444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US power market represents one of the most dynamic and rapidly evolving energy sectors globally, characterized by significant transformation driven by renewable energy adoption, grid modernization initiatives, and changing consumer demands. Market dynamics indicate substantial growth in clean energy generation capacity, with renewable sources experiencing remarkable expansion across multiple states and regions.

Current market conditions reflect a fundamental shift toward sustainable energy solutions, with solar and wind power installations achieving unprecedented growth rates of approximately 15-20% annually in key markets. The sector encompasses traditional fossil fuel generation, nuclear power, and rapidly expanding renewable energy sources, creating a complex but promising landscape for industry participants and stakeholders.

Infrastructure modernization remains a critical component of market development, with smart grid technologies and energy storage systems gaining significant traction. The integration of distributed energy resources and advanced grid management systems is reshaping how electricity is generated, transmitted, and consumed across the United States, presenting both challenges and opportunities for market participants.

The US power market refers to the comprehensive ecosystem encompassing electricity generation, transmission, distribution, and retail services across all fifty states and territories. This market includes traditional utility companies, independent power producers, renewable energy developers, and emerging technology providers focused on grid modernization and energy storage solutions.

Market structure varies significantly across different regions, with some areas operating under regulated utility models while others embrace competitive wholesale and retail electricity markets. The sector includes multiple stakeholder categories, from large-scale power generation facilities to distributed energy resources, energy storage systems, and advanced grid management technologies.

Regulatory frameworks play a crucial role in shaping market dynamics, with federal agencies, state public utility commissions, and regional transmission organizations establishing policies that influence investment decisions, technology adoption, and market competition patterns throughout the industry.

Strategic analysis reveals that the US power market is experiencing unprecedented transformation driven by technological innovation, environmental regulations, and changing consumer preferences. Renewable energy sources are capturing increasing market share, with wind and solar installations representing approximately 70% of new capacity additions in recent years.

Key market trends include accelerated retirement of coal-fired power plants, substantial investments in natural gas generation facilities, and rapid expansion of battery energy storage systems. The integration of smart grid technologies and distributed energy resources is creating new business models and revenue opportunities for industry participants.

Investment patterns demonstrate strong capital flows toward clean energy projects, grid modernization initiatives, and energy storage technologies. According to MarkWide Research analysis, the sector is experiencing robust growth across multiple segments, with particular strength in renewable energy development and grid infrastructure improvements.

Market outlook remains highly positive, supported by favorable policy frameworks, declining technology costs, and increasing corporate demand for clean energy solutions. The convergence of electrification trends, digitalization, and sustainability initiatives is expected to drive continued market expansion and innovation.

Fundamental market insights highlight several critical trends shaping the US power sector landscape:

Primary market drivers are propelling significant growth and transformation across the US power sector. Environmental regulations and climate commitments at federal and state levels are creating strong incentives for clean energy adoption, with many states establishing renewable portfolio standards requiring utilities to source specific percentages of electricity from renewable sources.

Economic factors play a crucial role in market dynamics, with renewable energy technologies achieving grid parity in most regions. Solar and wind power costs have declined dramatically, making these technologies increasingly attractive for both utility-scale and distributed generation applications. The availability of federal tax credits and state incentive programs further enhances the economic viability of clean energy projects.

Technological advancement continues to drive market evolution, with improvements in energy storage systems, smart grid technologies, and grid management software enabling better integration of variable renewable energy sources. These innovations are addressing traditional challenges associated with renewable energy intermittency and grid stability.

Consumer demand for sustainable energy solutions is influencing market development, with residential, commercial, and industrial customers increasingly seeking clean energy options. Corporate sustainability commitments are driving substantial demand for renewable energy through power purchase agreements and direct investment in clean energy projects.

Significant challenges continue to impact market development despite overall positive growth trends. Grid infrastructure limitations present substantial obstacles to renewable energy integration, with aging transmission systems requiring extensive upgrades to accommodate distributed generation and variable renewable sources.

Regulatory complexity creates barriers for market participants, with varying state and federal requirements complicating project development and market entry strategies. The patchwork of different regulatory frameworks across states can slow project deployment and increase development costs for companies operating in multiple jurisdictions.

Intermittency challenges associated with renewable energy sources require substantial investments in energy storage systems and grid flexibility solutions. While battery storage costs are declining, the scale of storage needed to support high renewable penetration levels represents a significant financial commitment for utilities and grid operators.

Capital intensity remains a constraint for many market participants, with power generation and transmission projects requiring substantial upfront investments. Access to financing can be challenging for smaller developers and emerging technology companies, potentially limiting market competition and innovation.

Emerging opportunities are creating substantial potential for growth and innovation across the US power market. Energy storage deployment represents a massive opportunity, with battery storage installations expected to grow at compound annual growth rates exceeding 25% as utilities and developers seek to enhance grid flexibility and renewable integration capabilities.

Grid modernization initiatives offer significant opportunities for technology providers and service companies. The need to upgrade aging infrastructure and implement smart grid technologies is creating demand for advanced metering systems, grid management software, and cybersecurity solutions.

Distributed energy resources present substantial market potential, with rooftop solar, community solar projects, and microgrids gaining traction across residential, commercial, and industrial segments. These distributed solutions are creating new business models and revenue streams for energy companies and technology providers.

Electrification trends in transportation and heating sectors are driving increased electricity demand, creating opportunities for power generation companies and grid infrastructure providers. Electric vehicle adoption and heat pump installations are expected to significantly increase electricity consumption patterns over the coming decade.

Complex market dynamics are shaping the competitive landscape and investment patterns across the US power sector. Supply and demand fundamentals are evolving rapidly, with renewable energy sources providing an increasing share of electricity generation while traditional fossil fuel plants face retirement pressures due to economic and environmental factors.

Price dynamics reflect the changing generation mix, with renewable energy sources contributing to lower wholesale electricity prices in many markets. However, the need for grid infrastructure investments and energy storage systems is creating upward pressure on electricity rates in some regions, requiring careful balance between affordability and reliability objectives.

Competitive dynamics are intensifying as new market entrants challenge traditional utility business models. Independent power producers, renewable energy developers, and technology companies are creating innovative solutions and competitive pressures that are driving industry transformation and efficiency improvements.

Investment dynamics show strong capital flows toward clean energy projects and grid modernization initiatives. Private equity, institutional investors, and corporate buyers are providing substantial funding for renewable energy development, while utilities are investing heavily in grid infrastructure and energy storage systems to maintain system reliability.

Comprehensive research methodology employed for this market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, utility managers, renewable energy developers, and technology providers to gather firsthand insights into market trends and competitive dynamics.

Secondary research encompasses analysis of regulatory filings, industry reports, government databases, and financial disclosures from publicly traded companies operating in the power sector. This approach provides quantitative data on market trends, capacity additions, and investment patterns across different market segments and geographic regions.

Data validation processes ensure information accuracy through cross-referencing multiple sources and conducting follow-up interviews with industry experts. Market projections and trend analysis are based on historical data patterns, regulatory policy developments, and technology cost trajectories to provide realistic and actionable insights.

Analytical framework incorporates both quantitative and qualitative assessment methodologies, including market sizing analysis, competitive positioning evaluation, and strategic opportunity identification. This comprehensive approach enables thorough understanding of market dynamics and future growth potential across all major market segments.

Regional market dynamics vary significantly across the United States, with different areas experiencing distinct growth patterns and competitive landscapes. Western states including California, Nevada, and Arizona are leading renewable energy adoption, with solar power representing approximately 40-50% of new capacity additions in these markets due to favorable solar resources and supportive policy frameworks.

Texas market demonstrates exceptional growth in wind power generation, with the state accounting for nearly 30% of total US wind capacity. The Electric Reliability Council of Texas operates one of the most competitive wholesale electricity markets in the country, fostering innovation and investment in renewable energy and energy storage technologies.

Northeast region is experiencing significant transformation as aging nuclear and coal plants retire, creating opportunities for renewable energy development and natural gas generation. States like New York and Massachusetts are implementing aggressive clean energy mandates that are driving substantial investments in offshore wind and energy storage projects.

Southeast markets are gradually increasing renewable energy adoption, with utilities in Florida, North Carolina, and Georgia investing heavily in solar power development. While historically dominated by coal and natural gas generation, these markets are experiencing growing interest in clean energy solutions driven by economic competitiveness and corporate demand.

Competitive landscape encompasses a diverse range of market participants, from traditional investor-owned utilities to independent power producers and emerging technology companies. Major market players are adapting their strategies to address changing market conditions and capitalize on growth opportunities in renewable energy and grid modernization.

Competitive strategies focus on renewable energy development, grid modernization investments, and customer service innovation. Companies are forming strategic partnerships with technology providers and pursuing vertical integration opportunities to enhance their competitive positioning in evolving market conditions.

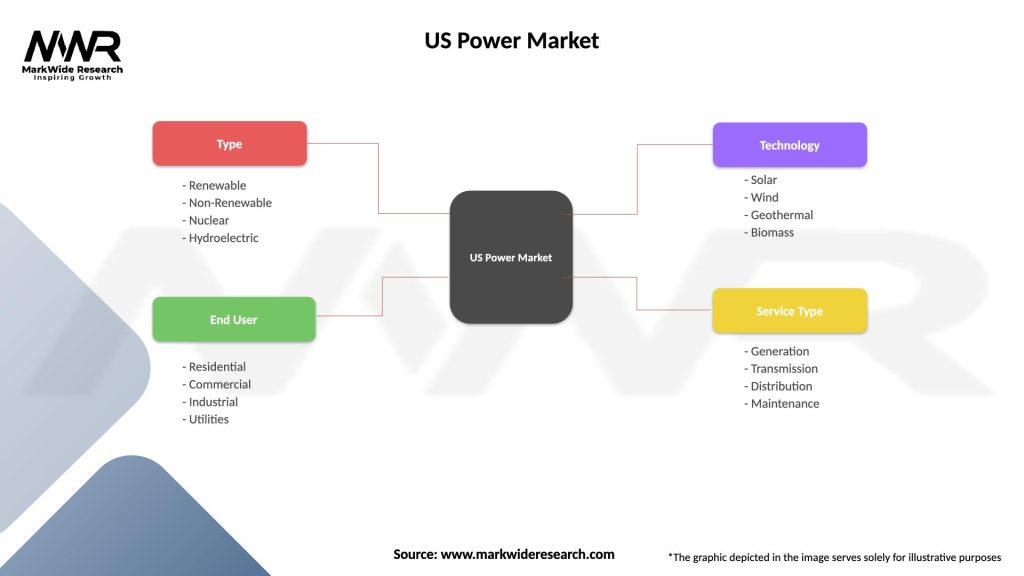

Market segmentation reveals distinct categories based on generation technology, customer segments, and geographic markets. By Generation Technology:

By Customer Segment:

Solar power segment demonstrates exceptional growth potential, with utility-scale and distributed solar installations achieving cost competitiveness across most US markets. Technological improvements in photovoltaic systems and declining equipment costs are driving widespread adoption among residential, commercial, and utility customers.

Wind power category continues expanding rapidly, particularly in states with favorable wind resources and transmission infrastructure. Offshore wind development is gaining momentum along the Atlantic coast, with several major projects in development that will significantly increase US offshore wind capacity over the next decade.

Energy storage segment represents the fastest-growing category, with battery storage installations increasing at exponential rates to support renewable energy integration and grid stability requirements. Utility-scale storage projects are becoming standard components of new renewable energy developments.

Natural gas generation maintains significant market share while serving as a bridge fuel during the clean energy transition. Combined cycle plants provide flexible generation capabilities that complement variable renewable energy sources, though long-term growth prospects are limited by environmental considerations and renewable energy cost competitiveness.

Utilities and power companies benefit from diversified generation portfolios that reduce fuel price volatility and environmental compliance risks. Renewable energy investments provide long-term cost stability and help utilities meet clean energy mandates while maintaining system reliability and customer satisfaction.

Investors and financial institutions gain access to stable, long-term revenue streams through power purchase agreements and regulated utility investments. The sector offers attractive risk-adjusted returns with growing emphasis on environmental, social, and governance factors that align with institutional investment objectives.

Technology providers benefit from substantial market opportunities in grid modernization, energy storage, and renewable energy equipment. The ongoing digital transformation of the power sector creates demand for advanced software solutions, cybersecurity services, and grid management technologies.

Consumers and communities benefit from improved air quality, economic development opportunities, and potentially lower electricity costs as renewable energy becomes increasingly cost-competitive. Distributed energy resources provide energy independence and resilience benefits for residential and commercial customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Decarbonization acceleration represents the most significant trend shaping the US power market, with utilities, corporations, and governments establishing aggressive clean energy targets. Net-zero commitments from major utilities are driving unprecedented investments in renewable energy and energy storage technologies across all market segments.

Grid modernization initiatives are transforming how electricity systems operate, with smart grid technologies enabling better integration of distributed energy resources and improved system reliability. Advanced metering infrastructure and grid management systems are providing utilities with enhanced visibility and control capabilities.

Distributed energy proliferation is changing traditional utility business models, with rooftop solar, community solar, and microgrids becoming increasingly common. This trend is creating new challenges and opportunities for utilities as they adapt to bidirectional power flows and customer energy independence.

Energy storage mainstream adoption is revolutionizing grid operations, with battery storage systems providing multiple grid services including frequency regulation, peak shaving, and renewable energy integration support. MarkWide Research indicates that energy storage deployments are experiencing remarkable growth rates across all market segments.

Recent industry developments highlight the rapid pace of transformation across the US power sector. Major utility mergers and acquisitions are reshaping the competitive landscape, with companies seeking to achieve scale advantages and diversify their generation portfolios through strategic combinations.

Technology partnerships between traditional utilities and innovative technology companies are accelerating the deployment of advanced grid solutions and energy storage systems. These collaborations are enabling faster adoption of digital technologies and improving grid reliability and efficiency.

Regulatory policy developments at federal and state levels continue to influence market dynamics, with new clean energy standards and grid modernization incentives creating favorable conditions for renewable energy investment and infrastructure upgrades.

Corporate renewable energy procurement has reached unprecedented levels, with major corporations signing long-term power purchase agreements for wind and solar projects. This trend is providing stable revenue streams for renewable energy developers and accelerating clean energy deployment across multiple states.

Strategic recommendations for market participants emphasize the importance of positioning for the clean energy transition while maintaining operational excellence and customer service quality. Utilities should prioritize renewable energy development and grid modernization investments to remain competitive and meet regulatory requirements.

Investment strategies should focus on technologies and business models that support grid flexibility and renewable energy integration. Energy storage systems, demand response programs, and advanced grid management solutions represent particularly attractive investment opportunities with strong growth potential.

Risk management approaches should address cybersecurity threats, extreme weather resilience, and regulatory compliance requirements. Companies should develop comprehensive strategies for managing the transition from traditional generation sources to renewable energy while maintaining system reliability.

Partnership opportunities with technology providers, financial institutions, and other industry participants can accelerate innovation and reduce development risks. Collaborative approaches to grid modernization and renewable energy development can provide competitive advantages and improved customer outcomes.

Long-term market outlook remains highly positive, with the US power sector expected to continue its transformation toward cleaner, more flexible, and more resilient electricity systems. Renewable energy sources are projected to provide the majority of new generation capacity additions, with solar and wind power achieving dominant market positions in most regions.

Technology advancement will continue driving cost reductions and performance improvements across renewable energy and energy storage technologies. Grid modernization investments will enable higher levels of renewable energy integration while maintaining system reliability and security.

Market structure evolution will likely include increased competition in wholesale and retail electricity markets, with new business models emerging around distributed energy resources and grid services. According to MWR projections, the sector will experience sustained growth driven by electrification trends and clean energy mandates.

Investment opportunities will remain substantial across renewable energy development, grid infrastructure, and energy storage deployment. The convergence of favorable policy support, technology cost reductions, and corporate demand for clean energy will sustain market growth and innovation over the coming decade.

The US power market stands at a pivotal moment in its evolution, with unprecedented transformation driven by technological innovation, environmental imperatives, and changing consumer preferences. Renewable energy sources have achieved cost competitiveness and are rapidly gaining market share, while energy storage technologies are enabling greater grid flexibility and renewable integration capabilities.

Market fundamentals support continued growth and investment across clean energy technologies, grid modernization initiatives, and innovative business models. The combination of supportive policy frameworks, declining technology costs, and increasing corporate demand for sustainable energy solutions creates a favorable environment for market participants and investors.

Strategic positioning for the clean energy transition will be critical for long-term success, with companies that embrace renewable energy development, grid modernization, and customer-centric solutions likely to achieve competitive advantages. The ongoing transformation presents both challenges and opportunities that will reshape the industry landscape over the coming decade, making the US power market one of the most dynamic and promising sectors in the global energy economy.

What is Power?

Power refers to the rate at which energy is produced or consumed. In the context of the US Power Market, it encompasses various forms of energy generation, including electricity from renewable sources, fossil fuels, and nuclear power.

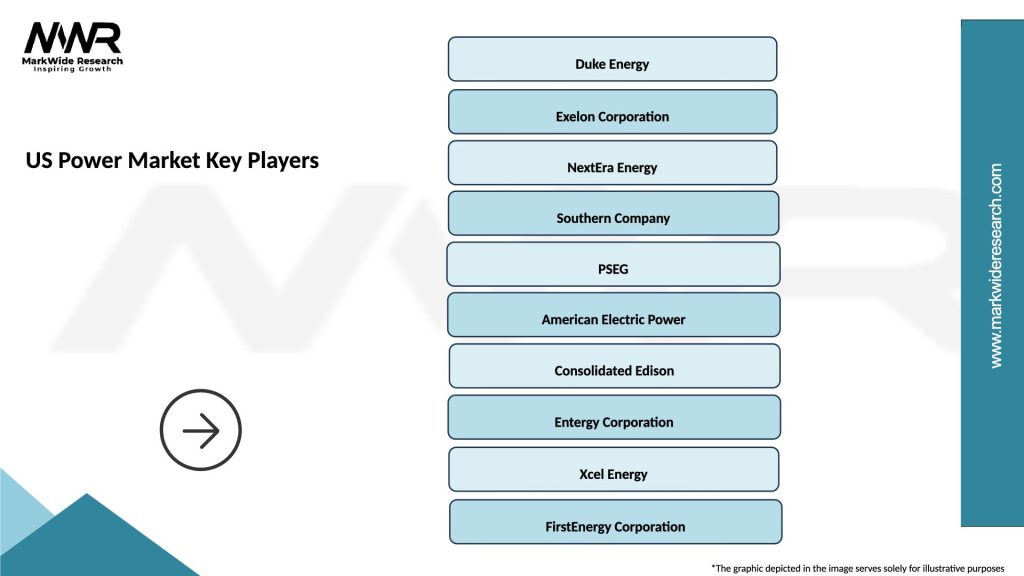

What are the key players in the US Power Market?

Key players in the US Power Market include companies like Duke Energy, NextEra Energy, and Southern Company, which are involved in electricity generation and distribution, among others.

What are the main drivers of growth in the US Power Market?

The main drivers of growth in the US Power Market include the increasing demand for renewable energy, advancements in energy storage technologies, and government policies promoting clean energy initiatives.

What challenges does the US Power Market face?

The US Power Market faces challenges such as regulatory hurdles, the aging infrastructure of power grids, and the need for significant investment in modernization and renewable energy integration.

What opportunities exist in the US Power Market?

Opportunities in the US Power Market include the expansion of smart grid technologies, the growth of electric vehicle charging infrastructure, and the potential for increased investment in solar and wind energy projects.

What trends are shaping the US Power Market?

Trends shaping the US Power Market include the transition towards decentralized energy systems, the rise of energy efficiency programs, and the increasing adoption of digital technologies for grid management.

US Power Market

| Segmentation Details | Description |

|---|---|

| Type | Renewable, Non-Renewable, Nuclear, Hydroelectric |

| End User | Residential, Commercial, Industrial, Utilities |

| Technology | Solar, Wind, Geothermal, Biomass |

| Service Type | Generation, Transmission, Distribution, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at