444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US luxury real estate market represents one of the most dynamic and resilient segments of the American property landscape, characterized by exceptional growth patterns and evolving consumer preferences. This premium sector encompasses high-end residential properties, exclusive commercial developments, and luxury investment opportunities across major metropolitan areas and prestigious locations nationwide. Market dynamics indicate sustained demand driven by affluent buyers, international investors, and changing lifestyle preferences accelerated by recent global events.

Geographic distribution reveals significant concentration in established luxury markets including New York, California, Florida, and Texas, while emerging markets in Colorado, North Carolina, and Tennessee demonstrate remarkable growth trajectories. The sector exhibits resilient performance with luxury properties maintaining value appreciation rates of approximately 8.2% annually over the past five years, outpacing conventional real estate segments.

Investment patterns show increasing diversification with domestic high-net-worth individuals comprising 72% of luxury purchases, while international buyers contribute significantly to market vitality. Technology integration, sustainability features, and wellness amenities have become defining characteristics of modern luxury properties, reshaping buyer expectations and market standards.

The US luxury real estate market refers to the segment of residential and commercial properties that command premium pricing due to exceptional location, architectural significance, exclusive amenities, and superior construction quality, typically representing the top tier of regional property markets.

Luxury classification varies significantly by geographic region, with properties generally falling within the top 10% of local market pricing. Key defining characteristics include prime locations, architectural distinction, high-end finishes, advanced technology integration, and exclusive amenities such as private elevators, wine cellars, home theaters, and resort-style outdoor spaces.

Market participants include ultra-high-net-worth individuals, celebrities, business executives, international investors, and institutional buyers seeking trophy assets. The sector encompasses various property types including single-family estates, luxury condominiums, penthouses, vacation homes, and commercial luxury developments.

Market performance demonstrates exceptional resilience with luxury properties experiencing sustained demand despite broader economic uncertainties. The sector benefits from limited inventory, exclusive locations, and growing wealth concentration among high-net-worth individuals. Technology adoption has accelerated, with smart home features and virtual touring capabilities becoming standard expectations.

Regional variations highlight diverse growth patterns, with traditional luxury markets maintaining stability while emerging destinations capture increasing buyer attention. Florida and Texas markets show particularly strong momentum, driven by favorable tax environments and lifestyle preferences. International investment remains significant, though domestic buyers increasingly dominate transactions.

Future projections indicate continued growth supported by demographic trends, wealth creation, and evolving lifestyle preferences. Sustainability features and wellness amenities are becoming essential rather than optional, reflecting changing buyer priorities and environmental consciousness among luxury consumers.

Market intelligence reveals several critical trends shaping the luxury real estate landscape:

Wealth concentration represents the primary driver of luxury real estate demand, with increasing numbers of high-net-worth individuals seeking premium properties as both residences and investment vehicles. The growing wealth gap has created a substantial buyer pool with significant purchasing power and diverse property requirements.

Geographic mobility trends accelerated by remote work capabilities enable luxury buyers to relocate to preferred destinations without career constraints. This flexibility has intensified competition in desirable markets while creating opportunities in previously overlooked locations with natural beauty, favorable climates, or tax advantages.

Investment diversification strategies increasingly include luxury real estate as a hedge against market volatility and inflation. Properties in prime locations offer tangible assets with potential for appreciation, rental income, and lifestyle benefits that traditional investment vehicles cannot provide.

Lifestyle evolution following recent global events has prioritized home-centric living, driving demand for properties with extensive amenities, private outdoor spaces, home offices, and wellness features. Buyers seek properties that function as comprehensive lifestyle destinations rather than simple residences.

Affordability challenges limit the buyer pool despite overall wealth growth, as luxury property prices have appreciated faster than income growth for many potential buyers. Rising interest rates compound affordability issues, particularly for leveraged purchases and investment properties.

Regulatory constraints in various markets include foreign buyer taxes, mansion taxes, and zoning restrictions that impact development and transaction volumes. Some jurisdictions have implemented policies specifically targeting luxury property ownership, creating additional costs and complexity.

Economic uncertainty can impact luxury spending patterns, as high-end real estate purchases are often discretionary and sensitive to broader economic conditions. Market volatility may cause potential buyers to delay decisions or seek alternative investment opportunities.

Supply limitations in prime locations restrict market growth, as desirable areas have limited developable land and strict zoning requirements. Construction costs and labor shortages further constrain new luxury development, maintaining tight inventory conditions.

Emerging markets present significant growth opportunities as buyers discover new luxury destinations with attractive pricing, natural amenities, and lifestyle benefits. Secondary cities and resort communities are experiencing unprecedented demand from luxury buyers seeking alternatives to traditional markets.

Technology integration offers opportunities for developers and agents to differentiate properties through advanced smart home systems, virtual reality marketing, and innovative amenities. Properties incorporating cutting-edge technology command premium pricing and attract tech-savvy luxury buyers.

Sustainable luxury represents a growing market segment as environmentally conscious buyers seek properties with green certifications, renewable energy systems, and sustainable materials. Developers focusing on eco-luxury positioning can capture this expanding buyer segment.

Wellness-focused properties address growing demand for homes that promote health and well-being through design, amenities, and location. Properties featuring home spas, fitness facilities, meditation spaces, and connection to nature appeal to health-conscious luxury buyers.

Supply-demand imbalances characterize most luxury markets, with limited inventory supporting price appreciation and competitive bidding situations. New construction cannot keep pace with demand in prime locations due to land constraints, regulatory hurdles, and extended development timelines.

Buyer behavior evolution reflects changing priorities and preferences, with increased emphasis on property functionality, technology integration, and lifestyle amenities. Modern luxury buyers conduct extensive research and expect comprehensive digital marketing presentations before viewing properties.

Market segmentation has become more pronounced, with distinct buyer categories including primary residence seekers, vacation home buyers, investment purchasers, and international clients. Each segment exhibits unique preferences, timelines, and decision-making processes requiring specialized marketing approaches.

Pricing dynamics vary significantly by location and property type, with waterfront properties, urban penthouses, and historic estates commanding different premium levels. Market timing and negotiation strategies have become increasingly sophisticated as buyers and sellers adapt to changing conditions.

Data collection encompasses comprehensive analysis of transaction records, listing data, market reports, and industry surveys from multiple reliable sources. Primary research includes interviews with luxury real estate professionals, developers, and market participants across key geographic regions.

Market analysis utilizes both quantitative and qualitative methodologies to assess trends, pricing patterns, and buyer behavior. Statistical analysis of sales data, inventory levels, and pricing trends provides foundational market intelligence supplemented by expert insights and industry observations.

Geographic scope covers major luxury markets including New York, California, Florida, Texas, Colorado, and emerging destinations. Regional analysis considers local market conditions, regulatory environments, and economic factors influencing luxury real estate performance.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review. MarkWide Research methodology incorporates industry best practices for luxury market analysis and forecasting to provide reliable market intelligence for stakeholders.

Northeast markets led by New York and Boston maintain their positions as established luxury destinations, though growth rates have moderated compared to emerging markets. Manhattan luxury sales represent approximately 18% of national luxury transaction volume, while the Hamptons and other exclusive enclaves continue attracting high-net-worth buyers.

West Coast markets in California demonstrate resilience despite regulatory challenges, with Los Angeles, San Francisco, and Napa Valley maintaining premium pricing. Technology wealth concentration supports continued demand, though some buyers are relocating to tax-friendly jurisdictions.

Southeast region experiences exceptional growth with Florida capturing 24% of luxury market expansion, driven by favorable tax policies, climate advantages, and lifestyle amenities. Miami, Naples, and Palm Beach lead luxury sales growth, while emerging markets in the Carolinas gain momentum.

Southwest markets including Texas, Arizona, and Colorado attract luxury buyers seeking value, space, and lifestyle benefits. Austin, Dallas, Scottsdale, and Aspen represent key growth markets with 31% increase in luxury property values over recent years.

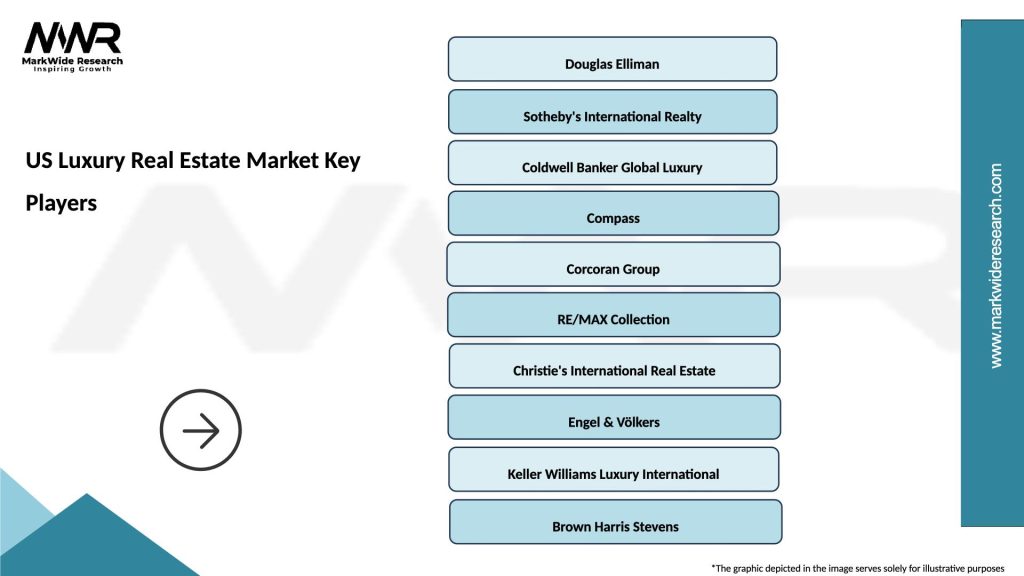

Market leaders in luxury real estate include established brokerages and independent specialists:

Competitive differentiation focuses on brand prestige, marketing capabilities, technology platforms, and agent expertise. Successful luxury brokerages combine traditional relationship-building with modern digital marketing and global networking capabilities.

By Property Type:

By Price Range:

By Buyer Category:

Waterfront properties command the highest premiums across all luxury markets, with oceanfront, lakefront, and riverfront locations consistently outperforming inland alternatives. These properties offer unique lifestyle benefits and limited supply characteristics that support premium pricing and strong appreciation potential.

Urban luxury condominiums appeal to buyers seeking maintenance-free living with premium amenities and services. Full-service buildings with concierge, fitness facilities, and rooftop amenities attract busy professionals and empty nesters prioritizing convenience and lifestyle services.

Luxury new construction incorporates latest technology, energy efficiency, and design trends to attract discerning buyers. Custom homes and luxury developments featuring smart systems, sustainable materials, and wellness amenities command significant premiums over existing properties.

Historic luxury properties offer unique character and architectural significance that appeals to buyers seeking distinctive homes with heritage value. Restored estates and landmark properties provide irreplaceable characteristics that justify premium pricing and attract collectors and history enthusiasts.

Real estate professionals benefit from higher commission structures and prestigious client relationships in luxury markets. Luxury specialists develop expertise in high-end marketing, international networking, and sophisticated transaction management that enhances their professional reputation and earning potential.

Developers and builders achieve higher profit margins on luxury projects while building brand recognition in premium markets. Successful luxury development creates opportunities for future projects and establishes relationships with affluent buyers and investors.

Service providers including architects, interior designers, and contractors benefit from luxury market participation through higher-value projects and referral opportunities. Luxury market involvement enhances professional portfolios and attracts additional high-end clientele.

Local communities benefit from luxury real estate development through increased property tax revenues, economic activity, and employment opportunities. Luxury properties often contribute significantly to local tax bases while supporting related service industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wellness integration has become a defining trend in luxury real estate, with properties incorporating spa facilities, meditation spaces, fitness centers, and outdoor wellness areas. Buyers increasingly prioritize homes that support physical and mental well-being through thoughtful design and amenities.

Technology sophistication continues advancing with smart home systems, automated climate control, security integration, and entertainment systems becoming standard expectations. Luxury properties showcase cutting-edge technology while maintaining elegant aesthetics and user-friendly interfaces.

Sustainable luxury gains momentum as environmentally conscious buyers seek properties with green certifications, renewable energy systems, and sustainable materials. Luxury developments increasingly incorporate environmental responsibility without compromising comfort or aesthetics.

Flexible living spaces reflect changing lifestyle needs with home offices, multi-purpose rooms, and adaptable layouts accommodating remote work and evolving family requirements. Modern luxury homes prioritize functionality alongside beauty and comfort.

Market consolidation among luxury brokerages creates larger platforms with enhanced marketing capabilities and global reach. Strategic acquisitions and partnerships enable firms to offer comprehensive services across multiple luxury markets and price segments.

Digital transformation accelerates with virtual reality tours, drone photography, and sophisticated online marketing becoming standard practice. MWR analysis indicates that digital marketing now reaches 96% of luxury buyers during their property search process.

International expansion by US luxury developers and brokerages creates global networks and cross-border investment opportunities. American luxury real estate brands increasingly establish international presence to serve global clientele and capture foreign investment.

Regulatory evolution includes new disclosure requirements, foreign buyer taxes, and luxury property transfer fees in various markets. Industry participants adapt to changing regulatory environments while maintaining service quality and client satisfaction.

Market diversification strategies should include geographic expansion into emerging luxury markets while maintaining presence in established destinations. Professionals benefit from developing expertise in multiple markets to serve clients with diverse location preferences and investment objectives.

Technology investment remains critical for competitive positioning in luxury markets. Firms should prioritize digital marketing capabilities, virtual tour technology, and customer relationship management systems to meet evolving client expectations and market standards.

Specialization development in specific luxury segments such as waterfront properties, historic estates, or sustainable luxury creates competitive advantages and expertise recognition. Specialists command higher fees and attract referrals from their focused market knowledge.

Client relationship management requires sophisticated approaches for high-net-worth individuals who expect exceptional service, privacy, and expertise. Long-term relationship building generates repeat business and referrals essential for luxury market success.

Growth projections indicate continued expansion of the luxury real estate market driven by wealth creation, demographic trends, and evolving lifestyle preferences. MarkWide Research forecasts suggest sustained demand growth of approximately 6.5% annually over the next five years, supported by favorable economic conditions and buyer demographics.

Geographic evolution will likely favor tax-friendly states and lifestyle destinations as remote work capabilities enable greater location flexibility. Traditional luxury markets will maintain importance while emerging destinations capture increasing market share and buyer attention.

Technology integration will deepen with artificial intelligence, virtual reality, and smart home systems becoming more sophisticated and user-friendly. Properties incorporating advanced technology will command premium pricing while older luxury homes may require updates to remain competitive.

Sustainability focus will intensify as environmental consciousness grows among luxury buyers and regulatory requirements evolve. Green building certifications and sustainable features will transition from optional amenities to essential characteristics for luxury properties.

The US luxury real estate market demonstrates remarkable resilience and growth potential despite broader economic uncertainties and evolving market conditions. Strong fundamentals including limited supply in prime locations, growing wealth concentration, and changing lifestyle preferences support continued market expansion and value appreciation.

Strategic opportunities exist for market participants who adapt to evolving buyer preferences, embrace technology integration, and develop expertise in emerging luxury segments. Success requires understanding sophisticated client needs, maintaining service excellence, and staying current with market trends and regulatory changes.

Future success in luxury real estate markets will depend on balancing traditional relationship-building with modern marketing techniques, geographic diversification with specialized expertise, and luxury amenities with sustainable practices. The market’s continued evolution presents both challenges and opportunities for industry participants committed to excellence and innovation in serving high-net-worth clientele.

What is Luxury Real Estate?

Luxury real estate refers to high-end properties that offer premium features, locations, and amenities, often catering to affluent buyers. These properties typically include upscale homes, penthouses, and estates in desirable neighborhoods.

What are the key players in the US Luxury Real Estate Market?

Key players in the US Luxury Real Estate Market include companies like Sotheby’s International Realty, Coldwell Banker Global Luxury, and Douglas Elliman. These firms specialize in high-value properties and provide tailored services to affluent clients, among others.

What are the main drivers of the US Luxury Real Estate Market?

The US Luxury Real Estate Market is driven by factors such as increasing wealth among high-net-worth individuals, low interest rates, and a growing demand for second homes. Additionally, urbanization and lifestyle changes contribute to the market’s expansion.

What challenges does the US Luxury Real Estate Market face?

Challenges in the US Luxury Real Estate Market include economic fluctuations, regulatory changes, and the impact of global events on buyer confidence. Additionally, competition among luxury listings can lead to pricing pressures.

What opportunities exist in the US Luxury Real Estate Market?

Opportunities in the US Luxury Real Estate Market include the rise of remote work, which has increased demand for luxury properties in suburban and rural areas. Furthermore, sustainable and eco-friendly luxury developments are gaining traction among environmentally conscious buyers.

What trends are shaping the US Luxury Real Estate Market?

Trends in the US Luxury Real Estate Market include a growing interest in smart home technology, increased focus on wellness amenities, and a shift towards experiential living. Additionally, the integration of virtual tours and digital marketing strategies is becoming more prevalent.

US Luxury Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Single-Family Homes, Condominiums, Townhouses, Mansions |

| Price Tier | High-End, Ultra-Luxury, Mid-Range, Affordable Luxury |

| Buyer Type | Investors, First-Time Buyers, Retirees, Foreign Nationals |

| Location | Urban Centers, Coastal Areas, Suburban Neighborhoods, Mountain Retreats |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Luxury Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at