444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US oil and gas midstream market represents a critical infrastructure backbone connecting upstream production with downstream refining and distribution networks. This sector encompasses pipeline transportation, storage facilities, processing plants, and terminal operations that facilitate the movement of crude oil, natural gas, and refined petroleum products across the United States. Market dynamics indicate robust expansion driven by increasing domestic production, infrastructure modernization, and growing export capabilities.

Pipeline networks form the cornerstone of midstream operations, with extensive systems spanning thousands of miles to transport hydrocarbons from production regions to refineries and distribution centers. The sector has experienced significant growth with domestic oil production reaching record levels and natural gas output expanding substantially. Infrastructure investments continue to accelerate, with companies focusing on capacity expansion, safety enhancements, and technological upgrades to meet evolving market demands.

Regional concentration remains prominent in key production areas including the Permian Basin, Bakken Formation, and Marcellus Shale, where midstream infrastructure development has intensified. The market demonstrates strong fundamentals supported by long-term contracts, regulated utility-like cash flows, and essential service provision to the energy value chain. Growth projections indicate continued expansion at approximately 4.2% CAGR through the forecast period, driven by increasing production volumes and infrastructure modernization initiatives.

The US oil and gas midstream market refers to the comprehensive network of infrastructure, services, and operations that transport, store, and process crude oil, natural gas, and petroleum products between upstream production sites and downstream refining or distribution facilities. This sector encompasses pipeline systems, storage terminals, processing plants, compression stations, and related infrastructure essential for energy transportation and logistics.

Midstream operations serve as the vital link in the energy value chain, ensuring efficient movement of hydrocarbons from wellheads to end markets. The sector includes both liquid and gas transportation systems, with specialized infrastructure designed to handle different product types, volumes, and transportation requirements. Key components include gathering systems, transmission pipelines, distribution networks, storage facilities, and processing plants that add value through separation, purification, and conditioning processes.

Market participants range from large integrated energy companies to specialized midstream operators, pipeline companies, and infrastructure developers. The sector operates under various regulatory frameworks, including federal and state oversight for interstate pipelines, safety regulations, and environmental compliance requirements that shape operational standards and investment decisions.

Strategic positioning within the US energy infrastructure landscape has established the midstream sector as a fundamental component of domestic energy security and economic growth. The market demonstrates resilient characteristics with stable cash flow generation, long-term contract structures, and essential service provision that supports both domestic consumption and export activities. Investment momentum continues to build as companies expand capacity, modernize aging infrastructure, and develop new transportation corridors.

Technological advancement drives operational efficiency improvements, with digital monitoring systems, automated controls, and predictive maintenance capabilities enhancing safety and reliability. The sector benefits from regulatory stability and supportive policy frameworks that encourage infrastructure development while maintaining safety and environmental standards. Market consolidation trends have created larger, more efficient operators with enhanced financial capabilities and operational expertise.

Growth drivers include sustained domestic production increases, expanding export infrastructure, and growing demand for natural gas in power generation and industrial applications. The market shows strong fundamentals with approximately 78% capacity utilization across major pipeline systems, indicating healthy demand-supply dynamics. Future prospects remain positive with continued investment in infrastructure expansion, technological innovation, and operational optimization initiatives.

Infrastructure capacity expansion represents the primary growth catalyst, with major pipeline projects and storage facility developments addressing transportation bottlenecks and regional supply-demand imbalances. The sector demonstrates operational resilience through diversified asset portfolios, geographic distribution, and multiple revenue streams that provide stability during market volatility.

Competitive dynamics emphasize operational excellence, safety performance, and customer service quality as key differentiators. Companies focus on strategic partnerships and joint ventures to share investment risks and leverage complementary capabilities in large-scale infrastructure projects.

Domestic production growth serves as the fundamental driver for midstream infrastructure expansion, with unconventional oil and gas development creating substantial transportation and processing requirements. The shale revolution has transformed the US energy landscape, generating significant volumes that require efficient transportation to market centers and export facilities.

Export market development drives infrastructure investment as the United States transitions from energy importer to major exporter of crude oil and natural gas. LNG export facilities and crude oil terminals require extensive pipeline connections and storage capabilities to support international trade activities. The sector benefits from growing global demand for US energy products, particularly in Asian and European markets.

Infrastructure modernization needs create ongoing investment opportunities as aging pipeline systems require replacement, upgrade, and capacity expansion. Safety regulations and environmental standards drive technology adoption and infrastructure improvements that enhance operational reliability and reduce environmental impact. Digital transformation initiatives enable operational optimization, predictive maintenance, and enhanced safety monitoring capabilities.

Natural gas demand growth from power generation, industrial applications, and export markets drives pipeline capacity expansion and processing facility development. The transition toward cleaner energy sources positions natural gas as a bridge fuel, supporting sustained demand growth and infrastructure investment requirements.

Regulatory challenges present significant constraints through lengthy permitting processes, environmental reviews, and stakeholder opposition that can delay or prevent infrastructure projects. Environmental concerns regarding pipeline safety, land use impacts, and climate change considerations create additional regulatory scrutiny and compliance requirements that increase project costs and timelines.

Capital intensity requirements for large-scale infrastructure projects create financial barriers and limit the number of companies capable of undertaking major developments. Construction costs have increased substantially due to material price inflation, labor shortages, and enhanced safety requirements that impact project economics and investment returns.

Market volatility in commodity prices affects upstream production levels and transportation demand, creating uncertainty for long-term infrastructure investments. Seasonal demand patterns and regional supply-demand imbalances can impact capacity utilization and revenue generation for midstream operators.

Competition from alternative transportation methods, including rail and truck transport, provides flexibility for producers but can reduce pipeline utilization during certain market conditions. Technology disruption risks from renewable energy adoption and electric vehicle penetration may impact long-term demand growth projections for petroleum products.

Export infrastructure expansion presents substantial growth opportunities as global demand for US energy products continues increasing. LNG export capacity development offers significant revenue potential with long-term contracts providing stable cash flows and attractive returns on investment. Crude oil export terminals and associated pipeline infrastructure create additional growth avenues as domestic production exceeds refining capacity.

Carbon capture and storage infrastructure development represents emerging opportunities as companies and governments focus on emissions reduction initiatives. Hydrogen transportation networks may utilize existing pipeline infrastructure with modifications, creating new revenue streams and market positioning advantages for forward-thinking operators.

Digital technology integration enables operational optimization, cost reduction, and service enhancement opportunities. Artificial intelligence and machine learning applications can improve predictive maintenance, optimize flow management, and enhance safety monitoring capabilities. Automation technologies reduce operational costs while improving safety and reliability performance.

Strategic acquisitions and consolidation opportunities allow companies to expand geographic coverage, increase scale efficiencies, and enhance competitive positioning. Joint venture partnerships enable risk sharing and capital optimization for large-scale infrastructure projects while leveraging complementary capabilities and market access.

Supply-demand fundamentals drive market dynamics with production growth creating transportation requirements while refining capacity and export demand determine infrastructure utilization levels. Regional price differentials incentivize pipeline development to arbitrage location-based pricing disparities and optimize product flows to highest-value markets.

Regulatory environment influences market dynamics through permitting processes, safety requirements, and environmental standards that affect project timelines, costs, and operational parameters. Federal energy policy regarding domestic production, exports, and infrastructure development creates market direction and investment incentives that shape industry growth patterns.

Technological innovation transforms operational capabilities with smart pipeline systems enabling real-time monitoring, automated controls, and predictive maintenance that improve efficiency and reduce operational risks. Advanced materials and construction techniques enhance pipeline durability, safety, and environmental performance while reducing long-term maintenance requirements.

Market competition intensifies as new entrants and existing players compete for transportation contracts, storage services, and processing opportunities. Customer relationships become increasingly important with long-term partnerships providing competitive advantages and stable revenue streams. Service quality and operational reliability serve as key differentiators in contract negotiations and customer retention efforts.

Comprehensive analysis methodology incorporates multiple data sources, industry expertise, and analytical frameworks to provide accurate market assessment and strategic insights. Primary research includes extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government databases, industry publications, financial reports, and regulatory filings to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth patterns and identify key performance indicators.

Market segmentation analysis examines various dimensions including geography, product type, infrastructure category, and end-user applications to provide detailed market understanding. Competitive intelligence gathering includes company analysis, strategic positioning assessment, and market share evaluation to understand competitive dynamics and industry structure.

Regulatory analysis incorporates examination of federal and state regulations, policy developments, and compliance requirements that impact market operations and growth prospects. Technology assessment evaluates emerging innovations, adoption patterns, and potential market disruptions that may influence future industry evolution.

Texas region dominates midstream infrastructure with extensive pipeline networks, storage facilities, and processing plants serving the Permian Basin and Eagle Ford Shale production areas. The state accounts for approximately 42% market share of US midstream capacity, driven by prolific oil and gas production and strategic Gulf Coast location for export activities.

Gulf Coast corridor represents the primary hub for refining, petrochemicals, and export infrastructure with major pipeline terminations, storage complexes, and marine terminals. Louisiana and Texas coastal regions concentrate LNG export facilities and crude oil terminals that serve international markets, creating substantial infrastructure investment and operational activity.

Midwest region serves as a critical transportation hub connecting production areas with refining centers and distribution networks. Oklahoma and Kansas host major pipeline intersections and storage facilities that provide operational flexibility and market access for producers across multiple basins. The region demonstrates strategic importance for product distribution to East and West Coast markets.

Northeast corridor focuses on natural gas transportation from Marcellus and Utica Shale production to population centers and export facilities. Pennsylvania and West Virginia concentrate gathering systems and processing plants while pipeline expansions connect to New England markets and proposed LNG export terminals. The region shows growing significance with approximately 28% share of natural gas midstream capacity.

Western regions including North Dakota, Colorado, and California maintain specialized infrastructure serving local production and consumption patterns. Bakken formation infrastructure in North Dakota connects to multiple pipeline systems for crude oil transportation to refining centers and export terminals.

Market leadership concentrates among several major operators with extensive infrastructure networks, operational expertise, and financial capabilities to undertake large-scale projects. Competitive positioning emphasizes geographic coverage, asset quality, safety performance, and customer relationships as key differentiating factors.

Strategic initiatives include capacity expansion projects, technology adoption, safety improvements, and operational optimization programs that enhance competitive positioning and market share. Partnership strategies enable risk sharing, capital optimization, and market access expansion through joint ventures and strategic alliances.

By Infrastructure Type: The market segments into pipeline transportation, storage facilities, processing plants, and terminal operations, each serving specific functions within the midstream value chain. Pipeline systems represent the largest segment with gathering, transmission, and distribution networks handling different product types and transportation requirements.

By Product Type: Market segmentation includes crude oil, natural gas, natural gas liquids, and refined petroleum products, each requiring specialized infrastructure and handling capabilities. Natural gas transportation demonstrates the highest growth rate with expanding production and demand from power generation and export markets.

By Application: End-use applications encompass domestic consumption, export markets, refining inputs, and petrochemical feedstocks that drive infrastructure utilization and capacity requirements. Export applications show rapid growth with increasing international demand for US energy products.

By Geography: Regional segmentation reflects production basin locations, refining center concentrations, and population density patterns that determine infrastructure development priorities and investment allocation. Unconventional production regions require the most intensive infrastructure development to connect remote production areas with existing transportation networks.

Crude Oil Pipelines: This category demonstrates robust growth driven by increasing domestic production and export demand. Long-haul transmission systems connect major production basins to refining centers and export terminals, while gathering systems collect production from individual wells and production facilities. The segment benefits from stable demand and long-term contract structures that provide predictable revenue streams.

Natural Gas Infrastructure: Rapid expansion characterizes this category with new pipeline capacity, processing plants, and compression facilities supporting growing production from unconventional sources. Interstate transmission systems transport gas to power plants, industrial users, and LNG export facilities, while distribution networks serve residential and commercial customers. The category shows strong fundamentals with approximately 85% capacity utilization across major systems.

Storage Facilities: Strategic storage infrastructure provides operational flexibility, seasonal supply management, and market timing advantages for producers and consumers. Salt cavern storage offers high-deliverability capabilities for natural gas, while tank farms provide crude oil and refined products storage near production areas and market centers. The category demonstrates steady growth with increasing demand for operational flexibility and supply security.

Processing Plants: Natural gas processing facilities separate valuable natural gas liquids from raw gas streams while conditioning gas for pipeline transportation. Fractionation plants further separate NGLs into individual components for petrochemical and fuel applications. The category benefits from growing NGL production and expanding petrochemical demand that drives processing capacity expansion.

Producers benefit from reliable transportation services, market access expansion, and operational flexibility that optimize production economics and reduce transportation costs. Midstream infrastructure enables producers to reach higher-value markets, manage production timing, and reduce operational risks through professional transportation and storage services.

Refiners and processors gain supply security, feedstock optimization, and operational flexibility through reliable pipeline connections and storage capabilities. Strategic infrastructure access enables refiners to source crude oil from multiple production regions, optimize feedstock costs, and maintain operational continuity during supply disruptions.

Consumers benefit from reliable energy supply, competitive pricing, and supply security through efficient transportation and distribution networks. Infrastructure reliability ensures consistent product availability while competitive transportation markets help maintain reasonable energy costs for end users.

Investors receive stable cash flows, inflation protection, and attractive returns through midstream infrastructure investments. Long-term contracts and essential service provision create predictable revenue streams while infrastructure assets provide inflation hedging characteristics and portfolio diversification benefits.

Economic development benefits include job creation, tax revenue generation, and industrial development support through reliable energy infrastructure. Local communities benefit from construction employment, ongoing operational jobs, and tax revenue that supports public services and infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the midstream sector with companies implementing advanced monitoring systems, predictive analytics, and automated controls to optimize operations and enhance safety performance. Internet of Things sensors and artificial intelligence applications enable real-time monitoring, leak detection, and predictive maintenance that reduce operational costs and improve reliability.

Sustainability initiatives gain prominence as companies focus on emissions reduction, environmental stewardship, and ESG performance improvement. Methane emission reduction programs, renewable energy adoption, and carbon offset initiatives demonstrate industry commitment to environmental responsibility while maintaining operational efficiency.

Infrastructure consolidation continues as companies seek scale advantages, operational synergies, and enhanced financial capabilities through strategic acquisitions and mergers. Market consolidation creates larger, more efficient operators with improved competitive positioning and investment capacity for major infrastructure projects.

Export infrastructure expansion represents a dominant trend with substantial investments in LNG terminals, crude oil export facilities, and associated pipeline connections. International market access drives infrastructure development as companies position for growing global demand for US energy products. The trend shows sustained momentum with approximately 67% of new capacity dedicated to export-related infrastructure.

Major pipeline projects advance through regulatory approval processes with several large-scale systems receiving permits for construction and operation. Permian Basin infrastructure expansion continues with multiple pipeline projects designed to transport growing oil and gas production to Gulf Coast markets and export facilities.

LNG export capacity expansion accelerates with new terminal developments and existing facility expansions supporting growing international demand. Long-term supply agreements with international buyers provide foundation for infrastructure investment and operational planning. MarkWide Research analysis indicates sustained growth in export infrastructure development through the forecast period.

Technology partnerships emerge between midstream operators and technology companies to develop advanced monitoring, automation, and optimization solutions. Digital innovation initiatives focus on operational efficiency, safety enhancement, and environmental performance improvement through integrated technology platforms.

Regulatory developments include updated safety standards, environmental requirements, and permitting procedures that influence project planning and operational practices. Federal infrastructure policies support energy security objectives while maintaining environmental protection and safety standards that guide industry development.

Strategic positioning recommendations emphasize focus on high-growth regions, export-oriented infrastructure, and technology integration to capture emerging opportunities. Investment priorities should target projects with long-term contracts, strategic market positioning, and operational synergies that enhance competitive advantages and financial returns.

Risk management strategies should address regulatory, environmental, and market risks through diversified asset portfolios, comprehensive insurance coverage, and proactive stakeholder engagement. Operational excellence initiatives focusing on safety, reliability, and environmental performance provide competitive differentiation and regulatory compliance advantages.

Technology adoption recommendations include investment in digital monitoring systems, predictive analytics, and automation technologies that improve operational efficiency and reduce costs. Partnership strategies with technology providers and joint ventures with industry participants can accelerate innovation adoption and share implementation risks.

Market expansion opportunities exist in emerging segments including carbon capture transportation, hydrogen infrastructure, and renewable energy integration. Forward-thinking companies should evaluate these opportunities while maintaining focus on core midstream operations and traditional market segments that provide stable cash flows.

Growth projections indicate continued expansion driven by domestic production increases, export market development, and infrastructure modernization requirements. MWR analysis suggests sustained investment in pipeline capacity, storage facilities, and processing infrastructure to support evolving market dynamics and growing transportation demand.

Technology integration will accelerate operational transformation with advanced monitoring, automation, and optimization systems becoming standard across the industry. Digital capabilities will enable predictive maintenance, real-time optimization, and enhanced safety performance that improve operational efficiency and reduce costs. Artificial intelligence applications will expand to include demand forecasting, route optimization, and automated decision-making systems.

Export infrastructure development will continue expanding with new LNG terminals, crude oil export facilities, and associated pipeline connections supporting growing international trade. Global energy demand growth and geopolitical considerations favor increased US energy exports, creating sustained infrastructure investment opportunities and operational growth.

Regulatory environment evolution will balance energy security objectives with environmental protection requirements, creating frameworks that support responsible infrastructure development. Policy stability and streamlined permitting processes will facilitate project development while maintaining safety and environmental standards. The outlook indicates positive momentum with projected growth rates of approximately 4.8% annually through the next decade, supported by fundamental market drivers and strategic infrastructure investments.

The US oil and gas midstream market demonstrates strong fundamentals and positive growth prospects driven by increasing domestic production, export market expansion, and infrastructure modernization requirements. Strategic positioning as essential energy infrastructure provides stability and growth opportunities for industry participants while supporting national energy security objectives and economic development.

Market dynamics favor continued investment in pipeline capacity, storage facilities, and processing infrastructure as companies respond to evolving supply-demand patterns and emerging market opportunities. Technology integration and operational excellence initiatives will drive efficiency improvements and competitive differentiation while maintaining safety and environmental performance standards.

Future success will depend on strategic asset positioning, operational excellence, technology adoption, and effective risk management as the industry navigates regulatory challenges, environmental considerations, and market evolution. Companies that focus on high-growth regions, export-oriented infrastructure, and innovative solutions will be best positioned to capture emerging opportunities and deliver sustainable returns to stakeholders in this dynamic and essential market sector.

What is Oil and Gas Midstream?

Oil and Gas Midstream refers to the sector involved in the transportation, storage, and processing of oil and natural gas. This includes activities such as pipeline transportation, storage facilities, and processing plants that connect upstream production with downstream refining and distribution.

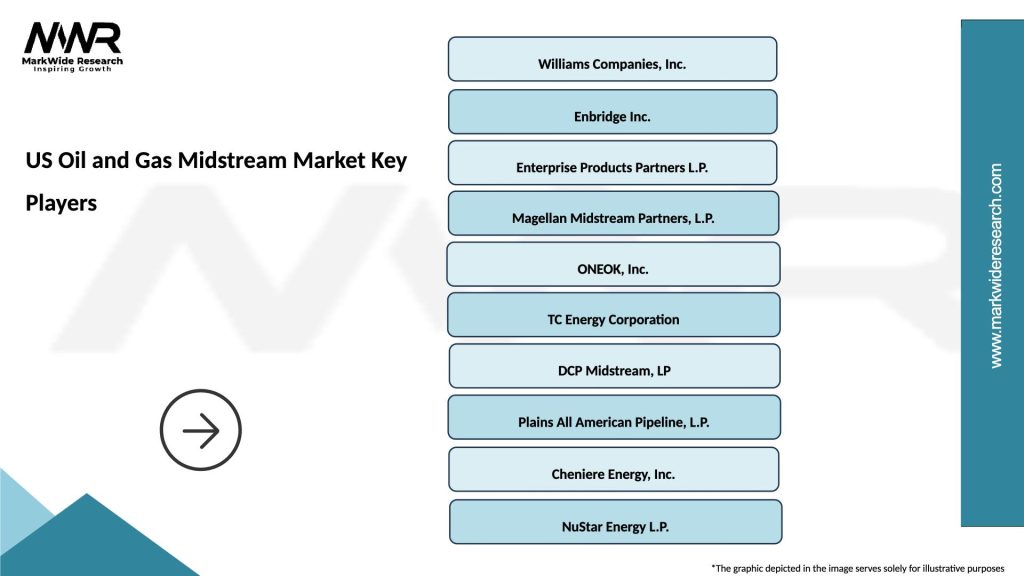

What are the key players in the US Oil and Gas Midstream Market?

Key players in the US Oil and Gas Midstream Market include companies like Kinder Morgan, Williams Companies, and Enbridge. These companies are involved in various aspects of midstream operations, including pipeline construction and management, storage solutions, and logistics, among others.

What are the growth factors driving the US Oil and Gas Midstream Market?

The US Oil and Gas Midstream Market is driven by increasing domestic production of oil and natural gas, rising energy demand, and the expansion of pipeline infrastructure. Additionally, the shift towards cleaner energy sources is prompting investments in midstream facilities that support natural gas and renewable energy integration.

What challenges does the US Oil and Gas Midstream Market face?

The US Oil and Gas Midstream Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating commodity prices. These factors can impact project viability and investment decisions, leading to delays in infrastructure development.

What opportunities exist in the US Oil and Gas Midstream Market?

Opportunities in the US Oil and Gas Midstream Market include the development of new pipeline projects, investments in technology for efficiency improvements, and the integration of renewable energy sources. Additionally, the growing demand for liquefied natural gas (LNG) presents significant prospects for midstream operators.

What trends are shaping the US Oil and Gas Midstream Market?

Trends shaping the US Oil and Gas Midstream Market include increased automation and digitalization of operations, a focus on sustainability practices, and the rise of decentralized energy systems. These trends are influencing how midstream companies operate and adapt to changing market dynamics.

US Oil and Gas Midstream Market

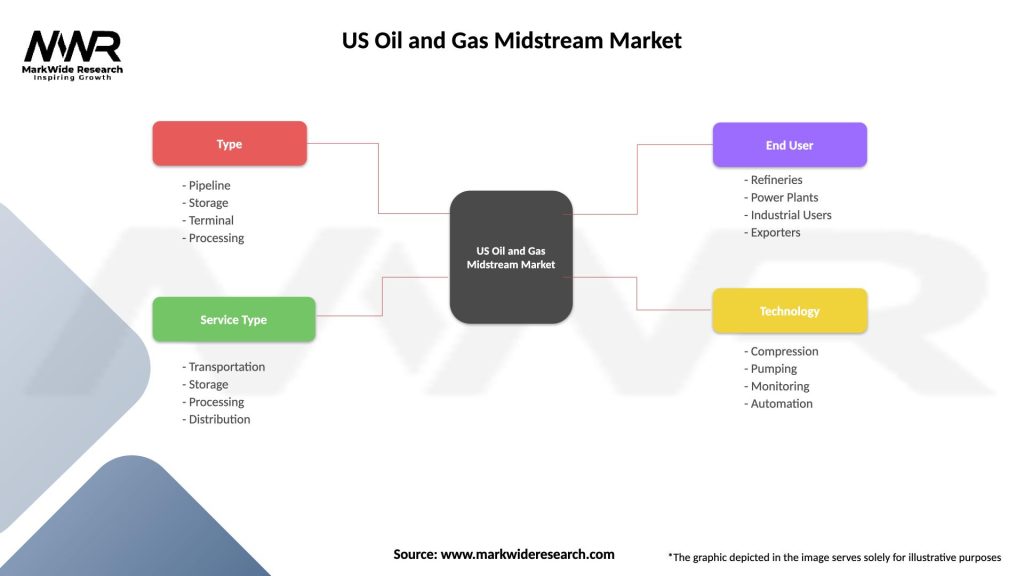

| Segmentation Details | Description |

|---|---|

| Type | Pipeline, Storage, Terminal, Processing |

| Service Type | Transportation, Storage, Processing, Distribution |

| End User | Refineries, Power Plants, Industrial Users, Exporters |

| Technology | Compression, Pumping, Monitoring, Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Oil and Gas Midstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at