444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US mortgage and loan brokers market represents a dynamic and essential component of the American financial services landscape, facilitating connections between borrowers and lending institutions across residential and commercial sectors. Mortgage brokers serve as intermediaries who help consumers navigate the complex lending environment by comparing loan products from multiple lenders and securing optimal financing solutions. The market has experienced significant transformation following regulatory changes, technological advancements, and evolving consumer preferences that have reshaped how mortgage professionals operate.

Market dynamics indicate robust growth potential driven by increasing homeownership aspirations, refinancing activities, and the growing complexity of lending products that require professional guidance. The industry benefits from a 7.2% annual growth rate in broker-originated loans, reflecting the value proposition that experienced mortgage professionals provide to both borrowers and lenders. Digital transformation has become a key differentiator, with technology-enabled brokers capturing larger market shares through enhanced customer experiences and streamlined processes.

Regulatory compliance remains a critical factor shaping market operations, with brokers adapting to evolving federal and state requirements while maintaining competitive service delivery. The market encompasses various broker types, from independent operators to large brokerage firms, each serving distinct customer segments with specialized expertise in residential mortgages, commercial loans, and specialized financing products.

The US mortgage and loan brokers market refers to the comprehensive ecosystem of licensed professionals and firms that act as intermediaries between borrowers seeking financing and lending institutions offering various loan products. Mortgage brokers leverage their relationships with multiple lenders to provide borrowers with access to diverse financing options, competitive rates, and expert guidance throughout the loan application and approval process.

Professional mortgage brokers differentiate themselves from direct lenders by offering unbiased advice, comparing multiple loan products, and advocating for borrowers’ interests while ensuring compliance with federal and state regulations. The market encompasses various service models, including traditional full-service brokerage, online platforms, and hybrid approaches that combine digital efficiency with personal consultation.

Loan brokerage services extend beyond simple loan origination to include comprehensive financial consulting, credit improvement guidance, and ongoing relationship management that supports long-term client financial success. The market serves diverse customer segments, from first-time homebuyers requiring extensive education to sophisticated investors seeking complex commercial financing structures.

Strategic market analysis reveals that the US mortgage and loan brokers market continues evolving rapidly, driven by technological innovation, regulatory adaptation, and changing consumer expectations for personalized financial services. The industry has successfully navigated post-recession regulatory requirements while embracing digital transformation to enhance operational efficiency and customer satisfaction.

Key performance indicators demonstrate strong market resilience, with broker-originated loans representing approximately 68% of total mortgage originations in key metropolitan markets. The market benefits from increasing recognition of broker value propositions, particularly among millennial homebuyers who appreciate the convenience and expertise that professional mortgage brokers provide.

Competitive landscape analysis indicates market consolidation trends, with successful brokers expanding through strategic acquisitions and technology investments that enable scalable service delivery. The industry faces ongoing challenges related to regulatory compliance costs and competition from direct lenders, while opportunities emerge from underserved market segments and innovative service delivery models.

Future market trajectory appears positive, supported by demographic trends, housing market dynamics, and the continued complexity of lending products that require professional expertise to navigate effectively. The market is positioned for sustained growth as brokers adapt to evolving customer preferences and leverage technology to enhance service delivery.

Market intelligence reveals several critical insights that define the current state and future direction of the US mortgage and loan brokers market:

Market research indicates that brokers who successfully combine technology adoption with personalized service delivery achieve superior customer satisfaction scores and higher retention rates compared to traditional service models.

Primary growth drivers propelling the US mortgage and loan brokers market include several interconnected factors that create favorable conditions for industry expansion and evolution.

Housing market dynamics continue generating strong demand for mortgage brokerage services, with increasing home prices and complex lending requirements driving borrowers to seek professional guidance. The market benefits from ongoing refinancing activities as borrowers optimize their financing structures in response to interest rate fluctuations and changing financial circumstances.

Demographic trends support sustained market growth, particularly the millennial generation entering prime homebuying years with distinct preferences for digital-enabled services combined with expert consultation. These borrowers value the convenience and expertise that mortgage brokers provide while navigating increasingly complex lending landscapes.

Regulatory complexity paradoxically drives market growth by creating demand for professional expertise in navigating compliance requirements and loan product variations. Borrowers increasingly recognize the value of working with licensed professionals who understand regulatory nuances and can identify optimal financing solutions.

Technology advancement enables brokers to serve larger customer bases more efficiently while providing enhanced service experiences through digital platforms, automated processes, and data-driven insights that improve loan matching and approval rates.

Lender relationships provide brokers with competitive advantages through access to wholesale pricing, specialized loan products, and expedited processing that individual borrowers cannot access directly from retail lenders.

Significant challenges facing the US mortgage and loan brokers market include regulatory compliance costs, competitive pressures from direct lenders, and technology investment requirements that impact profitability and market accessibility.

Regulatory compliance represents a substantial operational burden, with ongoing requirements for licensing, continuing education, and documentation that increase operational costs and create barriers to entry for new market participants. The complexity of federal and state regulations requires significant investment in compliance systems and personnel.

Direct lender competition intensifies as banks and online lenders invest in customer acquisition strategies and streamlined processes that challenge traditional broker value propositions. Large financial institutions leverage their resources to offer competitive rates and simplified application processes that appeal to price-sensitive borrowers.

Technology investment requirements create financial pressures for smaller brokers who must compete with well-funded competitors offering sophisticated digital platforms and automated services. The pace of technological change requires continuous investment in systems and training that strain operational budgets.

Market consolidation pressures smaller brokers as larger firms achieve economies of scale and invest in technology platforms that enable more efficient operations and competitive pricing structures.

Economic volatility impacts market stability through interest rate fluctuations, housing market cycles, and lending standard changes that affect transaction volumes and broker compensation structures.

Emerging opportunities within the US mortgage and loan brokers market present significant potential for growth and market expansion across various customer segments and service delivery models.

Underserved markets represent substantial growth opportunities, particularly self-employed borrowers, foreign nationals, and customers with complex financial situations who require specialized expertise that many direct lenders cannot provide effectively. These segments often require customized solutions and personalized service that align with broker strengths.

Technology integration creates opportunities for innovative service delivery models that combine digital efficiency with personal consultation, enabling brokers to serve larger customer bases while maintaining high service quality standards. Artificial intelligence and machine learning applications can enhance loan matching and risk assessment capabilities.

Geographic expansion opportunities exist as technology enables brokers to serve customers across multiple states while maintaining compliance with local regulations and market requirements. Remote service delivery models have gained acceptance and create scalability opportunities.

Product diversification enables brokers to expand beyond traditional mortgage services to offer comprehensive financial solutions including commercial lending, investment property financing, and specialized loan products that generate additional revenue streams.

Partnership development with real estate professionals, financial advisors, and other industry participants creates referral networks and integrated service delivery models that enhance customer value propositions and market reach.

Complex market dynamics shape the competitive landscape and operational environment for mortgage and loan brokers across the United States, creating both challenges and opportunities for market participants.

Competitive intensity continues increasing as traditional brokers compete with direct lenders, online platforms, and technology-enabled competitors who leverage automation and data analytics to streamline operations and reduce costs. The market rewards brokers who successfully differentiate their services through expertise, technology, and customer experience.

Customer expectations evolve rapidly, with borrowers demanding faster processing times, transparent communication, and digital-first experiences while maintaining access to expert consultation when needed. Successful brokers balance efficiency with personalized service to meet these evolving expectations.

Regulatory environment remains dynamic, with ongoing changes to federal and state requirements that impact operational procedures, compliance costs, and market entry barriers. Brokers must maintain current knowledge of regulatory developments while investing in compliance systems and training.

Technology disruption accelerates market transformation as new platforms and tools enable more efficient operations, enhanced customer experiences, and data-driven decision making. Brokers who embrace technology innovation gain competitive advantages while those who resist face market share erosion.

Economic factors including interest rates, housing prices, and employment levels significantly impact market demand and transaction volumes, requiring brokers to adapt their strategies and service offerings to changing economic conditions.

Comprehensive research methodology employed in analyzing the US mortgage and loan brokers market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accurate and actionable market insights.

Primary research includes extensive interviews with industry professionals, including mortgage brokers, lending executives, regulatory officials, and customer representatives to gather firsthand insights into market trends, challenges, and opportunities. Survey data from market participants provides quantitative validation of qualitative findings.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and market data from authoritative sources to establish baseline market understanding and identify key trends and patterns. MarkWide Research leverages proprietary databases and analytical tools to process large datasets and extract meaningful insights.

Market modeling techniques include statistical analysis, trend extrapolation, and scenario planning to project future market conditions and identify potential growth trajectories. Advanced analytics help identify correlations between market variables and predict responses to changing conditions.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and sensitivity analysis that tests key assumptions and findings. The methodology emphasizes objectivity and reliability in all analytical processes.

Continuous monitoring of market developments ensures research findings remain current and relevant as market conditions evolve and new information becomes available.

Regional market dynamics across the United States reveal significant variations in mortgage broker market penetration, regulatory environments, and competitive landscapes that influence local market opportunities and challenges.

Western regions demonstrate the highest broker market penetration rates, with California leading at approximately 78% broker origination share in major metropolitan areas. The region benefits from complex housing markets, high property values, and sophisticated borrower requirements that favor professional brokerage services. Technology adoption rates are highest in western markets, driving innovation and service delivery improvements.

Eastern markets show strong broker presence in major metropolitan areas, with New York and Florida representing significant market opportunities. These regions benefit from diverse housing markets, international buyer activity, and complex regulatory requirements that create demand for specialized expertise.

Southern regions experience rapid growth in broker services, driven by population migration, new construction activity, and expanding economic opportunities. Texas and North Carolina represent particularly dynamic markets with growing broker penetration rates and increasing customer acceptance of brokerage services.

Midwest markets demonstrate steady growth patterns with increasing recognition of broker value propositions among traditional borrowers. These regions offer opportunities for market expansion as awareness of broker services increases and technology adoption accelerates.

Rural markets present unique opportunities for brokers who can leverage technology to serve geographically dispersed customers while providing specialized expertise in agricultural and rural property financing.

Competitive market structure encompasses diverse participants ranging from large national brokerage firms to independent local operators, each serving distinct market segments with specialized capabilities and service delivery models.

Market competition intensifies as participants invest in technology platforms, expand geographic coverage, and develop specialized service capabilities to differentiate their offerings. Successful competitors balance operational efficiency with personalized service delivery to meet evolving customer expectations.

Strategic positioning varies significantly among competitors, with some focusing on technology leadership while others emphasize local market expertise and relationship-based service delivery models.

Market segmentation analysis reveals distinct customer groups and service categories that define the structure and opportunities within the US mortgage and loan brokers market.

By Service Type:

By Customer Segment:

By Geographic Scope:

Detailed category analysis provides insights into specific market segments and their unique characteristics, growth patterns, and competitive dynamics within the broader mortgage brokerage market.

Residential Purchase Loans represent the largest category, driven by ongoing homeownership demand and demographic trends favoring homebuying among younger consumers. This segment benefits from broker expertise in navigating complex lending requirements and securing competitive financing terms. Market share for brokers in this category reaches approximately 72% in competitive metropolitan markets.

Refinancing Services demonstrate cyclical patterns tied to interest rate movements and housing market conditions. Brokers excel in this category by identifying optimal refinancing opportunities and managing complex transaction requirements. The segment requires sophisticated market timing and customer relationship management capabilities.

Commercial Lending represents a high-value segment requiring specialized expertise in business financing, investment property loans, and complex commercial transactions. Brokers in this category typically serve sophisticated customers with substantial transaction values and ongoing financing needs.

Government Program Loans including FHA, VA, and USDA products require specialized knowledge and processing capabilities that favor experienced brokers. This segment serves important social purposes while providing stable revenue streams for qualified brokers.

Specialty Products including jumbo loans, foreign national financing, and alternative documentation loans create niche opportunities for brokers with specialized expertise and lender relationships.

Substantial benefits accrue to various stakeholders within the mortgage brokerage ecosystem, creating value for brokers, lenders, borrowers, and related industry participants.

For Mortgage Brokers:

For Lenders:

For Borrowers:

Comprehensive SWOT analysis examines the internal strengths and weaknesses of the mortgage brokerage industry alongside external opportunities and threats that influence market dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Significant market trends are reshaping the mortgage brokerage landscape, driving innovation and creating new opportunities for market participants who adapt effectively to changing conditions.

Digital Transformation accelerates across the industry as brokers invest in technology platforms that streamline operations, enhance customer experiences, and enable remote service delivery. Successful brokers balance automation with personal consultation to meet evolving customer expectations for both efficiency and expertise.

Customer Experience Focus drives service delivery improvements as brokers recognize that superior customer experiences create competitive advantages and generate referral business. Net Promoter Scores for technology-enabled brokers average 15-20 points higher than traditional service models.

Specialization Strategies emerge as brokers focus on niche markets and specialized services where they can develop expertise and command premium pricing. Successful specialization areas include self-employed borrowers, foreign nationals, and complex commercial transactions.

Partnership Integration increases as brokers develop strategic relationships with real estate professionals, financial advisors, and other industry participants to create comprehensive service offerings and referral networks.

Compliance Technology becomes essential as brokers invest in systems that automate regulatory compliance, document management, and audit trails to reduce operational risks and costs.

Data Analytics applications expand as brokers leverage customer data, market intelligence, and predictive analytics to improve loan matching, risk assessment, and customer relationship management.

Recent industry developments demonstrate the dynamic nature of the mortgage brokerage market and highlight key trends that will influence future market evolution and competitive positioning.

Technology Acquisitions accelerate as established brokers acquire fintech companies and digital platforms to enhance their technological capabilities and customer service offerings. These strategic investments enable traditional brokers to compete more effectively with technology-focused competitors.

Regulatory Updates continue shaping market operations, with recent changes to qualified mortgage rules and state licensing requirements affecting broker operations and compliance costs. MWR analysis indicates that regulatory adaptation costs represent approximately 8-12% of operational expenses for mid-sized brokers.

Market Consolidation trends persist as larger firms acquire smaller competitors to achieve economies of scale and expand geographic coverage. This consolidation creates opportunities for remaining independent brokers to serve customers seeking personalized service alternatives.

Product Innovation emerges through partnerships between brokers and lenders to develop specialized financing products for underserved market segments, including gig economy workers and alternative income borrowers.

Customer Service Enhancement initiatives focus on improving communication, transparency, and education throughout the loan process to build customer loyalty and generate referral business.

Geographic Expansion accelerates as successful brokers leverage technology to serve customers in multiple states while maintaining compliance with local regulations and market requirements.

Strategic recommendations for mortgage brokers seeking to enhance their competitive positioning and achieve sustainable growth in the evolving market environment focus on technology adoption, service differentiation, and operational excellence.

Technology Investment should prioritize customer-facing platforms that enhance the borrower experience while maintaining the personal consultation that differentiates brokers from direct lenders. Successful technology strategies balance automation with human expertise to create optimal service delivery models.

Market Specialization enables brokers to develop expertise in specific customer segments or product categories where they can command premium pricing and build sustainable competitive advantages. Focus areas should align with broker strengths and local market opportunities.

Partnership Development with real estate professionals, financial advisors, and other industry participants creates referral networks and integrated service offerings that enhance customer value propositions and generate consistent business flow.

Compliance Excellence requires investment in systems and processes that ensure regulatory adherence while minimizing operational disruption. Proactive compliance management reduces risks and enables focus on business development activities.

Customer Relationship Management systems should capture and leverage customer data to improve service delivery, identify cross-selling opportunities, and maintain long-term relationships that generate repeat business and referrals.

Geographic Strategy should consider expansion opportunities enabled by technology while ensuring adequate resources for compliance and service delivery in new markets.

Future market prospects for the US mortgage and loan brokers market appear positive, supported by demographic trends, housing market dynamics, and the continued value proposition that professional brokers provide in an increasingly complex lending environment.

Growth projections indicate sustained market expansion driven by millennial homebuying activity, ongoing refinancing demand, and increasing recognition of broker value propositions among sophisticated borrowers. MarkWide Research analysis suggests that broker market share could reach 75-80% in major metropolitan areas within the next five years as customer acceptance increases.

Technology evolution will continue transforming service delivery models, with successful brokers leveraging artificial intelligence, machine learning, and advanced analytics to enhance customer experiences and operational efficiency. The integration of technology with personal consultation will define competitive success in future market conditions.

Regulatory environment is expected to remain stable with gradual refinements that support market transparency and consumer protection while maintaining broker viability. Industry adaptation to regulatory requirements will continue strengthening the competitive position of compliant, professional brokers.

Market consolidation trends will likely continue, creating opportunities for well-positioned brokers to expand through strategic acquisitions while maintaining service quality and customer relationships. The market will reward brokers who successfully balance growth with operational excellence.

Customer expectations will continue evolving toward digital-first experiences combined with expert consultation, requiring brokers to invest in technology platforms while maintaining the personal relationships that differentiate their services from automated alternatives.

The US mortgage and loan brokers market represents a dynamic and essential component of the American financial services landscape, characterized by ongoing transformation driven by technology adoption, regulatory evolution, and changing customer expectations. The market demonstrates strong fundamentals supported by demographic trends, housing market dynamics, and the continued value proposition that professional brokers provide in navigating complex lending environments.

Market participants who successfully balance technology investment with personalized service delivery are positioned to capture growing market opportunities and achieve sustainable competitive advantages. The industry’s ability to adapt to regulatory requirements while embracing innovation creates a foundation for continued growth and market expansion.

Future success in the mortgage brokerage market will depend on strategic technology adoption, market specialization, partnership development, and operational excellence that delivers superior customer experiences while maintaining compliance with evolving regulatory requirements. The market rewards brokers who understand that technology enhances rather than replaces the human expertise and advocacy that define professional mortgage brokerage services.

Overall market outlook remains positive, with substantial opportunities for growth and innovation as the industry continues evolving to meet the changing needs of borrowers, lenders, and other stakeholders in the dynamic US mortgage market.

What is Mortgage/Loan Brokers?

Mortgage/Loan Brokers are professionals who help consumers find and secure loans for purchasing real estate. They act as intermediaries between borrowers and lenders, providing guidance on loan options, rates, and terms.

Who are the key players in the US Mortgage/Loan Brokers Market?

Key players in the US Mortgage/Loan Brokers Market include companies like Quicken Loans, LoanDepot, and Guaranteed Rate, which offer various mortgage products and services to consumers. These companies compete on factors such as interest rates, customer service, and loan processing speed, among others.

What are the main drivers of growth in the US Mortgage/Loan Brokers Market?

The main drivers of growth in the US Mortgage/Loan Brokers Market include low interest rates, increasing homebuyer demand, and a growing trend towards refinancing existing loans. Additionally, technological advancements in online mortgage applications are making the process more accessible.

What challenges does the US Mortgage/Loan Brokers Market face?

Challenges in the US Mortgage/Loan Brokers Market include regulatory changes that can impact lending practices, increased competition from online lenders, and economic fluctuations that affect consumer confidence. These factors can lead to market volatility and affect broker operations.

What opportunities exist in the US Mortgage/Loan Brokers Market?

Opportunities in the US Mortgage/Loan Brokers Market include the potential for growth in digital mortgage solutions and the expansion of services to underserved markets. Additionally, brokers can leverage data analytics to better understand consumer needs and tailor their offerings.

What trends are shaping the US Mortgage/Loan Brokers Market?

Trends shaping the US Mortgage/Loan Brokers Market include the rise of fintech companies offering innovative mortgage solutions, increased use of artificial intelligence for loan processing, and a growing emphasis on customer experience. These trends are transforming how brokers operate and engage with clients.

US Mortgage/Loan Brokers Market

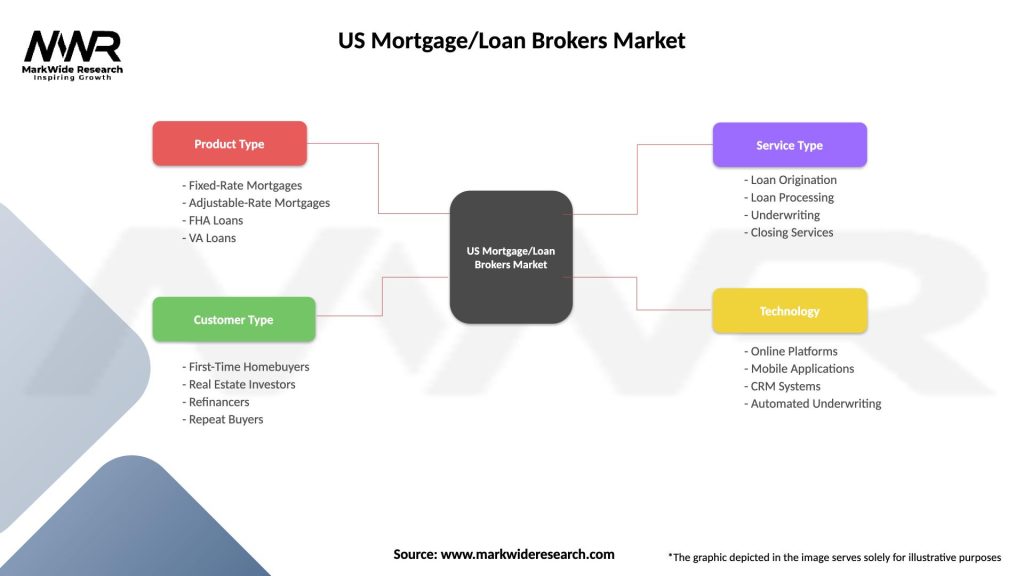

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Rate Mortgages, Adjustable-Rate Mortgages, FHA Loans, VA Loans |

| Customer Type | First-Time Homebuyers, Real Estate Investors, Refinancers, Repeat Buyers |

| Service Type | Loan Origination, Loan Processing, Underwriting, Closing Services |

| Technology | Online Platforms, Mobile Applications, CRM Systems, Automated Underwriting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Mortgage/Loan Brokers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at