444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US landscaping market represents a dynamic and rapidly evolving sector that encompasses residential, commercial, and institutional landscape design, installation, and maintenance services. This comprehensive industry has experienced remarkable growth driven by increasing urbanization, rising property values, and growing environmental consciousness among consumers. The market demonstrates strong resilience with consistent expansion across multiple service categories including lawn care, tree services, landscape design, and hardscaping solutions.

Market dynamics indicate sustained growth at a 6.2% CAGR over the forecast period, reflecting robust demand from both residential and commercial sectors. The industry benefits from seasonal consistency through diversified service offerings that span year-round maintenance, seasonal installations, and specialized environmental services. Regional variations show particularly strong performance in warmer climates where landscaping activities continue throughout the year, while northern regions demonstrate concentrated seasonal demand patterns.

Technology integration has become increasingly important, with 45% of landscaping companies adopting digital tools for project management, customer communication, and operational efficiency. The market encompasses various service segments including residential lawn care, commercial property maintenance, landscape architecture, irrigation systems, and specialized services such as tree care and pest management.

The US landscaping market refers to the comprehensive industry encompassing professional services related to outdoor space design, installation, maintenance, and enhancement across residential, commercial, and institutional properties. This market includes landscape contractors, lawn care services, garden centers, and specialized providers offering everything from basic maintenance to complex design-build projects.

Core services within this market span landscape design and architecture, hardscaping installation, softscaping and planting, irrigation system design and maintenance, lawn care and turf management, tree and shrub care, seasonal cleanup services, and specialized environmental solutions. The industry serves diverse customer segments including homeowners, property management companies, municipalities, educational institutions, healthcare facilities, and corporate campuses.

Market participants range from small local operators serving residential neighborhoods to large national chains providing comprehensive commercial services. The industry structure includes both franchise operations and independent businesses, with many companies offering specialized services such as organic lawn care, native plant landscaping, or sustainable design solutions to meet evolving consumer preferences.

The US landscaping market demonstrates exceptional growth potential driven by multiple converging factors including increased focus on outdoor living spaces, rising property investment, and growing environmental awareness. Market expansion is supported by strong residential construction activity, commercial development projects, and increasing consumer spending on home improvement and property enhancement services.

Key growth drivers include the trend toward outdoor entertainment spaces, with 78% of homeowners investing in landscape improvements to enhance property value and lifestyle quality. The commercial segment shows particularly strong demand as businesses recognize the importance of attractive outdoor spaces for employee satisfaction and customer attraction. Sustainability trends are reshaping service offerings, with increasing demand for native plant installations, water-efficient irrigation systems, and organic maintenance practices.

Competitive dynamics favor companies that can offer comprehensive service packages, demonstrate environmental expertise, and leverage technology for operational efficiency. The market benefits from relatively low barriers to entry while rewarding established players with strong local relationships and proven service quality. Regional expansion opportunities exist particularly in high-growth metropolitan areas where new construction and property development drive consistent demand.

Market analysis reveals several critical insights that define the current landscape and future trajectory of the US landscaping industry. Consumer behavior has shifted significantly toward viewing landscaping as an investment in property value and quality of life rather than merely maintenance expense.

Primary market drivers propelling the US landscaping industry forward include fundamental demographic, economic, and social trends that create sustained demand for professional landscape services. Urbanization patterns continue driving demand as metropolitan areas expand and property development increases across suburban and urban markets.

Property value enhancement serves as a major driver, with professional landscaping demonstrating proven return on investment for both residential and commercial properties. Homeowner investment in outdoor living spaces has accelerated, particularly following increased home occupancy during recent years. The trend toward outdoor entertainment areas creates demand for comprehensive landscape design and installation services.

Commercial sector growth reflects business recognition that attractive outdoor spaces contribute to employee satisfaction, customer attraction, and corporate image. Environmental regulations in many municipalities require professional landscape maintenance for commercial properties, creating consistent demand for qualified service providers. Water management requirements drive demand for professional irrigation design and maintenance services.

Demographic trends support market growth as aging homeowners increasingly rely on professional services for property maintenance they previously performed themselves. Dual-income households prioritize convenience and professional quality over do-it-yourself approaches, expanding the addressable market for landscape service providers.

Market challenges facing the US landscaping industry include several structural and operational factors that can limit growth potential and profitability for service providers. Labor shortage represents the most significant constraint, with 68% of landscaping companies reporting difficulty finding qualified workers for both skilled and entry-level positions.

Seasonal revenue fluctuations create cash flow challenges for many companies, particularly in northern climates where winter weather severely limits outdoor work opportunities. Weather dependency affects scheduling reliability and can impact customer satisfaction when services must be postponed or rescheduled due to adverse conditions.

Economic sensitivity makes the industry vulnerable to economic downturns when both residential and commercial customers reduce discretionary spending on landscape services. Competition intensity from both established companies and new market entrants can pressure pricing and profit margins, particularly in saturated local markets.

Regulatory compliance requirements for pesticide application, water usage, and environmental protection create operational complexity and cost burdens for service providers. Equipment costs and maintenance requirements represent significant capital investments that can strain smaller operators. Insurance expenses continue rising due to liability concerns and equipment risks associated with landscape operations.

Significant opportunities exist within the US landscaping market for companies positioned to capitalize on emerging trends and evolving customer needs. Sustainability services represent a high-growth segment as environmental consciousness drives demand for eco-friendly landscape solutions and organic maintenance practices.

Technology integration offers differentiation opportunities through smart irrigation systems, landscape design software, and digital customer communication platforms. Commercial expansion provides growth potential as businesses increasingly recognize landscaping as essential for competitive positioning and employee satisfaction.

Specialty services such as native plant installation, rain garden design, and pollinator habitat creation appeal to environmentally conscious customers willing to pay premium pricing. Year-round service diversification enables companies to smooth seasonal revenue fluctuations through snow removal, holiday decorating, and indoor plant services.

Franchise opportunities allow successful operators to expand geographically while maintaining operational control and brand consistency. Acquisition strategies enable growth-oriented companies to consolidate fragmented local markets and achieve operational efficiencies. Vertical integration through nursery operations or equipment sales can improve margins and customer retention.

Market dynamics within the US landscaping industry reflect complex interactions between supply and demand factors, competitive pressures, and evolving customer expectations. Demand patterns show increasing sophistication as customers seek comprehensive solutions rather than basic maintenance services.

Supply chain considerations affect material availability and pricing, particularly for specialized plants, hardscaping materials, and irrigation components. Labor market dynamics create both challenges and opportunities as companies compete for skilled workers while investing in training and retention programs.

Pricing dynamics vary significantly by service type and geographic region, with design and specialty services commanding premium rates while basic maintenance faces competitive pressure. Customer retention rates average 82% annually for companies providing consistent quality service, highlighting the importance of operational excellence.

Seasonal dynamics create predictable demand patterns that successful companies leverage through service diversification and strategic planning. Technology adoption accelerates as companies recognize efficiency gains and customer satisfaction benefits from digital tools and automated systems. Environmental regulations continue evolving, creating both compliance challenges and opportunities for companies with environmental expertise.

Comprehensive research methodology employed for analyzing the US landscaping market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry participants across various market segments, from small local operators to large national service providers.

Secondary research encompasses analysis of industry publications, government statistics, trade association data, and regulatory filings to establish market baseline and trend identification. MarkWide Research utilizes proprietary analytical frameworks to assess market dynamics, competitive positioning, and growth potential across different service categories and geographic regions.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews with key industry participants, and applying statistical analysis to ensure data consistency and reliability. Market sizing methodology incorporates bottom-up analysis of service categories combined with top-down validation using industry benchmarks and economic indicators.

Trend analysis employs both quantitative and qualitative approaches to identify emerging patterns and forecast future market development. Regional analysis considers climate variations, demographic differences, and local market characteristics that influence demand patterns and competitive dynamics across different geographic markets.

Regional market analysis reveals significant variations in demand patterns, service preferences, and competitive dynamics across different geographic areas of the United States. Southern regions demonstrate the strongest year-round activity levels, accounting for approximately 35% of total market activity due to favorable climate conditions that support continuous landscaping operations.

Western markets show particular strength in drought-resistant landscaping and water-efficient irrigation services, driven by environmental regulations and water conservation requirements. California leads in sustainable landscaping adoption, with 52% of residential projects incorporating native plant species and water-saving technologies.

Northeastern markets demonstrate strong seasonal demand concentration with premium pricing for spring cleanup and fall preparation services. Commercial landscaping shows consistent strength in metropolitan areas where business districts prioritize attractive outdoor environments. Midwest regions balance residential and agricultural landscaping services with growing commercial sector demand.

Mountain states present unique opportunities for specialized services including xeriscaping, altitude-appropriate plant selection, and snow removal integration. Southeast markets benefit from rapid population growth and new construction activity that drives consistent demand for landscape installation and maintenance services. Regional preferences vary significantly, with coastal areas favoring salt-tolerant plants while inland regions focus on drought resistance and low maintenance requirements.

The competitive landscape of the US landscaping market features a diverse mix of national chains, regional operators, and local service providers competing across various service segments and geographic markets. Market fragmentation remains high, with numerous small operators serving local markets alongside established national brands.

Competitive differentiation occurs through service specialization, technology adoption, environmental expertise, and customer relationship management. Market consolidation continues as larger companies acquire successful local operators to expand geographic coverage and service capabilities.

Market segmentation within the US landscaping industry reveals distinct categories based on service type, customer segment, and application focus. Service-based segmentation provides the primary framework for understanding market dynamics and competitive positioning across different offering categories.

By Service Type:

By Customer Segment:

Category analysis reveals distinct performance characteristics and growth patterns across different landscaping service segments. Lawn care services maintain the largest market share due to recurring revenue nature and broad customer appeal, with consistent demand across all geographic regions and property types.

Landscape design and installation demonstrates the highest profit margins and customer satisfaction scores, driven by customized solutions and premium service positioning. Project-based revenue in this category provides opportunities for significant contract values while building long-term customer relationships through ongoing maintenance agreements.

Tree and shrub care represents a specialized high-value segment requiring technical expertise and specialized equipment. Safety considerations and insurance requirements create barriers to entry that protect established providers from competitive pressure. Emergency services during storm events provide additional revenue opportunities.

Irrigation services show strong growth driven by water conservation requirements and smart technology adoption. System maintenance contracts provide recurring revenue while installation projects offer higher margins. Water management expertise becomes increasingly valuable as environmental regulations expand.

Hardscaping services appeal to customers seeking permanent landscape improvements with immediate visual impact. Material markup opportunities and skilled labor requirements support premium pricing while creating customer loyalty through quality craftsmanship.

Industry participants across the US landscaping market ecosystem realize multiple benefits from market growth and evolution. Service providers benefit from expanding customer base, increasing service sophistication, and opportunities for premium pricing through specialized expertise and technology integration.

Franchise operators gain advantages through established brand recognition, proven business systems, and ongoing support for marketing and operational efficiency. Independent operators benefit from local market knowledge, customer relationship flexibility, and ability to adapt quickly to changing market conditions.

Equipment manufacturers realize benefits from increasing technology adoption, replacement cycles, and demand for specialized tools and machinery. Supplier networks including nurseries, material distributors, and chemical providers benefit from consistent demand growth and expanding service categories.

Property owners benefit from professional expertise, time savings, and property value enhancement through quality landscape services. Commercial customers realize benefits including improved employee satisfaction, enhanced corporate image, and compliance with environmental regulations.

Environmental stakeholders benefit from increasing adoption of sustainable practices, native plant installations, and water conservation technologies. Local communities benefit from improved property values, environmental stewardship, and job creation within the landscaping industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the US landscaping market reflect evolving customer preferences, technological advancement, and environmental consciousness. Sustainable landscaping has become a dominant trend, with 61% of customers expressing preference for environmentally responsible service options including organic treatments and native plant installations.

Smart technology integration accelerates across the industry as companies adopt automated irrigation systems, landscape design software, and customer relationship management platforms. Water conservation drives demand for drought-resistant plants, efficient irrigation systems, and xeriscaping solutions particularly in water-stressed regions.

Outdoor living space enhancement continues growing as homeowners invest in landscape features that extend usable living areas including outdoor kitchens, fire features, and entertainment spaces. Low-maintenance landscaping appeals to busy homeowners seeking attractive landscapes with minimal ongoing care requirements.

Commercial landscape sophistication increases as businesses recognize outdoor spaces as extensions of their brand and workplace culture. Seasonal service expansion enables companies to maintain year-round customer relationships through holiday decorating, snow removal, and indoor plant services.

Native plant adoption grows driven by environmental benefits, reduced maintenance requirements, and wildlife habitat creation. Integrated pest management approaches gain popularity as customers seek effective solutions with minimal environmental impact.

Recent industry developments demonstrate the dynamic nature of the US landscaping market and ongoing evolution in service delivery, technology adoption, and business model innovation. Consolidation activity continues as larger companies acquire successful regional operators to expand geographic coverage and service capabilities.

Technology partnerships between landscaping companies and software providers create integrated solutions for design, project management, and customer communication. Sustainability certifications gain importance as companies seek differentiation through environmental expertise and responsible business practices.

Workforce development initiatives address labor shortage challenges through apprenticeship programs, technical training partnerships, and improved compensation packages. Equipment innovation focuses on electric and battery-powered tools that reduce noise, emissions, and operating costs while improving worker safety.

Customer experience enhancement through mobile apps, online scheduling, and digital communication platforms improves service delivery and customer satisfaction. Franchise expansion continues as successful business models scale to new geographic markets through proven operational systems.

Regulatory compliance drives investment in training, equipment, and procedures to meet evolving environmental and safety requirements. Insurance product development addresses industry-specific risks while supporting business growth and operational flexibility.

Strategic recommendations for US landscaping market participants focus on positioning for sustainable growth while addressing industry challenges and capitalizing on emerging opportunities. MWR analysis suggests that companies prioritizing technology adoption and workforce development will achieve competitive advantages in evolving market conditions.

Service diversification represents a critical strategy for reducing seasonal revenue fluctuations and improving customer retention. Companies should consider expanding into complementary services such as irrigation, hardscaping, or specialty treatments that leverage existing customer relationships and operational capabilities.

Technology investment priorities should focus on customer-facing applications that improve service delivery and communication while streamlining internal operations. Smart irrigation systems and landscape design software offer immediate customer value and operational efficiency benefits.

Sustainability positioning becomes increasingly important as environmental consciousness drives customer decision-making. Companies should develop expertise in native plants, organic treatments, and water conservation to capture premium pricing opportunities and differentiate from competitors.

Geographic expansion strategies should target high-growth metropolitan areas with favorable demographics and limited competitive presence. Acquisition opportunities may provide faster market entry and established customer relationships compared to organic growth approaches.

Future market prospects for the US landscaping industry remain highly positive, supported by fundamental demographic trends, increasing environmental awareness, and continued investment in property enhancement. Market growth is projected to continue at a robust pace driven by expanding customer base and increasing service sophistication.

Technology integration will accelerate as companies recognize competitive advantages from operational efficiency and enhanced customer experience. Automation adoption in equipment and systems will help address labor shortage challenges while improving service consistency and profitability.

Sustainability focus will intensify as environmental regulations expand and customer preferences increasingly favor eco-friendly solutions. Water conservation requirements will drive demand for efficient irrigation systems and drought-resistant landscaping across expanding geographic regions.

Commercial market expansion offers significant growth potential as businesses increasingly recognize landscaping as essential for competitive positioning and employee satisfaction. Institutional customers including healthcare facilities, educational institutions, and government properties represent expanding market opportunities.

Regional growth patterns will favor areas with population growth, new construction activity, and favorable climate conditions. Service premiumization will continue as customers seek comprehensive solutions and specialized expertise rather than basic maintenance services.

The US landscaping market presents exceptional opportunities for growth and profitability driven by favorable demographic trends, increasing environmental consciousness, and evolving customer expectations for professional landscape services. Market fundamentals remain strong with consistent demand growth across residential, commercial, and institutional customer segments.

Success factors for market participants include service diversification, technology adoption, sustainability expertise, and strong customer relationship management. Companies positioned to capitalize on emerging trends while addressing traditional industry challenges will achieve sustainable competitive advantages and superior financial performance.

Industry evolution toward more sophisticated services, environmental responsibility, and technology integration creates opportunities for differentiation and premium pricing. Market outlook remains highly positive with projected growth rates exceeding broader economic expansion, reflecting the essential nature of landscape services and increasing customer investment in outdoor space enhancement.

What is Landscaping?

Landscaping refers to the process of modifying the visible features of an area of land, including living elements like flora and fauna, as well as natural elements such as terrain shape and elevation. It encompasses various activities such as gardening, planting, and the installation of hardscapes.

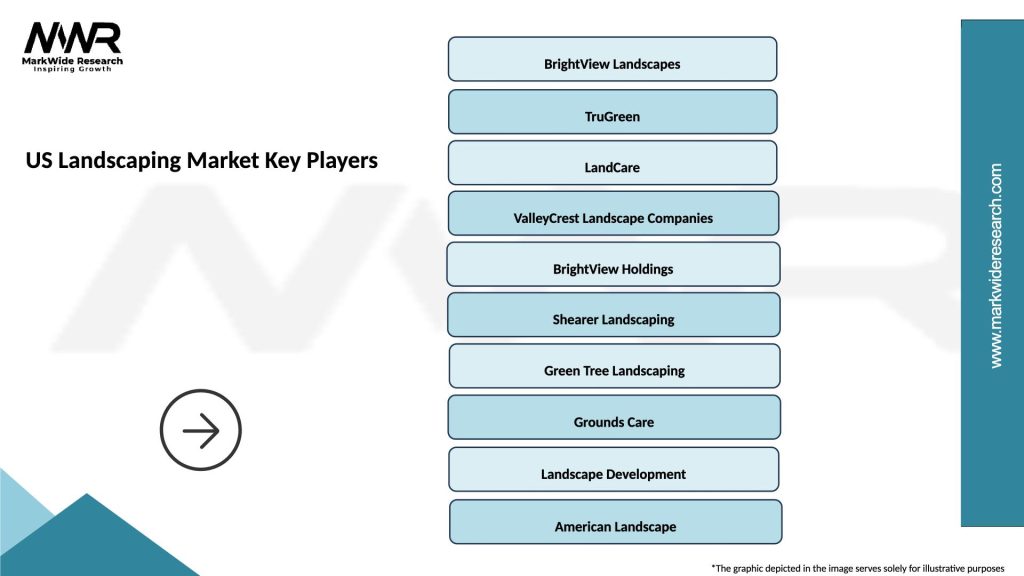

What are the key players in the US Landscaping Market?

Key players in the US Landscaping Market include BrightView Landscapes, TruGreen, and The Davey Tree Expert Company, among others. These companies provide a range of services from lawn care to landscape design and maintenance.

What are the main drivers of growth in the US Landscaping Market?

The main drivers of growth in the US Landscaping Market include increasing consumer interest in outdoor aesthetics, rising property values, and a growing trend towards sustainable landscaping practices. Additionally, the demand for professional landscaping services is on the rise as homeowners seek to enhance their outdoor spaces.

What challenges does the US Landscaping Market face?

The US Landscaping Market faces challenges such as labor shortages, fluctuating material costs, and seasonal demand variations. These factors can impact service delivery and profitability for landscaping companies.

What opportunities exist in the US Landscaping Market?

Opportunities in the US Landscaping Market include the growing demand for eco-friendly landscaping solutions and the integration of smart technology in landscape design. Additionally, urbanization and the trend towards outdoor living spaces present significant growth potential.

What trends are shaping the US Landscaping Market?

Trends shaping the US Landscaping Market include the increasing popularity of xeriscaping, the use of native plants, and the incorporation of outdoor living features such as kitchens and fire pits. Furthermore, there is a rising focus on sustainable practices and water conservation in landscaping.

US Landscaping Market

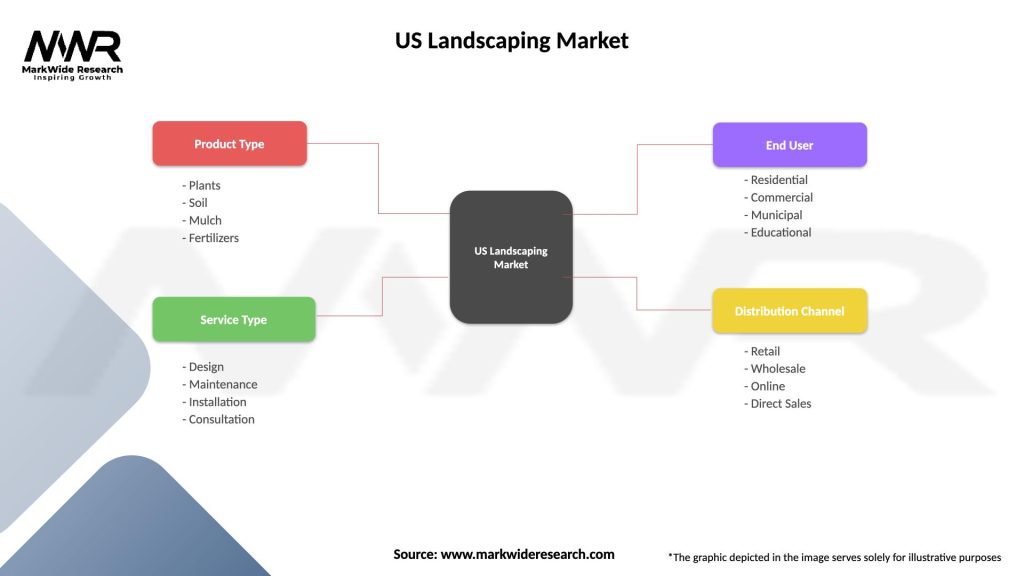

| Segmentation Details | Description |

|---|---|

| Product Type | Plants, Soil, Mulch, Fertilizers |

| Service Type | Design, Maintenance, Installation, Consultation |

| End User | Residential, Commercial, Municipal, Educational |

| Distribution Channel | Retail, Wholesale, Online, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Landscaping Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at