444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US laundry appliance market represents one of the most dynamic segments within the American home appliance industry, encompassing washing machines, dryers, and combination units that serve millions of households across the nation. Market dynamics indicate robust growth driven by technological innovations, energy efficiency demands, and evolving consumer preferences toward smart home integration. The sector demonstrates remarkable resilience with consistent demand patterns reflecting both replacement cycles and new household formations.

Consumer behavior in the laundry appliance sector has shifted significantly toward premium features, with 65% of consumers prioritizing energy efficiency ratings when making purchase decisions. Smart connectivity features have gained substantial traction, with adoption rates climbing to 42% among new appliance purchases in recent years. The market encompasses diverse product categories ranging from traditional top-loading washers to advanced front-loading systems with integrated drying capabilities.

Regional distribution across the United States shows concentrated demand in suburban markets, where larger household sizes and dedicated laundry spaces drive premium product adoption. Urban markets increasingly favor compact and stackable solutions, reflecting space constraints and apartment living trends. The market experiences seasonal fluctuations with peak sales periods during spring home improvement seasons and back-to-school periods.

The US laundry appliance market refers to the comprehensive ecosystem of washing machines, dryers, and related laundry equipment designed for residential use within the United States, encompassing traditional and smart-enabled devices that facilitate household fabric care and maintenance operations.

Market scope includes various appliance categories such as top-loading and front-loading washing machines, electric and gas dryers, washer-dryer combinations, and portable laundry solutions. The definition extends to encompass both standalone units and integrated laundry systems designed for different housing configurations and consumer preferences.

Industry boundaries encompass manufacturers, distributors, retailers, and service providers involved in the design, production, marketing, and maintenance of residential laundry equipment. The market includes both domestic production facilities and imported products that meet US safety and efficiency standards.

Market performance in the US laundry appliance sector demonstrates consistent growth momentum driven by replacement demand, new construction activity, and technological advancement adoption. Consumer preferences have evolved toward energy-efficient models with smart features, creating opportunities for premium product positioning and enhanced profit margins for manufacturers.

Key growth drivers include increasing household formation rates, rising disposable income levels, and growing awareness of energy conservation benefits. Technology integration represents a critical differentiator, with 38% of consumers expressing willingness to pay premium prices for connected appliances that offer remote monitoring and control capabilities.

Competitive dynamics feature established domestic manufacturers competing alongside international brands, with market share distribution reflecting brand loyalty, dealer relationships, and product innovation capabilities. Distribution channels span traditional retail outlets, online platforms, and direct-to-consumer sales models, each serving distinct customer segments with varying service expectations.

Future prospects indicate continued market expansion supported by demographic trends, technological innovation, and sustainability initiatives. Regulatory compliance requirements for energy efficiency standards drive ongoing product development investments and market differentiation opportunities.

Consumer behavior analysis reveals significant shifts in purchasing patterns and feature preferences within the US laundry appliance market. Primary insights demonstrate the following critical market characteristics:

Market research indicates that consumer decision-making processes increasingly incorporate sustainability considerations, with 72% of buyers evaluating environmental impact factors during appliance selection. Digital influence on purchasing decisions continues expanding, with online reviews and social media recommendations playing crucial roles in brand perception formation.

Primary growth catalysts propelling the US laundry appliance market forward encompass demographic, technological, and economic factors that create sustained demand momentum. Housing market dynamics represent a fundamental driver, with new construction projects and home renovation activities generating consistent appliance replacement needs.

Demographic trends significantly influence market expansion, particularly millennial household formation and aging baby boomer populations requiring appliance upgrades. Urbanization patterns drive demand for space-efficient solutions, while suburban growth supports premium full-size appliance adoption. Income growth in key demographic segments enables consumers to invest in higher-quality, feature-rich laundry equipment.

Technological advancement serves as a critical market driver, with innovations in smart connectivity, energy efficiency, and user interface design creating compelling upgrade incentives. Internet of Things integration enables remote monitoring, predictive maintenance, and energy optimization features that appeal to tech-savvy consumers. Artificial intelligence applications in cycle optimization and fabric care customization represent emerging driver categories.

Environmental consciousness among consumers drives demand for eco-friendly appliances with reduced water consumption, lower energy usage, and sustainable manufacturing practices. Utility rebate programs and government incentives for energy-efficient appliances provide additional purchase motivation. Corporate sustainability initiatives influence both product development priorities and consumer purchasing decisions.

Market challenges facing the US laundry appliance sector include economic, technological, and competitive factors that potentially limit growth momentum. Economic uncertainty periods can significantly impact discretionary spending on major appliances, as consumers defer replacement purchases during financial stress.

Supply chain disruptions have emerged as significant constraints, affecting component availability, manufacturing schedules, and delivery timelines. Raw material cost fluctuations impact manufacturing expenses and retail pricing strategies, potentially reducing consumer affordability and market accessibility. Semiconductor shortages particularly affect smart appliance production capabilities and feature implementation.

Competitive pricing pressure from imported products creates margin compression challenges for domestic manufacturers. Market saturation in certain segments limits organic growth opportunities, requiring companies to focus on replacement cycles rather than market expansion. Consumer price sensitivity during economic downturns constrains premium product adoption rates.

Regulatory compliance costs associated with evolving energy efficiency standards and safety requirements increase development expenses and time-to-market challenges. Installation complexity for advanced appliances may deter some consumers, particularly in older homes requiring electrical or plumbing modifications. Service availability limitations in rural markets can impact customer satisfaction and brand loyalty.

Emerging opportunities within the US laundry appliance market present significant growth potential across multiple dimensions. Smart home integration represents a substantial opportunity, with connected appliances offering enhanced functionality and user experience benefits that command premium pricing.

Sustainability focus creates opportunities for manufacturers to develop innovative eco-friendly solutions that appeal to environmentally conscious consumers. Water conservation technologies and energy-efficient designs align with utility company incentive programs and regulatory requirements. Circular economy initiatives including appliance recycling and refurbishment programs offer new revenue streams.

Demographic shifts present targeted market opportunities, particularly among millennial and Gen Z consumers who prioritize technology integration and environmental responsibility. Aging population segments require accessible design features and simplified operation interfaces, creating specialized product development opportunities. Multi-generational households drive demand for high-capacity and versatile appliance solutions.

E-commerce expansion enables direct-to-consumer sales models and enhanced customer engagement opportunities. Subscription service models for maintenance, detergent delivery, and appliance upgrades represent innovative business model opportunities. Partnership opportunities with home builders, interior designers, and smart home technology providers can expand market reach and customer acquisition channels.

Market forces shaping the US laundry appliance landscape reflect complex interactions between consumer behavior, technological innovation, and competitive positioning strategies. Demand patterns demonstrate cyclical characteristics influenced by housing market activity, economic conditions, and seasonal purchasing preferences.

Supply chain dynamics have evolved significantly, with manufacturers implementing resilience strategies to address component sourcing challenges and logistics disruptions. Inventory management practices balance cost optimization with service level requirements, particularly for seasonal demand fluctuations. Manufacturing flexibility enables rapid response to changing consumer preferences and market conditions.

Pricing dynamics reflect value-based positioning strategies, with premium features commanding higher margins while competitive pressure maintains affordability in entry-level segments. Promotional strategies including seasonal sales events, trade-in programs, and financing options influence purchase timing and brand selection decisions. Channel dynamics show ongoing shifts between traditional retail and online purchasing patterns.

Innovation cycles drive market differentiation opportunities, with 18-month product refresh schedules maintaining competitive relevance. Technology adoption rates vary across consumer segments, creating opportunities for targeted product positioning and marketing strategies. Regulatory dynamics continue influencing product development priorities and market entry strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US laundry appliance market dynamics. Primary research initiatives include consumer surveys, industry expert interviews, and manufacturer consultations to gather firsthand market intelligence and trend identification.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial disclosures to establish market baseline metrics and historical trend patterns. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights.

Quantitative analysis techniques include statistical modeling, trend analysis, and forecasting methodologies to project market development scenarios. Qualitative research methods such as focus groups, expert panels, and case study analysis provide contextual understanding of market dynamics and consumer behavior patterns.

Market segmentation analysis employs demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific needs. Competitive intelligence gathering includes product analysis, pricing studies, and market positioning evaluation to understand competitive landscape dynamics. Technology assessment methodologies evaluate innovation trends and their potential market impact.

Geographic distribution across the United States reveals distinct regional preferences and market characteristics within the laundry appliance sector. Northeast markets demonstrate strong preference for compact and energy-efficient solutions, reflecting urban living conditions and environmental consciousness. Market penetration in this region shows 28% share of premium appliance sales, driven by higher disposable income levels and early technology adoption patterns.

Southeast regional markets exhibit robust growth momentum supported by population migration, new construction activity, and economic development initiatives. Consumer preferences in this region favor traditional top-loading washers and gas dryers, reflecting cultural preferences and utility infrastructure characteristics. Market share distribution shows 22% regional concentration with strong growth trajectory projections.

Midwest markets represent stable demand patterns with emphasis on durability, reliability, and value positioning. Agricultural and rural markets within this region drive demand for heavy-duty appliances capable of handling work clothing and large family loads. Regional market share accounts for 18% of total volume with consistent replacement cycle patterns.

Western markets demonstrate leadership in smart appliance adoption and sustainability initiatives, with California leading in energy-efficient product penetration rates. Water conservation features gain particular importance in drought-prone areas, influencing product development and marketing strategies. Market concentration shows 32% regional share with premium product preference trends.

Market leadership in the US laundry appliance sector features established domestic manufacturers competing alongside international brands through innovation, distribution strength, and customer service excellence. Competitive positioning strategies emphasize brand differentiation, technology leadership, and comprehensive product portfolios.

Competitive strategies include product innovation investments, distribution channel expansion, and customer service enhancement initiatives. Market share dynamics reflect ongoing competition for dealer relationships, consumer mindshare, and technological differentiation. Partnership strategies with retailers, builders, and service providers strengthen market positioning and customer access.

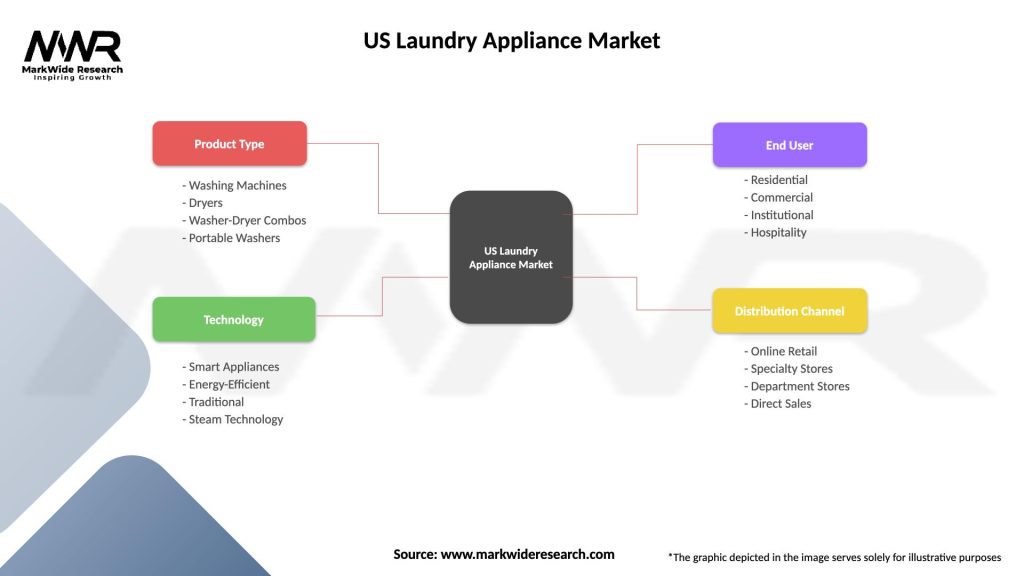

Market segmentation within the US laundry appliance sector encompasses multiple classification criteria that enable targeted product development and marketing strategies. Product type segmentation represents the primary categorization framework for market analysis and competitive positioning.

By Product Type:

By Capacity Range:

By Technology Level:

Washing machine category demonstrates distinct performance characteristics across different product types and consumer segments. Top-loading washers maintain strong market presence due to familiar operation, lower purchase prices, and easier loading ergonomics. Consumer loyalty in this segment reflects generational preferences and perceived reliability advantages.

Front-loading washers show accelerating adoption rates driven by energy efficiency benefits, superior cleaning performance, and stackable installation options. Water conservation features appeal to environmentally conscious consumers and utility rebate program participants. Premium positioning enables higher profit margins despite increased manufacturing complexity.

Dryer category analysis reveals preference patterns influenced by utility infrastructure and operating cost considerations. Electric dryers dominate markets without natural gas access, while gas dryers gain preference where infrastructure supports installation. Heat pump technology represents emerging opportunity for energy efficiency leadership.

Smart appliance category shows rapid growth momentum with connected features becoming standard in premium segments. Mobile app integration enables remote monitoring, cycle customization, and maintenance alerts that enhance user experience. Voice control compatibility with smart home ecosystems drives additional adoption among tech-savvy consumers.

Manufacturers benefit from diverse market opportunities spanning multiple product categories, price segments, and technology levels. Innovation investments in smart connectivity, energy efficiency, and user experience enhancements create competitive differentiation and premium pricing opportunities. Brand loyalty development through quality products and service excellence generates sustainable market share advantages.

Retailers gain from consistent consumer demand patterns and opportunities for value-added services including delivery, installation, and extended warranties. Product mix optimization across price points enables market coverage and profit margin management. Digital commerce integration expands customer reach and enhances shopping experience convenience.

Consumers receive significant value through improved appliance performance, energy cost savings, and enhanced convenience features. Technology integration provides remote monitoring capabilities and predictive maintenance alerts that reduce service disruptions. Energy efficiency improvements deliver ongoing utility cost reductions and environmental impact benefits.

Service providers benefit from ongoing maintenance requirements, installation services, and repair opportunities throughout appliance lifecycles. Smart appliance diagnostics enable proactive service scheduling and improved first-call resolution rates. Training programs for new technologies create skilled technician development opportunities and service differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration trends dominate the US laundry appliance market evolution, with smart connectivity features becoming increasingly standard across product categories. Internet of Things capabilities enable remote monitoring, cycle optimization, and predictive maintenance alerts that enhance user experience and operational efficiency. Artificial intelligence applications in fabric care customization and energy management represent emerging trend categories.

Sustainability trends influence both product development priorities and consumer purchasing decisions throughout the market. Water conservation technologies gain importance in drought-prone regions, while energy efficiency improvements align with utility rebate programs and environmental consciousness. Circular economy initiatives including appliance recycling and refurbishment programs create new business model opportunities.

Design aesthetic trends emphasize modern styling, premium finishes, and seamless integration with contemporary home décor. Color options expand beyond traditional white to include stainless steel, black stainless, and custom color matching capabilities. User interface evolution incorporates touchscreen controls, voice activation, and mobile app integration for enhanced convenience.

Market consolidation trends reflect ongoing merger and acquisition activity as companies seek scale advantages and technology capabilities. Vertical integration strategies enable better supply chain control and cost management. Partnership trends with technology companies, retailers, and service providers create ecosystem advantages and customer engagement opportunities.

Recent industry developments highlight significant technological advancement and market positioning initiatives across the US laundry appliance sector. Smart appliance launches by major manufacturers demonstrate commitment to connected home integration and premium market positioning strategies.

Manufacturing investments in domestic production facilities reflect supply chain resilience priorities and “Made in America” marketing advantages. Automation initiatives in manufacturing processes improve efficiency and quality consistency while addressing labor availability challenges. Research and development investments focus on energy efficiency improvements and user experience enhancements.

Partnership announcements between appliance manufacturers and technology companies enable advanced connectivity features and smart home ecosystem integration. Retail channel expansion includes direct-to-consumer sales platforms and enhanced online shopping experiences. Service network investments improve customer support capabilities and technician training programs.

Regulatory compliance initiatives address evolving energy efficiency standards and safety requirements through product redesign and testing programs. Sustainability programs include recycling initiatives, packaging reduction efforts, and renewable energy adoption in manufacturing operations. Market expansion strategies target underserved demographic segments and geographic regions with tailored product offerings.

Strategic recommendations for market participants emphasize technology integration, customer experience enhancement, and operational efficiency optimization. MarkWide Research analysis suggests that companies prioritizing smart appliance development and ecosystem integration will capture disproportionate market share growth in premium segments.

Investment priorities should focus on research and development capabilities, manufacturing flexibility, and distribution channel optimization. Technology partnerships with software companies and smart home platform providers create competitive advantages and market differentiation opportunities. Customer data analytics capabilities enable personalized marketing and product development insights.

Market positioning strategies require clear value proposition communication and targeted segment focus rather than broad market approaches. Premium positioning through technology leadership and design excellence commands higher margins than cost-based competition strategies. Service excellence initiatives including installation, maintenance, and customer support create loyalty and referral opportunities.

Operational recommendations include supply chain diversification, inventory optimization, and quality management system enhancement. Sustainability initiatives should align with consumer values and regulatory requirements while creating marketing differentiation. Digital transformation investments in e-commerce capabilities and customer engagement platforms support changing shopping preferences and market access requirements.

Market projections for the US laundry appliance sector indicate continued growth momentum supported by demographic trends, technology advancement, and replacement cycle dynamics. Smart appliance adoption is expected to accelerate significantly, with penetration rates reaching 75% in premium segments over the next five years. Connected features will transition from luxury options to standard expectations across most product categories.

Technology evolution will focus on artificial intelligence integration, predictive maintenance capabilities, and energy optimization algorithms that deliver measurable consumer benefits. Voice control integration and smart home ecosystem compatibility will become essential features for competitive positioning. Sustainability innovations including water recycling systems and renewable energy integration represent emerging development priorities.

Market structure evolution may include increased consolidation as companies seek scale advantages and technology capabilities. Direct-to-consumer sales channels are projected to grow at 12% annually, reflecting changing shopping preferences and digital commerce adoption. Service business models including subscription maintenance and appliance-as-a-service offerings will create new revenue opportunities.

Demographic influences will continue shaping product development priorities, with millennial and Gen Z preferences driving smart features, sustainability focus, and design aesthetics. Urbanization trends will sustain demand for compact and stackable solutions, while suburban markets maintain preference for full-size premium appliances. MWR projections indicate that market growth will remain resilient despite economic uncertainties, supported by essential replacement demand and ongoing household formation trends.

The US laundry appliance market demonstrates remarkable resilience and growth potential driven by technological innovation, demographic trends, and evolving consumer preferences. Market dynamics reflect a mature industry undergoing significant transformation through smart technology integration, sustainability initiatives, and enhanced customer experience focus.

Competitive positioning increasingly depends on technology leadership, brand differentiation, and comprehensive service offerings rather than traditional price-based competition. Consumer expectations continue evolving toward connected features, energy efficiency, and design aesthetics that integrate seamlessly with modern home environments. Market opportunities remain substantial for companies that successfully navigate technological transitions and demographic shifts while maintaining operational excellence and customer satisfaction focus.

Future success in the US laundry appliance market will require strategic investments in innovation capabilities, distribution optimization, and customer engagement platforms that deliver superior value propositions across diverse consumer segments and regional markets.

What is Laundry Appliance?

Laundry appliances refer to machines designed for washing and drying clothes, including washing machines, dryers, and combination units. These appliances are essential in both residential and commercial settings for efficient laundry care.

What are the key players in the US Laundry Appliance Market?

Key players in the US Laundry Appliance Market include Whirlpool Corporation, LG Electronics, Samsung Electronics, and Electrolux, among others. These companies are known for their innovative products and strong market presence.

What are the main drivers of growth in the US Laundry Appliance Market?

The main drivers of growth in the US Laundry Appliance Market include increasing consumer demand for energy-efficient appliances, advancements in technology, and the rising trend of smart home integration. Additionally, the growing focus on sustainability is influencing purchasing decisions.

What challenges does the US Laundry Appliance Market face?

The US Laundry Appliance Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market dynamics.

What opportunities exist in the US Laundry Appliance Market?

Opportunities in the US Laundry Appliance Market include the growing demand for smart appliances, the expansion of e-commerce platforms for appliance sales, and the increasing focus on eco-friendly products. These trends present avenues for innovation and market growth.

What trends are shaping the US Laundry Appliance Market?

Trends shaping the US Laundry Appliance Market include the rise of smart technology integration, the popularity of compact and stackable units for small spaces, and a shift towards more sustainable and energy-efficient models. These trends reflect changing consumer lifestyles and preferences.

US Laundry Appliance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Washing Machines, Dryers, Washer-Dryer Combos, Portable Washers |

| Technology | Smart Appliances, Energy-Efficient, Traditional, Steam Technology |

| End User | Residential, Commercial, Institutional, Hospitality |

| Distribution Channel | Online Retail, Specialty Stores, Department Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Laundry Appliance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at