444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US household refrigerators market represents a cornerstone of American home appliance industry, characterized by continuous innovation and evolving consumer preferences. This dynamic sector encompasses various refrigerator types, from traditional top-freezer models to sophisticated smart refrigerators equipped with advanced connectivity features. Market dynamics indicate robust growth driven by replacement demand, energy efficiency requirements, and technological advancements.

Consumer behavior patterns reveal increasing preference for energy-efficient models, with ENERGY STAR certified refrigerators capturing approximately 78% market adoption among new purchases. The market demonstrates resilience through economic cycles, supported by essential nature of refrigeration appliances and ongoing housing market activity. Premium segment growth accelerates as households invest in smart home integration and advanced features like multi-zone cooling and built-in water filtration systems.

Regional distribution shows concentrated demand in metropolitan areas and suburban markets, with the Northeast and West Coast regions leading in premium product adoption. Market participants benefit from established distribution networks, strong brand loyalty, and continuous product innovation cycles that drive replacement purchases every 10-15 years on average.

The US household refrigerators market refers to the comprehensive ecosystem encompassing manufacturing, distribution, and retail of residential refrigeration appliances across the United States. This market includes various refrigerator configurations such as top-freezer, bottom-freezer, side-by-side, French door, and compact models designed for household use.

Market scope extends beyond basic refrigeration to include advanced features like smart connectivity, energy efficiency technologies, specialized storage compartments, and integrated water and ice dispensing systems. The definition encompasses both replacement purchases by existing homeowners and new installations in residential construction projects.

Industry classification includes major appliance manufacturers, component suppliers, distribution channels, and retail networks that collectively serve American households’ refrigeration needs. This market operates within regulatory frameworks governing energy efficiency standards, environmental compliance, and consumer safety requirements established by federal and state agencies.

Market fundamentals demonstrate steady expansion driven by replacement cycles, new home construction, and technological innovation. The US household refrigerators market benefits from strong consumer spending on home appliances and increasing preference for premium features that enhance convenience and energy efficiency.

Key growth drivers include rising disposable income, smart home technology adoption, and environmental consciousness leading to demand for energy-efficient models. According to MarkWide Research analysis, the market experiences consistent demand with annual replacement rates averaging 6.8% of installed base, supporting sustained revenue generation for industry participants.

Competitive landscape features established manufacturers leveraging brand recognition, distribution networks, and continuous innovation to maintain market position. Premium segment expansion accelerates as consumers prioritize advanced features, with smart refrigerators representing the fastest-growing category despite higher price points.

Future prospects remain positive, supported by demographic trends, housing market activity, and ongoing technological advancement. Market participants focus on sustainability initiatives, connectivity features, and customization options to differentiate products and capture evolving consumer preferences in the dynamic household appliance sector.

Strategic market insights reveal fundamental trends shaping the US household refrigerators market landscape. Consumer preferences increasingly favor larger capacity models with advanced features, driving average selling prices higher while unit volumes remain stable.

Primary market drivers propel sustained growth in the US household refrigerators market through multiple demand channels. Replacement demand constitutes the largest driver, as existing refrigerators reach end-of-life cycles and consumers upgrade to more efficient models with enhanced features.

New home construction generates consistent appliance demand, with builders and homeowners selecting refrigerators that complement modern kitchen designs. The housing market recovery and ongoing construction activity support steady unit sales across various price segments and configuration types.

Energy efficiency regulations drive replacement purchases as older models become less cost-effective to operate. Federal and state energy standards encourage consumers to upgrade to ENERGY STAR certified refrigerators that reduce electricity consumption and environmental impact while qualifying for utility rebates.

Smart home technology adoption creates new demand categories as consumers seek connected appliances that integrate with home automation systems. Internet connectivity features enable remote monitoring, energy management, and convenience functions that appeal to technology-oriented households.

Kitchen renovation projects frequently include refrigerator upgrades to match updated aesthetics and improved functionality. Home improvement spending remains robust, supporting premium product sales and custom installation services that enhance overall market value.

Market restraints present challenges for the US household refrigerators market despite overall positive growth trajectory. High initial costs for premium models and smart refrigerators can deter price-sensitive consumers, particularly during economic uncertainty periods when households prioritize essential purchases.

Extended product lifecycles naturally limit replacement frequency, as quality refrigerators typically operate effectively for 12-15 years. This durability characteristic reduces annual replacement rates compared to other appliance categories with shorter useful lives, constraining overall market expansion potential.

Supply chain disruptions periodically impact manufacturing costs and product availability, affecting pricing strategies and delivery timelines. Component shortages and transportation challenges can delay new product launches and increase production expenses that manufacturers must absorb or pass to consumers.

Energy efficiency standards while driving upgrades, also increase manufacturing complexity and costs. Regulatory compliance requires continuous investment in research and development, potentially limiting resources available for other innovation initiatives or market expansion activities.

Market saturation in certain segments creates competitive pressure on pricing and margins. Mature market characteristics require manufacturers to differentiate through features and services rather than basic functionality, increasing marketing and development expenses while potentially limiting profit growth.

Significant opportunities emerge across the US household refrigerators market as consumer preferences evolve and technology advances create new product categories. Smart refrigerator adoption represents substantial growth potential, with current penetration rates suggesting considerable room for expansion among tech-savvy households.

Sustainability initiatives open opportunities for manufacturers developing eco-friendly refrigerants, recyclable materials, and energy-efficient technologies. Environmental consciousness among consumers creates demand for products that minimize carbon footprint while maintaining superior performance standards.

Customization services present revenue opportunities through panel-ready models, custom sizing, and integration services that address unique kitchen design requirements. Premium customization commands higher margins while strengthening customer relationships and brand loyalty.

Service and maintenance programs offer recurring revenue streams through extended warranties, preventive maintenance, and repair services. Connected refrigerators enable predictive maintenance capabilities that enhance service efficiency while providing valuable customer data for product improvement.

Emerging market segments include compact and specialty refrigerators for urban living, outdoor kitchens, and commercial-grade residential applications. Demographic trends toward smaller households and urban living create demand for space-efficient models with premium features adapted to modern lifestyle requirements.

Complex market dynamics shape the US household refrigerators market through interacting forces of supply, demand, technology, and regulation. Consumer behavior evolution drives manufacturers to balance traditional reliability expectations with innovative features that enhance convenience and efficiency.

Competitive dynamics intensify as established manufacturers face pressure from emerging brands offering specialized features or value propositions. Brand loyalty remains strong in appliance categories, but consumers increasingly evaluate energy efficiency, smart features, and design aesthetics when making replacement decisions.

Technology integration cycles accelerate product development timelines while requiring substantial investment in research and development. Smart home compatibility becomes increasingly important as consumers seek appliances that integrate seamlessly with existing home automation systems and mobile applications.

Regulatory environment influences product specifications through energy efficiency standards, environmental regulations, and safety requirements. Compliance costs affect pricing strategies while creating barriers to entry for smaller manufacturers lacking resources to meet complex regulatory requirements.

Distribution channel evolution reflects changing consumer shopping preferences, with online sales gaining importance alongside traditional appliance retailers. Omnichannel strategies become essential for manufacturers seeking to maintain market reach across diverse customer segments and geographic regions.

Comprehensive research methodology underpins analysis of the US household refrigerators market through multiple data collection and validation approaches. Primary research includes structured interviews with industry executives, retail partners, and consumer focus groups to gather qualitative insights on market trends and preferences.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial disclosures to establish quantitative market parameters. Data triangulation ensures accuracy through cross-validation of information sources and statistical analysis of market indicators.

Market modeling employs statistical techniques to project growth trends, segment analysis, and competitive positioning based on historical data and identified market drivers. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions to provide comprehensive market outlook.

Industry expert consultation provides specialized knowledge on technical developments, regulatory changes, and competitive strategies that influence market dynamics. Validation processes include peer review and data verification to ensure research findings meet professional standards for accuracy and reliability.

Continuous monitoring tracks market developments, product launches, and industry announcements to maintain current market intelligence. Research updates incorporate new information and emerging trends to provide stakeholders with timely and relevant market analysis for strategic decision-making.

Regional market analysis reveals distinct patterns across the US household refrigerators market influenced by demographics, housing characteristics, and economic conditions. Northeast region demonstrates strong preference for premium models and built-in refrigerators, reflecting higher disposable income and urban housing density requiring space-efficient solutions.

West Coast markets lead in smart refrigerator adoption and energy-efficient models, driven by environmental consciousness and technology-forward consumer base. California specifically shows highest penetration rates for connected appliances at approximately 23% of new purchases, significantly above national averages.

Southeast region experiences robust growth supported by population migration, new home construction, and economic expansion. Florida and Texas markets demonstrate strong demand across all price segments, with particular strength in mid-range French door models that balance features and affordability.

Midwest markets prioritize value and reliability, with traditional top-freezer and side-by-side models maintaining strong market share. Rural areas within these regions show preference for larger capacity models and extended warranty programs that ensure long-term reliability.

Mountain West region shows growing demand for outdoor-rated and garage-ready refrigerators, reflecting lifestyle preferences and climate considerations. Regional distribution indicates the West Coast captures 28% market share, followed by Southeast at 26%, Northeast at 22%, Midwest at 18%, and Mountain West at 6% of national sales volume.

Competitive landscape in the US household refrigerators market features established manufacturers with strong brand recognition and extensive distribution networks. Market leadership depends on product innovation, manufacturing efficiency, and customer service capabilities that differentiate offerings in increasingly competitive environment.

Competitive strategies emphasize product differentiation through smart technology, energy efficiency, and design innovation. Brand positioning varies from value-focused offerings to luxury segments, allowing manufacturers to address diverse consumer preferences and price sensitivity levels.

Market consolidation continues as manufacturers seek economies of scale and expanded distribution reach. Strategic partnerships with retailers, builders, and technology companies enhance market access and product integration capabilities across various customer segments.

Market segmentation of the US household refrigerators market encompasses multiple classification approaches based on product configuration, capacity, price range, and feature sets. Configuration-based segmentation represents the primary categorization method used by manufacturers and retailers to address specific consumer preferences.

By Configuration:

By Capacity Range:

By Price Segment:

Category-wise analysis reveals distinct performance patterns across US household refrigerators market segments. French door refrigerators demonstrate strongest growth momentum, capturing increasing market share through superior storage accessibility and premium aesthetics that appeal to modern kitchen designs.

Smart refrigerators category experiences rapid expansion as connectivity features become mainstream consumer expectations. Internet-enabled models offer remote monitoring, energy management, and integration with home automation systems, commanding premium pricing while driving category growth at 15.2% annual rate.

Energy-efficient models across all categories benefit from regulatory support and consumer environmental consciousness. ENERGY STAR certification becomes standard expectation rather than premium feature, with manufacturers focusing on exceeding minimum efficiency requirements to differentiate products.

Built-in refrigerators represent niche but profitable category serving luxury kitchen installations and custom home construction. Integration capabilities with cabinetry and premium finishes support higher margins while requiring specialized distribution and installation services.

Compact refrigerators serve growing urban market and secondary location applications. Space constraints in apartments and condominiums drive demand for efficient designs that maximize storage within limited footprints while maintaining essential features and reliability.

Industry participants in the US household refrigerators market realize multiple benefits through strategic positioning and operational excellence. Manufacturers benefit from stable replacement demand cycles that provide predictable revenue streams and opportunities for premium product positioning through innovation and brand development.

Retailers and distributors gain from strong consumer demand and healthy profit margins on appliance sales. Installation and service opportunities create additional revenue streams while building customer relationships that support future sales and referrals across product categories.

Technology suppliers benefit from increasing integration of smart features, energy-efficient components, and advanced materials in refrigerator manufacturing. Component innovation drives demand for specialized sensors, connectivity modules, and efficient cooling systems that enhance product performance.

Consumers realize significant benefits through improved energy efficiency, enhanced convenience features, and longer product lifecycles. Smart refrigerators provide energy savings, food management capabilities, and integration with home automation systems that improve daily living experiences.

Environmental stakeholders benefit from industry focus on energy efficiency, sustainable materials, and responsible end-of-life recycling programs. Regulatory compliance drives continuous improvement in environmental performance while supporting broader sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshape the US household refrigerators market as consumer preferences evolve and technology capabilities advance. Smart home integration emerges as dominant trend, with refrigerators becoming central hubs for kitchen management and home automation systems.

Energy efficiency advancement continues driving product development as manufacturers exceed regulatory requirements to differentiate offerings. Variable-speed compressors and advanced insulation technologies deliver energy savings exceeding 40% compared to older models while maintaining superior cooling performance.

Design aesthetics evolution reflects modern kitchen trends toward clean lines, integrated appearances, and premium finishes. Counter-depth models gain popularity as homeowners prioritize seamless integration with cabinetry over maximum storage capacity.

Health and wellness features address consumer interest in food preservation and safety. Air purification systems, humidity control, and specialized storage zones for different food types enhance freshness while reducing waste and supporting healthy eating habits.

Sustainability initiatives influence product development through eco-friendly refrigerants, recyclable materials, and energy-efficient operation. Circular economy principles drive manufacturers to design products for easier disassembly and component recovery at end-of-life.

Customization capabilities expand through modular designs, interchangeable panels, and flexible storage configurations. Consumer personalization extends beyond aesthetics to functional adaptations that address specific household needs and usage patterns.

Recent industry developments demonstrate accelerating innovation pace in the US household refrigerators market. Major manufacturers invest heavily in smart technology integration, launching connected models with advanced features like internal cameras, voice control, and mobile app integration for remote monitoring.

Energy efficiency breakthroughs include development of magnetic refrigeration technology and advanced heat pump systems that promise significant efficiency improvements. Research initiatives focus on alternative refrigerants with lower global warming potential while maintaining cooling performance standards.

Manufacturing automation advances reduce production costs while improving quality consistency. Industry 4.0 technologies enable flexible production lines that accommodate customization requests and rapid product variant introduction without significant tooling investments.

Partnership developments between appliance manufacturers and technology companies accelerate smart feature integration. Collaboration initiatives with home automation platforms ensure seamless connectivity and enhanced user experiences across integrated home systems.

Sustainability programs expand through manufacturer take-back initiatives, recycling partnerships, and sustainable packaging solutions. Environmental commitments include carbon-neutral manufacturing goals and responsible sourcing of materials throughout supply chains.

Distribution innovation includes direct-to-consumer sales channels, virtual showrooms, and augmented reality tools that help consumers visualize products in their kitchens before purchase decisions.

Strategic recommendations for US household refrigerators market participants focus on leveraging emerging opportunities while addressing competitive challenges. MWR analysis suggests manufacturers prioritize smart technology integration while maintaining reliability and energy efficiency as core value propositions.

Product development strategies should emphasize modular designs that allow customization without significant manufacturing complexity. Flexible platforms enable efficient production of diverse product variants while meeting specific consumer preferences and regional market requirements.

Distribution channel optimization requires omnichannel approaches that integrate online and offline customer experiences. Digital transformation initiatives should include virtual product demonstrations, augmented reality visualization tools, and streamlined ordering and delivery processes.

Service capability expansion presents opportunities for recurring revenue through maintenance programs, extended warranties, and smart appliance monitoring services. Connected refrigerators enable predictive maintenance that reduces service costs while improving customer satisfaction.

Sustainability initiatives should extend beyond regulatory compliance to create competitive advantages through environmental leadership. Circular economy approaches including product-as-a-service models and comprehensive recycling programs can differentiate brands while supporting long-term market positioning.

Market expansion strategies should target underserved segments including urban compact models, outdoor applications, and specialized commercial-grade residential products. Demographic trends toward smaller households and urban living create opportunities for innovative space-efficient designs.

Future market prospects for the US household refrigerators market remain positive, supported by fundamental demand drivers and emerging growth opportunities. Replacement demand provides stable foundation while smart technology adoption and sustainability trends create premium product opportunities.

Technology evolution will accelerate integration of artificial intelligence, advanced sensors, and predictive analytics that enhance food management and energy efficiency. Machine learning capabilities will enable refrigerators to optimize performance based on usage patterns while providing valuable insights to users.

Market growth projections indicate continued expansion at steady annual rates of 4.2% through the next five years, driven by housing market activity, replacement cycles, and premium product adoption. Smart refrigerator penetration is expected to reach 35% of new purchases within the forecast period.

Regulatory environment will continue driving energy efficiency improvements while potentially introducing new requirements for connectivity security and data privacy. Environmental regulations may accelerate adoption of natural refrigerants and sustainable manufacturing practices.

Consumer preferences will increasingly favor integrated designs, health-focused features, and personalization capabilities. Demographic shifts toward urban living and smaller households will support demand for compact and space-efficient models with premium features.

Industry consolidation may continue as manufacturers seek scale advantages and expanded distribution reach. Strategic partnerships with technology companies and service providers will become increasingly important for comprehensive smart home integration.

The US household refrigerators market demonstrates remarkable resilience and growth potential, driven by essential product nature, continuous innovation, and evolving consumer preferences. Market fundamentals remain strong with stable replacement demand, new home construction activity, and increasing adoption of premium features including smart technology and energy efficiency.

Industry transformation accelerates through smart home integration, sustainability initiatives, and customization capabilities that address diverse consumer needs. Competitive dynamics favor manufacturers that successfully balance innovation with reliability while building comprehensive service capabilities and distribution networks.

Future success in this market requires strategic focus on technology integration, environmental responsibility, and customer experience enhancement. Market participants that adapt to changing consumer preferences while maintaining operational excellence will capture the greatest opportunities in this evolving and dynamic sector of the American home appliance industry.

What is Household Refrigerators?

Household refrigerators are essential kitchen appliances designed to store food and beverages at low temperatures to preserve freshness and prevent spoilage. They come in various styles, sizes, and technologies, catering to different consumer needs and preferences.

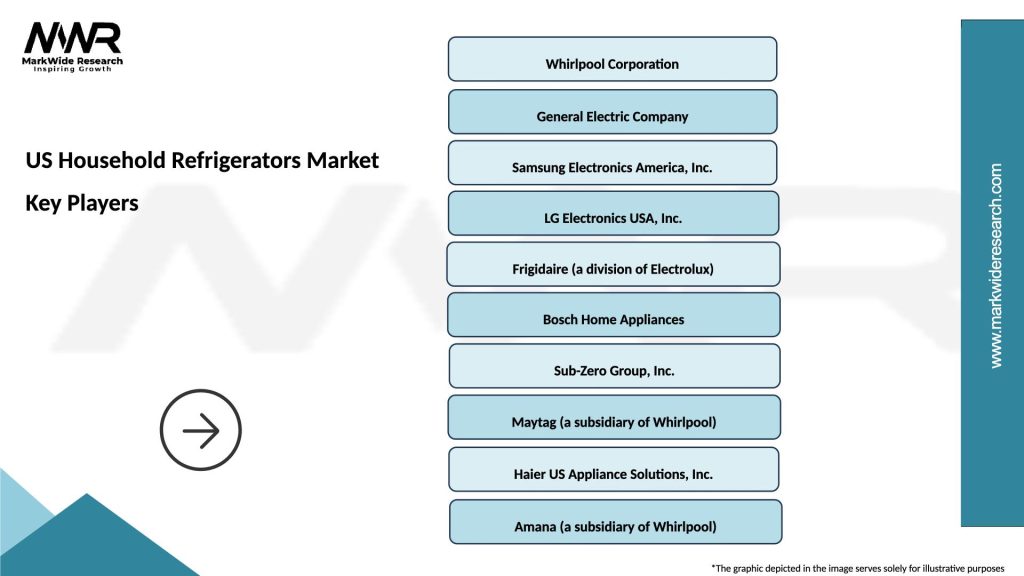

What are the key players in the US Household Refrigerators Market?

Key players in the US Household Refrigerators Market include Whirlpool Corporation, LG Electronics, Samsung Electronics, and Frigidaire, among others. These companies are known for their innovative designs and energy-efficient models.

What are the main drivers of the US Household Refrigerators Market?

The main drivers of the US Household Refrigerators Market include the growing demand for energy-efficient appliances, advancements in refrigeration technology, and increasing consumer awareness regarding food safety and preservation.

What challenges does the US Household Refrigerators Market face?

The US Household Refrigerators Market faces challenges such as rising raw material costs, intense competition among manufacturers, and the need for compliance with stringent energy efficiency regulations.

What opportunities exist in the US Household Refrigerators Market?

Opportunities in the US Household Refrigerators Market include the increasing trend towards smart refrigerators with IoT capabilities, the demand for eco-friendly models, and the potential for growth in the online retail segment.

What trends are shaping the US Household Refrigerators Market?

Trends shaping the US Household Refrigerators Market include the rise of smart technology integration, a focus on sustainable materials, and the popularity of customizable refrigerator designs to meet diverse consumer preferences.

US Household Refrigerators Market

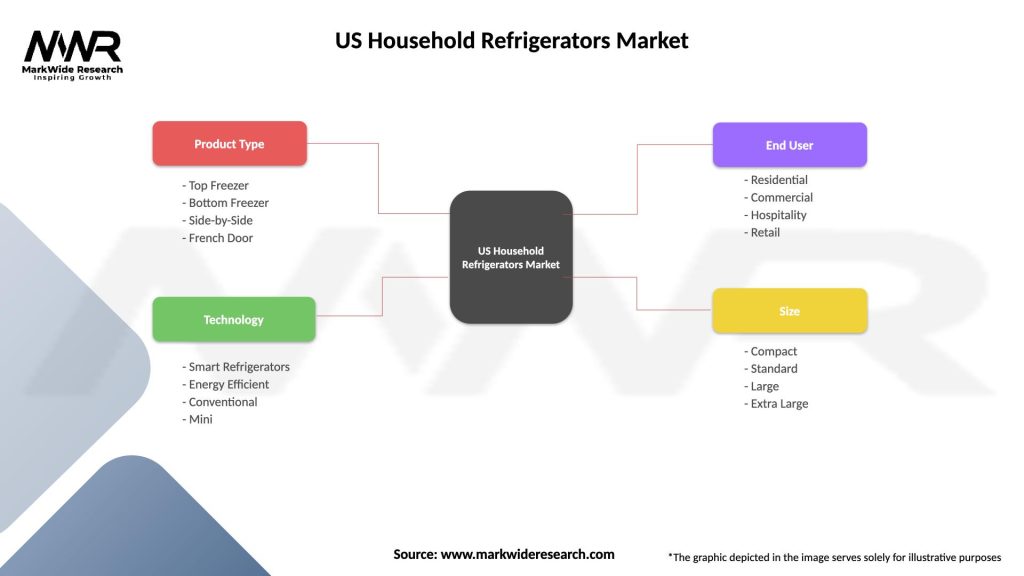

| Segmentation Details | Description |

|---|---|

| Product Type | Top Freezer, Bottom Freezer, Side-by-Side, French Door |

| Technology | Smart Refrigerators, Energy Efficient, Conventional, Mini |

| End User | Residential, Commercial, Hospitality, Retail |

| Size | Compact, Standard, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Household Refrigerators Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at