444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US pharmaceutical warehousing market represents a critical component of the nation’s healthcare supply chain infrastructure, encompassing specialized storage, handling, and distribution facilities designed to maintain the integrity of pharmaceutical products. This market has experienced unprecedented growth driven by increasing healthcare demands, regulatory compliance requirements, and the expansion of specialty pharmaceuticals requiring sophisticated storage conditions.

Market dynamics indicate robust expansion with the sector growing at a compound annual growth rate (CAGR) of 8.2%, reflecting the essential role these facilities play in ensuring medication safety and accessibility. The market encompasses various facility types, from traditional ambient storage warehouses to highly specialized cold chain facilities capable of maintaining ultra-low temperatures for biologics and vaccines.

Key market characteristics include stringent regulatory oversight by the FDA, advanced temperature monitoring systems, and sophisticated inventory management technologies. The sector serves diverse stakeholders including pharmaceutical manufacturers, third-party logistics providers, distributors, and healthcare institutions, each requiring tailored warehousing solutions to meet specific operational and compliance needs.

Geographic distribution shows concentration in major pharmaceutical hubs, with approximately 35% of facilities located in the Northeast corridor, 28% in the Midwest, and 22% across the Southeast, strategically positioned to serve major population centers and manufacturing locations.

The US pharmaceutical warehousing market refers to the comprehensive ecosystem of specialized storage and distribution facilities designed specifically for pharmaceutical products, biologics, medical devices, and related healthcare commodities. These facilities operate under strict regulatory guidelines to ensure product integrity, safety, and efficacy throughout the supply chain.

Core components of pharmaceutical warehousing include climate-controlled environments, advanced security systems, regulatory compliance protocols, and sophisticated inventory management technologies. These warehouses differ significantly from general logistics facilities due to their specialized requirements for temperature control, humidity management, contamination prevention, and detailed documentation processes.

Operational scope encompasses receiving, storage, order fulfillment, quality control, and distribution activities, all conducted under Good Distribution Practice (GDP) guidelines. The market includes various facility types ranging from ambient storage for stable medications to ultra-cold storage for sensitive biologics and vaccines requiring temperatures as low as -80°C.

Strategic market positioning reveals the US pharmaceutical warehousing sector as an indispensable component of healthcare infrastructure, experiencing sustained growth driven by demographic trends, regulatory evolution, and technological advancement. The market demonstrates resilience and adaptability, particularly evident during recent global health challenges that highlighted the critical importance of robust pharmaceutical supply chains.

Growth drivers include the aging population requiring increased medication access, the rise of specialty pharmaceuticals with complex storage requirements, and expanding e-commerce pharmaceutical distribution channels. Approximately 42% of market growth stems from cold chain expansion, while 31% relates to automation integration and 27% to capacity expansion for traditional storage.

Market segmentation reveals diverse operational models including dedicated pharmaceutical warehouses, multi-client facilities, and integrated distribution centers. The sector serves various end-users from large pharmaceutical manufacturers to specialty pharmacies, each requiring customized solutions to meet specific operational and regulatory requirements.

Competitive landscape features established logistics providers, specialized pharmaceutical warehousing companies, and emerging technology-driven operators. Market consolidation continues as companies seek to expand geographic coverage and enhance service capabilities through strategic acquisitions and partnerships.

Fundamental market insights reveal several critical trends shaping the pharmaceutical warehousing landscape:

Primary growth drivers propelling the US pharmaceutical warehousing market encompass demographic, regulatory, and technological factors creating sustained demand for specialized storage and distribution capabilities.

Demographic trends represent the most significant driver, with an aging population requiring increased pharmaceutical access and chronic disease management. The expanding elderly demographic, projected to reach 22% of the population by 2030, drives consistent demand for prescription medications and specialized storage facilities capable of maintaining product integrity.

Specialty pharmaceutical growth creates substantial warehousing demand, particularly for biologics, gene therapies, and personalized medicines requiring sophisticated storage conditions. These products often necessitate cold chain storage, specialized handling protocols, and enhanced security measures, driving investment in advanced warehousing infrastructure.

E-commerce expansion in pharmaceutical distribution transforms traditional warehousing models, requiring facilities capable of supporting direct-to-patient delivery, smaller order sizes, and faster fulfillment cycles. This shift demands flexible warehouse designs and advanced automation systems to manage increased order complexity.

Regulatory compliance requirements drive continuous facility upgrades and operational improvements. Evolving FDA guidelines, state licensing requirements, and international standards necessitate ongoing investment in monitoring systems, documentation processes, and staff training programs.

Supply chain resilience concerns, highlighted by recent global disruptions, encourage pharmaceutical companies to diversify warehousing partnerships and expand domestic storage capacity to ensure medication availability during emergencies.

Significant market restraints challenge growth and operational efficiency within the US pharmaceutical warehousing sector, requiring strategic planning and innovative solutions to overcome barriers.

High capital requirements represent a primary constraint, as specialized pharmaceutical warehouses require substantial upfront investment in climate control systems, security infrastructure, monitoring equipment, and regulatory compliance measures. These costs can exceed traditional warehouse development by 60-80%, limiting market entry for smaller operators.

Regulatory complexity creates operational challenges and compliance costs. Facilities must navigate federal FDA regulations, state licensing requirements, DEA controlled substance protocols, and various industry standards. Compliance failures can result in significant penalties, license suspension, or facility closure, creating operational risk.

Skilled workforce shortage impacts operational efficiency and growth potential. The specialized nature of pharmaceutical warehousing requires trained personnel familiar with regulatory requirements, handling protocols, and quality control procedures. Competition for qualified workers drives labor costs higher and can limit expansion plans.

Technology integration challenges arise from the need to implement sophisticated systems while maintaining operational continuity. Legacy systems, integration complexity, and staff training requirements can delay technology adoption and increase implementation costs.

Insurance and liability concerns create additional operational costs and risk management requirements. Pharmaceutical products’ high value and critical nature necessitate comprehensive insurance coverage and robust risk mitigation strategies, impacting profitability margins.

Emerging opportunities within the US pharmaceutical warehousing market present significant potential for growth, innovation, and market expansion across various segments and geographic regions.

Cold chain expansion represents the most substantial opportunity, driven by increasing biologics, vaccines, and gene therapy products requiring specialized temperature-controlled storage. Market projections indicate cold chain warehousing could capture 45% of total market growth over the next five years, creating opportunities for specialized facility development and service expansion.

Automation integration offers transformative potential for operational efficiency and accuracy improvements. Advanced robotics, AI-powered inventory management, and automated storage and retrieval systems can reduce labor costs, minimize errors, and enhance regulatory compliance, providing competitive advantages for early adopters.

Rural market penetration presents untapped opportunities as pharmaceutical companies seek to improve medication access in underserved areas. Strategic facility placement in secondary markets can capture growing demand while reducing distribution costs and delivery times to rural healthcare providers.

Value-added services create differentiation opportunities and additional revenue streams. Services including patient-specific packaging, clinical trial support, returns processing, and regulatory consulting can enhance customer relationships and improve profitability margins.

Sustainability initiatives align with corporate responsibility goals while reducing operational costs. Energy-efficient systems, renewable energy adoption, and sustainable packaging solutions can attract environmentally conscious clients and reduce long-term operating expenses.

International expansion opportunities emerge as US-based companies seek to serve global markets and foreign pharmaceutical companies require US distribution capabilities. Strategic partnerships and facility development can capture cross-border trade opportunities.

Complex market dynamics shape the US pharmaceutical warehousing landscape through interconnected forces influencing supply, demand, pricing, and competitive positioning across the sector.

Supply-demand imbalances create market tension as growing pharmaceutical distribution requirements outpace specialized warehouse capacity development. This dynamic drives facility utilization rates above 85% in major markets, supporting pricing power for warehouse operators while creating opportunities for capacity expansion.

Technological disruption transforms operational models and competitive dynamics. Companies investing in advanced automation, IoT monitoring, and predictive analytics gain operational advantages, while those relying on traditional methods face increasing pressure to modernize or risk market share loss.

Regulatory evolution continuously reshapes operational requirements and compliance costs. Recent FDA guidance on supply chain security, temperature monitoring, and documentation standards requires ongoing facility upgrades and process improvements, creating both challenges and opportunities for market participants.

Consolidation trends influence market structure as larger operators acquire smaller facilities to expand geographic coverage and service capabilities. This consolidation can improve operational efficiency and service quality while potentially reducing competition in specific markets.

Customer concentration dynamics affect market stability, as pharmaceutical warehousing often involves long-term contracts with major pharmaceutical companies. While this provides revenue stability, it also creates dependency risks and limits pricing flexibility.

Economic factors including interest rates, construction costs, and labor availability impact facility development and operational expenses. Current economic conditions favor established operators with strong balance sheets while challenging new market entrants.

Comprehensive research methodology employed for analyzing the US pharmaceutical warehousing market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights.

Primary research encompasses extensive interviews with industry stakeholders including warehouse operators, pharmaceutical manufacturers, third-party logistics providers, regulatory experts, and technology vendors. These interviews provide firsthand insights into market trends, operational challenges, and future outlook perspectives from key market participants.

Secondary research involves analysis of industry reports, regulatory filings, company financial statements, trade publications, and government databases. This research provides quantitative data on market size, growth rates, regulatory changes, and competitive positioning across the pharmaceutical warehousing sector.

Market segmentation analysis utilizes multiple classification criteria including facility type, storage requirements, geographic location, and end-user categories. This segmentation enables detailed understanding of market dynamics within specific subsectors and identification of growth opportunities.

Competitive intelligence gathering involves monitoring company announcements, facility developments, service expansions, and strategic partnerships. This intelligence provides insights into competitive strategies and market positioning of key industry players.

Regulatory analysis examines federal and state regulations, FDA guidance documents, industry standards, and compliance requirements affecting pharmaceutical warehousing operations. This analysis ensures understanding of regulatory impacts on market development and operational requirements.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and reliability of research findings and market projections.

Geographic distribution of the US pharmaceutical warehousing market reveals distinct regional characteristics influenced by pharmaceutical manufacturing concentration, population density, regulatory environments, and transportation infrastructure.

Northeast Region dominates market activity with approximately 35% of total warehouse capacity, driven by proximity to major pharmaceutical companies, research institutions, and dense population centers. States including New Jersey, Pennsylvania, and New York host significant pharmaceutical manufacturing and distribution operations, creating sustained demand for specialized warehousing services.

Midwest Region represents 28% of market capacity, benefiting from central geographic location, excellent transportation connectivity, and lower operational costs. States like Illinois, Ohio, and Indiana serve as distribution hubs for national pharmaceutical supply chains, with facilities strategically positioned to serve both coasts efficiently.

Southeast Region captures 22% of market share through rapid population growth, expanding healthcare infrastructure, and favorable business environments. Florida, North Carolina, and Georgia attract pharmaceutical warehousing investment due to growing elderly populations and strategic port access for international trade.

Western Region holds 15% of capacity but demonstrates the highest growth rates, driven by biotechnology cluster development, particularly in California. The region’s focus on innovative pharmaceuticals and biologics creates demand for specialized cold chain warehousing capabilities.

Regional growth patterns indicate continued expansion in the Southeast and West, while Northeast and Midwest markets focus on facility modernization and automation integration to maintain competitive advantages.

Competitive dynamics within the US pharmaceutical warehousing market feature diverse participants ranging from global logistics giants to specialized pharmaceutical storage providers, each competing on service quality, regulatory compliance, and operational efficiency.

Market leaders include established companies with extensive facility networks and comprehensive service offerings:

Competitive strategies focus on geographic expansion, technology integration, specialized service development, and strategic partnerships. Companies differentiate through regulatory expertise, automation capabilities, and value-added services including clinical trial support and patient-specific packaging.

Market consolidation continues as larger operators acquire regional providers to expand coverage and capabilities, while smaller specialized companies focus on niche markets and high-value services to maintain competitive positions.

Market segmentation analysis reveals diverse categories within the US pharmaceutical warehousing sector, each characterized by specific operational requirements, growth dynamics, and competitive factors.

By Storage Type:

By End User:

By Service Model:

Detailed category analysis provides comprehensive understanding of performance dynamics, growth potential, and competitive positioning across major pharmaceutical warehousing segments.

Cold Chain Storage Category demonstrates exceptional growth momentum, driven by expanding biologics market and vaccine distribution requirements. This segment experiences 12.5% annual growth, significantly outpacing traditional ambient storage. Investment in ultra-cold storage capabilities creates competitive advantages and premium pricing opportunities for operators capable of maintaining specialized temperature requirements.

Controlled Substances Storage represents a specialized high-value segment requiring enhanced security measures, detailed documentation, and regulatory compliance. Facilities serving this category benefit from limited competition due to stringent licensing requirements and substantial security investments, supporting premium pricing and stable customer relationships.

E-commerce Fulfillment emerges as a rapidly growing category, transforming traditional warehouse operations to support direct-to-patient delivery models. This segment requires flexible automation systems, smaller order processing capabilities, and integration with digital platforms, creating opportunities for technology-focused operators.

Clinical Trial Support provides specialized services for pharmaceutical research and development activities. This category offers high-margin opportunities through customized storage solutions, protocol compliance, and regulatory documentation support, attracting operators seeking differentiated service offerings.

Returns Processing represents an essential but often overlooked category involving reverse logistics for expired, recalled, or unused pharmaceutical products. Specialized capabilities in this area create competitive advantages and additional revenue streams for comprehensive service providers.

Comprehensive benefits derived from professional pharmaceutical warehousing services extend across the healthcare supply chain, providing value to manufacturers, distributors, healthcare providers, and ultimately patients.

For Pharmaceutical Manufacturers:

For Healthcare Distributors:

For Healthcare Providers:

Comprehensive SWOT analysis examines internal strengths and weaknesses alongside external opportunities and threats affecting the US pharmaceutical warehousing market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the US pharmaceutical warehousing market reflect technological advancement, regulatory evolution, and changing healthcare delivery models driving operational innovation and strategic repositioning.

Automation Revolution represents the most significant operational trend, with facilities implementing advanced robotics, automated storage and retrieval systems, and AI-powered inventory management. These technologies improve accuracy rates to 99.9% while reducing labor requirements and operational costs, creating competitive advantages for early adopters.

Cold Chain Expansion accelerates as biologics, gene therapies, and mRNA vaccines require sophisticated temperature-controlled storage. Facilities are investing in ultra-cold storage capabilities, with some operators reporting 40% of new capacity dedicated to specialized temperature requirements below -20°C.

Sustainability Integration gains momentum as pharmaceutical companies prioritize environmental responsibility. Warehouses are adopting energy-efficient systems, renewable energy sources, and sustainable packaging solutions, with leading facilities achieving 25-30% energy consumption reductions through green technology implementation.

Digital Transformation encompasses IoT sensor networks, blockchain tracking, and predictive analytics to enhance supply chain visibility and regulatory compliance. These technologies provide real-time monitoring capabilities and automated documentation, reducing compliance risks and operational inefficiencies.

Direct-to-Patient Distribution transforms traditional warehousing models as e-commerce pharmaceutical sales expand. Facilities are adapting to support smaller order sizes, faster fulfillment cycles, and specialized packaging requirements for home delivery services.

Consolidation Acceleration continues as larger operators acquire regional facilities to expand geographic coverage and service capabilities, creating more comprehensive national networks and integrated service offerings.

Recent industry developments highlight significant investments, strategic partnerships, and technological innovations driving transformation within the US pharmaceutical warehousing sector.

Facility Expansion Projects demonstrate market confidence with major operators announcing substantial capacity additions. Several companies have committed to developing new pharmaceutical warehousing facilities totaling millions of square feet, particularly focused on cold chain capabilities and automated systems integration.

Technology Partnerships between warehousing operators and technology providers accelerate automation adoption and operational innovation. These collaborations focus on implementing advanced robotics, AI-powered inventory management, and IoT monitoring systems to enhance efficiency and compliance capabilities.

Regulatory Compliance Initiatives respond to evolving FDA guidelines and industry standards. Operators are investing in enhanced monitoring systems, documentation processes, and staff training programs to ensure continued compliance with changing regulatory requirements.

Sustainability Programs gain prominence as companies implement environmental initiatives including renewable energy adoption, energy-efficient systems, and sustainable packaging solutions. These programs align with corporate responsibility goals while reducing long-term operational costs.

Strategic Acquisitions reshape market structure as larger operators acquire specialized facilities and regional providers to expand service capabilities and geographic coverage. These transactions create more comprehensive service networks and integrated supply chain solutions.

Cold Chain Investments accelerate with operators developing ultra-cold storage capabilities to serve growing biologics and vaccine markets. These investments include specialized equipment, monitoring systems, and trained personnel to maintain products requiring temperatures as low as -80°C.

Strategic recommendations from MarkWide Research analysis provide actionable insights for stakeholders seeking to optimize their position within the evolving US pharmaceutical warehousing market.

Investment Prioritization should focus on cold chain capabilities and automation technologies as these segments demonstrate the strongest growth potential and competitive differentiation opportunities. Companies should allocate resources toward ultra-cold storage development and advanced robotics integration to capture emerging market opportunities.

Geographic Strategy recommendations emphasize expansion in high-growth regions including the Southeast and Western markets, while optimizing existing facilities in mature Northeast and Midwest markets through modernization and automation upgrades. Strategic facility placement near major population centers and transportation hubs maximizes distribution efficiency.

Technology Integration requires comprehensive planning and phased implementation to minimize operational disruption while maximizing benefits. Companies should prioritize IoT monitoring systems, automated inventory management, and predictive analytics to enhance operational efficiency and regulatory compliance.

Partnership Development with pharmaceutical manufacturers, technology providers, and logistics companies creates synergies and competitive advantages. Strategic alliances can provide access to new markets, specialized capabilities, and innovative solutions while sharing investment risks and costs.

Regulatory Preparedness demands ongoing investment in compliance systems, staff training, and documentation processes to address evolving FDA guidelines and industry standards. Proactive compliance strategies reduce regulatory risks and support long-term operational sustainability.

Sustainability Integration should encompass energy efficiency, renewable energy adoption, and environmental responsibility initiatives that align with customer expectations while reducing operational costs and regulatory compliance requirements.

Future market projections indicate sustained growth and continued transformation within the US pharmaceutical warehousing sector, driven by demographic trends, technological advancement, and evolving healthcare delivery models.

Growth trajectory analysis suggests the market will maintain robust expansion with projected compound annual growth rates of 8.5-9.2% over the next five years. This growth reflects increasing pharmaceutical consumption, specialty drug development, and expanding cold chain requirements for biologics and advanced therapies.

Technology evolution will accelerate automation adoption, with MarkWide Research projecting that 65% of pharmaceutical warehouses will implement significant automation systems within the next decade. Artificial intelligence, robotics, and IoT integration will become standard operational components rather than competitive differentiators.

Cold chain dominance will continue expanding as biologics, gene therapies, and personalized medicines require sophisticated temperature-controlled storage. Specialized cold storage capacity is expected to represent 45% of total market growth through 2030, creating substantial investment opportunities for operators with ultra-cold capabilities.

Regulatory evolution will drive continued facility upgrades and operational improvements as FDA guidelines become more stringent regarding supply chain security, temperature monitoring, and documentation requirements. Companies maintaining proactive compliance strategies will benefit from competitive advantages and reduced regulatory risks.

Market consolidation will accelerate as larger operators acquire regional facilities and specialized providers to create comprehensive national networks. This consolidation will improve operational efficiency and service quality while potentially reducing competition in specific geographic markets.

Sustainability requirements will become increasingly important as pharmaceutical companies prioritize environmental responsibility and regulatory agencies implement green initiatives. Facilities demonstrating environmental leadership will attract premium clients and benefit from operational cost reductions.

The US pharmaceutical warehousing market represents a dynamic and essential component of the healthcare supply chain, characterized by sustained growth, technological innovation, and evolving operational requirements. Market analysis reveals a sector experiencing robust expansion driven by demographic trends, regulatory compliance needs, and the increasing complexity of pharmaceutical products requiring specialized storage conditions.

Key market drivers including an aging population, specialty pharmaceutical growth, and e-commerce expansion create sustained demand for professional warehousing services. The sector’s resilience during recent global challenges demonstrates its critical importance to healthcare infrastructure and medication accessibility, supporting continued investment and development.

Technological transformation through automation, IoT integration, and advanced monitoring systems enhances operational efficiency while ensuring regulatory compliance. Companies embracing these innovations gain competitive advantages through improved accuracy, reduced costs, and enhanced service capabilities that differentiate their market position.

Cold chain expansion emerges as the most significant growth opportunity, driven by biologics, vaccines, and advanced therapies requiring sophisticated temperature-controlled storage. This segment’s exceptional growth potential creates substantial opportunities for operators capable of developing and maintaining ultra-cold storage capabilities.

Strategic positioning for future success requires balanced investment in technology integration, geographic expansion, and specialized service development. Companies maintaining focus on regulatory compliance, operational excellence, and customer service will benefit from the market’s continued growth and evolution, while those failing to adapt risk competitive disadvantage in an increasingly sophisticated marketplace.

What is Pharmaceutical Warehousing?

Pharmaceutical warehousing refers to the storage and management of pharmaceutical products, including medications and medical supplies, in facilities designed to maintain their integrity and safety. These warehouses play a crucial role in the supply chain, ensuring that products are stored under appropriate conditions and distributed efficiently to healthcare providers and pharmacies.

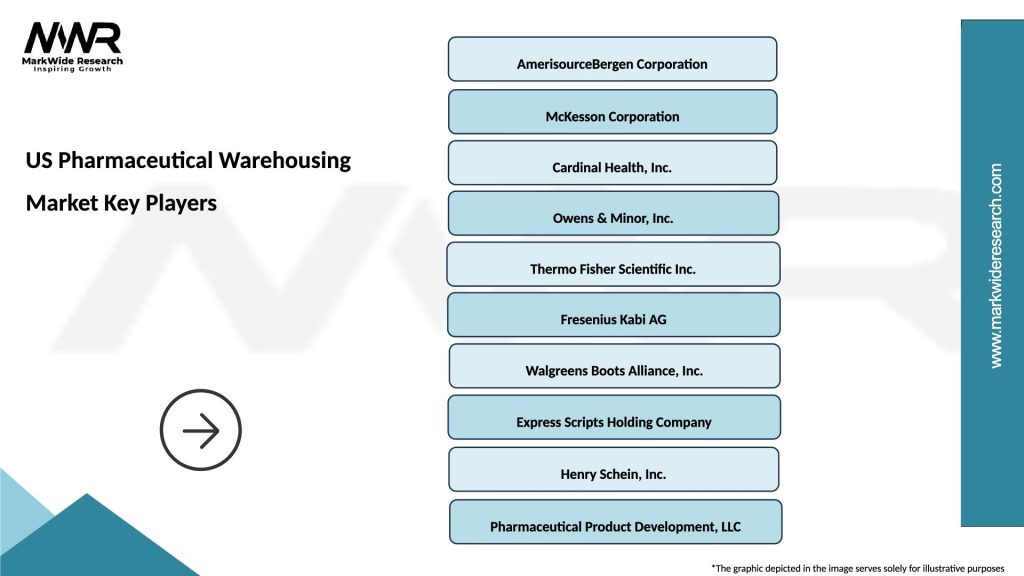

What are the key players in the US Pharmaceutical Warehousing Market?

Key players in the US Pharmaceutical Warehousing Market include AmerisourceBergen, McKesson Corporation, and Cardinal Health, among others. These companies provide comprehensive warehousing solutions, including inventory management and distribution services tailored to the pharmaceutical industry.

What are the main drivers of growth in the US Pharmaceutical Warehousing Market?

The growth of the US Pharmaceutical Warehousing Market is driven by factors such as the increasing demand for pharmaceuticals, the rise of e-commerce in healthcare, and the need for efficient supply chain management. Additionally, the expansion of biopharmaceuticals and personalized medicine is contributing to the demand for specialized warehousing solutions.

What challenges does the US Pharmaceutical Warehousing Market face?

The US Pharmaceutical Warehousing Market faces challenges such as stringent regulatory requirements, the need for advanced technology to ensure compliance, and the rising costs of maintaining temperature-controlled environments. Additionally, the complexity of managing diverse product lines can pose logistical difficulties.

What opportunities exist in the US Pharmaceutical Warehousing Market?

Opportunities in the US Pharmaceutical Warehousing Market include the adoption of automation and robotics to enhance efficiency, the integration of advanced tracking technologies, and the potential for expanding services to include cold chain logistics. These innovations can improve operational efficiency and meet the evolving needs of the pharmaceutical sector.

What trends are shaping the US Pharmaceutical Warehousing Market?

Trends shaping the US Pharmaceutical Warehousing Market include the increasing use of artificial intelligence for inventory management, the growth of omnichannel distribution strategies, and a focus on sustainability practices within warehousing operations. These trends are influencing how companies manage their supply chains and respond to market demands.

US Pharmaceutical Warehousing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Chain, Ambient Storage, Controlled Room Temperature, Hazardous Material Storage |

| End User | Pharmaceutical Manufacturers, Distributors, Retail Pharmacies, Hospitals |

| Technology | Automated Storage, RFID Tracking, Temperature Monitoring, Inventory Management Systems |

| Service Type | Third-Party Logistics, Warehousing Solutions, Inventory Management, Distribution Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Pharmaceutical Warehousing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at