444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US luxury hotel market represents one of the most dynamic and sophisticated segments within the American hospitality industry. This premium sector encompasses high-end accommodations that deliver exceptional service standards, exclusive amenities, and personalized guest experiences across major metropolitan areas, resort destinations, and emerging luxury travel hubs. Market dynamics indicate robust growth driven by increasing affluent traveler demand, corporate luxury travel requirements, and evolving consumer preferences for experiential hospitality.

Industry transformation continues to reshape the luxury hospitality landscape, with properties integrating advanced technology solutions, sustainable practices, and wellness-focused amenities to meet discerning guest expectations. The market demonstrates remarkable resilience, with occupancy rates recovering strongly and average daily rates showing consistent upward momentum across key luxury segments. Regional distribution spans from established markets in New York, California, and Florida to emerging luxury destinations in secondary cities experiencing significant economic growth.

Investment activity remains robust as institutional investors, private equity firms, and hospitality groups recognize the long-term value proposition of luxury hotel assets. The sector benefits from demographic trends including wealth accumulation among high-net-worth individuals, increased business travel budgets, and growing demand for premium leisure experiences among affluent millennials and Generation X travelers.

The US luxury hotel market refers to the segment of hospitality properties that provide premium accommodations, exceptional service standards, and exclusive amenities targeting affluent leisure and business travelers. This market encompasses full-service luxury hotels, boutique properties, luxury resorts, and ultra-luxury establishments that command premium pricing through superior guest experiences, prime locations, and distinctive brand positioning.

Luxury hotel properties typically feature high-end furnishings, personalized concierge services, fine dining restaurants, spa facilities, and exclusive amenities such as private clubs, rooftop lounges, and specialized business centers. These establishments maintain elevated service-to-guest ratios, employ highly trained hospitality professionals, and often hold prestigious industry certifications or awards recognizing their exceptional standards.

Market classification includes various luxury tiers from accessible luxury properties offering premium experiences at competitive price points to ultra-luxury establishments providing unparalleled exclusivity and personalized service. The segment serves diverse customer segments including corporate executives, high-net-worth leisure travelers, luxury group bookings, and special event clientele seeking exceptional hospitality experiences.

Strategic analysis reveals the US luxury hotel market experiencing sustained growth momentum driven by robust demand fundamentals, strategic market positioning, and evolving consumer preferences for premium hospitality experiences. The sector demonstrates exceptional resilience with revenue per available room metrics showing consistent improvement across major luxury markets nationwide.

Key performance indicators highlight strong operational metrics including elevated occupancy rates, premium pricing power, and expanding profit margins as luxury properties successfully implement revenue optimization strategies. The market benefits from demographic tailwinds including wealth creation among target customer segments, increased corporate travel budgets, and growing preference for experiential luxury among affluent consumers.

Competitive dynamics showcase established luxury hotel brands expanding their portfolios through strategic acquisitions, new property developments, and brand extensions targeting specific luxury niches. Independent luxury properties continue gaining market share through distinctive positioning, personalized service offerings, and unique guest experiences that differentiate them from traditional chain hotels.

Technology integration emerges as a critical success factor, with leading luxury properties implementing advanced guest experience platforms, contactless service solutions, and data analytics capabilities to enhance personalization and operational efficiency. Sustainability initiatives increasingly influence guest booking decisions, driving luxury hotels to adopt environmentally responsible practices while maintaining premium service standards.

Market intelligence reveals several transformative trends reshaping the luxury hospitality landscape across the United States. Consumer behavior analysis indicates shifting preferences toward authentic, locally-inspired luxury experiences that connect guests with destination culture and community.

Economic prosperity among high-net-worth individuals continues driving robust demand for luxury hospitality experiences across the United States. Wealth accumulation in key demographic segments, particularly among successful entrepreneurs, technology executives, and financial professionals, creates sustained demand for premium accommodations that justify elevated pricing strategies.

Corporate travel recovery significantly impacts luxury hotel performance as businesses restore travel budgets and prioritize employee comfort during business trips. Companies increasingly recognize that luxury accommodations enhance employee productivity, satisfaction, and retention, particularly for senior executives and key client entertainment activities. Business travel policies evolve to include luxury hotel options for extended stays and important business meetings.

Leisure travel transformation reflects changing consumer priorities toward experiential spending rather than material purchases. Affluent consumers demonstrate willingness to invest in memorable travel experiences, driving demand for luxury properties that offer unique amenities, exclusive access, and personalized service. Social media influence amplifies luxury travel experiences, creating aspirational demand among affluent millennials and Generation X consumers.

Urban development patterns in major metropolitan areas create opportunities for luxury hotel development in prime locations. Mixed-use developments increasingly incorporate luxury hotels as anchor tenants, providing integrated lifestyle experiences that appeal to both business and leisure travelers. Infrastructure improvements in secondary markets open new opportunities for luxury hotel expansion beyond traditional gateway cities.

Economic sensitivity remains a fundamental challenge for luxury hotel operators, as premium hospitality demand correlates closely with broader economic conditions and consumer confidence levels. Market volatility can rapidly impact booking patterns, particularly for discretionary leisure travel and corporate entertainment budgets that often face scrutiny during economic uncertainty.

Labor market constraints present ongoing operational challenges as luxury properties require highly skilled hospitality professionals capable of delivering exceptional service standards. Staffing costs continue rising as hotels compete for experienced personnel, while training requirements for luxury service delivery demand significant time and resource investments. Employee retention becomes increasingly challenging in competitive labor markets.

Regulatory compliance adds complexity and cost to luxury hotel operations, particularly regarding safety standards, accessibility requirements, and local zoning restrictions. Permitting processes for new luxury hotel developments often involve lengthy approval timelines and substantial regulatory costs that impact project feasibility and return on investment calculations.

Technology investment requirements create ongoing capital expenditure pressures as luxury guests expect cutting-edge amenities and seamless digital experiences. System integration challenges arise when implementing new technology platforms while maintaining operational continuity and service quality standards that define luxury hospitality experiences.

Emerging market expansion presents significant growth opportunities as secondary and tertiary cities develop luxury travel infrastructure and attract affluent visitors. Destination development in previously underserved markets creates first-mover advantages for luxury hotel brands willing to invest in emerging luxury travel destinations across the United States.

Wellness tourism integration offers substantial revenue diversification opportunities as luxury hotels develop comprehensive wellness programming, medical tourism partnerships, and holistic health experiences. Spa revenue potential extends beyond traditional treatments to include wellness retreats, fitness programming, and specialized health services that command premium pricing.

Extended stay luxury represents an expanding market segment as remote work trends and lifestyle changes drive demand for luxury accommodations supporting longer-term stays. Residential-style amenities including full kitchens, separate living areas, and personalized services create opportunities for premium pricing and enhanced guest loyalty among extended-stay clientele.

Corporate partnership opportunities enable luxury hotels to develop strategic relationships with major corporations, providing preferred rates, exclusive amenities, and customized services for business travelers. Loyalty program enhancements through corporate partnerships create competitive advantages and drive repeat business from high-value corporate accounts.

Supply and demand equilibrium in the luxury hotel market reflects careful balance between limited luxury property inventory and sustained affluent traveler demand. Market dynamics favor properties that successfully differentiate through unique positioning, exceptional service delivery, and exclusive amenities that justify premium pricing strategies.

Competitive intensity drives continuous innovation as luxury hotel brands invest in property renovations, service enhancements, and technology upgrades to maintain market position. Brand differentiation becomes increasingly important as consumers evaluate luxury options based on authentic experiences, personalized service, and distinctive property characteristics rather than traditional luxury markers alone.

Pricing power remains strong among well-positioned luxury properties that successfully communicate value proposition through superior guest experiences and exclusive amenities. Revenue management sophistication enables luxury hotels to optimize pricing strategies based on demand patterns, seasonal variations, and competitive positioning while maintaining occupancy levels and profit margins.

Investment capital availability supports continued market expansion as institutional investors recognize luxury hotel assets as stable, income-generating investments with long-term appreciation potential. Capital market conditions influence development activity, with favorable financing environments encouraging new luxury hotel projects and property acquisitions across key markets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable insights into US luxury hotel market dynamics, trends, and growth prospects. Primary research includes extensive interviews with luxury hotel executives, industry experts, investment professionals, and key stakeholders across the hospitality value chain.

Secondary research incorporates analysis of industry reports, financial statements, regulatory filings, and market data from authoritative hospitality industry sources. Data validation processes ensure accuracy and reliability through cross-referencing multiple information sources and expert verification of key findings and market projections.

Quantitative analysis examines operational metrics, financial performance indicators, and market trends using statistical modeling and forecasting techniques. Qualitative assessment provides contextual understanding of market dynamics, competitive positioning, and strategic implications for industry participants and stakeholders.

Market segmentation analysis evaluates luxury hotel categories, geographic markets, customer segments, and competitive landscapes to identify growth opportunities and strategic considerations. Trend analysis examines emerging market developments, technology adoption patterns, and evolving consumer preferences that influence luxury hospitality demand and operational strategies.

Geographic distribution across the United States reveals distinct regional characteristics and growth patterns within the luxury hotel market. Northeast markets including New York, Boston, and Washington DC maintain strong luxury hotel presence with 65% market concentration in major metropolitan areas, driven by business travel demand, cultural attractions, and established luxury travel infrastructure.

West Coast markets demonstrate robust growth momentum, particularly in California’s major cities and emerging Pacific Northwest destinations. California luxury hotels benefit from diverse demand drivers including technology industry business travel, entertainment sector activity, and premium leisure tourism. Market share distribution shows 23% concentration in West Coast luxury hotel inventory, with continued expansion in secondary markets.

Southeast regional markets experience accelerated luxury hotel development, driven by population growth, economic development, and expanding tourism infrastructure. Florida luxury resorts maintain strong performance through year-round demand, while emerging markets in North Carolina, Georgia, and Tennessee attract luxury hotel investment. Regional growth rates indicate 18% annual expansion in luxury hotel development across Southeast markets.

Mountain West and Southwest regions present significant growth opportunities as affluent populations migrate to these areas and luxury travel demand increases. Resort destinations in Colorado, Utah, Arizona, and Nevada command premium pricing through exclusive amenities and unique geographic positioning. Market penetration remains relatively low at 12% of national luxury inventory, suggesting substantial expansion potential.

Market leadership reflects diverse competitive dynamics among established luxury hotel brands, independent properties, and emerging boutique concepts. Brand positioning strategies vary significantly, with some emphasizing traditional luxury service standards while others focus on contemporary, experience-driven hospitality concepts.

Competitive differentiation increasingly focuses on unique guest experiences, local authenticity, and specialized amenities rather than traditional luxury markers alone. Brand loyalty programs play crucial roles in customer retention and revenue optimization across luxury hotel portfolios.

Market segmentation analysis reveals distinct categories within the US luxury hotel market, each serving specific customer needs and price points. Segmentation strategies enable targeted marketing, optimized pricing, and specialized service delivery that maximizes revenue potential and guest satisfaction across diverse luxury travel segments.

By Property Type:

By Customer Segment:

Full-service luxury hotels dominate market share through comprehensive amenity offerings and established brand recognition among business and leisure travelers. These properties typically feature multiple dining venues, extensive meeting facilities, spa services, and concierge programs that support diverse guest needs. Revenue diversification through food and beverage operations, spa services, and event hosting creates multiple income streams beyond room revenue.

Boutique luxury properties experience rapid growth as travelers seek authentic, personalized experiences that reflect local culture and character. These hotels command premium pricing through distinctive design, curated amenities, and intimate service delivery that creates memorable guest experiences. Market positioning emphasizes uniqueness and exclusivity rather than standardized luxury amenities.

Luxury resort properties benefit from destination appeal and comprehensive recreational amenities that support extended stays and higher spending per guest. Resort revenue models incorporate accommodation, dining, spa services, recreational activities, and retail operations that maximize guest spending throughout their stay. Seasonal demand patterns require sophisticated revenue management strategies to optimize occupancy and pricing.

Ultra-luxury segment represents the highest tier of hospitality service, with properties offering exceptional service ratios, exclusive amenities, and personalized experiences that justify premium pricing. Service differentiation includes personal butler service, private dining options, exclusive access to local experiences, and customized amenities that exceed traditional luxury standards.

Hotel operators benefit from strong revenue potential and profit margins associated with luxury hospitality positioning. Premium pricing power enables luxury properties to achieve higher average daily rates and revenue per available room compared to mid-scale accommodations. Brand value associated with luxury positioning creates competitive advantages and customer loyalty that support long-term business sustainability.

Real estate investors recognize luxury hotels as stable, income-generating assets with appreciation potential in prime locations. Investment returns benefit from both operational cash flow and long-term asset value appreciation, particularly in markets with limited luxury hotel supply and strong demand fundamentals. Portfolio diversification through luxury hotel investments provides exposure to hospitality sector growth while maintaining premium asset quality.

Local communities benefit from luxury hotel development through job creation, tax revenue generation, and economic activity that supports local businesses and service providers. Employment opportunities in luxury hospitality often provide above-average wages and career development prospects for hospitality professionals. Tourism promotion through luxury hotel presence enhances destination appeal and attracts high-spending visitors.

Guests and travelers benefit from exceptional service standards, exclusive amenities, and personalized experiences that enhance travel satisfaction and create lasting memories. Business productivity improves through luxury hotel amenities that support professional activities, while leisure experiences are enhanced through premium accommodations and exclusive access to local attractions and activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Experiential luxury emerges as the dominant trend shaping guest expectations and hotel programming across the luxury hospitality sector. Authentic experiences that connect guests with local culture, cuisine, and community become increasingly important differentiators, driving luxury hotels to develop unique programming and exclusive access opportunities that cannot be replicated elsewhere.

Technology integration transforms luxury hotel operations while maintaining the personal touch that defines premium hospitality. Digital concierge services, mobile check-in platforms, and personalized guest preference systems enhance convenience without replacing human interaction. Smart room technology enables customized environmental controls, entertainment systems, and communication platforms that respond to individual guest preferences.

Wellness-focused amenities become essential components of luxury hotel offerings as health-conscious travelers prioritize physical and mental well-being during travel. Comprehensive spa facilities, state-of-the-art fitness centers, healthy dining options, and wellness programming create competitive advantages and additional revenue opportunities. Biophilic design elements incorporating natural materials and outdoor spaces enhance guest well-being and property appeal.

Sustainable luxury practices influence guest booking decisions and operational strategies as environmentally conscious travelers seek properties that align with their values. Green building certifications, renewable energy systems, waste reduction programs, and local sourcing initiatives demonstrate environmental responsibility without compromising luxury service standards. Sustainability communication becomes important marketing differentiator among affluent, environmentally aware consumers.

Brand portfolio expansion continues as major luxury hotel companies acquire independent properties, develop new concepts, and extend existing brands into emerging markets. Strategic acquisitions enable rapid market entry and portfolio diversification while maintaining brand standards and operational efficiency across expanded property networks.

Technology partnerships between luxury hotels and technology companies create innovative guest experience platforms, operational efficiency tools, and revenue optimization systems. Artificial intelligence applications enhance personalization capabilities while data analytics platforms provide insights for revenue management and guest preference optimization.

Wellness industry collaboration results in comprehensive health and wellness programming that extends beyond traditional spa services. Medical tourism partnerships, fitness brand collaborations, and specialized wellness retreats create new revenue streams and attract health-conscious luxury travelers seeking comprehensive wellness experiences.

Sustainable development initiatives drive luxury hotel companies to implement environmental responsibility programs, achieve green building certifications, and develop carbon-neutral operational strategies. Industry leadership in sustainability creates competitive advantages and appeals to environmentally conscious luxury travelers and corporate clients with sustainability requirements.

MarkWide Research analysis indicates luxury hotel operators should prioritize experience differentiation and personalization capabilities to maintain competitive positioning in evolving market conditions. Investment strategies should focus on properties with unique positioning, prime locations, and potential for revenue diversification through multiple income streams beyond traditional accommodation services.

Technology integration requires careful balance between operational efficiency and personalized service delivery that defines luxury hospitality. Digital platform investments should enhance rather than replace human interaction, with technology serving as enabler for superior guest experiences and operational optimization rather than cost reduction primary focus.

Market expansion opportunities exist in secondary markets with growing affluent populations and limited luxury hotel supply. Development strategies should consider emerging destinations with strong economic fundamentals, infrastructure development, and demographic trends supporting luxury travel demand growth.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs, with environmental responsibility becoming fundamental component of luxury hotel operations and guest experience delivery. Green luxury positioning creates competitive advantages among environmentally conscious affluent travelers and corporate clients.

Long-term growth prospects remain positive for the US luxury hotel market, supported by demographic trends, wealth accumulation, and evolving consumer preferences for experiential luxury. Market projections indicate continued expansion with annual growth rates expected to maintain 6-8% CAGR over the next five years, driven by strong demand fundamentals and limited luxury property supply in key markets.

Technology evolution will continue transforming luxury hotel operations, with artificial intelligence, automation, and data analytics enhancing personalization capabilities while maintaining human service elements that define premium hospitality. Guest experience platforms will become increasingly sophisticated, enabling predictive service delivery and customized amenity offerings based on individual preferences and behavior patterns.

Wellness integration will expand beyond traditional spa services to encompass comprehensive health and wellness programming, medical tourism partnerships, and holistic lifestyle experiences. Wellness revenue is projected to represent 25-30% of total luxury hotel revenue within the next decade as health-conscious travel demand continues growing among affluent consumer segments.

Market expansion into secondary and tertiary markets will accelerate as luxury hotel brands recognize growth opportunities in emerging destinations with strong economic fundamentals and growing affluent populations. Geographic diversification will reduce dependence on traditional gateway markets while capturing demand in underserved luxury travel destinations across the United States.

The US luxury hotel market demonstrates remarkable resilience and growth potential, driven by strong demand fundamentals, evolving consumer preferences, and strategic industry adaptation to changing market conditions. Market dynamics favor properties that successfully balance traditional luxury service standards with contemporary guest expectations for authentic experiences, technological convenience, and environmental responsibility.

Competitive positioning increasingly depends on differentiation through unique experiences, personalized service delivery, and exclusive amenities that justify premium pricing strategies. Technology integration enhances operational efficiency and guest satisfaction while maintaining the human touch that defines luxury hospitality excellence. Sustainability initiatives become essential competitive differentiators as environmentally conscious travelers influence booking decisions and brand preferences.

Investment opportunities remain attractive for stakeholders seeking exposure to stable, income-generating assets with long-term appreciation potential in prime locations. Market expansion into emerging destinations and wellness-focused programming creates additional growth avenues for luxury hotel operators and investors. Future success will depend on adaptability, innovation, and commitment to exceptional guest experiences that exceed evolving expectations in the dynamic luxury hospitality marketplace.

What is Luxury Hotel?

Luxury hotels are high-end accommodations that offer premium services, amenities, and experiences to guests. They typically feature upscale dining, personalized service, and exclusive facilities, catering to affluent travelers seeking comfort and sophistication.

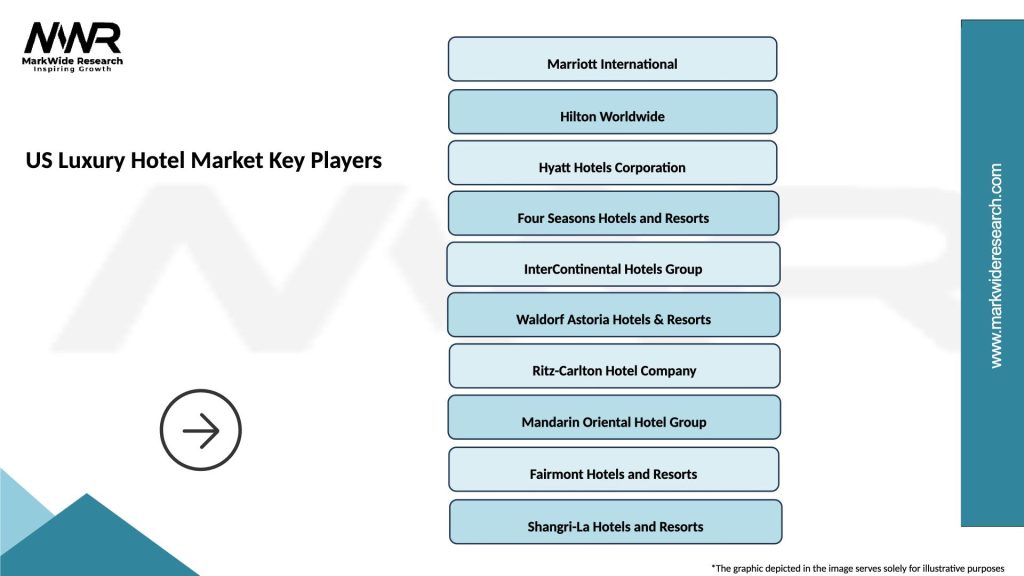

What are the key players in the US Luxury Hotel Market?

Key players in the US Luxury Hotel Market include brands like Four Seasons, Ritz-Carlton, and Waldorf Astoria, which are known for their exceptional service and luxurious offerings. Other notable companies include St. Regis and Mandarin Oriental, among others.

What are the growth factors driving the US Luxury Hotel Market?

The US Luxury Hotel Market is driven by factors such as increasing disposable income among consumers, a rise in international tourism, and a growing preference for unique and personalized travel experiences. Additionally, the expansion of luxury brands into new locations contributes to market growth.

What challenges does the US Luxury Hotel Market face?

Challenges in the US Luxury Hotel Market include intense competition among established brands, fluctuations in travel demand due to economic conditions, and the impact of global events on tourism. Additionally, maintaining high service standards can be a constant challenge.

What opportunities exist in the US Luxury Hotel Market?

Opportunities in the US Luxury Hotel Market include the potential for growth in eco-friendly and sustainable luxury accommodations, as well as the increasing popularity of wellness tourism. Furthermore, leveraging technology to enhance guest experiences presents significant opportunities.

What trends are shaping the US Luxury Hotel Market?

Trends in the US Luxury Hotel Market include a focus on experiential travel, where guests seek unique and immersive experiences. Additionally, there is a growing emphasis on sustainability and wellness, with hotels incorporating green practices and wellness programs into their offerings.

US Luxury Hotel Market

| Segmentation Details | Description |

|---|---|

| Customer Type | Business Travelers, Leisure Travelers, Event Attendees, VIP Guests |

| Service Type | Concierge Services, Spa Services, Fine Dining, Room Service |

| Price Tier | Premium, Ultra-Premium, Boutique, All-Inclusive |

| Location | Urban Centers, Coastal Areas, Mountain Resorts, Historic Districts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Luxury Hotel Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at