444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US modular kitchen market represents a dynamic and rapidly evolving segment within the broader home improvement and interior design industry. Modular kitchens have gained significant traction among American homeowners seeking customizable, efficient, and aesthetically pleasing kitchen solutions. The market encompasses pre-fabricated kitchen components, including cabinets, countertops, storage solutions, and integrated appliances that can be assembled in various configurations to suit different space requirements and design preferences.

Market dynamics indicate robust growth driven by increasing urbanization, rising disposable incomes, and evolving lifestyle preferences. The sector benefits from growing consumer awareness about space optimization and the desire for modern, functional kitchen designs. Industry trends show a marked shift toward sustainable materials, smart kitchen technologies, and personalized design solutions that cater to diverse demographic segments across the United States.

Regional distribution reveals strong demand concentration in metropolitan areas, with approximately 68% of market activity occurring in urban and suburban regions. The market demonstrates resilience through economic cycles, supported by both new construction projects and kitchen renovation activities. Consumer preferences increasingly favor modular solutions due to their cost-effectiveness, reduced installation time, and flexibility in design modifications.

The US modular kitchen market refers to the comprehensive ecosystem of pre-manufactured kitchen components and systems designed for easy assembly and customization in residential properties across the United States. Modular kitchen systems consist of standardized units that can be combined in multiple configurations to create functional cooking and dining spaces tailored to specific requirements and spatial constraints.

Key characteristics of modular kitchens include standardized dimensions, interchangeable components, and flexible design options that allow homeowners to create personalized kitchen layouts. These systems typically incorporate cabinets, drawers, shelving units, countertops, and integrated storage solutions manufactured using consistent specifications and quality standards. Installation processes are streamlined compared to traditional custom kitchen construction, reducing both time and labor costs.

Market participants include manufacturers, distributors, retailers, and installation service providers who collectively deliver complete modular kitchen solutions. The ecosystem encompasses various price points and design aesthetics, from budget-friendly options to premium luxury configurations, ensuring accessibility across diverse consumer segments throughout the American market.

Market performance in the US modular kitchen sector demonstrates consistent expansion driven by fundamental shifts in consumer behavior and housing market dynamics. The industry benefits from increasing preference for DIY home improvement projects, growing awareness of space optimization benefits, and rising demand for contemporary kitchen designs that integrate seamlessly with modern lifestyle requirements.

Growth drivers include urbanization trends, smaller living spaces requiring efficient design solutions, and technological advancements in manufacturing processes that reduce costs while improving quality. The market experiences approximately 12% annual growth in online sales channels, reflecting changing consumer shopping preferences and the impact of digital transformation on traditional retail models.

Competitive landscape features established manufacturers alongside emerging players who leverage innovative materials, sustainable production methods, and direct-to-consumer business models. Market consolidation activities and strategic partnerships continue to reshape industry structure, while technological integration creates new opportunities for smart kitchen solutions and enhanced customer experiences.

Future prospects remain positive, supported by demographic trends including millennial homeownership growth, increasing renovation activities among aging housing stock, and continued urbanization patterns that favor modular design solutions. Industry participants focus on sustainability initiatives, customization capabilities, and omnichannel distribution strategies to capture emerging market opportunities.

Consumer behavior analysis reveals significant insights into modular kitchen adoption patterns across different demographic segments. Primary drivers include cost considerations, installation convenience, and design flexibility that allows homeowners to achieve professional-quality results without extensive construction projects.

Market segmentation demonstrates diverse consumer preferences spanning budget-conscious first-time homeowners to affluent households seeking premium design solutions. Regional variations reflect local architectural styles, climate considerations, and cultural preferences that influence material choices and design aesthetics throughout different US markets.

Urbanization trends represent the primary catalyst driving modular kitchen market expansion across the United States. Metropolitan growth creates demand for efficient space utilization solutions as housing costs increase and average home sizes decrease in urban areas. Modular kitchen systems address these challenges by maximizing functionality within constrained spaces while maintaining aesthetic appeal.

Demographic shifts contribute significantly to market growth, particularly the increasing homeownership rates among millennials who prioritize convenience, sustainability, and cost-effectiveness. This generation demonstrates strong preference for DIY solutions and values the flexibility to modify living spaces according to changing needs and lifestyle preferences.

Technological advancement in manufacturing processes enables cost reduction while improving product quality and design options. Automation technologies streamline production, reduce waste, and ensure consistent quality standards that enhance consumer confidence in modular kitchen solutions. Digital design tools allow customers to visualize configurations before purchase, reducing decision-making uncertainty.

Economic factors including rising construction labor costs and material price volatility make modular solutions increasingly attractive compared to traditional custom kitchen construction. Time efficiency benefits appeal to busy homeowners who cannot accommodate extended construction timelines associated with conventional kitchen renovations.

Sustainability consciousness drives demand for eco-friendly materials and energy-efficient manufacturing processes. Consumers increasingly consider environmental impact when making home improvement decisions, favoring products that demonstrate responsible sourcing and reduced carbon footprints throughout the supply chain.

Design limitations present significant challenges for consumers seeking highly customized kitchen solutions that exceed standard modular configurations. Standardization requirements inherent in modular systems may not accommodate unique architectural features or specific functional requirements in older homes or unconventional spaces.

Quality perceptions among certain consumer segments associate modular products with lower quality compared to custom-built alternatives. Market education remains necessary to address misconceptions about durability, longevity, and aesthetic appeal of factory-manufactured kitchen components versus traditional construction methods.

Installation complexity can create barriers for DIY-oriented consumers who underestimate technical requirements for proper assembly and integration with existing plumbing and electrical systems. Professional installation needs may offset some cost advantages that initially attract consumers to modular solutions.

Supply chain disruptions impact product availability and delivery timelines, particularly affecting manufacturers who rely on global sourcing for materials and components. Inventory management challenges create customer satisfaction issues when desired configurations experience extended lead times or component shortages.

Competition intensity from traditional kitchen contractors and custom cabinet makers creates pricing pressure and market share challenges. Established relationships between contractors and homeowners may limit modular kitchen adoption in certain market segments that prioritize personal service and local expertise.

Smart home integration presents substantial growth opportunities as consumers increasingly adopt connected technologies throughout their living spaces. IoT-enabled appliances and automated systems create demand for modular kitchen designs that accommodate advanced technology while maintaining aesthetic appeal and functional efficiency.

Sustainable materials development opens new market segments among environmentally conscious consumers willing to pay premium prices for eco-friendly products. Recycled materials, renewable resources, and low-emission manufacturing processes align with growing sustainability trends and regulatory requirements.

Direct-to-consumer channels enable manufacturers to capture higher margins while providing customers with competitive pricing and enhanced service experiences. E-commerce platforms facilitate market expansion into underserved geographic regions and create opportunities for personalized customer engagement throughout the purchase journey.

Rental market growth creates demand for temporary and easily removable kitchen solutions that allow tenants to improve living spaces without permanent modifications. Flexible installation systems cater to this emerging segment while providing landlords with value-added amenities that differentiate rental properties.

Aging population demographics drive demand for accessible kitchen designs that accommodate mobility limitations and changing physical capabilities. Universal design principles integrated into modular systems create opportunities to serve this growing market segment with specialized product offerings.

Supply chain evolution significantly impacts market dynamics as manufacturers adapt to changing material costs, transportation challenges, and inventory management requirements. Vertical integration strategies enable some companies to maintain better cost control and quality consistency while reducing dependency on external suppliers.

Consumer preferences continue shifting toward personalization and customization within standardized frameworks. Mass customization approaches allow manufacturers to offer extensive design options while maintaining production efficiency and cost advantages associated with modular manufacturing processes.

Technology adoption accelerates across all market segments, from manufacturing automation to customer-facing design tools and installation support systems. Digital transformation creates competitive advantages for companies that successfully integrate technology throughout their value chains and customer interactions.

Regulatory environment influences market dynamics through building codes, safety standards, and environmental regulations that affect product design and manufacturing processes. Compliance requirements create barriers to entry while ensuring consumer protection and product quality standards across the industry.

Economic cycles impact market performance through their effects on housing construction, renovation activities, and consumer spending patterns. Market resilience varies by segment, with budget-friendly options typically maintaining demand during economic downturns while premium products experience greater volatility.

Comprehensive analysis of the US modular kitchen market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes surveys, interviews, and focus groups with consumers, manufacturers, distributors, and industry experts to gather firsthand insights about market trends, preferences, and challenges.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary research findings. Data triangulation methods ensure consistency across different information sources and research approaches.

Market segmentation analysis examines consumer behavior patterns, demographic characteristics, and purchasing decisions across different geographic regions and price points. Statistical modeling techniques identify correlations and trends that inform market projections and strategic recommendations.

Competitive intelligence gathering includes analysis of company strategies, product offerings, pricing models, and market positioning to understand competitive dynamics and identify emerging trends. Supply chain analysis examines manufacturing processes, distribution channels, and cost structures that influence market development.

Technology assessment evaluates emerging innovations, digital transformation initiatives, and automation trends that impact market evolution. Regulatory analysis considers current and proposed legislation, building codes, and industry standards that affect market participants and consumer choices.

Northeast region demonstrates strong market performance driven by high population density, elevated income levels, and extensive renovation activities in aging housing stock. Urban markets including New York, Boston, and Philadelphia show particularly robust demand for space-efficient modular kitchen solutions that maximize functionality in compact living spaces.

Southeast markets experience rapid growth supported by population migration, new construction activities, and increasing homeownership rates. Florida, Georgia, and North Carolina lead regional expansion with approximately 15% annual growth rates in modular kitchen installations, reflecting broader demographic and economic trends.

West Coast regions emphasize sustainability and technology integration, with California markets driving innovation in eco-friendly materials and smart kitchen solutions. Pacific Northwest consumers demonstrate strong preference for natural materials and minimalist design aesthetics that align with regional lifestyle preferences.

Midwest markets focus on value-oriented solutions and traditional design aesthetics, with Chicago, Detroit, and Minneapolis representing significant market opportunities. Rural areas throughout the region show increasing adoption of modular solutions due to limited access to custom kitchen contractors and cost considerations.

Southwest region benefits from rapid population growth and new home construction, particularly in Texas, Arizona, and Nevada markets. Climate considerations influence material choices and design preferences, with emphasis on durability and heat resistance in kitchen components and finishes.

Market leadership remains distributed among several major players who compete through different strategies including product innovation, pricing, distribution channels, and customer service. Industry consolidation continues as larger companies acquire smaller manufacturers to expand product portfolios and geographic reach.

Competitive strategies include vertical integration, direct-to-consumer sales models, technology adoption, and sustainability initiatives. Innovation focus areas encompass smart storage solutions, sustainable materials, and manufacturing process improvements that reduce costs while enhancing quality.

Market differentiation occurs through design aesthetics, quality levels, customization capabilities, and service offerings. Brand positioning strategies target specific consumer segments based on price sensitivity, design preferences, and installation requirements.

By Material Type: The market segments into various material categories that cater to different consumer preferences and budget considerations. Solid wood remains popular for traditional and premium applications, while engineered wood products offer cost-effective alternatives with improved consistency and environmental benefits.

By Price Range: Market segmentation reflects diverse consumer budgets and value expectations across different demographic groups and geographic regions.

By Application: Different installation contexts require specific product characteristics and service approaches to meet customer needs effectively.

Cabinet Systems represent the largest category within the modular kitchen market, encompassing base cabinets, wall units, and tall storage solutions. Innovation trends include soft-close mechanisms, pull-out organizers, and integrated lighting systems that enhance functionality and user experience. Customization options allow consumers to select door styles, hardware finishes, and internal configurations that match their specific needs and aesthetic preferences.

Countertop Solutions demonstrate significant growth in engineered materials that combine durability with aesthetic appeal. Quartz surfaces gain market share due to their non-porous properties and consistent appearance, while sustainable options including recycled materials attract environmentally conscious consumers. Installation efficiency improvements reduce labor costs and project timelines.

Storage Accessories category experiences rapid expansion as consumers prioritize organization and space optimization. Smart storage solutions include pull-out pantries, corner carousel systems, and drawer organizers that maximize accessibility and efficiency. Technology integration incorporates LED lighting and automated mechanisms that enhance user convenience.

Hardware Components influence both functionality and aesthetic appeal of modular kitchen systems. Premium hardware options include soft-close hinges, full-extension drawer slides, and decorative handles that complement various design styles. Durability standards ensure long-term performance under regular use conditions.

Appliance Integration becomes increasingly important as consumers seek seamless design coordination between cabinetry and kitchen appliances. Built-in solutions create streamlined appearances while flexible configurations accommodate different appliance sizes and brands throughout the kitchen layout.

Manufacturers benefit from standardized production processes that reduce costs, improve quality consistency, and enable efficient inventory management. Economies of scale in manufacturing allow competitive pricing while maintaining profit margins. Technology adoption streamlines operations and reduces waste throughout the production process.

Retailers gain advantages through reduced inventory requirements, faster turnover rates, and simplified customer consultation processes. Display efficiency allows showroom optimization with modular demonstration units that showcase multiple configurations in limited space. Installation partnerships create additional revenue streams and enhance customer satisfaction.

Consumers receive significant benefits including cost savings, reduced installation time, and design flexibility that accommodates changing needs. Quality assurance through factory manufacturing provides consistency and reliability compared to on-site construction. Warranty coverage offers protection and peace of mind for long-term investment decisions.

Contractors and Installers experience improved project efficiency, reduced labor requirements, and enhanced customer satisfaction through faster completion times. Training programs from manufacturers ensure proper installation techniques and reduce callbacks. Standardized components simplify inventory management and reduce job site complexity.

Real Estate Professionals leverage modern kitchen designs to enhance property values and appeal to potential buyers. Modular solutions enable cost-effective staging and renovation projects that improve marketability. Neutral designs appeal to broad buyer demographics while demonstrating quality and functionality.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with manufacturers increasingly adopting eco-friendly materials, renewable resources, and carbon-neutral production processes. Consumer awareness drives demand for products that demonstrate environmental responsibility throughout their lifecycle, from sourcing to disposal.

Smart Kitchen Technology gains momentum as homeowners embrace connected appliances, automated systems, and integrated control platforms. IoT connectivity enables remote monitoring, energy optimization, and predictive maintenance capabilities that enhance convenience and efficiency.

Minimalist Design Aesthetics influence product development with emphasis on clean lines, hidden storage, and seamless integration of components. Scandinavian influences promote functional simplicity while contemporary styles emphasize geometric forms and neutral color palettes.

Customization Technology advances through digital design tools, virtual reality visualization, and mass customization manufacturing processes. Consumer engagement improves through interactive planning tools that allow real-time configuration changes and instant pricing feedback.

Multi-functional Spaces reflect changing lifestyle patterns where kitchens serve multiple purposes including dining, working, and socializing. Flexible designs accommodate these diverse functions through adaptable furniture, moveable islands, and convertible surfaces.

Health and Wellness Focus influences material selection and design features that promote food safety, air quality, and ergonomic functionality. Antimicrobial surfaces and improved ventilation systems address health concerns while accessibility features accommodate aging populations.

Manufacturing Innovation continues advancing through automation technologies, robotics integration, and artificial intelligence applications that improve efficiency and quality control. Industry 4.0 principles enable predictive maintenance, real-time monitoring, and adaptive production processes that respond to demand fluctuations.

Strategic Partnerships between manufacturers, retailers, and technology companies create integrated solutions that enhance customer experiences and market reach. Collaboration initiatives focus on supply chain optimization, product development, and digital transformation projects that benefit all stakeholders.

Sustainability Certifications gain importance as industry organizations develop standards for environmental performance, material sourcing, and manufacturing processes. Third-party verification provides credibility and helps consumers make informed decisions about eco-friendly products.

Digital Transformation accelerates across all business functions from design and manufacturing to sales and customer service. E-commerce platforms expand capabilities while mobile applications provide convenient access to product information and ordering systems.

Supply Chain Resilience initiatives address vulnerabilities exposed by recent disruptions through diversification strategies, local sourcing programs, and inventory optimization systems. Risk management approaches balance cost efficiency with supply security considerations.

Market positioning strategies should emphasize value propositions that differentiate modular solutions from traditional custom kitchen alternatives. MarkWide Research analysis indicates successful companies focus on specific consumer segments rather than attempting to serve all market categories simultaneously.

Technology investment priorities should balance customer-facing innovations with operational efficiency improvements. Digital capabilities including virtual design tools, augmented reality applications, and e-commerce platforms create competitive advantages while improving customer engagement and satisfaction levels.

Sustainability initiatives require comprehensive approaches that address materials, manufacturing processes, packaging, and end-of-life considerations. Consumer education about environmental benefits helps justify premium pricing for eco-friendly products while building brand loyalty among conscious consumers.

Distribution channel optimization should incorporate omnichannel strategies that seamlessly integrate online and offline customer touchpoints. Retail partnerships remain important while direct-to-consumer channels offer opportunities for improved margins and customer relationships.

Product development focus should prioritize modularity, customization capabilities, and technology integration that align with evolving consumer preferences. Innovation cycles must balance novelty with proven functionality to maintain market competitiveness while managing development costs.

Long-term growth prospects remain positive for the US modular kitchen market, supported by fundamental demographic trends, technological advancement, and evolving consumer preferences. Market expansion is expected to continue at approximately 8-10% annual growth rates over the next five years, driven by urbanization, homeownership trends, and renovation activities.

Technology integration will accelerate as smart home adoption increases and manufacturing capabilities advance. Artificial intelligence applications in design optimization, predictive maintenance, and customer service will create new value propositions and competitive differentiators throughout the industry.

Sustainability requirements will intensify as regulatory frameworks evolve and consumer awareness increases. Circular economy principles including recyclability, durability, and responsible sourcing will become standard expectations rather than premium features, influencing product development and marketing strategies.

Market consolidation may continue as larger companies acquire specialized manufacturers and technology providers to expand capabilities and market reach. Vertical integration strategies will help companies control costs, quality, and customer experiences while reducing supply chain vulnerabilities.

Geographic expansion opportunities exist in underserved markets and emerging demographic segments. MWR projections suggest particular growth potential in suburban markets, rental properties, and multi-generational housing arrangements that require flexible kitchen solutions.

The US modular kitchen market demonstrates robust growth potential driven by fundamental shifts in consumer behavior, technological advancement, and demographic trends that favor efficient, customizable kitchen solutions. Market dynamics reflect increasing preference for cost-effective alternatives to traditional custom kitchen construction, supported by improvements in product quality, design options, and installation processes.

Industry evolution continues toward greater sustainability, technology integration, and customization capabilities that address diverse consumer needs across different price points and market segments. Competitive landscape developments indicate ongoing consolidation and strategic partnerships that enhance market efficiency while expanding consumer choice and accessibility.

Future success in this market will depend on companies’ ability to balance standardization benefits with customization demands, integrate emerging technologies effectively, and maintain cost competitiveness while improving sustainability performance. Strategic focus on customer experience, product innovation, and operational efficiency will determine market leadership positions as the industry continues maturing and expanding throughout the United States.

What is Modular Kitchen?

A modular kitchen refers to a modern kitchen design that utilizes pre-made cabinets and modules, allowing for flexible layouts and efficient use of space. This design often incorporates various materials and finishes to suit individual preferences and functionality.

What are the key players in the US Modular Kitchen Market?

Key players in the US Modular Kitchen Market include companies like IKEA, MasterBrand Cabinets, and American Woodmark, which offer a range of modular kitchen solutions. These companies focus on innovative designs and customization options to meet diverse consumer needs, among others.

What are the growth factors driving the US Modular Kitchen Market?

The growth of the US Modular Kitchen Market is driven by increasing urbanization, rising disposable incomes, and a growing preference for modern kitchen designs. Additionally, the demand for space-efficient solutions in smaller homes contributes to market expansion.

What challenges does the US Modular Kitchen Market face?

The US Modular Kitchen Market faces challenges such as fluctuating raw material prices and intense competition among manufacturers. Additionally, consumer preferences for custom solutions can complicate standardization in modular designs.

What opportunities exist in the US Modular Kitchen Market?

Opportunities in the US Modular Kitchen Market include the growing trend of smart kitchens and the integration of sustainable materials. As consumers become more environmentally conscious, there is potential for innovative designs that incorporate eco-friendly practices.

What trends are shaping the US Modular Kitchen Market?

Trends in the US Modular Kitchen Market include the rise of open-concept layouts and the use of multifunctional furniture. Additionally, advancements in technology, such as smart appliances and integrated lighting, are influencing modern kitchen designs.

US Modular Kitchen Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cabinets, Countertops, Backsplashes, Fixtures |

| Material | Wood, Laminate, Stainless Steel, Glass |

| End User | Residential, Commercial, Hospitality, Retail |

| Installation Type | Pre-fabricated, Custom-built, Modular, DIY |

Please note: The segmentation can be entirely customized to align with our client’s needs.

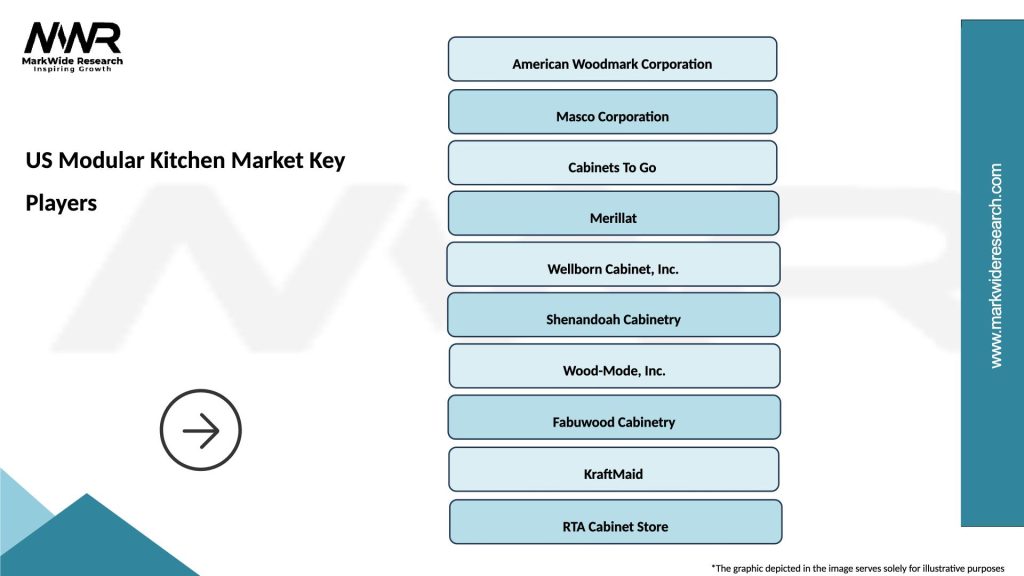

Leading companies in the US Modular Kitchen Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at