444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US occupational health market represents a critical component of the American healthcare ecosystem, focusing on the prevention, diagnosis, and treatment of work-related injuries and illnesses. This comprehensive market encompasses a wide range of services, technologies, and solutions designed to maintain and improve worker health and safety across diverse industries. Market dynamics indicate robust growth driven by increasing regulatory compliance requirements, rising awareness of workplace safety, and the evolving nature of occupational hazards in modern work environments.

Healthcare providers specializing in occupational medicine serve millions of American workers through various service delivery models, including on-site clinics, mobile health units, and integrated healthcare facilities. The market demonstrates significant expansion potential, with growth rates projected at approximately 6.2% CAGR over the next five years. Technological advancement continues to reshape service delivery, with digital health solutions, telemedicine platforms, and advanced diagnostic equipment enhancing the quality and accessibility of occupational health services.

Industry sectors driving demand include manufacturing, construction, healthcare, transportation, and emerging technology companies, each presenting unique occupational health challenges and requirements. The market’s evolution reflects broader trends in workplace safety culture, regulatory enforcement, and the recognition of occupational health as a strategic business investment rather than merely a compliance requirement.

The US occupational health market refers to the comprehensive ecosystem of healthcare services, products, and solutions specifically designed to address work-related health and safety concerns for American workers. This market encompasses preventive care, medical surveillance, injury treatment, rehabilitation services, and wellness programs tailored to occupational environments and industry-specific health risks.

Core components include pre-employment medical examinations, periodic health screenings, workplace injury treatment, occupational disease management, ergonomic assessments, and regulatory compliance services. The market serves as a bridge between traditional healthcare delivery and specialized workplace health requirements, ensuring workers receive appropriate medical care while helping employers maintain safe, productive work environments.

Service providers range from specialized occupational health clinics and hospital-based programs to integrated healthcare systems offering comprehensive workplace health solutions. The market also includes technology vendors, equipment manufacturers, and consulting services that support the delivery of occupational health programs across various industries and organizational structures.

Market expansion in the US occupational health sector reflects the growing recognition of workplace health as a critical business imperative. Organizations increasingly view occupational health programs as strategic investments that reduce healthcare costs, improve productivity, and enhance employee retention while ensuring regulatory compliance. Service utilization has increased by approximately 18% annually as companies expand their health and safety initiatives.

Technology integration represents a significant growth driver, with digital health platforms, wearable devices, and data analytics transforming traditional occupational health service delivery. These innovations enable more proactive health management, real-time risk assessment, and personalized intervention strategies that improve health outcomes while reducing costs.

Regulatory environment continues to influence market dynamics, with evolving OSHA standards, industry-specific health requirements, and emerging workplace safety regulations creating sustained demand for specialized occupational health services. The market benefits from strong fundamentals, including consistent demand across economic cycles and the essential nature of workplace health and safety services.

Strategic insights reveal several critical factors shaping the US occupational health market landscape:

Regulatory compliance serves as a primary market driver, with federal and state agencies continuously updating workplace health and safety requirements. OSHA regulations mandate specific medical surveillance programs for workers exposed to hazardous substances, creating consistent demand for specialized occupational health services. Industry-specific regulations in sectors like transportation, healthcare, and manufacturing further expand service requirements.

Cost containment initiatives drive employer investment in occupational health programs as organizations recognize the financial benefits of preventing workplace injuries and illnesses. Workers’ compensation costs can be reduced by up to 25% through effective occupational health programs, creating strong economic incentives for program expansion. Early intervention and preventive care strategies demonstrate measurable returns on investment through reduced claim frequency and severity.

Workforce demographics contribute to market growth as aging workers require more comprehensive health monitoring and age-related accommodation services. Chronic disease management becomes increasingly important as workplace health programs address conditions like diabetes, hypertension, and musculoskeletal disorders that can impact work performance and safety. The integration of occupational health with broader wellness initiatives creates additional service opportunities and market expansion potential.

Cost considerations present significant challenges for smaller organizations seeking to implement comprehensive occupational health programs. Budget constraints often limit the scope and frequency of occupational health services, particularly for companies with limited resources or those operating in highly competitive markets with thin profit margins.

Provider availability creates geographic and specialty-specific limitations, with rural areas and certain industrial sectors experiencing shortages of qualified occupational health professionals. Specialized expertise requirements for industry-specific health risks can limit service provider options and increase costs for organizations requiring specialized occupational health services.

Technology barriers include implementation costs, staff training requirements, and integration challenges with existing healthcare and human resources systems. Data privacy concerns and regulatory compliance requirements for health information management add complexity and cost to occupational health program administration, potentially limiting adoption among smaller organizations.

Digital transformation presents substantial opportunities for market expansion through telemedicine platforms, mobile health applications, and remote monitoring technologies. Virtual consultations can increase access to occupational health specialists while reducing costs and improving convenience for both employers and workers. Wearable technology integration enables continuous health monitoring and early intervention capabilities.

Industry expansion opportunities exist in emerging sectors like renewable energy, technology, and gig economy platforms where occupational health requirements are still developing. Service diversification into areas like mental health support, ergonomic consulting, and workplace wellness programs creates additional revenue streams and strengthens client relationships.

Partnership development with healthcare systems, insurance providers, and technology companies can enhance service delivery capabilities and market reach. Data analytics services that help employers optimize their occupational health programs and demonstrate return on investment represent growing market opportunities as organizations seek evidence-based health and safety solutions.

Supply and demand dynamics in the US occupational health market reflect the interplay between regulatory requirements, employer health and safety initiatives, and workforce health needs. Service demand remains relatively stable due to the essential nature of occupational health services and regulatory compliance requirements, providing market resilience during economic fluctuations.

Competitive dynamics involve traditional healthcare providers expanding into occupational health services, specialized occupational health companies enhancing their service offerings, and technology companies developing innovative health monitoring and management solutions. Market consolidation trends include larger healthcare systems acquiring specialized occupational health providers to expand their service portfolios.

Pricing dynamics vary significantly based on service complexity, geographic location, and client size, with larger organizations typically negotiating more favorable rates for comprehensive occupational health programs. Value-based contracting models are emerging, where providers are compensated based on health outcomes and cost savings rather than traditional fee-for-service arrangements. According to MarkWide Research analysis, value-based contracts now represent approximately 15% of occupational health service agreements.

Comprehensive analysis of the US occupational health market employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with occupational health service providers, healthcare administrators, employer representatives, and industry experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government databases, industry publications, regulatory filings, and academic research to validate primary findings and provide comprehensive market context. Data triangulation methods ensure consistency across multiple information sources and enhance the reliability of market projections and trend analysis.

Quantitative analysis includes statistical modeling of market trends, service utilization patterns, and growth projections based on historical data and current market indicators. Qualitative assessment provides deeper insights into market dynamics, competitive positioning, and strategic implications for industry participants. The methodology incorporates regular validation through industry expert panels and continuous monitoring of market developments to maintain accuracy and relevance.

Geographic distribution of occupational health services across the United States reflects industrial concentration, regulatory requirements, and healthcare infrastructure availability. Industrial regions including the Midwest manufacturing belt, Texas energy corridor, and California technology centers demonstrate the highest demand for specialized occupational health services.

Northeast region accounts for approximately 28% of market activity, driven by dense industrial activity, strict regulatory enforcement, and well-established healthcare infrastructure. Major metropolitan areas like New York, Boston, and Philadelphia serve as regional hubs for occupational health service delivery, supporting both local employers and multi-state organizations.

Southeast region shows rapid growth in occupational health service demand, with approximately 22% market share, reflecting industrial expansion, population growth, and increasing regulatory compliance focus. Manufacturing growth in states like North Carolina, Georgia, and Tennessee drives demand for specialized occupational health services tailored to automotive, textile, and aerospace industries.

Western states represent approximately 25% of market activity, with California leading in technology sector occupational health services and states like Colorado and Washington showing strong growth in renewable energy and aerospace occupational health requirements. Rural areas across all regions face service availability challenges, creating opportunities for mobile health services and telemedicine solutions.

Market leaders in the US occupational health sector include a diverse mix of healthcare systems, specialized occupational health providers, and integrated service companies:

Competitive strategies focus on service differentiation, technology integration, geographic expansion, and industry specialization. Market positioning varies from comprehensive healthcare systems leveraging existing infrastructure to specialized providers offering targeted occupational health expertise and innovative service delivery models.

Service type segmentation reveals distinct market categories with varying growth patterns and client requirements:

Industry segmentation demonstrates varying service requirements and growth opportunities:

Organization size segmentation influences service delivery models and pricing structures, with large enterprises typically requiring comprehensive on-site services while smaller organizations utilize clinic-based or mobile service options.

By Technology Integration:

By Service Delivery Model:

By Application Focus:

Employers benefit from comprehensive occupational health programs through reduced workers’ compensation costs, improved employee productivity, and enhanced regulatory compliance. Cost savings typically range from 15-30% in workers’ compensation expenses, while productivity improvements result from reduced absenteeism and enhanced worker health and safety awareness.

Healthcare providers gain access to stable revenue streams, opportunities for service diversification, and the ability to develop specialized expertise in occupational medicine. Market expansion opportunities include serving new industry sectors and geographic markets while building long-term client relationships through comprehensive service delivery.

Workers receive convenient access to specialized healthcare services, preventive care programs, and early intervention for work-related health concerns. Health outcomes improve through regular monitoring, ergonomic support, and workplace safety education, while career longevity benefits from proactive health management and injury prevention strategies.

Insurance providers benefit from reduced claim frequency and severity through effective occupational health programs, while regulatory agencies achieve improved workplace safety compliance and reduced occupational injury and illness rates across industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration represents the most significant trend reshaping occupational health service delivery, with telemedicine platforms, mobile health applications, and wearable technology enabling more accessible and efficient healthcare services. Remote monitoring capabilities allow continuous health assessment and early intervention, improving health outcomes while reducing service delivery costs.

Preventive care emphasis continues to grow as organizations recognize the cost-effectiveness of preventing workplace injuries and illnesses rather than treating them after occurrence. Wellness program integration combines occupational health services with broader employee wellness initiatives, creating comprehensive health management programs that address both work-related and general health concerns.

Industry specialization trends show providers developing expertise in specific sectors like healthcare, manufacturing, or construction to better address unique occupational health challenges and regulatory requirements. Data-driven approaches utilize advanced analytics to identify health risks, optimize intervention strategies, and demonstrate program effectiveness to employer clients.

Value-based contracting models are emerging where occupational health providers are compensated based on health outcomes and cost savings rather than traditional fee-for-service arrangements. MWR data indicates that approximately 12% of occupational health contracts now incorporate value-based elements, with this percentage expected to grow significantly over the next five years.

Technology advancement continues to drive industry evolution, with artificial intelligence and machine learning applications enhancing diagnostic capabilities, risk assessment, and treatment planning in occupational health settings. Wearable device integration enables real-time health monitoring and immediate alerts for potential health risks or safety concerns.

Regulatory updates include evolving OSHA standards for workplace safety, new industry-specific health requirements, and enhanced reporting obligations that create additional service opportunities for occupational health providers. COVID-19 response has accelerated adoption of infection control services, workplace health screening, and remote health monitoring capabilities.

Market consolidation activities include healthcare systems acquiring specialized occupational health providers, technology companies developing integrated health platforms, and service providers expanding their geographic reach through strategic partnerships and acquisitions. Service expansion trends show traditional occupational health providers adding mental health services, ergonomic consulting, and comprehensive wellness programs to their service portfolios.

Partnership development between occupational health providers, technology companies, and insurance organizations creates integrated service delivery models that enhance value proposition for employer clients while improving health outcomes for workers.

Strategic recommendations for occupational health market participants focus on technology adoption, service diversification, and geographic expansion to capitalize on market growth opportunities. Digital transformation should be prioritized to enhance service delivery efficiency, expand market reach, and meet evolving client expectations for convenient, accessible healthcare services.

Industry specialization represents a key differentiation strategy, with providers encouraged to develop deep expertise in specific sectors to better address unique occupational health challenges and build stronger client relationships. Partnership development with technology companies, healthcare systems, and insurance providers can enhance service capabilities and market competitiveness.

Investment priorities should include technology infrastructure, staff training, and service delivery innovation to maintain competitive positioning in an evolving market landscape. Quality metrics and outcome measurement capabilities become increasingly important as clients seek evidence-based occupational health solutions that demonstrate clear return on investment.

Market expansion opportunities exist in underserved geographic areas, emerging industry sectors, and small-to-medium enterprises that currently lack comprehensive occupational health services. Service integration with broader healthcare and wellness initiatives can create additional value for clients while expanding revenue opportunities for providers.

Market prospects for the US occupational health sector remain highly favorable, driven by sustained regulatory requirements, increasing employer focus on worker health and safety, and technological innovations that enhance service delivery capabilities. Growth projections indicate continued expansion at approximately 6.5% CAGR over the next decade, supported by strong fundamental demand drivers and evolving service requirements.

Technology evolution will continue to reshape service delivery models, with artificial intelligence, predictive analytics, and advanced monitoring technologies enabling more personalized and effective occupational health interventions. Telemedicine adoption is expected to reach 40% of occupational health services within five years, significantly expanding access and reducing service delivery costs.

Industry transformation trends include greater integration with broader healthcare systems, expansion of preventive and wellness services, and development of industry-specific service offerings that address unique occupational health challenges. Regulatory evolution will likely create new service requirements while potentially streamlining certain compliance processes through technology adoption.

Competitive dynamics will favor providers that successfully integrate technology, demonstrate measurable outcomes, and develop specialized expertise in high-growth industry sectors. MarkWide Research projects that market leaders will increasingly differentiate through comprehensive service portfolios, advanced technology platforms, and proven ability to deliver cost-effective health outcomes for employer clients.

The US occupational health market represents a dynamic and essential component of the American healthcare landscape, characterized by steady growth, technological innovation, and evolving service delivery models. Market fundamentals remain strong, supported by regulatory requirements, employer recognition of occupational health value, and the critical importance of worker health and safety across all industries.

Strategic opportunities abound for market participants willing to embrace technology, develop specialized expertise, and adapt to changing client needs and expectations. The integration of digital health solutions, emphasis on preventive care, and focus on measurable outcomes position the market for continued expansion and evolution.

Future success in the occupational health market will depend on providers’ ability to demonstrate clear value through improved health outcomes, cost savings, and regulatory compliance support while leveraging technology to enhance service accessibility and efficiency. The market’s essential nature and strong growth prospects make it an attractive sector for continued investment and development.

What is Occupational Health?

Occupational Health refers to the branch of healthcare that focuses on the physical and mental well-being of employees in the workplace. It encompasses various practices aimed at preventing work-related injuries and illnesses, promoting health, and ensuring a safe working environment.

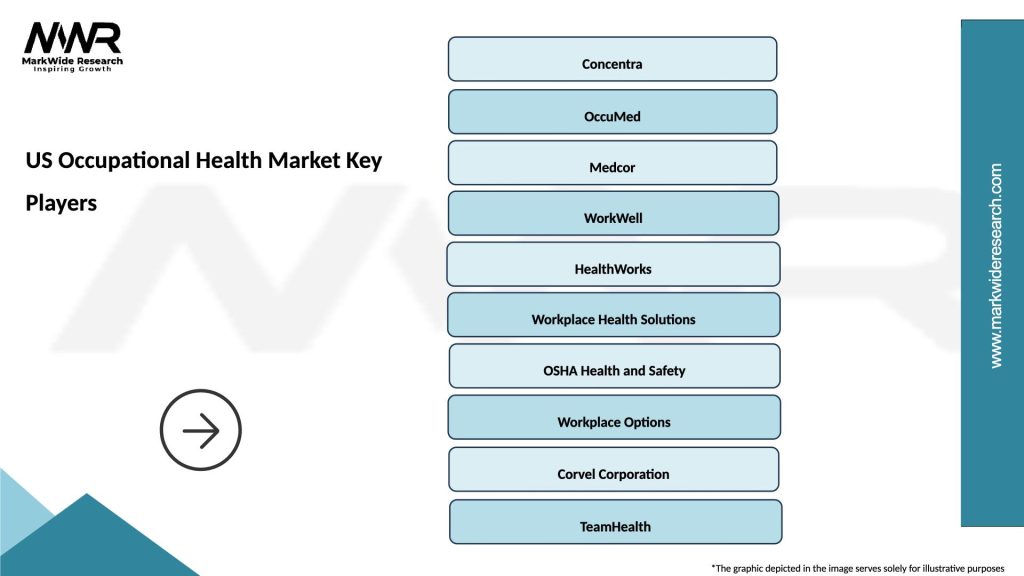

What are the key players in the US Occupational Health Market?

Key players in the US Occupational Health Market include companies like Concentra, OccuMed, and Medcor, which provide a range of services such as health screenings, injury management, and wellness programs, among others.

What are the main drivers of growth in the US Occupational Health Market?

The main drivers of growth in the US Occupational Health Market include the increasing awareness of workplace safety, the rising incidence of work-related injuries, and the growing emphasis on employee wellness programs. These factors contribute to a greater demand for occupational health services.

What challenges does the US Occupational Health Market face?

The US Occupational Health Market faces challenges such as regulatory compliance complexities, varying state laws regarding workplace health, and the need for continuous adaptation to emerging health risks. These factors can complicate the delivery of effective occupational health services.

What opportunities exist in the US Occupational Health Market?

Opportunities in the US Occupational Health Market include the integration of telehealth services, advancements in health technology, and the growing focus on mental health support in the workplace. These trends can enhance service delivery and improve employee health outcomes.

What trends are shaping the US Occupational Health Market?

Trends shaping the US Occupational Health Market include the increasing adoption of digital health solutions, a focus on preventive care, and the implementation of comprehensive wellness programs. These trends aim to improve employee engagement and reduce healthcare costs.

US Occupational Health Market

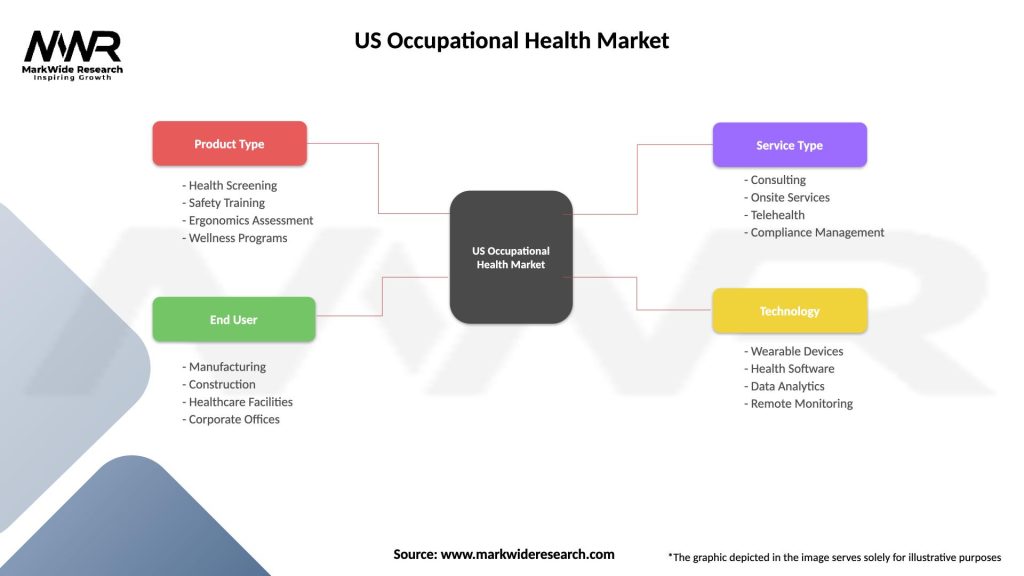

| Segmentation Details | Description |

|---|---|

| Product Type | Health Screening, Safety Training, Ergonomics Assessment, Wellness Programs |

| End User | Manufacturing, Construction, Healthcare Facilities, Corporate Offices |

| Service Type | Consulting, Onsite Services, Telehealth, Compliance Management |

| Technology | Wearable Devices, Health Software, Data Analytics, Remote Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Occupational Health Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at