444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US industrial laminate flooring market represents a dynamic and rapidly evolving sector within the broader commercial flooring industry. This specialized market segment focuses on providing durable, cost-effective flooring solutions specifically designed for industrial environments, manufacturing facilities, warehouses, and heavy-duty commercial applications. Industrial laminate flooring has gained significant traction due to its exceptional durability, moisture resistance, and ability to withstand heavy foot traffic and equipment loads.

Market dynamics indicate robust growth driven by increasing industrialization, expansion of manufacturing facilities, and growing demand for sustainable flooring solutions. The market is experiencing a compound annual growth rate (CAGR) of 6.2%, reflecting strong adoption across various industrial sectors. Manufacturing facilities account for approximately 45% of total market demand, followed by warehouse and distribution centers representing 32% market share.

Technological advancements in laminate manufacturing have significantly enhanced product performance, with modern industrial laminates offering superior wear resistance, chemical resistance, and dimensional stability. The integration of advanced surface treatments and core technologies has positioned industrial laminate flooring as a viable alternative to traditional industrial flooring materials such as epoxy coatings, concrete, and vinyl composition tiles.

The US industrial laminate flooring market refers to the comprehensive ecosystem encompassing the production, distribution, and installation of specialized laminate flooring products designed specifically for industrial and heavy-duty commercial applications. This market includes high-performance laminate flooring systems engineered to withstand extreme conditions, heavy machinery, chemical exposure, and intensive daily use in industrial environments.

Industrial laminate flooring differs significantly from residential laminate products through enhanced construction, specialized wear layers, and reinforced core materials. These products typically feature multi-layer construction with moisture-resistant cores, industrial-grade wear layers, and specialized locking mechanisms designed for commercial installation requirements. The market encompasses various product categories including luxury vinyl planks with laminate construction, high-pressure laminates, and specialized industrial-grade floating floor systems.

Key characteristics defining this market include superior durability ratings, compliance with industrial safety standards, resistance to chemicals and heavy loads, and compatibility with industrial cleaning protocols. The market serves diverse end-users including manufacturing plants, automotive facilities, food processing centers, pharmaceutical facilities, and large-scale distribution centers requiring reliable, long-lasting flooring solutions.

Market performance in the US industrial laminate flooring sector demonstrates strong momentum driven by industrial expansion, infrastructure modernization, and increasing preference for cost-effective flooring solutions. The market benefits from growing awareness of laminate flooring advantages including reduced installation time, lower maintenance requirements, and improved workplace safety features compared to traditional industrial flooring options.

Key growth drivers include the resurgence of domestic manufacturing, expansion of e-commerce fulfillment centers, and increasing focus on workplace safety and aesthetics in industrial environments. The market is experiencing particularly strong demand in the automotive sector, where industrial laminate adoption has increased by 28% over the past three years, and in food processing facilities requiring hygienic, easy-to-clean flooring solutions.

Competitive landscape features a mix of established flooring manufacturers and specialized industrial flooring companies, with market leaders focusing on product innovation, enhanced durability features, and comprehensive installation services. The market is characterized by increasing consolidation, strategic partnerships, and significant investment in research and development to meet evolving industrial requirements.

Future prospects remain highly favorable, with projected growth supported by continued industrial development, infrastructure investments, and technological advancements in laminate manufacturing. The market is expected to benefit from increasing adoption of sustainable building practices and growing demand for flooring solutions that combine performance, aesthetics, and environmental responsibility.

Market analysis reveals several critical insights shaping the US industrial laminate flooring landscape:

Market segmentation analysis indicates strong growth across multiple application areas, with warehouse and distribution centers showing the highest growth rates. The integration of smart building technologies and IoT sensors into flooring systems represents an emerging trend with significant potential for market expansion.

Industrial expansion serves as the primary catalyst driving market growth, with increasing domestic manufacturing activities creating substantial demand for reliable flooring solutions. The reshoring of manufacturing operations and establishment of new production facilities has generated significant opportunities for industrial laminate flooring providers. Manufacturing sector growth has contributed to increased flooring replacement cycles and new installation projects across diverse industrial segments.

Cost-effectiveness represents another crucial driver, as industrial laminate flooring offers superior value proposition compared to traditional alternatives. The combination of lower material costs, reduced installation time, and minimal maintenance requirements creates compelling economic benefits for facility managers. Total cost of ownership advantages include reduced downtime during installation, lower long-term maintenance expenses, and extended product lifecycles.

Performance improvements in modern laminate products have expanded application possibilities, with enhanced durability, moisture resistance, and chemical tolerance meeting stringent industrial requirements. Advanced surface treatments and core technologies have addressed historical limitations, making laminate flooring suitable for previously challenging environments including food processing, pharmaceutical, and chemical manufacturing facilities.

Aesthetic considerations increasingly influence flooring decisions in industrial environments, with modern facilities emphasizing workplace appearance and employee satisfaction. Industrial laminate flooring offers extensive design options, realistic wood and stone appearances, and consistent visual quality that enhances overall facility aesthetics while maintaining functional performance requirements.

Performance limitations in extreme industrial conditions continue to restrict market penetration in certain applications. While modern industrial laminates offer improved durability, they may not match the performance of specialized industrial flooring systems in environments with extreme temperatures, heavy chemical exposure, or exceptional load requirements. Load capacity constraints limit adoption in facilities with extremely heavy machinery or concentrated point loads.

Initial perception challenges persist among facility managers and industrial engineers who associate laminate flooring primarily with residential applications. Overcoming preconceived notions about laminate durability and suitability for industrial use requires extensive education and demonstration of product capabilities. Market education efforts remain necessary to communicate the performance advantages of modern industrial laminate products.

Installation complexity in certain industrial environments presents challenges, particularly in facilities with irregular floor conditions, extensive utility penetrations, or specialized drainage requirements. While floating floor systems offer installation advantages, they may not be suitable for all industrial applications requiring permanent adhesive installation or specialized subfloor preparation.

Competition from established alternatives including polished concrete, epoxy coatings, and vinyl composition tiles creates market pressure. These traditional solutions have established track records in industrial applications and may be preferred by conservative facility managers despite potential disadvantages in cost, installation time, or maintenance requirements.

Emerging industrial sectors present significant growth opportunities, particularly in advanced manufacturing, renewable energy, and technology sectors requiring modern, aesthetically pleasing industrial environments. The expansion of data centers, clean manufacturing facilities, and research and development centers creates demand for flooring solutions that combine industrial performance with contemporary aesthetics.

Retrofit and renovation projects offer substantial market potential as aging industrial facilities undergo modernization. The ability to install laminate flooring over existing surfaces without extensive preparation provides compelling advantages for facility upgrades. Renovation market segment represents approximately 40% of total market opportunity, with significant growth potential as industrial facilities prioritize modernization.

Sustainability initiatives create opportunities for eco-friendly laminate products featuring recycled content, low-emission formulations, and end-of-life recyclability. Industrial facilities increasingly prioritize environmental responsibility, creating demand for flooring solutions that support sustainability goals while maintaining performance requirements.

Technology integration opportunities include development of smart flooring systems incorporating sensors for monitoring foot traffic, equipment loads, and environmental conditions. The integration of IoT capabilities and predictive maintenance features could differentiate laminate flooring products and create additional value propositions for industrial customers.

Supply chain dynamics significantly influence market performance, with raw material availability, manufacturing capacity, and distribution networks affecting product availability and pricing. The market benefits from established supply chains for laminate manufacturing, though specialized industrial-grade materials may require dedicated sourcing relationships. Manufacturing efficiency improvements have reduced production costs by approximately 15% over the past five years.

Competitive dynamics feature intense competition among established flooring manufacturers and specialized industrial flooring companies. Market leaders compete on product performance, installation services, warranty coverage, and technical support capabilities. The market is experiencing consolidation as larger companies acquire specialized manufacturers to expand product portfolios and market reach.

Regulatory dynamics include evolving building codes, safety standards, and environmental regulations affecting product specifications and installation requirements. Compliance with industrial safety standards, fire codes, and environmental regulations influences product development and market acceptance. Regulatory compliance costs represent a growing portion of product development investments.

Customer dynamics reflect changing preferences toward integrated flooring solutions, comprehensive warranties, and value-added services including maintenance programs and performance monitoring. Industrial customers increasingly seek flooring partners capable of providing complete solutions rather than simply supplying products.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including manufacturers, distributors, installers, and end-users across diverse industrial sectors. The research approach includes structured surveys, in-depth interviews, and facility visits to understand market dynamics, customer preferences, and application requirements. Primary data collection involved over 200 industry participants representing all major market segments.

Secondary research incorporates analysis of industry reports, trade publications, regulatory filings, and company financial statements to validate primary findings and identify market trends. The methodology includes comprehensive review of patent filings, technology developments, and competitive intelligence to understand innovation trajectories and market positioning strategies.

Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify growth opportunities. The analytical framework considers macroeconomic factors, industry-specific drivers, and regional variations to create comprehensive market assessments. MarkWide Research employs proprietary analytical models to ensure accuracy and reliability of market projections.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical verification to ensure research accuracy and reliability. The methodology incorporates feedback loops and continuous monitoring to update findings based on market developments and emerging trends.

Midwest region dominates the US industrial laminate flooring market, accounting for approximately 35% of total demand due to concentrated manufacturing activities in automotive, machinery, and food processing sectors. States including Michigan, Ohio, Indiana, and Illinois drive significant market demand through established industrial bases and ongoing facility expansions. The region benefits from proximity to major laminate manufacturers and established distribution networks.

Southeast region represents the fastest-growing market segment with annual growth rates exceeding 8%, driven by industrial relocations, new manufacturing investments, and expanding logistics infrastructure. States including North Carolina, South Carolina, Georgia, and Tennessee attract manufacturing investments creating substantial flooring opportunities. The region’s business-friendly environment and lower operating costs drive industrial expansion.

West Coast markets focus on technology manufacturing, aerospace, and specialized industrial applications requiring high-performance flooring solutions. California leads regional demand through diverse industrial activities, while Washington and Oregon contribute through aerospace and technology sector growth. The region emphasizes sustainability and environmental compliance, driving demand for eco-friendly laminate products.

Northeast region maintains steady demand through established manufacturing, pharmaceutical, and food processing industries. The region’s focus on facility modernization and compliance with stringent environmental regulations creates opportunities for advanced laminate flooring solutions. Regional market share remains stable at approximately 18% of total demand.

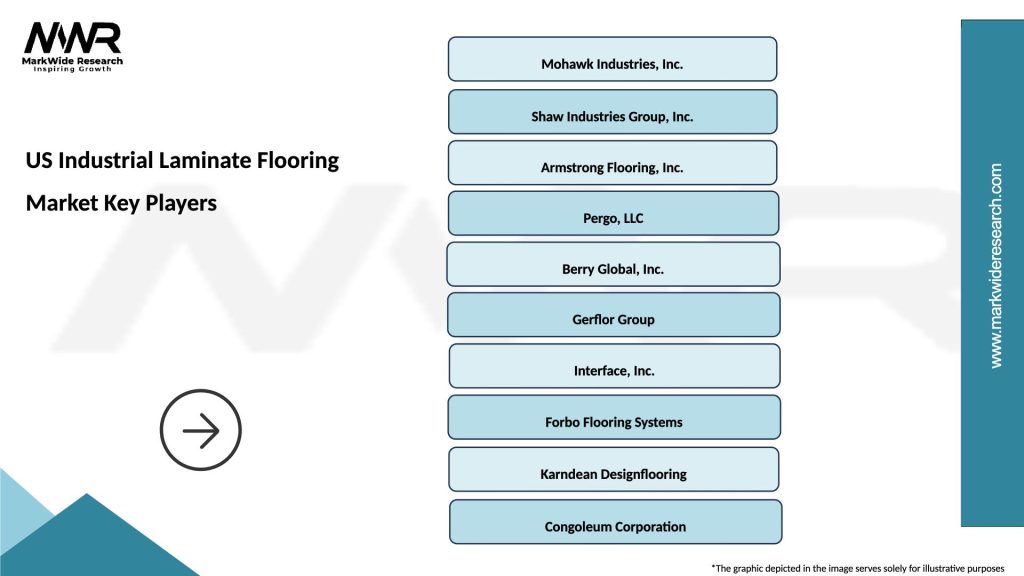

Market leadership is distributed among several key players, each bringing distinct strengths and market positioning strategies:

Competitive strategies include product innovation, vertical integration, strategic acquisitions, and expansion of service capabilities. Market leaders invest heavily in research and development to enhance product performance, develop specialized solutions, and maintain technological advantages. Innovation investments typically represent 3-5% of annual revenues among leading manufacturers.

Market consolidation continues as larger companies acquire specialized manufacturers to expand product portfolios and geographic reach. Strategic partnerships between manufacturers and distributors enhance market coverage and customer service capabilities.

By Product Type:

By Application:

By Installation Method:

Manufacturing sector represents the largest market category, driven by diverse industrial activities requiring reliable, cost-effective flooring solutions. This segment emphasizes durability, chemical resistance, and minimal maintenance requirements. Manufacturing applications account for approximately 45% of total market demand, with automotive and machinery manufacturing leading adoption rates.

Warehouse and distribution category shows strong growth driven by e-commerce expansion and supply chain modernization. These applications prioritize quick installation, damage resistance, and compatibility with material handling equipment. The segment benefits from increasing automation and focus on operational efficiency in logistics facilities.

Food processing represents a specialized but growing category requiring hygienic, easy-to-clean flooring solutions with antimicrobial properties. Regulatory compliance and food safety requirements drive demand for specialized laminate products meeting FDA and USDA standards. This segment commands premium pricing due to specialized requirements.

Healthcare and pharmaceutical applications require flooring solutions meeting stringent cleanliness, chemical resistance, and regulatory compliance standards. This category emphasizes seamless installation, antimicrobial properties, and compatibility with specialized cleaning protocols. Healthcare segment growth exceeds 12% annually driven by facility expansions and modernization projects.

Manufacturers benefit from growing market demand, opportunities for product innovation, and expanding application areas. The market offers potential for premium pricing through specialized products and value-added services. Manufacturing efficiency improvements and economies of scale provide competitive advantages and margin enhancement opportunities.

Distributors and dealers gain from increasing product demand, expanding customer base, and opportunities for service-based revenue streams. The market provides stable demand patterns and opportunities for long-term customer relationships through maintenance and replacement cycles.

Installers and contractors benefit from growing installation demand, reduced installation complexity with floating floor systems, and opportunities for specialized expertise development. The market offers potential for recurring revenue through maintenance services and facility upgrades.

End-users realize significant benefits including reduced total cost of ownership, improved workplace aesthetics, enhanced safety features, and simplified maintenance requirements. Operational cost savings through reduced downtime, lower maintenance expenses, and extended product lifecycles provide compelling value propositions.

Building owners and facility managers benefit from improved asset values, reduced maintenance burdens, and enhanced tenant satisfaction. The market provides solutions supporting sustainability goals and regulatory compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents a dominant trend driving product development and customer preferences. Manufacturers increasingly focus on eco-friendly formulations, recycled content, and end-of-life recyclability to meet environmental requirements. Sustainable product adoption has increased by 42% over the past three years, reflecting growing environmental consciousness among industrial customers.

Technology convergence includes integration of smart sensors, IoT capabilities, and predictive maintenance features into flooring systems. These innovations provide real-time monitoring of floor conditions, traffic patterns, and maintenance requirements, creating additional value propositions for industrial customers.

Customization demand grows as industrial facilities seek flooring solutions tailored to specific operational requirements. This trend drives development of specialized products with unique properties including conductivity, antimicrobial treatments, and enhanced chemical resistance for particular industrial applications.

Service integration becomes increasingly important as customers seek comprehensive solutions including installation, maintenance, and performance monitoring services. This trend creates opportunities for manufacturers and distributors to develop recurring revenue streams and strengthen customer relationships.

Aesthetic emphasis in industrial environments drives demand for attractive flooring options that enhance workplace appearance while maintaining functional performance. Modern industrial facilities increasingly prioritize employee satisfaction and facility aesthetics alongside operational requirements.

Product innovations include development of enhanced wear layers, improved core materials, and specialized surface treatments addressing specific industrial requirements. Recent developments focus on antimicrobial properties, enhanced chemical resistance, and improved dimensional stability for challenging environments.

Manufacturing investments by major players include capacity expansions, technology upgrades, and development of specialized production capabilities for industrial-grade products. These investments support market growth and enable manufacturers to meet increasing demand for high-performance laminate flooring.

Strategic partnerships between manufacturers, distributors, and installation contractors enhance market coverage and service capabilities. These collaborations improve customer access to products and services while creating more comprehensive solutions for industrial flooring requirements.

Regulatory developments include updated building codes, safety standards, and environmental regulations affecting product specifications and installation requirements. Industry participants actively engage in standards development to ensure products meet evolving regulatory requirements.

Market consolidation continues through acquisitions and mergers as larger companies seek to expand product portfolios and geographic reach. This trend creates opportunities for enhanced research and development capabilities and improved market coverage.

Product development focus should emphasize enhanced performance characteristics addressing specific industrial requirements including improved load capacity, chemical resistance, and temperature stability. MWR analysis indicates that products meeting specialized industrial standards command premium pricing and stronger customer loyalty.

Market education initiatives remain critical for overcoming perception challenges and demonstrating the capabilities of modern industrial laminate flooring. Manufacturers should invest in demonstration projects, case studies, and technical education programs to build market acceptance among facility managers and specifiers.

Service integration strategies should focus on developing comprehensive solutions including installation, maintenance, and performance monitoring services. This approach creates differentiation opportunities and recurring revenue streams while strengthening customer relationships and market position.

Geographic expansion opportunities exist in high-growth regions, particularly the Southeast, where industrial development creates substantial flooring demand. Companies should consider regional partnerships, distribution expansion, and local service capabilities to capitalize on growth opportunities.

Technology investment in smart flooring capabilities and IoT integration could create significant competitive advantages and new market opportunities. Early adoption of these technologies positions companies for future market leadership and enhanced customer value propositions.

Market growth prospects remain highly favorable, supported by continued industrial expansion, infrastructure modernization, and increasing acceptance of laminate flooring in industrial applications. The market is projected to maintain strong growth momentum driven by technological improvements and expanding application areas.

Technology evolution will continue enhancing product performance, with developments in core materials, surface treatments, and installation systems addressing current limitations and expanding market opportunities. Performance improvements are expected to increase market penetration by 25-30% over the next five years as products meet increasingly demanding industrial requirements.

Market maturation will likely result in increased consolidation, standardization of performance metrics, and development of industry-specific product categories. This evolution will create opportunities for specialized manufacturers while challenging companies to differentiate through innovation and service capabilities.

Sustainability requirements will increasingly influence product development and customer selection criteria, driving demand for eco-friendly formulations and circular economy approaches. Companies investing in sustainable product development and manufacturing processes will gain competitive advantages in environmentally conscious market segments.

MarkWide Research projects that the integration of smart building technologies and predictive maintenance capabilities will create new market categories and revenue opportunities, potentially expanding the addressable market significantly beyond traditional flooring applications.

The US industrial laminate flooring market presents compelling growth opportunities driven by industrial expansion, technological improvements, and increasing recognition of laminate flooring advantages in industrial applications. The market benefits from strong fundamentals including cost-effectiveness, installation efficiency, and enhanced product performance addressing traditional limitations.

Key success factors for market participants include continued investment in product innovation, market education initiatives, and development of comprehensive service capabilities. Companies that successfully address performance requirements while providing superior value propositions will capture significant market share in this growing sector.

Future market development will be shaped by sustainability requirements, technology integration, and evolving customer expectations for comprehensive flooring solutions. The market’s trajectory toward increased acceptance and broader application areas positions it for sustained growth and expansion into new industrial segments.

Strategic positioning for long-term success requires balancing product innovation with market education, geographic expansion with service capability development, and cost competitiveness with performance differentiation. Companies that achieve this balance will be well-positioned to capitalize on the substantial opportunities in the evolving US industrial laminate flooring market.

What is Industrial Laminate Flooring?

Industrial Laminate Flooring refers to a type of flooring made from composite materials that mimic the appearance of wood or stone while providing durability and ease of maintenance. It is commonly used in commercial and industrial settings due to its resistance to wear and tear.

What are the key players in the US Industrial Laminate Flooring Market?

Key players in the US Industrial Laminate Flooring Market include Mohawk Industries, Shaw Industries, and Armstrong Flooring, among others. These companies are known for their innovative designs and high-quality products that cater to various industrial applications.

What are the growth factors driving the US Industrial Laminate Flooring Market?

The growth of the US Industrial Laminate Flooring Market is driven by factors such as the increasing demand for cost-effective flooring solutions, the rise in construction activities, and the growing preference for sustainable building materials. Additionally, advancements in manufacturing technology are enhancing product offerings.

What challenges does the US Industrial Laminate Flooring Market face?

The US Industrial Laminate Flooring Market faces challenges such as competition from alternative flooring materials, fluctuating raw material prices, and environmental regulations. These factors can impact production costs and market dynamics.

What opportunities exist in the US Industrial Laminate Flooring Market?

Opportunities in the US Industrial Laminate Flooring Market include the expansion of e-commerce platforms for flooring sales, the increasing trend of home renovations, and the growing focus on eco-friendly products. These trends are likely to create new avenues for growth.

What trends are shaping the US Industrial Laminate Flooring Market?

Trends shaping the US Industrial Laminate Flooring Market include the rise of customizable flooring options, the integration of smart technology in flooring solutions, and a growing emphasis on aesthetic appeal. These trends reflect changing consumer preferences and technological advancements.

US Industrial Laminate Flooring Market

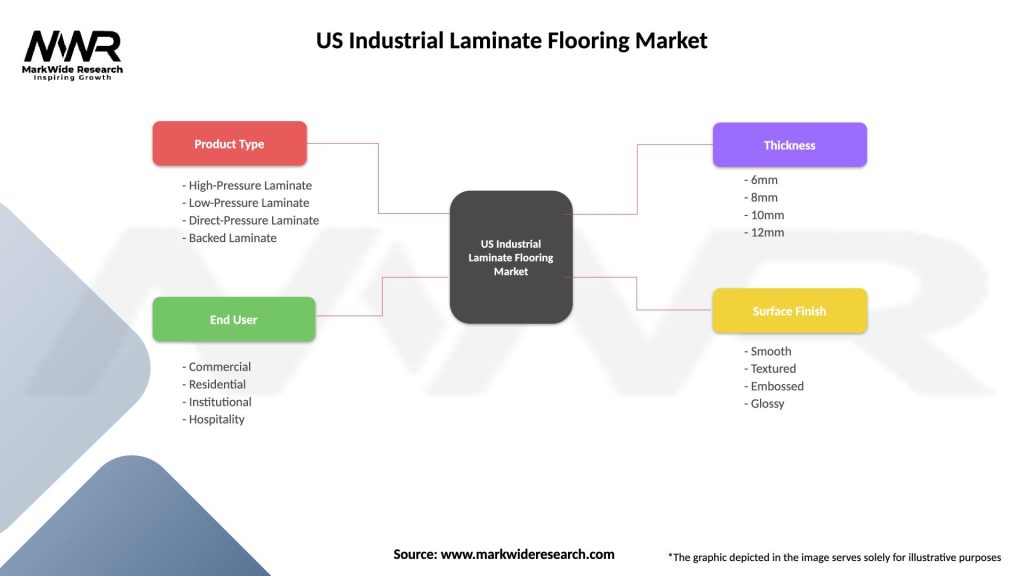

| Segmentation Details | Description |

|---|---|

| Product Type | High-Pressure Laminate, Low-Pressure Laminate, Direct-Pressure Laminate, Backed Laminate |

| End User | Commercial, Residential, Institutional, Hospitality |

| Thickness | 6mm, 8mm, 10mm, 12mm |

| Surface Finish | Smooth, Textured, Embossed, Glossy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Industrial Laminate Flooring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at