444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US ophthalmic sutures market is a thriving segment within the healthcare industry. Ophthalmic sutures are surgical threads used to close wounds and incisions in eye surgeries, ensuring proper healing and minimizing the risk of complications. These sutures are specifically designed to meet the unique requirements of ophthalmic procedures and are available in various materials and sizes.

Meaning

Ophthalmic sutures play a critical role in eye surgeries, such as cataract surgeries, corneal transplants, and glaucoma surgeries. They are essential for securing tissue and facilitating precise wound closure, promoting faster healing and optimal outcomes. Ophthalmic surgeons rely on these sutures to achieve the desired surgical results and maintain the integrity of the eye.

Executive Summary

The US ophthalmic sutures market has been experiencing steady growth in recent years. Factors such as the increasing prevalence of eye disorders, advancements in ophthalmic surgical techniques, and a growing geriatric population contribute to the market’s expansion. Additionally, the rising demand for minimally invasive ophthalmic procedures and the development of innovative suture materials further drive market growth.

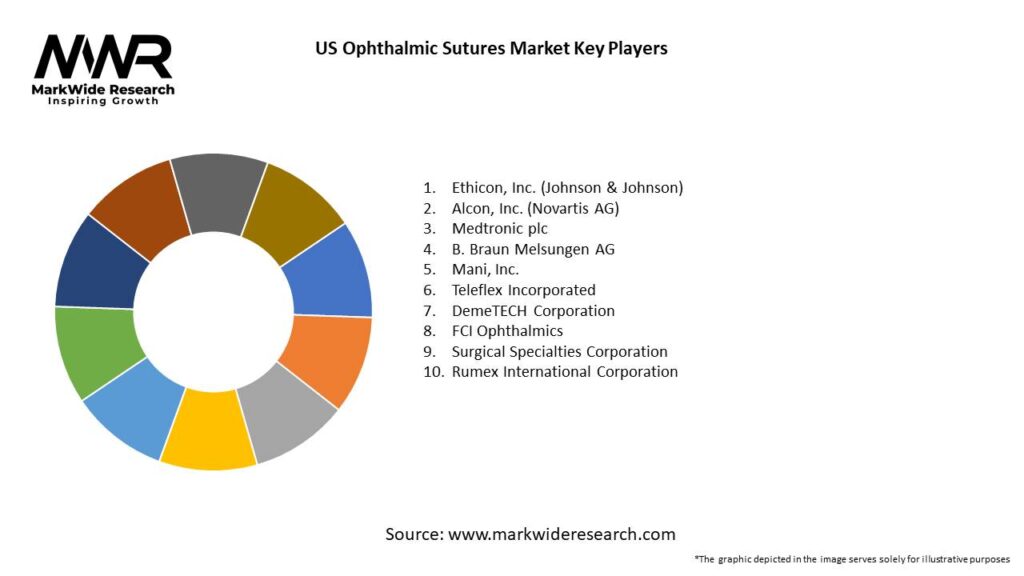

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Surgical Volume Growth: Cataract procedures in the U.S. exceed 4 million annually, creating substantial base demand for ophthalmic sutures.

Material Innovation: Coated multifilament sutures with antimicrobial agents are reducing postoperative endophthalmitis rates by up to 30%.

Shift to Outpatient Settings: Over 80% of ophthalmic surgeries now occur in ambulatory centers, driving demand for user-friendly packaging and pre-loaded suture systems.

Surgeon Preference Trends: Nylon and polypropylene non-absorbables account for over 60% of suture usage in corneal and lens-incision closures due to their predictable strength retention.

Regulatory Landscape: The FDA’s 510(k) pathway remains the primary approval route, with attention on biocompatibility testing and exotoxin levels in new suture formulations.

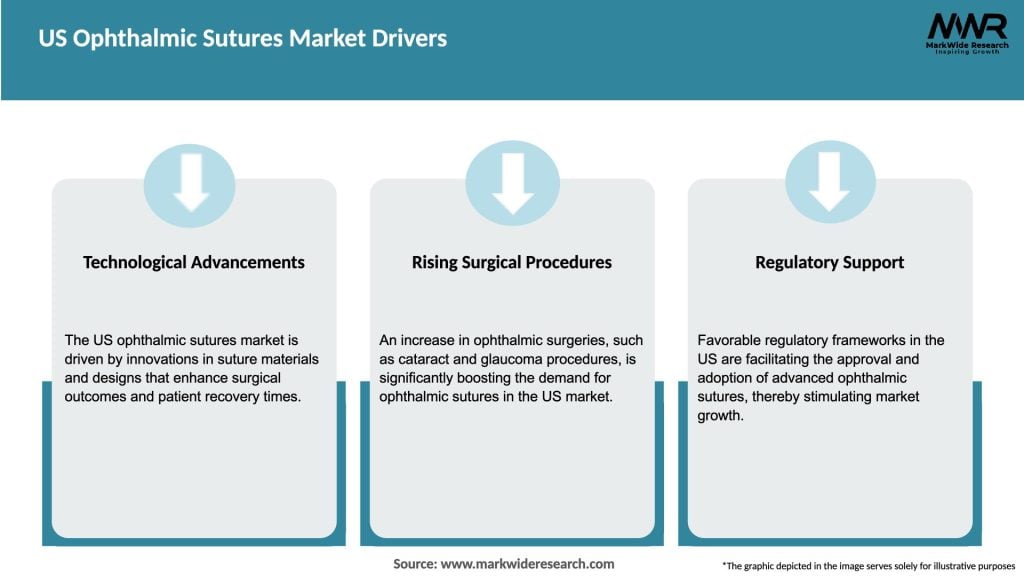

Market Drivers

Aging Population: With Americans aged 65+ projected to reach 74 million by 2030, age-related cataracts and glaucoma surgeries will continue to drive suture demand.

Technological Advancements: Innovations such as pre-threaded, single-use suture kits and knotless barbed sutures are enhancing procedural efficiency.

Rising Ophthalmologist Density: Growth in the number of ophthalmic surgeons and surgical centers, particularly in suburban and rural markets, expands market reach.

Healthcare Access Improvement: Increased insurance coverage and Medicare reimbursements for outpatient ophthalmic procedures are lowering patient out-of-pocket costs.

Patient Awareness: Campaigns by professional societies and patient advocacy groups are driving earlier detection and treatment, leading to increased surgical interventions.

Market Restraints

Cost Constraints: Advanced suture technologies often carry price premiums, which can limit adoption in cost-sensitive public hospitals and clinics.

Supply Chain Sensitivity: Raw material shortages—particularly of specialized polymers—can disrupt production and lead to price volatility.

Training Requirements: Adoption of new suture types and deployment devices requires surgeon training and may slow integration.

Infection Control Protocols: Stringent sterilization and packaging standards add complexity to product development and extend time-to-market.

Competition from Glues and Sealants: Tissue adhesives are increasingly used for conjunctival closure, posing a partial substitute for sutures in select procedures.

Market Opportunities

Biodegradable Nanofiber Sutures: R&D into nanofiber-based absorbable sutures promises faster tissue integration and reduced inflammation.

Antimicrobial Coatings: Partnerships with biotech firms to integrate silver or antibiotic coatings can capture share by reducing infection complications.

Pre-loaded Suture Systems: Ready-to-use cartridges that eliminate manual threading can shorten procedure time and minimize handling errors.

Customized Suture Sizes: Expansion of ultra-fine calibers (11-0, 12-0) tailored for micro-incisional surgeries will address niche surgical needs.

Digital Tracking: Embedding RFID tags in suture packaging to support inventory management and expiration monitoring in high-volume surgical centers.

Market Dynamics

Hospital vs. ASC Channels: Hospitals remain the largest purchasers by volume, but ASCs are the fastest-growing channel due to cost efficiency and higher procedure throughput.

Supplier Consolidation: Mergers among leading medical device firms are consolidating suture portfolios, driving standardization of suture types and packaging.

Value-Based Purchasing: Group purchasing organizations (GPOs) are negotiating volume-based contracts, favoring suppliers who can demonstrate clinical and economic value.

Surgeon Preference Programs: Manufacturer-sponsored training and “surgeon-to-surgeon” collaboration initiatives are influencing product selection.

Regulatory Scrutiny: Renewed FDA focus on biocompatibility studies and endotoxin thresholds is shaping product lifecycle and post-market surveillance.

Regional Analysis

The US ophthalmic sutures market exhibits a regional variation in terms of demand and market share. The market is primarily concentrated in urban areas with well-established healthcare infrastructure. Regions with a higher concentration of ophthalmic clinics and hospitals witness greater demand for ophthalmic sutures. Additionally, factors such as population density, healthcare expenditure, and awareness about eye health contribute to regional variations in market growth.

Competitive Landscape

Leading Companies in US Ophthalmic Sutures Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

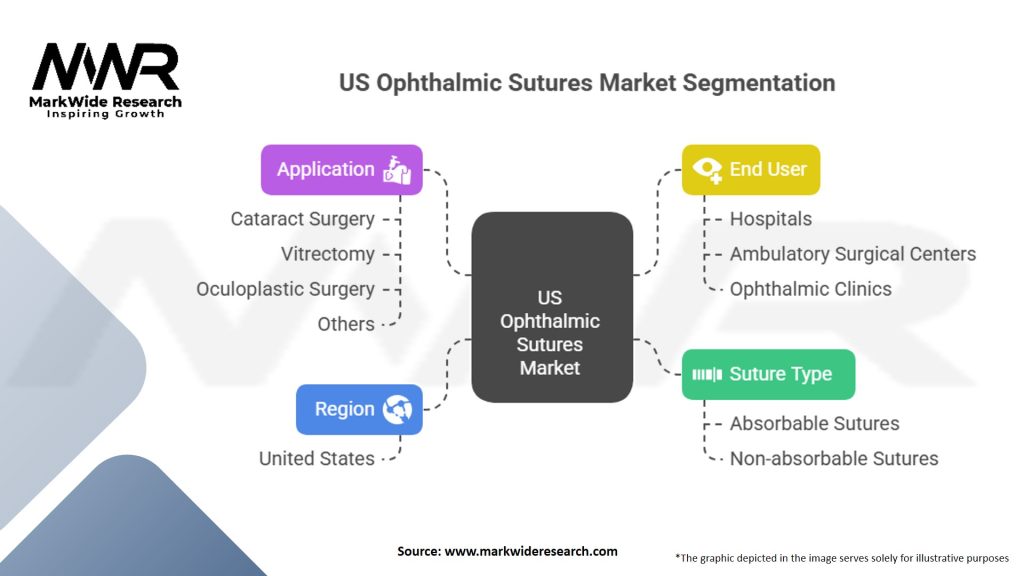

Segmentation

The US ophthalmic sutures market can be segmented based on suture material, suture type, application, and end-user. By suture material, the market can be categorized into silk sutures, nylon sutures, polypropylene sutures, and others. Based on suture type, the market can be divided into absorbable sutures and non-absorbable sutures. The application segment includes cataract surgery, corneal transplantation, glaucoma surgery, and others. End-users of ophthalmic sutures comprise hospitals, ophthalmic clinics, and ambulatory surgical centers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the US ophthalmic sutures market. The restrictions on elective surgeries and the diversion of healthcare resources towards managing the pandemic led to a temporary decline in the demand for ophthalmic surgeries. However, as the situation improved and healthcare facilities resumed normal operations, the market witnessed a rebound. The pandemic also highlighted the importance of maintaining a robust healthcare infrastructure to ensure timely access to eye care services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US ophthalmic sutures market is poised for steady growth in the coming years. Factors such as the increasing prevalence of eye disorders, advancements in surgical techniques, and the development of specialized sutures will drive market expansion. Additionally, the aging population and growing demand for minimally invasive procedures will contribute to the market’s growth potential.

Conclusion

The US ophthalmic sutures market is a vital segment of the healthcare industry, driven by the rising demand for ophthalmic surgeries and advancements in surgical techniques. The market offers significant opportunities for manufacturers, distributors, and healthcare providers to cater to the growing needs of patients with eye disorders. However, challenges such as high costs and regulatory requirements need to be addressed to ensure sustained market growth. With continuous innovation and strategic collaborations, the US ophthalmic sutures market is expected to flourish in the coming years, contributing to improved patient outcomes and eye health.

What is Ophthalmic Sutures?

Ophthalmic sutures are specialized surgical threads used in eye surgeries to close incisions or wounds. They are designed to be biocompatible and may be absorbable or non-absorbable, depending on the surgical requirements.

What are the key players in the US Ophthalmic Sutures Market?

Key players in the US Ophthalmic Sutures Market include Johnson & Johnson, Bausch + Lomb, and Alcon, among others. These companies are known for their innovative products and extensive distribution networks in the ophthalmic sector.

What are the growth factors driving the US Ophthalmic Sutures Market?

The US Ophthalmic Sutures Market is driven by the increasing prevalence of eye disorders, advancements in surgical techniques, and a growing aging population. Additionally, the rise in cataract and refractive surgeries contributes to market growth.

What challenges does the US Ophthalmic Sutures Market face?

The US Ophthalmic Sutures Market faces challenges such as stringent regulatory requirements and the high cost of advanced suturing materials. Additionally, the availability of alternative wound closure techniques can impact market growth.

What opportunities exist in the US Ophthalmic Sutures Market?

Opportunities in the US Ophthalmic Sutures Market include the development of innovative suturing materials and techniques, as well as the expansion of surgical procedures. The increasing focus on minimally invasive surgeries also presents significant growth potential.

What trends are shaping the US Ophthalmic Sutures Market?

Trends in the US Ophthalmic Sutures Market include the rising adoption of biodegradable sutures and advancements in suturing technology. Additionally, there is a growing emphasis on personalized medicine and tailored surgical solutions.

US Ophthalmic Sutures Market

| Segmentation Details | Description |

|---|---|

| Suture Type | Absorbable Sutures, Non-absorbable Sutures |

| Application | Cataract Surgery, Vitrectomy, Oculoplastic Surgery, Others |

| End User | Hospitals, Ambulatory Surgical Centers, Ophthalmic Clinics |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Ophthalmic Sutures Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at