444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US popcorn market represents a dynamic and evolving segment of the American snack food industry, characterized by remarkable innovation and sustained consumer demand. Market dynamics indicate robust growth driven by health-conscious consumer preferences, premium product innovations, and expanding distribution channels across retail and foodservice sectors. The market encompasses traditional movie theater popcorn, ready-to-eat packaged varieties, microwave popcorn, and gourmet specialty products that cater to diverse consumer tastes and dietary requirements.

Consumer preferences have shifted significantly toward healthier snacking options, positioning popcorn as a favorable alternative to traditional processed snacks. The market demonstrates strong performance across multiple channels, including grocery retail, convenience stores, online platforms, and entertainment venues. Growth projections suggest the market will expand at a compound annual growth rate of 7.2% through the forecast period, driven by product innovation, premium positioning, and increased health awareness among American consumers.

Regional distribution shows concentrated market activity in urban centers and suburban markets, with 65% of consumption occurring in metropolitan areas. The market benefits from established supply chains, advanced processing technologies, and strong brand recognition among leading manufacturers who continue to invest in product development and marketing initiatives.

The US popcorn market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and retail sale of popcorn products across various formats and channels throughout the United States. This market includes raw corn kernels, processed popcorn products, flavored varieties, organic options, and specialty gourmet offerings that serve diverse consumer segments and consumption occasions.

Market scope extends beyond traditional movie theater applications to include home consumption, workplace snacking, health-focused alternatives, and premium artisanal products. The definition encompasses both branded and private-label products distributed through multiple retail channels, including supermarkets, convenience stores, online platforms, entertainment venues, and specialty food retailers.

Product categories within this market range from basic air-popped varieties to complex flavored formulations incorporating natural and artificial seasonings, organic ingredients, and functional additives designed to meet specific dietary preferences and nutritional requirements of American consumers.

Market performance in the US popcorn sector demonstrates exceptional resilience and growth potential, supported by evolving consumer preferences toward healthier snacking alternatives and premium product innovations. The market has successfully adapted to changing demographic trends, dietary requirements, and consumption patterns while maintaining strong profitability across key product segments.

Key growth drivers include increasing health consciousness among consumers, with 78% of buyers considering popcorn a healthier snack option compared to traditional alternatives. Premium and gourmet segments show particularly strong performance, reflecting consumer willingness to pay higher prices for quality, unique flavors, and organic certifications. The market benefits from strong brand loyalty, effective marketing strategies, and continuous product innovation.

Competitive landscape features established national brands alongside emerging regional players and artisanal producers who focus on specialty markets and unique value propositions. Distribution channels have expanded significantly, with online sales representing 23% of total market volume, reflecting changing consumer shopping behaviors and convenience preferences.

Future prospects remain highly favorable, with projected growth supported by demographic trends, health awareness campaigns, and continued product innovation in flavors, packaging, and nutritional profiles that align with consumer demands for convenient, healthy, and enjoyable snacking experiences.

Consumer behavior analysis reveals significant shifts in purchasing patterns and consumption preferences that shape market dynamics and growth opportunities. MarkWide Research data indicates strong correlation between health awareness trends and popcorn consumption patterns across different demographic segments.

Health consciousness trends represent the primary catalyst driving sustained growth in the US popcorn market, as consumers increasingly seek nutritious alternatives to traditional processed snacks. The perception of popcorn as a whole grain product with relatively low calorie density appeals to health-focused demographics who prioritize nutritional value without sacrificing taste or satisfaction.

Demographic shifts toward younger consumer segments contribute significantly to market expansion, with millennials and Generation Z showing strong preferences for convenient, healthy, and innovative snacking options. These demographics demonstrate willingness to experiment with new flavors and premium products while maintaining loyalty to brands that align with their values and lifestyle preferences.

Product innovation initiatives by leading manufacturers continue to drive market growth through introduction of unique flavor profiles, organic certifications, functional ingredients, and improved packaging solutions. Innovation extends to processing techniques that enhance taste, texture, and nutritional profiles while meeting diverse dietary requirements including gluten-free, non-GMO, and vegan formulations.

Distribution channel expansion has significantly improved product accessibility and convenience for consumers, with online platforms, subscription services, and specialty retailers complementing traditional grocery and convenience store channels. This multi-channel approach enables manufacturers to reach diverse consumer segments while optimizing inventory management and customer engagement strategies.

Raw material price volatility presents ongoing challenges for manufacturers, as corn commodity prices fluctuate based on weather conditions, agricultural policies, and global supply chain disruptions. These fluctuations impact production costs and profit margins, requiring sophisticated hedging strategies and supply chain management to maintain competitive pricing while preserving product quality.

Intense competition from alternative snack categories creates pressure on market share and pricing strategies, as consumers have numerous options for healthy snacking including nuts, seeds, fruit-based products, and vegetable chips. This competitive environment requires continuous innovation and marketing investment to maintain brand relevance and consumer preference.

Regulatory compliance requirements related to food safety, labeling standards, and nutritional claims add complexity and costs to product development and manufacturing processes. Manufacturers must navigate evolving regulations while ensuring product quality and safety standards that meet consumer expectations and regulatory requirements.

Seasonal demand patterns create challenges for production planning and inventory management, as consumption spikes during certain periods while remaining relatively stable throughout other times of the year. This seasonality requires flexible manufacturing capabilities and strategic inventory management to optimize operational efficiency and customer service levels.

Premium segment expansion offers substantial growth potential as consumers demonstrate increasing willingness to pay higher prices for gourmet flavors, organic certifications, and artisanal quality products. This trend creates opportunities for manufacturers to develop high-margin products that cater to sophisticated taste preferences and health-conscious consumer segments.

Functional food integration presents innovative opportunities to incorporate beneficial ingredients such as probiotics, protein enhancements, vitamins, and minerals into popcorn formulations. These functional additions can position products in the growing nutraceutical market while maintaining the familiar taste and convenience that consumers expect from popcorn products.

E-commerce growth continues to create new distribution opportunities and direct-to-consumer sales channels that enable manufacturers to build stronger customer relationships while improving profit margins. Online platforms allow for targeted marketing, subscription models, and personalized product offerings that enhance customer loyalty and lifetime value.

International expansion potential exists for established US brands to leverage their expertise and product innovations in global markets where healthy snacking trends are emerging. Export opportunities and international partnerships can provide additional revenue streams while diversifying market risk and expanding brand recognition.

Supply chain integration has become increasingly sophisticated, with manufacturers developing closer relationships with corn growers to ensure consistent quality and supply security. These partnerships enable better cost management, quality control, and sustainability initiatives that align with consumer expectations and corporate responsibility objectives.

Technology advancement in processing equipment and packaging solutions continues to improve product quality, shelf life, and consumer convenience while reducing production costs. Advanced popping techniques, flavor application methods, and packaging innovations contribute to enhanced product differentiation and market competitiveness.

Consumer engagement strategies have evolved to include social media marketing, influencer partnerships, and experiential marketing campaigns that build brand awareness and emotional connections with target demographics. These approaches are particularly effective in reaching younger consumers who value authentic brand experiences and social responsibility.

Sustainability initiatives are becoming increasingly important as consumers and retailers prioritize environmentally responsible products and packaging. Manufacturers are investing in sustainable sourcing practices, recyclable packaging materials, and carbon footprint reduction programs that appeal to environmentally conscious consumers while meeting corporate sustainability goals.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US popcorn market dynamics, consumer behavior patterns, and competitive landscape developments. Primary research initiatives include consumer surveys, industry expert interviews, and retailer feedback collection to gather firsthand market intelligence.

Secondary research components encompass industry reports, government statistics, trade association data, and academic studies that provide historical context and market trend analysis. This approach ensures comprehensive coverage of market factors while validating findings through multiple independent sources and analytical frameworks.

Data collection processes utilize both quantitative and qualitative research techniques to capture numerical market metrics alongside nuanced consumer insights and industry expert perspectives. Statistical analysis methods ensure data accuracy and reliability while identifying significant trends and correlations that inform strategic recommendations.

Market modeling techniques incorporate economic indicators, demographic trends, and consumption patterns to develop accurate forecasts and scenario analyses. These models account for various market variables and external factors that influence demand patterns and competitive dynamics within the US popcorn market.

Northeast region demonstrates strong market performance driven by urban population density, higher disposable incomes, and established retail infrastructure that supports premium product distribution. This region shows 28% market share with particular strength in gourmet and organic product segments that appeal to health-conscious consumers in metropolitan areas.

Southeast markets exhibit robust growth potential supported by expanding population demographics and increasing health awareness among traditional snack food consumers. The region benefits from proximity to corn production areas, which provides supply chain advantages and supports local brand development initiatives that resonate with regional consumer preferences.

Midwest region represents the traditional heartland of popcorn production and consumption, maintaining 32% market share through established consumer loyalty and strong agricultural connections. This region shows steady growth in premium segments while maintaining strong performance in traditional product categories that serve diverse consumer demographics.

Western states demonstrate the highest growth rates in organic and specialty product segments, reflecting consumer preferences for innovative flavors and health-focused formulations. California leads regional consumption with 18% market share, driven by health-conscious demographics and strong retail presence of premium and artisanal brands.

Market leadership is characterized by a combination of established national brands and emerging regional players who compete across different product segments and price points. The competitive environment encourages continuous innovation while maintaining focus on quality, taste, and consumer satisfaction.

Competitive strategies emphasize product differentiation through flavor innovation, packaging improvements, and targeted marketing campaigns that build brand loyalty and market share. Companies invest significantly in research and development to maintain competitive advantages while responding to evolving consumer preferences and market trends.

Product type segmentation reveals distinct consumer preferences and market dynamics across different popcorn categories, each serving specific consumption occasions and demographic segments with unique value propositions and competitive characteristics.

By Product Type:

By Distribution Channel:

By Flavor Profile:

Ready-to-eat segment demonstrates the strongest growth trajectory, driven by consumer demand for convenience and portion control in snacking occasions. This category benefits from innovative packaging solutions, extended shelf life, and diverse flavor offerings that cater to various taste preferences and dietary requirements. Market penetration continues to expand through improved distribution and competitive pricing strategies.

Microwave popcorn category maintains steady performance despite increased competition from ready-to-eat alternatives, with manufacturers focusing on premium ingredients, reduced artificial additives, and family-friendly packaging formats. Innovation in this segment emphasizes natural flavoring, organic certifications, and improved nutritional profiles that address health-conscious consumer concerns.

Gourmet and artisanal segments show exceptional growth potential with premium price positioning and unique flavor combinations that appeal to sophisticated consumer palates. These categories benefit from gift market opportunities, seasonal promotions, and experiential retail concepts that create emotional connections with consumers and justify higher price points.

Organic and health-focused categories continue expanding as consumers prioritize clean labels, sustainable sourcing, and functional benefits in their snacking choices. These segments command premium pricing while maintaining strong demand growth, particularly among younger demographics and health-conscious consumer groups who value transparency and nutritional benefits.

Manufacturers benefit from strong consumer demand, diverse product development opportunities, and multiple distribution channels that support revenue growth and market expansion. The industry offers attractive profit margins, particularly in premium segments, while providing opportunities for brand building and customer loyalty development through innovative products and marketing strategies.

Retailers gain from high inventory turnover rates, strong consumer demand, and attractive profit margins that contribute to overall category performance. Popcorn products require minimal storage requirements while offering excellent shelf stability and impulse purchase potential that enhances retail profitability and customer satisfaction.

Consumers enjoy access to healthy, convenient, and affordable snacking options that satisfy taste preferences while supporting nutritional goals. The market provides diverse choices in flavors, formats, and price points that accommodate different dietary requirements, consumption occasions, and budget considerations.

Agricultural stakeholders benefit from stable demand for corn raw materials, premium pricing opportunities for specialty varieties, and long-term supply relationships with processing companies. The industry supports rural economies and agricultural communities while providing market stability for corn producers and related agricultural services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues driving product reformulations toward natural ingredients, minimal processing, and transparent labeling that meets consumer demands for authenticity and health consciousness. Manufacturers are eliminating artificial additives, preservatives, and flavor enhancers while maintaining taste quality and product appeal through innovative natural alternatives.

Sustainable packaging initiatives are gaining momentum as environmental consciousness influences purchasing decisions and corporate responsibility strategies. Companies are investing in recyclable materials, reduced packaging waste, and biodegradable options that appeal to environmentally aware consumers while meeting regulatory requirements and sustainability goals.

Flavor innovation acceleration reflects consumer desire for unique and exotic taste experiences that differentiate products in competitive markets. MWR analysis indicates 42% of consumers actively seek new flavor varieties, driving continuous product development and limited-edition offerings that create excitement and trial opportunities.

Functional ingredient integration represents an emerging trend where manufacturers incorporate protein, fiber, vitamins, and other beneficial components to enhance nutritional profiles while maintaining taste appeal. This trend positions popcorn products in the growing functional foods category that commands premium pricing and appeals to health-focused demographics.

Technology advancement in processing equipment has enabled improved product consistency, enhanced flavor application, and reduced production costs while maintaining quality standards. Advanced popping techniques and automated packaging systems increase efficiency and enable manufacturers to respond quickly to market demand fluctuations and product customization requirements.

Strategic partnerships between manufacturers and retailers have strengthened distribution relationships and improved market access for new products and innovations. These collaborations include category management programs, promotional support, and exclusive product launches that benefit both parties while enhancing consumer choice and market competitiveness.

Acquisition activity has consolidated certain market segments while enabling smaller companies to access larger distribution networks and resources for growth acceleration. Strategic acquisitions allow established companies to expand product portfolios, enter new market segments, and leverage synergies in manufacturing and distribution operations.

International expansion initiatives by leading US brands have opened new revenue streams and growth opportunities in global markets where healthy snacking trends are emerging. Export programs and international partnerships enable companies to leverage their expertise and brand recognition while diversifying market risk and expanding consumer reach.

Product innovation focus should prioritize health-conscious formulations, unique flavor profiles, and functional ingredient integration that differentiate products while meeting evolving consumer preferences. Companies should invest in research and development capabilities that enable rapid response to market trends and consumer feedback while maintaining quality standards and cost competitiveness.

Distribution strategy optimization requires multi-channel approaches that combine traditional retail presence with growing e-commerce opportunities and direct-to-consumer sales models. Manufacturers should develop omnichannel capabilities that provide consistent brand experiences while optimizing inventory management and customer service across all touchpoints.

Brand building investments are essential for maintaining market position and consumer loyalty in increasingly competitive environments. Marketing strategies should emphasize health benefits, quality attributes, and brand values that resonate with target demographics while building emotional connections and purchase intent through authentic storytelling and consumer engagement.

Supply chain resilience development should include diversified sourcing strategies, strategic inventory management, and technology integration that ensures consistent product availability while managing cost fluctuations and operational risks. Companies should build flexible manufacturing capabilities that can adapt to demand variations and market opportunities.

Market growth prospects remain highly favorable, supported by demographic trends toward healthier snacking, continued product innovation, and expanding distribution channels that enhance consumer accessibility and convenience. MarkWide Research projections indicate sustained growth momentum driven by premium segment expansion and functional food integration opportunities.

Consumer behavior evolution will continue favoring products that combine health benefits with taste satisfaction, convenience, and value positioning. Future success will depend on manufacturers’ ability to anticipate and respond to changing preferences while maintaining product quality and competitive pricing across diverse market segments and distribution channels.

Technology integration will play an increasingly important role in manufacturing efficiency, product customization, and consumer engagement strategies. Advanced analytics, automation, and digital marketing capabilities will enable companies to optimize operations while building stronger customer relationships and market responsiveness.

Sustainability considerations will become increasingly critical for long-term market success, as consumers and stakeholders prioritize environmental responsibility and corporate citizenship. Companies that proactively address sustainability challenges while maintaining profitability will gain competitive advantages and market leadership positions in evolving market landscapes.

The US popcorn market demonstrates exceptional resilience and growth potential, driven by favorable consumer trends toward healthier snacking alternatives, continuous product innovation, and expanding distribution opportunities. Market dynamics support sustained growth across multiple segments, with particular strength in premium, organic, and functional product categories that command higher margins while meeting evolving consumer preferences.

Strategic opportunities abound for manufacturers who can successfully balance innovation with operational efficiency while building strong brand relationships and distribution partnerships. The market rewards companies that prioritize consumer insights, quality excellence, and sustainable business practices while maintaining competitive positioning and financial performance.

Future success will depend on industry participants’ ability to adapt to changing market conditions while leveraging core strengths in product development, brand building, and operational excellence. Companies that embrace innovation, sustainability, and consumer-centric strategies will be best positioned to capitalize on growth opportunities and maintain market leadership in this dynamic and evolving industry landscape.

What is Popcorn?

Popcorn is a type of corn kernel that expands and puffs up when heated. It is a popular snack food, often enjoyed at movie theaters, sporting events, and in homes, with various flavorings and toppings.

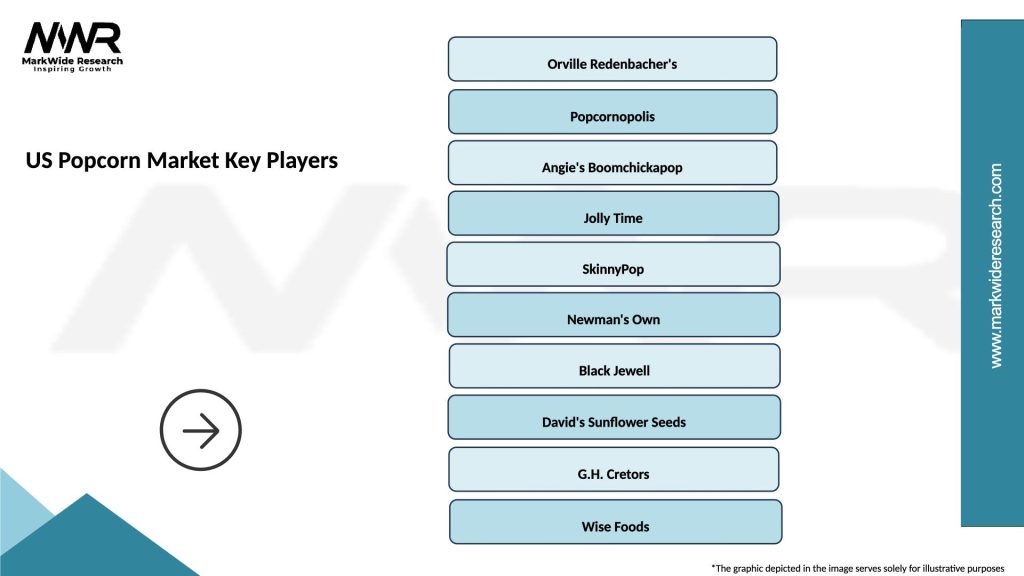

What are the key players in the US Popcorn Market?

Key players in the US Popcorn Market include ConAgra Foods, Orville Redenbacher’s, Popcornopolis, and Angie’s Boomchickapop, among others.

What are the growth factors driving the US Popcorn Market?

The growth of the US Popcorn Market is driven by increasing consumer demand for healthy snacks, the popularity of popcorn in movie theaters, and the rise of gourmet popcorn varieties.

What challenges does the US Popcorn Market face?

The US Popcorn Market faces challenges such as fluctuating corn prices, competition from other snack foods, and changing consumer preferences towards healthier options.

What opportunities exist in the US Popcorn Market?

Opportunities in the US Popcorn Market include the expansion of online sales channels, the introduction of innovative flavors, and the growing trend of popcorn as a versatile ingredient in recipes.

What trends are shaping the US Popcorn Market?

Trends in the US Popcorn Market include the rise of organic and non-GMO popcorn products, the popularity of popcorn as a gluten-free snack, and the increasing use of popcorn in gourmet food applications.

US Popcorn Market

| Segmentation Details | Description |

|---|---|

| Product Type | Butter, Cheese, Caramel, Kettle Corn |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Movie Theaters |

| End User | Households, Cinemas, Restaurants, Snack Bars |

| Packaging Type | Bags, Boxes, Tubs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Popcorn Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at