444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US household battery market represents a dynamic and rapidly evolving sector that powers countless devices across American homes. This comprehensive market encompasses various battery technologies including alkaline, lithium-ion, nickel-metal hydride, and rechargeable variants that serve diverse applications from remote controls to smart home devices. Market dynamics indicate robust growth driven by increasing consumer electronics adoption, smart home technology proliferation, and growing environmental consciousness regarding sustainable energy solutions.

Consumer preferences continue shifting toward high-performance, long-lasting battery solutions that offer superior value and environmental benefits. The market demonstrates significant expansion with growth rates reaching 6.2% CAGR as households increasingly rely on battery-powered devices for daily activities. Technological advancement in battery chemistry and manufacturing processes has enhanced product performance while reducing costs, making premium battery solutions more accessible to average consumers.

Regional distribution shows concentrated demand in urban areas where smart home adoption rates exceed 45% penetration, driving consistent battery replacement cycles. The market benefits from established retail infrastructure, e-commerce growth, and consumer awareness campaigns promoting proper battery disposal and recycling practices.

The US household battery market refers to the comprehensive ecosystem of portable power solutions designed for residential consumer applications, encompassing primary and secondary battery technologies that power everyday household devices and electronics. This market includes traditional alkaline batteries, advanced lithium-ion cells, rechargeable battery systems, and specialized power solutions for emerging smart home technologies.

Market scope extends beyond simple battery sales to include associated services such as recycling programs, battery management systems, and consumer education initiatives. The definition encompasses both branded and private-label battery products distributed through retail channels, online platforms, and specialty electronics stores serving American households.

Product categories within this market range from standard AA and AAA alkaline batteries to sophisticated lithium-ion power banks and rechargeable battery systems for high-drain devices. The market also includes emerging segments such as smart battery solutions with integrated monitoring capabilities and eco-friendly battery alternatives made from sustainable materials.

Market fundamentals reveal a robust and expanding US household battery sector characterized by technological innovation, changing consumer preferences, and increasing device proliferation. The market demonstrates consistent growth patterns driven by smart home adoption, portable electronics usage, and environmental sustainability concerns that influence purchasing decisions.

Key growth drivers include the proliferation of IoT devices requiring reliable power sources, with smart home device adoption contributing to 35% of new battery demand. Consumer electronics evolution continues creating opportunities for premium battery solutions that offer extended life cycles and superior performance characteristics.

Competitive landscape features established battery manufacturers alongside emerging technology companies developing innovative power solutions. Market leaders focus on product differentiation through advanced chemistry, longer life cycles, and sustainable manufacturing practices that appeal to environmentally conscious consumers.

Future prospects indicate continued expansion driven by emerging technologies, increased consumer awareness of battery performance benefits, and growing emphasis on sustainable energy solutions. The market shows strong potential for innovation in areas such as wireless charging integration, smart battery management, and recyclable battery materials.

Consumer behavior analysis reveals significant shifts in battery purchasing patterns, with households increasingly prioritizing performance over price considerations. Modern consumers demonstrate growing awareness of total cost of ownership, considering factors such as battery life, device compatibility, and environmental impact when making purchasing decisions.

Market segmentation reveals distinct consumer groups with specific battery needs, from basic household applications to advanced smart home systems requiring specialized power solutions. Understanding these segments enables manufacturers to develop targeted products and marketing strategies.

Smart home proliferation serves as a primary market driver, with connected devices requiring consistent, reliable power sources for optimal functionality. The integration of IoT technologies in household applications creates sustained demand for batteries capable of supporting always-on connectivity and advanced features.

Consumer electronics evolution continues driving battery demand as devices become more sophisticated and power-hungry. Modern electronics require batteries that can deliver consistent performance across varying load conditions while maintaining long operational life cycles.

Environmental sustainability concerns increasingly influence consumer choices, driving demand for rechargeable batteries and eco-friendly alternatives. Consumers demonstrate willingness to invest in premium battery solutions that offer environmental benefits alongside superior performance characteristics.

Retail accessibility improvements through expanded distribution channels and e-commerce platforms make batteries more convenient to purchase, encouraging regular replacement and premium product adoption. Enhanced product availability supports market growth across diverse consumer segments.

Price sensitivity among certain consumer segments limits adoption of premium battery solutions, particularly in price-conscious households where basic alkaline batteries remain the preferred choice despite inferior performance characteristics. Economic pressures can reduce consumer willingness to invest in advanced battery technologies.

Environmental concerns regarding battery disposal create challenges for market growth, as consumers become increasingly aware of environmental impacts associated with single-use batteries. Regulatory pressures and environmental advocacy influence consumer preferences toward rechargeable alternatives.

Market saturation in certain segments limits growth opportunities, particularly for traditional alkaline batteries where replacement cycles are well-established. Mature market segments require innovation and differentiation to drive continued growth and consumer engagement.

Competition intensity from alternative power solutions, including built-in rechargeable batteries and wireless charging technologies, challenges traditional battery market segments. Device manufacturers increasingly integrate non-removable power sources that reduce battery replacement frequency.

Smart battery technologies present significant opportunities for market expansion through integration of monitoring capabilities, wireless connectivity, and intelligent power management features. These advanced solutions appeal to tech-savvy consumers willing to pay premium prices for enhanced functionality.

Sustainable battery solutions offer growth opportunities as environmental consciousness increases among American consumers. Development of recyclable, biodegradable, or renewable battery materials can capture environmentally motivated market segments while supporting corporate sustainability initiatives.

E-commerce expansion enables direct-to-consumer sales models that improve margins while providing detailed product information and customer education. Online platforms facilitate subscription services, bulk purchasing, and personalized product recommendations based on usage patterns.

Partnership opportunities with device manufacturers, smart home system providers, and retail chains can create integrated solutions that enhance customer value while expanding market reach. Strategic partnerships enable access to new customer segments and distribution channels.

Supply chain evolution reflects changing market demands with manufacturers investing in advanced production capabilities and sustainable sourcing practices. Global supply chain disruptions have highlighted the importance of domestic manufacturing capacity and supply chain resilience for consistent product availability.

Consumer education initiatives play crucial roles in market development, helping consumers understand battery performance differences, proper usage practices, and environmental considerations. Educational efforts drive adoption of premium products while promoting responsible battery disposal and recycling behaviors.

Technology convergence between battery chemistry, device requirements, and consumer preferences creates dynamic market conditions requiring continuous innovation and adaptation. Manufacturers must balance performance improvements with cost considerations while addressing environmental sustainability concerns.

Regulatory landscape continues evolving with increased focus on environmental protection, product safety, and consumer rights. Compliance requirements influence product development, manufacturing processes, and marketing strategies while creating barriers for low-quality competitors.

Competitive pressures drive continuous improvement in battery performance, cost efficiency, and customer service. Market leaders invest heavily in research and development to maintain technological advantages while emerging competitors focus on niche segments and innovative solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes consumer surveys, industry expert interviews, and retail channel analysis to understand current market conditions and future trends.

Data collection processes utilize both quantitative and qualitative research approaches, incorporating statistical analysis of sales data, consumer behavior studies, and competitive intelligence gathering. MarkWide Research methodologies ensure comprehensive coverage of market segments and geographic regions.

Quality assurance measures include data validation, cross-referencing multiple sources, and expert review processes to ensure accuracy and reliability of market insights. Research findings undergo rigorous verification before inclusion in market analysis reports.

Analytical frameworks incorporate industry best practices for market research, utilizing proven methodologies for market sizing, trend analysis, and competitive assessment. Research processes adhere to professional standards while maintaining objectivity and analytical rigor.

Geographic distribution across the United States reveals distinct regional patterns in battery consumption, with urban areas showing higher adoption rates of premium battery solutions and smart home technologies. Regional preferences vary based on climate conditions, income levels, and technology adoption rates that influence battery selection and usage patterns.

Northeast region demonstrates strong demand for high-performance batteries driven by dense urban populations, high disposable incomes, and early adoption of smart home technologies. This region accounts for approximately 28% of premium battery sales despite representing a smaller geographic area.

Urban versus rural market dynamics show significant differences in product preferences, purchasing channels, and replacement frequencies. Urban consumers typically favor premium products and online purchasing, while rural markets often prioritize value and traditional retail channels.

Climate impact on battery performance varies across regions, with extreme temperatures affecting battery life and performance characteristics. Regional climate patterns influence consumer preferences for specific battery chemistries and performance specifications.

Market leadership remains concentrated among established battery manufacturers with strong brand recognition, extensive distribution networks, and proven product quality. These companies leverage economies of scale, research capabilities, and marketing resources to maintain competitive advantages.

Innovation strategies focus on battery chemistry improvements, packaging innovations, and sustainability initiatives that differentiate products while addressing evolving consumer needs. Companies invest heavily in research and development to maintain technological leadership and market position.

Distribution strategies encompass traditional retail channels, e-commerce platforms, and direct-to-consumer sales models. Successful companies maintain strong relationships with major retailers while developing online capabilities to reach diverse consumer segments.

Brand positioning strategies vary from premium performance focus to value-oriented messaging, with companies targeting specific consumer segments through tailored marketing approaches and product offerings.

Product segmentation reveals distinct categories based on battery chemistry, size, and application requirements. Each segment demonstrates unique growth patterns, consumer preferences, and competitive dynamics that influence market strategies and product development priorities.

By Battery Type:

By Application:

By Size Category: Standard sizes including AA, AAA, C, D, and 9V batteries serve different device requirements, with AA and AAA representing the largest volume segments due to widespread device compatibility.

Alkaline battery segment continues dominating overall market volume despite growing competition from alternative technologies. This category benefits from established consumer familiarity, broad device compatibility, and cost-effective pricing that appeals to mainstream market segments.

Lithium battery category demonstrates strong growth driven by superior performance characteristics and increasing consumer willingness to pay premium prices for enhanced device operation. This segment particularly appeals to users of high-drain devices and professional applications.

Rechargeable battery segment shows accelerating adoption rates as consumers recognize long-term cost benefits and environmental advantages. Market penetration in this category reaches 22% of total battery sales with continued growth expected as charging infrastructure improves.

Specialty applications create niche opportunities for customized battery solutions that command premium pricing while serving specific market needs. These segments often demonstrate higher margins and customer loyalty due to specialized performance requirements.

Manufacturers benefit from growing market demand, opportunities for product innovation, and potential for premium pricing through advanced battery technologies. The market offers multiple growth vectors including new applications, improved performance, and sustainable solutions that appeal to evolving consumer preferences.

Retailers gain from consistent product demand, attractive margins, and opportunities for private label development. Battery sales provide steady revenue streams with predictable replacement cycles that support inventory planning and customer relationship management.

Consumers receive improved battery performance, longer device operation, and enhanced convenience through advanced battery technologies. Market competition drives innovation while maintaining competitive pricing across different performance segments.

Environmental stakeholders benefit from increased focus on battery recycling, sustainable manufacturing practices, and development of eco-friendly alternatives that reduce environmental impact while maintaining performance standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as a dominant trend with consumers increasingly considering environmental impact when selecting battery products. This trend drives development of recyclable materials, improved recycling programs, and rechargeable alternatives that reduce waste generation.

Smart battery integration represents a growing trend as IoT technologies enable battery monitoring, performance optimization, and predictive replacement scheduling. These intelligent solutions appeal to tech-savvy consumers while providing valuable usage data for manufacturers.

Health and safety emphasis increases as consumers become more aware of battery safety requirements, proper disposal methods, and performance implications for critical devices. This trend supports premium products that offer enhanced safety features and reliability.

Customization trends emerge as consumers seek battery solutions tailored to specific applications and usage patterns. Manufacturers respond with specialized products designed for particular device categories or performance requirements.

Technology advancement continues driving industry evolution with breakthrough developments in battery chemistry, manufacturing processes, and performance optimization. Recent innovations focus on extending battery life, improving power density, and reducing environmental impact through sustainable materials.

Strategic partnerships between battery manufacturers and device companies create integrated solutions that optimize power management and user experience. These collaborations enable development of application-specific battery solutions that enhance device performance while building customer loyalty.

Manufacturing expansion reflects growing market demand with companies investing in production capacity, automation technologies, and quality control systems. Domestic manufacturing initiatives address supply chain resilience while reducing transportation costs and environmental impact.

Regulatory developments influence industry practices with new standards for battery performance, safety, and environmental impact. Companies adapt operations to meet evolving requirements while maintaining competitive positioning and profitability.

Market consolidation trends see larger companies acquiring smaller competitors to gain market share, technological capabilities, and distribution advantages. This consolidation creates opportunities for innovation while potentially reducing competitive intensity in certain segments.

Innovation investment remains critical for maintaining competitive advantage in the evolving battery market. Companies should prioritize research and development in areas such as sustainable materials, smart battery technologies, and application-specific solutions that address emerging consumer needs.

Brand differentiation strategies should focus on performance benefits, environmental responsibility, and customer experience rather than competing solely on price. MWR analysis suggests that successful companies will build strong brand equity through consistent quality and innovative features that justify premium pricing.

Customer education initiatives should help consumers understand battery performance differences, proper usage practices, and environmental considerations. Educational efforts can drive adoption of premium products while building brand loyalty and customer satisfaction.

Distribution strategy optimization should balance traditional retail relationships with growing e-commerce opportunities. Companies should develop omnichannel approaches that provide consistent customer experience across all touchpoints while maximizing market reach and profitability.

Market expansion prospects remain positive with continued growth expected across multiple segments driven by device proliferation, smart home adoption, and consumer preference for reliable power solutions. The market shows resilience to economic fluctuations due to essential nature of battery products in modern households.

Technology evolution will continue shaping market dynamics with advancement in battery chemistry, smart features, and sustainable materials creating new opportunities for differentiation and premium positioning. Companies investing in innovation are likely to capture disproportionate market share growth.

Growth projections indicate sustained expansion with the market expected to grow at 5.8% CAGR over the next five years, driven by smart home technology adoption and increasing consumer awareness of battery performance benefits. Premium segments are projected to grow faster than traditional alkaline categories.

Emerging opportunities include integration with renewable energy systems, development of biodegradable battery materials, and creation of intelligent power management solutions that optimize device performance while extending battery life.

Long-term trends suggest continued market evolution toward sustainable, high-performance solutions that align with consumer values and technological advancement. Companies positioning themselves as innovation leaders in sustainability and performance are likely to achieve superior long-term growth and profitability.

The US household battery market demonstrates robust fundamentals with strong growth prospects driven by technological advancement, changing consumer preferences, and expanding device applications. Market dynamics favor companies that invest in innovation, sustainability, and customer experience while maintaining competitive pricing across diverse market segments.

Strategic success in this market requires balancing traditional strengths with emerging opportunities, particularly in areas such as smart battery technologies, sustainable solutions, and premium performance segments. Companies that effectively navigate these trends while maintaining operational excellence are positioned for sustained growth and market leadership.

Future market evolution will likely favor brands that demonstrate clear value propositions through superior performance, environmental responsibility, and customer-centric innovation. The market offers significant opportunities for companies willing to invest in technology advancement and brand building while addressing evolving consumer needs and regulatory requirements.

What is Household Battery?

Household batteries are portable energy storage devices used in various applications, including powering household electronics, tools, and appliances. They come in different chemistries, such as alkaline, lithium-ion, and nickel-metal hydride, catering to diverse consumer needs.

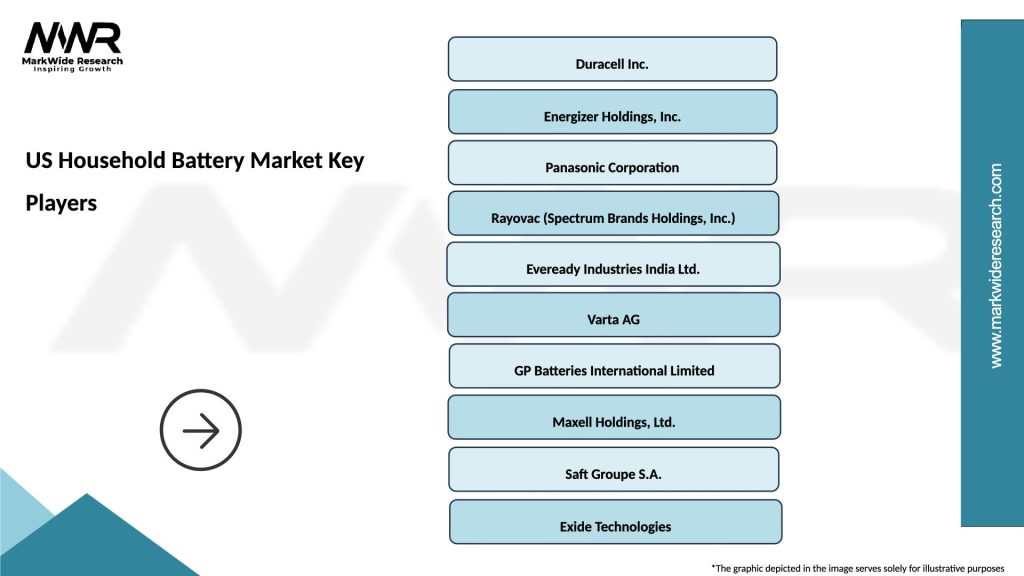

What are the key players in the US Household Battery Market?

Key players in the US Household Battery Market include Energizer Holdings, Duracell, Panasonic, and Rayovac, among others. These companies compete in terms of product innovation, sustainability practices, and market reach.

What are the growth factors driving the US Household Battery Market?

The US Household Battery Market is driven by the increasing demand for portable electronics, the rise in renewable energy storage solutions, and the growing trend of smart home devices. Additionally, consumer preferences for rechargeable batteries are contributing to market growth.

What challenges does the US Household Battery Market face?

The US Household Battery Market faces challenges such as environmental concerns regarding battery disposal, competition from alternative energy sources, and fluctuating raw material prices. These factors can impact production costs and sustainability efforts.

What opportunities exist in the US Household Battery Market?

Opportunities in the US Household Battery Market include advancements in battery technology, such as solid-state batteries, and the increasing adoption of electric vehicles. Additionally, the growing focus on energy efficiency and sustainability presents new avenues for innovation.

What trends are shaping the US Household Battery Market?

Trends in the US Household Battery Market include the shift towards eco-friendly battery solutions, the rise of smart batteries with integrated technology, and the expansion of battery recycling programs. These trends reflect a broader commitment to sustainability and innovation in energy storage.

US Household Battery Market

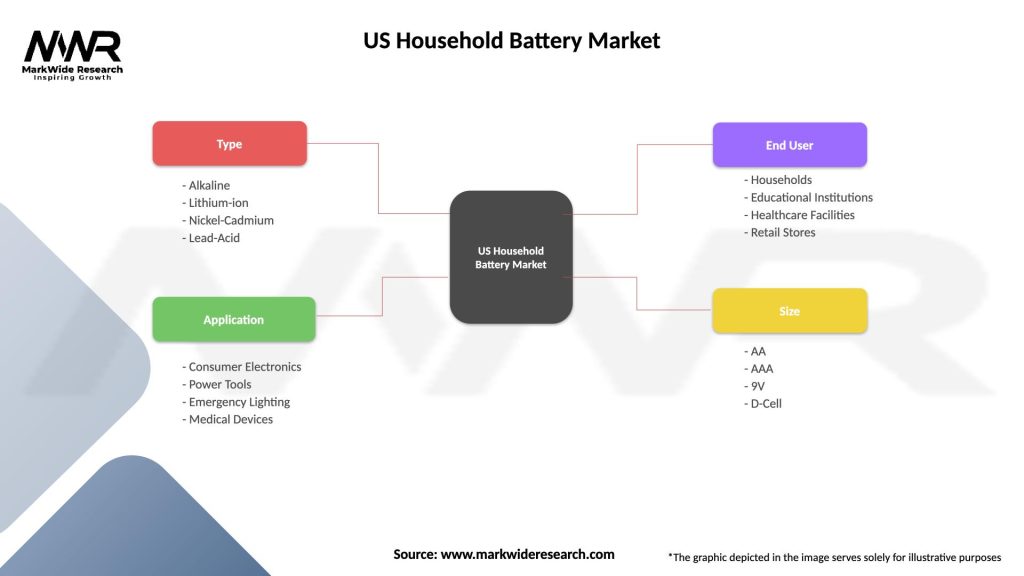

| Segmentation Details | Description |

|---|---|

| Type | Alkaline, Lithium-ion, Nickel-Cadmium, Lead-Acid |

| Application | Consumer Electronics, Power Tools, Emergency Lighting, Medical Devices |

| End User | Households, Educational Institutions, Healthcare Facilities, Retail Stores |

| Size | AA, AAA, 9V, D-Cell |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Household Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at