444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US pharmaceutical contract manufacturing organization (CMO) market represents a critical component of the American healthcare ecosystem, providing essential outsourcing services to pharmaceutical companies across the nation. This dynamic sector encompasses a comprehensive range of manufacturing services, from active pharmaceutical ingredient (API) production to finished dosage form manufacturing, packaging, and specialized drug delivery systems.

Market dynamics indicate robust growth driven by increasing demand for specialized manufacturing capabilities, cost optimization strategies, and the growing complexity of modern pharmaceutical products. The sector has experienced significant expansion, with annual growth rates exceb>8.5% CAGR over recent years, reflecting the industry’s strategic shift toward outsourcing non-core manufacturing activities.

Key market characteristics include the presence of both large-scale integrated CMOs and specialized niche providers, serving diverse client needs from emerging biotechnology companies to established pharmaceutical giants. The market demonstrates strong geographical concentration in traditional pharmaceutical hubs while expanding into emerging manufacturing regions across the United States.

Technological advancement remains a primary driver, with CMOs investing heavily in advanced manufacturing technologies, continuous manufacturing processes, and digital transformation initiatives. These investments enable enhanced efficiency, improved quality control, and greater flexibility in meeting evolving client requirements.

The US pharmaceutical contract manufacturing organization market refers to the comprehensive ecosystem of third-party service providers that offer manufacturing, packaging, and related services to pharmaceutical and biotechnology companies on a contractual basis, enabling clients to focus on core competencies while leveraging specialized manufacturing expertise and infrastructure.

Contract manufacturing organizations serve as strategic partners, providing end-to-end manufacturing solutions that encompass everything from early-stage development support to commercial-scale production. These organizations maintain state-of-the-art facilities, regulatory compliance expertise, and specialized technical capabilities that many pharmaceutical companies find more cost-effective to outsource rather than develop internally.

Service offerings typically include API manufacturing, formulation development, clinical trial material production, commercial manufacturing, packaging services, and supply chain management. Many CMOs also provide value-added services such as regulatory support, analytical testing, and product lifecycle management.

Strategic importance of CMOs extends beyond simple cost reduction, encompassing risk mitigation, capacity flexibility, access to specialized technologies, and accelerated time-to-market for new pharmaceutical products. This positioning makes CMOs integral to the modern pharmaceutical industry’s operational strategy.

Market leadership in the US pharmaceutical CMO sector is characterized by a diverse landscape of service providers ranging from global integrated organizations to specialized niche players. The market demonstrates strong fundamentals driven by increasing outsourcing trends, regulatory complexity, and the growing demand for specialized manufacturing capabilities.

Growth trajectory remains robust, with industry expansion supported by multiple favorable factors including patent cliff dynamics, increasing development costs, and the rising complexity of modern pharmaceutical products. Outsourcing penetration rates have reached approximately 42% of total pharmaceutical manufacturing, indicating substantial market maturity while maintaining growth potential.

Competitive dynamics feature both consolidation trends among larger players and the emergence of specialized service providers focusing on specific therapeutic areas or manufacturing technologies. This dual trend creates opportunities for differentiation and market positioning across various service segments.

Regulatory environment continues to evolve, with CMOs adapting to enhanced FDA oversight, quality requirements, and supply chain transparency mandates. These regulatory developments drive investment in compliance capabilities and quality systems, creating barriers to entry while strengthening established players.

Future prospects appear favorable, with continued growth expected across multiple service categories, particularly in biologics manufacturing, complex generics, and specialized drug delivery systems. The market’s evolution toward higher-value services and strategic partnerships positions it for sustained expansion.

Cost optimization pressures represent a fundamental driver as pharmaceutical companies seek to reduce manufacturing expenses while maintaining quality standards. CMOs offer economies of scale, operational efficiency, and reduced capital investment requirements that appeal to companies across all size categories.

Regulatory complexity continues to increase, making specialized compliance expertise more valuable. CMOs invest heavily in regulatory capabilities, quality systems, and facility certifications that many pharmaceutical companies find challenging to maintain internally. This expertise becomes particularly critical for companies operating in multiple therapeutic areas or geographic markets.

Patent cliff dynamics create significant market opportunities as branded pharmaceutical companies face generic competition and seek cost-effective manufacturing solutions. Generic drug manufacturing represents approximately 35% of total CMO activity, reflecting this important market segment.

Innovation requirements drive demand for specialized manufacturing capabilities, particularly in emerging therapeutic areas such as cell and gene therapy, complex biologics, and novel drug delivery systems. CMOs provide access to cutting-edge technologies and expertise that would be prohibitively expensive for individual companies to develop.

Supply chain resilience has become increasingly important, with companies seeking diversified manufacturing networks to mitigate risks. CMOs offer geographic diversification, redundant capacity, and flexible manufacturing arrangements that enhance supply security.

Quality control concerns remain a significant challenge as pharmaceutical companies must ensure that outsourced manufacturing maintains the same quality standards as internal operations. Regulatory agencies have increased scrutiny of CMO operations, leading to enhanced oversight requirements and potential supply disruptions.

Intellectual property risks create hesitation among some pharmaceutical companies, particularly for proprietary formulations or manufacturing processes. Concerns about technology transfer, confidentiality, and competitive intelligence sharing can limit outsourcing adoption in certain therapeutic areas.

Capacity constraints periodically impact the market, particularly during peak demand periods or when specific manufacturing capabilities are in high demand. Utilization rates at leading CMOs often exceed 85%, creating potential bottlenecks and pricing pressures.

Regulatory compliance costs continue to increase as quality standards become more stringent. CMOs must invest significantly in compliance infrastructure, documentation systems, and quality assurance capabilities, which can impact pricing and profitability.

Technology transfer challenges can create delays and additional costs when moving manufacturing processes from client facilities to CMO operations. Complex products may require extensive process development and validation work, extending timelines and increasing project costs.

Biologics manufacturing presents substantial growth opportunities as the pharmaceutical industry increasingly focuses on complex biological products. CMOs with specialized biologics capabilities can command premium pricing while serving a rapidly expanding market segment.

Emerging therapeutic modalities including cell therapy, gene therapy, and advanced drug delivery systems create new service categories with limited competition. Early movers in these areas can establish strong market positions and develop specialized expertise.

Digital transformation initiatives offer opportunities to enhance operational efficiency, improve quality control, and provide enhanced client services. CMOs investing in digital technologies can differentiate their offerings and improve competitive positioning.

Geographic expansion within the United States provides opportunities to serve regional markets, reduce transportation costs, and enhance supply chain flexibility. Strategic facility placement can create competitive advantages in specific market segments.

Value-added services beyond traditional manufacturing, including regulatory support, analytical testing, and supply chain management, offer higher margins and stronger client relationships. These services create opportunities for revenue diversification and enhanced client value propositions.

Competitive intensity varies significantly across different service segments, with commodity manufacturing experiencing price pressure while specialized services command premium pricing. Market leaders leverage scale advantages, technological capabilities, and regulatory expertise to maintain competitive positioning.

Client relationship evolution shows a clear trend toward strategic partnerships rather than transactional relationships. Long-term agreements provide revenue stability for CMOs while offering clients enhanced service levels and priority access to capacity.

Technology adoption accelerates across the industry, with continuous manufacturing adoption rates reaching approximately 28% among leading CMOs. These technologies offer improved efficiency, reduced costs, and enhanced quality control capabilities.

Regulatory environment continues to evolve, with increased FDA oversight and enhanced quality requirements. CMOs must balance compliance investments with operational efficiency while maintaining competitive pricing structures.

Market consolidation trends create both opportunities and challenges, as larger organizations acquire specialized capabilities while smaller players seek niche positioning. This dynamic reshapes competitive landscapes and service offerings across multiple market segments.

Primary research methodologies employed in analyzing the US pharmaceutical CMO market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and detailed analysis of operational metrics across leading service providers.

Secondary research encompasses extensive analysis of industry publications, regulatory filings, company financial reports, and market intelligence databases. This approach provides comprehensive coverage of market trends, competitive dynamics, and regulatory developments.

Data validation processes ensure accuracy and reliability through multiple source verification, expert review panels, and statistical analysis techniques. Cross-referencing of information sources helps eliminate inconsistencies and provides robust analytical foundations.

Market segmentation analysis utilizes both quantitative and qualitative approaches to identify key market categories, growth patterns, and competitive dynamics. This methodology enables detailed understanding of market structure and opportunity identification.

Forecasting models incorporate multiple variables including historical trends, regulatory changes, technological developments, and economic factors to project future market evolution. These models provide strategic insights for industry participants and stakeholders.

Northeast region maintains its position as the largest pharmaceutical CMO market, accounting for approximately 38% of total market activity. This concentration reflects the region’s established pharmaceutical infrastructure, skilled workforce, and proximity to major pharmaceutical companies and regulatory agencies.

Mid-Atlantic states represent another significant market concentration, with strong presence in both traditional pharmaceutical manufacturing and emerging biologics production. The region benefits from excellent transportation infrastructure and established supply chain networks.

Southeast region demonstrates rapid growth in CMO activity, driven by favorable business climates, lower operational costs, and strategic investments by major service providers. Regional growth rates exceed 12% annually in key markets.

Midwest manufacturing centers continue to play important roles in pharmaceutical CMO operations, particularly for large-scale production and logistics-intensive activities. The region’s manufacturing expertise and transportation advantages support continued market presence.

West Coast markets show strong growth in specialized manufacturing services, particularly biotechnology and advanced therapeutic modalities. The region’s innovation ecosystem and venture capital availability support emerging CMO service categories.

Market leadership is distributed among several categories of service providers, each with distinct competitive advantages and market positioning strategies.

Competitive differentiation strategies focus on specialized capabilities, quality excellence, regulatory expertise, and strategic partnership development. Leading providers invest heavily in technology advancement and capacity expansion to maintain market position.

By Service Type:

By Product Type:

By End User:

API Manufacturing represents the largest service category, driven by strong demand for both generic and branded active ingredients. This segment benefits from economies of scale and established manufacturing processes, though it faces pricing pressure from global competition.

Finished Dosage Form Manufacturing shows steady growth across multiple product categories, with particular strength in complex formulations and specialized delivery systems. Market share for this segment accounts for approximately 45% of total CMO activity.

Biologics Manufacturing demonstrates the highest growth rates, reflecting increasing pharmaceutical industry focus on biological products. This segment commands premium pricing due to specialized facility requirements and technical expertise needs.

Packaging Services continue to evolve with enhanced serialization requirements and supply chain security mandates. Advanced packaging capabilities including cold chain management and specialized handling create differentiation opportunities.

Analytical Services represent a growing value-added category, with CMOs expanding testing capabilities to provide comprehensive quality assurance and regulatory support services to clients.

Pharmaceutical Companies benefit from reduced capital investment requirements, access to specialized expertise, operational flexibility, and enhanced focus on core competencies. CMO partnerships enable faster market entry and risk mitigation across multiple therapeutic areas.

Biotechnology Companies gain access to commercial-scale manufacturing capabilities without significant capital investment, enabling resource allocation toward research and development activities. CMO relationships provide scalability and regulatory expertise critical for successful product commercialization.

Investors find attractive opportunities in the CMO sector due to recurring revenue models, growing market demand, and barriers to entry that protect established players. The sector offers exposure to pharmaceutical industry growth with potentially lower risk profiles.

Healthcare Systems benefit from improved drug availability, cost-effective manufacturing solutions, and enhanced supply chain resilience. CMO capabilities support generic drug availability and pricing competition that benefits healthcare cost management.

Regulatory Agencies work with CMOs to ensure quality standards and compliance across the pharmaceutical supply chain. Enhanced oversight capabilities and standardized processes improve overall pharmaceutical quality and safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Continuous Manufacturing adoption accelerates across the industry, with leading CMOs investing in advanced process technologies that offer improved efficiency, reduced costs, and enhanced quality control. This trend represents a fundamental shift from traditional batch processing methods.

Digital Integration transforms CMO operations through implementation of advanced data analytics, process automation, and digital quality systems. These technologies enable real-time monitoring, predictive maintenance, and enhanced client communication capabilities.

Sustainability Initiatives gain prominence as CMOs implement green manufacturing practices, waste reduction programs, and energy efficiency improvements. Environmental considerations increasingly influence client selection criteria and regulatory requirements.

Strategic Partnership Evolution shows movement toward long-term collaborative relationships that extend beyond traditional manufacturing services. These partnerships include joint development programs, risk-sharing arrangements, and integrated supply chain management.

Specialized Service Development focuses on emerging therapeutic areas including cell therapy, gene therapy, and personalized medicine. CMOs develop niche capabilities that command premium pricing and create competitive differentiation.

Facility Expansion activities continue across major CMO providers, with significant investments in biologics manufacturing capabilities, specialized therapy production, and geographic market development. These expansions reflect strong market demand and growth expectations.

Technology Partnerships between CMOs and technology providers accelerate innovation adoption and capability development. Collaborative arrangements enable access to cutting-edge manufacturing technologies and process improvements.

Regulatory Enhancements include implementation of enhanced quality systems, serialization capabilities, and supply chain transparency measures. According to MarkWide Research analysis, regulatory compliance investments have increased by 15% annually across leading CMO providers.

Acquisition Activity remains robust as larger CMOs acquire specialized capabilities and smaller providers seek scale advantages. Market consolidation creates opportunities for enhanced service offerings and geographic expansion.

Client Relationship Evolution demonstrates increasing preference for strategic partnerships over transactional relationships. Long-term agreements provide revenue stability while enabling enhanced service development and capacity planning.

Investment Focus should prioritize biologics manufacturing capabilities, advanced therapy production, and digital technology integration. These areas offer the highest growth potential and competitive differentiation opportunities in the evolving market landscape.

Geographic Strategy recommendations include selective expansion in emerging US markets while maintaining strong presence in established pharmaceutical hubs. Regional diversification provides supply chain resilience and cost optimization opportunities.

Service Portfolio Development should emphasize value-added services beyond traditional manufacturing, including regulatory support, analytical testing, and supply chain management. These services offer higher margins and stronger client relationships.

Quality Excellence remains paramount, with continued investment in compliance capabilities, quality systems, and regulatory expertise essential for maintaining market position. Quality leadership creates competitive advantages and client confidence.

Partnership Strategy should focus on developing long-term strategic relationships with key clients while maintaining operational flexibility. Collaborative arrangements enable mutual growth and risk sharing while providing revenue stability.

Market growth prospects remain favorable, with continued expansion expected across multiple service categories and therapeutic areas. MWR projects sustained growth driven by increasing outsourcing adoption, regulatory complexity, and technological advancement.

Biologics manufacturing will continue to represent the highest growth segment, with projected annual growth rates exceeding 12% as pharmaceutical companies increase focus on biological products and biosimilars.

Technology integration will accelerate, with digital transformation initiatives, continuous manufacturing adoption, and advanced analytics becoming standard capabilities rather than competitive differentiators.

Regulatory environment evolution will continue to drive demand for specialized compliance expertise and quality capabilities. CMOs with strong regulatory track records will maintain competitive advantages in client selection processes.

Market consolidation trends are expected to continue, with larger providers acquiring specialized capabilities while smaller companies focus on niche market positioning. This dynamic will reshape competitive landscapes across multiple service segments.

The US pharmaceutical CMO market represents a dynamic and essential component of the American healthcare ecosystem, providing critical manufacturing services that enable pharmaceutical innovation and cost-effective drug production. Market fundamentals remain strong, supported by increasing outsourcing trends, regulatory complexity, and growing demand for specialized manufacturing capabilities.

Growth prospects appear favorable across multiple market segments, with particular strength in biologics manufacturing, emerging therapeutic modalities, and value-added services. The sector’s evolution toward strategic partnerships and comprehensive service offerings positions it for sustained expansion and enhanced client value creation.

Competitive dynamics continue to evolve through market consolidation, technology advancement, and service portfolio expansion. Leading providers maintain advantages through scale, expertise, and regulatory compliance capabilities, while specialized players find opportunities in niche market segments.

Future success in the US pharmaceutical CMO market will depend on continued investment in advanced manufacturing capabilities, regulatory excellence, and strategic client relationships. Organizations that effectively balance operational efficiency with service innovation will be best positioned to capitalize on emerging market opportunities and maintain competitive leadership in this critical industry sector.

What is Pharmaceutical Contract Manufacturing Organization (CMO)?

Pharmaceutical Contract Manufacturing Organization (CMO) refers to companies that provide manufacturing services for pharmaceutical products on behalf of other companies. These organizations handle various processes including drug formulation, production, and packaging, allowing pharmaceutical firms to focus on research and development.

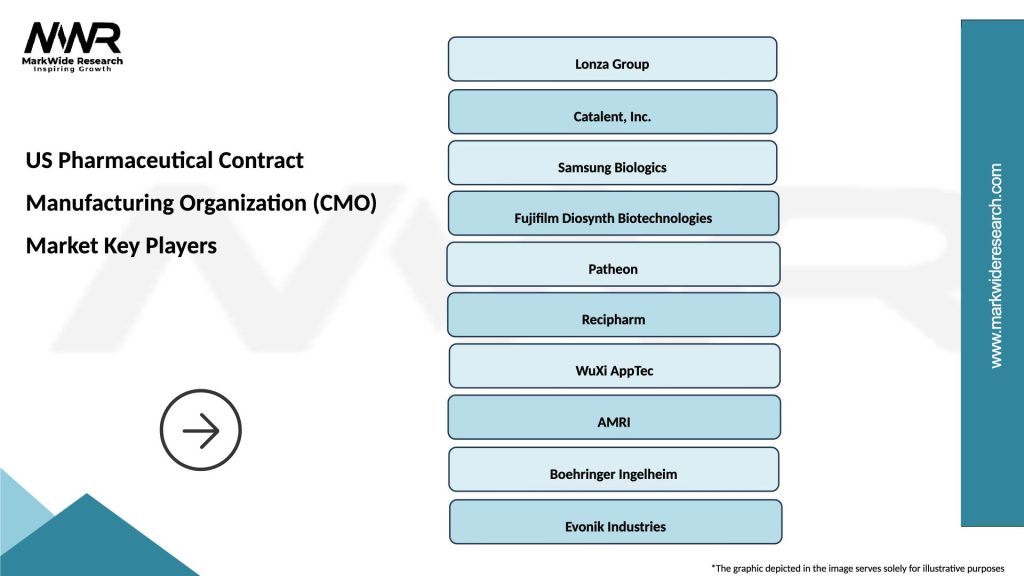

What are the key players in the US Pharmaceutical Contract Manufacturing Organization (CMO) Market?

Key players in the US Pharmaceutical Contract Manufacturing Organization (CMO) Market include Catalent, Lonza, and Patheon. These companies are known for their extensive capabilities in drug development and manufacturing, serving a wide range of pharmaceutical clients, among others.

What are the growth factors driving the US Pharmaceutical Contract Manufacturing Organization (CMO) Market?

The US Pharmaceutical Contract Manufacturing Organization (CMO) Market is driven by factors such as the increasing demand for generic drugs, the rise in biopharmaceutical production, and the need for cost-effective manufacturing solutions. Additionally, the growing trend of outsourcing manufacturing processes is contributing to market expansion.

What challenges does the US Pharmaceutical Contract Manufacturing Organization (CMO) Market face?

The US Pharmaceutical Contract Manufacturing Organization (CMO) Market faces challenges such as stringent regulatory requirements, quality control issues, and the need for advanced technology integration. These factors can complicate compliance and operational efficiency for CMOs.

What opportunities exist in the US Pharmaceutical Contract Manufacturing Organization (CMO) Market?

Opportunities in the US Pharmaceutical Contract Manufacturing Organization (CMO) Market include the increasing demand for personalized medicine and the expansion of biologics manufacturing. Additionally, advancements in technology such as automation and digitalization present new avenues for growth.

What trends are shaping the US Pharmaceutical Contract Manufacturing Organization (CMO) Market?

Trends shaping the US Pharmaceutical Contract Manufacturing Organization (CMO) Market include the rise of continuous manufacturing processes, increased focus on sustainability, and the integration of advanced analytics in production. These trends are influencing how CMOs operate and deliver services.

US Pharmaceutical Contract Manufacturing Organization (CMO) Market

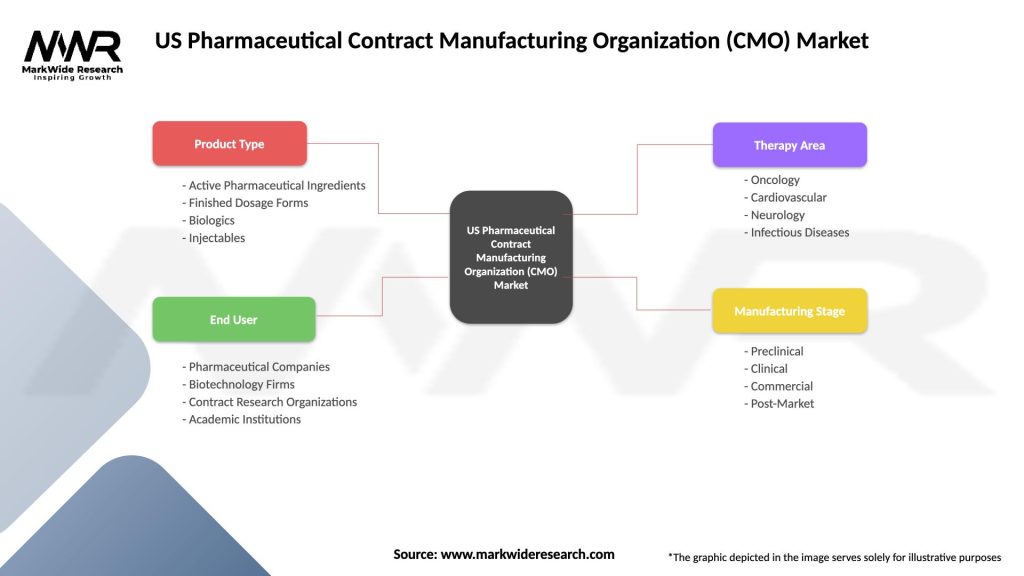

| Segmentation Details | Description |

|---|---|

| Product Type | Active Pharmaceutical Ingredients, Finished Dosage Forms, Biologics, Injectables |

| End User | Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations, Academic Institutions |

| Therapy Area | Oncology, Cardiovascular, Neurology, Infectious Diseases |

| Manufacturing Stage | Preclinical, Clinical, Commercial, Post-Market |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Pharmaceutical Contract Manufacturing Organization (CMO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at