444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US outdoor LED lighting market represents a transformative segment within the broader lighting industry, experiencing unprecedented growth driven by technological advancements and sustainability initiatives. LED technology has revolutionized outdoor illumination across residential, commercial, and municipal applications, offering superior energy efficiency and extended operational lifespans compared to traditional lighting solutions.

Market dynamics indicate robust expansion fueled by increasing environmental consciousness and stringent energy efficiency regulations. The transition from conventional lighting systems to LED alternatives has accelerated significantly, with adoption rates reaching 78% in commercial outdoor applications and continuing to climb across all sectors. Smart lighting integration and IoT connectivity have emerged as key differentiators, enabling advanced control systems and data analytics capabilities.

Regional distribution shows concentrated growth in urban areas where municipalities prioritize energy cost reduction and carbon footprint minimization. California, Texas, and New York lead adoption rates, driven by supportive regulatory frameworks and substantial infrastructure investments. The market encompasses diverse applications including street lighting, architectural illumination, landscape lighting, and security systems, each presenting unique growth opportunities and technological requirements.

The US outdoor LED lighting market refers to the comprehensive ecosystem of light-emitting diode technologies specifically designed for exterior applications across residential, commercial, and public infrastructure segments. This market encompasses the manufacturing, distribution, installation, and maintenance of LED lighting systems that operate in outdoor environments, providing illumination for safety, security, aesthetics, and functional purposes.

LED technology utilizes semiconductor materials to convert electrical energy directly into light through electroluminescence, offering significant advantages over traditional incandescent, fluorescent, and high-intensity discharge lighting solutions. Outdoor LED systems are engineered to withstand environmental challenges including temperature fluctuations, moisture exposure, UV radiation, and physical impacts while maintaining consistent performance and longevity.

Market scope includes various product categories such as streetlights, floodlights, wall packs, canopy lights, landscape fixtures, and specialty architectural lighting. Smart LED systems incorporate advanced features including dimming capabilities, motion sensors, wireless connectivity, and centralized control platforms that enable remote monitoring and energy optimization.

Market transformation in the US outdoor LED lighting sector reflects a fundamental shift toward sustainable and intelligent lighting solutions. The industry has witnessed accelerated adoption driven by energy efficiency mandates and technological innovations that deliver superior performance characteristics. Government initiatives promoting LED conversion have created substantial market opportunities, with federal and state programs providing financial incentives for infrastructure upgrades.

Technology evolution continues advancing with developments in chip efficiency, thermal management, and optical design. Smart lighting integration has become increasingly prevalent, with 42% of new installations incorporating connected features that enable remote monitoring and adaptive control. Cost reduction trends have made LED solutions more accessible across all market segments, driving widespread replacement of legacy lighting systems.

Competitive dynamics feature established lighting manufacturers alongside emerging technology companies specializing in smart lighting solutions. Market consolidation has occurred through strategic acquisitions and partnerships, creating comprehensive solution providers capable of addressing complex outdoor lighting requirements. Innovation focus centers on improving luminous efficacy, extending operational lifespans, and enhancing connectivity features that support smart city initiatives.

Technology advancement drives market evolution with continuous improvements in LED chip efficiency and system integration capabilities. Energy savings potential remains the primary adoption driver, with LED systems typically reducing energy consumption by 60-80% compared to conventional alternatives. Maintenance cost reduction provides additional value through extended operational lifespans that can exceed 50,000 hours under optimal conditions.

Energy efficiency mandates represent the most significant market driver, with federal and state regulations increasingly requiring LED adoption for public lighting applications. Environmental consciousness among consumers and organizations has accelerated the transition toward sustainable lighting solutions that reduce carbon footprints and support climate change mitigation efforts.

Cost reduction trends have made LED technology increasingly attractive from a financial perspective. Total cost of ownership calculations demonstrate substantial savings through reduced energy consumption and maintenance requirements. Utility rebate programs and government incentives further enhance the economic attractiveness of LED conversions, with some programs covering up to 75% of installation costs.

Smart city initiatives drive demand for connected lighting systems that integrate with broader urban infrastructure management platforms. IoT connectivity enables advanced features including traffic monitoring, environmental sensing, and public safety enhancement. Technological advancement continues improving LED performance characteristics while reducing system costs, creating a virtuous cycle of increased adoption and further innovation.

High initial investment requirements present the primary barrier to LED adoption, particularly for large-scale municipal and commercial installations. Capital constraints often delay conversion projects despite favorable long-term economics, especially in budget-constrained public sector applications. Financing challenges can impede adoption when organizations lack access to capital or face competing investment priorities.

Technical complexity associated with smart LED systems can create implementation challenges requiring specialized expertise and training. Integration difficulties with existing infrastructure may necessitate additional investments in control systems and networking equipment. Quality concerns regarding lower-cost LED products have created market skepticism, particularly following experiences with early-generation systems that failed to meet performance expectations.

Regulatory uncertainty in some jurisdictions creates hesitation among potential adopters who prefer to wait for clearer policy direction. Grid compatibility issues may arise when LED systems interact with existing electrical infrastructure, potentially requiring costly upgrades. Aesthetic preferences for traditional lighting appearance can slow adoption in historic districts and architecturally sensitive areas.

Infrastructure modernization presents substantial opportunities as aging lighting systems reach end-of-life and require replacement. Smart city development creates demand for integrated lighting solutions that support multiple municipal functions beyond basic illumination. Retrofit market potential remains significant, with millions of existing fixtures suitable for LED conversion across the United States.

Emerging applications in areas such as horticultural lighting, sports facilities, and transportation infrastructure offer new growth avenues. Technology convergence with renewable energy systems creates opportunities for solar-powered LED installations that operate independently of grid connections. Data monetization through smart lighting networks enables new revenue streams from environmental monitoring and traffic analytics.

Rural market expansion represents an underserved segment with significant potential as LED costs continue declining and connectivity options improve. International export opportunities exist for US manufacturers developing innovative LED solutions that can compete in global markets. Circular economy initiatives create opportunities for LED recycling and refurbishment services as first-generation systems reach replacement cycles.

Supply chain evolution has adapted to support rapid market growth, with domestic manufacturing capacity expanding to meet increasing demand. Component availability has generally improved, though periodic shortages of specialized chips and drivers can impact production schedules. Quality standardization efforts by industry organizations have helped establish performance benchmarks and testing protocols.

Competitive intensity continues increasing as new entrants challenge established players with innovative products and aggressive pricing strategies. Technology differentiation focuses on smart features, energy efficiency improvements, and specialized applications that command premium pricing. Market maturation in certain segments has led to price compression and margin pressure, driving consolidation and operational efficiency improvements.

Customer sophistication has increased significantly, with buyers developing detailed technical requirements and performance expectations. Procurement processes have evolved to consider total cost of ownership rather than initial purchase price alone. Performance monitoring capabilities enable data-driven decision making and continuous optimization of lighting systems, with efficiency improvements of 15-25% achievable through smart controls.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, technology developers, municipal officials, and end-users across diverse market segments. Secondary research incorporates analysis of government databases, industry publications, patent filings, and financial reports from public companies.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Market sizing methodologies utilize bottom-up analysis based on installation data and top-down validation through industry shipment statistics. Trend analysis incorporates historical data spanning multiple years to identify consistent patterns and emerging developments.

Regional analysis examines market conditions across different geographic areas, considering local regulations, economic conditions, and infrastructure characteristics. Segmentation analysis evaluates market dynamics within specific application areas and customer categories. Competitive intelligence gathering includes monitoring of product launches, strategic partnerships, and market positioning activities by key industry participants.

West Coast leadership in LED adoption reflects supportive regulatory environments and environmental consciousness, with California maintaining the highest penetration rates at 85% of municipal installations. Pacific Northwest states demonstrate strong growth driven by utility incentive programs and sustainability initiatives. Southwest markets benefit from abundant solar resources that complement LED efficiency advantages.

Northeast corridor shows accelerating adoption as aging infrastructure requires replacement and cities prioritize energy cost reduction. New York, Massachusetts, and Pennsylvania lead regional growth through comprehensive LED conversion programs. Mid-Atlantic states demonstrate increasing momentum with 65% adoption rates in commercial applications and growing municipal interest.

Southeast expansion reflects economic growth and infrastructure development, with Florida, Georgia, and North Carolina showing particularly strong market activity. Texas represents the largest single state market due to its size and rapid urbanization trends. Midwest adoption varies significantly by state, with Illinois and Michigan leading regional conversion efforts while rural areas lag behind urban centers.

Market leadership features a mix of established lighting manufacturers and innovative technology companies specializing in LED solutions. Strategic positioning varies from broad-based lighting suppliers to specialized smart lighting providers targeting specific applications or customer segments.

Application-based segmentation reveals distinct market dynamics across different outdoor lighting categories. Street lighting represents the largest segment due to extensive municipal infrastructure requirements and ongoing conversion programs. Architectural lighting shows strong growth driven by aesthetic considerations and energy efficiency mandates in commercial buildings.

By Technology:

By End-User:

Street lighting category dominates market activity with municipalities driving large-scale conversion projects. Performance requirements emphasize reliability, longevity, and maintenance reduction, with smart features increasingly important for traffic management and public safety applications. Standardization efforts help municipalities compare products and ensure interoperability across different suppliers.

Commercial outdoor lighting focuses on aesthetic appeal combined with energy efficiency, particularly in retail and hospitality applications. Architectural lighting demands precise color rendering and beam control to achieve desired visual effects. Security lighting emphasizes reliability and integration with surveillance systems, often requiring specialized mounting and control options.

Industrial applications prioritize durability and performance in challenging environments, with hazardous location ratings and extreme temperature tolerance often required. Sports lighting represents a specialized segment requiring high-intensity illumination and precise beam control for television broadcasting compatibility. Landscape lighting emphasizes aesthetic considerations while maintaining energy efficiency and environmental compatibility.

Manufacturers benefit from expanding market opportunities and premium pricing for innovative LED solutions. Technology differentiation enables competitive advantages through smart features, improved efficiency, and specialized applications. Market growth provides opportunities for capacity expansion and geographic diversification, with export potential for advanced US-developed technologies.

End-users realize substantial operational cost savings through reduced energy consumption and maintenance requirements. Environmental benefits support sustainability goals and regulatory compliance while improving corporate social responsibility profiles. Smart lighting capabilities enable new applications and revenue opportunities through data collection and analysis.

Utility companies benefit from reduced peak demand and improved grid stability through LED adoption and smart controls. Government entities achieve budget savings and environmental objectives while improving public services and safety. Installation contractors find new business opportunities in LED conversion projects and ongoing maintenance services, with service revenue growth of 35% reported by specialized LED installers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend, with connected systems becoming standard in new installations. IoT connectivity enables remote monitoring, predictive maintenance, and integration with broader smart city platforms. Data analytics capabilities transform lighting infrastructure into information gathering networks supporting traffic management, environmental monitoring, and public safety applications.

Sustainability focus drives demand for environmentally responsible lighting solutions that minimize energy consumption and environmental impact. Circular economy principles influence product design with emphasis on recyclability and component reuse. Carbon neutrality goals by municipalities and corporations accelerate LED adoption as a key strategy for emission reduction.

Customization trends reflect growing demand for application-specific solutions that optimize performance for particular use cases. Modular designs enable flexible configurations and easier maintenance. Human-centric lighting concepts influence outdoor applications with attention to circadian rhythm impacts and visual comfort considerations.

Technology breakthroughs continue advancing LED efficiency and performance characteristics. Chip-on-board technology improvements enable higher lumen output and better thermal management. Driver electronics evolution enhances reliability and enables advanced dimming and control capabilities with efficiency gains of 12% in recent generations.

Strategic partnerships between lighting manufacturers and technology companies accelerate smart lighting development. Acquisition activity consolidates market participants and combines complementary capabilities. Standards development efforts by industry organizations improve interoperability and performance consistency across different suppliers.

Government initiatives expand support for LED adoption through updated procurement policies and enhanced incentive programs. Utility programs evolve to address smart lighting capabilities and grid integration benefits. Research investments by federal agencies support next-generation lighting technology development and market acceleration efforts.

Market participants should prioritize smart lighting capabilities and IoT integration to differentiate products and capture premium pricing opportunities. Investment focus on research and development will be critical for maintaining competitive advantages as technology continues evolving rapidly. Partnership strategies with technology companies and system integrators can accelerate market penetration and expand solution capabilities.

MarkWide Research analysis suggests that companies should develop comprehensive service offerings including installation, maintenance, and performance optimization to capture recurring revenue streams. Geographic expansion strategies should target underserved rural markets and emerging applications in industrial and transportation sectors. Quality assurance programs will be essential for building customer confidence and supporting premium positioning.

End-users should conduct thorough total cost of ownership analyses when evaluating LED conversion projects, considering energy savings, maintenance reduction, and potential smart features benefits. Pilot programs can help organizations evaluate different technologies and suppliers before committing to large-scale implementations. Financing options including energy service company arrangements can overcome initial cost barriers and accelerate adoption timelines.

Market evolution will continue toward increasingly intelligent and connected lighting systems that integrate seamlessly with smart city infrastructure. Technology advancement will focus on improving efficiency, reducing costs, and enhancing functionality through artificial intelligence and machine learning capabilities. Adoption acceleration is expected as LED costs continue declining and performance characteristics improve.

Growth projections indicate sustained expansion with compound annual growth rates of 8.5% expected through the next decade. Market maturation in basic LED replacement applications will shift focus toward smart features and specialized solutions. International competitiveness of US manufacturers will depend on continued innovation and technology leadership rather than cost competition alone.

Regulatory environment will likely become more supportive with expanded energy efficiency mandates and smart city initiatives. Climate change concerns will drive additional emphasis on sustainable lighting solutions and carbon footprint reduction. MWR forecasts indicate that smart lighting will represent over 60% of new outdoor LED installations by 2030, fundamentally transforming the market landscape and creating new opportunities for technology-focused companies.

The US outdoor LED lighting market stands at a pivotal transformation point where traditional illumination gives way to intelligent, connected systems that serve multiple functions beyond basic lighting. Market dynamics reflect strong fundamentals driven by energy efficiency mandates, environmental consciousness, and technological innovation that continues advancing performance while reducing costs.

Growth trajectory remains robust across all market segments, with particularly strong momentum in smart lighting applications that integrate with broader infrastructure management systems. Competitive landscape evolution favors companies that combine technological innovation with comprehensive service capabilities, while traditional lighting suppliers face pressure to adapt or risk market share erosion.

Future success in this market will depend on companies’ ability to navigate the transition from product-centric to solution-centric business models while maintaining technological leadership in an increasingly competitive environment. Stakeholders who embrace smart lighting capabilities and develop integrated service offerings will be best positioned to capitalize on the substantial opportunities ahead as the US outdoor LED lighting market continues its remarkable transformation.

What is Outdoor LED Lighting?

Outdoor LED lighting refers to the use of light-emitting diodes (LEDs) for illumination in outdoor spaces. This technology is commonly used in streetlights, landscape lighting, and architectural lighting due to its energy efficiency and long lifespan.

What are the key players in the US Outdoor LED Lighting Market?

Key players in the US Outdoor LED Lighting Market include Philips Lighting, Cree, Inc., General Electric, and Acuity Brands, among others. These companies are known for their innovative lighting solutions and extensive product offerings.

What are the main drivers of growth in the US Outdoor LED Lighting Market?

The main drivers of growth in the US Outdoor LED Lighting Market include the increasing demand for energy-efficient lighting solutions, government initiatives promoting LED adoption, and the rising focus on smart city developments. Additionally, advancements in LED technology are enhancing performance and reducing costs.

What challenges does the US Outdoor LED Lighting Market face?

Challenges in the US Outdoor LED Lighting Market include high initial installation costs and the need for specialized knowledge for installation and maintenance. Additionally, competition from traditional lighting technologies can hinder market growth.

What opportunities exist in the US Outdoor LED Lighting Market?

Opportunities in the US Outdoor LED Lighting Market include the integration of smart lighting systems and the growing trend of urbanization. Furthermore, the increasing focus on sustainability and environmental impact is driving demand for LED solutions.

What trends are shaping the US Outdoor LED Lighting Market?

Trends shaping the US Outdoor LED Lighting Market include the rise of smart lighting technologies, the adoption of IoT-enabled lighting systems, and a growing emphasis on energy efficiency. Additionally, there is an increasing interest in solar-powered LED lighting solutions.

US Outdoor LED Lighting Market

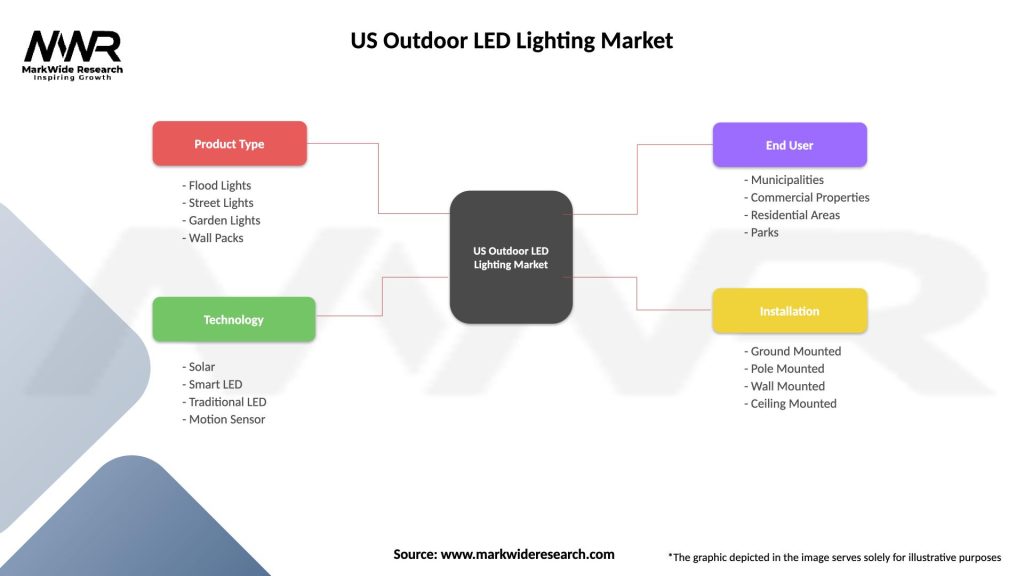

| Segmentation Details | Description |

|---|---|

| Product Type | Flood Lights, Street Lights, Garden Lights, Wall Packs |

| Technology | Solar, Smart LED, Traditional LED, Motion Sensor |

| End User | Municipalities, Commercial Properties, Residential Areas, Parks |

| Installation | Ground Mounted, Pole Mounted, Wall Mounted, Ceiling Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Outdoor LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at