444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US paperboard container market is a vital segment of the packaging industry, providing versatile and sustainable solutions for packaging various products across different sectors. Paperboard containers are widely used for packaging food and beverages, pharmaceuticals, personal care products, and consumer goods. With their lightweight, eco-friendly properties, and customizable designs, paperboard containers have gained popularity among manufacturers and consumers alike, driving growth in the US market.

Meaning

Paperboard containers refer to packaging made from thick paper or paperboard material, typically used for the packaging of goods. These containers come in various shapes, sizes, and configurations, ranging from folding cartons and corrugated boxes to tubes and trays. Paperboard containers offer several advantages, including cost-effectiveness, recyclability, and customization options, making them a preferred choice for packaging applications in the US market.

Executive Summary

The US paperboard container market is experiencing steady growth, driven by factors such as the increasing demand for sustainable packaging solutions, the growth of e-commerce, and the rising preference for convenience among consumers. Paperboard containers offer manufacturers and retailers a versatile and eco-friendly packaging option that meets both regulatory requirements and consumer preferences. With innovations in design, printing, and material technology, the US paperboard container market is poised for further expansion in the coming years.

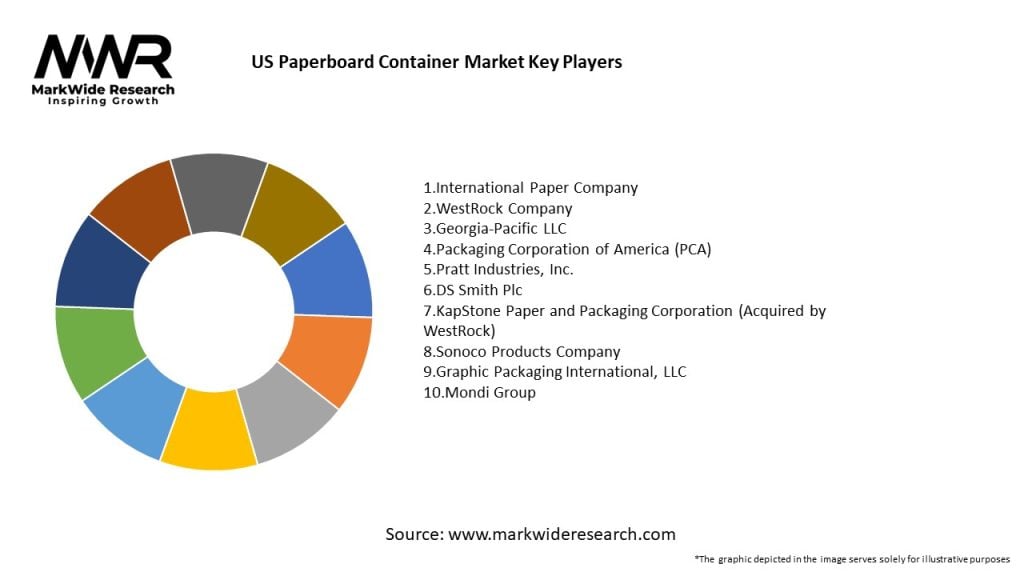

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US paperboard container market operates in a dynamic environment shaped by factors such as changing consumer preferences, technological advancements, regulatory developments, and market competition. Understanding these dynamics is essential for manufacturers, retailers, and stakeholders to identify opportunities, mitigate risks, and drive growth in the market.

Regional Analysis

The US paperboard container market exhibits regional variations in demand, driven by factors such as population density, economic activity, industry presence, and consumer preferences. Major regions for paperboard container consumption in the US include:

Competitive Landscape

Leading Companies in the US Paperboard Container Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

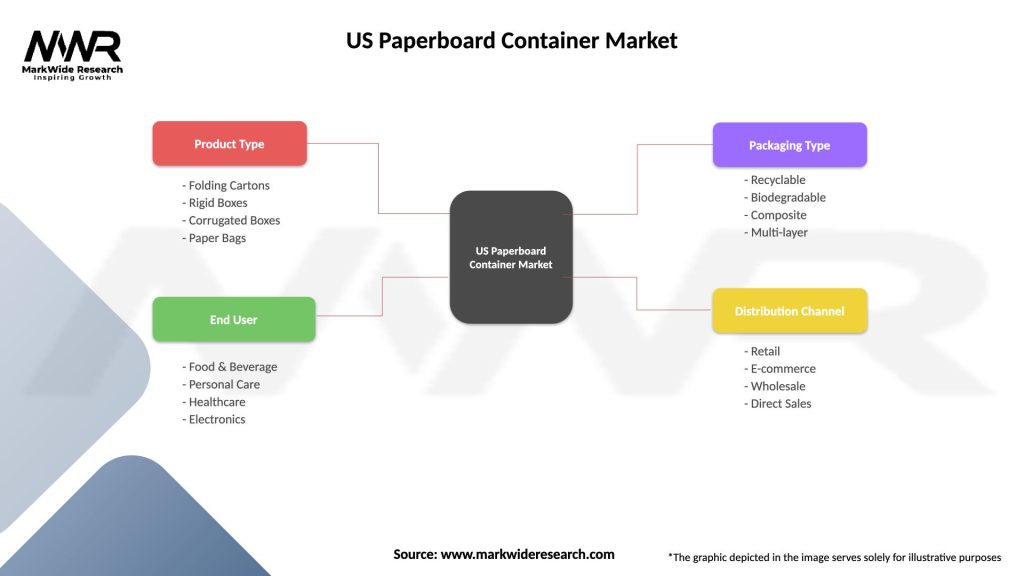

Segmentation

The US paperboard container market can be segmented based on various factors, including:

Segmentation provides insights into market trends, customer preferences, and growth opportunities, enabling companies to tailor their products and strategies to specific market segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated trends in the US paperboard container market, including the growth of e-commerce, demand for sustainable packaging, and emphasis on product safety and hygiene. Paperboard containers have played a crucial role in packaging essential goods, healthcare products, and online purchases during the pandemic, driving market growth and innovation.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US paperboard container market is expected to witness continued growth and innovation driven by factors such as sustainability, e-commerce expansion, customization, and technological advancements. As consumer preferences evolve, manufacturers will need to adapt by offering sustainable, customizable, and technologically advanced packaging solutions to meet market demand and stay competitive.

Conclusion

The US paperboard container market plays a crucial role in the packaging industry, offering sustainable, customizable, and versatile packaging solutions for various products and industries. With growing demand for eco-friendly packaging, the rise of e-commerce, and advancements in technology, paperboard containers are poised for further growth and innovation. By focusing on sustainability, innovation, collaboration, and digital transformation, manufacturers can navigate market challenges, seize opportunities, and shape the future of packaging in the US.

What is Paperboard Container?

Paperboard containers are packaging solutions made from paperboard, a thick paper-based material. They are widely used for various applications, including food packaging, consumer goods, and industrial products due to their lightweight and recyclable nature.

What are the key players in the US Paperboard Container Market?

Key players in the US Paperboard Container Market include International Paper Company, WestRock Company, and Smurfit Kappa Group, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the US Paperboard Container Market?

The main drivers of the US Paperboard Container Market include the increasing demand for sustainable packaging solutions, the growth of the e-commerce sector, and the rising consumer preference for eco-friendly products. These factors are pushing manufacturers to innovate and expand their product offerings.

What challenges does the US Paperboard Container Market face?

The US Paperboard Container Market faces challenges such as fluctuating raw material prices and competition from alternative packaging materials like plastics. Additionally, regulatory pressures regarding sustainability can impact production processes.

What opportunities exist in the US Paperboard Container Market?

Opportunities in the US Paperboard Container Market include the growing trend towards sustainable packaging and the expansion of online retail. Companies can leverage these trends to develop new products that meet consumer demands for environmentally friendly options.

What trends are shaping the US Paperboard Container Market?

Trends shaping the US Paperboard Container Market include the increasing use of digital printing technologies for customization and branding, as well as the rise of smart packaging solutions. These innovations are enhancing the functionality and appeal of paperboard containers.

US Paperboard Container Market

| Segmentation Details | Description |

|---|---|

| Product Type | Folding Cartons, Rigid Boxes, Corrugated Boxes, Paper Bags |

| End User | Food & Beverage, Personal Care, Healthcare, Electronics |

| Packaging Type | Recyclable, Biodegradable, Composite, Multi-layer |

| Distribution Channel | Retail, E-commerce, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Paperboard Container Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at