444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The US Home Medical Equipment Market is a pivotal sector within the broader healthcare industry, catering to the growing demand for medical devices and equipment that enable patients to receive care in the comfort of their homes. This market encompasses a wide range of products designed to assist individuals with various medical conditions, disabilities, or age-related limitations, allowing them to manage their health and daily activities independently or with minimal assistance. With an aging population, increasing prevalence of chronic diseases, and a shift towards home-based care models, the demand for home medical equipment continues to rise, driving market growth and innovation.

Meaning:

Home medical equipment refers to a diverse array of devices, aids, and technologies designed to support individuals with medical needs or disabilities in their home environment. These products include mobility aids (such as wheelchairs, walkers, and scooters), respiratory therapy equipment (such as oxygen concentrators, CPAP machines, and nebulizers), patient monitoring devices (such as blood pressure monitors, glucose meters, and pulse oximeters), home dialysis equipment, home infusion therapy devices, and various assistive devices for activities of daily living (such as bath safety aids, adaptive furniture, and home modifications).

Executive Summary:

The US Home Medical Equipment Market is witnessing significant growth driven by factors such as demographic trends, technological advancements, shifting healthcare policies, and the preference for home-based care models. The market offers numerous opportunities for manufacturers, distributors, healthcare providers, and caregivers to meet the evolving needs of patients and improve the quality of care delivery. However, challenges such as regulatory compliance, reimbursement issues, supply chain disruptions, and competitive pressures require careful navigation and strategic planning to capitalize on market opportunities and sustain growth in the long term.

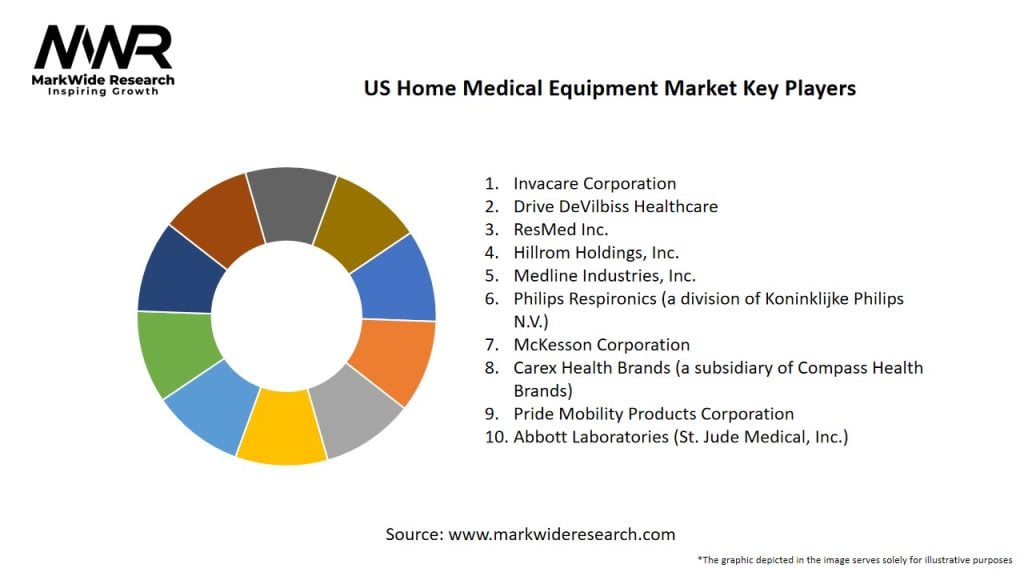

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The US Home Medical Equipment Market operates in a dynamic environment shaped by evolving consumer preferences, technological innovations, regulatory changes, and healthcare delivery models. Market dynamics such as demographic shifts, reimbursement trends, competitive pressures, and technological disruptions require industry participants to adapt, innovate, and collaborate to capitalize on emerging opportunities and address evolving challenges.

Regional Analysis:

The US Home Medical Equipment Market exhibits regional variations in demand, adoption, and reimbursement policies due to differences in population demographics, healthcare infrastructure, payer mix, and regulatory frameworks. While urban areas with higher population density and healthcare resources may have greater access to home medical equipment and services, rural and underserved communities face challenges related to healthcare access, provider shortages, and infrastructure limitations, impacting market penetration and patient outcomes.

Competitive Landscape:

Leading Companies in US Home Medical Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The US Home Medical Equipment Market can be segmented based on various factors such as:

Segmentation provides insights into market trends, customer preferences, and growth opportunities, enabling market participants to tailor their strategies, product offerings, and distribution channels to specific market segments and target audiences.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the US Home Medical Equipment Market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has accelerated the adoption of home medical equipment and home-based care models, driving market growth and innovation in response to changing healthcare needs and preferences. Key impacts of COVID-19 on the US Home Medical Equipment Market include:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The US Home Medical Equipment Market is poised for continued growth and innovation, driven by factors such as demographic trends, technological advancements, healthcare policy changes, and consumer preferences. The market’s future outlook is characterized by opportunities for expansion, collaboration, and disruption, as industry participants seek to leverage emerging trends, address unmet needs, and shape the future of home-based care delivery.

Conclusion:

The US Home Medical Equipment Market plays a vital role in enabling individuals to receive quality healthcare services in the comfort and privacy of their homes. With the aging population, rising prevalence of chronic diseases, and the growing preference for home-based care models, the demand for home medical equipment continues to surge, driving market growth, innovation, and investment. By embracing technological advancements, fostering collaboration, and prioritizing patient-centered care, industry stakeholders can capitalize on market opportunities, address evolving challenges, and enhance the quality of life for millions of Americans requiring home-based medical support.

What is Home Medical Equipment?

Home Medical Equipment refers to a variety of medical devices and supplies that are used in the home to support patient care. This includes items such as wheelchairs, oxygen equipment, and home dialysis machines.

What are the key players in the US Home Medical Equipment Market?

Key players in the US Home Medical Equipment Market include companies like Invacare Corporation, Medline Industries, and Philips Healthcare, among others.

What are the main drivers of growth in the US Home Medical Equipment Market?

The growth of the US Home Medical Equipment Market is driven by factors such as the increasing aging population, rising prevalence of chronic diseases, and advancements in technology that enhance home care solutions.

What challenges does the US Home Medical Equipment Market face?

Challenges in the US Home Medical Equipment Market include regulatory hurdles, reimbursement issues, and the need for continuous innovation to meet evolving patient needs.

What opportunities exist in the US Home Medical Equipment Market?

Opportunities in the US Home Medical Equipment Market include the expansion of telehealth services, the development of smart home medical devices, and increasing consumer awareness about home healthcare options.

What trends are shaping the US Home Medical Equipment Market?

Trends in the US Home Medical Equipment Market include the rise of connected devices, a focus on patient-centered care, and the integration of artificial intelligence in home healthcare solutions.

US Home Medical Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobility Aids, Respiratory Equipment, Monitoring Devices, Home Care Beds |

| End User | Patients, Caregivers, Hospitals, Rehabilitation Centers |

| Technology | Telehealth Solutions, Wearable Devices, Smart Home Integration, Remote Monitoring |

| Application | Chronic Disease Management, Post-Surgery Recovery, Elderly Care, Disability Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Home Medical Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at