444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US nuts market represents one of the most dynamic and rapidly expanding segments within the American food industry, driven by increasing consumer awareness of health benefits and growing demand for plant-based protein sources. Market dynamics indicate robust growth across multiple nut varieties, with almonds, walnuts, pecans, and pistachios leading consumption trends. The market encompasses both domestic production and imported varieties, creating a diverse ecosystem that serves various consumer preferences and dietary requirements.

Consumer behavior has shifted significantly toward premium and organic nut products, with health-conscious demographics driving demand for raw, unsalted, and minimally processed options. The market benefits from strong agricultural foundations in key producing states including California, Georgia, Texas, and Oregon, which collectively contribute to 78% of domestic nut production. Distribution channels have evolved to include traditional retail, e-commerce platforms, specialty health stores, and direct-to-consumer sales, expanding market accessibility and consumer reach.

Innovation trends within the sector focus on value-added products such as nut butters, flavored varieties, and functional blends targeting specific health benefits. The market demonstrates resilience through diverse applications spanning snack foods, baking ingredients, confectionery products, and plant-based alternatives. Sustainability initiatives have become increasingly important, with producers implementing water-efficient farming practices and eco-friendly packaging solutions to meet evolving consumer expectations.

The US nuts market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of tree nuts and peanuts within the United States domestic market. This market includes both domestically grown varieties and imported nuts that are processed, packaged, or sold within US borders. Market participants range from large-scale agricultural producers and processing facilities to specialty retailers and direct-to-consumer brands.

Product categories within this market include raw nuts, roasted varieties, flavored options, organic selections, and value-added products such as nut butters, oils, and flour alternatives. The market serves multiple end-use applications including direct consumption as snacks, ingredients for food manufacturing, baking applications, and specialty dietary products. Geographic scope encompasses all fifty states, with varying consumption patterns and preferences across different regions.

Market definition extends beyond simple commodity trading to include branded products, private label offerings, and artisanal varieties that command premium pricing. The sector integrates traditional agricultural practices with modern processing technologies, creating diverse product portfolios that meet evolving consumer demands for convenience, health benefits, and sustainable sourcing practices.

Market performance in the US nuts sector demonstrates consistent expansion driven by health and wellness trends, with consumption patterns showing sustained growth across demographic segments. Key growth drivers include increasing awareness of nuts’ nutritional benefits, rising demand for plant-based protein sources, and expanding applications in food manufacturing and specialty dietary products. The market benefits from strong domestic production capabilities combined with strategic import relationships that ensure year-round product availability.

Competitive landscape features a mix of large-scale agricultural cooperatives, established food processing companies, and emerging specialty brands that focus on premium and organic offerings. Market consolidation trends have created opportunities for both scale efficiencies and niche market development, with companies pursuing vertical integration strategies to control quality and supply chain reliability.

Consumer trends indicate growing preference for convenience packaging, sustainable sourcing, and functional benefits beyond basic nutrition. The market shows particular strength in premium segments, with organic and specialty varieties experiencing growth rates of 12-15% annually. Distribution evolution toward omnichannel approaches has expanded market reach while creating new opportunities for brand differentiation and customer engagement.

Market segmentation reveals distinct consumption patterns across different nut varieties, with almonds maintaining the largest market share followed by peanuts, walnuts, and pecans. Regional preferences vary significantly, with West Coast consumers showing higher demand for premium and organic varieties, while Southern markets demonstrate strong preference for traditional varieties and value-oriented products.

Health and wellness trends serve as the primary catalyst for market expansion, with consumers increasingly recognizing nuts as nutrient-dense foods that support heart health, weight management, and overall wellness. Scientific research continues to validate the health benefits of regular nut consumption, including reduced risk of cardiovascular disease, improved cognitive function, and enhanced metabolic health. These findings drive consumer adoption across age groups and dietary preferences.

Plant-based nutrition movement has significantly boosted demand for nuts as protein alternatives, with vegetarian and vegan consumers seeking sustainable protein sources. Dietary flexibility trends encourage omnivorous consumers to incorporate more plant-based options, expanding the addressable market beyond traditional vegetarian demographics. The growing popularity of Mediterranean and other health-focused dietary patterns further supports nut consumption growth.

Convenience and portability factors drive demand for nuts as healthy snack alternatives to processed foods. Busy lifestyles create opportunities for portion-controlled packaging and on-the-go consumption formats that meet consumer needs for nutritious, convenient food options. Innovation in processing and flavoring techniques has expanded appeal beyond traditional consumer segments, attracting younger demographics and diverse taste preferences.

Food industry applications continue expanding as manufacturers incorporate nuts into various products including plant-based milk alternatives, protein bars, baked goods, and confectionery items. Functional food development leverages nuts’ natural nutritional profiles to create products targeting specific health benefits, driving B2B demand from food manufacturers and ingredient suppliers.

Price volatility represents a significant challenge for market participants, with nut prices subject to weather conditions, crop yields, and global supply-demand dynamics. Production costs have increased due to water scarcity issues in key growing regions, labor shortages, and rising input costs for fertilizers and equipment. These factors create pricing pressures that can limit market accessibility for price-sensitive consumer segments.

Allergy concerns restrict market penetration, as tree nut and peanut allergies affect significant portions of the population and create liability concerns for food service establishments and manufacturers. Cross-contamination risks require extensive facility modifications and testing protocols, increasing operational costs and limiting production flexibility for companies serving allergen-sensitive markets.

Competition from alternative snacks and protein sources creates market share pressures, particularly from processed snack foods that offer lower prices and longer shelf lives. Consumer education challenges persist regarding the health benefits of nuts versus perceived high calorie content, requiring ongoing marketing investments to address misconceptions about nuts’ role in healthy diets.

Regulatory compliance requirements for food safety, labeling, and organic certification create operational complexities and costs that can burden smaller market participants. International trade policies and tariff structures affect import costs and competitive dynamics, particularly for specialty varieties not produced domestically in sufficient quantities.

Product innovation presents substantial growth opportunities through development of functional nut products targeting specific health benefits such as cognitive enhancement, immune support, and digestive health. Flavor innovation and exotic variety introductions can attract adventurous consumers and create premium pricing opportunities. Sustainable packaging solutions align with environmental consciousness trends while potentially reducing costs and improving brand positioning.

E-commerce expansion offers significant growth potential, particularly for specialty and premium products that benefit from direct-to-consumer relationships and subscription models. Digital marketing capabilities enable targeted consumer education and brand building that can drive premium positioning and customer loyalty. International market development provides opportunities for US producers to leverage quality reputation and expand beyond domestic markets.

Foodservice sector growth creates opportunities for bulk sales and custom product development targeting restaurants, cafeterias, and institutional food service providers. Private label partnerships with major retailers offer volume growth opportunities while reducing marketing costs and improving distribution efficiency. Vertical integration strategies can improve margin capture and supply chain control for companies with sufficient scale and capital resources.

Emerging applications in plant-based meat alternatives, dairy substitutes, and functional beverages create new demand streams beyond traditional snack and baking applications. Nutraceutical market development leverages nuts’ natural compounds for supplement and functional food applications, potentially commanding significant price premiums over commodity products.

Supply chain dynamics in the US nuts market reflect complex interactions between domestic production capabilities, international sourcing relationships, and seasonal demand fluctuations. Production concentration in specific geographic regions creates both efficiencies and vulnerabilities, with California’s dominance in almond production exemplifying this dynamic. Weather dependency continues to influence supply reliability and pricing, driving industry investments in drought-resistant varieties and water-efficient farming practices.

Consumer behavior evolution demonstrates increasing sophistication in nut selection, with buyers showing greater awareness of origin, processing methods, and nutritional profiles. Premium segment expansion reflects willingness to pay higher prices for perceived quality, sustainability, and health benefits. Seasonal consumption patterns create predictable demand spikes during holiday periods, requiring strategic inventory management and production planning.

Technology integration throughout the value chain improves efficiency and quality control, from precision agriculture techniques in production to advanced sorting and packaging technologies in processing facilities. Traceability systems enable quality assurance and support premium positioning while addressing consumer demands for transparency. Automation adoption helps address labor challenges while improving consistency and reducing operational costs.

Competitive dynamics feature ongoing consolidation among larger players while creating opportunities for specialized smaller companies to serve niche markets. Brand differentiation strategies focus on origin stories, processing methods, and sustainability credentials to justify premium pricing and build customer loyalty.

Data collection for US nuts market analysis employs comprehensive primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry participants across the value chain, from growers and processors to retailers and consumers. Survey methodologies capture consumer preferences, purchasing behaviors, and demographic trends through statistically representative sampling across major metropolitan areas and rural regions.

Secondary research incorporates analysis of government agricultural statistics, trade association reports, and industry publications to establish baseline market data and historical trends. Market sizing methodologies utilize multiple data sources and validation techniques to ensure accuracy of consumption estimates and growth projections. Competitive intelligence gathering includes analysis of public company filings, product launches, and strategic announcements from major market participants.

Analytical frameworks employ both quantitative and qualitative assessment techniques to identify market drivers, constraints, and opportunities. Trend analysis utilizes time-series data to identify patterns and project future market developments. Regional analysis incorporates geographic consumption data and demographic factors to understand market variations across different areas of the United States.

Validation processes include cross-referencing multiple data sources and conducting expert interviews to confirm findings and assumptions. Quality assurance measures ensure data integrity and analytical rigor throughout the research process, supporting reliable market insights and strategic recommendations for industry participants.

West Coast markets demonstrate the highest consumption rates and strongest preference for premium and organic nut varieties, driven by health-conscious demographics and higher disposable income levels. California serves as both the largest production region and consumption center, with 42% of national nut consumption occurring in western states. Innovation adoption rates are highest in this region, with consumers showing greater willingness to try new varieties and value-added products.

Southeast region shows strong traditional consumption patterns, particularly for pecans and peanuts, reflecting cultural preferences and local production heritage. Georgia, Texas, and North Carolina represent key consumption centers with growing interest in premium products. Market penetration of organic and specialty varieties remains lower than national averages but shows accelerating growth rates of 8-10% annually.

Northeast markets demonstrate sophisticated consumer preferences with strong demand for imported specialty varieties and artisanal products. Urban centers including New York, Boston, and Philadelphia drive premium segment growth through specialty retailers and gourmet food establishments. Seasonal consumption patterns are most pronounced in this region, with holiday demand creating significant market opportunities.

Midwest region represents a balanced market with growing health consciousness driving increased consumption across all nut categories. Distribution efficiency benefits from central location and established logistics networks. Private label penetration is highest in this region, with major retailers based in the Midwest driving value-oriented product development and pricing strategies.

Market leadership in the US nuts sector features a combination of large agricultural cooperatives, established food processing companies, and emerging specialty brands that serve different market segments and consumer preferences. Competitive positioning strategies vary significantly across market participants, with some focusing on scale and efficiency while others emphasize premium quality and brand differentiation.

Strategic initiatives among leading companies include vertical integration to control supply chains, innovation investments in new product development, and sustainability programs to meet evolving consumer expectations. Market consolidation trends create opportunities for scale efficiencies while maintaining space for specialized players serving niche segments.

Product segmentation in the US nuts market encompasses multiple categories based on variety, processing method, packaging format, and target application. Primary variety segments include almonds, peanuts, walnuts, pecans, pistachios, cashews, hazelnuts, and mixed nut products, each serving distinct consumer preferences and usage occasions.

By Processing Method:

By Application:

By Distribution Channel:

Almonds category maintains market leadership through strong California production base and extensive health marketing, with consumption growing at 6-8% annually. Product innovation in flavored varieties and convenient packaging formats drives premium positioning. Export strength supports domestic pricing while creating opportunities for quality positioning in international markets.

Peanuts segment benefits from established consumer familiarity and competitive pricing, though faces challenges from tree nut competition in premium segments. Value-added products including flavored varieties and nut butters drive category growth beyond commodity applications. Allergy considerations create both challenges and opportunities for dedicated production facilities.

Walnuts category leverages strong health positioning and omega-3 content messaging to drive premium pricing and consumption growth. Seasonal demand patterns create opportunities for strategic marketing and inventory management. California production dominance ensures supply reliability while supporting quality consistency.

Pistachios segment demonstrates strong brand building success and premium positioning, with domestic production meeting growing consumer demand. Convenience packaging innovations and flavor varieties expand appeal beyond traditional consumer segments. Marketing investments have successfully positioned pistachios as premium snack options.

Specialty nuts including pecans, cashews, and hazelnuts serve niche markets with higher margins and distinct consumer preferences. Regional preferences influence distribution strategies and product positioning. Import dependency for some varieties creates supply chain considerations and pricing volatility.

Producers and growers benefit from sustained demand growth and premium pricing opportunities in specialty segments, with organic and sustainable production methods commanding significant price premiums. Diversification opportunities through value-added processing and direct-to-consumer sales channels improve margin capture and reduce commodity price exposure. Technology adoption in farming practices improves efficiency and sustainability while reducing operational costs.

Processors and manufacturers gain advantages through vertical integration opportunities and innovation in product development, creating differentiated offerings that command premium pricing. Scale efficiencies in processing and packaging operations improve cost competitiveness while maintaining quality standards. Brand building investments create customer loyalty and reduce price sensitivity in competitive markets.

Retailers and distributors benefit from strong category growth and healthy profit margins, particularly in premium and organic segments. Private label opportunities provide margin enhancement while meeting consumer demand for value-oriented products. E-commerce integration expands market reach and enables direct customer relationships that support loyalty programs and targeted marketing.

Consumers gain access to diverse, nutritious food options that support health and wellness goals while offering convenience and taste satisfaction. Product innovation provides expanded choices in flavors, packaging, and preparation methods. Transparency initiatives enable informed purchasing decisions based on origin, processing methods, and sustainability practices.

Food service operators benefit from versatile ingredients that enhance menu offerings while meeting health-conscious consumer demands. Bulk purchasing opportunities provide cost advantages while ensuring consistent supply for menu planning. Nutritional positioning supports healthy menu initiatives and dietary accommodation requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become a defining trend across the US nuts market, with consumers increasingly prioritizing environmentally responsible production methods and packaging solutions. Water conservation initiatives in major growing regions demonstrate industry commitment to sustainable agriculture while addressing resource scarcity challenges. Carbon footprint reduction programs and renewable energy adoption in processing facilities support environmental goals while potentially reducing operational costs.

Premium product expansion continues driving market growth, with consumers showing willingness to pay higher prices for organic, artisanal, and specialty varieties. Flavor innovation and exotic variety introductions create differentiation opportunities and attract adventurous consumers. Functional positioning leverages specific health benefits to justify premium pricing and build brand loyalty among health-conscious demographics.

Convenience packaging innovations address busy lifestyle demands through portion-controlled formats, resealable packages, and on-the-go consumption solutions. Subscription services and direct-to-consumer models create recurring revenue streams while building customer relationships. Smart packaging technologies provide freshness indicators and product information that enhance consumer experience.

Technology integration throughout the value chain improves efficiency and quality control, from precision agriculture in production to blockchain traceability systems. Automation adoption addresses labor challenges while improving consistency and reducing costs. Data analytics applications optimize inventory management, demand forecasting, and personalized marketing strategies.

Vertical integration strategies among major players have intensified, with companies acquiring production facilities, processing capabilities, and distribution networks to control quality and capture margin throughout the value chain. Strategic partnerships between growers and processors create supply security while enabling innovation investments and market expansion initiatives.

Product innovation accelerates across categories, with companies launching functional nut products targeting specific health benefits such as cognitive enhancement, immune support, and digestive health. Plant-based applications expand beyond traditional uses into meat alternatives, dairy substitutes, and protein supplements. Flavor development incorporates global cuisine influences and exotic seasonings to attract diverse consumer segments.

Sustainability certifications and transparency initiatives gain prominence as companies respond to consumer demands for ethical sourcing and environmental responsibility. Regenerative agriculture practices adoption demonstrates commitment to soil health and biodiversity while potentially improving long-term production sustainability. Packaging innovations focus on recyclable materials and reduced environmental impact while maintaining product freshness and shelf life.

Digital transformation initiatives encompass e-commerce platform development, social media marketing, and customer relationship management systems that enable direct consumer engagement. Supply chain digitization improves traceability and efficiency while supporting quality assurance and regulatory compliance requirements. Market intelligence systems provide real-time insights into consumer preferences and competitive dynamics.

MarkWide Research analysis indicates that companies should prioritize sustainability initiatives and transparency programs to meet evolving consumer expectations while building long-term competitive advantages. Investment strategies should focus on technology adoption, supply chain optimization, and brand building activities that create differentiation in increasingly competitive markets.

Product development recommendations emphasize functional benefits and convenience features that address specific consumer needs and lifestyle demands. Innovation priorities should include flavor variety expansion, packaging improvements, and value-added processing that commands premium pricing. Market positioning strategies should leverage health benefits and sustainability credentials to justify higher prices and build brand loyalty.

Distribution strategy optimization should embrace omnichannel approaches that combine traditional retail with e-commerce and direct-to-consumer capabilities. Partnership development with specialty retailers, health food stores, and food service operators can expand market reach while maintaining margin integrity. International expansion opportunities should be evaluated based on quality reputation and competitive positioning advantages.

Risk management strategies should address supply chain vulnerabilities through diversification, inventory optimization, and alternative sourcing relationships. Financial planning should account for seasonal demand patterns and commodity price volatility while maintaining investment capacity for growth initiatives. Regulatory compliance preparation should anticipate evolving food safety and labeling requirements.

Market trajectory for the US nuts sector indicates continued expansion driven by health consciousness trends, demographic shifts, and innovation in product development and distribution channels. Growth projections suggest sustained consumption increases of 5-7% annually across most nut categories, with premium and organic segments experiencing higher growth rates. Consumer behavior evolution toward health-focused purchasing decisions supports long-term market expansion and premium positioning opportunities.

Technology integration will continue transforming production, processing, and distribution operations, creating efficiency gains and quality improvements that support competitive positioning. Sustainability initiatives will become increasingly important for market access and consumer acceptance, driving investments in environmentally responsible practices and transparent supply chains. Innovation focus on functional benefits and convenience features will create new product categories and consumption occasions.

Competitive dynamics are expected to feature continued consolidation among larger players while maintaining opportunities for specialized companies serving niche markets. Brand differentiation will become increasingly important as commodity pricing pressures intensify and consumer sophistication grows. International market development presents significant opportunities for US producers leveraging quality reputation and production capabilities.

MWR projections indicate that successful market participants will be those that effectively combine operational efficiency with innovation capabilities and brand building investments. Long-term success factors include sustainability leadership, technology adoption, and customer relationship management that creates loyalty and reduces price sensitivity in competitive markets.

The US nuts market represents a dynamic and growing sector within the American food industry, characterized by strong fundamentals, diverse product offerings, and expanding consumer acceptance across demographic segments. Market drivers including health consciousness, convenience demands, and sustainability preferences create favorable conditions for continued expansion and innovation opportunities.

Industry participants benefit from established production capabilities, strong brand recognition, and growing consumer awareness of nuts’ nutritional benefits. Strategic opportunities exist in premium product development, e-commerce expansion, and sustainability leadership that can create competitive advantages and margin enhancement. Market challenges including price volatility, allergy concerns, and competitive pressures require strategic responses and operational excellence.

The future outlook for the US nuts market remains positive, with sustained growth expected across most product categories and distribution channels. Success factors will include innovation capability, brand building, sustainability leadership, and operational efficiency that enables competitive positioning in evolving market conditions. Companies that effectively address consumer needs while managing operational challenges will be best positioned to capture growth opportunities and build long-term market leadership in this expanding sector.

What is Nuts?

Nuts are hard-shelled fruits or seeds that are typically high in healthy fats, protein, and various nutrients. They are commonly consumed as snacks, used in cooking, and incorporated into various food products.

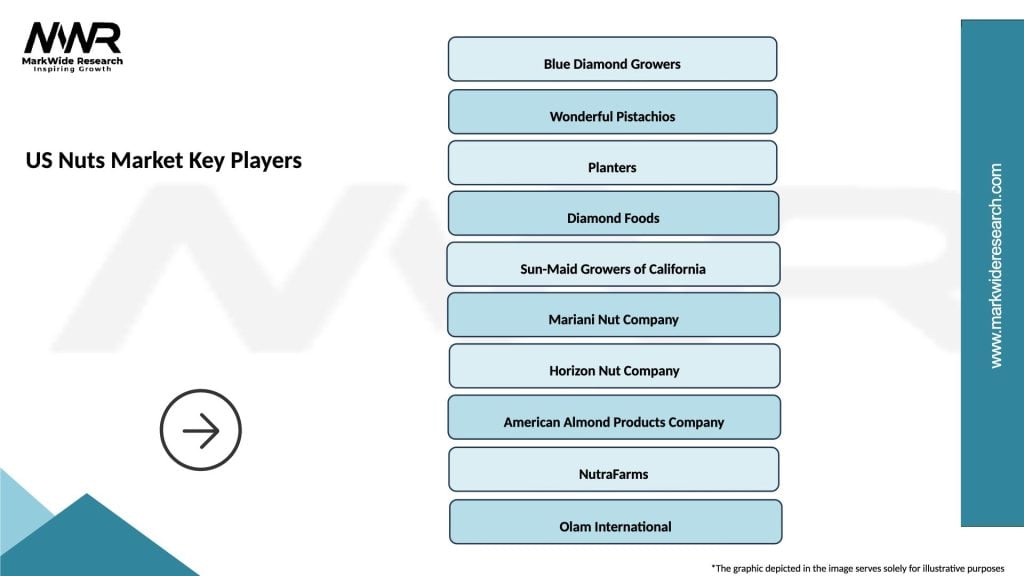

What are the key players in the US Nuts Market?

Key players in the US Nuts Market include companies like Blue Diamond Growers, Wonderful Pistachios, and Planters, among others. These companies are involved in the production, processing, and distribution of various nut products.

What are the growth factors driving the US Nuts Market?

The US Nuts Market is driven by increasing health consciousness among consumers, the rising demand for plant-based snacks, and the growing popularity of nuts as a source of protein and healthy fats.

What challenges does the US Nuts Market face?

The US Nuts Market faces challenges such as fluctuating raw material prices, potential supply chain disruptions, and competition from alternative snack options that may impact consumer choices.

What opportunities exist in the US Nuts Market?

Opportunities in the US Nuts Market include the expansion of product lines to include flavored and organic nuts, as well as increasing distribution channels through e-commerce platforms to reach a broader audience.

What trends are shaping the US Nuts Market?

Trends in the US Nuts Market include the growing demand for sustainable and ethically sourced nuts, innovations in packaging to enhance shelf life, and the introduction of new nut-based products catering to diverse dietary preferences.

US Nuts Market

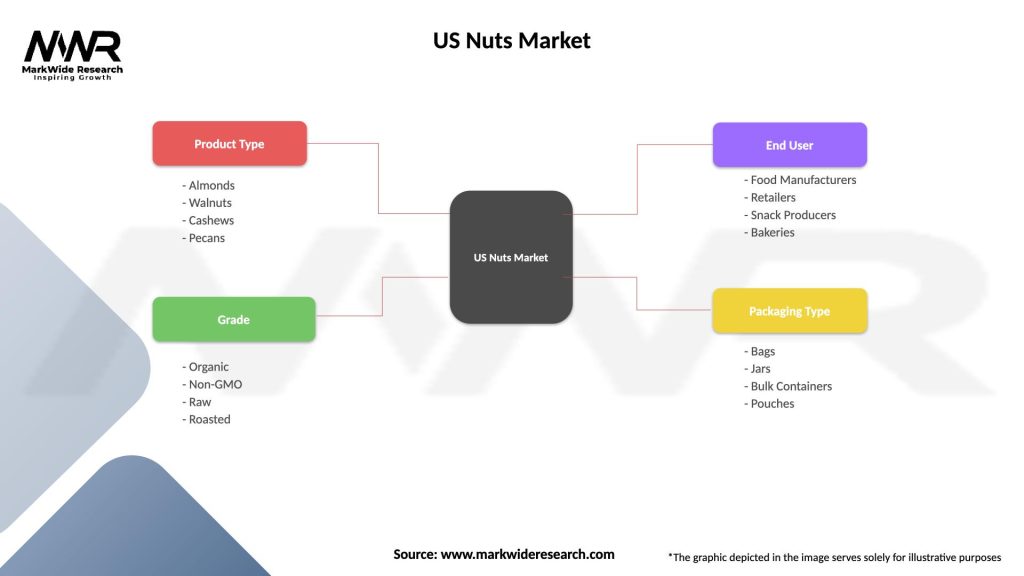

| Segmentation Details | Description |

|---|---|

| Product Type | Almonds, Walnuts, Cashews, Pecans |

| Grade | Organic, Non-GMO, Raw, Roasted |

| End User | Food Manufacturers, Retailers, Snack Producers, Bakeries |

| Packaging Type | Bags, Jars, Bulk Containers, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Nuts Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at