444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US pharma contract packaging market represents a dynamic and rapidly evolving segment of the pharmaceutical supply chain, characterized by increasing outsourcing trends and growing demand for specialized packaging solutions. Contract packaging organizations (CPOs) have become integral partners for pharmaceutical companies seeking to optimize their operations while maintaining compliance with stringent regulatory requirements. The market encompasses a comprehensive range of services including primary packaging, secondary packaging, labeling, serialization, and distribution services.

Market dynamics indicate robust growth driven by pharmaceutical companies’ strategic focus on core competencies while outsourcing non-core activities. The sector benefits from increasing complexity in drug formulations, rising demand for personalized medicines, and evolving regulatory landscapes requiring specialized expertise. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting strong underlying demand fundamentals.

Technological advancement plays a crucial role in market evolution, with automation, robotics, and digital solutions transforming traditional packaging processes. The integration of track-and-trace technologies, smart packaging solutions, and advanced quality control systems has enhanced operational efficiency while ensuring regulatory compliance. These innovations have positioned contract packaging as a strategic value-add service rather than merely a cost-reduction initiative.

The US pharma contract packaging market refers to the comprehensive ecosystem of third-party service providers that offer specialized packaging solutions to pharmaceutical and biotechnology companies. These services encompass the complete packaging value chain from initial product receipt through final distribution-ready packaging.

Contract packaging services include primary packaging (bottles, vials, syringes), secondary packaging (cartons, labels, inserts), tertiary packaging (cases, pallets), and value-added services such as serialization, aggregation, and regulatory compliance support. The market serves diverse pharmaceutical segments including prescription drugs, over-the-counter medications, biologics, and medical devices.

Service providers in this market range from large multinational organizations offering comprehensive solutions to specialized niche players focusing on specific therapeutic areas or packaging technologies. The model enables pharmaceutical companies to leverage external expertise, reduce capital investments, and maintain flexibility in their supply chain operations while ensuring compliance with FDA regulations and other regulatory requirements.

Strategic positioning within the US pharma contract packaging market reflects the sector’s evolution from a cost-focused service model to a value-driven partnership approach. The market demonstrates strong growth momentum supported by increasing pharmaceutical outsourcing trends, with outsourcing penetration rates reaching approximately 42% of total packaging operations across the pharmaceutical industry.

Key market drivers include the growing complexity of drug delivery systems, increasing regulatory requirements for serialization and track-and-trace capabilities, and pharmaceutical companies’ strategic focus on core research and development activities. The market benefits from rising demand for specialized packaging solutions for biologics and personalized medicines, which require sophisticated handling and storage capabilities.

Competitive dynamics are characterized by ongoing consolidation among service providers, with leading companies expanding their geographic footprint and service capabilities through strategic acquisitions. The market structure includes both large integrated service providers and specialized niche players, creating a diverse ecosystem that serves various pharmaceutical company needs and preferences.

Future growth prospects remain robust, driven by continued pharmaceutical industry expansion, increasing complexity of drug formulations, and evolving regulatory requirements. The integration of advanced technologies including automation, artificial intelligence, and blockchain solutions is expected to further enhance service capabilities and market attractiveness.

Market segmentation reveals distinct growth patterns across different service categories and pharmaceutical segments. The following key insights highlight critical market dynamics:

Pharmaceutical outsourcing trends represent the primary driver of contract packaging market growth, as companies increasingly focus resources on core competencies while leveraging external expertise for non-core activities. This strategic shift enables pharmaceutical companies to reduce fixed costs, improve operational flexibility, and access specialized capabilities without significant capital investments.

Regulatory complexity continues to drive demand for specialized contract packaging services, particularly in areas such as serialization, track-and-trace implementation, and compliance with evolving FDA requirements. The implementation of the Drug Supply Chain Security Act has created substantial demand for specialized expertise and technology capabilities that many pharmaceutical companies prefer to access through external partnerships.

Technology advancement serves as both a market driver and enabler, with contract packaging providers investing heavily in automation, robotics, and digital solutions to enhance operational efficiency and service quality. These technological capabilities often exceed what individual pharmaceutical companies can economically justify for their internal operations, making outsourcing increasingly attractive.

Market expansion in specialized therapeutic areas, particularly biologics and personalized medicines, drives demand for sophisticated packaging solutions requiring specialized handling, storage, and distribution capabilities. The growing complexity of drug delivery systems and combination products further increases the value proposition of specialized contract packaging services.

Quality control concerns represent a significant market restraint, as pharmaceutical companies maintain stringent requirements for product quality and regulatory compliance. The potential risks associated with outsourcing critical packaging operations, including product contamination, labeling errors, or regulatory non-compliance, can limit market adoption among risk-averse pharmaceutical companies.

Regulatory oversight complexity creates challenges for both service providers and pharmaceutical clients, requiring extensive documentation, validation, and ongoing compliance monitoring. The need for comprehensive quality agreements, regular audits, and regulatory inspections can increase operational complexity and costs for all parties involved.

Intellectual property protection concerns may limit pharmaceutical companies’ willingness to outsource packaging operations, particularly for proprietary formulations or innovative drug delivery systems. The need to share sensitive product information and manufacturing processes with external partners can create competitive risks that some companies prefer to avoid.

Supply chain disruption risks have become more prominent following recent global events, with pharmaceutical companies increasingly focused on supply chain resilience and risk mitigation. Dependence on external packaging providers can create additional supply chain vulnerabilities that may discourage outsourcing in certain situations.

Biologics packaging represents a substantial growth opportunity, as the increasing development and commercialization of biological drugs requires specialized packaging solutions with sophisticated cold chain management, stability monitoring, and handling capabilities. The unique requirements of biologics create opportunities for service providers to develop specialized expertise and command premium pricing.

Personalized medicine packaging offers significant potential as the pharmaceutical industry moves toward more targeted therapies requiring individualized packaging solutions. This trend creates opportunities for flexible, small-batch packaging capabilities and advanced labeling systems that can accommodate patient-specific information and dosing requirements.

Digital transformation initiatives present opportunities for contract packaging providers to differentiate their services through advanced analytics, real-time monitoring, and integrated supply chain visibility solutions. The integration of Internet of Things (IoT) technologies, blockchain solutions, and artificial intelligence can create new value propositions for pharmaceutical clients.

Geographic expansion opportunities exist as pharmaceutical companies globalize their operations and seek contract packaging partners with international capabilities. The ability to provide consistent service quality across multiple geographic markets represents a significant competitive advantage and growth opportunity for established service providers.

Competitive intensity within the US pharma contract packaging market continues to evolve as established players expand their service capabilities while new entrants target specialized market segments. The market demonstrates characteristics of both consolidation among larger players and fragmentation in specialized service areas, creating a complex competitive landscape.

Client relationship dynamics have shifted toward longer-term strategic partnerships rather than transactional service relationships. Pharmaceutical companies increasingly value service providers that can demonstrate deep industry expertise, regulatory compliance capabilities, and technology innovation. This trend has led to average contract duration increases of approximately 28% over recent years.

Technology integration continues to reshape market dynamics, with service providers investing heavily in automation, digitalization, and advanced quality control systems. These investments create competitive advantages while also raising barriers to entry for smaller players lacking the resources to implement sophisticated technology solutions.

Regulatory evolution remains a constant dynamic force, with ongoing changes in FDA requirements, international harmonization efforts, and emerging regulations for new therapeutic categories. Service providers must continuously adapt their capabilities and processes to maintain compliance and support client regulatory requirements.

Primary research methodologies employed in analyzing the US pharma contract packaging market include comprehensive surveys of pharmaceutical industry executives, contract packaging service providers, and regulatory experts. These primary research activities provide insights into market trends, competitive dynamics, and future growth prospects from key industry stakeholders.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and trade association publications to develop a comprehensive understanding of market structure and dynamics. This research approach ensures broad market coverage while identifying key trends and growth drivers affecting the industry.

Market sizing methodologies utilize multiple approaches including top-down analysis based on pharmaceutical industry outsourcing trends and bottom-up analysis based on service provider capacity and utilization rates. Cross-validation of results ensures accuracy and reliability of market assessments and growth projections.

Competitive analysis incorporates detailed evaluation of service provider capabilities, geographic presence, client relationships, and strategic positioning. This analysis provides insights into market structure, competitive advantages, and potential consolidation trends affecting the industry landscape.

Northeast region dominates the US pharma contract packaging market, accounting for approximately 38% of total market activity, driven by the concentration of pharmaceutical companies and established contract packaging infrastructure. States including New Jersey, New York, and Pennsylvania host numerous pharmaceutical headquarters and manufacturing facilities, creating strong demand for local packaging services.

Midwest region represents the second-largest market segment with approximately 27% market share, benefiting from lower operational costs and central geographic positioning that supports efficient distribution to national markets. The region’s strong manufacturing heritage and skilled workforce provide competitive advantages for contract packaging operations.

Southeast region demonstrates the fastest growth rate among all regions, with expansion driven by pharmaceutical companies relocating manufacturing operations to benefit from favorable business climates and lower operational costs. States including North Carolina, South Carolina, and Florida have emerged as significant pharmaceutical manufacturing hubs.

West Coast region maintains a strong market position, particularly in specialized packaging for biotechnology companies and innovative drug delivery systems. The region’s concentration of biotech companies and venture capital funding creates demand for specialized packaging solutions supporting clinical trials and product launches.

Market leadership is characterized by a mix of large integrated service providers and specialized niche players, creating a diverse competitive ecosystem. The competitive landscape continues to evolve through strategic acquisitions, capacity expansions, and technology investments.

Competitive strategies increasingly focus on technology differentiation, geographic expansion, and development of specialized capabilities for high-growth therapeutic areas. Service providers are investing in automation, digital solutions, and advanced quality systems to enhance their competitive positioning.

By Service Type:

By Product Type:

By End User:

Primary packaging services represent the largest market segment, driven by pharmaceutical companies’ need for specialized expertise in direct product contact packaging. This category benefits from increasing complexity in drug delivery systems and growing demand for patient-friendly packaging solutions. Innovation trends include smart packaging technologies, child-resistant closures, and specialized materials for sensitive formulations.

Secondary packaging services demonstrate strong growth driven by regulatory requirements for serialization and track-and-trace capabilities. The implementation of Drug Supply Chain Security Act requirements has created substantial demand for specialized expertise and technology capabilities. This segment benefits from increasing complexity in labeling requirements and multi-language packaging needs for global markets.

Biologics packaging represents the fastest-growing category, with specialized requirements for cold chain management, stability monitoring, and contamination prevention. The unique characteristics of biological products create opportunities for premium pricing and long-term client relationships. Growth rates in this category exceed 12% annually, reflecting the expanding biologics market.

Serialization services have emerged as a critical category following regulatory implementation requirements. Service providers with advanced technology capabilities and regulatory expertise command premium pricing in this segment. The category benefits from ongoing global harmonization efforts and expanding regulatory requirements in international markets.

Pharmaceutical companies benefit from contract packaging partnerships through reduced capital requirements, improved operational flexibility, and access to specialized expertise. Outsourcing enables companies to focus resources on core competencies while leveraging external capabilities for non-core activities. Cost optimization typically ranges from 15-25% compared to internal packaging operations.

Contract packaging providers benefit from stable, long-term client relationships and opportunities for value-added service expansion. The market provides opportunities for geographic expansion, technology investment, and specialized capability development. Successful providers can achieve premium pricing through differentiated service offerings and regulatory expertise.

Healthcare stakeholders benefit from improved product quality, enhanced supply chain efficiency, and better regulatory compliance through specialized contract packaging services. The focus on quality management systems and advanced technology solutions contributes to overall pharmaceutical supply chain reliability and patient safety.

Regulatory agencies benefit from contract packaging providers’ specialized expertise and investment in compliance capabilities. The concentration of regulatory expertise among service providers can enhance overall industry compliance and reduce regulatory risks associated with packaging operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the contract packaging landscape, with service providers investing heavily in automation, artificial intelligence, and advanced analytics capabilities. These technologies enable real-time monitoring, predictive maintenance, and enhanced quality control while improving operational efficiency and client visibility.

Sustainability initiatives are gaining prominence as pharmaceutical companies and contract packaging providers focus on environmental responsibility. This trend includes adoption of recyclable packaging materials, energy-efficient operations, and waste reduction programs. Sustainable packaging adoption rates have increased by 31% among leading service providers over recent years.

Supply chain resilience has become a critical focus area following recent global disruptions, with companies implementing diversification strategies, nearshoring initiatives, and enhanced risk management capabilities. Contract packaging providers are expanding their geographic footprint and developing redundant capacity to support client supply chain resilience requirements.

Personalized medicine packaging is emerging as a significant trend, driven by the pharmaceutical industry’s movement toward targeted therapies and individualized treatment approaches. This trend requires flexible packaging capabilities, advanced labeling systems, and sophisticated inventory management to accommodate patient-specific requirements.

Regulatory implementation of enhanced serialization requirements has driven significant industry investment in track-and-trace capabilities and technology infrastructure. The Drug Supply Chain Security Act implementation has created new compliance requirements that benefit specialized service providers with advanced technology capabilities.

Strategic acquisitions continue to reshape the competitive landscape, with leading service providers expanding their capabilities and geographic presence through targeted acquisitions. Recent consolidation activity has focused on companies with specialized technology capabilities or strong positions in high-growth therapeutic areas.

Technology partnerships between contract packaging providers and technology companies are accelerating innovation in automation, digital solutions, and advanced analytics. These partnerships enable service providers to access cutting-edge technologies while technology companies gain industry expertise and market access.

Capacity expansion initiatives are underway across the industry as service providers respond to growing demand and geographic expansion requirements. New facility investments focus on advanced automation, flexible manufacturing capabilities, and specialized services for high-growth therapeutic areas.

MarkWide Research analysis suggests that pharmaceutical companies should evaluate contract packaging partnerships based on comprehensive criteria including technology capabilities, regulatory expertise, and long-term strategic alignment rather than focusing solely on cost considerations. The complexity of modern pharmaceutical packaging requires specialized expertise that justifies premium pricing for qualified service providers.

Service provider selection should prioritize companies with demonstrated capabilities in relevant therapeutic areas, strong regulatory compliance records, and investment in advanced technology solutions. The ability to provide comprehensive services across multiple packaging categories can reduce complexity and improve supply chain efficiency for pharmaceutical clients.

Technology investment priorities should focus on solutions that enhance operational efficiency, improve quality control, and provide real-time visibility into packaging operations. The integration of digital solutions, automation, and advanced analytics can create competitive advantages while supporting regulatory compliance requirements.

Geographic diversification strategies should consider both domestic and international expansion opportunities, with particular focus on regions experiencing pharmaceutical industry growth. The ability to provide consistent service quality across multiple geographic markets represents a significant competitive advantage in the global pharmaceutical industry.

Market growth prospects remain robust through the forecast period, driven by continued pharmaceutical industry expansion, increasing outsourcing trends, and growing complexity in drug formulations and packaging requirements. MWR projections indicate sustained growth momentum with particular strength in specialized therapeutic areas and advanced technology solutions.

Technology evolution will continue to reshape the market landscape, with artificial intelligence, machine learning, and advanced robotics becoming standard capabilities among leading service providers. The integration of Internet of Things technologies and blockchain solutions will enhance supply chain visibility and regulatory compliance capabilities.

Regulatory developments are expected to drive continued demand for specialized expertise, particularly in areas such as global harmonization, emerging therapeutic categories, and enhanced supply chain security requirements. Service providers with strong regulatory capabilities and technology infrastructure will benefit from these evolving requirements.

Market consolidation trends are likely to continue, with leading service providers expanding their capabilities and geographic presence through strategic acquisitions. This consolidation will create opportunities for specialized niche players while increasing competitive pressure on mid-sized providers lacking differentiated capabilities.

The US pharma contract packaging market represents a dynamic and rapidly evolving industry segment positioned for continued growth driven by pharmaceutical industry trends, regulatory requirements, and technology advancement. The market benefits from strong underlying demand fundamentals including increasing outsourcing penetration, growing complexity in drug formulations, and evolving regulatory landscapes requiring specialized expertise.

Strategic positioning within this market requires focus on technology differentiation, regulatory expertise, and specialized capabilities in high-growth therapeutic areas. Service providers that successfully integrate advanced automation, digital solutions, and comprehensive quality management systems will capture disproportionate value creation opportunities while building sustainable competitive advantages.

Future success in the contract packaging market will depend on the ability to adapt to evolving pharmaceutical industry requirements, invest in advanced technology solutions, and develop specialized expertise in emerging therapeutic categories. The market outlook remains positive, with robust growth prospects supported by fundamental industry trends and increasing recognition of contract packaging as a strategic value-add service rather than merely a cost-reduction initiative.

What is Pharma Contract Packaging?

Pharma Contract Packaging refers to the outsourcing of packaging services by pharmaceutical companies to specialized firms. This process includes various packaging solutions such as blister packaging, bottle filling, and labeling, ensuring compliance with regulatory standards.

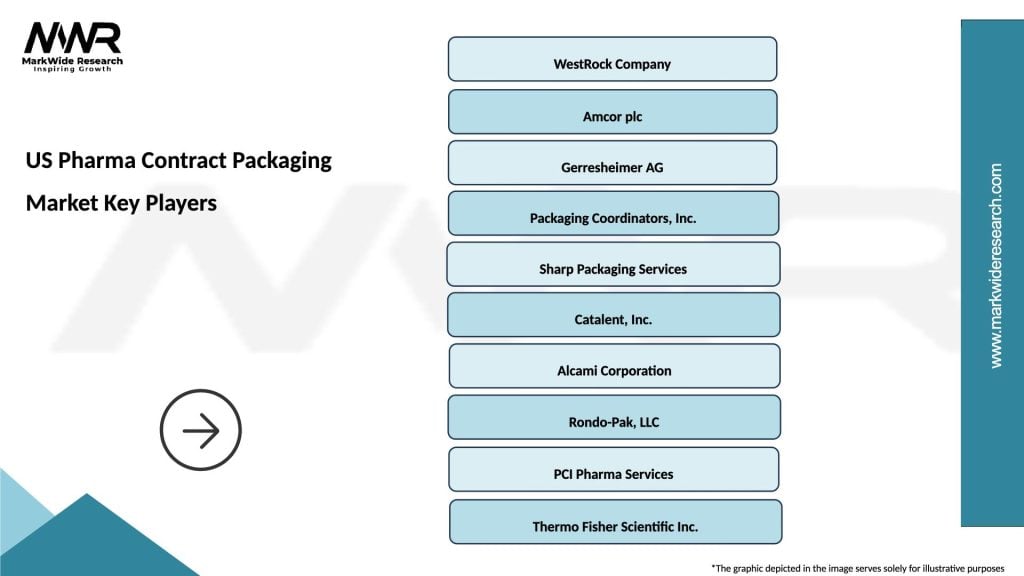

What are the key players in the US Pharma Contract Packaging Market?

Key players in the US Pharma Contract Packaging Market include companies like Catalent, Inc., West Pharmaceutical Services, and Amcor plc, among others. These companies provide a range of packaging solutions tailored to the pharmaceutical industry.

What are the growth factors driving the US Pharma Contract Packaging Market?

The US Pharma Contract Packaging Market is driven by factors such as the increasing demand for pharmaceutical products, the need for compliance with stringent regulations, and the growing trend of outsourcing packaging services to reduce costs and improve efficiency.

What challenges does the US Pharma Contract Packaging Market face?

Challenges in the US Pharma Contract Packaging Market include the complexity of regulatory compliance, the need for advanced technology to meet packaging requirements, and the potential for supply chain disruptions that can affect timely delivery.

What opportunities exist in the US Pharma Contract Packaging Market?

Opportunities in the US Pharma Contract Packaging Market include the rise of biologics and biosimilars, advancements in packaging technology, and the increasing focus on sustainability in packaging materials and processes.

What trends are shaping the US Pharma Contract Packaging Market?

Trends in the US Pharma Contract Packaging Market include the adoption of smart packaging solutions, the integration of automation in packaging processes, and a growing emphasis on patient-centric packaging designs that enhance user experience.

US Pharma Contract Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Blister Packs, Bottles, Pouches, Cartons |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Institutions, Biotech Firms |

| Material | Plastic, Glass, Aluminum, Paperboard |

| Technology | Thermoforming, Injection Molding, Flexographic Printing, Digital Printing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Pharma Contract Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at