concerns. Companies should invest in demonstration projects, customer education programs, and marketing initiatives that showcase successful applications across diverse market segments. MarkWide Research analysis indicates that companies with strong market positioning and customer education programs achieve 25% higher market penetration rates compared to those relying solely on cost advantages.

Technology investment priorities should focus on manufacturing automation, design software integration, and quality control systems that enhance both efficiency and product differentiation. Companies should evaluate opportunities to integrate advanced materials, smart building systems, and sustainable manufacturing processes that create competitive advantages while addressing evolving customer requirements. Strategic technology investments enable companies to expand market applications while improving operational efficiency and profit margins.

Partnership development represents a critical success factor for prefabricated building companies seeking to expand market reach and service capabilities. Strategic alliances with architects, developers, contractors, and suppliers can provide access to new customer segments while sharing market development costs and risks. Companies should prioritize partnerships that complement their core capabilities while providing opportunities for mutual value creation and market expansion.

Regulatory engagement should be a priority for industry participants seeking to address code compliance challenges and expand market opportunities. Active participation in industry associations, building code development processes, and regulatory discussions can help shape favorable policy environments while building relationships with key stakeholders. Companies that proactively engage with regulatory processes often achieve competitive advantages through early awareness of regulatory changes and opportunities to influence policy development.

Market expansion projections indicate continued robust growth for the US prefabricated building sector, driven by persistent housing affordability challenges, construction labor shortages, and increasing recognition of prefabricated construction advantages. The market is expected to achieve a compound annual growth rate of 7.2% over the next five years, with particularly strong growth in commercial applications and urban markets where efficiency advantages are most pronounced.

Technology evolution will continue to transform prefabricated construction capabilities, with advanced manufacturing systems, artificial intelligence, and sustainable materials enabling new applications and improved performance. The integration of smart building technologies during factory assembly will create opportunities for enhanced building performance and user experience that differentiate prefabricated construction from traditional methods. These technological advancements position the industry for sustained innovation and market expansion.

Market maturation trends suggest increasing acceptance of prefabricated construction across mainstream market segments, supported by successful project demonstrations and evolving customer preferences. MWR projections indicate that prefabricated construction could achieve 22% market penetration in residential construction and 18% penetration in commercial applications within the next decade, representing substantial growth from current levels.

Regulatory environment improvements are expected to continue supporting market growth through updated building codes, streamlined approval processes, and government initiatives promoting efficient construction methods. The alignment of regulatory frameworks with modern prefabricated construction capabilities will reduce barriers to adoption while expanding market opportunities across diverse applications and geographic regions.

The US prefabricated building market stands positioned for significant expansion as construction industry challenges create compelling demand for efficient, quality-focused building solutions. The convergence of housing affordability pressures, construction labor shortages, and environmental sustainability requirements creates favorable conditions for prefabricated construction adoption across residential, commercial, and institutional applications. Technological advancement in manufacturing processes, design capabilities, and building performance continues to enhance the competitive position of prefabricated construction while expanding market applications.

Market dynamics indicate strong growth potential supported by improving regulatory environments, increasing customer acceptance, and expanding manufacturing capacity across key geographic regions. The industry’s evolution from basic manufactured housing to sophisticated modular construction systems demonstrates the sector’s ability to adapt to changing market requirements while maintaining core advantages in cost, quality, and construction efficiency. Strategic investments in technology, partnerships, and market development position leading companies to capture growth opportunities while building sustainable competitive advantages.

Future success in the prefabricated building market will depend on companies’ ability to balance manufacturing efficiency with design flexibility, quality consistency with customization capabilities, and cost competitiveness with performance differentiation. The industry’s continued maturation and mainstream acceptance create opportunities for sustained growth while requiring ongoing innovation and market development investments to realize the full potential of prefabricated construction in addressing America’s building and infrastructure needs.

What is Prefabricated Building?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in sections or modules, and then transported to the construction site for assembly. This method is often used in residential, commercial, and industrial applications due to its efficiency and cost-effectiveness.

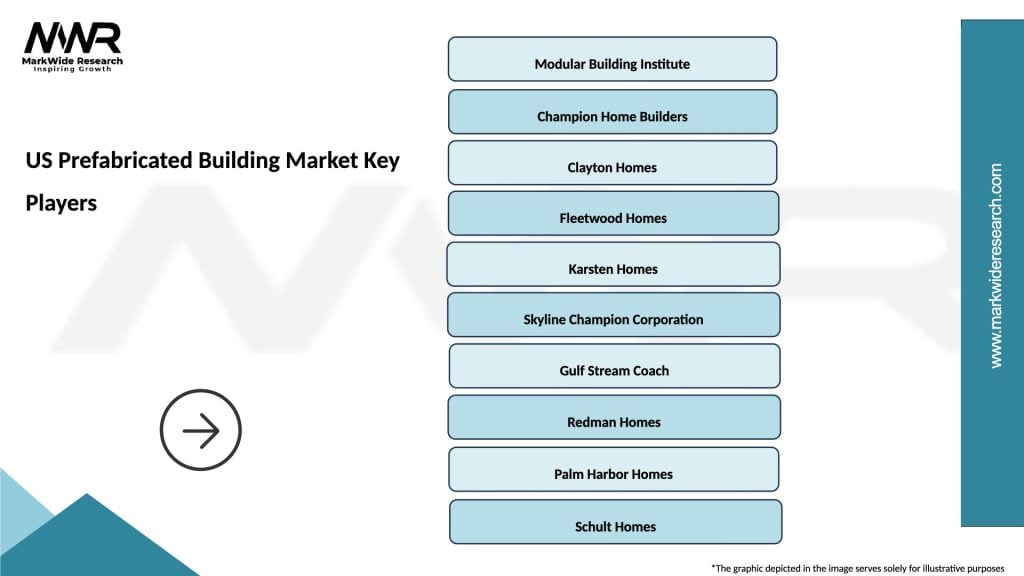

What are the key players in the US Prefabricated Building Market?

Key players in the US Prefabricated Building Market include companies like Modulus, Katerra, and Factory OS, which specialize in modular construction and prefabricated solutions. These companies are known for their innovative approaches to building design and construction processes, among others.

What are the growth factors driving the US Prefabricated Building Market?

The US Prefabricated Building Market is driven by factors such as the increasing demand for affordable housing, the need for faster construction timelines, and the growing emphasis on sustainable building practices. Additionally, advancements in technology and materials are enhancing the appeal of prefabricated solutions.

What challenges does the US Prefabricated Building Market face?

Challenges in the US Prefabricated Building Market include regulatory hurdles, potential quality control issues, and the perception of prefabricated buildings as lower quality compared to traditional construction. These factors can impact consumer acceptance and market growth.

What opportunities exist in the US Prefabricated Building Market?

Opportunities in the US Prefabricated Building Market include the expansion into urban areas where space is limited, the integration of smart technologies in prefabricated designs, and the increasing interest in sustainable and energy-efficient building solutions. These trends are likely to shape the future of the market.

What trends are shaping the US Prefabricated Building Market?

Trends in the US Prefabricated Building Market include the rise of modular construction techniques, the use of advanced manufacturing technologies, and a growing focus on eco-friendly materials. These trends are influencing how buildings are designed, constructed, and perceived in the market.

US Prefabricated Building Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Panelized Buildings, Pre-Cast Concrete, Steel Structures |

| End User | Residential, Commercial, Educational, Healthcare |

| Installation Type | On-Site, Off-Site, Hybrid, Temporary |

| Material | Wood, Steel, Concrete, Composite |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Prefabricated Building Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at