444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US life and non-life insurance market represents one of the most sophisticated and mature insurance ecosystems globally, encompassing comprehensive coverage solutions for individuals, businesses, and institutions. This dynamic marketplace continues to evolve through technological innovation, regulatory changes, and shifting consumer preferences, establishing itself as a cornerstone of American financial security infrastructure.

Market dynamics indicate robust growth potential driven by increasing awareness of risk management, demographic shifts, and expanding coverage requirements across diverse sectors. The insurance landscape demonstrates remarkable resilience, with life insurance penetration rates reaching approximately 3.2% of GDP while non-life insurance maintains strong market positioning through property, casualty, and specialty coverage offerings.

Digital transformation initiatives are reshaping traditional insurance models, with insurtech companies and established carriers investing heavily in artificial intelligence, machine learning, and data analytics capabilities. These technological advancements enable enhanced risk assessment, streamlined claims processing, and personalized product offerings that meet evolving customer expectations.

Regulatory frameworks continue to influence market development, with state-level oversight ensuring consumer protection while fostering competitive innovation. The market benefits from strong institutional foundations, sophisticated distribution networks, and comprehensive reinsurance mechanisms that support stability and growth across economic cycles.

The US life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services that provide financial protection against various risks affecting individuals, families, and businesses throughout the United States. This market encompasses life insurance policies that offer death benefits and investment components, alongside non-life insurance products covering property, casualty, health, and specialty risks.

Life insurance components include term life, whole life, universal life, and variable life policies designed to provide financial security for beneficiaries and estate planning solutions. These products serve critical roles in wealth transfer, business continuity planning, and retirement income strategies, addressing long-term financial security needs across diverse demographic segments.

Non-life insurance segments encompass property and casualty coverage, including auto insurance, homeowners insurance, commercial property protection, liability coverage, and specialized products for emerging risks. These insurance solutions protect against immediate and tangible losses while supporting economic stability through risk transfer mechanisms.

Market participants include traditional insurance carriers, mutual companies, reinsurers, insurance brokers, agents, and emerging insurtech platforms that collectively serve millions of policyholders across all fifty states and territories.

Strategic positioning within the US insurance market reveals significant opportunities for growth and innovation as carriers adapt to changing consumer behaviors, technological capabilities, and regulatory requirements. The market demonstrates exceptional resilience through economic uncertainties while maintaining strong capital positions and expanding coverage accessibility.

Key performance indicators highlight sustained premium growth across both life and non-life segments, with digital adoption rates accelerating at 18% annually as consumers embrace online policy management and claims processing capabilities. This digital transformation drives operational efficiency improvements while enhancing customer experience across traditional and emerging distribution channels.

Competitive dynamics reflect increasing consolidation among traditional carriers alongside rapid growth of insurtech startups that challenge conventional business models through innovative product design and streamlined operations. Market leaders maintain competitive advantages through scale, brand recognition, and comprehensive distribution networks while adapting to technological disruption.

Growth drivers include demographic trends such as aging populations requiring enhanced life insurance coverage, increasing property values driving higher coverage limits, and expanding commercial insurance needs as businesses navigate complex risk environments. These factors contribute to sustained market expansion and product innovation opportunities.

Market intelligence reveals several critical insights shaping the US insurance landscape and influencing strategic decision-making across industry participants:

Fundamental drivers propelling growth within the US insurance market reflect both traditional risk management needs and emerging challenges that require innovative coverage solutions. These drivers create sustained demand across life and non-life insurance segments while encouraging product development and market expansion.

Demographic trends serve as primary growth catalysts, with an aging population requiring enhanced life insurance coverage for estate planning and wealth transfer purposes. Baby boomer retirement patterns drive increased demand for annuity products and long-term care insurance, while younger generations seek affordable term life coverage and digital-first insurance experiences.

Economic prosperity and rising asset values contribute to increased insurance needs as homeowners and business owners seek adequate protection for valuable properties and investments. Higher property values necessitate increased coverage limits, while growing business revenues require expanded commercial insurance protection across multiple risk categories.

Regulatory requirements mandate insurance coverage across various sectors, including auto insurance for vehicle operators and workers’ compensation for employers. These mandatory coverage requirements provide stable demand foundations while regulatory changes often expand coverage requirements and create new market opportunities.

Technology advancement enables more sophisticated risk assessment and personalized pricing models, making insurance products more accessible and affordable for previously underserved market segments. Digital distribution channels reduce operational costs while improving customer acquisition and retention capabilities.

Market constraints present ongoing challenges for insurance carriers and industry participants, requiring strategic adaptation and innovative solutions to maintain competitive positioning and profitability. These restraints influence pricing strategies, product development, and operational efficiency initiatives across the insurance ecosystem.

Regulatory complexity creates compliance burdens and operational costs as carriers navigate varying state regulations, reporting requirements, and consumer protection mandates. The fragmented regulatory environment requires significant resources for compliance management while potentially limiting product innovation and market expansion strategies.

Interest rate volatility impacts investment returns and product profitability, particularly affecting life insurance carriers that rely on long-term investment performance to support policy obligations. Low interest rate environments compress margins while creating challenges for traditional whole life and annuity product designs.

Natural catastrophe exposure increases claims volatility and reinsurance costs, particularly affecting property and casualty carriers operating in hurricane, wildfire, and earthquake-prone regions. Climate change impacts intensify weather-related risks while creating uncertainty around long-term loss projections and pricing adequacy.

Competitive pressure from insurtech startups and non-traditional market entrants challenges established carriers through aggressive pricing, streamlined operations, and innovative customer experiences. This competition compresses margins while requiring significant technology investments to maintain market relevance.

Consumer price sensitivity limits premium growth opportunities as individuals and businesses seek cost-effective insurance solutions during economic uncertainty periods. Price competition intensifies across commodity insurance products while reducing profitability for carriers unable to differentiate through service quality or coverage innovation.

Strategic opportunities within the US insurance market present significant potential for growth, innovation, and market share expansion as carriers adapt to evolving consumer needs and technological capabilities. These opportunities span product development, distribution enhancement, and operational optimization initiatives.

Insurtech collaboration offers established carriers opportunities to accelerate digital transformation through partnerships with technology startups specializing in artificial intelligence, blockchain, and data analytics solutions. These collaborations enable rapid innovation while leveraging existing carrier strengths in underwriting expertise and regulatory compliance.

Underserved market segments present expansion opportunities as carriers develop targeted products for specific demographic groups, geographic regions, or industry sectors with limited insurance penetration. Micro-insurance products and usage-based coverage models address affordability concerns while expanding market accessibility.

Product innovation opportunities emerge from evolving risk landscapes, including cyber insurance for businesses and individuals, parametric coverage for weather-related risks, and embedded insurance solutions integrated into digital platforms and services. These innovative products address emerging coverage gaps while creating new revenue streams.

Distribution modernization enables carriers to reach consumers through digital channels, strategic partnerships, and omnichannel approaches that combine traditional agent relationships with online self-service capabilities. Enhanced distribution strategies improve customer acquisition efficiency while reducing operational costs.

Data monetization opportunities allow carriers to leverage vast data assets for improved risk selection, personalized pricing, and value-added services that enhance customer relationships while generating additional revenue streams beyond traditional insurance premiums.

Complex interactions between market forces, regulatory influences, and technological developments create dynamic conditions that continuously reshape the US insurance landscape. Understanding these dynamics enables stakeholders to anticipate changes and develop adaptive strategies for sustained success.

Supply and demand equilibrium fluctuates based on economic conditions, risk perception, and competitive positioning among carriers. Market hardening periods increase premium rates and tighten underwriting standards, while soft market conditions promote competitive pricing and expanded coverage availability.

Technology disruption accelerates across all market segments, with artificial intelligence adoption improving underwriting accuracy by 15-20% while reducing processing times and operational costs. Machine learning algorithms enhance fraud detection capabilities and enable real-time risk assessment for dynamic pricing models.

Customer expectations evolve rapidly as digital natives enter the insurance market with demands for seamless online experiences, transparent pricing, and personalized coverage options. These expectations drive carriers to invest in user-friendly digital platforms and streamlined claims processing capabilities.

Capital market conditions influence carrier profitability and growth strategies through investment returns, reinsurance availability, and access to growth capital. Strong capital positions enable expansion initiatives while market volatility requires conservative risk management approaches.

Regulatory evolution adapts to technological innovation and changing market conditions while maintaining consumer protection objectives. Regulatory sandboxes and modernized frameworks support innovation while ensuring market stability and fair competition among participants.

Comprehensive research approaches employed in analyzing the US insurance market combine quantitative data analysis with qualitative insights from industry experts, regulatory filings, and market participant interviews. This multi-faceted methodology ensures accurate market assessment and reliable trend identification.

Primary research activities include structured interviews with insurance executives, regulatory officials, and industry analysts to gather firsthand insights about market conditions, competitive dynamics, and future outlook perspectives. These interviews provide contextual understanding beyond publicly available data sources.

Secondary research analysis encompasses examination of financial reports, regulatory filings, industry publications, and academic studies to establish comprehensive market baselines and identify emerging trends. Data validation processes ensure accuracy and reliability of research findings.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project future market conditions based on historical trends, demographic shifts, and economic indicators. These models incorporate multiple variables to provide robust growth projections and scenario analysis.

Industry benchmarking compares US market characteristics with international insurance markets to identify best practices, innovation opportunities, and competitive positioning relative to global standards. This comparative analysis enhances understanding of market maturity and development potential.

Geographic distribution across the United States reveals distinct regional characteristics influencing insurance market dynamics, with varying risk profiles, regulatory environments, and competitive landscapes shaping local market conditions and growth opportunities.

Northeast region maintains approximately 22% of total market share, characterized by high population density, mature insurance penetration, and sophisticated commercial insurance needs. Major metropolitan areas drive demand for complex coverage solutions while established carrier presence creates competitive market conditions.

Southeast markets experience rapid growth driven by population migration, economic development, and increasing property values, though natural catastrophe exposure creates unique challenges for property and casualty carriers. Florida and Texas represent significant market opportunities despite weather-related risk concentrations.

Western states demonstrate innovation leadership through technology adoption and insurtech development, with California serving as a primary hub for insurance innovation and regulatory modernization initiatives. Wildfire risks influence property insurance availability and pricing across the region.

Midwest region offers stable market conditions with strong agricultural insurance needs, manufacturing sector coverage requirements, and traditional insurance distribution models. This region maintains 18% of national market share with steady growth patterns and conservative risk profiles.

Mountain and Plains states present emerging opportunities as economic diversification and population growth drive increased insurance demand across both personal and commercial lines. Energy sector development creates specialized coverage needs while rural markets require innovative distribution approaches.

Market leadership within the US insurance industry reflects a combination of traditional carriers with extensive distribution networks and emerging players leveraging technology to capture market share through innovative approaches and competitive pricing strategies.

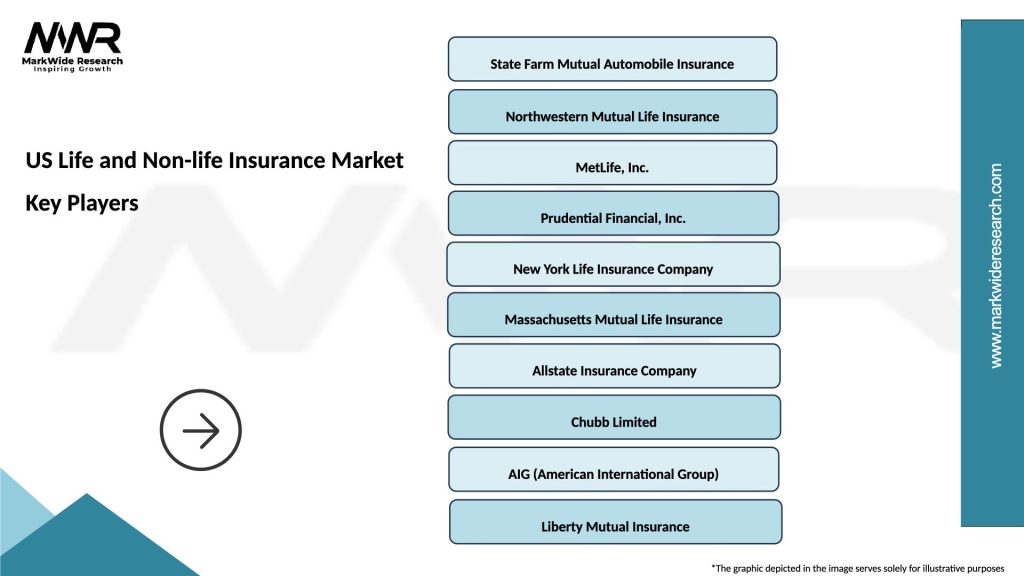

Major market participants include:

Competitive strategies focus on digital transformation, customer experience enhancement, and operational efficiency improvements while maintaining strong capital positions and regulatory compliance standards. Market leaders invest heavily in technology infrastructure and data analytics capabilities to support growth initiatives.

Emerging competitors include insurtech companies such as Lemonade, Root Insurance, and Oscar Health that challenge traditional models through streamlined operations, artificial intelligence integration, and direct-to-consumer distribution approaches.

Market segmentation within the US insurance industry reflects diverse product categories, customer demographics, and distribution channels that serve distinct market needs and risk profiles across life and non-life insurance segments.

By Product Type:

By Customer Segment:

Life insurance categories demonstrate varying growth patterns and market dynamics based on product design, target demographics, and economic conditions affecting consumer purchasing decisions and carrier profitability.

Term life insurance maintains strong demand among younger consumers seeking affordable death benefit protection, with online sales growth reaching 35% annually as direct-to-consumer platforms simplify application and underwriting processes. This category benefits from simplified underwriting and competitive pricing strategies.

Permanent life insurance products including whole life and universal life serve estate planning and wealth transfer needs for affluent consumers, though low interest rate environments challenge traditional product designs and require innovative solutions to maintain competitiveness.

Property and casualty categories reflect diverse risk exposures and coverage requirements across personal and commercial markets, with varying growth rates and profitability profiles based on loss experience and competitive dynamics.

Auto insurance represents the largest non-life category with mandatory coverage requirements driving consistent demand, while telematics and usage-based programs enable personalized pricing and improved risk selection. Electric vehicle adoption creates new coverage considerations and pricing challenges.

Homeowners insurance experiences growth driven by rising property values and increasing coverage limits, though natural catastrophe exposure creates volatility and requires sophisticated risk management approaches. Climate change impacts influence long-term pricing and availability considerations.

Commercial insurance categories serve diverse business sectors with specialized coverage needs, from general liability and property protection to cyber insurance and directors and officers coverage addressing emerging risk exposures.

Strategic advantages within the US insurance market create value for various stakeholders including carriers, policyholders, investors, and regulatory authorities through improved risk management, financial security, and economic stability contributions.

For Insurance Carriers:

For Policyholders:

For Investors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformational trends reshaping the US insurance market reflect technological advancement, changing consumer preferences, and evolving risk landscapes that influence product development, distribution strategies, and competitive positioning across industry participants.

Digital-First Customer Experience emerges as a critical differentiator as consumers expect seamless online policy management, instant quotes, and mobile-friendly claims processing. Carriers invest heavily in user interface design and omnichannel capabilities to meet these evolving expectations while reducing operational costs.

Artificial Intelligence Integration accelerates across underwriting, claims processing, and customer service functions, with AI adoption rates increasing 28% annually among major carriers. Machine learning algorithms improve risk assessment accuracy while chatbots and virtual assistants enhance customer support capabilities.

Usage-Based Insurance Models gain traction across auto and property insurance segments, leveraging telematics, IoT devices, and behavioral data to enable personalized pricing and risk-based coverage adjustments. These models appeal to safety-conscious consumers while improving carrier loss ratios.

Embedded Insurance Solutions integrate coverage into digital platforms, e-commerce transactions, and service offerings, creating seamless protection for consumers while expanding distribution reach for carriers. This trend particularly impacts specialty lines and micro-insurance products.

Sustainability and ESG Focus influences investment strategies, underwriting guidelines, and product development as carriers respond to climate change risks and stakeholder expectations for responsible business practices. Green insurance products and sustainable investment portfolios gain market acceptance.

Parametric Insurance Growth addresses coverage gaps for weather-related and catastrophic risks through automated claim payments based on predetermined triggers rather than traditional loss adjustment processes. This innovation improves claim settlement speed while reducing administrative costs.

Recent developments within the US insurance industry demonstrate ongoing evolution through technological innovation, regulatory adaptation, and strategic initiatives that reshape competitive dynamics and market opportunities.

Regulatory Modernization initiatives across multiple states streamline licensing requirements, support insurtech innovation through regulatory sandboxes, and modernize consumer protection frameworks while maintaining market stability objectives. These changes facilitate market entry and product innovation.

Strategic Acquisitions accelerate as traditional carriers acquire insurtech companies to gain technology capabilities and digital expertise, while private equity investment in insurance platforms increases significantly. MarkWide Research analysis indicates consolidation activity reaching multi-year highs across various market segments.

Climate Risk Assessment advances through sophisticated modeling capabilities and data analytics platforms that enable more accurate catastrophe risk pricing and portfolio management. Carriers invest in climate science expertise and advanced forecasting technologies.

Cyber Insurance Evolution responds to increasing cyber threats and regulatory requirements with enhanced coverage options, risk assessment tools, and loss prevention services. This rapidly growing segment addresses critical protection gaps for businesses and individuals.

Distribution Innovation includes direct-to-consumer platforms, digital broker networks, and embedded insurance partnerships that expand market reach while reducing distribution costs. Traditional agent networks adapt through technology integration and enhanced service offerings.

Product Personalization advances through data analytics and customer segmentation capabilities that enable customized coverage options, flexible policy terms, and dynamic pricing models based on individual risk profiles and preferences.

Strategic recommendations for insurance industry participants focus on adapting to market evolution while maintaining competitive positioning and profitability through technological innovation, operational efficiency, and customer-centric approaches.

Technology Investment Priorities should emphasize customer-facing digital platforms, data analytics capabilities, and automation technologies that improve operational efficiency while enhancing customer experience. Carriers should prioritize mobile-first design and seamless integration across distribution channels.

Partnership Strategy Development enables traditional carriers to accelerate innovation through collaborations with insurtech companies, technology providers, and distribution partners. These strategic alliances provide access to new capabilities while sharing development costs and risks.

Risk Management Enhancement requires sophisticated modeling capabilities for emerging risks including cyber threats, climate change impacts, and pandemic-related exposures. Carriers should invest in predictive analytics and scenario planning capabilities to improve risk selection and pricing accuracy.

Customer Segmentation Refinement enables personalized product offerings and targeted marketing strategies that improve customer acquisition and retention rates. Advanced analytics support micro-segmentation approaches that identify profitable customer niches and coverage preferences.

Regulatory Engagement should focus on proactive participation in regulatory modernization initiatives while ensuring compliance with evolving requirements. Carriers benefit from early engagement in regulatory discussions about innovation frameworks and consumer protection standards.

Talent Acquisition priorities should emphasize technology expertise, data science capabilities, and digital marketing skills that support transformation initiatives. Traditional insurance expertise remains valuable when combined with modern technological competencies.

Long-term projections for the US insurance market indicate continued growth and evolution driven by demographic trends, technological advancement, and changing risk landscapes that create both opportunities and challenges for industry participants.

Market expansion is expected to continue at a steady growth rate of 4-6% annually across combined life and non-life segments, supported by population growth, economic development, and increasing insurance awareness among younger demographics. Digital distribution channels will capture an increasing share of new business generation.

Technology integration will accelerate across all market segments, with artificial intelligence, machine learning, and blockchain technologies becoming standard operational tools rather than competitive differentiators. MWR projects that digital transformation investments will increase by 22% annually as carriers modernize legacy systems and enhance customer capabilities.

Product innovation will focus on emerging risks and underserved market segments, with parametric insurance, cyber coverage, and climate-related products experiencing rapid growth. Usage-based insurance models will expand beyond auto insurance to property and specialty lines.

Regulatory evolution will continue supporting innovation while maintaining consumer protection objectives, with potential federal involvement in insurance regulation and standardization initiatives. Climate risk disclosure requirements and cyber security standards will influence operational practices.

Competitive landscape changes will reflect ongoing consolidation among traditional carriers and continued growth of insurtech companies that successfully scale operations and achieve profitability. Partnership models between traditional and technology-focused companies will become increasingly common.

Customer expectations will continue evolving toward digital-first experiences, personalized coverage options, and transparent pricing models. Carriers that successfully adapt to these expectations while maintaining operational efficiency will capture market share and achieve sustainable growth.

The US life and non-life insurance market represents a dynamic and evolving ecosystem that continues to adapt to technological innovation, changing consumer preferences, and emerging risk landscapes while maintaining its fundamental role in providing financial security and risk management solutions.

Market fundamentals remain strong with diverse product offerings, sophisticated distribution networks, and robust regulatory frameworks supporting sustainable growth and innovation. The combination of traditional insurance expertise and emerging technology capabilities creates significant opportunities for carriers that successfully navigate digital transformation challenges.

Future success will depend on strategic adaptation to technological disruption, customer experience enhancement, and operational efficiency improvements while maintaining strong risk management capabilities and regulatory compliance standards. The market rewards innovation and customer-centricity while requiring prudent risk management and capital allocation.

Stakeholder value creation emerges through comprehensive approaches that balance growth objectives with stability requirements, leveraging technology to enhance traditional insurance strengths rather than replacing proven business models entirely. The US life and non-life insurance market continues to offer substantial opportunities for participants who embrace change while respecting the fundamental principles of risk transfer and financial protection that define the insurance industry.

What is Life and Non-life Insurance?

Life and Non-life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the US Life and Non-life Insurance Market?

Key players in the US Life and Non-life Insurance Market include companies like State Farm, Allstate, MetLife, and Prudential, which offer a range of insurance products to consumers and businesses, among others.

What are the main drivers of growth in the US Life and Non-life Insurance Market?

The growth of the US Life and Non-life Insurance Market is driven by factors such as increasing awareness of insurance products, a growing aging population, and rising healthcare costs that necessitate comprehensive coverage.

What challenges does the US Life and Non-life Insurance Market face?

Challenges in the US Life and Non-life Insurance Market include regulatory changes, increasing competition from insurtech companies, and the need for traditional insurers to adapt to digital transformation.

What opportunities exist in the US Life and Non-life Insurance Market?

Opportunities in the US Life and Non-life Insurance Market include the expansion of digital insurance solutions, the rise of personalized insurance products, and the potential for growth in underserved markets.

What trends are shaping the US Life and Non-life Insurance Market?

Trends in the US Life and Non-life Insurance Market include the adoption of artificial intelligence for underwriting and claims processing, increased focus on customer experience, and the integration of sustainability practices in insurance offerings.

US Life and Non-life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Universal Life, Variable Life |

| Customer Type | Individuals, Families, Corporations, Non-profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Service Type | Claims Processing, Underwriting, Risk Assessment, Policy Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Life and Non-life Insurance Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at