444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Maintenance Repair and Operations (MRO) market represents a critical segment of the industrial supply chain, encompassing all products and services required to maintain operational efficiency across manufacturing, aerospace, automotive, and infrastructure sectors. This comprehensive market includes everything from basic consumables and spare parts to sophisticated predictive maintenance technologies and specialized repair services.

Market dynamics indicate robust growth driven by increasing industrial automation, aging infrastructure, and the rising adoption of predictive maintenance strategies. The sector has experienced significant transformation with the integration of Internet of Things (IoT) technologies, artificial intelligence, and data analytics, fundamentally changing how organizations approach maintenance operations.

Industrial sectors across the United States are increasingly recognizing the strategic importance of efficient MRO operations in maintaining competitive advantage. The market encompasses diverse product categories including electrical components, mechanical parts, safety equipment, cleaning supplies, and cutting tools, serving industries ranging from manufacturing and energy to healthcare and transportation.

Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 4.2% through the forecast period, driven by technological advancements and increasing focus on operational efficiency. The shift toward digital transformation and smart manufacturing is creating new opportunities for MRO suppliers and service providers to deliver enhanced value propositions.

The US Maintenance Repair and Operations (MRO) market refers to the comprehensive ecosystem of products, services, and solutions required to maintain, repair, and operate industrial facilities, equipment, and infrastructure across various sectors of the American economy.

MRO encompasses a broad spectrum of activities and materials that are not directly incorporated into finished products but are essential for maintaining operational continuity. This includes routine maintenance supplies, emergency repair components, safety equipment, facility management products, and specialized services that ensure equipment reliability and workplace safety.

The market definition extends beyond traditional spare parts and consumables to include advanced technologies such as condition monitoring systems, predictive analytics platforms, and digital maintenance management solutions. Modern MRO operations integrate physical products with digital services to optimize asset performance and minimize unplanned downtime.

Strategic importance of MRO lies in its direct impact on operational efficiency, safety compliance, and cost management across industrial operations. Organizations typically allocate 3-5% of their annual revenue to MRO activities, making it a significant component of operational expenditure and a critical area for optimization and strategic sourcing.

The US MRO market demonstrates remarkable resilience and growth potential, supported by diverse industrial sectors and evolving technological capabilities. Key market drivers include increasing industrial automation, aging infrastructure requiring enhanced maintenance, and growing emphasis on predictive maintenance strategies that reduce operational costs and improve equipment reliability.

Market segmentation reveals significant opportunities across multiple categories, with electrical and electronic components representing the largest segment, followed by mechanical components and safety equipment. The aerospace and defense sector continues to be a major consumer of specialized MRO products and services, accounting for approximately 22% of total market demand.

Digital transformation is reshaping the MRO landscape, with companies increasingly adopting cloud-based maintenance management systems, IoT-enabled monitoring solutions, and AI-powered predictive analytics. These technologies are enabling more efficient inventory management, reduced downtime, and improved maintenance scheduling across industrial operations.

Competitive dynamics show a fragmented market structure with numerous regional and national suppliers competing alongside global industrial distributors. The market benefits from strong relationships between suppliers and end-users, with many organizations preferring long-term partnerships that provide comprehensive MRO solutions and technical support.

Future outlook indicates continued growth driven by infrastructure modernization, increasing regulatory compliance requirements, and the ongoing shift toward proactive maintenance strategies. The integration of advanced technologies and sustainability initiatives will likely create new market segments and business models within the MRO ecosystem.

Strategic market insights reveal several critical trends shaping the US MRO landscape and creating opportunities for growth and innovation:

Industrial automation expansion serves as a primary driver for MRO market growth, as automated systems require specialized maintenance products and services to ensure optimal performance. The increasing complexity of manufacturing equipment and production systems creates demand for sophisticated diagnostic tools, specialized lubricants, and precision components that support automated operations.

Infrastructure aging across the United States presents significant opportunities for MRO suppliers, as facilities built decades ago require enhanced maintenance to meet modern operational standards. This includes upgrading electrical systems, replacing mechanical components, and implementing new safety measures that comply with current regulations and industry best practices.

Predictive maintenance adoption is accelerating across industries, driven by the potential to reduce maintenance costs by 20-30% while improving equipment reliability. Organizations are investing in condition monitoring systems, vibration analysis equipment, and thermal imaging technologies that enable proactive maintenance strategies and prevent costly equipment failures.

Regulatory compliance requirements continue to drive demand for specialized MRO products and services, particularly in highly regulated industries such as aerospace, pharmaceuticals, and food processing. Companies must maintain detailed maintenance records, use certified components, and follow specific procedures that require specialized products and documentation systems.

Cost optimization pressures are encouraging organizations to adopt more strategic approaches to MRO procurement and management. This includes implementing vendor consolidation programs, negotiating long-term contracts, and utilizing technology solutions that improve inventory management and reduce total cost of ownership for maintenance operations.

Supply chain disruptions continue to challenge MRO operations, with component shortages and extended lead times affecting maintenance schedules and operational continuity. The complexity of global supply chains and dependence on specialized suppliers creates vulnerabilities that can impact critical maintenance activities and increase operational risks.

High implementation costs associated with advanced MRO technologies can limit adoption, particularly among smaller organizations with constrained budgets. The initial investment required for predictive maintenance systems, digital platforms, and training programs may deter some companies from upgrading their maintenance capabilities despite long-term benefits.

Skills shortage challenges affect the MRO market as experienced maintenance professionals retire and younger workers may lack specialized technical knowledge. This skills gap can limit the effective utilization of advanced maintenance technologies and create dependencies on external service providers for complex maintenance tasks.

Inventory management complexity presents ongoing challenges for MRO operations, as organizations must balance the need for parts availability with inventory carrying costs. The diverse nature of MRO products, varying demand patterns, and long shelf life considerations make inventory optimization particularly challenging for many organizations.

Technology integration difficulties can slow the adoption of digital MRO solutions, particularly in organizations with legacy systems and established processes. The complexity of integrating new technologies with existing maintenance management systems and operational workflows can create implementation barriers and resistance to change.

Digital transformation initiatives present substantial opportunities for MRO suppliers to develop innovative solutions that combine physical products with digital services. The integration of IoT sensors, cloud-based analytics, and mobile applications creates new business models and value propositions that can differentiate suppliers in competitive markets.

Sustainability initiatives are creating demand for environmentally friendly MRO products and circular economy solutions. Organizations are increasingly seeking suppliers that offer recycled components, biodegradable lubricants, and take-back programs that support their environmental goals and regulatory compliance requirements.

Industry 4.0 adoption is driving demand for smart maintenance solutions that integrate with manufacturing execution systems and enterprise resource planning platforms. This creates opportunities for MRO suppliers to develop connected products and services that provide real-time visibility into maintenance operations and asset performance.

Outsourcing trends are creating opportunities for specialized MRO service providers to offer comprehensive maintenance solutions that allow organizations to focus on core business activities. This includes vendor-managed inventory programs, on-site maintenance services, and integrated supply chain solutions that reduce operational complexity.

Emerging technologies such as augmented reality, artificial intelligence, and robotics are creating new categories of MRO products and services. These technologies enable remote diagnostics, automated maintenance procedures, and enhanced training programs that improve maintenance efficiency and safety outcomes.

Competitive dynamics within the US MRO market reflect a complex ecosystem of manufacturers, distributors, and service providers competing across multiple segments and customer types. The market structure includes global industrial suppliers, regional distributors, and specialized niche providers that serve specific industries or product categories with tailored solutions and expertise.

Customer behavior patterns are evolving as organizations adopt more strategic approaches to MRO procurement and management. End-users increasingly prefer suppliers that offer comprehensive solutions, technical support, and digital tools that simplify procurement processes and improve operational efficiency. The shift toward long-term partnerships and vendor consolidation is reshaping supplier relationships and competitive positioning.

Technology integration is fundamentally changing market dynamics, with digital platforms enabling new business models and service delivery methods. E-commerce adoption has reached 35% of total MRO transactions, while mobile applications and cloud-based systems are improving accessibility and user experience for maintenance professionals and procurement teams.

Price sensitivity varies significantly across market segments, with commodity products experiencing intense price competition while specialized and technical products command premium pricing. Organizations are increasingly focused on total cost of ownership rather than initial purchase price, creating opportunities for suppliers that can demonstrate value through improved reliability, efficiency, and service support.

Innovation cycles are accelerating as suppliers invest in research and development to create differentiated products and services. The integration of smart technologies, sustainable materials, and advanced manufacturing techniques is enabling new product categories and performance capabilities that address evolving customer requirements and regulatory standards.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to provide accurate and actionable insights into the US MRO market. The research framework incorporates quantitative data analysis, qualitative assessments, and industry expert consultations to ensure comprehensive market coverage and reliable findings.

Primary research activities included structured interviews with industry executives, procurement professionals, and maintenance managers across key sectors including manufacturing, aerospace, energy, and transportation. These interviews provided insights into purchasing behaviors, technology adoption trends, and emerging market requirements that shape MRO demand patterns and supplier selection criteria.

Secondary research sources encompassed industry publications, government databases, trade association reports, and company financial statements to gather comprehensive market data and validate primary research findings. This approach ensures data accuracy and provides historical context for market trends and competitive dynamics analysis.

Market segmentation analysis utilized statistical modeling techniques to identify key market segments, growth opportunities, and competitive positioning factors. The analysis considered multiple variables including product categories, end-user industries, geographic regions, and technology adoption levels to provide detailed market insights and forecasts.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews, and utilizing industry benchmarks to ensure research accuracy and reliability. The methodology incorporates continuous monitoring of market developments and regular updates to maintain current and relevant market intelligence for stakeholders and decision-makers.

Geographic distribution of the US MRO market reflects the concentration of industrial activity and infrastructure across different regions, with distinct patterns of demand and supplier presence that influence market dynamics and growth opportunities.

Midwest region dominates MRO market activity, accounting for approximately 32% of total market demand, driven by the concentration of manufacturing facilities, automotive production, and heavy industry operations. States like Michigan, Ohio, and Illinois represent major consumption centers with established supplier networks and distribution infrastructure that support diverse industrial sectors.

Southeast region demonstrates strong growth potential with expanding manufacturing base, aerospace industry presence, and energy sector development. The region benefits from favorable business conditions, skilled workforce availability, and strategic location advantages that attract industrial investment and create demand for comprehensive MRO solutions and services.

West Coast markets show distinct characteristics with emphasis on technology integration, sustainability initiatives, and specialized industry requirements. California’s diverse industrial base, including aerospace, technology, and food processing sectors, creates demand for advanced MRO solutions and environmentally friendly products that meet stringent regulatory requirements.

Northeast corridor maintains significant MRO market presence through established industrial infrastructure, pharmaceutical manufacturing, and energy sector operations. The region’s mature industrial base creates steady demand for replacement parts, upgrade components, and specialized maintenance services that support aging facilities and equipment systems.

Texas and Gulf Coast regions represent major growth areas driven by energy sector expansion, petrochemical industry development, and aerospace manufacturing presence. The concentration of refineries, chemical plants, and energy infrastructure creates substantial demand for specialized MRO products and services that meet industry-specific requirements and safety standards.

Market leadership in the US MRO sector is distributed among several categories of suppliers, each serving different market segments with distinct value propositions and competitive advantages:

Competitive strategies vary across market participants, with larger distributors focusing on comprehensive product portfolios, digital platforms, and supply chain efficiency, while smaller specialists emphasize technical expertise, customer relationships, and niche market knowledge. The competitive landscape continues to evolve with consolidation activities and technology investments that reshape market dynamics.

Product category segmentation reveals the diverse nature of the MRO market and distinct growth patterns across different product types:

By Product Type:

By End-User Industry:

By Distribution Channel:

Electrical components category represents the largest segment within the MRO market, driven by increasing industrial automation and the need for reliable electrical infrastructure. This category includes motors, drives, controls, and power distribution equipment that are essential for modern manufacturing operations. Growth in this segment is supported by the ongoing digital transformation of industrial facilities and the adoption of smart manufacturing technologies.

Mechanical components segment maintains steady demand across diverse industrial applications, with bearings, belts, and transmission components representing core maintenance requirements. The segment benefits from equipment modernization trends and the need to maintain aging industrial infrastructure. Predictive maintenance adoption is driving demand for high-performance components that offer extended service life and improved reliability.

Safety equipment category experiences consistent growth driven by regulatory compliance requirements and increasing focus on workplace safety. Personal protective equipment, safety systems, and monitoring devices represent key product areas with steady demand across all industrial sectors. The COVID-19 pandemic has heightened awareness of safety requirements and accelerated adoption of advanced safety technologies.

Cutting tools and abrasives segment serves the metalworking and manufacturing sectors with specialized products that directly impact production efficiency and quality. This category is characterized by continuous innovation in materials and coatings that improve tool performance and reduce operational costs. The segment benefits from reshoring trends and increased domestic manufacturing activity.

Cleaning and maintenance supplies category encompasses consumable products essential for facility maintenance and equipment care. This segment includes lubricants, cleaning chemicals, and specialty maintenance products that support operational continuity. Environmental regulations and sustainability initiatives are driving demand for eco-friendly alternatives and biodegradable products within this category.

Operational efficiency improvements represent primary benefits for organizations implementing strategic MRO programs, with potential cost reductions of 15-25% through optimized inventory management, vendor consolidation, and predictive maintenance strategies. These improvements directly impact bottom-line performance and competitive positioning in respective markets.

Supply chain optimization benefits include reduced procurement costs, improved supplier relationships, and enhanced supply security through strategic sourcing initiatives. Organizations can achieve better pricing, service levels, and risk management through comprehensive MRO programs that align with business objectives and operational requirements.

Technology integration advantages enable organizations to leverage digital tools and analytics for improved decision-making and operational visibility. Cloud-based maintenance management systems, mobile applications, and IoT-enabled monitoring solutions provide real-time insights that support proactive maintenance strategies and asset optimization initiatives.

Compliance and risk management benefits help organizations meet regulatory requirements and reduce operational risks through proper maintenance procedures and documentation. Comprehensive MRO programs support safety compliance, environmental regulations, and quality standards that are essential for business continuity and regulatory approval.

Competitive advantage creation through strategic MRO management enables organizations to focus resources on core business activities while ensuring reliable operations and equipment performance. This includes improved uptime, reduced maintenance costs, and enhanced operational flexibility that support business growth and market expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues to reshape the MRO landscape, with organizations increasingly adopting cloud-based maintenance management systems, mobile applications, and IoT-enabled monitoring solutions. This trend is driven by the need for real-time visibility, improved decision-making capabilities, and enhanced operational efficiency across maintenance operations.

Predictive maintenance adoption is gaining momentum across industries, with organizations recognizing the potential to reduce maintenance costs by 20-30% while improving equipment reliability and operational uptime. Advanced analytics, machine learning, and condition monitoring technologies are enabling proactive maintenance strategies that prevent failures and optimize maintenance schedules.

Sustainability focus intensification is driving demand for environmentally friendly MRO products and circular economy solutions. Organizations are increasingly seeking suppliers that offer recycled components, biodegradable lubricants, energy-efficient products, and take-back programs that support environmental goals and regulatory compliance requirements.

E-commerce platform growth continues to transform MRO procurement, with digital channels now accounting for 35% of total transactions. Online platforms offer improved convenience, pricing transparency, and access to comprehensive product information that supports informed purchasing decisions and streamlined procurement processes.

Vendor consolidation trends reflect organizations’ desire to simplify supply chains and improve procurement efficiency through strategic partnerships with comprehensive MRO suppliers. This trend includes vendor-managed inventory programs, integrated service offerings, and long-term contracts that provide cost savings and operational benefits.

Skills development initiatives are becoming critical as organizations address workforce challenges and technology adoption requirements. Training programs, certification courses, and knowledge transfer initiatives are essential for maximizing the value of advanced maintenance technologies and ensuring effective implementation of best practices.

Technology integration advancements have accelerated significantly, with major MRO suppliers investing heavily in digital platforms, analytics capabilities, and IoT-enabled solutions. These developments include the launch of comprehensive e-commerce platforms, mobile applications for field maintenance, and cloud-based inventory management systems that improve customer experience and operational efficiency.

Strategic acquisitions and partnerships continue to reshape the competitive landscape, with leading distributors acquiring specialized suppliers and technology companies to expand capabilities and market reach. Recent developments include partnerships between traditional MRO suppliers and technology providers to offer integrated solutions that combine physical products with digital services.

Sustainability initiatives expansion has gained prominence, with suppliers introducing environmentally friendly product lines, implementing circular economy programs, and achieving sustainability certifications. These developments respond to customer demand for responsible sourcing and environmental compliance while creating competitive differentiation opportunities.

Supply chain resilience improvements have become priority focus areas following recent disruptions, with suppliers diversifying sourcing strategies, increasing inventory levels for critical components, and implementing risk management programs. These developments aim to ensure reliable product availability and minimize the impact of supply chain volatility on customer operations.

Regulatory compliance enhancements continue to drive product development and service offerings, particularly in highly regulated industries such as aerospace, pharmaceuticals, and food processing. Suppliers are investing in certification programs, quality management systems, and documentation capabilities that support customer compliance requirements and regulatory standards.

Strategic procurement optimization should be a priority for organizations seeking to maximize MRO value and operational efficiency. MarkWide Research analysis indicates that companies implementing comprehensive vendor consolidation programs can achieve cost savings of 12-18% while improving service levels and reducing procurement complexity through strategic supplier partnerships.

Technology investment prioritization requires careful evaluation of digital solutions that provide measurable returns on investment and support long-term operational goals. Organizations should focus on platforms that integrate with existing systems, provide scalability for future growth, and offer comprehensive analytics capabilities that enable data-driven maintenance decisions.

Predictive maintenance implementation should follow a phased approach that begins with critical equipment and high-impact applications before expanding to broader asset portfolios. This strategy allows organizations to develop expertise, demonstrate value, and build internal support for advanced maintenance technologies while managing implementation risks and costs.

Supplier relationship development should emphasize long-term partnerships with providers that offer comprehensive solutions, technical expertise, and innovation capabilities. Organizations benefit from suppliers that understand their specific requirements, provide proactive support, and contribute to continuous improvement initiatives that enhance operational performance.

Sustainability integration should be incorporated into MRO strategies through supplier selection criteria, product specifications, and performance metrics that support environmental goals. This approach creates competitive advantages while meeting stakeholder expectations and regulatory requirements for responsible business practices and environmental stewardship.

Market growth trajectory indicates continued expansion driven by industrial modernization, infrastructure investment, and technology adoption across diverse sectors. The integration of advanced technologies, sustainability initiatives, and strategic procurement approaches will create new opportunities for suppliers and customers to achieve enhanced value and operational performance.

Technology evolution will accelerate with the adoption of artificial intelligence, machine learning, and advanced analytics that enable autonomous maintenance systems and self-optimizing operations. MWR projections suggest that smart maintenance technologies will achieve 45% market penetration within the next five years, fundamentally changing how organizations approach asset management and maintenance operations.

Industry transformation will be driven by the convergence of physical and digital systems, creating new business models and service delivery methods that provide enhanced value propositions. The shift toward outcome-based contracts, performance guarantees, and integrated solutions will reshape supplier relationships and competitive dynamics within the MRO market.

Sustainability imperatives will become increasingly important, with organizations requiring suppliers to demonstrate environmental responsibility and contribute to circular economy initiatives. This trend will drive innovation in product development, packaging solutions, and service delivery methods that minimize environmental impact while maintaining operational effectiveness.

Workforce development will remain critical as organizations adapt to new technologies and changing skill requirements. Investment in training programs, knowledge management systems, and technology-enabled maintenance procedures will be essential for maximizing the value of advanced MRO solutions and ensuring successful implementation of best practices.

The US MRO market represents a dynamic and evolving sector that plays a critical role in supporting industrial operations and economic growth across diverse industries. The market demonstrates strong fundamentals with consistent demand drivers, technological innovation opportunities, and strategic importance for operational efficiency and competitive advantage.

Key success factors for market participants include embracing digital transformation, developing comprehensive solution capabilities, and building strategic customer relationships that provide long-term value. The integration of advanced technologies, sustainability initiatives, and data-driven approaches will be essential for maintaining competitive positioning and meeting evolving customer requirements.

Future growth prospects remain positive, supported by industrial modernization trends, infrastructure investment, and the ongoing adoption of predictive maintenance strategies. Organizations that invest in technology capabilities, develop specialized expertise, and focus on customer value creation will be well-positioned to capitalize on emerging opportunities and market expansion.

Strategic implications suggest that the MRO market will continue to evolve toward more integrated, technology-enabled solutions that provide comprehensive value propositions beyond traditional product supply. This transformation creates opportunities for innovation, differentiation, and enhanced customer relationships that support sustainable growth and market leadership in the evolving industrial landscape.

What is Maintenance Repair and Operations (MRO)?

Maintenance Repair and Operations (MRO) refers to the processes and activities involved in maintaining and repairing equipment, machinery, and facilities to ensure their optimal performance. This includes a wide range of products and services such as tools, spare parts, and maintenance services used across various industries.

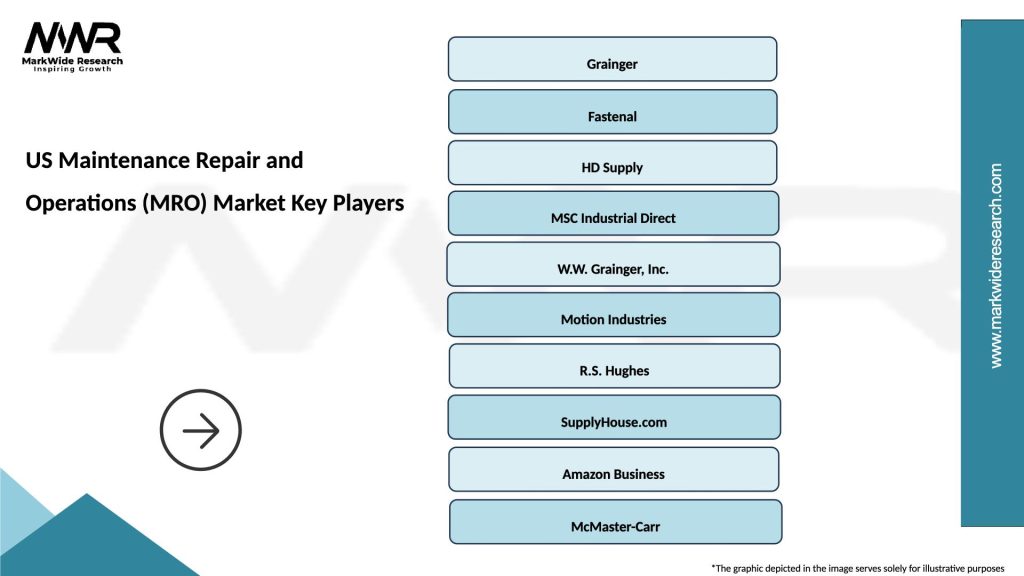

What are the key companies in the US Maintenance Repair and Operations (MRO) Market?

Key companies in the US Maintenance Repair and Operations (MRO) Market include Grainger, Fastenal, and MSC Industrial Direct, among others. These companies provide a variety of MRO supplies and services to support different sectors such as manufacturing, construction, and healthcare.

What are the growth factors driving the US Maintenance Repair and Operations (MRO) Market?

The growth of the US Maintenance Repair and Operations (MRO) Market is driven by increasing industrial activities, the need for efficient maintenance practices, and advancements in technology. Additionally, the rising focus on minimizing downtime and enhancing operational efficiency in various industries contributes to market expansion.

What challenges does the US Maintenance Repair and Operations (MRO) Market face?

The US Maintenance Repair and Operations (MRO) Market faces challenges such as supply chain disruptions, fluctuating material costs, and the need for skilled labor. These factors can impact the availability and pricing of MRO products and services, affecting overall market performance.

What opportunities exist in the US Maintenance Repair and Operations (MRO) Market?

Opportunities in the US Maintenance Repair and Operations (MRO) Market include the adoption of smart technologies and automation in maintenance processes. Additionally, the growing emphasis on sustainability and eco-friendly practices presents avenues for innovation and new product development.

What trends are shaping the US Maintenance Repair and Operations (MRO) Market?

Trends shaping the US Maintenance Repair and Operations (MRO) Market include the increasing use of digital tools for inventory management and predictive maintenance. Furthermore, the integration of IoT devices in MRO practices is enhancing operational efficiency and data-driven decision-making.

US Maintenance Repair and Operations (MRO) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tools, Fasteners, Cleaning Supplies, Safety Equipment |

| End User | Manufacturing, Construction, Healthcare, Hospitality |

| Technology | IoT Solutions, Cloud-Based Systems, Automation Tools, Predictive Maintenance |

| Service Type | Repair Services, Maintenance Services, Installation Services, Consulting Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Maintenance Repair and Operations (MRO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at