444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US healthcare fraud detection market represents a critical component of the nation’s healthcare infrastructure, addressing the growing need to combat fraudulent activities that plague the medical industry. Healthcare fraud costs the United States healthcare system billions annually, making sophisticated detection systems essential for protecting patients, providers, and payers alike. The market encompasses advanced technologies including artificial intelligence, machine learning algorithms, predictive analytics, and data mining solutions designed to identify suspicious patterns and anomalous behaviors in healthcare transactions.

Market dynamics indicate robust growth driven by increasing healthcare expenditures, rising fraud incidents, and stringent regulatory requirements. The implementation of electronic health records and digital payment systems has created vast datasets that require sophisticated monitoring capabilities. Healthcare organizations are increasingly investing in comprehensive fraud detection solutions to protect their revenue streams and maintain compliance with federal regulations.

Technology adoption across healthcare sectors shows accelerating momentum, with hospitals, insurance companies, and government agencies implementing advanced detection systems. The market benefits from growing awareness of fraud’s impact on healthcare costs and patient safety, driving demand for more sophisticated detection capabilities with real-time monitoring and automated alert systems.

The US healthcare fraud detection market refers to the comprehensive ecosystem of technologies, services, and solutions designed to identify, prevent, and investigate fraudulent activities within the American healthcare system. Healthcare fraud detection encompasses systematic approaches to monitoring medical claims, billing patterns, prescription activities, and provider behaviors to identify anomalies that may indicate fraudulent conduct.

Fraud detection systems utilize sophisticated algorithms and analytical tools to process vast amounts of healthcare data, identifying patterns that deviate from normal operational parameters. These systems analyze various data points including billing codes, treatment patterns, patient demographics, and provider histories to flag potentially fraudulent activities for further investigation.

Market participants include technology vendors, healthcare organizations, insurance companies, government agencies, and consulting firms that collaborate to develop and implement comprehensive fraud prevention strategies. The market encompasses both preventive measures designed to stop fraud before it occurs and detective capabilities that identify fraudulent activities after they have taken place.

Market leadership in the US healthcare fraud detection sector is characterized by rapid technological advancement and increasing adoption across healthcare organizations. The market demonstrates strong growth potential driven by escalating healthcare costs, sophisticated fraud schemes, and regulatory pressure for enhanced oversight capabilities.

Key market drivers include the transition to value-based care models, increasing digitization of healthcare records, and growing awareness of fraud’s impact on healthcare accessibility and affordability. Healthcare organizations are prioritizing fraud detection investments to protect their financial integrity and ensure compliance with evolving regulatory requirements.

Technology trends show significant advancement in artificial intelligence and machine learning applications, enabling more accurate fraud detection with reduced false positive rates. The integration of predictive analytics and real-time monitoring capabilities is transforming how healthcare organizations approach fraud prevention and detection.

Market challenges include the complexity of healthcare data, evolving fraud schemes, and the need for solutions that balance detection accuracy with operational efficiency. Organizations must navigate privacy regulations while implementing comprehensive monitoring systems that protect sensitive patient information.

Strategic insights reveal several critical factors shaping the US healthcare fraud detection market landscape:

Primary market drivers propelling growth in the US healthcare fraud detection sector include escalating healthcare costs and the urgent need to protect healthcare resources from fraudulent activities. Healthcare expenditures continue rising, making fraud detection a critical component of cost containment strategies across the industry.

Regulatory pressure represents a significant driver, with government agencies implementing stricter oversight requirements and penalty structures for healthcare organizations. The Affordable Care Act and subsequent healthcare legislation have established comprehensive fraud prevention requirements that mandate sophisticated detection capabilities.

Technology advancement in artificial intelligence and machine learning is enabling more effective fraud detection solutions with improved accuracy and reduced false positive rates. Healthcare organizations are leveraging these technological capabilities to enhance their fraud prevention programs while maintaining operational efficiency.

Data proliferation from electronic health records, digital payment systems, and connected medical devices creates both opportunities and challenges for fraud detection. The vast amounts of available data enable more comprehensive monitoring but require sophisticated analytical tools to process effectively.

Industry collaboration initiatives are driving market growth through shared intelligence networks and collaborative fraud prevention programs. Healthcare stakeholders are recognizing that coordinated efforts are more effective than isolated fraud detection initiatives.

Significant challenges facing the US healthcare fraud detection market include the complexity of healthcare data and the sophisticated nature of modern fraud schemes. Data integration across disparate healthcare systems remains a persistent challenge, limiting the effectiveness of comprehensive fraud detection programs.

Privacy concerns and regulatory compliance requirements create constraints on data sharing and analysis capabilities. Healthcare organizations must balance fraud detection effectiveness with patient privacy protection, requiring sophisticated solutions that maintain data security while enabling comprehensive monitoring.

Implementation costs and resource requirements can be substantial, particularly for smaller healthcare organizations with limited IT budgets. The complexity of modern fraud detection systems requires significant investment in technology infrastructure and specialized personnel.

False positive rates in fraud detection systems can create operational inefficiencies and investigation costs that impact overall program effectiveness. Healthcare organizations must carefully balance detection sensitivity with operational practicality to maintain effective fraud prevention programs.

Evolving fraud schemes require continuous system updates and refinements, creating ongoing costs and complexity for healthcare organizations. Fraudulent actors continuously adapt their methods, requiring fraud detection systems to evolve rapidly to maintain effectiveness.

Emerging opportunities in the US healthcare fraud detection market include the integration of advanced artificial intelligence capabilities and the development of more sophisticated predictive analytics solutions. Machine learning algorithms are becoming more effective at identifying complex fraud patterns that traditional rule-based systems cannot detect.

Cloud-based solutions present significant opportunities for healthcare organizations to access advanced fraud detection capabilities without substantial infrastructure investments. Software-as-a-Service models enable smaller organizations to implement comprehensive fraud detection programs that were previously accessible only to large healthcare systems.

Real-time processing capabilities offer opportunities to prevent fraudulent transactions before they are completed, significantly improving fraud prevention effectiveness. Healthcare organizations are increasingly seeking solutions that can identify and block suspicious activities in real-time rather than detecting fraud after the fact.

Integration opportunities with existing healthcare information systems enable more comprehensive fraud detection across the entire healthcare delivery process. Interoperability improvements are creating opportunities for more effective data sharing and collaborative fraud detection initiatives.

Specialized solutions for specific healthcare sectors, such as pharmaceutical fraud detection and medical device fraud prevention, present targeted market opportunities for technology vendors and service providers.

Market dynamics in the US healthcare fraud detection sector are characterized by rapid technological evolution and increasing sophistication of both fraud detection capabilities and fraudulent schemes. Healthcare organizations are continuously adapting their fraud prevention strategies to address emerging threats while maintaining operational efficiency.

Competitive pressures are driving innovation in fraud detection technologies, with vendors developing more advanced analytical capabilities and user-friendly interfaces. Market participants are focusing on solutions that provide comprehensive fraud detection while minimizing false positives and operational disruption.

Regulatory evolution continues to shape market dynamics, with government agencies implementing new requirements and enforcement mechanisms. Healthcare organizations must stay current with changing regulations while implementing fraud detection systems that ensure ongoing compliance.

Technology convergence is creating opportunities for more integrated fraud detection solutions that combine multiple analytical approaches and data sources. Artificial intelligence, blockchain technology, and advanced analytics are converging to create more powerful fraud detection capabilities.

Industry consolidation trends are influencing market dynamics, with larger healthcare organizations acquiring smaller entities and requiring integrated fraud detection capabilities across expanded operations.

Comprehensive research methodology employed in analyzing the US healthcare fraud detection market incorporates multiple data collection and analysis approaches to ensure accurate and reliable market insights. Primary research includes extensive interviews with healthcare executives, fraud prevention specialists, technology vendors, and regulatory officials across the healthcare industry.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic publications related to healthcare fraud detection and prevention. Market analysis incorporates both quantitative and qualitative research methodologies to provide comprehensive market understanding.

Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market trends. Industry experts provide validation of market insights and trends to ensure accuracy and relevance of research conclusions.

Market modeling incorporates statistical analysis and trend projection methodologies to develop accurate market forecasts and growth projections. MarkWide Research employs proprietary analytical frameworks to assess market dynamics and competitive positioning across the healthcare fraud detection sector.

Continuous monitoring of market developments ensures research findings remain current and relevant to market participants and stakeholders seeking comprehensive market intelligence.

Regional market dynamics across the United States reveal significant variations in healthcare fraud detection adoption and implementation strategies. Northeast regions demonstrate the highest concentration of advanced fraud detection implementations, driven by large healthcare systems and stringent state regulations.

California and New York lead in market adoption with 78% penetration rate of advanced fraud detection systems among major healthcare organizations. These states benefit from substantial healthcare technology investments and comprehensive regulatory frameworks that encourage fraud prevention initiatives.

Southeast markets show rapid growth in fraud detection adoption, particularly in Florida and Texas, where large Medicare populations create significant fraud risks. Healthcare organizations in these regions are implementing comprehensive fraud detection programs to address specific demographic and regulatory challenges.

Midwest regions demonstrate steady adoption of fraud detection technologies, with particular focus on integrated health systems that serve large rural populations. Regional healthcare networks are collaborating on fraud detection initiatives to share costs and improve effectiveness.

Western states beyond California show emerging adoption patterns, with technology-forward healthcare organizations leading implementation of innovative fraud detection solutions. Regional variations in fraud patterns and regulatory requirements drive customized solution development across different geographic markets.

Market leadership in the US healthcare fraud detection sector is distributed among several key categories of providers, each offering specialized capabilities and market focus areas:

Competitive differentiation focuses on analytical sophistication, implementation expertise, industry specialization, and integration capabilities with existing healthcare information systems.

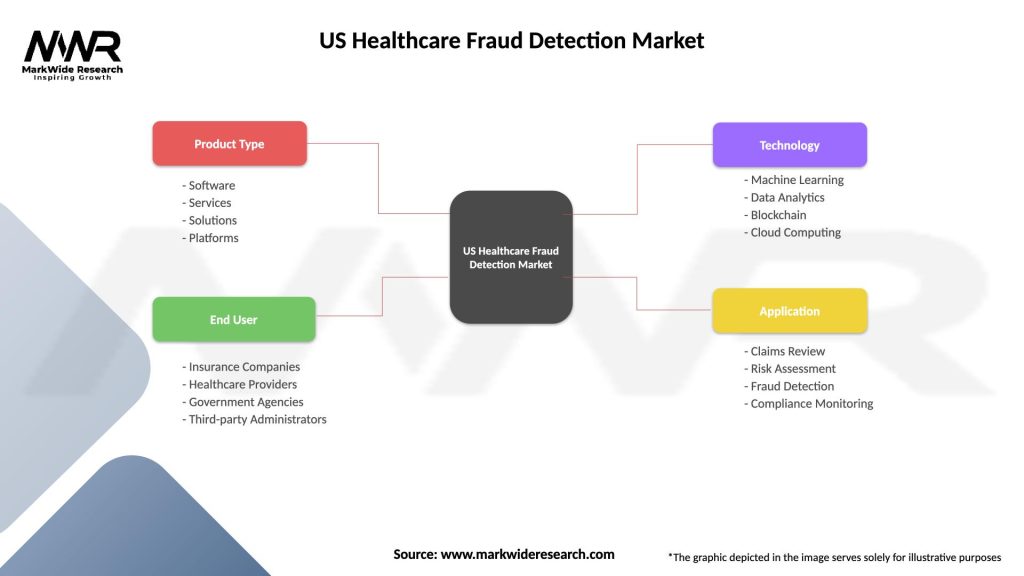

Market segmentation analysis reveals distinct categories based on technology type, deployment model, end-user, and application focus areas:

By Technology:

By Deployment Model:

By End-User:

Claims fraud detection represents the largest market segment, driven by the high volume of healthcare claims processing and the significant financial impact of fraudulent claims. Healthcare payers are implementing sophisticated analytical tools to identify suspicious billing patterns and anomalous provider behaviors.

Provider fraud detection focuses on identifying fraudulent activities by healthcare providers, including billing for services not rendered, upcoding, and unbundling of services. Advanced analytics enable identification of provider behavior patterns that deviate from normal practice standards.

Prescription fraud detection addresses the growing problem of pharmaceutical fraud, including prescription drug diversion, doctor shopping, and fraudulent prescribing practices. Real-time monitoring systems enable identification of suspicious prescription patterns and potential drug abuse.

Medical device fraud detection focuses on identifying fraudulent activities related to medical equipment and device billing, including unnecessary procedures and equipment fraud. Specialized algorithms analyze device utilization patterns and billing anomalies.

Identity theft detection in healthcare addresses the growing problem of medical identity theft, where fraudulent actors use stolen patient information to obtain medical services or prescription drugs. Patient verification systems and biometric technologies are increasingly important in this segment.

Healthcare organizations implementing comprehensive fraud detection systems realize substantial benefits including significant cost savings, improved operational efficiency, and enhanced regulatory compliance. Financial protection from fraudulent activities enables organizations to allocate resources more effectively toward patient care and service improvement.

Regulatory compliance benefits include reduced risk of government penalties and sanctions, improved audit performance, and enhanced reputation management. Healthcare organizations with effective fraud detection programs demonstrate commitment to ethical practices and responsible resource stewardship.

Operational improvements include streamlined claims processing, reduced investigation costs, and improved accuracy in payment systems. Automated fraud detection reduces manual review requirements while improving detection accuracy and response times.

Patient protection benefits include reduced risk of medical identity theft, improved care quality through elimination of fraudulent providers, and enhanced privacy protection. Fraud detection systems help ensure that healthcare resources are directed toward legitimate patient care needs.

Industry stakeholders benefit from improved market integrity, reduced healthcare costs, and enhanced public trust in healthcare systems. Collaborative fraud detection initiatives create industry-wide benefits through shared intelligence and coordinated prevention efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming healthcare fraud detection, with machine learning algorithms becoming increasingly sophisticated in identifying complex fraud patterns. Healthcare organizations are leveraging AI capabilities to improve detection accuracy while reducing false positive rates.

Real-time processing capabilities are becoming standard requirements, enabling healthcare organizations to prevent fraudulent transactions before they are completed. Streaming analytics and real-time monitoring systems provide immediate alerts and automated response capabilities.

Collaborative intelligence initiatives are expanding across the healthcare industry, with organizations sharing fraud intelligence and coordinating prevention efforts. Industry consortiums and data sharing networks are enhancing fraud detection effectiveness through collective knowledge.

Mobile integration is increasing as healthcare organizations implement mobile-friendly fraud detection and investigation tools. Mobile applications enable field investigators and healthcare professionals to access fraud detection systems and report suspicious activities from any location.

Blockchain technology is emerging as a potential solution for healthcare fraud prevention, offering secure and transparent transaction recording capabilities. Distributed ledger systems could provide tamper-proof records of healthcare transactions and provider credentials.

Recent industry developments demonstrate accelerating innovation and market evolution in healthcare fraud detection capabilities. Major technology vendors are introducing advanced AI-powered solutions with improved accuracy and reduced implementation complexity.

Regulatory developments include new government initiatives for healthcare fraud prevention and enhanced penalty structures for fraudulent activities. Centers for Medicare & Medicaid Services has implemented new fraud detection requirements and collaborative programs with private sector organizations.

Partnership announcements between technology vendors and healthcare organizations are creating comprehensive fraud detection ecosystems. Strategic alliances enable organizations to access advanced fraud detection capabilities while sharing implementation costs and expertise.

Investment activities in healthcare fraud detection startups and established companies indicate strong market confidence and continued innovation. Venture capital funding is supporting development of next-generation fraud detection technologies and specialized solutions.

Acquisition activities among major healthcare technology companies are consolidating fraud detection capabilities and creating more comprehensive solution portfolios. Market consolidation is enabling development of integrated platforms that address multiple aspects of healthcare fraud prevention.

Strategic recommendations for healthcare organizations include prioritizing comprehensive fraud detection programs that integrate multiple analytical approaches and data sources. MarkWide Research analysis suggests that organizations should focus on solutions that provide real-time detection capabilities while maintaining operational efficiency.

Technology investment strategies should emphasize scalable cloud-based solutions that can evolve with changing fraud patterns and regulatory requirements. Healthcare organizations should consider hybrid deployment models that balance security requirements with operational flexibility and cost effectiveness.

Implementation approaches should include comprehensive change management programs and staff training initiatives to ensure effective adoption of fraud detection systems. Organizational readiness and user acceptance are critical factors in successful fraud detection program implementation.

Collaboration strategies should include participation in industry-wide fraud prevention initiatives and information sharing networks. Healthcare organizations can enhance their fraud detection effectiveness through collaborative intelligence and shared resources.

Continuous improvement programs should include regular system updates, performance monitoring, and adaptation to emerging fraud patterns. Fraud detection systems require ongoing refinement and evolution to maintain effectiveness against sophisticated fraudulent schemes.

Market projections indicate continued strong growth in the US healthcare fraud detection sector, driven by increasing healthcare costs, regulatory requirements, and technological advancement. Industry analysts expect sustained investment in fraud detection capabilities across all healthcare sectors with compound annual growth rates exceeding historical averages.

Technology evolution will continue advancing AI and machine learning capabilities, enabling more sophisticated fraud detection with improved accuracy and reduced false positive rates. Next-generation systems will incorporate advanced predictive analytics and automated response capabilities that can prevent fraud before it occurs.

Regulatory landscape evolution will likely include expanded fraud detection requirements and enhanced penalty structures for healthcare organizations. Government initiatives will continue supporting collaborative fraud prevention programs and industry-wide information sharing efforts.

Market expansion opportunities will emerge in specialized healthcare sectors and underserved market segments. Technology vendors will develop targeted solutions for specific fraud types and healthcare delivery models, creating new market opportunities and competitive dynamics.

Integration trends will continue toward comprehensive healthcare information systems that incorporate fraud detection as a core capability rather than an add-on feature. Healthcare organizations will increasingly seek integrated platforms that provide fraud detection alongside other critical healthcare management functions.

The US healthcare fraud detection market represents a critical and rapidly evolving sector that plays an essential role in protecting the integrity and sustainability of the American healthcare system. Market dynamics indicate strong growth potential driven by increasing healthcare costs, sophisticated fraud schemes, and expanding regulatory requirements that mandate comprehensive fraud prevention programs.

Technology advancement in artificial intelligence, machine learning, and predictive analytics is transforming fraud detection capabilities, enabling healthcare organizations to identify and prevent fraudulent activities with unprecedented accuracy and efficiency. Real-time processing and automated response systems are becoming standard requirements as organizations seek to prevent fraud rather than simply detect it after the fact.

Industry collaboration and information sharing initiatives are enhancing fraud detection effectiveness across the healthcare sector, creating collective intelligence networks that benefit all participants. Healthcare organizations are recognizing that coordinated fraud prevention efforts are more effective than isolated initiatives, driving increased participation in collaborative programs and shared intelligence networks.

Future market development will be characterized by continued technological innovation, expanded regulatory requirements, and growing recognition of fraud detection as a critical component of healthcare cost containment and quality improvement. Organizations that invest in comprehensive fraud detection capabilities will be better positioned to protect their financial resources, ensure regulatory compliance, and maintain public trust in their healthcare delivery systems.

What is Healthcare Fraud Detection?

Healthcare Fraud Detection refers to the processes and technologies used to identify and prevent fraudulent activities within the healthcare system, including billing fraud, identity theft, and prescription fraud.

What are the key players in the US Healthcare Fraud Detection Market?

Key players in the US Healthcare Fraud Detection Market include Optum, IBM Watson Health, and SAS Institute, among others.

What are the main drivers of growth in the US Healthcare Fraud Detection Market?

The main drivers of growth in the US Healthcare Fraud Detection Market include the increasing prevalence of healthcare fraud, the rising costs associated with fraudulent claims, and advancements in data analytics technologies.

What challenges does the US Healthcare Fraud Detection Market face?

Challenges in the US Healthcare Fraud Detection Market include the complexity of healthcare regulations, the need for continuous updates in detection technologies, and the difficulty in distinguishing between legitimate claims and fraudulent ones.

What opportunities exist in the US Healthcare Fraud Detection Market?

Opportunities in the US Healthcare Fraud Detection Market include the integration of artificial intelligence for better fraud detection, the expansion of telehealth services, and the growing demand for compliance with regulatory standards.

What trends are shaping the US Healthcare Fraud Detection Market?

Trends shaping the US Healthcare Fraud Detection Market include the increasing use of machine learning algorithms, the adoption of blockchain technology for secure transactions, and a focus on real-time data analysis to enhance fraud detection capabilities.

US Healthcare Fraud Detection Market

| Segmentation Details | Description |

|---|---|

| Product Type | Software, Services, Solutions, Platforms |

| End User | Insurance Companies, Healthcare Providers, Government Agencies, Third-party Administrators |

| Technology | Machine Learning, Data Analytics, Blockchain, Cloud Computing |

| Application | Claims Review, Risk Assessment, Fraud Detection, Compliance Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Healthcare Fraud Detection Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at