444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US optical detector market is a crucial segment within the broader optics and photonics industry, encompassing a wide range of detectors used for various applications such as sensing, imaging, communications, and research. With the increasing demand for advanced detection technologies across sectors including healthcare, telecommunications, aerospace, and defense, the US optical detector market presents significant growth opportunities for industry players to innovate, expand their product portfolios, and address evolving market needs.

Meaning

Optical detectors are devices that convert optical signals into electrical signals, enabling the detection, measurement, and analysis of light across different wavelengths and intensities. In the context of the US market, optical detectors serve as essential components in various systems and applications, including optical communications, spectroscopy, lidar, imaging, and sensing, driving innovation and technological advancements across industries.

Executive Summary

The US optical detector market is experiencing steady growth, driven by factors such as technological advancements, increasing adoption of photonics-based solutions, and growing demand for high-performance detection systems. Despite challenges such as competition from alternative technologies and supply chain disruptions, the market offers lucrative opportunities for industry participants to leverage their expertise, develop cutting-edge solutions, and capitalize on emerging trends in optical detection.

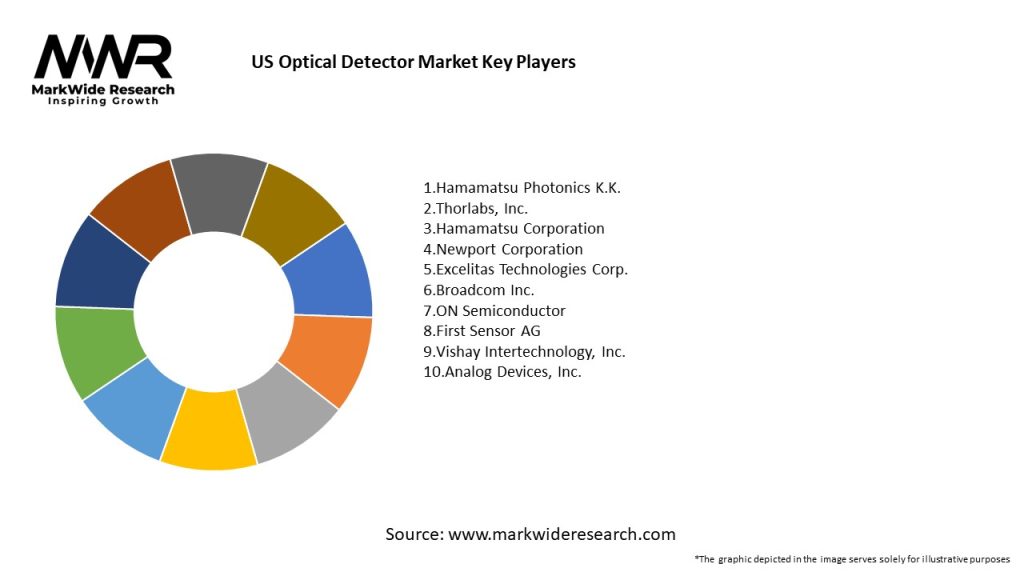

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US optical detector market operates within a dynamic ecosystem shaped by technological advancements, market trends, regulatory developments, and competitive dynamics. These dynamics influence market demand, supply chains, pricing strategies, and innovation trajectories, requiring industry players to stay agile, adaptable, and responsive to changing market conditions and customer requirements.

Regional Analysis

As a leading hub for technology innovation, research, and development, the United States plays a pivotal role in the global photonics industry, including the optical detector market. Key regions such as Silicon Valley, Boston, and the Research Triangle in North Carolina serve as centers of excellence for photonics research, innovation, and commercialization, driving market growth and technological leadership in the US optical detector market.

Competitive Landscape

Leading Companies in US Optical Detector Markets:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

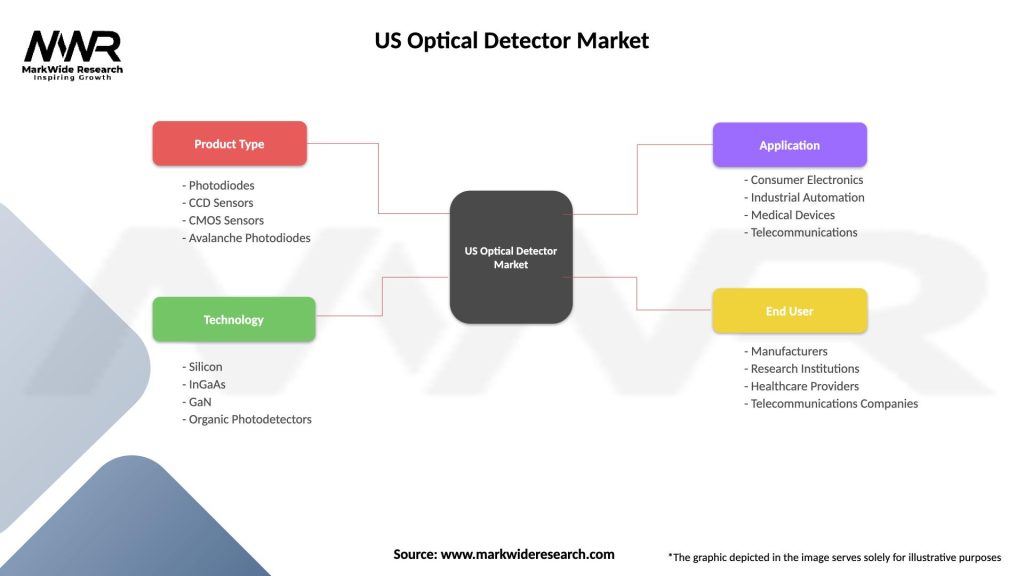

Segmentation

The US optical detector market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The US optical detector market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the US optical detector market:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the US optical detector market. While disruptions in supply chains, manufacturing operations, and demand patterns were prevalent during the initial phases of the pandemic, the optical detection industry demonstrated resilience and adaptability, with rapid recovery and adaptation to changing market dynamics. Key impacts include shifts in market demand, accelerated digital transformation, and increased focus on healthcare and life sciences applications.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the US optical detector market remains optimistic, driven by factors such as technological advancements, market expansion, regulatory support, and growing demand across diverse application domains. While challenges such as competition, supply chain disruptions, and regulatory complexities persist, strategic planning, innovation, and collaboration are pivotal in unlocking growth opportunities and sustaining market leadership in the dynamic and competitive market landscape.

Conclusion

In conclusion, the US optical detector market presents significant growth opportunities for industry participants and stakeholders, driven by technological advancements, market expansion, and growing demand across diverse application domains. Strategic investments in innovation, collaboration, and regulatory compliance are essential for capitalizing on emerging opportunities and navigating challenges in the dynamic and competitive market landscape. By staying agile, customer-focused, and adaptive to market trends, players can position themselves for success and contribute to the advancement of photonics technology and applications in the United States and beyond.

What is Optical Detector?

Optical detectors are devices that convert light signals into electrical signals. They are widely used in applications such as telecommunications, imaging systems, and environmental monitoring.

What are the key players in the US Optical Detector Market?

Key players in the US Optical Detector Market include companies like Hamamatsu Photonics, Thorlabs, and OSI Optoelectronics, among others.

What are the main drivers of growth in the US Optical Detector Market?

The growth of the US Optical Detector Market is driven by advancements in technology, increasing demand for high-speed communication systems, and the rising adoption of optical sensors in various industries.

What challenges does the US Optical Detector Market face?

Challenges in the US Optical Detector Market include the high cost of advanced optical detection technologies and competition from alternative sensing technologies, which may limit market growth.

What opportunities exist in the US Optical Detector Market?

Opportunities in the US Optical Detector Market include the development of new applications in areas such as autonomous vehicles, smart cities, and healthcare, which are expected to drive demand for innovative optical detection solutions.

What trends are shaping the US Optical Detector Market?

Trends in the US Optical Detector Market include the integration of artificial intelligence in detection systems, miniaturization of devices, and the increasing use of photonic technologies in various applications.

US Optical Detector Market

| Segmentation Details | Description |

|---|---|

| Product Type | Photodiodes, CCD Sensors, CMOS Sensors, Avalanche Photodiodes |

| Technology | Silicon, InGaAs, GaN, Organic Photodetectors |

| Application | Consumer Electronics, Industrial Automation, Medical Devices, Telecommunications |

| End User | Manufacturers, Research Institutions, Healthcare Providers, Telecommunications Companies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Optical Detector Markets:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at