444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US home organizers and storage market represents a dynamic and rapidly expanding sector within the broader home improvement industry. This market encompasses a comprehensive range of products designed to maximize space utilization, enhance home organization, and improve overall living experiences for American consumers. Market dynamics indicate substantial growth driven by evolving lifestyle patterns, urbanization trends, and increasing consumer awareness about the benefits of organized living spaces.

Consumer preferences have shifted significantly toward multifunctional storage solutions that combine aesthetic appeal with practical functionality. The market includes various product categories such as closet organizers, kitchen storage systems, bathroom organizers, garage storage solutions, and specialty organizational products. Growth projections suggest the market is expanding at a robust CAGR of 6.2%, reflecting strong consumer demand and innovative product development initiatives across the industry.

Regional distribution shows that the market maintains strong presence across all major US regions, with particularly notable growth in metropolitan areas where space optimization becomes increasingly critical. The market benefits from diverse distribution channels including home improvement retailers, specialty storage stores, online platforms, and direct-to-consumer sales models. Technology integration has emerged as a key differentiator, with smart storage solutions gaining 23% adoption rate among tech-savvy consumers.

The US home organizers and storage market refers to the comprehensive ecosystem of products, services, and solutions designed to help American households optimize their living spaces through effective organization and storage systems. This market encompasses both physical products and organizational services that enable consumers to maximize space utilization, reduce clutter, and create more functional living environments.

Market scope includes traditional storage containers, modular shelving systems, closet organization solutions, kitchen storage accessories, bathroom organizers, and innovative space-saving furniture. The definition extends beyond mere storage to include organizational consulting services, custom installation solutions, and smart storage technologies that integrate with modern home automation systems.

Industry boundaries encompass manufacturers, retailers, installers, and organizational consultants who collectively serve the growing demand for home organization solutions. The market addresses various consumer needs ranging from basic storage requirements to comprehensive home organization transformations, reflecting the diverse approaches Americans take toward creating organized living spaces.

Market performance demonstrates exceptional resilience and growth potential within the US home organizers and storage sector. The industry has experienced consistent expansion driven by fundamental shifts in consumer behavior, housing trends, and lifestyle preferences. Key growth drivers include urbanization patterns that create space constraints, remote work trends requiring home office organization, and increased consumer awareness about the psychological benefits of organized living spaces.

Competitive landscape features a diverse mix of established manufacturers, innovative startups, and specialized service providers. Major market participants have invested heavily in product innovation, sustainable materials, and digital marketing strategies to capture market share. Consumer adoption rates show that 78% of households have purchased organizational products within the past two years, indicating strong market penetration and recurring purchase patterns.

Future prospects remain highly favorable with emerging opportunities in smart storage solutions, sustainable organizational products, and personalized storage systems. The market benefits from strong demographic trends including millennial homeownership growth, aging population requiring accessible storage solutions, and increasing focus on home-based lifestyle optimization.

Consumer behavior analysis reveals significant insights into purchasing patterns and preferences within the home organization market. Primary motivations for purchasing organizational products include space optimization needs, aesthetic improvement desires, and functional efficiency requirements. Research indicates that consumers increasingly prioritize products that offer both storage functionality and visual appeal.

Market segmentation reveals distinct consumer groups with varying needs and purchasing behaviors. Professional organizers report that 65% of clients require comprehensive storage system overhauls rather than individual product purchases, indicating opportunities for integrated solution providers.

Urbanization trends serve as a primary catalyst for market growth, as increasing numbers of Americans live in smaller spaces that require efficient organization solutions. Metropolitan areas experience particularly strong demand for space-saving storage products that maximize functionality within limited square footage. Housing market dynamics contribute significantly, with smaller homes and apartments creating consistent demand for innovative storage solutions.

Lifestyle changes have fundamentally altered how Americans approach home organization. Remote work arrangements have created new organizational needs for home offices, while changing family structures require flexible storage solutions that adapt to evolving household compositions. Consumer awareness about the psychological benefits of organized spaces has increased dramatically, with studies showing that 82% of consumers report improved mental well-being after implementing organizational systems.

Technological advancement drives innovation in smart storage solutions that integrate with home automation systems. These products offer features such as inventory tracking, automated organization suggestions, and integration with shopping applications. Social media influence plays a crucial role, with home organization content generating significant engagement and driving consumer interest in organizational products and services.

Economic factors support market growth through increased disposable income allocation toward home improvement projects. Consumer spending patterns show growing investment in home organization as part of broader lifestyle enhancement initiatives. Demographic shifts including millennial homeownership growth and aging population needs create diverse market opportunities across different consumer segments.

Economic sensitivity represents a significant challenge for the home organizers and storage market, as organizational products are often considered discretionary purchases that consumers may defer during economic uncertainty. Price competition intensifies pressure on manufacturers to balance quality with affordability, particularly in mass-market segments where consumers prioritize cost over premium features.

Installation complexity creates barriers for certain consumer segments, particularly older adults who may find assembly and installation processes challenging. Many organizational systems require technical skills or professional installation, which adds to the total cost of ownership and may discourage some potential buyers. Space limitations in rental properties often restrict consumers from implementing permanent organizational solutions, limiting market penetration in certain housing segments.

Product durability concerns affect consumer confidence, particularly with lower-priced organizational products that may not withstand long-term use. Market saturation in certain product categories creates challenges for differentiation and may lead to price erosion. Additionally, seasonal demand fluctuations create inventory management challenges for retailers and manufacturers, impacting overall market efficiency.

Consumer behavior patterns show that organizational purchases often occur in response to specific life events or seasonal motivations, creating unpredictable demand cycles. Competition from DIY solutions and alternative organizational approaches may limit market growth in certain segments where consumers prefer custom or homemade storage solutions.

Smart technology integration presents substantial opportunities for market expansion through innovative products that combine traditional storage functionality with digital capabilities. IoT-enabled storage systems that track inventory, suggest organization improvements, and integrate with smart home ecosystems represent a rapidly growing market segment with significant potential for premium pricing and customer loyalty.

Sustainability initiatives create opportunities for manufacturers to develop eco-friendly organizational products using recycled materials, biodegradable components, and sustainable manufacturing processes. Consumer demand for environmentally responsible products continues growing, with 71% of consumers expressing willingness to pay premium prices for sustainable storage solutions.

Customization services offer significant growth potential through personalized storage solutions tailored to specific household needs, space constraints, and aesthetic preferences. 3D printing technology enables cost-effective production of custom organizational components, opening new possibilities for personalized storage systems. Professional services expansion includes organizational consulting, installation services, and ongoing maintenance programs that create recurring revenue opportunities.

E-commerce growth provides expanded market reach and opportunities for direct-to-consumer sales models. Subscription services for organizational products and seasonal storage solutions represent emerging business models with strong growth potential. Partnership opportunities with home builders, interior designers, and real estate professionals create new distribution channels and market expansion possibilities.

Supply chain evolution within the home organizers and storage market reflects broader trends toward efficiency, sustainability, and consumer responsiveness. Manufacturing processes have adapted to accommodate increasing demand for customization while maintaining cost-effectiveness through advanced production technologies and flexible manufacturing systems. Distribution networks have expanded significantly through e-commerce platforms, enabling direct manufacturer-to-consumer relationships and reducing traditional retail dependencies.

Competitive dynamics demonstrate increasing consolidation among major manufacturers while simultaneously supporting innovation from smaller, specialized companies. Market leaders focus on brand building, product innovation, and distribution expansion, while emerging companies often target niche segments with specialized solutions. Pricing strategies vary significantly across market segments, with premium products commanding higher margins through superior design, materials, and functionality.

Consumer engagement patterns show increasing reliance on digital channels for product research, comparison shopping, and purchase decisions. Social media influence drives significant market awareness and product adoption, with home organization content generating substantial consumer interest and engagement. Seasonal fluctuations create predictable demand patterns that manufacturers and retailers leverage through targeted marketing campaigns and inventory management strategies.

Innovation cycles accelerate as companies invest in research and development to differentiate products and capture market share. Technology adoption rates indicate that 34% of consumers are interested in smart storage solutions, representing significant growth potential for technology-integrated organizational products.

Data collection approaches for analyzing the US home organizers and storage market employ comprehensive methodologies that combine quantitative and qualitative research techniques. Primary research includes consumer surveys, industry interviews, and focus group discussions with target demographics to understand purchasing behaviors, preferences, and market trends. Secondary research incorporates industry reports, trade publications, and government statistics to provide comprehensive market context and validation.

Market analysis frameworks utilize established research methodologies including Porter’s Five Forces analysis, SWOT assessments, and competitive benchmarking studies. Consumer behavior studies employ statistical analysis techniques to identify patterns, preferences, and purchasing drivers across different demographic segments. Trend analysis incorporates longitudinal data to identify market evolution patterns and predict future developments.

Validation processes ensure data accuracy through multiple source verification, expert consultation, and statistical validation techniques. MarkWide Research methodologies emphasize comprehensive market coverage through diverse data sources and analytical approaches that provide reliable insights for industry stakeholders. Sampling methodologies ensure representative coverage across geographic regions, demographic segments, and product categories to provide comprehensive market understanding.

Analytical tools include advanced statistical software, market modeling techniques, and predictive analytics to generate actionable insights and accurate market projections. Quality assurance processes maintain high standards for data integrity and analytical rigor throughout the research process.

Northeast region demonstrates strong market performance driven by high population density, smaller living spaces, and elevated consumer spending on home improvement products. Urban markets in cities like New York, Boston, and Philadelphia show particularly robust demand for space-saving organizational solutions. The region accounts for approximately 28% of national market share, reflecting strong consumer purchasing power and awareness of organizational benefits.

Southeast region exhibits rapid growth fueled by population migration, new home construction, and expanding suburban development. Market penetration increases steadily as consumers in growing metropolitan areas like Atlanta, Charlotte, and Nashville invest in home organization systems. Climate considerations influence product preferences, with increased demand for moisture-resistant storage solutions and seasonal organization systems.

Midwest region maintains steady market performance with strong demand for traditional storage solutions and growing interest in smart organizational products. Consumer preferences tend toward durable, value-oriented products that provide long-term functionality. The region shows 22% market share with consistent growth patterns across both urban and suburban markets.

West Coast markets lead in innovation adoption and premium product segments, with California representing the largest single state market. Sustainability focus drives demand for eco-friendly organizational products, while technology integration preferences support smart storage solution adoption. Housing costs create strong demand for space optimization products across the region.

Southwest region demonstrates emerging growth potential with expanding populations and new home construction driving organizational product demand. Cultural preferences influence product design and functionality requirements, creating opportunities for specialized regional product offerings.

Market leadership within the US home organizers and storage sector features a diverse competitive environment with established manufacturers, innovative startups, and specialized service providers competing across multiple market segments. Industry consolidation trends show larger companies acquiring smaller specialized firms to expand product portfolios and market reach.

Competitive strategies vary significantly across market segments, with premium brands emphasizing design, quality, and customization while mass market competitors focus on affordability and broad distribution. Innovation investments drive product differentiation through smart technology integration, sustainable materials, and enhanced functionality features.

Market positioning strategies reflect diverse approaches to brand building, customer engagement, and distribution channel optimization. Partnership development with retailers, home builders, and design professionals creates competitive advantages and expanded market access opportunities.

Product category segmentation reveals distinct market segments with varying growth rates, consumer preferences, and competitive dynamics. Closet organization systems represent the largest segment, driven by consumer focus on bedroom and wardrobe organization. Kitchen storage solutions show strong growth as consumers invest in functional kitchen improvements and space optimization.

By Application:

By Material Type:

By Price Range:

Distribution channel segmentation shows 43% of sales occurring through traditional retail channels, while e-commerce platforms account for rapidly growing market share. Specialty stores maintain strong positions in premium segments through expert consultation and comprehensive product selection.

Closet organization systems dominate market share through consistent consumer demand for wardrobe management solutions. Product innovation focuses on modular designs that accommodate changing storage needs and diverse closet configurations. Consumer preferences emphasize adjustable systems that maximize vertical space utilization while maintaining easy access to stored items.

Kitchen storage solutions experience robust growth driven by cooking trend popularity and kitchen renovation projects. Functionality improvements include pull-out drawers, lazy susans, and specialized storage for small appliances and cookware. Integration capabilities with existing cabinetry create opportunities for both retrofit and new construction applications.

Bathroom organizers represent a growing segment as consumers focus on spa-like bathroom experiences and efficient personal care product storage. Moisture resistance requirements drive material innovation and specialized product development. Space constraints in typical bathrooms create demand for compact, multifunctional storage solutions.

Garage storage systems show strong growth potential as homeowners seek to optimize garage spaces for multiple uses including vehicle storage, workshops, and general household storage. Heavy-duty requirements influence product design and material selection, while seasonal storage needs drive demand for flexible organizational systems.

Home office organization emerges as a significant growth category driven by remote work trends and home-based business operations. Technology integration requirements include cable management, device storage, and document organization solutions that support productive work environments.

Manufacturers benefit from expanding market opportunities through diverse product categories, growing consumer awareness, and increasing household spending on organizational solutions. Innovation potential enables product differentiation and premium pricing through advanced materials, smart technology integration, and customization capabilities. Market expansion opportunities exist through new distribution channels, international markets, and emerging consumer segments.

Retailers gain from strong consumer demand, recurring purchase patterns, and opportunities for cross-selling complementary products. E-commerce growth provides expanded market reach and direct consumer relationships that enhance profitability and customer loyalty. Service integration opportunities include installation services, design consultation, and ongoing customer support programs.

Consumers receive significant value through improved home functionality, enhanced living experiences, and psychological benefits from organized spaces. Cost savings result from better space utilization, reduced item replacement needs, and improved household efficiency. Lifestyle improvements include reduced stress, increased productivity, and enhanced home aesthetics.

Professional organizers benefit from growing market awareness and consumer willingness to invest in organizational services. Business opportunities expand through partnerships with product manufacturers, retailers, and home improvement professionals. Service diversification includes ongoing maintenance programs, seasonal organization services, and specialized consultation offerings.

Real estate professionals leverage organized homes as selling points that enhance property values and buyer appeal. Home builders differentiate new construction through integrated storage solutions and organizational features that meet modern lifestyle requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart storage integration emerges as a dominant trend with consumers increasingly seeking organizational solutions that incorporate technology features such as inventory tracking, automated organization suggestions, and integration with home automation systems. Adoption rates for smart storage solutions show 38% annual growth, indicating strong consumer interest in technology-enhanced organizational products.

Sustainability consciousness drives significant changes in product development and consumer preferences. Eco-friendly materials including recycled plastics, sustainable wood sources, and biodegradable components gain market traction as consumers prioritize environmental responsibility. Circular economy principles influence product design toward durability, repairability, and end-of-life recyclability.

Customization demand increases as consumers seek storage solutions tailored to specific needs, space constraints, and aesthetic preferences. Modular systems that allow for configuration flexibility and future expansion become increasingly popular. 3D printing technology enables cost-effective production of custom organizational components and specialized storage accessories.

Aesthetic integration becomes increasingly important as consumers demand organizational products that complement home décor and design themes. Color coordination and style matching drive product development toward more sophisticated design options. Instagram-worthy organizational solutions gain popularity through social media influence and visual appeal.

Subscription services emerge as alternative business models offering regular delivery of organizational products, seasonal storage solutions, and replacement components. Service integration combines product sales with professional consultation, installation services, and ongoing organizational support.

Technology advancement drives significant industry developments through smart storage solutions that integrate with home automation systems and mobile applications. IoT connectivity enables inventory management, usage tracking, and automated reordering capabilities that enhance consumer convenience and engagement. Artificial intelligence applications include personalized organization recommendations and space optimization algorithms.

Manufacturing innovation incorporates advanced materials, sustainable production processes, and flexible manufacturing systems that accommodate customization requirements. 3D printing adoption enables rapid prototyping, custom component production, and small-batch manufacturing for specialized applications. Automation integration improves production efficiency and quality consistency across product lines.

Distribution evolution reflects changing consumer shopping behaviors through expanded e-commerce capabilities, direct-to-consumer sales models, and omnichannel retail strategies. Augmented reality applications help consumers visualize organizational solutions in their homes before purchase. Virtual consultation services provide professional organizational advice through digital platforms.

Partnership development creates new market opportunities through collaborations between manufacturers, retailers, home builders, and design professionals. Strategic alliances enable expanded product offerings, enhanced customer services, and improved market penetration. Acquisition activity consolidates market participants and creates larger companies with comprehensive product portfolios.

Regulatory developments influence product safety standards, environmental requirements, and consumer protection measures that shape industry practices and product development priorities.

Investment priorities should focus on technology integration capabilities that differentiate products and create sustainable competitive advantages. Smart storage development represents the highest growth potential segment with opportunities for premium pricing and customer loyalty building. MWR analysis indicates that companies investing in IoT capabilities and mobile application development achieve superior market performance compared to traditional product manufacturers.

Market expansion strategies should emphasize e-commerce channel development, direct-to-consumer sales models, and digital marketing initiatives that reach target demographics effectively. Customization capabilities provide opportunities for margin improvement and customer differentiation. Sustainability initiatives become increasingly important for brand positioning and consumer appeal.

Product development focus should prioritize modular designs, aesthetic integration, and multifunctional capabilities that address evolving consumer needs. Material innovation toward sustainable options and enhanced durability creates competitive advantages. Installation simplification expands market accessibility and reduces customer barriers to adoption.

Partnership opportunities with home builders, interior designers, and real estate professionals create new distribution channels and market expansion possibilities. Service integration including consultation, installation, and maintenance programs generate recurring revenue streams and enhanced customer relationships.

Geographic expansion should target high-growth metropolitan areas and emerging suburban markets where demographic trends support organizational product demand. International opportunities exist for established companies with strong brand recognition and proven product portfolios.

Market trajectory indicates continued strong growth driven by fundamental demographic trends, lifestyle changes, and technological advancement. Long-term projections suggest sustained expansion with annual growth rates maintaining momentum through evolving consumer preferences and market innovation. MarkWide Research forecasts indicate that smart storage solutions will represent 45% of premium segment sales within the next five years.

Technology integration will accelerate with artificial intelligence, machine learning, and IoT connectivity becoming standard features in premium organizational products. Automation capabilities including inventory management, space optimization, and predictive organization suggestions will drive consumer adoption and market differentiation. Voice control integration and smart home compatibility will become essential features for technology-focused consumer segments.

Sustainability requirements will intensify with consumers increasingly demanding eco-friendly materials, circular economy principles, and carbon-neutral manufacturing processes. Regulatory pressure may drive industry standards toward enhanced environmental responsibility and product lifecycle management. Innovation opportunities exist in biodegradable materials, renewable resource utilization, and closed-loop manufacturing systems.

Market consolidation trends suggest continued acquisition activity as larger companies seek to expand product portfolios, distribution capabilities, and technological expertise. Startup innovation will continue driving market evolution through specialized solutions, niche applications, and disruptive business models. International expansion opportunities will grow as global markets develop similar organizational needs and consumer preferences.

Consumer behavior evolution toward experience-focused purchasing, subscription services, and integrated lifestyle solutions will reshape market dynamics and business models. Demographic shifts including aging population needs and millennial homeownership growth will create diverse market opportunities requiring specialized product development and marketing approaches.

The US home organizers and storage market demonstrates exceptional growth potential driven by fundamental shifts in consumer behavior, technological advancement, and evolving lifestyle requirements. Market dynamics support continued expansion through diverse product categories, innovative solutions, and expanding distribution channels that serve growing consumer demand for organizational products and services.

Industry evolution toward smart technology integration, sustainability focus, and customization capabilities creates significant opportunities for manufacturers, retailers, and service providers who adapt to changing market requirements. Consumer trends indicate sustained interest in home organization solutions that combine functionality, aesthetics, and technological enhancement to improve living experiences and space utilization.

Future success in this market will depend on companies’ ability to innovate continuously, embrace technological advancement, and respond effectively to evolving consumer preferences. Strategic positioning through product differentiation, service integration, and brand building will determine competitive advantages in an increasingly dynamic marketplace. The US home organizers and storage market represents a compelling investment opportunity with strong fundamentals and promising long-term growth prospects across multiple market segments and consumer demographics.

What is Home Organizers and Storage?

Home Organizers and Storage refers to products and solutions designed to help individuals and families efficiently manage and store their belongings, enhancing space utilization and organization in homes.

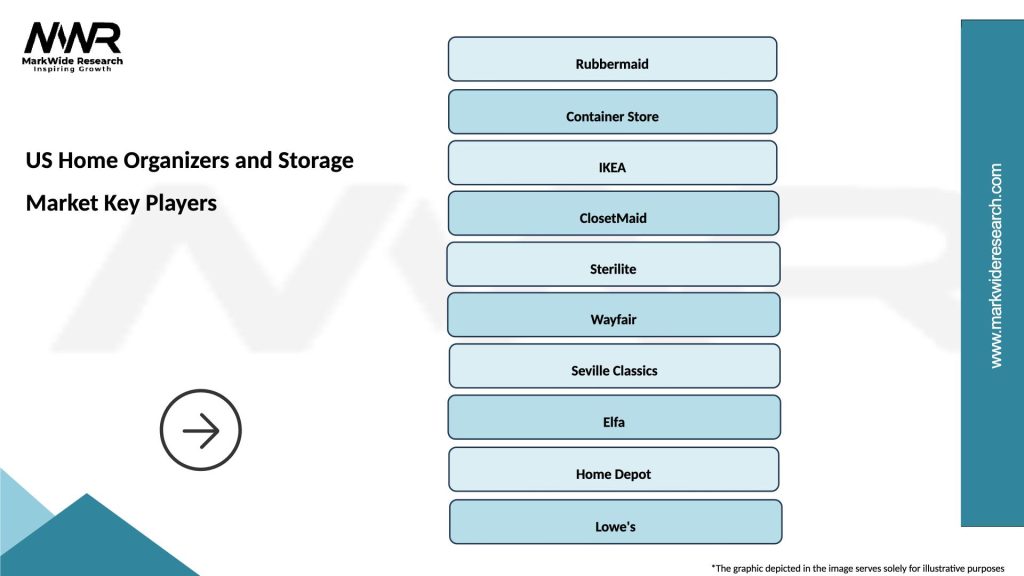

What are the key players in the US Home Organizers and Storage Market?

Key players in the US Home Organizers and Storage Market include The Container Store, Rubbermaid, IKEA, and ClosetMaid, among others.

What are the main drivers of growth in the US Home Organizers and Storage Market?

The growth of the US Home Organizers and Storage Market is driven by increasing urbanization, a rise in consumer interest in home organization, and the growing trend of minimalism and decluttering.

What challenges does the US Home Organizers and Storage Market face?

Challenges in the US Home Organizers and Storage Market include intense competition among brands, fluctuating material costs, and changing consumer preferences towards sustainable products.

What opportunities exist in the US Home Organizers and Storage Market?

Opportunities in the US Home Organizers and Storage Market include the expansion of e-commerce platforms, the introduction of smart storage solutions, and increasing demand for customized organization systems.

What trends are shaping the US Home Organizers and Storage Market?

Trends in the US Home Organizers and Storage Market include the rise of multifunctional furniture, the popularity of DIY organization projects, and a growing emphasis on eco-friendly materials.

US Home Organizers and Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bins, Shelves, Racks, Containers |

| Material | Plastic, Wood, Metal, Fabric |

| End User | Residential, Commercial, Industrial, Educational |

| Distribution Channel | Online, Retail Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Home Organizers and Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at