444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US outpatient rehabilitation centers market represents a rapidly expanding healthcare sector focused on providing comprehensive therapeutic services without requiring overnight hospital stays. This dynamic market encompasses physical therapy, occupational therapy, speech therapy, and specialized rehabilitation programs designed to help patients recover from injuries, surgeries, and chronic conditions. Market growth is driven by an aging population, increasing prevalence of chronic diseases, and growing awareness of the benefits of early intervention and preventive care.

Healthcare transformation has positioned outpatient rehabilitation centers as essential components of the continuum of care, offering cost-effective alternatives to inpatient services. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, reflecting strong demand for accessible rehabilitation services. Technological integration and evidence-based treatment protocols have enhanced service delivery, attracting both patients and healthcare providers to outpatient rehabilitation models.

Regional distribution shows significant concentration in metropolitan areas, with approximately 68% of facilities located in urban centers where population density and healthcare infrastructure support comprehensive service offerings. The market benefits from favorable reimbursement policies, increased insurance coverage for rehabilitation services, and growing recognition of outpatient care’s role in reducing overall healthcare costs while improving patient outcomes.

The US outpatient rehabilitation centers market refers to the comprehensive network of healthcare facilities that provide therapeutic and rehabilitative services to patients who do not require overnight hospitalization. These centers specialize in helping individuals recover from injuries, manage chronic conditions, and improve functional capabilities through structured treatment programs delivered by licensed healthcare professionals.

Outpatient rehabilitation encompasses a wide range of services including physical therapy for mobility restoration, occupational therapy for daily living skills, speech-language pathology for communication disorders, and specialized programs for neurological, orthopedic, and cardiac rehabilitation. Service delivery models vary from standalone rehabilitation clinics to hospital-affiliated outpatient departments and integrated health system facilities.

Market participants include independent rehabilitation providers, hospital-based outpatient departments, skilled nursing facility outpatient programs, and comprehensive outpatient rehabilitation facilities (CORFs). The sector serves diverse patient populations ranging from post-surgical recovery cases to individuals managing chronic conditions requiring ongoing therapeutic intervention and support services.

Market dynamics in the US outpatient rehabilitation centers sector reflect strong growth momentum driven by demographic trends, healthcare policy changes, and evolving patient preferences for convenient, accessible care. The market benefits from increasing recognition of rehabilitation’s role in preventing complications, reducing readmissions, and improving long-term health outcomes across various medical conditions and age groups.

Key growth drivers include the aging baby boomer population, rising incidence of chronic diseases, increased sports and recreational injuries, and growing emphasis on value-based healthcare delivery models. Approximately 78% of rehabilitation providers report increased demand for outpatient services, particularly in orthopedic, neurological, and cardiac rehabilitation specialties.

Competitive landscape features a mix of large healthcare systems, specialized rehabilitation companies, and independent providers competing on service quality, convenience, and patient outcomes. Technology adoption has accelerated, with telehealth integration, electronic health records, and outcome measurement systems becoming standard practice across leading facilities.

Future prospects remain highly favorable, supported by continued healthcare system evolution toward outpatient care models, expanding insurance coverage, and growing consumer awareness of rehabilitation benefits. The market is positioned for sustained growth as healthcare stakeholders increasingly recognize outpatient rehabilitation’s cost-effectiveness and clinical value.

Strategic market insights reveal several critical trends shaping the US outpatient rehabilitation centers landscape. The sector demonstrates remarkable resilience and adaptability, particularly following healthcare disruptions that accelerated adoption of innovative service delivery models and technology-enhanced treatment approaches.

Primary market drivers propelling growth in the US outpatient rehabilitation centers sector stem from fundamental healthcare trends, demographic shifts, and evolving treatment paradigms. These factors create sustained demand for accessible, high-quality rehabilitation services across diverse patient populations and geographic regions.

Aging population dynamics represent the most significant growth driver, with baby boomers entering their senior years and requiring increased rehabilitation services for age-related conditions, joint replacements, and chronic disease management. This demographic shift generates consistent demand for orthopedic rehabilitation, balance training, and mobility enhancement programs.

Chronic disease prevalence continues expanding, creating ongoing need for rehabilitation services among patients managing diabetes, cardiovascular disease, stroke recovery, and neurological conditions. Healthcare policy emphasis on managing chronic conditions through comprehensive care models positions outpatient rehabilitation as an essential service component.

Market restraints in the US outpatient rehabilitation centers sector include regulatory challenges, reimbursement limitations, and operational complexities that can impact growth potential and service delivery effectiveness. Understanding these constraints is essential for strategic planning and market positioning.

Reimbursement challenges remain a persistent concern, with insurance coverage variations, prior authorization requirements, and therapy caps creating barriers to patient access and provider revenue optimization. Medicare and Medicaid reimbursement rates often fail to keep pace with operational costs, particularly affecting providers serving high proportions of government-insured patients.

Regulatory compliance requirements impose significant administrative burdens, with documentation standards, quality reporting mandates, and licensing requirements varying across states and payer systems. These complexities increase operational costs and can limit market entry for smaller providers.

Significant market opportunities exist within the US outpatient rehabilitation centers sector, driven by evolving healthcare needs, technological innovations, and changing consumer preferences. These opportunities enable providers to expand services, improve outcomes, and capture new market segments.

Telehealth integration presents transformative opportunities for service delivery expansion, particularly in rural and underserved markets where traditional access barriers limit patient care. Remote monitoring technologies and virtual therapy sessions enable providers to extend their reach while maintaining quality care standards.

Specialized program development offers differentiation opportunities, particularly in high-growth areas such as neurological rehabilitation, pediatric services, and sports medicine. MarkWide Research indicates that specialized programs demonstrate 23% higher patient satisfaction rates compared to general rehabilitation services.

Market dynamics in the US outpatient rehabilitation centers sector reflect complex interactions between healthcare policy changes, demographic trends, technological advancement, and competitive pressures. These forces shape market evolution and influence strategic decision-making across the industry.

Supply and demand equilibrium varies significantly across geographic regions and specialty areas, with urban markets often experiencing provider saturation while rural areas face service shortages. Demand patterns show seasonal variations, with higher volumes during winter months due to increased fall-related injuries and post-holiday surgical procedures.

Competitive dynamics intensify as healthcare systems expand outpatient services, independent providers seek differentiation, and new market entrants introduce innovative service models. Price competition remains limited due to insurance reimbursement structures, shifting focus toward quality, convenience, and patient experience differentiation.

Technology disruption accelerates market transformation, with artificial intelligence, wearable devices, and mobile health applications creating new treatment possibilities and operational efficiencies. Patient expectations evolve toward more convenient, personalized, and technology-enhanced rehabilitation experiences.

Regulatory environment continues evolving, with quality measurement programs, value-based payment initiatives, and telehealth policy changes creating both opportunities and challenges for market participants. Workforce dynamics remain critical, with therapist shortages in certain specialties and regions constraining growth potential.

Comprehensive research methodology employed for analyzing the US outpatient rehabilitation centers market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research includes extensive interviews with industry stakeholders, including rehabilitation center administrators, healthcare executives, therapy professionals, and patient representatives. Survey methodologies capture quantitative data on market trends, operational challenges, and growth expectations across diverse provider types and geographic regions.

Secondary research encompasses analysis of government databases, industry reports, academic publications, and regulatory filings to establish market baselines and identify emerging trends. Data triangulation techniques validate findings across multiple sources, ensuring comprehensive market understanding.

Regional market analysis reveals significant variations in the US outpatient rehabilitation centers landscape, with distinct patterns of growth, service delivery, and competitive dynamics across different geographic areas. Market concentration remains highest in metropolitan areas, while rural regions present both challenges and opportunities for service expansion.

Northeast region demonstrates mature market characteristics with high provider density, particularly in states like New York, Massachusetts, and Pennsylvania. This region shows 42% market share in specialized neurological rehabilitation services, driven by major medical centers and research institutions. Competition intensity remains high, with providers focusing on differentiation through specialized programs and technology integration.

Southeast region experiences rapid growth driven by population migration, aging demographics, and healthcare system expansion. Florida leads regional growth with 15% annual increase in outpatient rehabilitation utilization, while states like North Carolina and Georgia show strong market development in suburban and rural areas.

Midwest region presents mixed market conditions, with urban centers like Chicago and Detroit showing stable demand while rural areas face provider shortages. Agricultural injury patterns create unique service needs, with approximately 28% of rural facilities offering specialized occupational rehabilitation programs.

West region leads in technology adoption and innovative service models, with California and Washington state pioneering telehealth integration and digital health solutions. The region demonstrates 35% higher adoption rates for remote monitoring technologies compared to national averages.

Southwest region shows robust growth potential, driven by population expansion and healthcare infrastructure development. Texas and Arizona lead regional market development, with integrated health systems expanding outpatient rehabilitation services to meet growing demand.

Competitive landscape in the US outpatient rehabilitation centers market features diverse participants ranging from large healthcare systems to specialized independent providers, each employing distinct strategies to capture market share and differentiate service offerings.

Market leaders include major healthcare systems that leverage their integrated networks, brand recognition, and financial resources to expand outpatient rehabilitation services. These organizations benefit from referral networks, shared resources, and comprehensive care coordination capabilities.

Independent providers compete through specialized expertise, personalized service, and local market knowledge. These organizations often focus on specific therapy disciplines or patient populations, creating niche market positions and strong community relationships.

Market segmentation in the US outpatient rehabilitation centers sector reflects diverse service categories, patient populations, and delivery models that address varying healthcare needs and preferences across different market segments.

By Service Type:

By Patient Population:

By Facility Type:

Category-wise analysis reveals distinct growth patterns, operational characteristics, and market dynamics across different segments of the US outpatient rehabilitation centers market, providing strategic insights for stakeholders and investors.

Physical Therapy Category dominates market volume, representing approximately 58% of total visits across outpatient rehabilitation centers. This category benefits from broad application across multiple conditions, strong insurance coverage, and growing awareness of physical therapy’s role in pain management and injury prevention. Orthopedic rehabilitation leads subcategory growth, driven by increasing joint replacement procedures and sports-related injuries.

Occupational Therapy Category shows steady growth with increasing recognition of its importance in helping patients return to work and daily activities. Workplace rehabilitation programs demonstrate particular strength, with employers increasingly investing in injury prevention and early intervention services. The category benefits from aging population trends and growing awareness of occupational therapy’s role in chronic disease management.

Speech-Language Pathology Category experiences robust growth driven by stroke recovery needs, pediatric developmental services, and swallowing disorder treatment. Neurological rehabilitation represents the fastest-growing subcategory, with specialized programs for traumatic brain injury and progressive neurological conditions showing strong demand.

Specialized Rehabilitation Categories including cardiac, pulmonary, and vestibular rehabilitation demonstrate niche growth opportunities. These programs typically command higher reimbursement rates and create differentiation opportunities for providers. MWR analysis indicates that specialized programs achieve 31% higher patient retention rates compared to general rehabilitation services.

Industry participants in the US outpatient rehabilitation centers market realize significant benefits through strategic positioning, operational excellence, and patient-centered service delivery. These advantages create sustainable competitive positions and support long-term growth objectives.

Healthcare Systems benefit from outpatient rehabilitation integration through improved care coordination, reduced readmission rates, and enhanced patient satisfaction scores. Revenue diversification through rehabilitation services provides stability and growth opportunities while supporting overall system financial performance.

Independent Providers leverage flexibility and specialization to create competitive advantages, often achieving higher patient satisfaction and clinical outcomes through personalized care approaches. Market positioning in specific therapy disciplines or patient populations enables premium pricing and strong referral relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the US outpatient rehabilitation centers sector reflect evolving healthcare delivery models, technological innovation, and changing patient expectations. These trends create both opportunities and challenges for market participants.

Digital Health Integration accelerates across the sector, with providers implementing electronic health records, outcome measurement systems, and patient engagement platforms. Telehealth adoption reached unprecedented levels, with approximately 67% of providers now offering virtual rehabilitation services as part of their standard care models.

Personalized Medicine Approaches gain traction through genetic testing, biomarker analysis, and individualized treatment protocols. Precision rehabilitation programs tailor interventions based on patient-specific factors, improving outcomes and reducing treatment duration.

Preventive Care Emphasis shifts focus from reactive treatment to proactive intervention, with wellness programs, injury prevention services, and health maintenance becoming integral service components. Corporate wellness partnerships expand as employers recognize rehabilitation’s role in workforce health management.

Recent industry developments in the US outpatient rehabilitation centers market demonstrate accelerating innovation, strategic consolidation, and evolving service delivery models that reshape competitive dynamics and market opportunities.

Technology Partnerships between rehabilitation providers and digital health companies create innovative treatment solutions, with major providers investing in virtual reality therapy, robotic assistance devices, and AI-powered treatment planning systems. These collaborations enhance clinical capabilities while improving operational efficiency.

Acquisition Activity intensifies as healthcare systems expand outpatient services and specialized providers seek scale advantages. Strategic consolidation creates larger provider networks with enhanced service capabilities and geographic coverage, while maintaining local market presence and specialized expertise.

Regulatory Changes including Medicare payment updates, quality reporting requirements, and telehealth policy modifications create both opportunities and compliance challenges. Value-based payment initiatives reward providers demonstrating superior patient outcomes and cost-effectiveness.

Strategic recommendations for stakeholders in the US outpatient rehabilitation centers market emphasize positioning for long-term growth while addressing current market challenges and capitalizing on emerging opportunities.

Technology Investment should prioritize patient engagement platforms, outcome measurement systems, and telehealth capabilities that enhance service delivery and operational efficiency. Digital transformation initiatives must balance innovation with practical implementation considerations and staff training requirements.

Specialization Strategy offers differentiation opportunities, particularly in high-growth areas such as neurological rehabilitation, pediatric services, and sports medicine. MarkWide Research analysis suggests that specialized programs achieve 26% higher margins compared to general rehabilitation services.

Geographic Expansion should focus on underserved markets with favorable demographics and limited competition. Rural market entry strategies may require innovative service delivery models, including mobile clinics and telehealth integration.

Future outlook for the US outpatient rehabilitation centers market remains highly positive, supported by fundamental demographic trends, healthcare policy evolution, and technological advancement that create sustained growth opportunities across multiple market segments.

Demographic tailwinds provide long-term growth support, with the aging population requiring increased rehabilitation services for age-related conditions, joint replacements, and chronic disease management. Population projections indicate continued growth in the 65+ age group, the primary consumer of rehabilitation services.

Healthcare system transformation toward value-based care models positions outpatient rehabilitation as an essential component of comprehensive care delivery. Cost-effectiveness and outcome improvement capabilities align with healthcare stakeholder priorities for sustainable, high-quality care delivery.

Technology integration will accelerate, with artificial intelligence, robotics, and digital health platforms becoming standard components of rehabilitation service delivery. Innovation adoption rates are expected to increase significantly, with providers recognizing technology’s role in improving outcomes and operational efficiency.

Market expansion into underserved geographic areas and specialized service categories presents significant growth opportunities. Rural market development through innovative delivery models and telehealth integration addresses current access gaps while creating new revenue streams.

Growth projections indicate sustained market expansion with a CAGR of 6.8% through the next decade, driven by demographic trends, technology adoption, and healthcare policy support for outpatient care models. The market is well-positioned for continued evolution and expansion across all major segments.

The US outpatient rehabilitation centers market represents a dynamic and rapidly expanding healthcare sector positioned for sustained growth through favorable demographic trends, technological innovation, and evolving healthcare delivery models. Market fundamentals remain strong, supported by an aging population, increasing chronic disease prevalence, and growing recognition of rehabilitation’s role in improving patient outcomes while reducing healthcare costs.

Strategic opportunities abound for providers willing to invest in technology, specialization, and innovative service delivery models. The market rewards organizations that prioritize quality outcomes, patient experience, and operational efficiency while adapting to changing healthcare policy and payment structures.

Future success in this market will depend on providers’ ability to balance growth ambitions with quality care delivery, embrace technological innovation while maintaining the human element of rehabilitation, and develop sustainable business models that serve diverse patient populations across varied geographic markets. The US outpatient rehabilitation centers market offers compelling opportunities for stakeholders committed to advancing healthcare through accessible, effective rehabilitation services.

What is Outpatient Rehabilitation Centers?

Outpatient Rehabilitation Centers provide therapeutic services to patients recovering from injuries, surgeries, or chronic conditions. These centers focus on physical therapy, occupational therapy, and speech therapy, allowing patients to receive care without being admitted to a hospital.

What are the key players in the US Outpatient Rehabilitation Centers Market?

Key players in the US Outpatient Rehabilitation Centers Market include Select Medical Corporation, ATI Physical Therapy, and Encompass Health Corporation, among others. These companies offer a range of rehabilitation services and have established networks across the country.

What are the growth factors driving the US Outpatient Rehabilitation Centers Market?

The US Outpatient Rehabilitation Centers Market is driven by an aging population, increasing prevalence of chronic diseases, and a growing emphasis on preventive care. Additionally, advancements in rehabilitation technology and patient-centered care models are contributing to market growth.

What challenges does the US Outpatient Rehabilitation Centers Market face?

The US Outpatient Rehabilitation Centers Market faces challenges such as reimbursement issues, regulatory compliance, and competition from alternative care models. These factors can impact the financial viability of outpatient centers and their ability to attract patients.

What opportunities exist in the US Outpatient Rehabilitation Centers Market?

Opportunities in the US Outpatient Rehabilitation Centers Market include expanding telehealth services, integrating advanced technologies like virtual reality for rehabilitation, and increasing partnerships with healthcare providers. These trends can enhance service delivery and patient engagement.

What trends are shaping the US Outpatient Rehabilitation Centers Market?

Trends shaping the US Outpatient Rehabilitation Centers Market include a shift towards value-based care, increased focus on patient outcomes, and the adoption of digital health solutions. These trends are influencing how rehabilitation services are delivered and measured.

US Outpatient Rehabilitation Centers Market

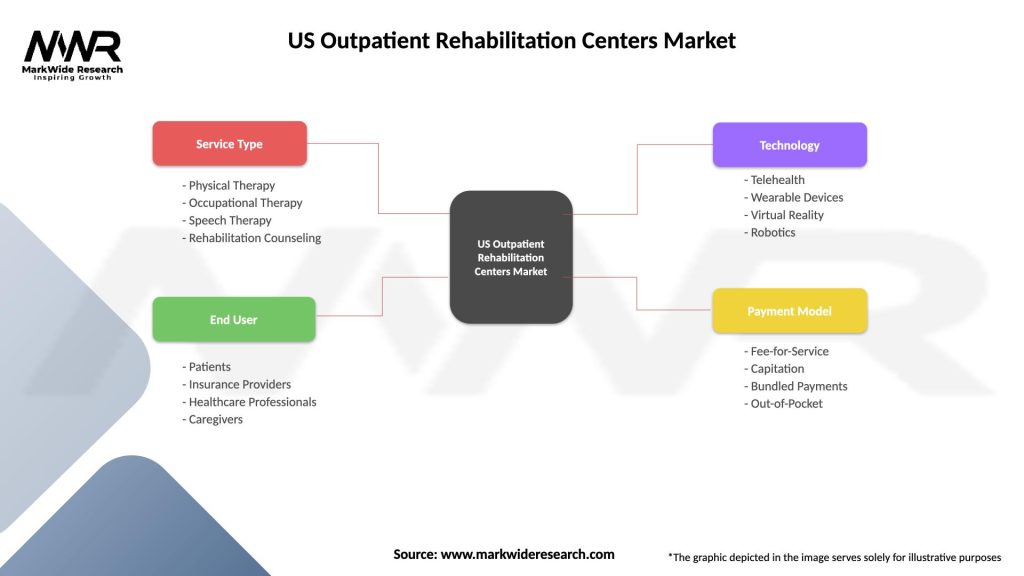

| Segmentation Details | Description |

|---|---|

| Service Type | Physical Therapy, Occupational Therapy, Speech Therapy, Rehabilitation Counseling |

| End User | Patients, Insurance Providers, Healthcare Professionals, Caregivers |

| Technology | Telehealth, Wearable Devices, Virtual Reality, Robotics |

| Payment Model | Fee-for-Service, Capitation, Bundled Payments, Out-of-Pocket |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Outpatient Rehabilitation Centers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at