444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US ophthalmic devices market represents a dynamic and rapidly evolving sector within the broader medical device industry, characterized by continuous technological advancement and increasing demand for vision care solutions. This comprehensive market encompasses a wide range of sophisticated medical instruments and equipment designed to diagnose, treat, and manage various eye conditions and disorders affecting millions of Americans annually.

Market dynamics indicate robust growth driven by an aging population, rising prevalence of eye diseases, and technological innovations in surgical and diagnostic equipment. The market demonstrates significant expansion across multiple segments, with cataract surgery devices and refractive surgery equipment leading adoption rates. Recent analysis shows the market experiencing a 6.8% CAGR over the forecast period, reflecting strong demand fundamentals and technological advancement.

Key market drivers include the increasing incidence of age-related macular degeneration, diabetic retinopathy, and cataracts among the growing elderly population. Additionally, rising awareness about eye health, improved healthcare infrastructure, and favorable reimbursement policies contribute to market expansion. The integration of artificial intelligence and advanced imaging technologies further enhances the market’s growth trajectory.

The US ophthalmic devices market refers to the comprehensive ecosystem of medical devices, instruments, and equipment specifically designed for the diagnosis, treatment, and management of eye-related conditions and disorders within the United States healthcare system. This market encompasses surgical instruments, diagnostic equipment, vision correction devices, and therapeutic apparatus used by ophthalmologists, optometrists, and other eye care professionals.

Ophthalmic devices include a diverse range of products from basic diagnostic tools like ophthalmoscopes and tonometers to sophisticated surgical equipment such as phacoemulsification systems, vitrectomy machines, and laser therapy devices. The market also encompasses contact lenses, intraocular lenses, and various therapeutic devices designed to address specific eye conditions.

Market significance extends beyond traditional medical device applications, incorporating cutting-edge technologies like optical coherence tomography, femtosecond lasers, and AI-powered diagnostic systems. These innovations enable precise diagnosis, minimally invasive treatments, and improved patient outcomes across various ophthalmic specialties.

Strategic market analysis reveals the US ophthalmic devices market as a high-growth sector driven by demographic trends, technological innovation, and increasing healthcare expenditure on vision care. The market demonstrates strong fundamentals with consistent demand growth across multiple product categories and application segments.

Key growth factors include the aging baby boomer population, with approximately 78% of Americans over 65 experiencing some form of vision impairment, driving demand for both diagnostic and therapeutic ophthalmic devices. The market benefits from continuous innovation in surgical techniques, diagnostic capabilities, and treatment modalities.

Competitive landscape features established medical device manufacturers alongside emerging technology companies developing next-generation solutions. Market leaders focus on research and development, strategic acquisitions, and expanding product portfolios to maintain competitive advantages in this dynamic environment.

Future prospects indicate sustained growth driven by technological advancement, expanding applications, and increasing adoption of minimally invasive procedures. The integration of digital health technologies and telemedicine capabilities presents additional growth opportunities for market participants.

Critical market insights reveal several transformative trends shaping the US ophthalmic devices landscape:

Market penetration varies significantly across different device categories, with surgical equipment maintaining the largest market share while diagnostic devices demonstrate the highest growth rates. Regional variations in adoption patterns reflect differences in healthcare infrastructure and reimbursement policies.

Primary market drivers propelling the US ophthalmic devices market include demographic, technological, and healthcare policy factors that create sustained demand for vision care solutions.

Aging Population Demographics represent the most significant driver, with the US Census Bureau projecting substantial growth in the 65+ population segment. This demographic shift directly correlates with increased incidence of age-related eye conditions, driving demand for both diagnostic and therapeutic devices. Cataract prevalence affects approximately 24.4 million Americans over age 40, creating substantial market opportunities.

Technological Innovation continues driving market expansion through improved treatment outcomes, reduced procedure times, and enhanced patient safety. Advanced laser systems, premium intraocular lenses, and sophisticated diagnostic equipment enable ophthalmologists to provide more precise and effective treatments.

Healthcare Infrastructure Development supports market growth through expanded access to specialized eye care services, particularly in underserved regions. Ambulatory surgery centers and specialized eye clinics increase procedure volumes and device utilization rates.

Reimbursement Policy Support from Medicare and private insurance providers ensures patient access to necessary treatments and procedures, maintaining steady demand for ophthalmic devices across various economic conditions.

Market constraints present challenges that may limit growth potential and market expansion in certain segments of the US ophthalmic devices market.

High Capital Investment Requirements for advanced ophthalmic equipment create barriers for smaller practices and healthcare facilities. Premium diagnostic and surgical devices often require significant upfront investments, limiting adoption rates among cost-sensitive providers.

Regulatory Compliance Complexity associated with FDA approval processes can delay product launches and increase development costs for manufacturers. Stringent safety and efficacy requirements, while ensuring patient safety, may slow innovation cycles and market entry for new technologies.

Skilled Personnel Shortage in specialized ophthalmic procedures limits the effective utilization of advanced devices. Training requirements for complex surgical equipment and diagnostic systems create adoption barriers in regions with limited access to specialized education programs.

Reimbursement Limitations for certain procedures and devices may restrict patient access and reduce demand for premium technologies. Coverage gaps for elective procedures and newer treatment modalities can impact market growth in specific segments.

Economic Sensitivity affects elective procedures and premium device adoption during economic downturns, as patients may defer non-urgent treatments and providers may delay equipment upgrades.

Emerging opportunities within the US ophthalmic devices market present significant potential for growth and innovation across multiple segments and applications.

Artificial Intelligence Integration offers transformative opportunities for diagnostic accuracy and treatment planning. AI-powered imaging analysis, predictive modeling, and automated screening systems can revolutionize eye care delivery and create new market segments for technology-enabled devices.

Telemedicine Expansion creates opportunities for remote diagnostic devices and monitoring systems, particularly valuable for underserved populations and routine screening applications. The growing acceptance of telehealth services opens new distribution channels and service delivery models.

Minimally Invasive Surgery Growth presents opportunities for innovative surgical devices and techniques that reduce patient recovery times and improve outcomes. Micro-incision procedures and advanced laser technologies represent high-growth market segments.

Personalized Medicine Applications enable customized treatment approaches using patient-specific data and advanced diagnostic capabilities. Precision medicine concepts in ophthalmology create opportunities for specialized devices and targeted therapies.

Emerging Market Segments including pediatric ophthalmology, sports vision, and occupational eye health present untapped opportunities for specialized device development and market expansion.

Market dynamics in the US ophthalmic devices sector reflect complex interactions between technological advancement, regulatory requirements, competitive pressures, and evolving healthcare delivery models.

Innovation Cycles drive continuous product development and market evolution, with manufacturers investing heavily in research and development to maintain competitive advantages. The rapid pace of technological change creates both opportunities and challenges for market participants.

Competitive Intensity varies across different device categories, with established players maintaining strong positions in traditional segments while emerging companies focus on innovative technologies and niche applications. Market consolidation through acquisitions and partnerships shapes competitive dynamics.

Regulatory Environment influences product development timelines and market entry strategies. FDA approval processes, quality standards, and post-market surveillance requirements impact competitive positioning and market access for new technologies.

Healthcare Policy Changes affect reimbursement rates, coverage decisions, and market access for various devices and procedures. Policy shifts can create significant market impacts across different segments and geographic regions.

Technology Convergence between ophthalmology and other medical specialties creates new opportunities for integrated solutions and cross-platform compatibility, driving innovation in device design and functionality.

Comprehensive research methodology employed in analyzing the US ophthalmic devices market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights.

Primary Research includes extensive interviews with industry executives, healthcare professionals, and key opinion leaders across the ophthalmic device ecosystem. Direct engagement with ophthalmologists, optometrists, and healthcare administrators provides valuable insights into market trends, adoption patterns, and future requirements.

Secondary Research encompasses analysis of industry reports, regulatory filings, clinical studies, and market databases to establish comprehensive market understanding. Academic research, patent analysis, and technology assessments contribute to the analytical foundation.

Market Modeling utilizes advanced statistical techniques and forecasting models to project market trends and growth patterns. Quantitative analysis incorporates demographic data, healthcare utilization statistics, and economic indicators to develop robust market projections.

Data Validation processes ensure accuracy through triangulation of multiple sources, expert review, and consistency checks across different analytical approaches. Quality assurance protocols maintain high standards for data integrity and analytical rigor.

Continuous Monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence throughout the research process.

Regional market dynamics within the United States reveal significant variations in adoption patterns, growth rates, and market opportunities across different geographic areas.

Northeast Region demonstrates the highest market concentration with 32% market share, driven by dense population centers, advanced healthcare infrastructure, and high concentrations of specialized eye care facilities. Major metropolitan areas like New York, Boston, and Philadelphia lead in adoption of premium technologies and innovative procedures.

West Coast Markets show strong growth in technology adoption and minimally invasive procedures, with California representing the largest single state market. The region benefits from proximity to medical device innovation centers and early adoption of new technologies.

Southeast Region experiences rapid growth driven by demographic trends and healthcare infrastructure expansion. Florida’s large retiree population creates substantial demand for age-related eye care services and devices.

Midwest Markets demonstrate steady growth with strong adoption of cost-effective solutions and established healthcare systems. The region shows particular strength in comprehensive eye care and routine diagnostic procedures.

Southwest Region presents emerging opportunities with growing populations and expanding healthcare access. Texas leads regional growth with major metropolitan areas driving device adoption and procedure volumes.

Competitive dynamics in the US ophthalmic devices market feature a mix of established multinational corporations, specialized medical device companies, and innovative technology startups competing across various market segments.

Market positioning strategies vary among competitors, with some focusing on comprehensive product portfolios while others specialize in specific technology areas or market segments. Innovation, clinical evidence, and customer support capabilities drive competitive differentiation.

Strategic partnerships and acquisitions shape competitive dynamics, enabling companies to expand capabilities, access new technologies, and strengthen market positions across different segments.

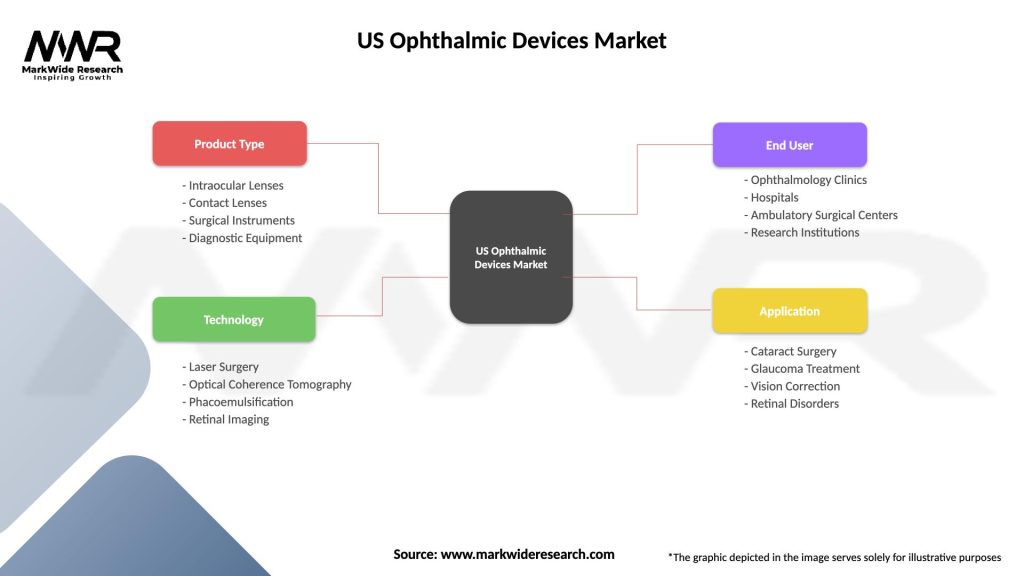

Market segmentation analysis reveals distinct categories within the US ophthalmic devices market, each characterized by specific growth patterns, competitive dynamics, and market opportunities.

By Product Type:

By Application:

By End User:

Surgical Devices Category represents the largest market segment, driven by high-value equipment and increasing procedure volumes. Cataract surgery devices dominate this category with 4.2 million procedures performed annually in the US. Premium IOLs and advanced phacoemulsification systems drive revenue growth and technological advancement.

Diagnostic Equipment Segment shows the highest growth rate at 8.2% CAGR, fueled by early detection initiatives and advanced imaging technologies. Optical coherence tomography systems lead adoption rates, while AI-powered diagnostic tools represent emerging high-growth opportunities.

Refractive Surgery Equipment demonstrates strong recovery following pandemic-related delays, with LASIK procedures showing renewed growth momentum. Premium technologies including femtosecond lasers and wavefront-guided systems drive market expansion and improved patient outcomes.

Retinal Treatment Devices represent a high-growth specialty segment addressing increasing prevalence of diabetic retinopathy and age-related macular degeneration. Advanced imaging systems and therapeutic laser devices show particularly strong adoption rates.

Glaucoma Management Systems benefit from improved screening programs and early intervention strategies. Minimally invasive glaucoma surgery devices represent the fastest-growing subsegment within this category.

Healthcare Providers benefit from advanced ophthalmic devices through improved diagnostic accuracy, enhanced surgical outcomes, and increased operational efficiency. Modern equipment enables faster procedures, better patient satisfaction, and expanded service capabilities.

Patients experience significant benefits including improved visual outcomes, reduced recovery times, and access to minimally invasive treatment options. Advanced diagnostic capabilities enable early detection and intervention, preventing vision loss and improving quality of life.

Device Manufacturers benefit from strong market demand, technological innovation opportunities, and expanding applications for ophthalmic devices. The growing market provides sustainable revenue growth and opportunities for product differentiation.

Healthcare Systems realize value through improved efficiency, reduced complications, and better resource utilization. Outpatient procedures and minimally invasive techniques reduce healthcare costs while maintaining high-quality outcomes.

Insurance Providers benefit from cost-effective treatments, reduced long-term care requirements, and improved patient outcomes that minimize future healthcare expenditures related to vision complications.

Research Institutions gain access to advanced technologies for clinical research, training programs, and development of new treatment protocols that advance the field of ophthalmology.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation represents the most significant trend reshaping the ophthalmic devices market, with artificial intelligence integration becoming standard in diagnostic equipment. AI-powered screening systems demonstrate 95% accuracy rates in detecting diabetic retinopathy, revolutionizing early detection capabilities.

Minimally Invasive Procedures continue gaining adoption across all ophthalmic specialties, driven by patient preferences for faster recovery and reduced complications. Micro-incision cataract surgery and minimally invasive glaucoma surgery represent the fastest-growing procedure categories.

Telemedicine Integration accelerates following pandemic-driven adoption, with remote diagnostic capabilities and virtual consultations becoming standard practice. Remote monitoring devices enable continuous patient care and early intervention strategies.

Personalized Medicine approaches gain traction through advanced diagnostic capabilities and customized treatment planning. Genetic testing integration and biomarker analysis enable targeted therapies and improved outcomes.

Sustainability Focus drives development of environmentally friendly devices and packaging, with manufacturers adopting circular economy principles and sustainable manufacturing practices.

Value-Based Care Models influence device selection and utilization patterns, emphasizing outcomes measurement and cost-effectiveness in clinical decision-making processes.

Recent industry developments highlight the dynamic nature of the US ophthalmic devices market and emerging trends shaping future growth trajectories.

Regulatory Approvals for next-generation devices continue accelerating, with FDA approving multiple AI-powered diagnostic systems and advanced surgical platforms. Breakthrough device designations expedite approval processes for innovative technologies addressing unmet clinical needs.

Strategic Acquisitions reshape competitive dynamics as major players acquire specialized technology companies and emerging innovators. Recent transactions focus on digital health capabilities, AI technologies, and minimally invasive surgical systems.

Clinical Evidence Generation supports adoption of new technologies through comprehensive studies demonstrating safety and efficacy. Real-world evidence collection becomes increasingly important for reimbursement decisions and clinical adoption.

Partnership Formations between device manufacturers and healthcare providers create integrated solutions and value-based care models. Technology partnerships enable rapid innovation and market access for emerging companies.

Manufacturing Expansion in the US supports supply chain resilience and reduces dependence on international suppliers. Domestic production capabilities strengthen market position and ensure reliable product availability.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the evolving ophthalmic devices landscape.

Technology Investment Priorities should emphasize AI integration, digital health capabilities, and minimally invasive surgical technologies. MarkWide Research analysis indicates companies investing in these areas show superior growth performance compared to traditional approaches.

Market Entry Strategies for new participants should focus on specialized segments and unmet clinical needs rather than competing directly with established players in mature markets. Niche applications and innovative technologies provide better opportunities for market penetration.

Partnership Development becomes critical for accessing complementary technologies, distribution channels, and clinical expertise. Strategic alliances enable faster market access and reduced development risks for innovative products.

Regulatory Strategy should incorporate early FDA engagement and breakthrough device pathway utilization for innovative technologies. Proactive regulatory planning reduces approval timelines and accelerates market entry.

Value Demonstration through clinical evidence and health economic studies becomes essential for market access and reimbursement approval. Outcomes research and real-world evidence generation support adoption decisions.

Geographic Expansion strategies should prioritize underserved markets and emerging opportunities in rural and suburban areas where access to specialized eye care remains limited.

Future market prospects for the US ophthalmic devices market remain highly positive, supported by favorable demographic trends, technological innovation, and expanding healthcare access initiatives.

Growth Projections indicate sustained expansion across all major market segments, with diagnostic equipment and minimally invasive surgical devices leading growth rates. MWR forecasts suggest the market will maintain robust growth momentum through the next decade, driven by aging demographics and technology adoption.

Technology Evolution will continue reshaping market dynamics through AI integration, robotics advancement, and digital health convergence. Next-generation platforms combining multiple functionalities and automated capabilities represent the future of ophthalmic device development.

Market Expansion opportunities emerge from addressing underserved populations, developing cost-effective solutions, and expanding applications beyond traditional ophthalmology into related medical specialties.

Regulatory Environment evolution toward streamlined approval processes and outcome-based evaluations will accelerate innovation cycles and market access for breakthrough technologies.

Healthcare Delivery Models will increasingly emphasize value-based care, preventive interventions, and patient-centered approaches, creating new opportunities for innovative device solutions and service models.

Investment Outlook remains strong with continued venture capital funding, strategic acquisitions, and public market interest in ophthalmic device companies demonstrating innovative technologies and strong growth potential.

The US ophthalmic devices market represents a dynamic and rapidly evolving sector with exceptional growth prospects driven by demographic trends, technological innovation, and expanding healthcare needs. Market fundamentals remain strong across all major segments, with particular strength in surgical devices, diagnostic equipment, and emerging technology applications.

Key success factors for market participants include strategic technology investments, effective regulatory navigation, and development of value-based solutions that address evolving healthcare delivery models. The integration of artificial intelligence, minimally invasive techniques, and digital health capabilities creates significant opportunities for innovation and market differentiation.

Future growth trajectory appears highly favorable, supported by an aging population, increasing prevalence of eye diseases, and continuous advancement in treatment technologies. The market’s resilience and adaptability, demonstrated through recent challenges, position it well for sustained expansion and value creation across the healthcare ecosystem.

Strategic positioning for long-term success requires focus on patient outcomes, cost-effectiveness, and technological leadership while maintaining strong relationships with healthcare providers and regulatory authorities. The US ophthalmic devices market offers compelling opportunities for companies committed to innovation, quality, and addressing the evolving needs of eye care professionals and patients nationwide.

What is Ophthalmic Devices?

Ophthalmic devices are medical instruments and tools used for diagnosing, treating, and managing eye conditions and diseases. They include a variety of products such as diagnostic equipment, surgical instruments, and vision correction devices.

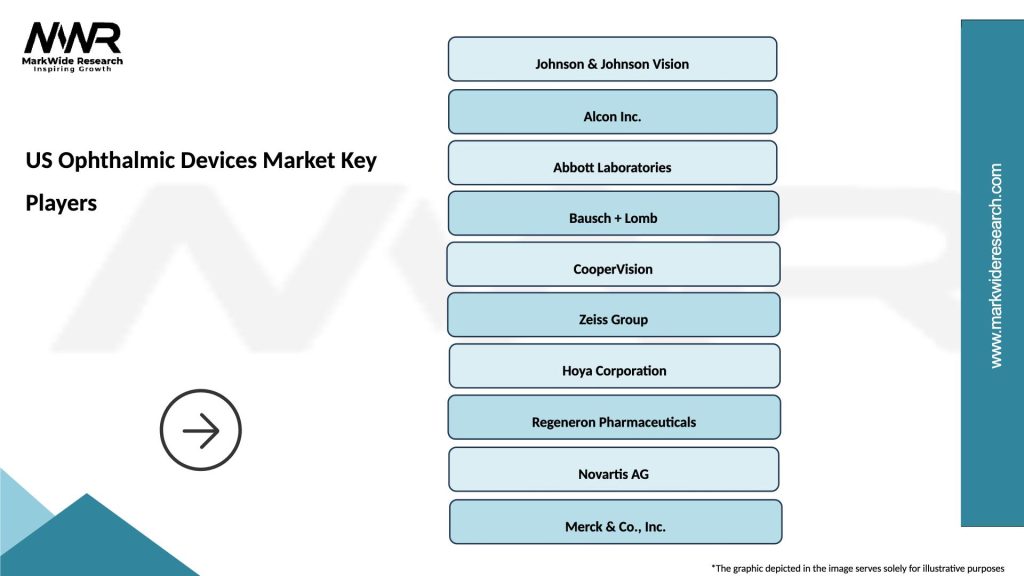

What are the key players in the US Ophthalmic Devices Market?

Key players in the US Ophthalmic Devices Market include Johnson & Johnson Vision, Alcon, and Bausch + Lomb. These companies are known for their innovative products and significant market presence, among others.

What are the main drivers of growth in the US Ophthalmic Devices Market?

The growth of the US Ophthalmic Devices Market is driven by factors such as the increasing prevalence of eye disorders, advancements in technology, and a growing aging population that requires vision correction and eye care solutions.

What challenges does the US Ophthalmic Devices Market face?

The US Ophthalmic Devices Market faces challenges such as stringent regulatory requirements, high costs of advanced devices, and competition from alternative treatments. These factors can hinder market growth and innovation.

What opportunities exist in the US Ophthalmic Devices Market?

Opportunities in the US Ophthalmic Devices Market include the development of smart and connected devices, increasing demand for minimally invasive surgical procedures, and the potential for growth in telemedicine applications for eye care.

What trends are shaping the US Ophthalmic Devices Market?

Trends in the US Ophthalmic Devices Market include the rise of personalized medicine, advancements in laser technology, and the integration of artificial intelligence in diagnostic tools. These innovations are enhancing patient outcomes and operational efficiency.

US Ophthalmic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Intraocular Lenses, Contact Lenses, Surgical Instruments, Diagnostic Equipment |

| Technology | Laser Surgery, Optical Coherence Tomography, Phacoemulsification, Retinal Imaging |

| End User | Ophthalmology Clinics, Hospitals, Ambulatory Surgical Centers, Research Institutions |

| Application | Cataract Surgery, Glaucoma Treatment, Vision Correction, Retinal Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Ophthalmic Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at