444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US insulin drugs and delivery devices market represents one of the most critical segments in American healthcare, serving millions of diabetes patients across the nation. This comprehensive market encompasses both traditional insulin formulations and innovative delivery mechanisms that have revolutionized diabetes management. Market dynamics indicate substantial growth driven by rising diabetes prevalence, technological advancements, and increasing patient demand for convenient treatment options.

Current market trends show a significant shift toward advanced delivery systems, with insulin pens and continuous glucose monitoring devices gaining remarkable traction. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting the urgent need for effective diabetes management solutions. Healthcare providers increasingly recommend combination therapies and personalized treatment approaches, driving demand for diverse insulin products and sophisticated delivery technologies.

Regional distribution across the United States shows concentrated demand in metropolitan areas, with approximately 65% of market activity occurring in major urban centers. The market benefits from strong healthcare infrastructure, favorable reimbursement policies, and growing awareness about diabetes complications. Innovation cycles continue to accelerate, with manufacturers investing heavily in next-generation insulin formulations and smart delivery devices that enhance patient compliance and treatment outcomes.

The US insulin drugs and delivery devices market refers to the comprehensive ecosystem of pharmaceutical products and medical devices designed to manage diabetes mellitus through insulin therapy. This market encompasses rapid-acting, long-acting, and intermediate-acting insulin formulations alongside various delivery mechanisms including traditional syringes, insulin pens, insulin pumps, and emerging smart delivery systems.

Market scope extends beyond basic insulin products to include sophisticated delivery technologies that improve dosing accuracy, patient convenience, and treatment adherence. The definition encompasses both prescription insulin medications approved by the FDA and the associated delivery devices that enable effective administration. Healthcare integration plays a crucial role, as these products must seamlessly fit into existing treatment protocols while meeting stringent safety and efficacy standards.

Technological convergence has expanded the market definition to include connected devices, mobile health applications, and integrated monitoring systems that provide comprehensive diabetes management solutions. This holistic approach reflects the evolution from simple drug delivery to complete therapeutic ecosystems that support patient empowerment and clinical decision-making.

Strategic market analysis reveals the US insulin drugs and delivery devices market as a dynamic and rapidly evolving sector driven by increasing diabetes prevalence and technological innovation. The market demonstrates exceptional resilience with consistent growth patterns supported by demographic trends, healthcare policy developments, and continuous product innovation. Key market drivers include the rising incidence of Type 1 and Type 2 diabetes, aging population demographics, and growing preference for user-friendly delivery systems.

Competitive landscape features established pharmaceutical giants alongside emerging technology companies, creating a diverse ecosystem of solutions. Market leaders focus on developing integrated platforms that combine insulin formulations with advanced delivery mechanisms, while newer entrants emphasize digital health integration and patient-centric design. Regulatory environment remains supportive with streamlined approval processes for innovative delivery devices and biosimilar insulin products.

Market segmentation shows strong performance across multiple categories, with insulin pens capturing approximately 42% market share due to their convenience and accuracy. The delivery devices segment experiences particularly robust growth, driven by technological advancements and patient preference for discrete, easy-to-use systems. Future projections indicate continued expansion with emerging technologies like smart insulin pens and closed-loop systems poised to reshape the market landscape.

Market intelligence reveals several critical insights that define the current and future trajectory of the US insulin drugs and delivery devices market. These insights provide essential understanding for stakeholders navigating this complex healthcare segment:

Primary market drivers propelling the US insulin drugs and delivery devices market stem from demographic, technological, and healthcare system factors that create sustained demand for innovative diabetes management solutions. These drivers work synergistically to maintain robust market growth and encourage continuous innovation.

Demographic trends represent the most significant driver, with diabetes prevalence increasing across all population segments. The aging baby boomer generation contributes substantially to market growth, as Type 2 diabetes incidence rises with age. Additionally, lifestyle factors including sedentary behavior and dietary changes contribute to earlier diabetes onset, expanding the patient population requiring insulin therapy.

Technological advancement serves as a crucial growth catalyst, with innovations in insulin formulations and delivery mechanisms improving treatment outcomes and patient satisfaction. Smart insulin pens, continuous glucose monitors, and integrated diabetes management platforms enhance treatment precision while reducing the burden of daily diabetes management. Digital health integration enables remote monitoring and personalized treatment adjustments, appealing to both patients and healthcare providers.

Healthcare system evolution toward value-based care models incentivizes effective diabetes management, driving demand for solutions that improve patient outcomes while reducing long-term healthcare costs. Insurance coverage expansion and improved reimbursement policies for advanced delivery devices make innovative solutions more accessible to broader patient populations. Clinical evidence supporting the benefits of modern insulin delivery systems strengthens provider recommendations and patient adoption rates.

Market constraints affecting the US insulin drugs and delivery devices market include economic, regulatory, and clinical factors that may limit growth potential or create barriers to market expansion. Understanding these restraints enables stakeholders to develop strategies for overcoming challenges and maintaining market momentum.

Cost considerations represent a significant restraint, particularly for advanced delivery devices and newer insulin formulations that may carry premium pricing. Despite insurance coverage, patient out-of-pocket costs can limit access to innovative solutions, especially for underinsured populations. Healthcare budget constraints at institutional levels may restrict adoption of expensive technologies, even when clinical benefits are demonstrated.

Regulatory complexity creates challenges for market entry and product development, with lengthy approval processes potentially delaying innovation introduction. The FDA’s stringent requirements for combination products that integrate drugs and devices require extensive clinical testing and documentation. Quality control standards for insulin manufacturing and device reliability add complexity and cost to product development processes.

Clinical adoption barriers include healthcare provider resistance to changing established treatment protocols and patient reluctance to adopt new technologies. Training requirements for complex delivery systems may limit provider recommendations, while patient concerns about device reliability or complexity can slow adoption rates. Interoperability challenges between different diabetes management technologies may create fragmented user experiences that discourage comprehensive system adoption.

Emerging opportunities within the US insulin drugs and delivery devices market present substantial potential for growth and innovation, driven by unmet medical needs, technological possibilities, and evolving healthcare delivery models. These opportunities enable market participants to expand their presence and develop differentiated solutions.

Digital health integration offers tremendous opportunity for creating comprehensive diabetes management ecosystems that combine insulin delivery with data analytics, patient education, and remote monitoring capabilities. The convergence of artificial intelligence and diabetes care enables predictive analytics for insulin dosing optimization and personalized treatment recommendations. Mobile health applications integrated with delivery devices can improve patient engagement and treatment adherence while providing valuable data for clinical decision-making.

Underserved market segments present significant expansion opportunities, particularly in rural areas where access to specialized diabetes care may be limited. Telemedicine integration with insulin delivery systems can bridge geographic gaps and improve care access. Pediatric diabetes management represents a specialized opportunity requiring age-appropriate devices and family-centered care approaches that address unique challenges of childhood diabetes.

Biosimilar development creates opportunities for expanding affordable insulin access while maintaining quality standards. Generic insulin alternatives can capture price-sensitive market segments while established brands focus on premium innovation. Combination therapies that integrate insulin with other diabetes medications offer opportunities for simplified treatment regimens and improved patient outcomes through synergistic therapeutic effects.

Market dynamics in the US insulin drugs and delivery devices sector reflect the complex interplay between healthcare needs, technological innovation, regulatory environment, and competitive forces. These dynamics create a constantly evolving landscape that requires adaptive strategies from market participants.

Supply chain considerations play an increasingly important role in market dynamics, with manufacturers focusing on resilient distribution networks and inventory management systems. The COVID-19 pandemic highlighted vulnerabilities in healthcare supply chains, prompting investments in domestic manufacturing capabilities and strategic stockpiling. Cold chain logistics for insulin products require specialized handling and storage systems that add complexity but ensure product integrity.

Competitive intensity continues to increase as traditional pharmaceutical companies face competition from medical device manufacturers and technology companies entering the diabetes care space. This convergence creates opportunities for innovative partnerships and integrated solutions while intensifying price competition. Market consolidation through mergers and acquisitions enables companies to combine complementary capabilities and expand their product portfolios.

Patient empowerment trends shift market dynamics toward consumer-driven healthcare decisions, with patients increasingly researching treatment options and advocating for specific products. Social media and online communities influence product perception and adoption rates, requiring companies to engage directly with patient communities. Value-based care models emphasize outcomes over volume, encouraging development of solutions that demonstrate measurable improvements in patient health and quality of life.

Comprehensive research methodology employed in analyzing the US insulin drugs and delivery devices market combines quantitative and qualitative research approaches to provide accurate and actionable market intelligence. The methodology ensures reliable data collection, analysis, and interpretation that supports informed decision-making by market stakeholders.

Primary research activities include extensive interviews with healthcare providers, diabetes specialists, patients, and industry executives to gather firsthand insights about market trends, challenges, and opportunities. Survey methodologies capture patient preferences, treatment experiences, and adoption patterns for various insulin products and delivery systems. Clinical data analysis examines treatment outcomes, safety profiles, and efficacy measures across different product categories.

Secondary research sources encompass peer-reviewed medical literature, regulatory filings, company annual reports, and healthcare databases to validate primary findings and provide comprehensive market context. Industry publications, conference proceedings, and expert presentations contribute additional insights about emerging trends and technological developments. Market surveillance activities monitor competitive activities, product launches, and strategic partnerships that influence market dynamics.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources, expert review panels, and statistical analysis techniques. Market modeling incorporates demographic projections, epidemiological data, and healthcare utilization patterns to develop realistic growth scenarios. Quality assurance protocols maintain research integrity while protecting confidential information and ensuring ethical compliance throughout the research process.

Regional market distribution across the United States reveals distinct patterns influenced by demographics, healthcare infrastructure, economic factors, and disease prevalence rates. Understanding these regional variations enables targeted market strategies and resource allocation decisions that maximize market penetration and patient access.

Northeast region demonstrates strong market performance with approximately 28% of national market share, driven by high population density, advanced healthcare systems, and favorable insurance coverage. Major metropolitan areas including New York, Boston, and Philadelphia serve as innovation hubs where new products gain initial market acceptance. Academic medical centers in this region often participate in clinical trials and early adoption programs for emerging technologies.

Southeast region represents the fastest-growing market segment with 24% market share, reflecting higher diabetes prevalence rates and expanding healthcare access. States including Florida, Texas, and Georgia show particularly strong growth driven by aging populations and lifestyle-related diabetes risk factors. Healthcare infrastructure development in this region creates opportunities for market expansion and improved patient care access.

Western region accounts for 26% of market activity, with California leading in innovation adoption and technology integration. The region’s emphasis on digital health solutions and preventive care aligns well with advanced insulin delivery systems and connected diabetes management platforms. Midwest region maintains steady market presence with 22% share, characterized by strong healthcare systems and insurance coverage that support consistent product adoption across both urban and rural areas.

Competitive environment in the US insulin drugs and delivery devices market features established pharmaceutical giants, innovative medical device companies, and emerging technology firms that collectively drive market evolution and patient care improvements. This diverse competitive landscape fosters innovation while maintaining focus on patient outcomes and safety.

Market segmentation analysis reveals distinct categories within the US insulin drugs and delivery devices market, each characterized by unique growth patterns, customer needs, and competitive dynamics. This segmentation enables targeted product development and marketing strategies that address specific patient populations and clinical requirements.

By Product Type:

By Diabetes Type:

By End User:

Detailed category analysis provides comprehensive understanding of performance patterns, growth drivers, and market opportunities within each segment of the US insulin drugs and delivery devices market. These insights enable stakeholders to make informed decisions about product development, market entry, and strategic investments.

Rapid-Acting Insulin Category demonstrates strong growth with 15% annual expansion driven by patient preference for mealtime flexibility and improved glycemic control. This category benefits from continuous innovation in onset speed and duration profiles, with newer formulations offering enhanced convenience for active lifestyles. Market leaders focus on developing ultra-rapid formulations that provide even faster glucose response times while maintaining safety profiles.

Long-Acting Insulin Segment maintains steady growth supported by once-daily dosing convenience and improved patient compliance rates. Biosimilar competition in this category creates pricing pressure while expanding access to affordable treatment options. Innovation focus centers on extending duration of action and reducing injection frequency to further improve patient experience and treatment adherence.

Insulin Pen Devices capture the largest market share within delivery systems, with smart pen technology representing the fastest-growing subsegment. These devices combine traditional pen convenience with digital health features including dose tracking, reminder systems, and data sharing capabilities. User experience improvements continue to drive adoption, particularly among younger patient populations comfortable with technology integration.

Continuous Glucose Monitoring Integration creates new category opportunities as standalone monitoring devices evolve into comprehensive diabetes management platforms. The convergence of insulin delivery and glucose monitoring enables closed-loop systems that automatically adjust insulin delivery based on real-time glucose readings. Clinical outcomes from integrated systems demonstrate superior glycemic control compared to traditional management approaches.

Strategic advantages available to industry participants in the US insulin drugs and delivery devices market span multiple dimensions including financial returns, market positioning, and societal impact. Understanding these benefits enables stakeholders to develop comprehensive strategies that maximize value creation while advancing patient care objectives.

For Pharmaceutical Companies:

For Medical Device Companies:

For Healthcare Providers:

Comprehensive SWOT analysis of the US insulin drugs and delivery devices market reveals internal strengths and weaknesses alongside external opportunities and threats that influence market dynamics and strategic decision-making. This analysis provides framework for understanding competitive positioning and market evolution.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends in the US insulin drugs and delivery devices sector reflect evolving patient needs, technological capabilities, and healthcare delivery models that shape future market development. These trends provide insight into strategic opportunities and competitive positioning requirements.

Smart Device Integration represents the most significant trend, with insulin delivery systems incorporating connectivity features that enable data sharing, remote monitoring, and automated dosing adjustments. Smart insulin pens with memory functions and mobile app integration appeal to tech-savvy patients while providing healthcare providers with comprehensive treatment data. Artificial intelligence algorithms analyze patient data patterns to provide personalized dosing recommendations and predict glucose fluctuations.

Closed-Loop Systems gain momentum as integrated platforms that combine continuous glucose monitoring with automated insulin delivery create artificial pancreas functionality. These systems reduce patient burden while improving glycemic control through real-time adjustments based on glucose readings. Clinical evidence supporting closed-loop benefits drives provider recommendations and insurance coverage expansion.

Biosimilar Adoption accelerates as generic insulin alternatives receive regulatory approval and market acceptance, creating cost-effective treatment options for price-sensitive patient segments. Healthcare systems increasingly adopt biosimilar formularies to control costs while maintaining treatment quality. Market competition from biosimilars encourages innovation in branded products and value-added services.

Patient-Centric Design influences product development priorities, with manufacturers focusing on user experience improvements that reduce treatment burden and improve quality of life. Discrete delivery devices, simplified interfaces, and reduced injection frequency address common patient concerns about diabetes management. Pediatric considerations drive development of age-appropriate devices and family-friendly management systems.

Recent industry developments highlight the dynamic nature of the US insulin drugs and delivery devices market, with significant advances in product innovation, regulatory approvals, and strategic partnerships that influence competitive positioning and market growth trajectories.

Regulatory Milestones include FDA approvals for next-generation insulin formulations and advanced delivery devices that expand treatment options for diabetes patients. Recent approvals of ultra-rapid insulin formulations provide faster onset times for improved mealtime glucose control. Streamlined approval pathways for combination products that integrate drugs and devices accelerate innovation introduction while maintaining safety standards.

Strategic Partnerships between pharmaceutical companies and technology firms create integrated solutions that combine insulin expertise with digital health capabilities. Collaborations focus on developing comprehensive diabetes management platforms that address multiple aspects of patient care. Cross-industry alliances enable companies to leverage complementary strengths while sharing development risks and costs.

Technology Breakthroughs in insulin delivery systems include development of needle-free injection technologies and implantable devices that eliminate daily injection requirements. Advanced algorithms for automated insulin dosing improve treatment precision while reducing hypoglycemia risks. Bioengineering advances in insulin formulations extend duration of action and improve stability profiles.

Market Expansion Activities include geographic expansion into underserved regions and development of specialized products for pediatric populations. Companies invest in manufacturing capacity expansion to meet growing demand while ensuring supply chain resilience. Direct-to-consumer initiatives leverage digital platforms to improve patient access and engagement with diabetes management solutions.

Strategic recommendations from MarkWide Research analysis provide actionable insights for stakeholders navigating the complex US insulin drugs and delivery devices market landscape. These suggestions address key success factors and risk mitigation strategies that support sustainable growth and competitive advantage.

Innovation Investment Priorities should focus on digital health integration and artificial intelligence applications that enhance treatment personalization and patient engagement. Companies should prioritize development of connected devices that provide comprehensive diabetes management solutions rather than standalone products. User experience design requires significant attention to ensure products meet evolving patient expectations for convenience and discretion.

Market Access Strategies must address diverse payer requirements and value-based care models that emphasize patient outcomes over product features. Developing robust health economics data and real-world evidence supports reimbursement coverage and provider adoption. Patient assistance programs can improve access for underinsured populations while building brand loyalty and market share.

Partnership Development opportunities exist across the healthcare ecosystem, including collaborations with digital health companies, healthcare providers, and payer organizations. Strategic alliances enable companies to leverage complementary capabilities while sharing development risks and market access challenges. Academic partnerships support clinical research and validation studies that strengthen product positioning and regulatory submissions.

Geographic Expansion should target underserved regions with growing diabetes prevalence and improving healthcare infrastructure. Rural market penetration requires telemedicine integration and simplified product offerings that address resource constraints. Cultural considerations influence product design and marketing approaches for diverse patient populations across different geographic regions.

Future market projections for the US insulin drugs and delivery devices market indicate sustained growth driven by demographic trends, technological innovation, and evolving healthcare delivery models. The market outlook reflects optimistic growth scenarios supported by multiple positive factors while acknowledging potential challenges that may influence development trajectories.

Technology Evolution will continue transforming the market landscape with artificial intelligence integration enabling predictive analytics and personalized treatment optimization. Smart insulin delivery systems will become increasingly sophisticated, offering automated dosing adjustments and comprehensive health monitoring capabilities. Nanotechnology applications may enable development of ultra-long-acting insulin formulations and novel delivery mechanisms that further improve patient convenience.

Market Growth Projections indicate continued expansion with compound annual growth rates exceeding historical averages due to increasing diabetes prevalence and technology adoption. The delivery devices segment shows particularly strong growth potential as patients increasingly prefer convenient, discrete delivery options. Digital health integration creates new revenue streams and service models that extend beyond traditional product sales.

Regulatory Environment is expected to remain supportive with continued emphasis on patient safety and treatment access. Streamlined approval processes for innovative combination products will accelerate market introduction of advanced solutions. Biosimilar regulations will continue evolving to balance market competition with quality assurance requirements.

Competitive Dynamics will intensify as traditional boundaries between pharmaceutical and technology companies continue blurring. Market consolidation through strategic acquisitions may create integrated platforms with comprehensive diabetes management capabilities. New entrants from adjacent industries will bring fresh perspectives and innovative approaches to diabetes care solutions.

The US insulin drugs and delivery devices market represents a dynamic and rapidly evolving healthcare sector characterized by strong growth fundamentals, continuous innovation, and expanding patient needs. Market analysis reveals a robust ecosystem driven by increasing diabetes prevalence, technological advancement, and evolving patient preferences for convenient, effective treatment solutions.

Key market drivers including demographic trends, healthcare policy support, and digital health integration create sustainable growth opportunities for industry participants. The market demonstrates resilience through diverse product portfolios, established distribution networks, and strong clinical evidence supporting product efficacy and safety. Innovation cycles continue accelerating with smart delivery devices, biosimilar alternatives, and integrated management platforms reshaping competitive dynamics.

Strategic opportunities exist across multiple market segments, from traditional insulin formulations to advanced delivery technologies and digital health applications. Companies that successfully integrate pharmaceutical expertise with technology capabilities while maintaining focus on patient outcomes are positioned for sustained success. Market expansion into underserved populations and geographic regions provides additional growth avenues supported by improving healthcare access and reimbursement coverage.

Future outlook remains optimistic with projected growth rates reflecting both market fundamentals and innovation potential. The convergence of artificial intelligence, connected devices, and personalized medicine creates unprecedented opportunities for improving diabetes care while building sustainable competitive advantages. Stakeholder collaboration across the healthcare ecosystem will be essential for realizing the full potential of emerging technologies and ensuring broad patient access to innovative diabetes management solutions.

What is Insulin Drugs & Delivery Devices?

Insulin Drugs & Delivery Devices refer to the medications and tools used to manage diabetes by regulating blood sugar levels. This includes various types of insulin formulations and delivery methods such as pens, pumps, and syringes.

What are the key players in the US Insulin Drugs & Delivery Devices Market?

Key players in the US Insulin Drugs & Delivery Devices Market include companies like Novo Nordisk, Sanofi, and Eli Lilly, which are known for their innovative insulin products and delivery systems, among others.

What are the growth factors driving the US Insulin Drugs & Delivery Devices Market?

The US Insulin Drugs & Delivery Devices Market is driven by the increasing prevalence of diabetes, advancements in insulin delivery technologies, and a growing focus on personalized medicine to improve patient outcomes.

What challenges does the US Insulin Drugs & Delivery Devices Market face?

Challenges in the US Insulin Drugs & Delivery Devices Market include high costs of insulin products, regulatory hurdles, and the need for better patient education on diabetes management.

What future opportunities exist in the US Insulin Drugs & Delivery Devices Market?

Future opportunities in the US Insulin Drugs & Delivery Devices Market include the development of smart insulin delivery systems, biosimilar insulin products, and increased integration of digital health technologies for diabetes management.

What trends are shaping the US Insulin Drugs & Delivery Devices Market?

Trends in the US Insulin Drugs & Delivery Devices Market include the rise of continuous glucose monitoring systems, the shift towards more user-friendly delivery devices, and a growing emphasis on sustainability in product development.

US Insulin Drugs & Delivery Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Pens, Insulin Pumps, Syringes, Inhalers |

| Delivery Mode | Subcutaneous, Intravenous, Intramuscular, Oral |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Smart Insulin Pens, Continuous Glucose Monitors, Automated Delivery Systems, Wearable Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

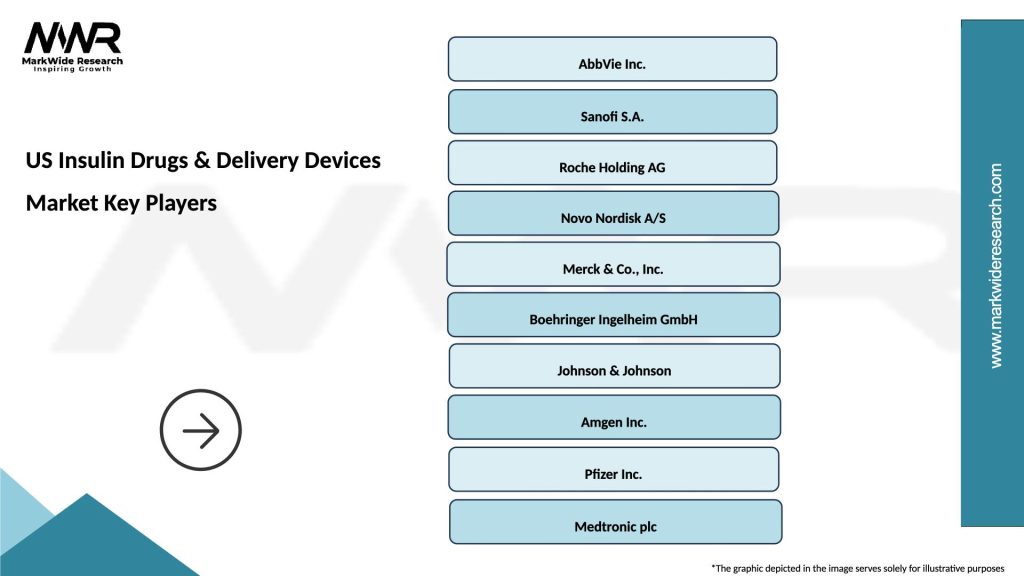

Leading companies in the US Insulin Drugs & Delivery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at