444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Full Truckload Freight Market represents a critical component of America’s transportation infrastructure, serving as the backbone for moving large-volume shipments across the nation. This market encompasses freight transportation services where entire truck trailers are dedicated to single shipments, typically weighing between 10,000 to 80,000 pounds. The full truckload sector has experienced remarkable transformation driven by e-commerce growth, supply chain optimization demands, and technological advancement integration.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 4.2% over recent years. The increasing demand for direct-to-consumer deliveries, coupled with manufacturing resurgence and infrastructure development projects, continues to fuel market growth. Regional distribution patterns show concentrated activity along major freight corridors including the Interstate 95 corridor, Trans-Continental routes, and key industrial hubs spanning from California to the Northeast.

Technology integration has revolutionized operational efficiency within the full truckload market. Advanced fleet management systems, electronic logging devices, and route optimization software have enhanced delivery precision while reducing operational costs. The market’s evolution reflects broader economic trends, with capacity utilization rates reaching approximately 87% during peak shipping seasons, demonstrating the sector’s vital role in supporting American commerce.

The US Full Truckload Freight Market refers to the transportation sector specializing in dedicated truck services where entire trailer capacity is reserved for single shipper loads, providing direct point-to-point delivery without intermediate stops or cargo consolidation. This market segment distinguishes itself from less-than-truckload services by offering exclusive trailer usage, faster transit times, and reduced handling requirements.

Full truckload services encompass various transportation modes including dry van trailers, refrigerated units, flatbed carriers, and specialized equipment for oversized or hazardous materials. The market operates through complex networks involving owner-operators, fleet operators, freight brokers, and third-party logistics providers who coordinate shipment movements across diverse geographic regions and industry verticals.

Service characteristics include dedicated pickup and delivery schedules, direct routing without transloading, and customized handling procedures tailored to specific cargo requirements. This transportation model serves manufacturers, retailers, distributors, and industrial customers requiring reliable, time-sensitive freight movement solutions with minimal cargo exposure and handling risks.

The US Full Truckload Freight Market demonstrates sustained growth momentum driven by evolving supply chain requirements and expanding e-commerce activities. Market expansion reflects increasing demand for dedicated transportation services across manufacturing, retail, and distribution sectors, with technology adoption accelerating operational efficiency improvements and customer service enhancement.

Key market drivers include supply chain regionalization trends, inventory management optimization, and growing preference for direct shipping solutions. The sector benefits from driver shortage mitigation efforts through improved compensation packages and technology-enabled route optimization, resulting in driver retention rates improving by approximately 12% industry-wide.

Competitive landscape features diverse participants ranging from large national carriers to regional specialists and independent owner-operators. Market consolidation continues as larger operators acquire smaller fleets to expand geographic coverage and service capabilities. Capacity constraints during peak seasons create pricing opportunities while driving innovation in fleet utilization and scheduling optimization.

Future prospects indicate continued market expansion supported by infrastructure investment, regulatory compliance improvements, and sustainable transportation initiatives. The integration of autonomous vehicle technology and alternative fuel systems positions the market for long-term transformation while maintaining focus on reliability and cost-effectiveness.

Strategic market analysis reveals several critical insights shaping the US Full Truckload Freight Market landscape:

E-commerce expansion continues driving unprecedented demand for full truckload services as retailers and manufacturers adapt to direct-to-consumer shipping requirements. The surge in online retail activities has created new shipping patterns requiring dedicated transportation solutions for large-volume deliveries to distribution centers and fulfillment facilities.

Supply chain regionalization trends encourage manufacturers to establish production and distribution facilities closer to end markets, generating increased demand for medium-distance truckload services. This nearshoring movement reduces international shipping dependencies while creating opportunities for domestic freight carriers to capture additional market share.

Infrastructure development projects across the United States stimulate demand for specialized truckload services transporting construction materials, equipment, and supplies. Government investment in highway improvements, bridge construction, and facility development creates sustained freight movement requirements supporting market growth.

Manufacturing resurgence in key industrial sectors including automotive, aerospace, and technology drives consistent demand for reliable truckload services. Production increases require coordinated transportation solutions for raw materials, components, and finished goods movement between manufacturing facilities and distribution networks.

Technology integration enhances operational efficiency while reducing costs, making truckload services more competitive against alternative transportation modes. Advanced fleet management systems, predictive maintenance programs, and automated dispatch solutions improve service reliability while optimizing resource utilization.

Driver shortage challenges continue constraining market growth as the industry struggles to attract and retain qualified commercial drivers. Demographic trends, regulatory requirements, and lifestyle preferences limit the available driver pool, creating capacity constraints during peak demand periods and increasing operational costs.

Regulatory compliance costs impose significant financial burdens on carriers through electronic logging device requirements, safety rating programs, and environmental standards. These regulations, while improving safety and environmental performance, increase operational complexity and require substantial technology investments.

Fuel price volatility creates unpredictable cost structures affecting profitability and pricing strategies. Fluctuating diesel prices impact operational margins while requiring sophisticated fuel management and hedging strategies to maintain competitive pricing structures.

Infrastructure limitations including highway congestion, bridge weight restrictions, and parking shortages reduce operational efficiency while increasing transit times. Aging transportation infrastructure creates bottlenecks that limit productivity and increase operational costs across major freight corridors.

Insurance and liability costs continue escalating due to increased accident settlements and regulatory requirements. Rising insurance premiums affect smaller carriers disproportionately while creating barriers to market entry for new operators.

Technology advancement opportunities present significant potential for operational improvement and cost reduction. Autonomous vehicle development, artificial intelligence applications, and Internet of Things integration offer pathways for enhanced efficiency and reduced labor dependency in freight operations.

Sustainable transportation initiatives create opportunities for carriers investing in alternative fuel systems, electric vehicles, and carbon reduction programs. Environmental compliance requirements and corporate sustainability goals drive demand for eco-friendly transportation solutions.

Specialized service development offers differentiation opportunities through temperature-controlled transportation, hazardous materials handling, and oversized cargo services. Niche market segments often command premium pricing while building customer loyalty through specialized expertise.

Geographic expansion potential exists in underserved markets and emerging industrial regions. Population growth in secondary markets and industrial development in rural areas create new freight movement requirements for carriers willing to expand service territories.

Partnership and consolidation opportunities enable smaller carriers to access larger customers and expanded service capabilities through strategic alliances. Collaboration with technology providers, logistics companies, and complementary service providers creates competitive advantages.

Supply and demand balance fluctuates seasonally with peak shipping periods creating tight capacity conditions while slower seasons generate competitive pricing pressure. Market dynamics reflect broader economic conditions, with manufacturing activity and consumer spending patterns directly influencing freight demand levels.

Pricing mechanisms respond to capacity utilization, fuel costs, and competitive pressures through sophisticated rate management systems. Carriers employ dynamic pricing strategies adjusting rates based on lane density, equipment availability, and customer relationships while maintaining profitability targets.

Competitive intensity varies by geographic region and service specialty, with some markets experiencing fierce competition while others maintain more stable pricing structures. Market fragmentation creates opportunities for differentiation through service quality, reliability, and specialized capabilities.

Customer relationship dynamics emphasize long-term partnerships over transactional arrangements as shippers seek reliable capacity and consistent service quality. Contract penetration rates have increased to approximately 75% of total market volume as customers prioritize service reliability.

Regulatory influence shapes market dynamics through safety requirements, environmental standards, and operational restrictions. Compliance costs and operational constraints affect competitive positioning while creating barriers to entry for new market participants.

Comprehensive market analysis employs multiple research methodologies combining primary data collection, secondary source analysis, and industry expert consultations. The research framework incorporates quantitative analysis of market trends, competitive positioning assessment, and qualitative evaluation of industry dynamics.

Primary research activities include structured interviews with industry executives, carrier management teams, shipper representatives, and regulatory officials. Survey methodologies capture operational metrics, performance indicators, and strategic priorities across diverse market participants.

Secondary research sources encompass government transportation statistics, industry association reports, regulatory filings, and academic studies. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification procedures.

Market modeling techniques utilize statistical analysis, trend projection, and scenario planning to develop comprehensive market forecasts. Analytical frameworks incorporate economic indicators, demographic trends, and technological advancement factors affecting market development.

Quality assurance protocols include peer review processes, data verification procedures, and expert validation to ensure research accuracy and reliability. Continuous monitoring and updating procedures maintain current market intelligence and trend identification capabilities.

Western Region markets demonstrate strong growth driven by Pacific Coast trade activities and technology sector expansion. California leads in freight volume generation while supporting extensive agricultural and manufacturing shipments. Regional market share accounts for approximately 28% of national truckload activity.

Southern Region dynamics reflect robust manufacturing activity, energy sector operations, and agricultural production. Texas serves as a major freight hub with extensive cross-border trade activities and industrial development. The region benefits from favorable business climates and strategic geographic positioning.

Midwest Region characteristics include concentrated manufacturing activities, agricultural production, and distribution center operations. Illinois, Ohio, and Michigan generate substantial freight volumes through automotive, food processing, and industrial manufacturing sectors.

Northeast Region patterns emphasize high-value cargo movements, dense population centers, and import/export activities through major ports. Despite geographic constraints, the region maintains significant market presence with approximately 22% of national freight movements.

Southeast Region growth reflects expanding manufacturing activities, population increases, and infrastructure development. States like Georgia, North Carolina, and Florida experience rapid freight volume growth through industrial expansion and distribution center development.

Market leadership features diverse participants ranging from large national carriers to specialized regional operators. The competitive environment reflects market fragmentation with numerous participants competing across different service segments and geographic regions.

Competitive strategies emphasize service differentiation, technology adoption, and operational efficiency improvements. Market participants invest in driver recruitment, equipment modernization, and customer relationship management to maintain competitive positioning.

By Equipment Type:

By Distance:

By Customer Industry:

Dry Van Transportation represents the largest market segment, accounting for approximately 65% of total truckload movements. This category serves diverse industries with standardized equipment and operational procedures, enabling economies of scale and efficient asset utilization across carrier networks.

Refrigerated Transportation demonstrates consistent growth driven by food industry expansion and pharmaceutical distribution requirements. Temperature-controlled services command premium pricing while requiring specialized equipment and operational expertise, creating barriers to entry for new market participants.

Flatbed Services experience cyclical demand patterns reflecting construction activity and industrial production levels. This segment requires specialized loading and securing expertise while serving customers with unique transportation requirements and premium pricing tolerance.

Specialized Transportation offers the highest profit margins through customized services for unique cargo requirements. Market participants in this segment develop specialized expertise and equipment to serve niche markets with limited competition and premium pricing opportunities.

Dedicated Contract Services provide stable revenue streams through long-term customer relationships and customized service arrangements. This segment emphasizes operational consistency and customer-specific solutions while reducing market volatility exposure.

Carriers benefit from diverse revenue opportunities across multiple market segments and geographic regions. The full truckload market provides scalable business models enabling growth through equipment expansion, service diversification, and geographic coverage extension.

Shippers gain access to reliable transportation capacity with predictable service levels and competitive pricing structures. Full truckload services offer supply chain flexibility while reducing inventory carrying costs through efficient transportation scheduling and delivery coordination.

Drivers enjoy improved working conditions through technology integration, better compensation packages, and enhanced safety programs. The industry’s focus on driver retention creates opportunities for career advancement and improved work-life balance.

Technology providers find expanding market opportunities through fleet management systems, route optimization software, and safety enhancement technologies. The industry’s digital transformation creates demand for innovative solutions improving operational efficiency.

Financial institutions benefit from equipment financing opportunities and working capital solutions supporting carrier growth and modernization initiatives. The market’s stability and growth prospects create attractive investment opportunities across various financial products.

Regulatory agencies achieve improved safety compliance and environmental performance through industry cooperation and technology adoption. Enhanced data collection and reporting capabilities support regulatory oversight and policy development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives accelerate across the industry as carriers invest in advanced technology platforms improving operational visibility and customer communication. Electronic documentation, real-time tracking, and automated dispatch systems enhance service quality while reducing administrative costs.

Sustainability focus drives equipment modernization and alternative fuel adoption as carriers respond to environmental regulations and customer sustainability requirements. Fuel efficiency improvements and carbon reduction programs become competitive differentiators while supporting cost management objectives.

Driver-centric programs emphasize recruitment, retention, and satisfaction through improved compensation, flexible scheduling, and enhanced working conditions. Technology integration reduces administrative burdens while improving communication between drivers and dispatch operations.

Customer collaboration deepens through integrated planning, shared technology platforms, and performance measurement systems. Shippers and carriers develop strategic partnerships emphasizing mutual benefit and long-term relationship sustainability.

Capacity optimization utilizes advanced analytics and artificial intelligence to improve asset utilization and reduce empty miles. Dynamic routing and load matching technologies enhance operational efficiency while reducing environmental impact.

Safety enhancement programs integrate advanced driver assistance systems, predictive maintenance, and comprehensive training programs. Technology-enabled safety improvements reduce accident rates while supporting regulatory compliance and insurance cost management.

Regulatory modernization includes electronic logging device implementation, safety rating system updates, and environmental compliance enhancements. These developments improve industry safety performance while creating operational standardization across market participants.

Technology partnerships between carriers and software providers accelerate innovation adoption and operational improvement initiatives. Collaborative development programs create customized solutions addressing specific industry challenges and operational requirements.

Infrastructure investment programs support highway improvements, truck parking expansion, and freight corridor enhancements. Government and private sector collaboration addresses infrastructure constraints while improving operational efficiency.

Workforce development initiatives include driver training programs, apprenticeship opportunities, and career advancement pathways. Industry associations and educational institutions collaborate to address labor shortage challenges while improving professional development opportunities.

Sustainability programs encompass alternative fuel adoption, carbon reduction initiatives, and environmental performance measurement systems. Industry leadership in environmental responsibility creates competitive advantages while supporting regulatory compliance.

Market consolidation activities continue as larger carriers acquire regional operators and specialized service providers. Strategic acquisitions enable geographic expansion, service diversification, and operational scale improvements.

MarkWide Research recommends that carriers prioritize technology investment and driver retention programs to maintain competitive positioning in evolving market conditions. Strategic focus on operational efficiency and customer service quality creates sustainable competitive advantages while supporting long-term growth objectives.

Investment in specialized services offers differentiation opportunities and premium pricing potential for carriers willing to develop niche market expertise. Temperature-controlled transportation, hazardous materials handling, and oversized cargo services provide growth opportunities with higher profit margins.

Geographic expansion strategies should focus on underserved markets and emerging industrial regions where competition remains limited and growth potential exists. Strategic market entry requires careful analysis of local demand patterns, competitive dynamics, and operational requirements.

Partnership development with technology providers, logistics companies, and complementary service providers creates competitive advantages through enhanced service capabilities and operational efficiency improvements. Collaborative relationships enable resource sharing and market expansion opportunities.

Sustainability initiatives should be integrated into strategic planning as environmental compliance requirements and customer expectations continue evolving. Early adoption of alternative fuel systems and carbon reduction programs creates competitive differentiation while supporting long-term viability.

Financial management strategies must address fuel price volatility, insurance cost increases, and capital investment requirements through sophisticated planning and risk management programs. Diversified revenue streams and flexible operational models reduce market volatility exposure.

Market expansion prospects remain positive supported by continued economic growth, e-commerce development, and infrastructure investment initiatives. The full truckload market benefits from fundamental demand drivers including population growth, industrial production increases, and supply chain optimization requirements.

Technology transformation will accelerate through autonomous vehicle development, artificial intelligence integration, and Internet of Things applications. These technological advances offer potential for significant operational improvement and cost reduction while addressing labor shortage challenges.

Regulatory evolution continues emphasizing safety improvement, environmental protection, and operational standardization. Industry adaptation to regulatory changes creates opportunities for competitive differentiation through compliance excellence and operational innovation.

Sustainability requirements will intensify as environmental regulations become more stringent and customer expectations for carbon-neutral transportation increase. MWR analysis indicates that carriers investing in sustainable technologies will achieve competitive advantages and improved customer relationships.

Market consolidation trends are expected to continue as larger carriers seek geographic expansion and service diversification through strategic acquisitions. Industry consolidation creates opportunities for operational efficiency improvement and enhanced service capabilities.

Growth projections indicate sustained market expansion with annual growth rates expected to maintain 4-5% annually over the next decade. This growth reflects underlying economic trends, demographic changes, and evolving supply chain requirements supporting long-term market development.

The US Full Truckload Freight Market demonstrates remarkable resilience and growth potential despite facing significant operational challenges including driver shortages, regulatory compliance requirements, and infrastructure constraints. Market participants who successfully navigate these challenges through strategic planning, technology adoption, and operational excellence will capture substantial growth opportunities.

Strategic success factors include technology integration, driver retention programs, customer relationship development, and operational efficiency improvements. Carriers that invest in these critical areas while maintaining financial discipline and market focus will achieve sustainable competitive advantages in evolving market conditions.

Future market development will be shaped by technological advancement, regulatory evolution, and changing customer expectations. The industry’s transformation toward greater efficiency, sustainability, and service quality creates opportunities for innovative market participants while rewarding operational excellence and strategic vision.

Long-term prospects remain favorable as fundamental demand drivers including economic growth, population increases, and supply chain optimization continue supporting market expansion. The full truckload freight market’s essential role in American commerce ensures continued relevance and growth potential for well-positioned industry participants.

What is Full Truckload Freight?

Full Truckload Freight refers to a shipping method where an entire truck is dedicated to transporting goods for a single customer. This method is often used for large shipments that require the full capacity of the truck, providing efficiency and reduced handling of goods.

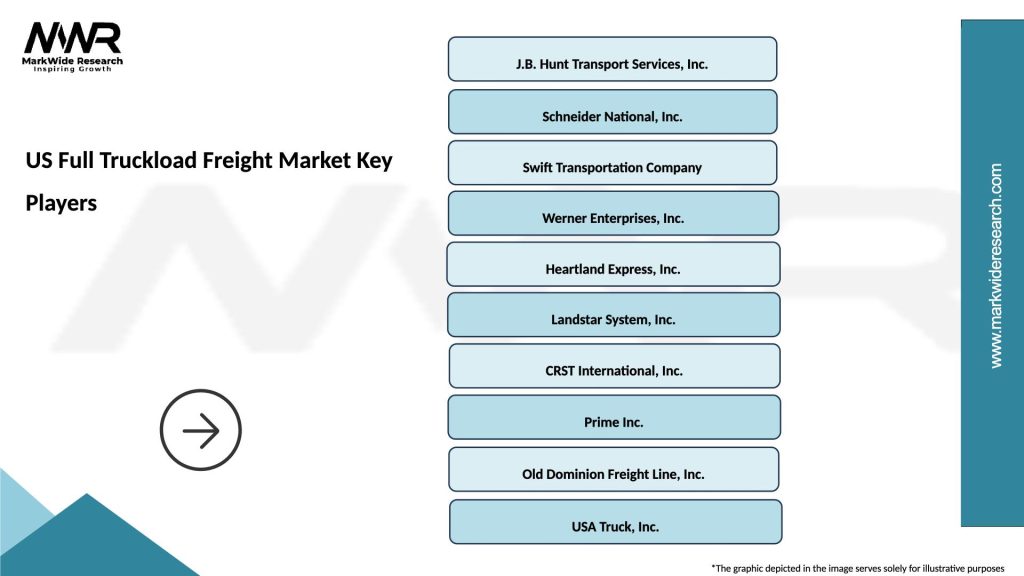

What are the key players in the US Full Truckload Freight Market?

Key players in the US Full Truckload Freight Market include companies like J.B. Hunt Transport Services, Schneider National, and Knight-Swift Transportation, among others. These companies provide extensive logistics and transportation services across various sectors.

What are the main drivers of the US Full Truckload Freight Market?

The main drivers of the US Full Truckload Freight Market include the growth of e-commerce, increasing demand for efficient supply chain solutions, and the need for timely deliveries in various industries. Additionally, the expansion of manufacturing and retail sectors contributes to market growth.

What challenges does the US Full Truckload Freight Market face?

The US Full Truckload Freight Market faces challenges such as driver shortages, fluctuating fuel prices, and regulatory compliance issues. These factors can impact operational efficiency and cost management for freight companies.

What opportunities exist in the US Full Truckload Freight Market?

Opportunities in the US Full Truckload Freight Market include advancements in technology such as automation and real-time tracking, which can enhance operational efficiency. Additionally, the growing demand for sustainable logistics solutions presents new avenues for innovation.

What trends are shaping the US Full Truckload Freight Market?

Trends shaping the US Full Truckload Freight Market include the increasing adoption of digital freight matching platforms and the integration of artificial intelligence in logistics operations. Furthermore, there is a rising focus on sustainability and reducing carbon footprints in transportation.

US Full Truckload Freight Market

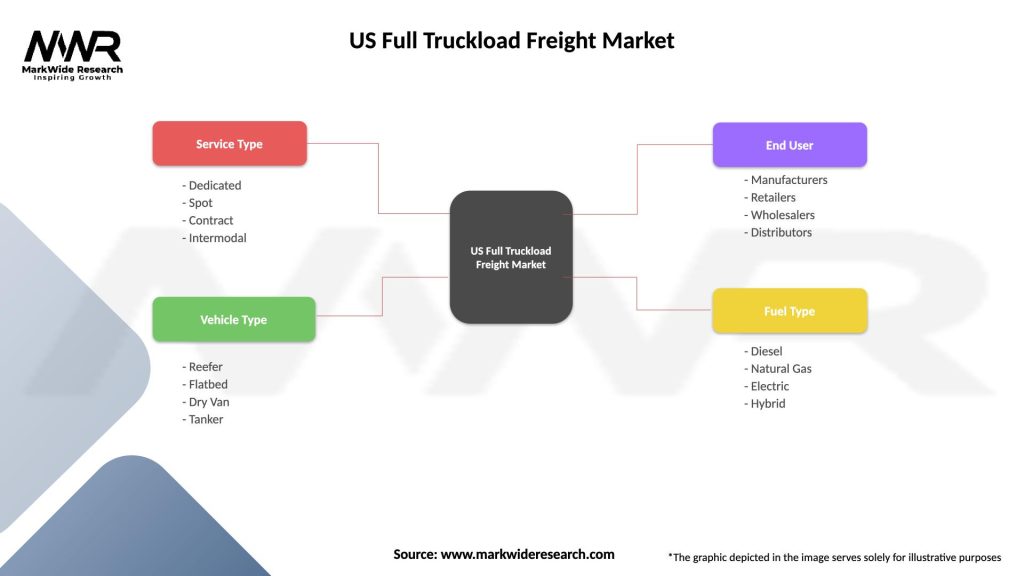

| Segmentation Details | Description |

|---|---|

| Service Type | Dedicated, Spot, Contract, Intermodal |

| Vehicle Type | Reefer, Flatbed, Dry Van, Tanker |

| End User | Manufacturers, Retailers, Wholesalers, Distributors |

| Fuel Type | Diesel, Natural Gas, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Full Truckload Freight Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at