444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Mexico cross border FTL freight transport market represents a critical component of North American trade infrastructure, facilitating the movement of full truckload shipments between the United States and Mexico. This dynamic market has experienced substantial growth driven by the United States-Mexico-Canada Agreement (USMCA), increased manufacturing activities in Mexico, and the ongoing nearshoring trend that has accelerated since 2020.

Cross-border freight transportation between the US and Mexico encompasses various industries including automotive, electronics, textiles, agriculture, and consumer goods. The market has demonstrated remarkable resilience, with cross-border truck traffic growing at approximately 8.2% annually over the past five years. This growth trajectory reflects the deepening economic integration between both nations and the strategic importance of Mexico as a manufacturing hub for US companies.

Border infrastructure improvements and technological advancements in freight management systems have significantly enhanced operational efficiency. The implementation of advanced customs clearance processes, digital documentation systems, and improved border crossing facilities has reduced transit times by approximately 25% compared to previous decades. These improvements have made FTL freight transport increasingly attractive for businesses seeking reliable and cost-effective shipping solutions.

Market dynamics are influenced by seasonal agricultural shipments, manufacturing production cycles, and evolving trade policies. The automotive sector alone accounts for approximately 35% of total cross-border freight volume, highlighting the sector’s critical role in bilateral trade relationships.

The US Mexico cross border FTL freight transport market refers to the comprehensive ecosystem of full truckload shipping services that facilitate the movement of goods between the United States and Mexico through designated border crossings. This market encompasses transportation services, logistics coordination, customs clearance, and regulatory compliance activities required for international freight movement.

Full Truckload (FTL) transportation specifically involves dedicated truck capacity for single shipper loads, providing enhanced security, reduced handling, and faster transit times compared to less-than-truckload alternatives. In the cross-border context, FTL services require specialized expertise in international regulations, customs procedures, and cross-cultural business practices.

Key market participants include freight carriers, logistics service providers, customs brokers, and technology platforms that enable seamless cross-border operations. The market operates within a complex regulatory framework involving both US and Mexican transportation authorities, customs agencies, and trade compliance organizations.

Strategic market positioning of the US Mexico cross border FTL freight transport sector reflects the fundamental importance of bilateral trade relationships between North America’s largest economies. The market has evolved into a sophisticated logistics ecosystem supporting diverse industries and enabling supply chain optimization strategies for multinational corporations.

Growth acceleration has been particularly pronounced in recent years, with nearshoring initiatives driving increased demand for reliable cross-border transportation services. Manufacturing companies are increasingly relocating production facilities to Mexico to reduce supply chain risks and transportation costs, creating sustained demand for FTL freight services.

Technology integration has transformed traditional freight operations through digital platforms, real-time tracking systems, and automated customs clearance processes. These technological advances have improved operational efficiency by approximately 30% while reducing documentation errors and compliance risks.

Market consolidation trends are evident as larger logistics providers acquire specialized cross-border carriers to expand service capabilities and geographic coverage. This consolidation is creating more comprehensive service offerings while maintaining competitive pricing structures for shippers.

Fundamental market drivers reveal the strategic importance of cross-border freight transportation in supporting North American economic integration:

Economic integration between the United States and Mexico serves as the primary catalyst for cross-border FTL freight market expansion. The USMCA trade agreement has eliminated numerous trade barriers while establishing favorable conditions for increased commercial activity between both nations.

Manufacturing sector growth in Mexico has created substantial demand for inbound raw materials and components from US suppliers, while simultaneously generating outbound finished goods shipments to US markets. This bidirectional trade flow provides carriers with balanced freight opportunities and improved asset utilization rates.

Nearshoring initiatives have accelerated significantly as companies seek to reduce supply chain risks associated with distant manufacturing locations. Mexico’s proximity to major US markets, combined with competitive labor costs and established manufacturing infrastructure, has attracted substantial foreign investment in production facilities.

Infrastructure development on both sides of the border has enhanced transportation efficiency and reliability. Modern border crossing facilities, expanded highway capacity, and improved customs processing capabilities have reduced transit times and operational uncertainties that previously hindered cross-border freight movement.

Technology advancement in fleet management, cargo tracking, and customs clearance systems has streamlined operations while providing enhanced visibility for shippers. These technological improvements have reduced administrative burdens and improved service reliability, making FTL freight services more attractive to potential customers.

Regulatory complexity remains a significant challenge for cross-border FTL freight operations, as carriers must navigate dual regulatory frameworks involving both US and Mexican transportation authorities. Compliance requirements for driver qualifications, vehicle specifications, and safety standards can create operational complications and increased costs.

Border crossing delays continue to impact service reliability despite infrastructure improvements. Customs inspections, documentation verification, and security screening processes can create unpredictable transit times that affect delivery schedules and customer satisfaction levels.

Driver shortage issues affect both domestic and international freight operations, with cross-border drivers requiring additional qualifications and documentation. The specialized nature of international freight operations limits the available driver pool and can create capacity constraints during peak demand periods.

Currency fluctuation risks impact pricing strategies and profitability for carriers operating in both US dollar and Mexican peso markets. Exchange rate volatility can affect fuel costs, driver compensation, and overall operational expenses in unpredictable ways.

Security concerns related to cargo theft and border security requirements add operational complexity and costs to cross-border freight operations. Enhanced security measures, while necessary, can slow transit times and require additional administrative processes.

E-commerce expansion in Mexico presents significant growth opportunities for cross-border FTL freight providers as US retailers and manufacturers seek to serve Mexican consumers. The growing Mexican middle class and increasing internet penetration rates are driving demand for US consumer goods and creating new freight transportation requirements.

Automotive industry evolution toward electric vehicles and advanced manufacturing technologies is creating opportunities for specialized freight services. The transportation of high-value automotive components and finished vehicles requires enhanced security and handling capabilities that command premium pricing.

Cold chain logistics development for perishable goods transportation represents an underserved market segment with substantial growth potential. Increasing demand for fresh produce, pharmaceuticals, and temperature-sensitive products creates opportunities for carriers with specialized refrigerated equipment and expertise.

Digital platform integration offers opportunities for technology-forward carriers to differentiate their services through enhanced customer experiences. Real-time tracking, automated documentation, and predictive analytics capabilities can provide competitive advantages in an increasingly sophisticated market.

Sustainability initiatives are creating demand for environmentally friendly transportation solutions. Carriers investing in fuel-efficient equipment, alternative fuel technologies, and carbon offset programs can appeal to environmentally conscious shippers and potentially command premium rates.

Competitive landscape evolution reflects the market’s maturation as established logistics providers expand cross-border capabilities while specialized carriers develop comprehensive service offerings. This dynamic environment encourages innovation and service enhancement while maintaining competitive pricing pressures.

Seasonal demand fluctuations significantly impact market dynamics, with agricultural shipments creating peak demand periods during harvest seasons. Carriers must balance capacity allocation between seasonal agricultural freight and year-round manufacturing shipments to optimize revenue and asset utilization.

Fuel price volatility affects operational costs and pricing strategies throughout the market. Carriers have implemented various fuel surcharge mechanisms and hedging strategies to manage cost fluctuations while maintaining competitive pricing for customers.

Labor market conditions influence service capacity and operational costs as qualified cross-border drivers command premium compensation. The specialized skills required for international freight operations create workforce development challenges that affect market growth potential.

Regulatory changes can rapidly alter market dynamics as new safety requirements, environmental standards, or trade policies impact operational procedures and costs. Market participants must maintain flexibility to adapt to evolving regulatory environments while ensuring compliance and service continuity.

Comprehensive market analysis for the US Mexico cross border FTL freight transport sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, freight carriers, shippers, and regulatory officials to gather firsthand insights into market conditions and trends.

Secondary research components encompass analysis of government trade statistics, industry association reports, and regulatory filings to establish quantitative market foundations. This approach provides historical context and trend analysis capabilities essential for understanding market evolution patterns.

Data validation processes involve cross-referencing information from multiple sources to ensure consistency and accuracy. Industry expert consultations and peer review procedures help verify findings and identify potential data gaps or inconsistencies that require additional investigation.

Market segmentation analysis utilizes both quantitative and qualitative research techniques to identify distinct market segments and their respective characteristics. This segmentation approach enables detailed analysis of specific industry verticals, geographic regions, and service categories within the broader market context.

Texas border region dominates cross-border FTL freight activity, accounting for approximately 65% of total truck crossings between the US and Mexico. Major border crossings including Laredo, El Paso, and Brownsville serve as critical gateways for automotive, electronics, and consumer goods shipments.

California border crossings primarily handle agricultural products, with the Otay Mesa and Calexico crossings serving as important gateways for fresh produce shipments from Mexican agricultural regions. The proximity to major US population centers makes this region strategically important for perishable goods transportation.

Arizona border infrastructure supports significant freight volumes through the Nogales crossing, which specializes in agricultural and manufacturing shipments. The region’s strategic location provides efficient access to western US markets and serves as an alternative route during peak traffic periods at other border crossings.

New Mexico border operations represent a smaller but growing segment of cross-border freight activity. The Columbus crossing primarily serves regional manufacturing and agricultural shipments, with potential for expansion as trade volumes increase.

Mexican border states including Nuevo León, Chihuahua, and Baja California have developed substantial manufacturing capabilities that generate significant outbound freight volumes. These regions benefit from proximity to US markets and established transportation infrastructure that supports efficient cross-border operations.

Market leadership in the US Mexico cross border FTL freight transport sector is distributed among several categories of service providers, each offering distinct capabilities and market positioning strategies:

Industry vertical segmentation reveals distinct market characteristics and service requirements across different sectors utilizing cross-border FTL freight services:

By Industry Vertical:

By Service Type:

Automotive sector dominance in cross-border FTL freight reflects the integrated nature of North American automotive manufacturing. Just-in-time production requirements demand reliable transportation services with minimal delays, creating premium pricing opportunities for carriers that can consistently meet stringent delivery schedules.

Electronics transportation requires specialized handling procedures and enhanced security measures due to high cargo values and theft risks. Carriers serving this segment typically invest in advanced tracking systems, secure parking facilities, and trained personnel to meet customer requirements and insurance standards.

Agricultural freight seasonality creates both opportunities and challenges for cross-border carriers. Peak harvest periods generate substantial freight volumes but require significant capacity allocation, while off-season periods may result in reduced utilization rates and revenue challenges.

Consumer goods diversity provides carriers with opportunities to develop specialized expertise in different product categories. Textile shipments, household goods, and retail merchandise each have distinct handling requirements and service expectations that enable service differentiation strategies.

Industrial materials transportation often involves bulk commodities and raw materials that require specialized equipment and handling procedures. This segment typically offers stable, long-term shipping relationships but may have lower profit margins compared to higher-value manufactured goods.

Shippers benefit significantly from the competitive cross-border FTL freight market through access to reliable transportation services, competitive pricing, and enhanced supply chain flexibility. The availability of multiple service providers enables shippers to optimize transportation costs while maintaining service quality standards.

Manufacturing companies utilizing cross-border freight services can implement nearshoring strategies that reduce supply chain risks while maintaining cost competitiveness. Access to reliable transportation enables manufacturers to locate production facilities in optimal locations without compromising market access or delivery performance.

Freight carriers operating in the cross-border market can achieve higher revenue per mile compared to domestic-only operations due to the specialized nature of international freight services. The complexity of cross-border operations creates barriers to entry that help protect established carriers from excessive competition.

Economic development in border regions benefits from increased freight activity through job creation, infrastructure investment, and business development opportunities. Cross-border freight operations support numerous ancillary services including fuel, maintenance, lodging, and customs brokerage.

Technology providers serving the cross-border freight market can develop specialized solutions that command premium pricing due to the unique requirements of international transportation operations. Advanced tracking, customs clearance, and fleet management systems create value for both carriers and shippers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives are reshaping cross-border freight operations through implementation of advanced technology platforms that provide real-time visibility, automated documentation, and predictive analytics capabilities. These technological advances are improving operational efficiency by approximately 22% while reducing manual processes and human error rates.

Sustainability focus is driving carriers to invest in fuel-efficient equipment, alternative fuel technologies, and carbon reduction programs. Environmental considerations are becoming increasingly important in shipper selection criteria, creating competitive advantages for carriers with demonstrated sustainability commitments.

Service specialization trends reflect market maturation as carriers develop expertise in specific industry verticals or service categories. This specialization enables premium pricing for value-added services while creating competitive barriers through specialized knowledge and equipment investments.

Capacity optimization strategies are becoming more sophisticated as carriers utilize advanced analytics to improve asset utilization and reduce empty miles. According to MarkWide Research analysis, carriers implementing advanced capacity management systems have achieved utilization improvements of approximately 18% compared to traditional operational approaches.

Cross-border collaboration between US and Mexican carriers is increasing through partnerships and joint ventures that combine complementary capabilities and market knowledge. These collaborative arrangements enable expanded service offerings while sharing risks and operational complexities.

Infrastructure modernization projects at major border crossings have significantly improved processing capacity and reduced wait times for commercial vehicles. Recent expansions at Laredo and El Paso crossings have increased throughput capacity by approximately 40%, enabling more efficient freight movement during peak periods.

Regulatory harmonization efforts between US and Mexican transportation authorities have streamlined safety standards and driver qualification requirements. These improvements have reduced administrative burdens while maintaining safety standards, making cross-border operations more accessible for qualified carriers.

Technology platform deployments by major logistics providers have enhanced customer service capabilities through real-time tracking, automated status updates, and digital documentation systems. These platforms have improved customer satisfaction rates while reducing operational costs for participating carriers.

Merger and acquisition activity has consolidated market leadership among larger carriers while creating opportunities for specialized service providers. Recent transactions have combined complementary capabilities and expanded geographic coverage for participating companies.

Sustainability program launches by major carriers demonstrate industry commitment to environmental responsibility while meeting customer expectations for sustainable transportation solutions. These programs include fleet modernization, alternative fuel adoption, and carbon offset initiatives.

Strategic positioning recommendations for cross-border FTL freight providers emphasize the importance of developing specialized capabilities that differentiate services from commodity transportation offerings. Carriers should focus on industry vertical expertise, technology integration, and value-added services that justify premium pricing.

Technology investment priorities should focus on customer-facing platforms that provide enhanced visibility and service quality. Real-time tracking, automated documentation, and predictive analytics capabilities are becoming essential competitive requirements rather than optional enhancements.

Capacity management strategies must balance dedicated contract services with spot market flexibility to optimize revenue and asset utilization. MWR analysis suggests that carriers achieving optimal balance between contracted and spot market capacity can improve profitability by approximately 15% compared to single-strategy approaches.

Partnership development with complementary service providers can expand market reach while sharing operational risks and capital requirements. Strategic alliances with customs brokers, warehouse operators, and technology providers can create comprehensive service offerings that appeal to sophisticated shippers.

Risk management protocols should address currency fluctuations, regulatory changes, and security concerns that are inherent in cross-border operations. Carriers with comprehensive risk management strategies are better positioned to maintain service continuity and profitability during challenging market conditions.

Market expansion prospects remain favorable as nearshoring trends continue to drive manufacturing investment in Mexico and create sustained demand for cross-border transportation services. The ongoing diversification of supply chains away from distant manufacturing locations positions Mexico as a preferred alternative for US companies seeking to reduce supply chain risks.

Technology evolution will continue transforming cross-border freight operations through autonomous vehicle development, artificial intelligence applications, and blockchain-based documentation systems. These technological advances promise to further improve efficiency while reducing operational costs and human error rates.

Infrastructure development projects on both sides of the border will enhance transportation capacity and reliability. Planned improvements to border crossings, highway systems, and customs processing facilities will support continued market growth while improving service quality for shippers and carriers.

Regulatory environment evolution is expected to continue favoring increased trade integration between the US and Mexico. Ongoing harmonization efforts and trade facilitation initiatives will likely reduce operational complexities while maintaining necessary safety and security standards.

Sustainability requirements will become increasingly important as environmental regulations and customer expectations drive demand for cleaner transportation solutions. Carriers investing in sustainable technologies and practices will be better positioned to capture market share and command premium pricing in the evolving market landscape.

The US Mexico cross border FTL freight transport market represents a dynamic and strategically important sector that facilitates critical trade relationships between North America’s largest economies. Market growth prospects remain strong, supported by nearshoring trends, manufacturing expansion in Mexico, and continued economic integration under the USMCA trade agreement.

Competitive dynamics favor carriers that can provide reliable, technology-enhanced services while navigating the complexities of international freight operations. Success in this market requires specialized expertise, strategic partnerships, and ongoing investment in technology and infrastructure capabilities that differentiate services from commodity transportation offerings.

Future market evolution will be shaped by technological advancement, sustainability requirements, and continued infrastructure development that enhances operational efficiency and service reliability. Carriers and logistics providers that adapt to these evolving requirements while maintaining operational excellence will be best positioned to capture growth opportunities and achieve sustainable competitive advantages in this essential market segment.

What is US Mexico Cross Border FTL Freight Transport?

US Mexico Cross Border FTL Freight Transport refers to the logistics and transportation services that facilitate the movement of full truckload freight across the border between the United States and Mexico. This includes various types of goods, such as consumer products, automotive parts, and agricultural products.

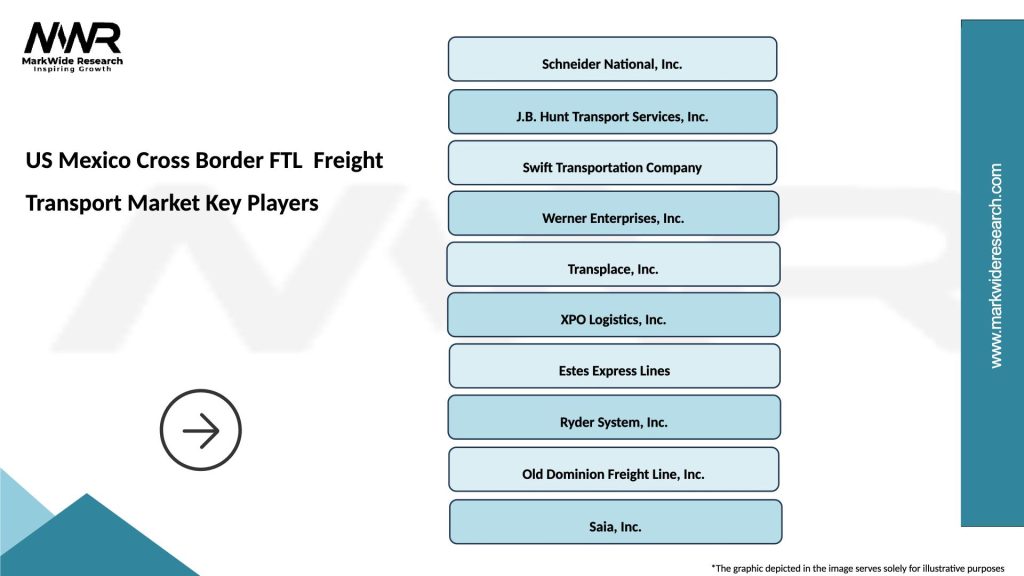

What are the key players in the US Mexico Cross Border FTL Freight Transport Market?

Key players in the US Mexico Cross Border FTL Freight Transport Market include companies like Schneider National, J.B. Hunt Transport Services, and C.H. Robinson, which provide extensive logistics and transportation solutions. These companies are known for their cross-border expertise and efficient supply chain management, among others.

What are the growth factors driving the US Mexico Cross Border FTL Freight Transport Market?

The growth of the US Mexico Cross Border FTL Freight Transport Market is driven by increasing trade volumes between the two countries, the rise of e-commerce, and the demand for just-in-time delivery services. Additionally, improvements in infrastructure and trade agreements also contribute to market expansion.

What challenges does the US Mexico Cross Border FTL Freight Transport Market face?

Challenges in the US Mexico Cross Border FTL Freight Transport Market include regulatory compliance issues, border delays, and fluctuating fuel prices. These factors can impact delivery times and operational costs for logistics providers.

What opportunities exist in the US Mexico Cross Border FTL Freight Transport Market?

Opportunities in the US Mexico Cross Border FTL Freight Transport Market include the potential for technological advancements in logistics, such as automation and real-time tracking systems. Additionally, expanding trade agreements and increasing demand for cross-border e-commerce present significant growth prospects.

What trends are shaping the US Mexico Cross Border FTL Freight Transport Market?

Trends in the US Mexico Cross Border FTL Freight Transport Market include the adoption of digital freight platforms, a focus on sustainability in logistics, and the increasing use of data analytics for route optimization. These trends are transforming how freight is managed and delivered across borders.

US Mexico Cross Border FTL Freight Transport Market

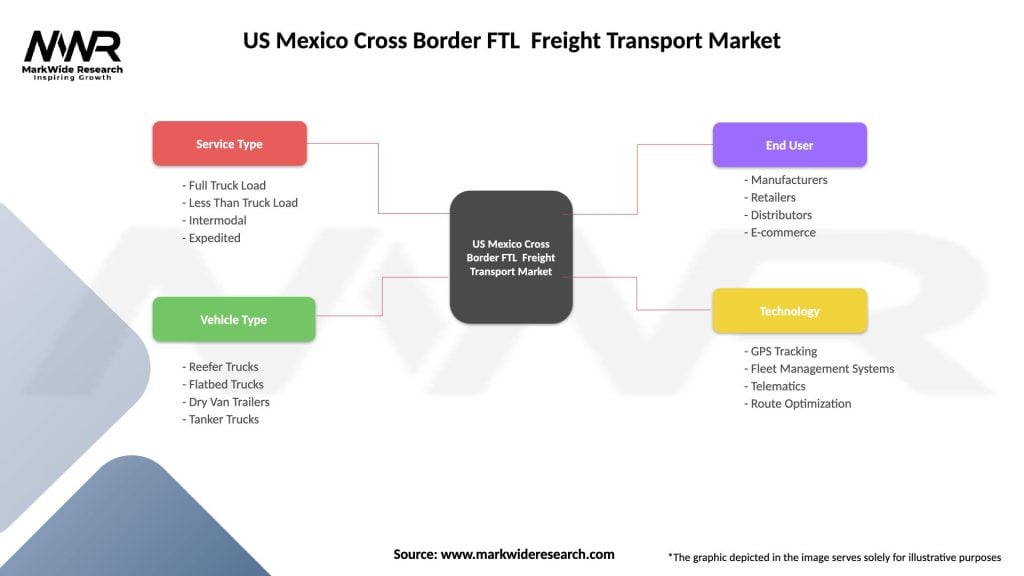

| Segmentation Details | Description |

|---|---|

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Expedited |

| Vehicle Type | Reefer Trucks, Flatbed Trucks, Dry Van Trailers, Tanker Trucks |

| End User | Manufacturers, Retailers, Distributors, E-commerce |

| Technology | GPS Tracking, Fleet Management Systems, Telematics, Route Optimization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Mexico Cross Border FTL Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at