444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US OTT market represents one of the most dynamic and rapidly evolving segments of the entertainment industry, fundamentally transforming how Americans consume video content. Over-the-top streaming services have revolutionized traditional television viewing patterns, offering unprecedented convenience and content variety directly to consumers through internet-connected devices. The market encompasses a diverse ecosystem of subscription-based, ad-supported, and transactional video-on-demand platforms that compete for viewer attention and subscription dollars.

Market dynamics indicate robust growth driven by cord-cutting trends, improved broadband infrastructure, and changing consumer preferences toward on-demand entertainment. The sector has experienced accelerated adoption rates of 12.5% annually, with streaming services becoming the primary entertainment source for millions of American households. Content diversity has expanded dramatically, featuring everything from original productions to licensed international content, catering to increasingly fragmented audience preferences.

Technology advancement continues to shape the competitive landscape, with platforms investing heavily in artificial intelligence for personalized recommendations, 4K streaming capabilities, and multi-device synchronization. The market demonstrates strong resilience and adaptability, particularly evident during recent global events that accelerated digital adoption across all demographic segments.

The US OTT market refers to the comprehensive ecosystem of over-the-top streaming services that deliver video content directly to consumers via internet connections, bypassing traditional cable and satellite television distribution methods. This market encompasses subscription video-on-demand platforms, ad-supported streaming services, live television streaming, and transactional video services that operate independently of conventional broadcast infrastructure.

OTT platforms leverage internet protocol networks to distribute content across multiple devices including smart televisions, smartphones, tablets, gaming consoles, and streaming media players. The market includes both domestic and international service providers competing for American consumers, offering diverse content libraries ranging from original productions to licensed entertainment from traditional media companies.

Service models within the market vary significantly, including subscription-based services requiring monthly fees, ad-supported free platforms generating revenue through advertising, hybrid models combining subscriptions with advertising, and premium video-on-demand services charging per transaction. This diversity creates a complex competitive environment where platforms differentiate through content quality, pricing strategies, user experience, and technological capabilities.

The US OTT market stands as a cornerstone of modern entertainment consumption, characterized by intense competition among established technology giants and emerging content creators. Streaming adoption has reached unprecedented levels, with penetration rates exceeding 78% of American households actively using at least one over-the-top service for regular entertainment consumption.

Content investment has become the primary differentiator among competing platforms, with major providers allocating substantial resources toward original programming development. The market demonstrates clear segmentation between premium subscription services focusing on exclusive content and ad-supported platforms emphasizing accessibility and broad content libraries. Consumer behavior patterns reveal increasing willingness to maintain multiple streaming subscriptions simultaneously, creating opportunities for specialized niche services.

Technological innovation drives continuous market evolution, with platforms implementing advanced features including offline viewing, multi-user profiles, parental controls, and cross-platform content synchronization. The competitive landscape remains highly dynamic, with traditional media companies launching proprietary streaming services while technology companies expand their entertainment offerings. Market consolidation trends suggest potential future partnerships and acquisitions as companies seek to strengthen their competitive positions through enhanced content libraries and expanded subscriber bases.

Consumer preferences have fundamentally shifted toward on-demand entertainment consumption, with traditional television viewership declining as streaming services gain prominence. MarkWide Research analysis reveals several critical market insights that define the current competitive environment:

Cord-cutting acceleration represents the most significant driver transforming the US entertainment landscape, with traditional cable and satellite television subscriptions declining as consumers embrace streaming alternatives. Cost considerations play a crucial role, as streaming services typically offer more affordable options compared to comprehensive cable packages, particularly appealing to budget-conscious consumers and younger demographics.

Content quality improvements have elevated streaming platforms to compete directly with traditional television networks and movie studios. Original programming investments have resulted in award-winning productions that attract both critics and audiences, legitimizing streaming services as premium entertainment destinations. Technological advancement in broadband infrastructure has eliminated many historical barriers to high-quality streaming, with widespread availability of high-speed internet enabling seamless 4K video delivery.

Convenience factors continue driving adoption, including on-demand viewing schedules, multi-device accessibility, and personalized content recommendations. The ability to pause, rewind, and resume content across different devices provides flexibility that traditional broadcasting cannot match. Global content access has expanded dramatically, with streaming platforms offering international films, series, and documentaries that were previously unavailable through conventional distribution channels.

Demographic shifts favor streaming adoption, particularly among millennials and Generation Z consumers who prioritize digital-first entertainment experiences. These demographics demonstrate higher willingness to pay for multiple streaming subscriptions while maintaining lower traditional television usage patterns.

Subscription fatigue emerges as a primary constraint limiting market expansion, with consumers becoming increasingly selective about maintaining multiple streaming service subscriptions. Content fragmentation across numerous platforms forces viewers to subscribe to multiple services to access desired programming, creating financial burden and decision complexity that may limit overall market growth.

Internet infrastructure limitations in rural and underserved areas restrict streaming service accessibility, particularly for high-definition and 4K content requiring substantial bandwidth. Data usage concerns affect mobile streaming consumption, especially among consumers with limited data plans or those facing additional charges for excessive usage.

Content licensing complexities create ongoing challenges for streaming platforms, with licensing agreements often restricting geographic availability or requiring substantial financial commitments. Competition intensity has led to bidding wars for popular content, driving up acquisition costs and potentially impacting service profitability.

Technical challenges including streaming interruptions, buffering issues, and platform compatibility problems can negatively impact user experience and subscriber retention. Privacy concerns regarding data collection and viewing habit tracking may deter some consumers from adopting streaming services or limit their engagement with personalization features.

Emerging technologies present significant opportunities for market expansion and service enhancement, particularly through integration of virtual reality, augmented reality, and interactive content experiences. Artificial intelligence advancement enables more sophisticated content recommendation systems and personalized viewing experiences that can increase user engagement and subscription retention rates.

Niche market development offers substantial growth potential, with specialized streaming services focusing on specific genres, languages, or demographic segments demonstrating strong subscriber loyalty and growth rates. International expansion provides opportunities for US-based platforms to extend their reach into global markets while offering international content to domestic audiences.

Live streaming integration represents a significant opportunity, particularly for sports, news, and event programming that traditionally required cable or satellite subscriptions. Educational content streaming has gained prominence, creating opportunities for platforms specializing in documentaries, instructional content, and academic programming.

Advertising technology evolution enables more targeted and less intrusive advertising experiences, potentially making ad-supported streaming models more attractive to both consumers and advertisers. Partnership opportunities with telecommunications companies, device manufacturers, and content creators can expand market reach and reduce customer acquisition costs.

Competitive intensity defines the current market environment, with established technology companies, traditional media conglomerates, and emerging startups competing for subscriber attention and market share. Content creation has become the primary battleground, with platforms investing heavily in original programming to differentiate their offerings and reduce dependence on licensed content.

Pricing strategies vary significantly across the market, from premium subscription services commanding higher monthly fees to ad-supported platforms offering free access with advertising revenue models. Bundle offerings have emerged as a competitive strategy, with companies combining streaming services with other digital products or telecommunications services to increase value propositions.

Technology integration continues evolving rapidly, with platforms implementing advanced features including offline downloads, multiple user profiles, parental controls, and cross-device synchronization. User experience optimization has become crucial for subscriber retention, with platforms focusing on intuitive interfaces, fast loading times, and seamless content discovery mechanisms.

Market consolidation trends suggest potential future mergers and acquisitions as companies seek to strengthen their competitive positions through expanded content libraries and increased subscriber bases. Regulatory considerations may impact future market dynamics, particularly regarding content licensing, data privacy, and antitrust concerns as the market continues maturing.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US OTT market landscape. Primary research includes extensive consumer surveys, industry expert interviews, and focus group discussions with streaming service subscribers across diverse demographic segments to understand viewing preferences, subscription behaviors, and platform satisfaction levels.

Secondary research incorporates analysis of publicly available financial reports, industry publications, regulatory filings, and academic studies related to streaming media consumption patterns. Data collection spans multiple sources including subscriber statistics, content library analyses, pricing comparisons, and technology feature assessments across major streaming platforms.

Quantitative analysis utilizes statistical modeling to identify market trends, growth patterns, and correlation factors affecting streaming service adoption and retention rates. Qualitative assessment examines consumer sentiment, brand perception, and competitive positioning through content analysis of social media discussions, online reviews, and industry commentary.

Market segmentation analysis categorizes the market by service type, content genre, pricing model, and target demographic to provide detailed insights into specific market segments. Competitive benchmarking compares platform features, content offerings, pricing strategies, and market positioning to identify competitive advantages and market gaps.

Geographic distribution of streaming service adoption varies significantly across the United States, with urban areas demonstrating higher penetration rates compared to rural regions. West Coast markets including California, Washington, and Oregon show the highest streaming adoption rates at 85% household penetration, driven by technology-savvy populations and robust broadband infrastructure.

Northeast corridor states including New York, Massachusetts, and Connecticut maintain strong streaming service adoption, with 82% of households subscribing to at least one over-the-top platform. These markets demonstrate preference for premium content services and willingness to maintain multiple simultaneous subscriptions.

Southern states show growing streaming adoption, though traditional television viewing remains more prevalent compared to coastal regions. Texas and Florida lead southern market adoption with 76% household penetration, while rural areas in Alabama, Mississippi, and Arkansas show lower adoption rates due to infrastructure limitations.

Midwest markets demonstrate steady streaming growth, with major metropolitan areas including Chicago, Detroit, and Minneapolis showing 79% adoption rates. Rural midwest regions face challenges related to broadband availability and data usage costs that impact streaming service accessibility.

Mountain West and Plains states show varied adoption patterns, with urban centers demonstrating strong streaming uptake while rural areas lag behind national averages due to internet infrastructure constraints and traditional entertainment preferences.

Market leadership remains highly contested among several major platforms, each employing distinct strategies to attract and retain subscribers. The competitive environment features both established technology companies and traditional media conglomerates adapting to streaming-first business models.

Competitive differentiation occurs primarily through content exclusivity, pricing strategies, user experience design, and technology integration. Original programming investment has become the primary competitive weapon, with platforms spending substantial resources on exclusive content creation to attract and retain subscribers.

Service model segmentation divides the market into distinct categories based on revenue generation and content access approaches:

By Revenue Model:

By Content Type:

By Device Category:

Subscription-based services continue dominating the market landscape, with consumers demonstrating willingness to pay monthly fees for ad-free, high-quality content experiences. Premium SVOD platforms maintain the highest subscriber retention rates at 89% annually, indicating strong customer satisfaction and content value perception.

Ad-supported streaming has gained significant traction, particularly among price-sensitive consumers and younger demographics comfortable with advertising-supported content consumption. AVOD platforms show rapid growth in user acquisition, though average viewing time per session remains lower compared to subscription services.

Original content programming has become the primary differentiator across all service categories, with platforms investing heavily in exclusive productions to attract subscribers and reduce content licensing dependencies. MWR analysis indicates that platforms with strong original content portfolios demonstrate 23% higher subscriber retention compared to those relying primarily on licensed content.

Live streaming integration represents a growing category, with platforms incorporating real-time programming including sports, news, and special events to compete with traditional television offerings. Sports streaming shows particular promise, with dedicated sports platforms experiencing rapid subscriber growth among cord-cutting demographics.

International content has emerged as a significant category driver, with foreign language programming attracting diverse audience segments and expanding platform appeal beyond traditional demographic boundaries.

Content creators benefit from expanded distribution opportunities and direct audience relationships through streaming platforms, enabling independent producers and established studios to reach global audiences without traditional distribution constraints. Revenue diversification allows content creators to monetize their productions through multiple streaming platforms simultaneously, increasing overall profitability potential.

Technology companies gain opportunities to leverage their infrastructure capabilities and data analytics expertise to create competitive advantages in content recommendation, user experience optimization, and platform performance. Cross-platform integration enables technology providers to create ecosystem benefits that increase customer retention across multiple services and products.

Telecommunications providers can bundle streaming services with internet and mobile plans, creating additional revenue streams while improving customer retention through comprehensive entertainment packages. Infrastructure investment in broadband networks becomes more valuable as streaming demand drives higher bandwidth requirements.

Advertisers benefit from advanced targeting capabilities and detailed viewer analytics that enable more precise audience segmentation and campaign optimization compared to traditional television advertising. Interactive advertising opportunities through streaming platforms provide new engagement mechanisms and measurable response tracking.

Consumers enjoy unprecedented content variety, viewing flexibility, and cost control through diverse subscription options and on-demand access to entertainment programming. Personalization features enhance viewing experiences through tailored content recommendations and customizable user interfaces.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization advancement represents a dominant trend, with streaming platforms implementing sophisticated artificial intelligence algorithms to provide increasingly accurate content recommendations based on viewing history, preferences, and behavioral patterns. Machine learning integration enables platforms to predict viewer preferences and surface relevant content more effectively than traditional programming schedules.

Mobile-first strategies have gained prominence as smartphone and tablet viewing continues expanding, with platforms optimizing their applications and content for mobile consumption patterns. Vertical video content and short-form programming specifically designed for mobile viewing demonstrate growing importance in platform strategies.

Interactive content development shows increasing adoption, with platforms experimenting with choose-your-own-adventure programming, live viewer participation, and gamified viewing experiences that engage audiences beyond passive consumption. Social viewing features enable shared viewing experiences and community building around content programming.

Global content localization has become essential, with platforms investing in international programming, dubbing, and subtitling to serve diverse audience segments and expand their market reach beyond English-speaking demographics.

Sustainability initiatives are gaining attention, with streaming companies implementing energy-efficient data centers and carbon-neutral content delivery networks to address environmental concerns related to digital content consumption.

Platform consolidation has accelerated through strategic mergers and acquisitions, with traditional media companies combining their streaming services to compete more effectively against established technology platforms. Content library integration through these consolidations creates more comprehensive entertainment offerings for subscribers.

Original programming expansion continues at unprecedented levels, with streaming platforms commissioning exclusive content across all genres including scripted series, documentaries, reality programming, and international productions. Creator partnerships with established filmmakers, actors, and producers have resulted in high-profile exclusive content deals.

Technology infrastructure improvements include widespread deployment of content delivery networks, edge computing capabilities, and 5G network integration to enhance streaming quality and reduce buffering issues. Cloud gaming integration represents an emerging development as platforms explore interactive entertainment beyond traditional video content.

Advertising technology evolution has introduced more sophisticated targeting capabilities, interactive advertising formats, and measurement tools that make ad-supported streaming models more attractive to both advertisers and consumers. Programmatic advertising implementation enables real-time ad placement optimization based on viewer demographics and content context.

International market expansion has accelerated, with US-based platforms launching services in new geographic markets while investing in local content production to appeal to regional audiences and comply with local content regulations.

Content strategy optimization should focus on balancing original programming investments with strategic licensed content acquisitions to create comprehensive libraries that appeal to diverse audience segments. MarkWide Research recommends platforms prioritize data-driven content development based on viewer analytics and engagement metrics rather than traditional industry intuition.

Technology investment priorities should emphasize user experience improvements, streaming quality optimization, and personalization algorithm advancement to maintain competitive advantages in an increasingly crowded market. Mobile optimization deserves particular attention as mobile viewing continues expanding across all demographic segments.

Pricing strategy refinement requires careful balance between subscription affordability and revenue generation, with consideration for tiered service offerings that provide flexibility for different consumer segments. Bundle opportunities with telecommunications providers, device manufacturers, or complementary digital services can improve value propositions and reduce customer acquisition costs.

International expansion should prioritize markets with growing internet infrastructure and increasing disposable income, while investing in local content production and cultural adaptation to ensure market acceptance. Regulatory compliance planning becomes essential as governments worldwide implement new regulations affecting streaming services.

Partnership development with content creators, technology providers, and distribution partners can accelerate growth while reducing operational costs and market entry barriers in new segments or geographic regions.

Market maturation is expected to continue over the next five years, with growth rates moderating as streaming adoption reaches saturation levels in major demographic segments. Competition intensification will likely drive platform consolidation and strategic partnerships as companies seek to maintain market positions through enhanced content offerings and improved operational efficiency.

Technology integration will advance significantly, with virtual reality, augmented reality, and interactive content becoming more mainstream as hardware costs decrease and content creation tools improve. Artificial intelligence applications will expand beyond content recommendation to include automated content creation, personalized advertising, and predictive analytics for subscriber behavior.

Global expansion opportunities remain substantial, particularly in emerging markets where internet infrastructure continues improving and disposable income levels rise. Local content production will become increasingly important for international success as audiences demand culturally relevant programming in their native languages.

Advertising evolution will transform ad-supported streaming models through improved targeting capabilities, interactive advertising formats, and seamless integration with content programming. Subscription model diversification may include micro-subscriptions, pay-per-content options, and dynamic pricing based on usage patterns.

Regulatory developments will likely impact market dynamics through content licensing requirements, data privacy regulations, and antitrust considerations as streaming platforms become increasingly dominant in entertainment distribution. Industry consolidation trends suggest fewer but more comprehensive platforms may emerge through mergers and strategic partnerships.

The US OTT market represents a transformative force in entertainment consumption, fundamentally altering how Americans access and engage with video content. Streaming platforms have successfully disrupted traditional television distribution models through superior convenience, content variety, and personalized viewing experiences that resonate with modern consumer preferences.

Market dynamics continue evolving rapidly, driven by intense competition among established technology companies and traditional media conglomerates seeking to capture subscriber attention and market share. Content creation has emerged as the primary competitive battleground, with platforms investing substantially in original programming to differentiate their offerings and reduce dependence on licensed content.

Future success in the US OTT market will depend on platforms’ ability to balance content investment with sustainable business models, optimize user experiences through advanced technology integration, and adapt to changing consumer preferences and regulatory requirements. The market’s continued growth and evolution promise ongoing opportunities for innovation, competition, and consumer benefit in the years ahead.

What is OTT?

OTT, or Over-The-Top, refers to content delivered over the internet without the need for traditional cable or satellite television services. This includes streaming services that provide video, audio, and other media directly to consumers.

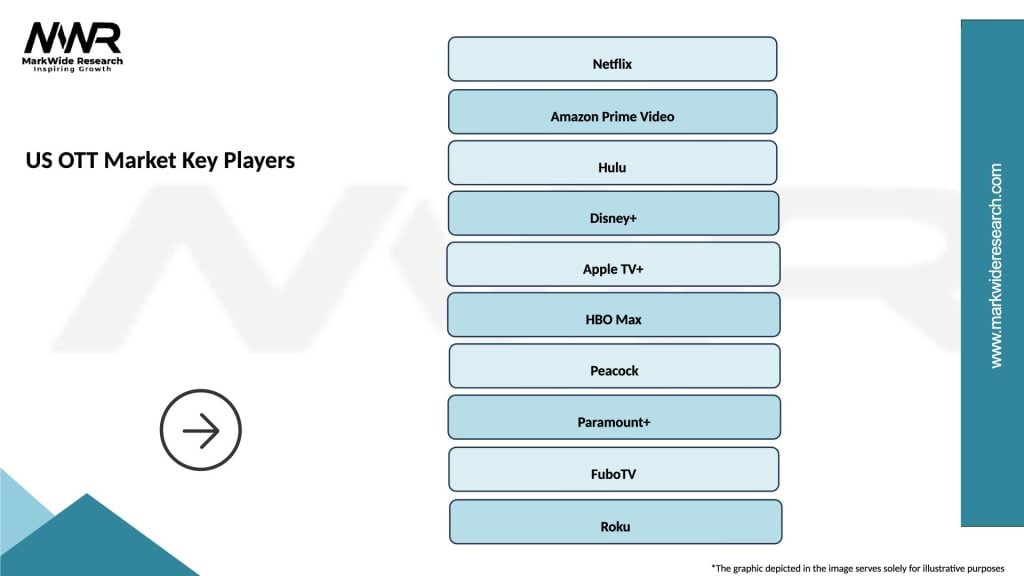

What are the key players in the US OTT Market?

Key players in the US OTT Market include Netflix, Hulu, Amazon Prime Video, and Disney+, among others. These companies offer a variety of content, including movies, TV shows, and original programming, catering to diverse audience preferences.

What are the main drivers of growth in the US OTT Market?

The main drivers of growth in the US OTT Market include increasing internet penetration, the rise of mobile streaming, and changing consumer preferences towards on-demand content. Additionally, the availability of diverse content libraries attracts more subscribers.

What challenges does the US OTT Market face?

The US OTT Market faces challenges such as intense competition among streaming services, content licensing issues, and the need for continuous innovation to retain subscribers. Additionally, market saturation may limit growth opportunities.

What opportunities exist in the US OTT Market?

Opportunities in the US OTT Market include expanding into niche content segments, enhancing user experience through technology, and potential partnerships with telecom providers. The growing demand for localized content also presents new avenues for growth.

What trends are shaping the US OTT Market?

Trends shaping the US OTT Market include the rise of ad-supported streaming models, increased investment in original content, and the integration of interactive features. Additionally, the shift towards bundled services is becoming more prevalent among consumers.

US OTT Market

| Segmentation Details | Description |

|---|---|

| Service Type | Subscription, Ad-Supported, Transactional, Hybrid |

| Content Type | Movies, TV Shows, Documentaries, Sports |

| Device Type | Smart TVs, Streaming Devices, Mobile Phones, Tablets |

| Customer Type | Individual Users, Families, Enterprises, Educational Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US OTT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at