444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US insecticide market represents a critical component of the agricultural and pest control industry, encompassing a diverse range of chemical and biological solutions designed to manage insect populations across various sectors. Market dynamics indicate robust growth driven by increasing agricultural productivity demands, rising pest resistance challenges, and evolving regulatory frameworks that shape product development and application strategies.

Agricultural applications dominate the market landscape, with farmers and agricultural professionals relying heavily on advanced insecticide formulations to protect crops from destructive insect infestations. The market demonstrates significant diversification across multiple product categories, including organophosphates, pyrethroids, neonicotinoids, and emerging biopesticide alternatives that address environmental sustainability concerns.

Growth projections suggest the market will expand at a CAGR of 4.2% through the forecast period, driven by technological innovations in formulation chemistry, precision agriculture adoption, and increasing awareness of integrated pest management practices. Regional distribution shows concentrated activity in major agricultural states, with California, Iowa, Illinois, and Nebraska representing approximately 45% of total market consumption.

Industry transformation continues as manufacturers invest in research and development of next-generation insecticide technologies, including targeted delivery systems, reduced-risk formulations, and environmentally compatible solutions that meet stringent regulatory requirements while maintaining efficacy against evolving pest populations.

The US insecticide market refers to the comprehensive ecosystem of chemical and biological products specifically formulated to control, eliminate, or repel insect populations that threaten agricultural crops, residential properties, commercial facilities, and public health initiatives across the United States.

Market scope encompasses various product categories including contact insecticides, systemic formulations, biological control agents, and integrated pest management solutions. These products serve multiple end-user segments ranging from large-scale agricultural operations to residential consumers, professional pest control services, and specialized industrial applications.

Regulatory framework plays a crucial role in market definition, with the Environmental Protection Agency (EPA) overseeing product registration, safety standards, and usage guidelines that directly impact market dynamics. The market includes both synthetic chemical formulations and naturally-derived alternatives that meet federal and state regulatory requirements for safety and efficacy.

Value chain integration connects raw material suppliers, formulation manufacturers, distribution networks, and end-users through complex supply relationships that ensure product availability and technical support across diverse geographic regions and application scenarios.

Strategic positioning of the US insecticide market reflects a mature yet dynamic industry experiencing significant transformation driven by regulatory pressures, environmental concerns, and technological innovations. Market leadership remains concentrated among established multinational corporations while emerging biotechnology companies gain traction in specialized segments.

Key growth drivers include increasing agricultural intensification, climate change impacts on pest populations, and rising consumer demand for food security. Technology adoption accelerates as precision agriculture practices integrate advanced insecticide application methods, resulting in improved efficacy and reduced environmental impact.

Competitive landscape demonstrates ongoing consolidation through strategic acquisitions and partnerships, with major players investing heavily in research and development of next-generation formulations. Market share distribution shows the top five companies controlling approximately 68% of total market revenue, indicating significant industry concentration.

Future outlook suggests continued evolution toward sustainable pest management solutions, with biological insecticides and integrated pest management approaches gaining prominence. Regulatory trends increasingly favor reduced-risk products, driving innovation in formulation chemistry and application technologies that minimize environmental exposure while maintaining agricultural productivity.

Market intelligence reveals several critical insights that shape industry dynamics and strategic decision-making across the US insecticide sector:

Market segmentation analysis indicates distinct growth patterns across different product categories, with biological insecticides experiencing the fastest expansion while traditional synthetic formulations maintain dominant market positions through continuous innovation and reformulation efforts.

Agricultural intensification serves as the primary driver for US insecticide market growth, as farmers face increasing pressure to maximize crop yields on limited arable land. Population growth and rising food demand create sustained pressure for enhanced agricultural productivity, driving consistent demand for effective pest control solutions.

Climate change impacts significantly influence pest population dynamics, with changing temperature and precipitation patterns creating new challenges for traditional pest management strategies. Invasive species introduction and range expansion of existing pests require adaptive insecticide applications and novel control approaches.

Technological advancement in precision agriculture enables more targeted and efficient insecticide applications, reducing waste while improving efficacy. GPS-guided application systems, variable rate technology, and real-time pest monitoring create opportunities for optimized insecticide use patterns.

Economic factors including commodity price volatility and farm profitability concerns drive demand for cost-effective pest control solutions that provide reliable return on investment. Crop insurance requirements and risk management considerations further support consistent insecticide adoption across agricultural operations.

Regulatory compliance needs create demand for products that meet evolving safety and environmental standards while maintaining agricultural effectiveness. Integrated pest management adoption increases as farmers seek sustainable approaches that combine multiple control strategies including targeted insecticide applications.

Regulatory restrictions represent the most significant constraint on US insecticide market growth, with increasing EPA scrutiny leading to product cancellations, use limitations, and extended registration processes. Environmental concerns drive policy changes that restrict certain active ingredients and application methods, particularly those affecting pollinator populations.

Resistance development in target insect populations reduces the effectiveness of existing products, requiring continuous investment in new active ingredients and formulation technologies. Cross-resistance patterns limit the utility of certain chemical classes, forcing farmers to adopt more complex and expensive pest management strategies.

Public perception challenges regarding pesticide safety create market headwinds, with consumer advocacy groups and environmental organizations promoting reduced chemical use in agriculture. Organic agriculture growth represents market share erosion as producers transition away from synthetic insecticide applications.

Cost pressures from commodity price volatility and input cost inflation constrain farmer purchasing decisions, particularly for premium-priced specialty products. Generic competition intensifies as patent protections expire on major active ingredients, reducing profit margins for innovative products.

Application challenges including weather dependencies, timing constraints, and technical complexity limit market accessibility for some agricultural operations. Labor shortages and specialized equipment requirements create barriers to optimal insecticide utilization across diverse farming operations.

Biological insecticides present substantial growth opportunities as regulatory agencies and farmers increasingly favor environmentally compatible pest control solutions. Market expansion in this segment benefits from reduced registration barriers and growing acceptance among agricultural professionals seeking sustainable alternatives.

Precision agriculture integration creates opportunities for smart insecticide delivery systems that optimize application timing, placement, and dosage based on real-time field conditions. Digital agriculture platforms enable data-driven pest management decisions that improve insecticide effectiveness while reducing environmental impact.

Specialty crop markets offer premium pricing opportunities for targeted insecticide formulations designed for high-value agricultural segments including fruits, vegetables, and nuts. Geographic expansion into emerging agricultural regions provides growth potential as farming operations intensify and modernize.

Resistance management solutions create market opportunities for companies developing novel modes of action and innovative application strategies. Combination products that integrate multiple active ingredients or delivery mechanisms address complex pest management challenges while providing competitive differentiation.

Urban pest control markets expand as population growth and urbanization increase demand for professional and residential insecticide applications. Public health applications including vector control programs represent stable market segments with consistent funding and regulatory support.

Supply chain dynamics in the US insecticide market reflect complex interactions between raw material availability, manufacturing capacity, and seasonal demand patterns. Global supply dependencies for key active ingredients create vulnerability to international trade disruptions and currency fluctuations that impact product pricing and availability.

Competitive dynamics demonstrate ongoing industry consolidation as major players acquire specialized companies and technologies to enhance product portfolios. Innovation cycles typically span 8-12 years from discovery to market introduction, requiring substantial investment in research and development capabilities.

Regulatory dynamics significantly influence market structure through product approvals, use restrictions, and safety requirements that shape competitive positioning. MarkWide Research analysis indicates that regulatory compliance costs represent approximately 15-20% of total product development expenses for new insecticide introductions.

Customer dynamics evolve as agricultural operations adopt more sophisticated pest management approaches that integrate multiple control strategies. Service integration becomes increasingly important as customers seek comprehensive solutions rather than individual product purchases.

Technology dynamics drive continuous product evolution through advances in formulation chemistry, delivery systems, and application methods. Digital integration creates new value propositions that combine insecticide products with data analytics and decision support tools.

Primary research methodologies employed in analyzing the US insecticide market include comprehensive surveys of agricultural producers, pest control professionals, and industry stakeholders across major geographic regions. Data collection encompasses structured interviews with key market participants, including manufacturers, distributors, and end-users representing diverse application segments.

Secondary research incorporates analysis of government databases, industry publications, regulatory filings, and academic research to establish market baselines and trend identification. EPA registration data provides critical insights into product approvals, cancellations, and usage patterns that influence market dynamics.

Market modeling utilizes econometric analysis to quantify relationships between market drivers, regulatory changes, and demand patterns across different product categories and geographic regions. Forecasting methodologies integrate historical trends with forward-looking indicators to project market evolution under various scenarios.

Industry validation processes ensure research accuracy through expert panel reviews, stakeholder feedback sessions, and cross-verification with multiple data sources. Quality assurance protocols maintain research integrity through systematic data verification and analytical consistency checks.

Analytical frameworks employ both quantitative and qualitative assessment methods to capture market complexity and provide actionable insights for strategic decision-making across the insecticide value chain.

Midwest region dominates US insecticide consumption, accounting for approximately 42% of total market volume due to intensive corn and soybean production across states including Iowa, Illinois, Indiana, and Ohio. Seasonal demand patterns in this region align closely with spring planting and summer growing seasons, creating concentrated purchasing periods.

California market represents the largest single-state opportunity, driven by diverse specialty crop production including fruits, vegetables, and nuts that require specialized insecticide applications. Regulatory environment in California often exceeds federal requirements, influencing product development and market entry strategies for the broader US market.

Southern states including Texas, Georgia, and North Carolina demonstrate strong growth potential driven by cotton production, expanding specialty crops, and year-round growing seasons that extend application windows. Climate conditions in these regions create unique pest pressure challenges requiring adapted insecticide solutions.

Western region markets show increasing demand for precision agriculture solutions and sustainable pest management approaches, particularly in states with water scarcity concerns and environmental regulations. Organic agriculture concentration in certain western markets creates opportunities for biological insecticide alternatives.

Northeastern markets focus primarily on specialty crops, urban pest control, and forestry applications, with distinct seasonal patterns and regulatory considerations that influence product positioning and distribution strategies.

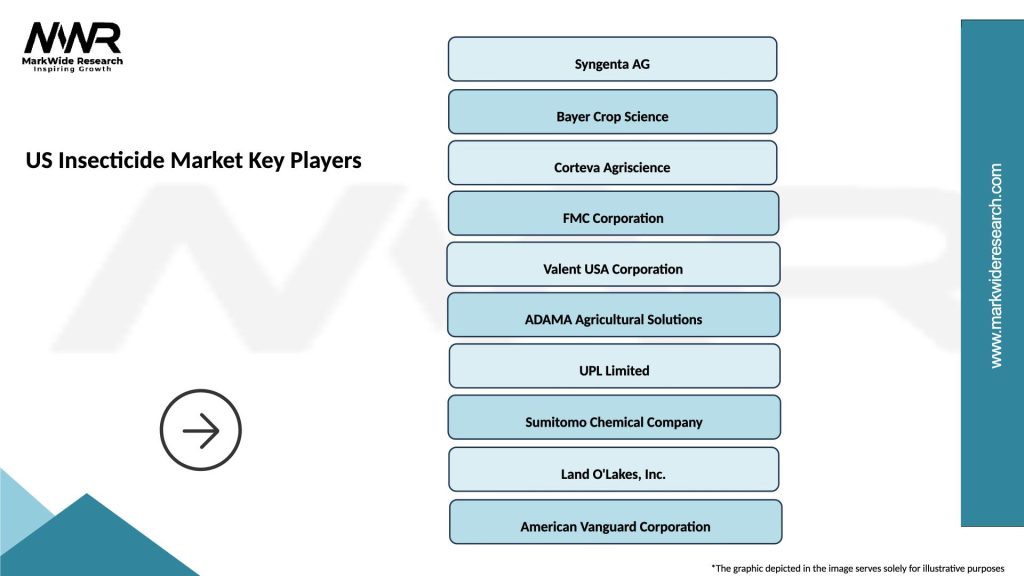

Market leadership in the US insecticide sector remains concentrated among several multinational corporations that maintain comprehensive product portfolios and extensive distribution networks:

Competitive strategies emphasize research and development investment, regulatory expertise, and distribution network optimization to maintain market position. Strategic partnerships between established companies and biotechnology firms accelerate innovation in biological insecticide development.

Market consolidation continues through acquisitions and joint ventures that combine complementary technologies and market access capabilities. Innovation competition intensifies as companies invest in next-generation formulations and application technologies.

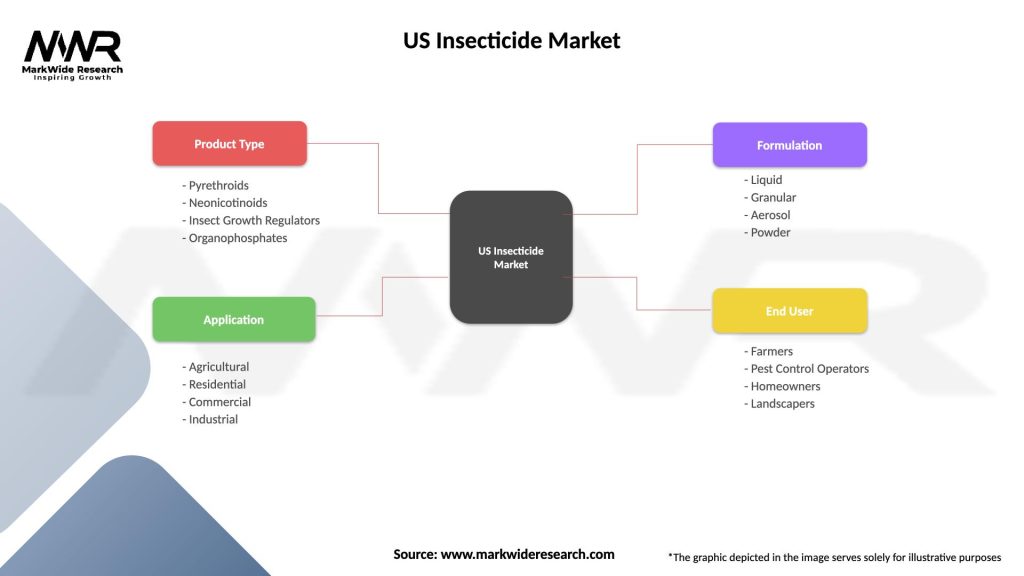

Product type segmentation reveals distinct market dynamics across major insecticide categories:

By Chemical Class:

By Application Method:

By End-Use Sector:

Agricultural insecticides demonstrate the strongest market fundamentals, driven by consistent demand from major commodity crops and specialty agricultural segments. Corn insecticides represent the largest single crop category, with rootworm and armyworm control driving significant product volumes during peak application seasons.

Soybean applications show increasing complexity as pest pressure intensifies and resistance management becomes critical for maintaining crop yields. Cotton insecticides face unique challenges from bollworm resistance while benefiting from premium pricing for effective control solutions.

Specialty crop insecticides command higher margins due to specialized formulations and targeted pest control requirements. Fruit and vegetable applications require careful residue management and pre-harvest interval considerations that influence product selection and pricing strategies.

Residential insecticides focus on convenience, safety, and broad-spectrum activity for homeowner applications. Professional pest control products emphasize efficacy, application flexibility, and regulatory compliance for commercial service providers.

Biological insecticides gain traction across all categories as environmental concerns and regulatory pressures favor sustainable alternatives. MWR analysis indicates biological products achieve 85% customer satisfaction rates when properly integrated into pest management programs.

Agricultural producers benefit from advanced insecticide technologies that provide reliable pest control while supporting sustainable farming practices and regulatory compliance. Yield protection capabilities ensure consistent crop production and economic returns on agricultural investments.

Manufacturers gain competitive advantages through innovation in formulation chemistry, delivery systems, and integrated pest management solutions. Market differentiation opportunities arise from developing products that address specific pest challenges and environmental requirements.

Distributors and retailers benefit from diverse product portfolios that serve multiple market segments and seasonal demand patterns. Technical support services create additional value streams while strengthening customer relationships and market position.

Regulatory agencies achieve public health and environmental protection objectives through science-based product evaluations and risk assessment processes. Industry collaboration facilitates development of safer and more effective pest control technologies.

Environmental stakeholders benefit from industry investments in reduced-risk formulations and sustainable pest management approaches. Pollinator protection initiatives demonstrate industry commitment to environmental stewardship while maintaining agricultural productivity.

Research institutions participate in collaborative development programs that advance scientific understanding of pest biology and control mechanisms. Innovation partnerships accelerate technology transfer and commercial application of research discoveries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping US insecticide market evolution, with manufacturers investing heavily in reduced-risk formulations and biological alternatives. Environmental stewardship becomes a competitive differentiator as customers increasingly prioritize sustainable pest management solutions.

Digital agriculture adoption accelerates the integration of insecticide applications with precision farming technologies, enabling data-driven decision making and optimized pest control strategies. Smart application systems improve efficiency while reducing environmental exposure through targeted delivery mechanisms.

Resistance management strategies gain prominence as industry stakeholders collaborate to preserve the effectiveness of existing active ingredients through integrated pest management approaches. Mode of action diversity becomes critical for maintaining long-term pest control efficacy.

Regulatory evolution continues to shape market dynamics through updated safety assessments, environmental impact evaluations, and pollinator protection requirements. Proactive compliance strategies become essential for maintaining market access and competitive position.

Customer education initiatives expand as manufacturers invest in technical support services and training programs that promote proper product use and integrated pest management practices. Value-added services create differentiation opportunities beyond product performance characteristics.

Product innovations continue to drive industry advancement through novel active ingredients, improved formulation technologies, and enhanced delivery systems. Biological insecticide development accelerates with multiple companies launching new microbial and biochemical products that address environmental and regulatory concerns.

Strategic acquisitions reshape competitive dynamics as major players acquire specialized biotechnology companies and regional manufacturers to expand product portfolios and market reach. Technology integration becomes a key driver of merger and acquisition activity in the sector.

Regulatory milestones include EPA approvals for new active ingredients and formulation technologies that expand pest control options while meeting enhanced safety standards. Registration renewals and product cancellations continue to influence market availability and competitive positioning.

Sustainability initiatives gain momentum through industry commitments to reduce environmental impact and support pollinator health. Stewardship programs demonstrate proactive approaches to responsible product use and environmental protection.

Research collaborations between industry, academia, and government agencies advance scientific understanding of pest biology and control mechanisms. Public-private partnerships accelerate development of innovative solutions for emerging pest challenges and resistance management.

Strategic positioning recommendations emphasize the importance of balancing innovation investment with regulatory compliance to maintain competitive advantage in an evolving market environment. Portfolio diversification across chemical classes and biological alternatives provides risk mitigation against regulatory restrictions and resistance development.

Market entry strategies should prioritize segments with favorable regulatory environments and growing customer acceptance of new technologies. Specialty crop markets offer premium pricing opportunities for companies with specialized formulation capabilities and technical expertise.

Investment priorities should focus on biological insecticide development, precision application technologies, and integrated pest management solutions that address sustainability concerns while maintaining efficacy. Digital agriculture integration creates opportunities for value-added services and customer relationship enhancement.

Partnership strategies can accelerate innovation and market access through collaborations with biotechnology companies, agricultural technology providers, and academic research institutions. Strategic alliances enable resource sharing and risk mitigation in high-investment development programs.

Regulatory engagement remains critical for successful market participation, requiring proactive communication with agencies and stakeholder groups to influence policy development and maintain product access. MarkWide Research recommends establishing dedicated regulatory affairs capabilities to navigate complex approval processes effectively.

Market evolution over the next decade will be characterized by continued shift toward sustainable pest management solutions, with biological insecticides and integrated approaches gaining significant market share. Growth projections indicate the biological segment will achieve 15-18% annual expansion while traditional synthetic products maintain steady but slower growth rates.

Technology advancement will drive development of next-generation formulations that combine multiple active ingredients, enhanced delivery systems, and digital integration capabilities. Precision agriculture adoption will accelerate, creating demand for smart application technologies and data-driven pest management solutions.

Regulatory landscape will continue evolving toward stricter environmental and safety standards, favoring products with reduced environmental impact and improved safety profiles. Pollinator protection requirements will influence product development priorities and application practices across agricultural sectors.

Market consolidation is expected to continue as companies seek scale advantages and complementary technologies through strategic acquisitions. Innovation competition will intensify as firms invest in breakthrough technologies that address resistance management and sustainability challenges.

Customer expectations will increasingly focus on integrated solutions that combine products, services, and digital tools to optimize pest management outcomes. Value proposition evolution will emphasize total system performance rather than individual product characteristics, creating opportunities for service-oriented business models.

Strategic assessment of the US insecticide market reveals a dynamic industry undergoing significant transformation driven by regulatory pressures, environmental concerns, and technological innovations. Market fundamentals remain strong, supported by consistent agricultural demand and expanding applications in specialty crop and urban pest control segments.

Growth opportunities are most pronounced in biological insecticides, precision agriculture integration, and sustainable pest management solutions that address evolving customer needs and regulatory requirements. Competitive success will depend on companies’ ability to innovate while maintaining regulatory compliance and environmental stewardship commitments.

Industry evolution toward more sustainable and technologically advanced solutions creates both challenges and opportunities for market participants. Investment strategies that prioritize research and development, regulatory expertise, and customer relationship management will be essential for long-term success in this evolving market landscape.

The US insecticide market represents a critical component of agricultural productivity and food security, requiring continued innovation and responsible stewardship to meet future challenges while maintaining environmental and human health protection standards.

What is Insecticide?

Insecticide refers to substances used to kill or control insects that are harmful to crops, livestock, and human health. They are essential in agriculture for protecting plants from pests and are also used in public health to manage disease vectors.

What are the key companies in the US Insecticide Market?

Key companies in the US Insecticide Market include Bayer AG, Syngenta AG, and Corteva Agriscience, among others. These companies are known for their innovative products and extensive research in pest management solutions.

What are the growth factors driving the US Insecticide Market?

The US Insecticide Market is driven by factors such as the increasing demand for food production, the rise in pest resistance to traditional methods, and advancements in insecticide formulations. Additionally, the growing awareness of pest-related diseases contributes to market growth.

What challenges does the US Insecticide Market face?

The US Insecticide Market faces challenges such as regulatory pressures regarding chemical usage, environmental concerns, and the development of pest resistance. These factors can hinder the effectiveness and acceptance of certain insecticides.

What opportunities exist in the US Insecticide Market?

Opportunities in the US Insecticide Market include the development of biopesticides and integrated pest management solutions. There is also potential for growth in organic farming practices that require environmentally friendly insecticides.

What trends are shaping the US Insecticide Market?

Trends in the US Insecticide Market include the increasing adoption of precision agriculture technologies and the shift towards sustainable pest management practices. Additionally, there is a growing focus on research and development of novel insecticide formulations.

US Insecticide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pyrethroids, Neonicotinoids, Insect Growth Regulators, Organophosphates |

| Application | Agricultural, Residential, Commercial, Industrial |

| Formulation | Liquid, Granular, Aerosol, Powder |

| End User | Farmers, Pest Control Operators, Homeowners, Landscapers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Insecticide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at