444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US marketing analytics services market represents a rapidly evolving landscape where data-driven decision making has become the cornerstone of successful marketing strategies. This dynamic sector encompasses comprehensive analytical solutions that enable businesses to measure, analyze, and optimize their marketing performance across multiple channels and touchpoints. Marketing analytics services have transformed from basic reporting tools into sophisticated platforms that leverage artificial intelligence, machine learning, and advanced statistical modeling to deliver actionable insights.

Current market dynamics indicate robust growth driven by increasing digital transformation initiatives and the proliferation of customer data across various touchpoints. Organizations are investing heavily in analytics capabilities to understand customer behavior, optimize marketing spend, and improve return on investment. The market demonstrates strong momentum with a projected CAGR of 12.3% through the forecast period, reflecting the critical importance of data-driven marketing strategies in today’s competitive business environment.

Technology advancement continues to reshape the marketing analytics landscape, with cloud-based solutions gaining significant traction among enterprises of all sizes. The integration of predictive analytics, real-time data processing, and automated reporting capabilities has elevated the strategic value of marketing analytics services, making them indispensable for modern marketing operations.

The marketing analytics services market refers to the comprehensive ecosystem of tools, platforms, and professional services designed to collect, process, analyze, and interpret marketing data to drive strategic decision-making and optimize marketing performance across all channels and customer touchpoints.

Marketing analytics services encompass a broad spectrum of capabilities including customer segmentation, campaign performance measurement, attribution modeling, predictive analytics, and marketing mix optimization. These services enable organizations to transform raw marketing data into actionable insights that drive revenue growth, improve customer acquisition and retention, and enhance overall marketing effectiveness.

Service providers in this market offer various solutions ranging from basic reporting and dashboard creation to advanced predictive modeling and artificial intelligence-powered analytics. The services typically include data integration, visualization, statistical analysis, and strategic consulting to help organizations maximize their marketing investments and achieve measurable business outcomes.

Market expansion in the US marketing analytics services sector is being driven by the increasing complexity of customer journeys and the need for sophisticated measurement capabilities. Organizations across industries are recognizing that traditional marketing metrics are insufficient for understanding modern consumer behavior and optimizing multi-channel marketing strategies.

Digital transformation initiatives have accelerated the adoption of advanced analytics solutions, with companies seeking to leverage big data and artificial intelligence to gain competitive advantages. The market is characterized by strong demand for real-time analytics, predictive modeling, and automated reporting capabilities that enable marketers to make data-driven decisions quickly and effectively.

Key growth drivers include the proliferation of digital marketing channels, increasing customer data volume, and the growing emphasis on marketing accountability and ROI measurement. Organizations are investing approximately 23% more in analytics capabilities compared to previous years, reflecting the strategic importance of data-driven marketing approaches.

Service innovation continues to evolve with the integration of machine learning algorithms, natural language processing, and automated insights generation. These technological advancements are making marketing analytics more accessible to non-technical users while providing deeper insights into customer behavior and campaign performance.

Strategic insights from the US marketing analytics services market reveal several critical trends shaping the industry’s future direction:

Market maturation is evident in the increasing sophistication of analytics requirements and the growing demand for specialized expertise in areas such as attribution modeling, customer lifetime value analysis, and marketing mix optimization.

Digital transformation acceleration serves as the primary catalyst for marketing analytics services adoption across US enterprises. Organizations are generating unprecedented volumes of customer data through digital channels, creating both opportunities and challenges for marketing teams seeking to extract actionable insights from complex datasets.

Customer experience optimization has become a strategic imperative, driving demand for advanced analytics capabilities that enable personalized marketing approaches. Companies are investing in analytics solutions to understand customer preferences, predict behavior, and deliver targeted experiences that drive engagement and loyalty.

Marketing accountability requirements continue to intensify as organizations seek to demonstrate clear return on investment for marketing expenditures. Advanced analytics services provide the measurement capabilities necessary to track performance, optimize campaigns, and justify marketing budgets to executive leadership.

Competitive pressure in digital markets is compelling organizations to leverage data-driven insights for strategic advantage. Companies utilizing sophisticated marketing analytics report 18% higher customer acquisition rates compared to those relying on traditional measurement approaches.

Regulatory compliance needs are driving adoption of privacy-compliant analytics solutions that enable effective marketing measurement while adhering to data protection regulations. This requirement is particularly important for organizations operating in highly regulated industries or handling sensitive customer information.

Implementation complexity represents a significant barrier to marketing analytics adoption, particularly for organizations lacking technical expertise or adequate data infrastructure. The integration of multiple data sources, establishment of proper data governance, and development of analytical capabilities require substantial time and resource investments.

Data quality challenges continue to impede effective analytics implementation, with many organizations struggling to maintain clean, consistent, and accurate data across multiple systems. Poor data quality can undermine analytics accuracy and lead to misguided strategic decisions.

Skills shortage in the analytics domain poses ongoing challenges for organizations seeking to maximize their marketing analytics investments. The demand for qualified data scientists, analysts, and marketing technologists significantly exceeds supply, creating talent acquisition and retention difficulties.

Privacy regulations and changing data collection practices are creating uncertainty around analytics capabilities and measurement accuracy. Organizations must navigate complex regulatory requirements while maintaining effective marketing measurement and optimization capabilities.

Cost considerations can limit adoption, particularly among smaller organizations with constrained budgets. The total cost of ownership for comprehensive marketing analytics solutions, including technology, personnel, and ongoing maintenance, can be substantial and may require significant upfront investments.

Artificial intelligence integration presents substantial growth opportunities for marketing analytics service providers. The incorporation of machine learning algorithms, natural language processing, and automated insights generation can significantly enhance the value proposition of analytics solutions while reducing the technical expertise required for effective utilization.

Small and medium enterprise expansion represents an underserved market segment with significant growth potential. The development of cost-effective, easy-to-implement analytics solutions tailored for SME requirements could unlock substantial market opportunities.

Industry-specific solutions offer opportunities for specialization and differentiation in the competitive analytics services market. Providers developing deep expertise in specific verticals such as healthcare, financial services, or retail can command premium pricing and build strong customer relationships.

Real-time analytics capabilities are becoming increasingly important as organizations seek to respond quickly to market changes and customer behavior. Service providers that can deliver instant insights and automated decision-making capabilities will be well-positioned for growth.

Privacy-first analytics solutions present opportunities for providers that can deliver effective measurement capabilities while ensuring compliance with evolving data protection regulations. Organizations are actively seeking analytics partners that can navigate the complex privacy landscape while maintaining measurement accuracy.

Technological evolution continues to reshape the marketing analytics landscape, with cloud computing, artificial intelligence, and advanced statistical modeling driving innovation and capability expansion. These technological advances are making sophisticated analytics more accessible while reducing implementation complexity and costs.

Customer expectations for personalized experiences are driving demand for advanced segmentation and targeting capabilities. Organizations require analytics solutions that can process large volumes of customer data in real-time to deliver relevant, timely marketing messages across multiple channels.

Competitive intensity among analytics service providers is fostering innovation and driving down costs while improving solution quality. This dynamic market environment benefits customers through expanded capabilities, better pricing, and enhanced service offerings.

Data ecosystem complexity is increasing as organizations utilize more marketing channels and collect customer information from diverse touchpoints. Analytics services must evolve to handle this complexity while providing unified views of customer behavior and campaign performance.

Regulatory landscape changes are influencing analytics practices and solution development, with providers adapting their offerings to ensure compliance while maintaining measurement effectiveness. Organizations report that 34% of analytics initiatives now include specific privacy compliance requirements from the outset.

Comprehensive market analysis for the US marketing analytics services sector employed a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporated quantitative and qualitative data collection techniques to ensure robust market insights and accurate trend identification.

Primary research activities included structured interviews with marketing analytics service providers, enterprise customers, and industry experts. These interviews provided valuable insights into market dynamics, customer requirements, competitive positioning, and future growth prospects across different market segments.

Secondary research sources encompassed industry reports, company financial statements, technology vendor documentation, and regulatory filings. This comprehensive data collection approach ensured thorough market coverage and validation of primary research findings.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews for clarification, and employing statistical analysis techniques to ensure data accuracy and reliability. The research methodology adhered to established market research standards and best practices.

Market sizing and forecasting utilized advanced statistical modeling techniques incorporating historical trends, current market conditions, and forward-looking indicators. The analysis considered various growth scenarios and market development factors to provide accurate projections and strategic insights.

Geographic distribution of the US marketing analytics services market reveals significant concentration in major metropolitan areas with strong technology and business services sectors. The Northeast region, particularly the New York and Boston metropolitan areas, accounts for approximately 28% of market activity, driven by the presence of major financial services, media, and technology companies.

West Coast dominance is evident with California leading market adoption, representing roughly 35% of total market demand. The concentration of technology companies, digital marketing agencies, and innovative enterprises in Silicon Valley and Los Angeles drives sophisticated analytics requirements and early adoption of advanced solutions.

Southeast region growth is accelerating, with states like Florida, Georgia, and North Carolina experiencing increased demand for marketing analytics services. This growth is driven by business relocations, expanding technology sectors, and increasing recognition of analytics importance among traditional industries.

Midwest market development shows steady progress with Chicago, Detroit, and Minneapolis emerging as significant analytics hubs. The region’s strong manufacturing and financial services sectors are driving demand for specialized analytics solutions tailored to traditional industry requirements.

Southwest expansion is notable in Texas and Arizona markets, where growing technology sectors and business-friendly environments are attracting companies seeking advanced marketing analytics capabilities. The region demonstrates 15% higher growth rates compared to national averages in analytics services adoption.

Market leadership in the US marketing analytics services sector is characterized by a diverse ecosystem of established technology vendors, specialized analytics firms, and emerging startups offering innovative solutions. The competitive environment fosters continuous innovation and service enhancement.

Competitive differentiation strategies focus on specialized capabilities, industry expertise, ease of use, and integration with existing marketing technology stacks. Service providers are investing heavily in artificial intelligence, machine learning, and automated insights generation to maintain competitive advantages.

Market consolidation trends are evident through strategic acquisitions and partnerships as larger technology companies seek to expand their analytics capabilities and market reach. This consolidation is creating more comprehensive solution offerings while potentially reducing competitive options for customers.

Service type segmentation reveals distinct categories within the marketing analytics services market, each addressing specific customer requirements and use cases:

By Service Type:

By Deployment Model:

By Organization Size:

Descriptive analytics services continue to represent the largest market segment, accounting for approximately 42% of total market demand. These services focus on historical data analysis, reporting, and dashboard creation, providing organizations with essential insights into past marketing performance and customer behavior patterns.

Predictive analytics adoption is accelerating rapidly as organizations seek to anticipate customer behavior and optimize future marketing strategies. This segment demonstrates the highest growth rate, with organizations increasingly investing in machine learning and statistical modeling capabilities to gain competitive advantages.

Real-time analytics demand is driving innovation in data processing and visualization technologies. Organizations require instant insights to respond quickly to market changes, optimize campaign performance, and deliver personalized customer experiences across digital channels.

Customer journey analytics represents an emerging high-growth category as organizations seek to understand complete customer lifecycles and optimize touchpoint interactions. These services provide comprehensive views of customer behavior across multiple channels and devices.

Attribution modeling services are gaining importance as marketing becomes increasingly complex and multi-channel. Organizations need sophisticated measurement capabilities to understand the true impact of different marketing activities and optimize budget allocation accordingly.

Marketing organizations benefit significantly from advanced analytics services through improved campaign performance, better customer targeting, and enhanced return on investment measurement. These capabilities enable data-driven decision making and strategic optimization of marketing activities across all channels.

Customer experience enhancement represents a major benefit as analytics services enable personalized marketing approaches based on individual customer preferences and behavior patterns. Organizations can deliver more relevant, timely marketing messages that improve engagement and conversion rates.

Operational efficiency gains result from automated reporting, real-time monitoring, and predictive insights that reduce manual analysis requirements. Marketing teams can focus on strategic activities rather than data collection and basic reporting tasks.

Competitive advantage development occurs through access to sophisticated analytics capabilities that were previously available only to large enterprises with substantial technical resources. Advanced analytics democratization enables smaller organizations to compete more effectively in digital markets.

Risk mitigation benefits include improved fraud detection, better customer churn prediction, and enhanced campaign performance monitoring. Organizations can identify and address potential issues before they impact business results or customer relationships.

Stakeholder value creation extends to investors, partners, and customers through improved business performance, enhanced customer satisfaction, and stronger competitive positioning in the marketplace.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming marketing analytics services through automated insights generation, predictive modeling, and natural language processing capabilities. Organizations are increasingly adopting AI-powered solutions that reduce the technical expertise required for effective analytics utilization.

Real-time analytics adoption continues to accelerate as organizations seek instant insights for rapid decision making and campaign optimization. This trend is driving innovation in data processing technologies and streaming analytics capabilities.

Privacy-first analytics approaches are gaining prominence as organizations navigate complex regulatory requirements while maintaining effective measurement capabilities. Service providers are developing innovative solutions that balance privacy protection with analytics effectiveness.

Self-service analytics tools are becoming increasingly popular as organizations seek to democratize data access and reduce dependence on technical specialists. User-friendly interfaces and automated insights generation are making analytics more accessible to non-technical marketers.

Cross-channel attribution modeling is evolving to address the complexity of modern customer journeys spanning multiple devices and touchpoints. Advanced statistical techniques and machine learning algorithms are improving attribution accuracy and strategic insights.

Customer journey analytics focus is intensifying as organizations seek comprehensive understanding of customer lifecycles and touchpoint optimization opportunities. According to MarkWide Research analysis, organizations implementing comprehensive customer journey analytics report 26% improvement in customer retention rates.

Technology partnerships between analytics service providers and major cloud platforms are expanding solution capabilities and improving integration options. These collaborations are creating more comprehensive offerings while reducing implementation complexity for customers.

Acquisition activity continues as larger technology companies seek to expand their analytics capabilities through strategic purchases of specialized providers. This consolidation trend is creating more integrated solution offerings while potentially reducing competitive options.

Regulatory compliance enhancements are driving product development as service providers adapt their offerings to meet evolving data protection requirements. These developments include enhanced privacy controls, data governance features, and compliance reporting capabilities.

Industry-specific solutions are emerging as providers develop specialized expertise and tailored offerings for specific vertical markets. Healthcare, financial services, and retail sectors are seeing particularly strong development in specialized analytics solutions.

Open-source integration is increasing as organizations seek to leverage existing analytics investments and avoid vendor lock-in. Service providers are developing solutions that integrate with popular open-source analytics tools and frameworks.

Mobile analytics advancement reflects the growing importance of mobile marketing channels and the need for specialized measurement capabilities. Enhanced mobile attribution, in-app analytics, and cross-device tracking are key development areas.

Investment prioritization should focus on cloud-based solutions that offer scalability, cost-effectiveness, and rapid deployment capabilities. Organizations should evaluate providers based on integration capabilities, ease of use, and long-term strategic alignment rather than solely on feature sets.

Skills development initiatives are critical for maximizing analytics investments and ensuring successful implementation. Organizations should invest in training programs, hire qualified personnel, and consider partnerships with analytics service providers for ongoing support and expertise.

Data governance establishment should precede major analytics investments to ensure data quality, consistency, and compliance with regulatory requirements. Proper data foundation is essential for effective analytics implementation and accurate insights generation.

Vendor selection criteria should emphasize long-term viability, integration capabilities, and industry expertise rather than focusing solely on current feature offerings. Organizations should evaluate providers’ roadmaps, financial stability, and commitment to ongoing innovation.

Pilot program implementation is recommended for organizations new to advanced analytics, allowing for learning, refinement, and gradual scaling of capabilities. Starting with focused use cases enables organizations to demonstrate value and build internal expertise before broader deployment.

Privacy compliance planning should be integrated into all analytics initiatives from the outset, ensuring solutions meet current and anticipated regulatory requirements. MWR research indicates that organizations addressing privacy compliance proactively experience 31% fewer implementation delays and regulatory challenges.

Market evolution in the US marketing analytics services sector points toward continued growth driven by increasing data volumes, advancing artificial intelligence capabilities, and growing recognition of analytics importance for competitive success. The market is expected to maintain robust expansion with a projected CAGR of 14.2% over the next five years.

Technology advancement will continue to reshape the analytics landscape through improved artificial intelligence integration, enhanced real-time processing capabilities, and more sophisticated predictive modeling techniques. These developments will make advanced analytics more accessible while increasing the strategic value of insights generated.

Industry specialization is expected to increase as service providers develop deeper expertise in specific vertical markets and use cases. This specialization will enable more targeted solutions and higher value propositions for customers in specific industries.

Privacy-compliant solutions will become increasingly important as regulatory requirements evolve and consumer privacy expectations continue to rise. Service providers that successfully balance privacy protection with analytics effectiveness will gain significant competitive advantages.

Small business adoption is projected to accelerate as cost-effective, easy-to-use analytics solutions become more widely available. This expansion will significantly broaden the market opportunity and drive overall sector growth.

Integration ecosystem development will continue as organizations seek comprehensive marketing technology stacks with seamless data flow and unified reporting capabilities. Analytics services that integrate effectively with existing systems will be better positioned for success in the evolving market landscape.

The US marketing analytics services market represents a dynamic and rapidly evolving sector that has become essential for modern marketing success. Organizations across industries are recognizing the critical importance of data-driven decision making and investing heavily in advanced analytics capabilities to gain competitive advantages and optimize marketing performance.

Market growth prospects remain strong, driven by increasing data volumes, advancing artificial intelligence technologies, and growing recognition of analytics importance for business success. The sector is well-positioned for continued expansion as organizations seek to leverage sophisticated measurement and optimization capabilities.

Technology innovation continues to reshape the analytics landscape, making advanced capabilities more accessible while increasing the strategic value of insights generated. The integration of artificial intelligence, machine learning, and real-time processing capabilities is transforming how organizations approach marketing measurement and optimization.

Strategic considerations for market participants include the importance of privacy compliance, skills development, and technology integration in successful analytics implementation. Organizations that address these factors proactively will be better positioned to maximize their analytics investments and achieve sustainable competitive advantages in the evolving digital marketplace.

What is Marketing Analytics Services?

Marketing Analytics Services refer to the systematic analysis of data related to marketing activities, helping businesses understand consumer behavior, optimize marketing strategies, and improve ROI. These services encompass various techniques and tools for data collection, analysis, and reporting.

What are the key players in the US Marketing Analytics Services Market?

Key players in the US Marketing Analytics Services Market include companies like Adobe, IBM, Salesforce, and Google, which provide advanced analytics solutions and platforms for businesses to enhance their marketing efforts and customer engagement.

What are the main drivers of growth in the US Marketing Analytics Services Market?

The growth of the US Marketing Analytics Services Market is driven by the increasing demand for data-driven decision-making, the rise of digital marketing channels, and the need for personalized customer experiences. Businesses are leveraging analytics to gain insights into consumer preferences and optimize their marketing strategies.

What challenges does the US Marketing Analytics Services Market face?

The US Marketing Analytics Services Market faces challenges such as data privacy concerns, the complexity of integrating various data sources, and the need for skilled professionals to interpret analytics. These factors can hinder the effective implementation of marketing analytics strategies.

What opportunities exist in the US Marketing Analytics Services Market?

Opportunities in the US Marketing Analytics Services Market include the growing adoption of artificial intelligence and machine learning for predictive analytics, the expansion of e-commerce, and the increasing focus on customer experience management. These trends present avenues for innovation and service enhancement.

What trends are shaping the US Marketing Analytics Services Market?

Trends shaping the US Marketing Analytics Services Market include the rise of real-time analytics, the integration of social media data into marketing strategies, and the emphasis on customer journey mapping. These trends are helping businesses to better understand and engage with their target audiences.

US Marketing Analytics Services Market

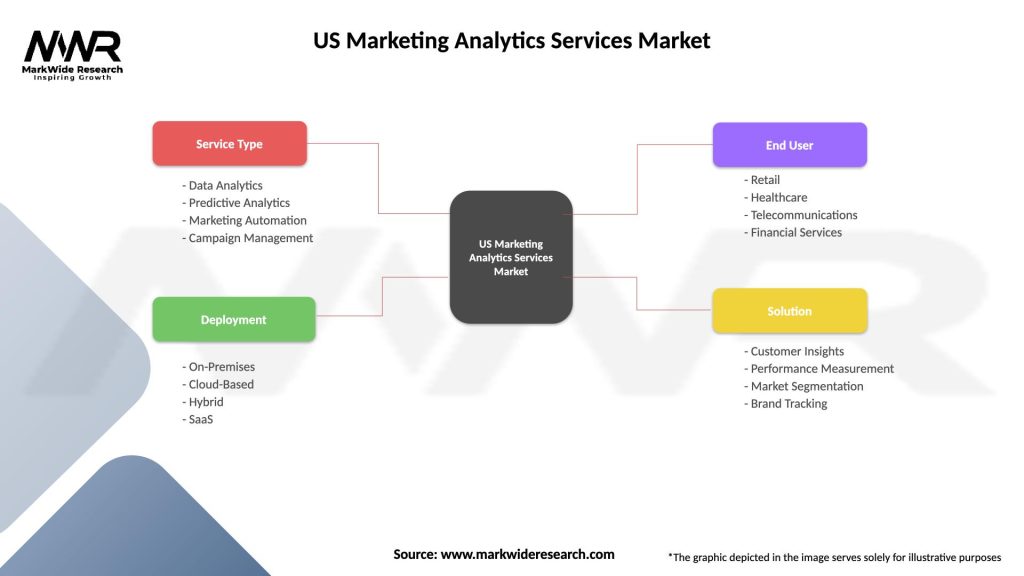

| Segmentation Details | Description |

|---|---|

| Service Type | Data Analytics, Predictive Analytics, Marketing Automation, Campaign Management |

| Deployment | On-Premises, Cloud-Based, Hybrid, SaaS |

| End User | Retail, Healthcare, Telecommunications, Financial Services |

| Solution | Customer Insights, Performance Measurement, Market Segmentation, Brand Tracking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Marketing Analytics Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at