444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US oil and gas downstream market represents a critical component of America’s energy infrastructure, encompassing refining, petrochemical production, and distribution activities that transform crude oil and natural gas into consumer-ready products. This sector demonstrates robust operational capacity with the United States maintaining its position as one of the world’s largest refining centers, processing millions of barrels daily across strategically located facilities.

Market dynamics indicate sustained growth driven by technological advancement, infrastructure modernization, and evolving consumer demands. The downstream sector benefits from abundant domestic feedstock availability, enhanced by the shale revolution that has transformed the US energy landscape. Refining capacity utilization rates consistently exceed 85%, reflecting strong operational efficiency and market demand alignment.

Geographic distribution spans key regions including the Gulf Coast, Midwest, and West Coast, with Texas leading in refining capacity and infrastructure development. The sector encompasses diverse product portfolios ranging from transportation fuels and heating oils to specialty chemicals and petrochemical feedstocks, serving both domestic consumption and export markets.

Technological integration continues advancing through digitalization, process optimization, and environmental compliance systems. The market demonstrates resilient performance despite periodic volatility, supported by strategic investments in facility upgrades, capacity expansions, and operational efficiency improvements that position the sector for sustained competitiveness.

The US oil and gas downstream market refers to the comprehensive industrial sector encompassing all activities that occur after crude oil and natural gas extraction, including refining, processing, distribution, and marketing of petroleum products to end consumers and industrial users.

Downstream operations transform raw hydrocarbons into valuable finished products through sophisticated refining processes, petrochemical manufacturing, and distribution networks. This sector bridges the gap between upstream production and consumer markets, creating essential products including gasoline, diesel fuel, jet fuel, heating oil, lubricants, asphalt, and various petrochemical derivatives.

Market participants include integrated oil companies, independent refiners, petrochemical manufacturers, distributors, and retailers who collectively operate extensive infrastructure networks. The downstream sector encompasses refining facilities, petrochemical plants, storage terminals, pipeline systems, and retail distribution networks that ensure reliable product availability across diverse market segments.

Value creation occurs through complex processing technologies that maximize product yields, optimize quality specifications, and meet stringent environmental standards. The downstream market serves as a critical economic driver, supporting employment, generating tax revenues, and providing essential energy products that fuel transportation, heating, industrial processes, and chemical manufacturing throughout the United States.

Strategic positioning of the US oil and gas downstream market reflects exceptional competitive advantages derived from abundant domestic feedstock supplies, advanced refining technologies, and comprehensive distribution infrastructure. The sector demonstrates operational excellence through high capacity utilization rates and efficient product yield optimization across diverse refining configurations.

Market fundamentals remain robust, supported by steady domestic demand growth and expanding export opportunities that leverage competitive production costs and strategic geographic positioning. Refining margins show cyclical resilience with crack spreads maintaining favorable levels that support continued investment in facility modernization and capacity optimization initiatives.

Technology adoption accelerates across digital transformation, process automation, and environmental compliance systems that enhance operational efficiency while reducing emissions footprints. The downstream sector benefits from regulatory stability and supportive policy frameworks that encourage domestic energy production and infrastructure development.

Investment trends focus on facility upgrades, capacity expansions, and specialty product capabilities that capture higher-value market segments. The sector demonstrates financial strength through consistent cash flow generation, debt reduction initiatives, and shareholder return programs that reflect confident long-term market outlook and operational performance expectations.

Operational capacity across US refining facilities demonstrates exceptional scale and efficiency, with total processing capability representing significant global market share. The downstream sector benefits from strategic geographic distribution that optimizes feedstock access, transportation logistics, and market proximity for both domestic and international customers.

Competitive advantages include access to abundant shale oil and gas resources, established infrastructure networks, and experienced workforce capabilities that support sustained operational excellence. The market demonstrates resilient performance through economic cycles while maintaining strategic focus on efficiency improvements and market expansion opportunities.

Domestic feedstock abundance serves as the primary growth catalyst, with shale oil and gas production providing cost-effective raw materials that enhance refining margins and competitive positioning. The energy independence achieved through domestic production reduces supply chain risks while creating opportunities for export market expansion and strategic inventory management.

Infrastructure modernization drives sustained investment in facility upgrades, process optimization, and environmental compliance systems that improve operational efficiency and product quality. These investments support capacity utilization improvements and enable processing of diverse crude oil grades while meeting evolving product specifications and regulatory requirements.

Transportation demand growth continues supporting gasoline, diesel, and jet fuel consumption across expanding economic activity and population growth. The downstream sector benefits from steady consumption patterns in transportation fuels while capturing growth opportunities in specialty products and petrochemical applications that serve diverse industrial markets.

Export market expansion creates additional revenue streams through international sales of refined products and petrochemicals, leveraging competitive production costs and strategic port access. Global demand growth particularly in developing markets provides sustained opportunities for US downstream products, supported by quality advantages and reliable supply capabilities that enhance market penetration and customer relationships.

Regulatory complexity presents ongoing challenges through evolving environmental standards, safety requirements, and compliance costs that require continuous investment in monitoring systems and operational modifications. The downstream sector faces stringent oversight across air quality, water management, and waste disposal that necessitates sophisticated control technologies and comprehensive reporting systems.

Capital intensity requirements for facility construction, upgrades, and maintenance create significant financial commitments that impact investment flexibility and return timelines. Project complexity in refining and petrochemical operations involves extended development periods, permitting processes, and technical risks that can affect project economics and completion schedules.

Market volatility in crude oil prices and refined product margins creates periodic pressure on profitability and investment planning. The downstream sector experiences cyclical performance influenced by global supply-demand dynamics, geopolitical events, and economic conditions that can impact operating margins and cash flow generation.

Environmental transition pressures from renewable energy adoption and electrification trends may influence long-term demand patterns for traditional petroleum products. The sector faces evolving consumer preferences and policy initiatives promoting alternative energy sources that could affect future market growth and investment priorities in conventional downstream operations.

Petrochemical integration presents substantial growth opportunities through facility conversions and capacity additions that capture higher-value chemical markets. The downstream sector can leverage abundant feedstock supplies and existing infrastructure to expand into specialty chemicals, plastics, and advanced materials that serve growing industrial and consumer applications.

Export market development offers significant revenue expansion through international sales of refined products and petrochemicals to growing global markets. Strategic positioning near major shipping routes and port facilities enables competitive access to Latin American, European, and Asian markets seeking reliable supply sources and quality products.

Technology advancement creates opportunities for operational efficiency improvements, yield optimization, and environmental performance enhancement through digital systems and process innovations. The sector can implement advanced analytics, artificial intelligence, and automation technologies that reduce operating costs while improving safety and reliability performance.

Specialty product development enables market differentiation and margin enhancement through high-performance lubricants, specialty chemicals, and custom formulations serving niche applications. Value-added products command premium pricing while reducing commodity exposure and creating stronger customer relationships across diverse industrial segments and specialized applications.

Supply-demand fundamentals demonstrate balanced market conditions with refining capacity closely aligned to domestic consumption patterns and export opportunities. The downstream sector benefits from flexible production capabilities that can adjust product slate compositions based on seasonal demand variations and market pricing signals across different product categories.

Competitive landscape features both integrated oil companies and independent refiners competing through operational efficiency, strategic positioning, and product differentiation. Market participants focus on margin optimization through yield improvements, cost reduction initiatives, and value-added product development that enhances profitability and market share growth.

Technology evolution continues transforming operational practices through digitalization, process automation, and advanced control systems that improve efficiency while reducing environmental impacts. The sector demonstrates innovation adoption rates exceeding 75% across major facilities, reflecting commitment to technological advancement and competitive positioning.

Investment patterns emphasize facility modernization, capacity optimization, and environmental compliance upgrades that support long-term competitiveness. Capital allocation strategies balance maintenance requirements with growth initiatives, creating sustainable operational platforms that can adapt to evolving market conditions and regulatory requirements while maintaining reliable product supply capabilities.

Comprehensive analysis of the US oil and gas downstream market employs multiple research approaches including primary industry interviews, secondary data analysis, and quantitative modeling techniques. Data collection encompasses operational statistics, financial performance metrics, and market trend analysis from authoritative industry sources and regulatory databases.

Primary research involves structured interviews with industry executives, facility operators, and market analysts to gather insights on operational practices, investment priorities, and market outlook perspectives. Survey methodologies capture quantitative data on capacity utilization, production costs, and technology adoption rates across representative market participants.

Secondary research incorporates analysis of public company filings, industry publications, government statistics, and trade association reports that provide comprehensive market coverage. Data validation processes ensure accuracy and consistency through cross-referencing multiple sources and expert review of findings and conclusions.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend projection modeling that identify key growth drivers and market opportunities. MarkWide Research methodologies emphasize objective analysis and evidence-based conclusions that support strategic decision-making and investment planning across downstream market participants and stakeholders.

Gulf Coast region dominates US downstream capacity with approximately 45% of total refining capability, benefiting from strategic port access, pipeline connectivity, and proximity to domestic crude oil production. This region features integrated complexes combining refining and petrochemical operations that optimize feedstock utilization and product diversification strategies.

Midwest region represents significant refining capacity serving central US markets with approximately 25% of national processing capability. Strategic positioning provides access to Canadian crude oil imports and domestic shale production while serving major population centers and agricultural markets requiring diverse petroleum products and specialty applications.

West Coast region maintains specialized refining capacity designed for heavy crude oil processing and serves California’s unique fuel specifications. This region demonstrates premium product focus with approximately 15% of national capacity, emphasizing environmental compliance and specialty fuel production that commands higher margins.

East Coast region features strategic import terminals and distribution facilities serving major metropolitan markets, representing approximately 10% of refining capacity. Market access advantages include proximity to major population centers and established distribution networks that support efficient product delivery and customer service capabilities across diverse market segments.

Market leadership encompasses both integrated oil companies and independent refiners that compete through operational excellence, strategic positioning, and product differentiation. The competitive environment demonstrates diverse business models ranging from large-scale integrated operations to specialized niche players focusing on specific market segments or geographic regions.

Competitive strategies emphasize operational efficiency improvements, margin optimization, and strategic investments in facility upgrades and capacity expansions. Market participants focus on cost leadership through technology adoption, process optimization, and supply chain integration that enhance profitability and market positioning across diverse operating environments.

By Product Type: The downstream market encompasses diverse product categories serving transportation, industrial, and consumer applications. Transportation fuels including gasoline, diesel, and jet fuel represent the largest segment, while specialty products and petrochemicals provide higher-margin opportunities for market differentiation and value creation.

By Application: Market segmentation reflects diverse end-use applications across transportation, industrial, residential, and commercial sectors. Application diversity provides market stability through balanced demand patterns and reduces exposure to individual sector volatility while creating opportunities for specialized product development and customer relationship building.

By Technology: Refining technology segmentation includes fluid catalytic cracking, hydrocracking, and specialty processing units that optimize product yields and quality specifications. Technology advancement enables processing flexibility and efficiency improvements that enhance competitive positioning and operational performance across diverse market conditions.

Transportation Fuels Category represents the largest downstream market segment, with gasoline demand showing seasonal variations and regional differences in specifications and pricing. Market dynamics reflect consumer driving patterns, economic activity levels, and vehicle fleet composition changes that influence consumption trends and product requirements across diverse geographic markets.

Industrial Products Category encompasses heating oils, lubricants, and specialty chemicals serving manufacturing, construction, and commercial applications. This segment demonstrates steady demand growth aligned with industrial activity and infrastructure development, providing stable revenue streams and opportunities for value-added product development.

Petrochemical Feedstocks Category represents growing market opportunities through integration with chemical manufacturing operations. Feedstock demand benefits from expanding plastics, synthetic materials, and specialty chemical production that creates higher-value applications for downstream products and enhances overall facility profitability.

Specialty Products Category includes aviation fuels, marine bunkers, and custom formulations serving niche applications with specific quality requirements. This segment commands premium pricing and provides market differentiation opportunities through technical expertise, quality assurance, and specialized distribution capabilities that strengthen customer relationships and competitive positioning.

Operational Excellence benefits include enhanced efficiency through advanced process technologies, digital optimization systems, and integrated supply chain management that reduce costs while improving product quality and reliability. Technology adoption enables real-time monitoring, predictive maintenance, and automated control systems that optimize performance across diverse operating conditions.

Market Access advantages encompass comprehensive distribution networks, strategic facility locations, and established customer relationships that support market share growth and revenue expansion. Geographic positioning provides competitive access to both domestic and international markets while optimizing transportation costs and delivery reliability.

Financial Performance benefits include stable cash flow generation, margin optimization opportunities, and capital efficiency improvements through strategic investments and operational excellence initiatives. Investment returns reflect sustained profitability and shareholder value creation through disciplined capital allocation and market-responsive strategies.

Strategic Positioning advantages include market leadership capabilities, competitive cost structures, and diversified product portfolios that provide resilience across market cycles. Stakeholder value creation encompasses employment opportunities, tax revenue generation, and economic development contributions that support community growth and regional competitiveness in global energy markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across downstream operations through implementation of advanced analytics, artificial intelligence, and automation systems that optimize process efficiency and reduce operating costs. Technology adoption rates exceed 80% among major facilities, reflecting industry commitment to operational excellence and competitive positioning through innovation.

Environmental Compliance drives investment in emission control systems, waste reduction technologies, and renewable energy integration that meet evolving regulatory standards. Sustainability initiatives include carbon capture technologies, energy efficiency improvements, and circular economy practices that reduce environmental footprints while maintaining operational performance.

Product Diversification trends toward higher-value specialty chemicals, advanced lubricants, and custom formulations that command premium pricing and reduce commodity exposure. Value-added products represent growing revenue shares as facilities optimize product slates and develop niche market capabilities that enhance profitability and customer relationships.

Export Market Expansion continues through strategic investments in port facilities, storage capacity, and international marketing capabilities that leverage competitive production costs. Global market penetration creates additional revenue streams while providing operational flexibility and risk diversification across diverse geographic markets and customer segments.

Capacity Expansion Projects include major facility upgrades and new construction initiatives that enhance processing capabilities and product diversification. Investment commitments focus on petrochemical integration, specialty product capabilities, and environmental compliance systems that position facilities for long-term competitiveness and market growth.

Technology Partnerships between downstream operators and technology providers accelerate innovation adoption and process optimization capabilities. Collaborative initiatives include digital platform development, advanced catalyst systems, and environmental control technologies that enhance operational efficiency while reducing costs and environmental impacts.

Merger and Acquisition Activity continues reshaping the competitive landscape through strategic consolidation and asset optimization. Transaction focus emphasizes operational synergies, geographic expansion, and capability enhancement that create value through improved efficiency and market positioning across diverse operating environments.

Regulatory Developments include updated environmental standards, safety requirements, and product specifications that influence operational practices and investment priorities. Policy initiatives support domestic energy production while promoting environmental stewardship and technological advancement that balances economic growth with sustainability objectives across the downstream sector.

Strategic Focus recommendations emphasize operational excellence through technology adoption, process optimization, and cost reduction initiatives that enhance competitive positioning. Investment priorities should balance facility modernization with growth opportunities in specialty products and petrochemical integration that provide higher-value market positioning.

Market Positioning strategies should leverage domestic feedstock advantages while expanding export capabilities and international market presence. MarkWide Research analysis suggests focusing on operational flexibility and product diversification that can adapt to evolving market conditions and customer requirements across diverse applications.

Technology Investment priorities include digital transformation initiatives, environmental compliance systems, and process automation that improve efficiency while reducing operational risks. Innovation adoption should emphasize proven technologies with clear return on investment and competitive advantage creation through enhanced capabilities and performance metrics.

Risk Management approaches should address market volatility, regulatory compliance, and operational safety through comprehensive planning and contingency strategies. Portfolio diversification across products, markets, and applications provides stability while maintaining flexibility to capture emerging opportunities and respond to changing market dynamics effectively.

Growth Trajectory projections indicate sustained expansion driven by domestic demand growth, export market development, and specialty product opportunities. The downstream sector demonstrates resilient fundamentals with capacity utilization rates expected to maintain levels above 85% through continued operational efficiency improvements and market demand alignment.

Technology Evolution will continue transforming operational practices through advanced digitalization, process automation, and environmental control systems. Innovation adoption rates are projected to exceed 90% across major facilities within the next decade, reflecting industry commitment to technological advancement and competitive positioning through operational excellence.

Market Expansion opportunities include growing petrochemical integration, specialty product development, and international market penetration that leverage competitive advantages. Export growth potential remains substantial with projected market share increases in key international markets seeking reliable supply sources and quality products from US downstream operations.

Investment Outlook remains positive with sustained capital allocation supporting facility modernization, capacity optimization, and environmental compliance initiatives. Financial performance expectations include stable cash flow generation, margin improvement opportunities, and shareholder value creation through disciplined growth strategies and operational excellence across diverse market conditions and competitive environments.

Market assessment of the US oil and gas downstream sector reveals a robust and strategically positioned industry benefiting from abundant domestic feedstock supplies, advanced infrastructure, and comprehensive market access capabilities. The sector demonstrates operational excellence through high capacity utilization rates, technological innovation, and competitive cost structures that support sustained market leadership and growth opportunities.

Strategic advantages include geographic positioning, integrated supply chains, and diversified product portfolios that provide resilience across market cycles while capturing growth opportunities in specialty products and export markets. Investment momentum continues supporting facility modernization, technology adoption, and environmental compliance initiatives that enhance long-term competitiveness and operational performance.

Future prospects remain favorable with projected growth driven by domestic demand expansion, international market development, and value-added product opportunities that leverage existing capabilities and infrastructure investments. The downstream sector maintains strong fundamentals through balanced supply-demand dynamics, operational flexibility, and strategic positioning that support continued market leadership and stakeholder value creation across diverse operating environments and market conditions.

What is Oil and Gas Downstream?

Oil and Gas Downstream refers to the sector of the oil and gas industry that involves the refining of crude oil, the distribution of petroleum products, and the marketing of these products to consumers. This includes activities such as refining, transportation, and retailing of fuels and other products derived from crude oil.

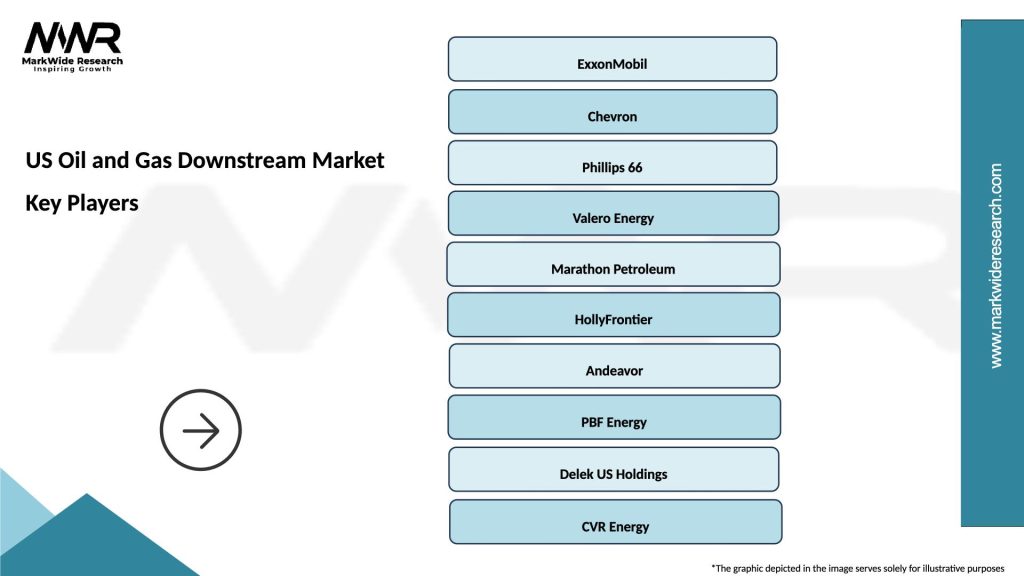

What are the key players in the US Oil and Gas Downstream Market?

Key players in the US Oil and Gas Downstream Market include major companies such as ExxonMobil, Chevron, and Phillips 66. These companies are involved in refining, distribution, and marketing of petroleum products, among others.

What are the growth factors driving the US Oil and Gas Downstream Market?

The growth of the US Oil and Gas Downstream Market is driven by increasing demand for refined petroleum products, advancements in refining technologies, and the expansion of distribution networks. Additionally, the rise in vehicle ownership and industrial activities contributes to this growth.

What challenges does the US Oil and Gas Downstream Market face?

The US Oil and Gas Downstream Market faces challenges such as regulatory pressures, fluctuating crude oil prices, and environmental concerns related to emissions and waste management. These factors can impact profitability and operational efficiency.

What opportunities exist in the US Oil and Gas Downstream Market?

Opportunities in the US Oil and Gas Downstream Market include the development of cleaner refining technologies, the growth of biofuels, and the increasing demand for petrochemical products. Companies are also exploring new markets and innovative distribution methods.

What trends are shaping the US Oil and Gas Downstream Market?

Trends in the US Oil and Gas Downstream Market include a shift towards sustainability, increased investment in renewable energy sources, and the adoption of digital technologies for operational efficiency. These trends are influencing how companies operate and engage with consumers.

US Oil and Gas Downstream Market

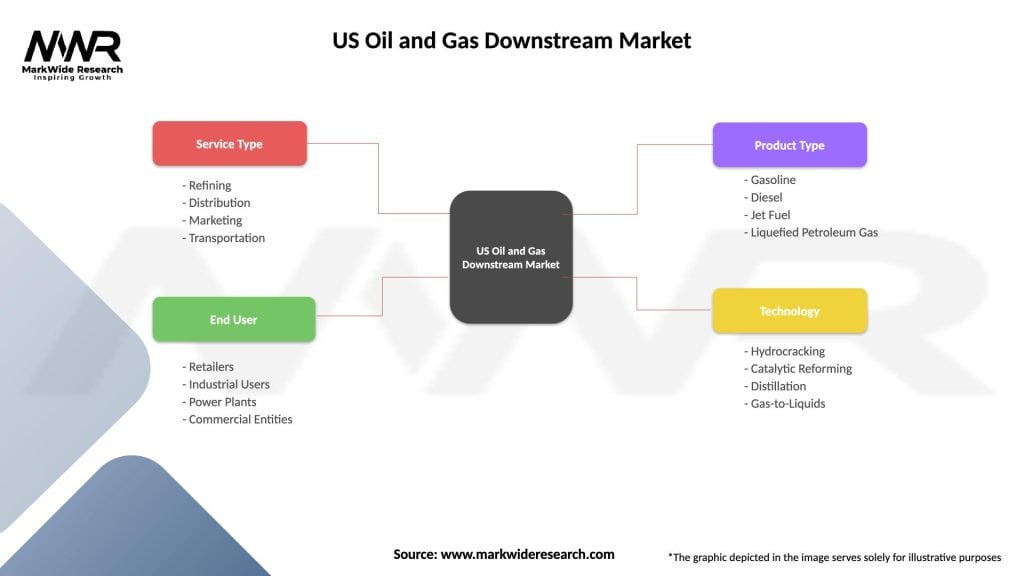

| Segmentation Details | Description |

|---|---|

| Service Type | Refining, Distribution, Marketing, Transportation |

| End User | Retailers, Industrial Users, Power Plants, Commercial Entities |

| Product Type | Gasoline, Diesel, Jet Fuel, Liquefied Petroleum Gas |

| Technology | Hydrocracking, Catalytic Reforming, Distillation, Gas-to-Liquids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Oil and Gas Downstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at