444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US frozen and canned seafood market represents a dynamic and essential segment of the American food industry, characterized by robust consumer demand and evolving dietary preferences. This market encompasses a comprehensive range of preserved seafood products, from traditional canned tuna and salmon to premium frozen fish fillets and shellfish varieties. Market dynamics indicate sustained growth driven by health-conscious consumers seeking convenient, nutritious protein sources that align with busy lifestyles.

Consumer preferences have significantly shifted toward seafood products due to their recognized health benefits, including high-quality protein content, omega-3 fatty acids, and essential nutrients. The market demonstrates remarkable resilience, with frozen seafood segments experiencing particularly strong growth at approximately 6.2% CAGR over recent years. Canned seafood products maintain steady demand, supported by their extended shelf life, affordability, and versatility in meal preparation.

Distribution channels have evolved considerably, with traditional grocery retail maintaining dominance while e-commerce platforms capture increasing market share at approximately 18% annual growth. The market benefits from technological advancements in freezing and canning processes, ensuring product quality and extending shelf life while preserving nutritional value.

The US frozen and canned seafood market refers to the comprehensive industry segment encompassing all commercially processed seafood products that undergo freezing or canning preservation methods for consumer distribution across the United States. This market includes various species of fish, shellfish, and other marine products that are processed, packaged, and distributed through multiple channels to meet diverse consumer needs.

Frozen seafood products encompass individually quick frozen (IQF) fish fillets, whole fish, shrimp, scallops, crab, lobster, and specialty seafood items that maintain freshness through controlled freezing processes. Canned seafood varieties include traditional products like tuna, salmon, sardines, anchovies, crab meat, and innovative ready-to-eat seafood meals that offer convenience and extended storage capabilities.

Market scope extends beyond basic preservation to include value-added products featuring seasoning, marinades, breading, and pre-cooked options that cater to evolving consumer preferences for convenient meal solutions without compromising nutritional quality.

Market performance in the US frozen and canned seafood sector demonstrates consistent expansion, driven by increasing health awareness and convenience-seeking consumer behavior. The industry benefits from diverse product portfolios that address various demographic segments, from budget-conscious families to premium seafood enthusiasts seeking restaurant-quality options at home.

Key growth drivers include rising awareness of seafood’s health benefits, with 73% of consumers recognizing seafood as a healthy protein alternative. Technological innovations in processing and packaging have enhanced product quality while extending shelf life, making seafood more accessible to inland markets previously underserved by fresh seafood options.

Competitive landscape features established industry leaders alongside emerging brands that focus on sustainability, traceability, and premium positioning. Private label products have gained significant traction, capturing approximately 28% market share as retailers develop exclusive seafood lines to differentiate their offerings and improve margins.

Future prospects remain positive, supported by demographic trends favoring protein-rich diets, increasing Hispanic population driving demand for traditional seafood varieties, and growing acceptance of frozen foods as quality alternatives to fresh products.

Consumer behavior analysis reveals significant shifts in seafood consumption patterns, with convenience and health considerations driving purchasing decisions. The market demonstrates strong resilience during economic fluctuations, as seafood products offer affordable protein alternatives while maintaining nutritional benefits.

Health consciousness trends represent the primary driver propelling market expansion, as consumers increasingly recognize seafood’s role in balanced nutrition. Medical recommendations supporting regular seafood consumption for cardiovascular health, brain function, and overall wellness create sustained demand across age groups. The protein trend particularly benefits seafood products, as fitness-conscious consumers seek lean, high-quality protein sources.

Convenience demands from modern lifestyles significantly impact market growth, with working families and busy professionals seeking quick meal solutions without sacrificing nutritional quality. Frozen seafood products address this need by offering restaurant-quality options that can be prepared in minutes, while canned varieties provide shelf-stable convenience for emergency meals and quick lunch options.

Demographic shifts contribute substantially to market expansion, particularly the growing Hispanic population that traditionally consumes higher quantities of seafood products. Aging population segments also drive demand, as older consumers prioritize heart-healthy food choices and appreciate the convenience of preserved seafood options.

Economic factors support market growth through seafood’s positioning as an affordable protein alternative compared to premium meat products. Value perception remains strong, especially for canned seafood that offers significant cost savings while delivering essential nutrients and versatile meal options.

Price volatility presents ongoing challenges for market participants, as seafood commodity prices fluctuate based on catch volumes, weather conditions, and international trade dynamics. Raw material costs directly impact product pricing, potentially limiting accessibility for price-sensitive consumer segments and affecting overall demand patterns.

Quality perceptions continue to challenge frozen and canned seafood acceptance among certain consumer groups who perceive fresh seafood as superior in taste and nutritional value. Texture concerns particularly affect frozen products, where improper handling or storage can compromise product quality and consumer satisfaction.

Competition from alternatives intensifies as plant-based protein options and other convenient protein sources gain market share. Substitute products including chicken, turkey, and emerging alternative proteins create competitive pressure on seafood market positioning and pricing strategies.

Regulatory compliance requirements impose additional costs and operational complexity, particularly regarding food safety standards, labeling requirements, and sustainability certifications. Import regulations and trade policies can disrupt supply chains and affect product availability, creating market uncertainty for both producers and consumers.

Product innovation presents substantial opportunities for market expansion through development of new flavors, preparation methods, and packaging formats that appeal to evolving consumer preferences. Value-added products including seasoned, marinated, and ready-to-eat options command premium pricing while addressing convenience demands.

E-commerce expansion offers significant growth potential, particularly for specialty and premium seafood products that benefit from direct-to-consumer distribution models. Online platforms enable broader market reach and facilitate introduction of niche products that might not achieve sufficient shelf space in traditional retail environments.

Sustainability positioning creates opportunities for brands that can effectively communicate environmental responsibility and ethical sourcing practices. Certification programs and traceability initiatives appeal to environmentally conscious consumers willing to pay premium prices for responsibly sourced products.

Foodservice partnerships represent untapped potential for frozen seafood suppliers to expand into restaurant, institutional, and catering markets. Private label development offers opportunities to work with major retailers in creating exclusive product lines that drive customer loyalty and improve margin structures.

Supply chain dynamics significantly influence market performance, with global sourcing networks providing diverse product options while creating vulnerability to international disruptions. Seasonal availability of certain species creates predictable supply fluctuations that impact pricing and product availability throughout the year.

Consumer education initiatives by industry associations and health organizations continue to drive awareness of seafood benefits, contributing to sustained demand growth. Cooking education programs and recipe development help overcome preparation barriers that historically limited frozen seafood adoption among less experienced home cooks.

Technology integration throughout the supply chain improves product quality, traceability, and efficiency. Advanced freezing techniques preserve texture and flavor more effectively, while smart packaging solutions provide better protection and consumer information.

Competitive dynamics intensify as traditional seafood companies face competition from new entrants focusing on specific market segments or innovative approaches to product development and marketing. Market consolidation trends create larger, more efficient operations while potentially reducing competition in certain product categories.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive surveys of consumers, retailers, and industry participants to gather firsthand perspectives on market trends, preferences, and challenges.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market baselines and identify growth patterns. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market assessments.

Quantitative analysis utilizes statistical modeling to project market trends and identify correlation patterns between various market factors. Qualitative research through expert interviews and focus groups provides deeper insights into consumer motivations and industry dynamics that influence market development.

Market segmentation analysis examines performance across product categories, distribution channels, and geographic regions to identify specific growth opportunities and challenges. Competitive intelligence gathering provides insights into competitor strategies, product positioning, and market share dynamics.

Northeast region demonstrates the highest per-capita consumption of frozen and canned seafood, driven by established seafood traditions and higher income levels that support premium product purchases. Coastal markets in this region show particular strength in frozen seafood segments, with approximately 35% market share of premium frozen fish products.

Southeast markets exhibit strong growth in both frozen and canned categories, supported by cultural preferences for seafood and growing Hispanic populations. Florida and Texas lead regional consumption, with canned seafood products capturing approximately 42% market share in these states due to convenience preferences and price sensitivity.

West Coast regions demonstrate sophisticated consumer preferences for sustainably sourced and premium seafood products. California markets particularly favor frozen seafood options, with health-conscious consumers driving demand for organic and wild-caught varieties that command premium pricing.

Midwest and Mountain regions represent significant growth opportunities, as improved distribution networks and consumer education initiatives increase seafood acceptance in traditionally meat-focused markets. Canned seafood products show particular strength in these regions, capturing approximately 38% market share due to shelf stability and affordability advantages.

Market leadership is distributed among several major players who have established strong brand recognition and distribution networks across multiple product categories. The competitive environment features both large multinational corporations and specialized seafood companies that focus on specific market segments.

Product category segmentation reveals distinct performance patterns across frozen and canned seafood varieties. Frozen seafood includes fish fillets, shellfish, whole fish, and value-added products, while canned seafood encompasses traditional varieties like tuna and salmon alongside specialty products and ready-to-eat meals.

By Product Type:

By Distribution Channel:

Frozen fish category demonstrates robust growth driven by consumer preference for convenient, high-quality protein options. Salmon products lead this segment with strong health positioning and versatile preparation options, while white fish varieties like cod and tilapia appeal to budget-conscious consumers seeking mild-flavored options.

Frozen shellfish segment shows premium positioning with higher price points justified by perceived quality and special occasion consumption patterns. Shrimp products dominate this category with approximately 65% segment share, supported by versatility and broad consumer acceptance across demographic groups.

Canned tuna category maintains market leadership in preserved seafood, benefiting from established consumer habits and protein-focused dietary trends. Premium tuna products featuring sustainable sourcing and superior quality command growing market share as consumers become more discerning about product origins and processing methods.

Value-added products represent the fastest-growing segment, with breaded and seasoned options appealing to convenience-seeking consumers. Ready-to-cook products eliminate preparation barriers while maintaining nutritional benefits, creating new consumption occasions and expanding market reach to less experienced seafood consumers.

Manufacturers benefit from diverse revenue streams across multiple product categories and distribution channels, enabling risk mitigation and market expansion opportunities. Operational efficiencies in processing and packaging create cost advantages while improving product quality and shelf life.

Retailers gain from seafood’s role as a traffic driver and margin contributor, with frozen and canned options offering inventory advantages over fresh seafood. Private label opportunities allow retailers to differentiate their offerings while capturing higher margins through exclusive product development.

Consumers receive convenient access to nutritious protein sources that support healthy dietary goals without requiring specialized preparation skills. Cost benefits make seafood accessible to broader demographic segments, while extended shelf life reduces food waste and shopping frequency requirements.

Foodservice operators benefit from consistent product availability and standardized portion control that simplifies menu planning and cost management. Quality consistency in frozen and canned products enables reliable menu execution across multiple locations and service periods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus emerges as a dominant trend, with consumers increasingly demanding transparency in sourcing practices and environmental impact. Certification programs like MSC (Marine Stewardship Council) and ASC (Aquaculture Stewardship Council) gain importance as purchasing decision factors, particularly among younger consumers willing to pay premium prices for responsibly sourced products.

Premium positioning trends show consumers trading up to higher-quality frozen and canned seafood options that offer superior taste, texture, and nutritional profiles. Wild-caught products command premium pricing over farm-raised alternatives, while organic certifications create additional differentiation opportunities in competitive markets.

Convenience innovation drives product development toward ready-to-eat and minimal preparation options that fit busy lifestyles. Portion control packaging appeals to smaller households and health-conscious consumers, while microwave-ready products eliminate cooking barriers for inexperienced seafood consumers.

Flavor diversification reflects America’s growing culinary sophistication, with ethnic flavors and gourmet preparations expanding beyond traditional seafood seasonings. Global cuisine influences introduce Asian, Mediterranean, and Latin American flavor profiles that appeal to diverse demographic segments and create new consumption occasions.

Technology advancement in freezing and canning processes improves product quality while reducing processing costs. Individual Quick Freezing (IQF) technology preserves texture and nutritional content more effectively, while advanced packaging solutions extend shelf life and improve product presentation.

Supply chain optimization initiatives focus on reducing environmental impact while improving efficiency and traceability. Blockchain technology implementation enables complete product tracking from ocean to consumer, addressing growing demands for transparency and authenticity verification.

Strategic partnerships between seafood processors and major retailers create exclusive product lines and improved market access. Vertical integration trends see companies expanding control over supply chains to ensure quality consistency and cost management.

Regulatory developments include updated food safety standards and labeling requirements that increase compliance costs but improve consumer confidence. Sustainability regulations drive industry adoption of responsible sourcing practices and environmental impact reduction initiatives.

MarkWide Research recommends that industry participants focus on product innovation and sustainability positioning to capture growing consumer interest in responsible consumption. Investment priorities should emphasize technology upgrades that improve product quality while reducing environmental impact and operational costs.

Market expansion strategies should target underserved geographic regions and demographic segments through tailored product offerings and educational marketing campaigns. E-commerce capabilities require development to capture growing online sales opportunities and enable direct consumer relationships.

Partnership opportunities with retailers, foodservice operators, and health organizations can expand market reach while building brand credibility. Private label development offers revenue diversification while leveraging manufacturing capabilities and market expertise.

Risk management strategies should address supply chain vulnerabilities through diversified sourcing and inventory management practices. Price hedging mechanisms can help manage commodity price volatility while maintaining competitive pricing structures.

Market projections indicate continued growth driven by health consciousness trends and convenience demands that favor preserved seafood products. Demographic shifts including aging population and increasing Hispanic representation support sustained demand expansion across multiple product categories.

Technology integration will continue improving product quality and supply chain efficiency, while sustainability initiatives become increasingly important for brand differentiation and consumer acceptance. MWR analysis suggests that companies investing in responsible sourcing and environmental stewardship will capture disproportionate market share growth.

Innovation opportunities in product development, packaging, and distribution methods will create new market segments and revenue streams. Plant-based seafood alternatives may create competitive pressure, but traditional seafood’s nutritional advantages and taste profiles provide defensive positioning.

Growth projections anticipate continued expansion at approximately 5.8% CAGR over the next five years, with frozen seafood segments outperforming canned varieties due to quality perceptions and preparation versatility. Premium product segments are expected to grow at 8.2% annually as consumers increasingly prioritize quality and sustainability over price considerations.

The US frozen and canned seafood market demonstrates remarkable resilience and growth potential, supported by fundamental trends in health consciousness, convenience demands, and demographic shifts that favor seafood consumption. Market dynamics reveal a mature industry with established infrastructure and distribution networks, yet significant opportunities remain for innovation and expansion.

Competitive advantages will increasingly depend on sustainability positioning, product quality, and convenience features that address evolving consumer preferences. Technology investments in processing, packaging, and supply chain management will determine long-term success as companies navigate commodity price volatility and regulatory requirements.

Strategic positioning should emphasize the unique nutritional benefits and convenience advantages that frozen and canned seafood provide compared to fresh alternatives and competing protein sources. Market participants who successfully balance quality, sustainability, and affordability will capture the greatest share of future growth opportunities in this dynamic and essential food industry segment.

What is Frozen and Canned Seafood?

Frozen and canned seafood refers to various types of fish and shellfish that are preserved through freezing or canning processes. These methods help maintain the quality, flavor, and nutritional value of seafood for extended periods, making it convenient for consumers.

What are the key players in the US Frozen and Canned Seafood Market?

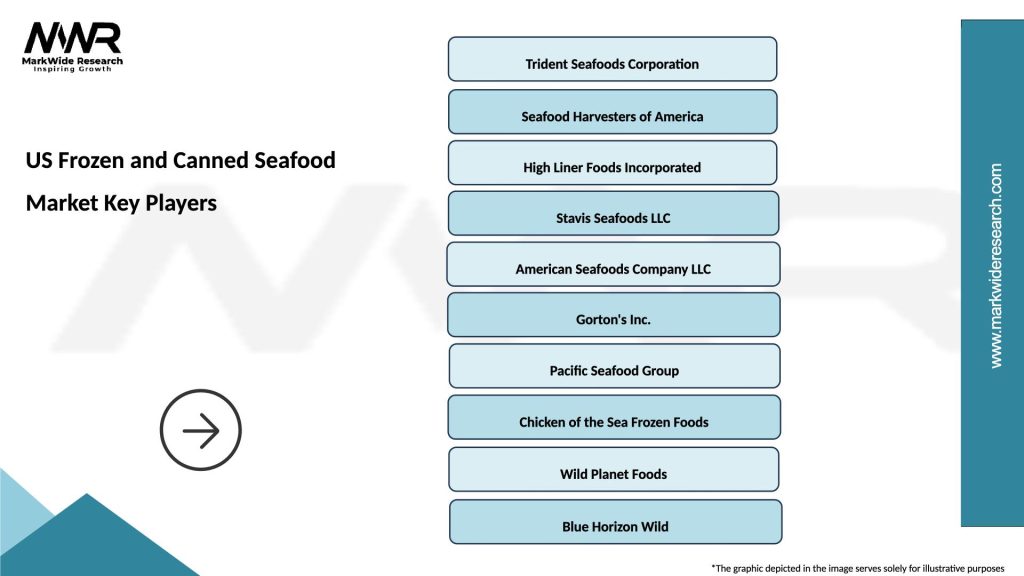

Key players in the US Frozen and Canned Seafood Market include companies like Bumble Bee Foods, Trident Seafoods, and Chicken of the Sea, which are known for their extensive product ranges and distribution networks. These companies compete on quality, sustainability, and innovation among others.

What are the growth factors driving the US Frozen and Canned Seafood Market?

The US Frozen and Canned Seafood Market is driven by increasing consumer demand for convenient meal options, rising health consciousness, and the popularity of seafood as a source of lean protein. Additionally, advancements in freezing and canning technologies enhance product quality and shelf life.

What challenges does the US Frozen and Canned Seafood Market face?

Challenges in the US Frozen and Canned Seafood Market include fluctuating raw material prices, sustainability concerns regarding overfishing, and competition from alternative protein sources. These factors can impact supply chains and consumer preferences.

What opportunities exist in the US Frozen and Canned Seafood Market?

Opportunities in the US Frozen and Canned Seafood Market include the growing trend of online grocery shopping, increasing interest in sustainable seafood options, and the potential for product innovation, such as ready-to-eat meals and gourmet offerings.

What trends are shaping the US Frozen and Canned Seafood Market?

Trends in the US Frozen and Canned Seafood Market include a rise in demand for organic and sustainably sourced products, the introduction of new flavors and recipes, and an increase in health-focused marketing strategies. These trends reflect changing consumer preferences towards healthier and more responsible food choices.

US Frozen and Canned Seafood Market

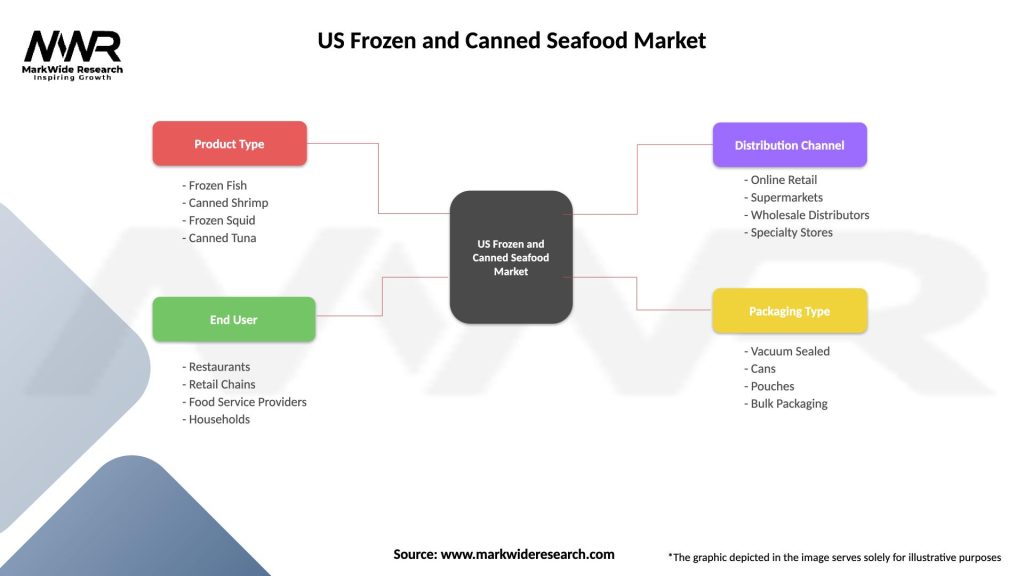

| Segmentation Details | Description |

|---|---|

| Product Type | Frozen Fish, Canned Shrimp, Frozen Squid, Canned Tuna |

| End User | Restaurants, Retail Chains, Food Service Providers, Households |

| Distribution Channel | Online Retail, Supermarkets, Wholesale Distributors, Specialty Stores |

| Packaging Type | Vacuum Sealed, Cans, Pouches, Bulk Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Frozen and Canned Seafood Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at