444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US hazardous location LED lighting market represents a critical segment of the industrial safety and energy efficiency sector, experiencing robust growth driven by stringent safety regulations and increasing adoption of energy-efficient lighting solutions. Hazardous location LED lighting systems are specifically engineered to operate safely in environments where flammable gases, vapors, liquids, or combustible dusts may be present, making them essential for industries such as oil and gas, chemical processing, mining, and pharmaceuticals.

Market dynamics indicate significant expansion opportunities as industries prioritize worker safety and operational efficiency. The transition from traditional lighting technologies to LED solutions in hazardous environments has accelerated, with adoption rates reaching 68% across major industrial sectors. This growth trajectory reflects the superior performance characteristics of LED technology, including longer operational lifespans, reduced maintenance requirements, and enhanced safety features specifically designed for explosive atmospheres.

Regulatory compliance serves as a primary market driver, with organizations increasingly investing in certified lighting solutions that meet National Electrical Code (NEC) standards and Occupational Safety and Health Administration (OSHA) requirements. The market encompasses various product categories, including explosion-proof fixtures, intrinsically safe lighting systems, and dust-ignition-proof solutions, each tailored to specific hazardous classification requirements.

The US hazardous location LED lighting market refers to the specialized sector focused on manufacturing, distributing, and installing LED lighting systems designed for safe operation in potentially explosive or dangerous industrial environments. These lighting solutions are engineered to prevent ignition of flammable substances while providing efficient illumination for critical industrial operations.

Hazardous locations are classified according to the National Electrical Code into specific classes, divisions, and groups based on the type and likelihood of hazardous substances present. Class I locations involve flammable gases and vapors, Class II locations feature combustible dusts, and Class III locations contain easily ignitable fibers and flyings. LED lighting systems for these environments must meet rigorous certification standards to ensure safe operation without becoming ignition sources.

Strategic market positioning reveals the US hazardous location LED lighting sector as a high-growth, technology-driven market segment characterized by increasing demand for energy-efficient, safety-compliant lighting solutions. The market demonstrates strong fundamentals supported by regulatory requirements, technological advancement, and growing industrial safety awareness.

Key market drivers include mandatory compliance with safety regulations, with 78% of industrial facilities upgrading their lighting systems to meet current standards. The superior energy efficiency of LED technology, offering up to 75% energy savings compared to traditional lighting, creates compelling economic incentives for adoption. Additionally, the extended operational lifespan of LED systems, typically exceeding 50,000 hours, significantly reduces maintenance costs and operational disruptions.

Market segmentation reveals diverse application areas, with the oil and gas sector representing the largest demand segment, followed by chemical processing, mining operations, and pharmaceutical manufacturing. Explosion-proof fixtures dominate product categories, while intrinsically safe systems show the highest growth rates due to their versatility and ease of installation.

Critical market insights demonstrate the transformative impact of LED technology adoption in hazardous industrial environments. The following key insights shape market dynamics:

Regulatory enforcement represents the most significant market driver, with federal and state agencies increasingly mandating compliance with updated safety standards. The Occupational Safety and Health Administration continues to strengthen enforcement of workplace safety regulations, creating sustained demand for certified hazardous location lighting systems. Insurance requirements also drive adoption, as many insurers now require compliant lighting systems for coverage in high-risk industrial facilities.

Energy cost reduction initiatives provide compelling economic drivers for LED adoption. Industrial facilities typically experience 60-80% reduction in lighting-related energy costs following LED upgrades, creating rapid return on investment periods. The extended operational lifespan of LED systems, often exceeding 10 years of continuous operation, significantly reduces maintenance expenses and operational disruptions in critical industrial processes.

Technological advancement continues to enhance LED system capabilities, with innovations in thermal management, optical design, and control systems expanding application possibilities. Smart lighting integration enables remote monitoring, predictive maintenance, and energy optimization, adding operational value beyond basic illumination. The development of wireless control systems specifically designed for hazardous locations eliminates complex wiring requirements while maintaining safety compliance.

High initial investment requirements present significant barriers to market adoption, particularly for smaller industrial operations. Certified hazardous location LED systems typically cost 3-5 times more than standard industrial lighting, creating budget constraints for facility upgrades. The specialized engineering and installation requirements add additional costs, making comprehensive lighting system upgrades substantial capital expenditures.

Technical complexity in system design and installation creates challenges for end users. Hazardous area classification requires specialized expertise to ensure proper product selection and installation compliance. The need for certified electricians and specialized installation procedures increases project timelines and costs, potentially deterring some potential adopters from pursuing LED upgrades.

Market fragmentation across different hazardous location classifications creates complexity in product standardization and inventory management. The diverse requirements for Class I, II, and III locations necessitate specialized product variants, increasing manufacturing complexity and limiting economies of scale. Additionally, varying regional interpretations of safety standards can create compliance challenges for manufacturers and end users.

Infrastructure modernization initiatives across aging industrial facilities present substantial growth opportunities. Many facilities built decades ago require comprehensive lighting system upgrades to meet current safety standards, creating a large addressable market for retrofit LED solutions. The growing focus on industrial IoT integration opens opportunities for smart lighting systems that provide operational data and predictive maintenance capabilities.

Emerging applications in renewable energy sectors, particularly offshore wind farms and solar installations, create new demand segments for specialized hazardous location lighting. The expansion of battery storage facilities and hydrogen production plants introduces additional market opportunities requiring specialized lighting solutions for emerging hazardous environment classifications.

Export opportunities for US manufacturers continue expanding as international markets adopt similar safety standards and seek proven LED technologies. The expertise developed in meeting stringent US safety requirements positions domestic manufacturers advantageously for international expansion, particularly in developing industrial markets seeking to improve workplace safety standards.

Supply chain dynamics reflect the specialized nature of hazardous location LED manufacturing, with key components sourced from certified suppliers meeting stringent quality requirements. LED chip technology continues advancing, with manufacturers developing specialized semiconductors optimized for hazardous environment applications. The integration of advanced thermal management systems ensures reliable operation in extreme temperature conditions common in industrial hazardous locations.

Competitive dynamics emphasize product differentiation through specialized engineering capabilities and comprehensive certification portfolios. Leading manufacturers invest heavily in research and development to create innovative solutions addressing specific industry challenges. The market rewards companies that can provide complete system solutions, including design engineering, installation support, and ongoing maintenance services.

Customer dynamics show increasing sophistication in lighting system procurement, with end users seeking comprehensive solutions rather than individual products. Total cost of ownership considerations drive purchasing decisions, with buyers evaluating energy savings, maintenance costs, and operational reliability over extended periods. The growing emphasis on sustainability reporting creates additional value for energy-efficient LED solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, end users, and regulatory experts. These interviews provide firsthand insights into market trends, challenges, and opportunities from diverse perspectives across the value chain.

Secondary research encompasses analysis of industry publications, regulatory documents, patent filings, and company financial reports to validate primary research findings. Regulatory analysis includes detailed review of National Electrical Code updates, OSHA guidelines, and industry-specific safety standards to understand compliance requirements driving market demand.

Quantitative analysis utilizes statistical modeling to project market trends and growth patterns based on historical data and identified market drivers. Market sizing methodologies combine bottom-up analysis of end-user segments with top-down analysis of industry spending patterns to ensure comprehensive market coverage and accurate projections.

Geographic distribution of the US hazardous location LED lighting market reflects the concentration of heavy industrial activities across specific regions. Texas leads market demand with approximately 28% market share, driven by extensive oil and gas operations, petrochemical facilities, and refining capacity. The state’s industrial infrastructure and ongoing facility modernization initiatives create sustained demand for specialized lighting solutions.

Louisiana and Alaska represent significant regional markets, collectively accounting for 18% of national demand. Louisiana’s chemical processing corridor along the Mississippi River requires extensive hazardous location lighting installations, while Alaska’s oil production facilities drive demand for cold-weather LED solutions. California’s diverse industrial base, including aerospace, electronics, and food processing, contributes 15% of market demand.

Midwest industrial regions, particularly Ohio, Michigan, and Illinois, account for 22% of market activity through automotive manufacturing, steel production, and chemical processing operations. The region’s aging industrial infrastructure creates substantial retrofit opportunities for LED lighting upgrades. Northeast markets focus primarily on pharmaceutical manufacturing and specialty chemical production, representing 12% of national demand.

Market leadership is characterized by companies offering comprehensive product portfolios, specialized engineering capabilities, and extensive certification credentials. The competitive landscape includes both large multinational corporations and specialized manufacturers focused exclusively on hazardous location applications.

Product segmentation reflects the diverse requirements of different hazardous location classifications and application needs. Explosion-proof fixtures dominate the market with 65% share, designed for Class I hazardous locations where flammable gases and vapors may be present. These robust fixtures feature heavy-duty construction and specialized sealing systems to contain potential internal explosions.

Intrinsically safe lighting systems represent 25% of market volume, offering installation flexibility and lower costs for applications where explosion-proof fixtures may be unnecessary. Dust-ignition-proof fixtures account for 10% of the market, specifically designed for Class II locations with combustible dust hazards.

Application segmentation demonstrates market diversity across industrial sectors:

Class I hazardous locations generate the highest demand for LED lighting solutions, driven by extensive oil and gas industry requirements. Division 1 applications require the most robust explosion-proof fixtures capable of containing internal explosions, while Division 2 applications allow for more diverse product options including some intrinsically safe systems.

Class II locations present unique challenges for LED system design, requiring specialized dust-tight construction and careful thermal management to prevent dust ignition. Agricultural applications increasingly drive demand in this category, particularly grain handling and processing facilities where combustible dust hazards are prevalent.

Temperature classification significantly impacts product selection and pricing, with T6 temperature class systems commanding premium pricing due to specialized thermal management requirements. Marine applications require additional certifications for salt spray resistance and vibration tolerance, creating specialized product subcategories with higher margins.

End users realize substantial operational benefits through LED adoption, including significant energy cost reductions and improved workplace safety. The extended operational lifespan of LED systems minimizes maintenance disruptions in critical industrial processes, while enhanced light quality improves worker productivity and safety. Compliance assurance reduces regulatory risks and potential liability exposure.

Manufacturers benefit from growing market demand and opportunities for product differentiation through specialized engineering capabilities. The technical complexity of hazardous location applications creates barriers to entry, protecting market positions for established players. Recurring revenue opportunities through maintenance services and system upgrades provide stable income streams.

Distributors and installers gain access to high-margin product categories requiring specialized expertise and certification. The technical nature of hazardous location lighting creates opportunities for value-added services including system design, installation, and ongoing maintenance support. Training and certification programs enable channel partners to differentiate their service offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant emerging trend, with manufacturers developing IoT-enabled LED systems that provide operational data and remote monitoring capabilities. These systems enable predictive maintenance, energy optimization, and integration with broader facility management systems. Wireless communication protocols specifically designed for hazardous locations eliminate complex wiring requirements while maintaining safety compliance.

Modular design approaches gain popularity as end users seek flexible solutions that can adapt to changing operational requirements. Plug-and-play systems reduce installation complexity and enable easier maintenance procedures. The trend toward standardized mounting systems facilitates retrofits and reduces inventory requirements for maintenance operations.

Sustainability focus drives demand for LED systems with enhanced recyclability and reduced environmental impact. Circular economy principles influence product design, with manufacturers developing systems that can be easily disassembled and recycled at end of life. Carbon footprint reduction initiatives create additional value for energy-efficient LED solutions in corporate sustainability programs.

Recent technological advancement includes the development of explosion-proof LED fixtures with integrated emergency backup systems, eliminating the need for separate emergency lighting installations. Advanced thermal management systems enable LED operation in extreme temperature environments previously unsuitable for solid-state lighting.

Regulatory developments include updated National Electrical Code provisions specifically addressing LED technology in hazardous locations. New certification standards for wireless control systems enable remote monitoring and control capabilities while maintaining safety compliance. OSHA guidance updates clarify requirements for LED system installations in various hazardous location classifications.

Market consolidation continues as larger manufacturers acquire specialized companies to expand their hazardous location product portfolios. Strategic partnerships between LED manufacturers and industrial automation companies create integrated solutions combining lighting with broader facility control systems. According to MarkWide Research analysis, these developments position the market for continued expansion and technological innovation.

Investment recommendations favor companies with comprehensive product portfolios and strong engineering capabilities. Market leaders with established distribution networks and extensive certification credentials are best positioned to capitalize on growing demand. Investors should prioritize companies demonstrating innovation in smart lighting technologies and IoT integration capabilities.

Strategic recommendations for market participants include focusing on total solution offerings rather than individual products. Companies should invest in application engineering capabilities to provide customized solutions for specific industry requirements. Partnership strategies with industrial automation providers can create competitive advantages through integrated system offerings.

End user recommendations emphasize the importance of comprehensive total cost of ownership analysis when evaluating LED lighting investments. Organizations should consider energy savings, maintenance cost reductions, and operational reliability improvements over extended periods. MWR suggests prioritizing suppliers with proven track records in similar applications and comprehensive support capabilities.

Long-term market prospects remain highly favorable, driven by ongoing industrial infrastructure modernization and increasingly stringent safety regulations. The market is projected to maintain robust growth rates exceeding 8% annually over the next decade, supported by expanding applications and technological advancement.

Technology evolution will focus on enhanced smart capabilities and integration with industrial IoT systems. Future LED systems will provide comprehensive operational data, enabling predictive maintenance and energy optimization. Artificial intelligence integration will enable adaptive lighting systems that automatically adjust to operational conditions and safety requirements.

Market expansion will be driven by emerging applications in renewable energy infrastructure, battery storage facilities, and hydrogen production plants. The growing focus on industrial automation and Industry 4.0 initiatives will create additional demand for intelligent lighting systems. MarkWide Research projects that these trends will sustain market growth well into the next decade, creating substantial opportunities for industry participants.

The US hazardous location LED lighting market represents a dynamic and growing sector characterized by strong fundamentals, technological innovation, and expanding application opportunities. Regulatory compliance requirements provide a stable foundation for sustained demand, while energy efficiency benefits and operational improvements create compelling value propositions for end users.

Market participants are well-positioned to capitalize on infrastructure modernization trends and emerging applications in new industrial sectors. The combination of technological advancement, regulatory support, and growing safety awareness creates a favorable environment for continued market expansion. Success in this market requires specialized expertise, comprehensive product portfolios, and strong customer support capabilities.

Future growth prospects remain robust, supported by ongoing industrial development and increasing adoption of smart lighting technologies. The market’s evolution toward integrated solutions and IoT capabilities will create additional value opportunities for innovative companies. As industries continue prioritizing safety and efficiency, the US hazardous location LED lighting market is positioned for sustained growth and technological advancement.

What is Hazardous Location LED Lighting?

Hazardous Location LED Lighting refers to lighting solutions specifically designed for environments where flammable gases, vapors, or dust may be present. These lights are built to meet strict safety standards to prevent ignition and ensure safe operation in industrial settings such as oil refineries, chemical plants, and mining operations.

What are the key players in the US Hazardous Location LED Lighting Market?

Key players in the US Hazardous Location LED Lighting Market include companies like Eaton Corporation, Emerson Electric Co., and Philips Lighting. These companies are known for their innovative lighting solutions tailored for hazardous environments, among others.

What are the main drivers of the US Hazardous Location LED Lighting Market?

The main drivers of the US Hazardous Location LED Lighting Market include the increasing focus on workplace safety regulations, the growing demand for energy-efficient lighting solutions, and advancements in LED technology that enhance durability and performance in hazardous conditions.

What challenges does the US Hazardous Location LED Lighting Market face?

Challenges in the US Hazardous Location LED Lighting Market include the high initial costs of installation and the need for compliance with stringent safety standards. Additionally, the complexity of retrofitting existing facilities with new lighting solutions can pose significant hurdles.

What opportunities exist in the US Hazardous Location LED Lighting Market?

Opportunities in the US Hazardous Location LED Lighting Market include the expansion of industrial sectors such as oil and gas, pharmaceuticals, and food processing. The increasing adoption of smart lighting technologies also presents avenues for growth and innovation.

What trends are shaping the US Hazardous Location LED Lighting Market?

Trends shaping the US Hazardous Location LED Lighting Market include the integration of IoT technology for remote monitoring and control, the shift towards sustainable lighting solutions, and the development of more compact and efficient LED fixtures designed for extreme conditions.

US Hazardous Location LED Lighting Market

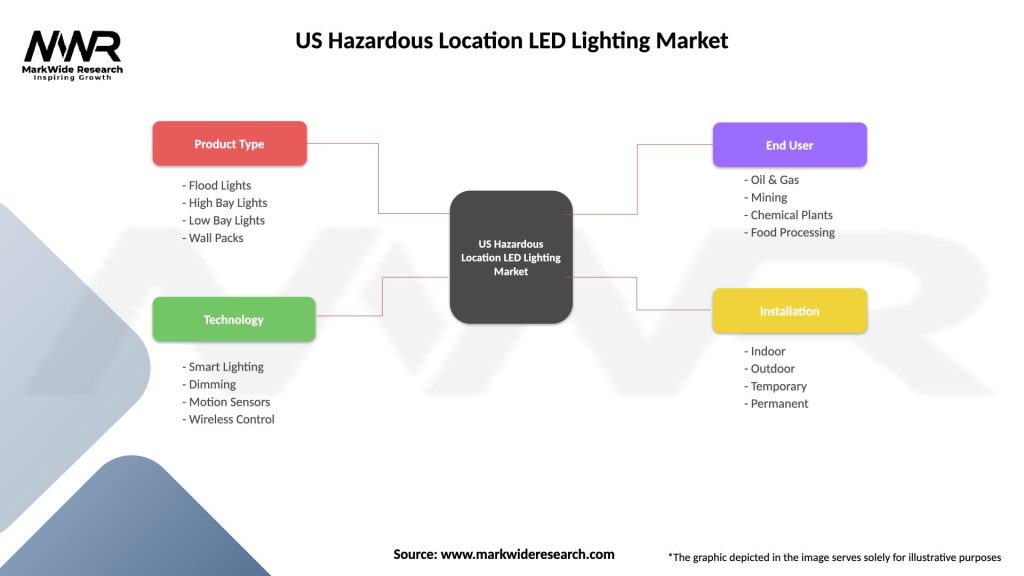

| Segmentation Details | Description |

|---|---|

| Product Type | Flood Lights, High Bay Lights, Low Bay Lights, Wall Packs |

| Technology | Smart Lighting, Dimming, Motion Sensors, Wireless Control |

| End User | Oil & Gas, Mining, Chemical Plants, Food Processing |

| Installation | Indoor, Outdoor, Temporary, Permanent |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Hazardous Location LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at