444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US pet market represents one of the most resilient and consistently growing consumer sectors in the American economy. This comprehensive market encompasses pet food, veterinary care, pet supplies, grooming services, and various pet-related products and services. Market dynamics indicate sustained growth driven by increasing pet ownership rates, humanization of pets, and evolving consumer preferences toward premium pet products.

Pet ownership trends show that approximately 70% of American households own at least one pet, creating a substantial consumer base that continues to expand. The market demonstrates remarkable stability even during economic downturns, as pet owners prioritize their animals’ well-being regardless of financial constraints. Growth patterns indicate consistent expansion across all major segments, with premium and specialized products experiencing particularly robust demand.

Consumer spending patterns reveal a shift toward higher-quality products and services, with pet owners increasingly willing to invest in premium nutrition, advanced veterinary care, and luxury accessories. This trend reflects the growing perception of pets as family members rather than mere companions. Market projections suggest continued growth at a compound annual growth rate of 6.1% through the forecast period, driven by demographic shifts and changing lifestyle preferences.

The US pet market refers to the comprehensive ecosystem of products, services, and solutions designed to meet the needs of domesticated animals and their owners across the United States. This market encompasses everything from basic necessities like food and shelter to luxury items and specialized services that enhance pets’ quality of life.

Market scope includes traditional segments such as pet food, veterinary services, and basic supplies, as well as emerging categories like pet insurance, technology-enabled products, and premium grooming services. The market reflects the evolving relationship between Americans and their pets, characterized by increased emotional attachment and willingness to spend on pet-related products and services.

Industry definition extends beyond simple product sales to include service-based offerings such as pet sitting, training, boarding, and specialized healthcare. This comprehensive approach recognizes that modern pet ownership involves multiple touchpoints and service providers, creating a complex but lucrative market ecosystem that serves diverse consumer needs and preferences.

Market performance in the US pet industry demonstrates exceptional resilience and consistent growth across all major segments. The industry benefits from favorable demographic trends, including an aging population seeking companionship and millennials embracing pet ownership as a lifestyle choice. Key growth drivers include the humanization of pets, increasing disposable income, and growing awareness of pet health and wellness.

Segment analysis reveals that pet food represents the largest market share at approximately 42% of total spending, followed by veterinary care and pet supplies. Premium and organic pet food categories are experiencing particularly strong growth, reflecting consumer preferences for high-quality nutrition. Service segments including grooming, boarding, and training are expanding rapidly as pet owners seek professional care solutions.

Competitive landscape features a mix of large multinational corporations and specialized niche players. Major companies like Mars Petcare, Nestlé Purina, and Hill’s Pet Nutrition dominate the food segment, while veterinary services remain largely fragmented among independent practices and emerging corporate chains. Innovation trends focus on natural ingredients, technology integration, and personalized products tailored to specific pet needs and owner preferences.

Consumer behavior analysis reveals significant insights into pet owner spending patterns and preferences. Modern pet owners demonstrate strong brand loyalty while remaining open to premium alternatives that offer perceived health benefits. MarkWide Research analysis indicates that pet owners are increasingly influenced by veterinary recommendations and online reviews when making purchasing decisions.

Primary growth drivers in the US pet market stem from fundamental shifts in American society and consumer behavior. The increasing humanization of pets represents the most significant driver, as owners treat their animals as family members deserving of high-quality care and products. This trend manifests in willingness to spend on premium food, advanced veterinary care, and luxury accessories that enhance pets’ quality of life.

Demographic factors play a crucial role in market expansion. The aging baby boomer population increasingly turns to pets for companionship, while millennials and Gen Z consumers embrace pet ownership as a lifestyle choice. Urbanization trends contribute to growth as city dwellers seek smaller pets that fit apartment living, driving demand for specialized urban pet products and services.

Economic prosperity enables increased discretionary spending on pets, with many households allocating significant portions of their budgets to pet-related expenses. Rising disposable income levels support premium product adoption and frequent veterinary visits. Health awareness drives demand for preventive care products and services, as pet owners recognize the long-term benefits of proactive health management for their animals.

Technology advancement creates new market opportunities through innovative products like smart feeding systems, GPS tracking devices, and telemedicine platforms. These technological solutions address modern pet owners’ desires for convenience, monitoring capabilities, and enhanced care options that fit busy lifestyles.

Economic sensitivity remains a significant constraint despite the market’s general resilience. During economic downturns, some pet owners may delay non-essential purchases or switch to lower-priced alternatives. Price inflation in premium pet food and veterinary services can impact demand among price-sensitive consumers, particularly those with multiple pets or limited disposable income.

Regulatory challenges affect various market segments, particularly pet food manufacturing and veterinary pharmaceuticals. Stringent FDA regulations and safety requirements increase compliance costs for manufacturers, potentially limiting innovation and market entry for smaller companies. Supply chain disruptions can impact product availability and pricing, affecting consumer satisfaction and brand loyalty.

Market saturation in certain segments creates competitive pressure and limits growth opportunities. The pet food market, in particular, faces intense competition with numerous brands competing for shelf space and consumer attention. Consumer education gaps regarding pet nutrition and care can limit adoption of premium products and services, as some owners remain unaware of available options or their benefits.

Veterinary workforce shortages constrain growth in professional services, leading to longer wait times and higher costs that may discourage some pet owners from seeking regular care. This shortage particularly affects rural areas where veterinary services may be limited or unavailable.

Emerging opportunities in the US pet market center around technological innovation and evolving consumer preferences. The growing interest in personalized pet nutrition presents significant potential for companies developing customized food formulations based on individual pet characteristics, health conditions, and dietary requirements. Subscription-based models offer recurring revenue opportunities while providing convenience for busy pet owners.

Digital transformation creates opportunities for telemedicine platforms, mobile apps for pet care management, and e-commerce solutions that enhance the customer experience. Smart pet products including health monitors, automated feeders, and interactive toys represent rapidly expanding market segments with substantial growth potential.

Aging pet population drives demand for senior pet products and services, including specialized nutrition, mobility aids, and geriatric veterinary care. This demographic shift creates opportunities for companies developing age-specific solutions that address the unique needs of older pets and their concerned owners.

Sustainability initiatives present opportunities for eco-friendly product development, sustainable packaging solutions, and environmentally responsible manufacturing processes. Consumers increasingly seek brands that align with their environmental values, creating competitive advantages for companies embracing sustainability practices.

Market forces shaping the US pet industry reflect complex interactions between consumer behavior, technological advancement, and economic factors. The fundamental driver remains the emotional bond between pets and their owners, which creates relatively inelastic demand for essential products and services. Consumer loyalty tends to be high in this market, with pet owners reluctant to switch brands that their animals accept and enjoy.

Competitive dynamics vary significantly across market segments. The pet food sector features intense competition among established brands, while emerging categories like pet technology offer opportunities for new entrants. Innovation cycles are accelerating as companies invest in research and development to differentiate their offerings and capture market share.

Distribution channels are evolving rapidly with the growth of e-commerce and direct-to-consumer models. Traditional pet specialty retailers face competition from online platforms, big-box stores, and subscription services. Omnichannel strategies become increasingly important as consumers expect seamless shopping experiences across multiple touchpoints.

Regulatory environment influences market dynamics through safety standards, labeling requirements, and approval processes for new products. Companies must navigate complex regulatory frameworks while maintaining innovation momentum and competitive positioning in rapidly evolving market segments.

Data collection approaches for US pet market analysis employ multiple methodologies to ensure comprehensive coverage and accuracy. Primary research includes consumer surveys, industry interviews, and focus groups with pet owners across diverse demographic segments. Secondary research incorporates industry reports, government statistics, and company financial disclosures to validate findings and identify trends.

Quantitative analysis utilizes statistical modeling to project market growth rates, segment performance, and competitive positioning. Market sizing methodologies combine top-down and bottom-up approaches to ensure accuracy and reliability. Qualitative insights from industry experts and consumer interviews provide context for quantitative findings and help identify emerging trends and opportunities.

Market segmentation analysis employs demographic, psychographic, and behavioral variables to identify distinct consumer groups and their preferences. Geographic analysis considers regional variations in pet ownership patterns, spending levels, and product preferences across different US markets.

Validation processes include cross-referencing multiple data sources, conducting sensitivity analyses, and engaging industry stakeholders for feedback on findings and projections. This comprehensive approach ensures research reliability and provides actionable insights for market participants and stakeholders.

Geographic distribution of the US pet market reveals significant regional variations in pet ownership rates, spending patterns, and product preferences. The West Coast leads in premium product adoption and innovative pet services, with California representing approximately 12% of national pet spending. This region demonstrates strong preferences for organic and natural pet foods, reflecting broader health and wellness trends.

Northeast markets show high spending per pet due to elevated income levels and urban living conditions that favor smaller, higher-maintenance pets. Cities like New York and Boston drive demand for professional pet services including grooming, walking, and boarding. Market concentration in metropolitan areas creates opportunities for specialized service providers and premium product retailers.

Southern states demonstrate strong pet ownership rates with preferences for traditional pet food brands and basic care products. However, growing urbanization and income levels are driving increased adoption of premium products and services. Rural markets throughout the South and Midwest maintain focus on functional products and value-oriented purchasing decisions.

Midwest regions balance between traditional and premium product adoption, with strong representation of family-owned pets and emphasis on practical solutions. Regional preferences vary significantly, with coastal areas favoring innovation and interior regions prioritizing proven products and established brands. Climate considerations also influence product demand, with seasonal variations affecting certain categories like outdoor gear and grooming services.

Market leadership in the US pet industry is distributed across multiple segments, with different companies dominating specific categories. The competitive environment features both global corporations and specialized niche players, creating a dynamic marketplace with varied strategies and positioning approaches.

Competitive strategies vary significantly across market segments, with food companies focusing on product innovation and brand building, while service providers emphasize convenience and customer experience. Consolidation trends continue as larger companies acquire specialized brands and regional players to expand their market presence and capabilities.

Market segmentation in the US pet industry reflects diverse consumer needs and preferences across multiple dimensions. Product-based segmentation represents the primary categorization method, dividing the market into distinct categories that serve different aspects of pet ownership and care requirements.

By Product Category:

By Pet Type:

By Distribution Channel:

Pet food category dominates market spending and demonstrates consistent innovation in nutrition, ingredients, and packaging. Premium and super-premium segments show the strongest growth, driven by consumer awareness of nutrition’s impact on pet health and longevity. Natural and organic subcategories experience particularly robust demand, with growth rates exceeding 15% annually in many product lines.

Veterinary services represent the second-largest spending category, with increasing emphasis on preventive care and wellness programs. Specialty veterinary care including oncology, cardiology, and orthopedics shows strong growth as pet owners seek advanced treatment options. Emergency and critical care services maintain steady demand with premium pricing reflecting specialized expertise and equipment requirements.

Pet supplies segment encompasses diverse product categories from basic necessities to luxury accessories. Technology-enabled products including smart collars, automated feeders, and health monitors represent the fastest-growing subcategory. Traditional categories like toys and bedding maintain steady growth while evolving to incorporate new materials and design innovations.

Pet services category benefits from busy lifestyles and increasing pet humanization trends. Professional grooming services show consistent growth, while boarding and daycare facilities expand to meet demand from working pet owners. Training services gain popularity as owners seek professional help with behavior modification and skill development.

Manufacturers benefit from the pet market’s resilience and consistent growth patterns, providing stable revenue streams and opportunities for premium pricing. The emotional attachment between pets and owners creates strong brand loyalty and reduces price sensitivity for quality products. Innovation opportunities abound in areas like functional nutrition, technology integration, and sustainable packaging solutions.

Retailers gain from the pet market’s regular purchase patterns and high customer lifetime value. Pet owners typically shop frequently for food and supplies, creating multiple touchpoints for relationship building and cross-selling opportunities. Service integration allows retailers to expand beyond product sales into higher-margin services like grooming and training.

Service providers benefit from growing demand for professional pet care as owners seek expert solutions for their animals’ needs. Recurring revenue models in services like boarding, grooming, and veterinary care provide predictable income streams and strong customer relationships. Specialization opportunities exist in areas like senior pet care, behavioral training, and alternative therapies.

Investors find the pet market attractive due to its defensive characteristics and consistent growth trajectory. Market stability during economic downturns makes pet-related businesses appealing for portfolio diversification. Emerging segments like pet technology and subscription services offer high-growth potential with scalable business models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Humanization trend continues to reshape the pet market as owners increasingly treat their animals as family members. This fundamental shift drives demand for premium products, advanced healthcare, and luxury services that mirror human consumption patterns. Premium positioning becomes more important as consumers seek products that reflect their care and affection for their pets.

Health and wellness focus influences product development across all categories, with emphasis on functional ingredients, preventive care, and holistic approaches to pet health. Natural and organic products gain market share as owners apply their own health consciousness to their pets’ needs. Supplement categories expand rapidly as preventive health measures gain acceptance.

Technology integration accelerates across multiple product categories, from smart feeding systems to health monitoring devices. Connected products appeal to tech-savvy pet owners who want to monitor and interact with their pets remotely. Mobile apps and digital platforms enhance the customer experience and create new service delivery models.

Sustainability consciousness drives demand for eco-friendly products, sustainable packaging, and responsible sourcing practices. Environmental considerations influence purchasing decisions as consumers seek brands that align with their values. Companies respond with recyclable packaging, sustainable ingredients, and carbon-neutral initiatives.

Convenience demand fuels growth in subscription services, online purchasing, and home delivery options. Busy lifestyles create opportunities for services that save time and effort while ensuring pets receive consistent care and nutrition. Automated solutions and scheduled deliveries become increasingly popular among working pet owners.

Recent acquisitions and mergers continue to reshape the competitive landscape as companies seek to expand their market presence and capabilities. Strategic partnerships between manufacturers, retailers, and service providers create integrated solutions that enhance customer value and market reach. Technology companies increasingly enter the pet market through partnerships with established players.

Product innovation accelerates in areas like functional nutrition, with companies developing specialized formulations for specific health conditions and life stages. Ingredient transparency becomes a competitive differentiator as consumers demand detailed information about product contents and sourcing practices. Clean label trends drive reformulation efforts across multiple product categories.

Digital transformation initiatives focus on enhancing customer experience through e-commerce platforms, mobile apps, and subscription services. Data analytics capabilities enable personalized marketing and product recommendations based on individual pet characteristics and purchase history. Telemedicine platforms expand access to veterinary care, particularly in underserved rural areas.

Regulatory developments include updated safety standards for pet food manufacturing and new requirements for product labeling and health claims. Industry self-regulation initiatives aim to maintain consumer confidence and prevent more stringent government oversight. Companies invest in compliance systems and quality assurance programs to meet evolving standards.

Strategic recommendations for market participants focus on leveraging key growth trends while addressing emerging challenges. MWR analysis suggests that companies should prioritize innovation in premium and specialized product categories where consumer willingness to pay higher prices remains strong. Investment in technology integration and digital capabilities becomes essential for maintaining competitive positioning.

Market positioning strategies should emphasize brand differentiation through quality, innovation, and customer experience rather than competing solely on price. Omnichannel approaches become critical as consumers expect seamless shopping experiences across multiple touchpoints. Companies should invest in direct-to-consumer capabilities while maintaining strong retail partnerships.

Growth opportunities exist in underserved segments like senior pet care, small animal products, and specialized services. Geographic expansion into emerging markets and underserved regions offers potential for market share growth. International expansion should consider local preferences and regulatory requirements while leveraging core brand strengths.

Risk management strategies should address supply chain vulnerabilities, regulatory compliance, and competitive pressures. Diversification across product categories and geographic markets can reduce dependence on single revenue streams. Companies should maintain financial flexibility to navigate economic uncertainties and capitalize on acquisition opportunities.

Long-term projections for the US pet market indicate continued robust growth driven by favorable demographic trends and evolving consumer preferences. Market expansion is expected to maintain a steady pace with growth rates of 5-7% annually across most segments. Premium and specialized product categories will likely outperform traditional segments as consumer sophistication increases.

Technology adoption will accelerate across all market segments, with smart products and digital services becoming mainstream rather than niche offerings. Artificial intelligence and machine learning applications will enhance product personalization and customer service capabilities. Telemedicine and remote monitoring solutions will expand access to veterinary care and preventive health services.

Demographic shifts will continue to favor market growth as millennials and Gen Z consumers embrace pet ownership and prioritize their animals’ well-being. Aging pet populations will drive demand for specialized senior care products and services. Urban living trends will influence product development toward space-efficient and convenience-oriented solutions.

Sustainability initiatives will become increasingly important for competitive positioning as environmental consciousness grows among consumers. Circular economy principles will influence packaging design and product lifecycle management. Companies that successfully integrate sustainability with performance and convenience will gain competitive advantages in the evolving marketplace.

The US pet market represents a dynamic and resilient industry with strong fundamentals supporting continued growth and innovation. The deep emotional bonds between Americans and their pets create a stable foundation for market expansion, while evolving consumer preferences drive demand for premium products and specialized services. Market participants who successfully navigate changing consumer expectations and technological advancement will find significant opportunities for growth and profitability.

Key success factors include maintaining focus on quality and innovation while building strong customer relationships across multiple channels. The industry’s defensive characteristics and consistent growth patterns make it attractive for both established players and new entrants seeking stable, long-term opportunities. Strategic positioning around emerging trends like technology integration, sustainability, and personalization will determine competitive success in the evolving marketplace.

Future prospects remain highly favorable as demographic trends, lifestyle changes, and increasing pet humanization continue to drive market expansion. Companies that invest in innovation, customer experience, and operational excellence while maintaining financial discipline will be well-positioned to capitalize on the substantial opportunities ahead in this thriving and essential American industry.

What is a pet?

A pet is an animal kept primarily for companionship and enjoyment, rather than for utility. Common pets include dogs, cats, birds, and small mammals, which are often considered part of the family in many households.

What are the major companies in the US Pet Market?

Major companies in the US Pet Market include PetSmart, Petco, and Chewy, which offer a wide range of pet products and services. These companies compete in areas such as pet food, grooming, and veterinary services, among others.

What are the growth factors driving the US Pet Market?

The US Pet Market is driven by factors such as increasing pet ownership, a growing trend of pet humanization, and rising spending on premium pet products. Additionally, the demand for pet health and wellness products is contributing to market growth.

What challenges does the US Pet Market face?

Challenges in the US Pet Market include rising costs of pet care and products, supply chain disruptions, and increasing competition from online retailers. These factors can impact pricing and availability for consumers.

What opportunities exist in the US Pet Market?

Opportunities in the US Pet Market include the expansion of e-commerce platforms, the introduction of innovative pet products, and the growing interest in pet services such as training and pet sitting. These trends can lead to new revenue streams for businesses.

What trends are shaping the US Pet Market?

Trends in the US Pet Market include a rise in organic and natural pet foods, increased focus on pet health and wellness, and the growing popularity of pet technology products. These trends reflect changing consumer preferences and a desire for higher quality pet care.

US Pet Market

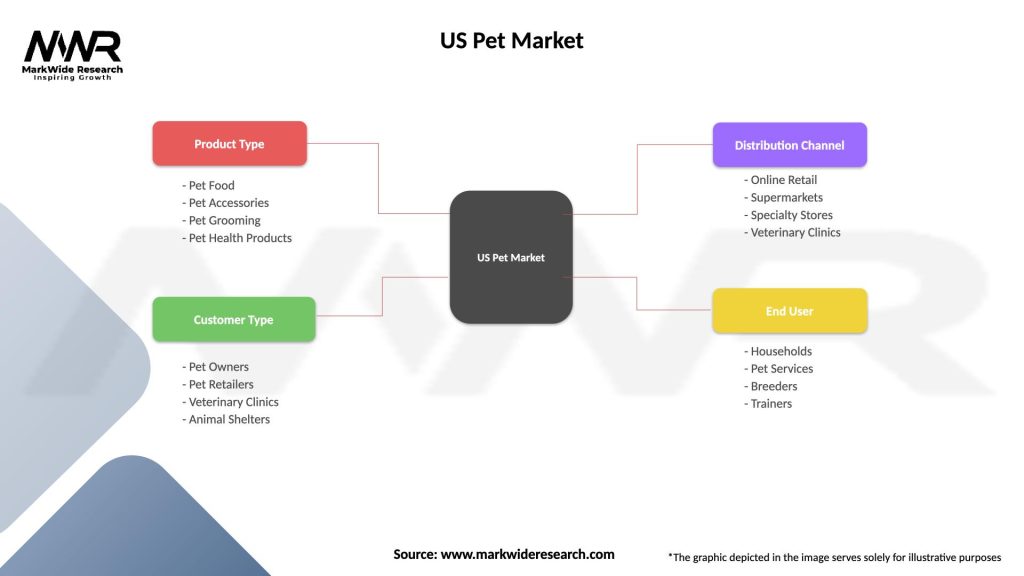

| Segmentation Details | Description |

|---|---|

| Product Type | Pet Food, Pet Accessories, Pet Grooming, Pet Health Products |

| Customer Type | Pet Owners, Pet Retailers, Veterinary Clinics, Animal Shelters |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Veterinary Clinics |

| End User | Households, Pet Services, Breeders, Trainers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Pet Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at