444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US Intelligent Virtual Assistant (IVA) Based Banking Market represents a significant evolution in the banking sector, leveraging artificial intelligence (AI) and natural language processing (NLP) technologies to enhance customer experiences, streamline operations, and drive efficiency. Intelligent virtual assistants, powered by advanced algorithms and machine learning models, offer personalized assistance, automate routine tasks, and provide real-time support across various banking channels, including websites, mobile apps, and chat platforms. As banks strive to meet evolving customer expectations and digitalize their operations, IVAs emerge as a pivotal solution reshaping the future of banking in the United States.

Meaning

Intelligent Virtual Assistants (IVAs) in the banking context refer to AI-driven digital assistants designed to interact with customers, answer queries, perform transactions, and deliver personalized banking services through natural language conversations. These virtual assistants utilize sophisticated algorithms to understand user intent, analyze customer data, and provide tailored recommendations, thereby augmenting traditional banking services with intelligent automation and enhanced user experiences. In the US banking landscape, IVAs serve as frontline representatives, enabling seamless interactions between customers and financial institutions across digital touchpoints.

Executive Summary

The US Intelligent Virtual Assistant (IVA) Based Banking Market is witnessing rapid growth fueled by the increasing adoption of digital banking solutions, rising customer demand for personalized experiences, and advancements in AI technologies. Leading banks and financial institutions are deploying IVAs to optimize customer engagement, reduce operational costs, and drive competitive differentiation in the market. Key players offer a range of IVA solutions tailored to meet the diverse needs of retail banking, wealth management, and corporate banking segments. As the banking industry continues its digital transformation journey, IVAs emerge as a strategic imperative, empowering banks to deliver superior services, drive innovation, and stay ahead in the digital age.

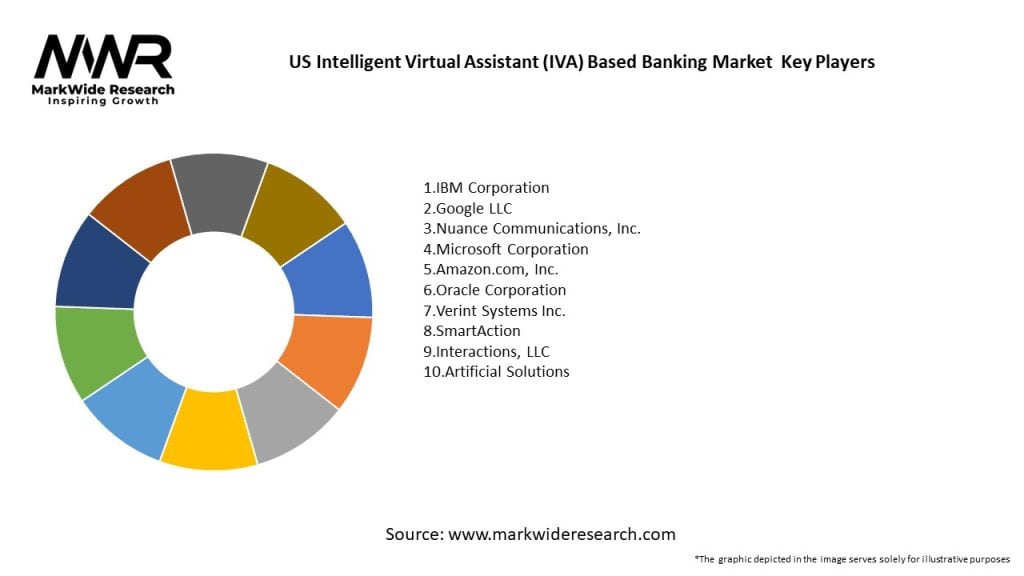

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US Intelligent Virtual Assistant (IVA) Based Banking Market operates within a dynamic ecosystem shaped by technological innovation, regulatory evolution, competitive pressures, and shifting consumer preferences. The convergence of AI, data analytics, and digital banking trends drives market growth and disruption, creating opportunities for incumbents and new entrants to redefine the future of banking services. Continuous investment in AI research and development, strategic partnerships, and customer-centric innovation are essential for banks to navigate market dynamics, drive digital transformation, and unlock the full potential of IVAs in banking.

Regional Analysis

The US Intelligent Virtual Assistant (IVA) Based Banking Market exhibits regional variations influenced by factors such as demographic trends, technological adoption rates, regulatory frameworks, and competitive dynamics. Major metropolitan areas and urban centers with high digital penetration and tech-savvy populations are early adopters of IVAs, driving market growth and innovation. However, rural and underserved communities present untapped opportunities for banks to extend IVAs and expand financial inclusion efforts, bridging the digital divide and reaching underserved demographics with accessible and affordable banking services.

Competitive Landscape

Leading Companies US Intelligent Virtual Assistant (IVA) Based Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The US Intelligent Virtual Assistant (IVA) Based Banking Market can be segmented based on various factors, including:

Segmentation enables banks to target specific customer segments, tailor their IVA offerings to unique requirements, and optimize resource allocation to maximize ROI and customer satisfaction.

Category-wise Insights

Each banking category presents unique opportunities for leveraging IVAs to enhance customer experiences, optimize operational efficiencies, and drive business growth in the US banking market.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the US Intelligent Virtual Assistant (IVA) Based Banking Market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors enables banks and industry stakeholders to capitalize on market opportunities, address challenges, and develop strategies for sustainable growth and competitiveness.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic accelerates the adoption of IVAs in banking, as banks seek to address surging digital demand, support remote workforces, and maintain customer service levels amidst physical branch closures and social distancing measures. IVAs serve as frontline responders, handling increased call volumes, assisting with pandemic-related inquiries, and providing automated support for account management, loan assistance, and financial advice. The pandemic reinforces the importance of digitalization and automation in banking, driving banks to invest in AI-driven solutions such as IVAs to future-proof their operations and enhance resilience in times of crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US Intelligent Virtual Assistant (IVA) Based Banking Market is poised for significant growth and innovation, driven by ongoing digital transformation initiatives, increasing customer demand for personalized experiences, and advancements in AI technologies. IVAs will continue to evolve as intelligent assistants, expanding their capabilities to encompass predictive analytics, voice-first interfaces, and omnichannel integration, redefining the future of banking interactions and reimagining the role of virtual assistants as trusted financial advisors and companions for consumers.

Conclusion

The US Intelligent Virtual Assistant (IVA) Based Banking Market represents a transformative shift in the banking landscape, harnessing the power of AI, NLP, and automation to deliver personalized, convenient, and efficient banking experiences. IVAs serve as strategic assets for banks, enabling them to drive digital innovation, optimize operations, and differentiate their services in a competitive market. As banks navigate the complexities of digital transformation and customer-centricity, IVAs emerge as indispensable tools for delivering on the promise of intelligent banking, fostering deeper customer relationships, and shaping the future of financial services in the United States.

What is Intelligent Virtual Assistant (IVA) Based Banking?

Intelligent Virtual Assistant (IVA) Based Banking refers to the use of AI-driven virtual assistants in the banking sector to enhance customer service, streamline operations, and provide personalized financial advice. These systems can handle inquiries, process transactions, and assist with account management, improving overall customer experience.

What are the key players in the US Intelligent Virtual Assistant (IVA) Based Banking Market?

Key players in the US Intelligent Virtual Assistant (IVA) Based Banking Market include companies like Bank of America, JPMorgan Chase, and Wells Fargo, which leverage IVA technology to improve customer interactions and operational efficiency, among others.

What are the main drivers of growth in the US Intelligent Virtual Assistant (IVA) Based Banking Market?

The main drivers of growth in the US Intelligent Virtual Assistant (IVA) Based Banking Market include the increasing demand for enhanced customer service, the need for operational efficiency, and the growing adoption of AI technologies in financial services. Additionally, the shift towards digital banking solutions is propelling market expansion.

What challenges does the US Intelligent Virtual Assistant (IVA) Based Banking Market face?

Challenges in the US Intelligent Virtual Assistant (IVA) Based Banking Market include concerns over data privacy and security, the need for continuous technological updates, and potential resistance from customers who prefer human interaction. These factors can hinder the widespread adoption of IVA solutions.

What opportunities exist in the US Intelligent Virtual Assistant (IVA) Based Banking Market?

Opportunities in the US Intelligent Virtual Assistant (IVA) Based Banking Market include the potential for enhanced personalization of banking services, the ability to analyze customer data for better insights, and the expansion of IVA capabilities into new areas such as investment advice and fraud detection.

What trends are shaping the US Intelligent Virtual Assistant (IVA) Based Banking Market?

Trends shaping the US Intelligent Virtual Assistant (IVA) Based Banking Market include the integration of natural language processing for improved communication, the rise of voice-activated banking services, and the increasing use of machine learning algorithms to enhance the accuracy and efficiency of virtual assistants.

US Intelligent Virtual Assistant (IVA) Based Banking Market

| Segmentation Details | Description |

|---|---|

| Service Type | Customer Support, Transaction Processing, Account Management, Financial Advisory |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

| End User | Retail Banking, Commercial Banking, Investment Banking, Credit Unions |

| Technology | Natural Language Processing, Machine Learning, Voice Recognition, Chatbot |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies US Intelligent Virtual Assistant (IVA) Based Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at