444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US frequency control and timing devices market represents a critical segment of the broader electronics and telecommunications infrastructure, experiencing robust growth driven by increasing demand for precision timing solutions across multiple industries. Frequency control devices including crystal oscillators, atomic clocks, and timing modules serve as the backbone for modern electronic systems, ensuring accurate synchronization in applications ranging from telecommunications networks to aerospace systems.

Market dynamics indicate substantial expansion opportunities, with the sector demonstrating a projected compound annual growth rate of 6.2% CAGR through the forecast period. This growth trajectory reflects the increasing complexity of electronic systems and the critical need for precise timing solutions in emerging technologies such as 5G networks, Internet of Things (IoT) devices, and autonomous vehicles.

Industry participants are witnessing heightened demand from telecommunications infrastructure providers, automotive manufacturers, and aerospace companies seeking advanced timing solutions. The market encompasses various product categories including temperature-compensated crystal oscillators (TCXOs), voltage-controlled crystal oscillators (VCXOs), and oven-controlled crystal oscillators (OCXOs), each serving specific precision requirements across different applications.

Regional concentration within the United States shows significant activity in technology hubs including California’s Silicon Valley, Texas technology corridors, and the Northeast manufacturing belt. These regions benefit from proximity to major electronics manufacturers, research institutions, and defense contractors requiring high-precision timing solutions for mission-critical applications.

The US frequency control and timing devices market refers to the domestic industry segment focused on manufacturing, distributing, and servicing electronic components that generate, control, and maintain precise frequency and timing signals essential for electronic system operation. These devices ensure accurate synchronization and signal integrity across diverse applications from consumer electronics to critical infrastructure systems.

Frequency control devices encompass a broad range of products including crystal oscillators, resonators, filters, and timing modules that provide stable reference frequencies for electronic circuits. These components serve as the fundamental timing source for processors, communication systems, and measurement instruments, enabling proper functionality and coordination between different system elements.

Timing devices within this market category include atomic clocks, GPS disciplined oscillators, and network time protocol servers that provide highly accurate time references for applications requiring precise synchronization. These solutions are particularly critical in telecommunications networks, financial trading systems, and scientific instrumentation where timing accuracy directly impacts system performance and reliability.

Strategic market analysis reveals the US frequency control and timing devices sector as a mature yet rapidly evolving industry driven by technological advancement and increasing precision requirements across multiple application domains. The market demonstrates strong fundamentals supported by growing demand from 5G infrastructure deployment, automotive electronics integration, and aerospace modernization programs.

Key growth drivers include the proliferation of connected devices requiring precise timing synchronization, with IoT device deployments contributing approximately 28% of market demand growth. Additionally, the transition to 5G networks necessitates advanced timing solutions capable of supporting ultra-low latency applications and massive device connectivity scenarios.

Competitive landscape features established players alongside emerging technology companies developing innovative solutions for next-generation applications. Market consolidation trends indicate strategic acquisitions and partnerships aimed at expanding product portfolios and enhancing technological capabilities to address evolving customer requirements.

Investment patterns show increased funding directed toward research and development activities focused on miniaturization, power efficiency, and enhanced performance characteristics. These investments support the development of timing solutions suitable for emerging applications including autonomous vehicles, edge computing systems, and advanced manufacturing automation.

Market segmentation analysis reveals distinct growth patterns across different product categories and application sectors, with telecommunications infrastructure representing the largest demand segment followed by automotive and aerospace applications.

Telecommunications infrastructure expansion serves as the primary market driver, with 5G network deployments requiring sophisticated timing solutions to support advanced features including network slicing, ultra-reliable low-latency communications, and massive machine-type communications. These applications demand timing accuracy measured in nanoseconds, driving adoption of high-performance frequency control devices.

Automotive electronics integration represents another significant growth catalyst, as modern vehicles incorporate increasing numbers of electronic control units requiring precise timing coordination. Advanced driver assistance systems (ADAS), infotainment systems, and electric vehicle powertrains all depend on accurate timing signals for optimal performance and safety compliance.

Internet of Things proliferation creates substantial demand for compact, low-power timing solutions suitable for battery-operated devices. IoT applications spanning smart cities, industrial automation, and healthcare monitoring require reliable timing references to ensure proper network synchronization and data integrity across distributed sensor networks.

Aerospace and defense modernization programs drive demand for high-reliability timing solutions capable of operating in harsh environments while maintaining exceptional accuracy. Military communications systems, satellite navigation, and radar applications require timing devices meeting stringent performance specifications and environmental qualification standards.

Data center infrastructure growth necessitates precise timing solutions for server synchronization, network switching, and storage systems. Cloud computing expansion and edge computing deployment create additional demand for timing devices supporting high-speed data processing and low-latency applications.

High development costs associated with advanced timing solutions present significant barriers for market participants, particularly smaller companies seeking to compete with established players. The substantial investment required for research and development, testing facilities, and manufacturing capabilities limits market entry opportunities and constrains innovation pace.

Complex qualification processes required for critical applications create lengthy product development cycles and increase time-to-market challenges. Aerospace, defense, and telecommunications applications often require extensive testing and certification procedures that can span multiple years, limiting responsiveness to market opportunities.

Supply chain vulnerabilities affecting raw materials and specialized components pose ongoing challenges for manufacturers. The concentration of quartz crystal production in specific geographic regions creates potential supply disruptions, while semiconductor shortages impact integrated timing solution availability.

Technical complexity barriers limit adoption in certain applications where simpler timing solutions may be perceived as adequate. The sophisticated nature of advanced frequency control devices requires specialized expertise for proper implementation, potentially restricting market penetration in cost-sensitive applications.

Competitive pricing pressure from international manufacturers affects profit margins and limits investment capacity for domestic companies. Low-cost alternatives from overseas suppliers challenge premium positioning strategies, particularly in high-volume consumer electronics applications where timing precision requirements may be less stringent.

Emerging technology applications present substantial growth opportunities for frequency control and timing device manufacturers. Quantum computing systems, advanced radar technologies, and next-generation satellite communications require ultra-precise timing solutions that exceed current performance standards, creating demand for innovative products.

Industrial automation expansion offers significant market potential as manufacturing facilities adopt Industry 4.0 technologies requiring synchronized operation across multiple systems. Time-sensitive networking (TSN) implementations in industrial environments demand precise timing coordination to ensure deterministic communication and real-time control capabilities.

Smart infrastructure development including smart grids, intelligent transportation systems, and connected city initiatives creates new application areas for timing devices. These systems require accurate time synchronization to coordinate distributed operations and ensure reliable service delivery across complex infrastructure networks.

Medical device innovation represents an emerging opportunity segment where precise timing enables advanced diagnostic and therapeutic capabilities. Medical imaging systems, patient monitoring devices, and surgical robotics increasingly rely on accurate timing references for optimal performance and patient safety.

Space commercialization trends drive demand for space-qualified timing solutions supporting satellite constellations, space exploration missions, and commercial space activities. The growing commercial space sector requires reliable timing devices capable of operating in the harsh space environment while maintaining exceptional accuracy.

Technology evolution patterns within the frequency control and timing devices market demonstrate accelerating innovation cycles driven by increasing performance requirements and miniaturization demands. MEMS-based timing solutions are gaining market share due to their compact size, lower power consumption, and improved shock resistance compared to traditional quartz-based devices.

Customer requirements continue evolving toward integrated solutions combining multiple timing functions in single packages, reducing system complexity and board space requirements. This trend drives development of system-in-package (SiP) solutions incorporating oscillators, phase-locked loops, and timing distribution circuits in unified modules.

Manufacturing trends emphasize automation and quality control improvements to meet increasing precision requirements while maintaining cost competitiveness. Advanced manufacturing techniques including automated assembly, precision testing, and statistical process control enable production of high-performance timing devices at scale.

Market consolidation dynamics reflect strategic positioning by major players seeking to expand technological capabilities and market reach through acquisitions and partnerships. These activities create opportunities for specialized companies while potentially limiting competition in certain market segments.

Regulatory influences shape product development priorities, particularly in telecommunications and aerospace applications where timing accuracy standards continue becoming more stringent. Compliance with evolving regulations drives continuous improvement in device performance and reliability characteristics.

Comprehensive market analysis employed multiple research approaches to ensure accurate and reliable market insights. Primary research activities included structured interviews with industry executives, technology experts, and key customers across major application segments to understand market trends, challenges, and growth opportunities.

Secondary research methodology encompassed extensive analysis of industry reports, company financial statements, patent filings, and technical publications to identify market patterns and competitive dynamics. This approach provided historical context and quantitative data supporting market projections and trend analysis.

Data validation processes incorporated cross-referencing multiple information sources and expert review to ensure accuracy and reliability of market findings. Statistical analysis techniques were applied to identify significant trends and correlations within the collected data sets.

Market modeling approaches utilized both bottom-up and top-down analysis methodologies to develop comprehensive market size estimates and growth projections. These models incorporated various factors including technology adoption rates, application growth patterns, and competitive dynamics.

Expert consultation involved engagement with industry specialists, academic researchers, and technology consultants to validate findings and gain insights into emerging trends and future market developments. This collaborative approach enhanced the depth and accuracy of the market analysis.

West Coast dominance characterizes the US frequency control and timing devices market, with California representing approximately 35% of total market activity. Silicon Valley’s concentration of technology companies, semiconductor manufacturers, and telecommunications equipment providers creates substantial demand for advanced timing solutions across multiple application categories.

Texas technology corridor emerges as a significant market region, accounting for roughly 18% of market share through its diverse industrial base including aerospace, defense, and telecommunications sectors. The state’s favorable business environment and skilled workforce attract timing device manufacturers and their customers.

Northeast manufacturing belt maintains strong market presence with approximately 22% market share, driven by aerospace and defense contractors, automotive suppliers, and industrial equipment manufacturers. This region benefits from established supply chains and proximity to major research universities supporting innovation activities.

Southeast growth markets demonstrate increasing activity in automotive electronics and telecommunications infrastructure, representing about 15% of market activity. The region’s expanding manufacturing base and favorable cost structure attract both domestic and international companies establishing operations.

Midwest industrial centers contribute approximately 10% of market demand through automotive manufacturing, industrial automation, and agricultural technology applications. These markets emphasize cost-effective timing solutions suitable for high-volume production requirements while maintaining adequate performance characteristics.

Market leadership is distributed among several established companies with strong technological capabilities and comprehensive product portfolios serving diverse application requirements.

Competitive strategies emphasize technological differentiation, customer service excellence, and application-specific solution development. Companies invest heavily in research and development to maintain technological leadership while building strong customer relationships through technical support and collaborative product development.

Innovation focus areas include MEMS technology advancement, integrated solution development, and performance enhancement for emerging applications. Strategic partnerships with customers and technology providers enable access to new markets and application opportunities.

By Product Type:

By Application:

By End-User:

Crystal Oscillator Segment maintains market leadership through proven reliability and cost-effectiveness across diverse applications. Temperature-compensated crystal oscillators (TCXOs) demonstrate strong growth in mobile communications and automotive applications where moderate precision requirements combine with size and power constraints.

MEMS Oscillator Technology gains market traction with approximately 12% annual growth rate driven by superior shock resistance and integration capabilities. These devices particularly appeal to automotive and industrial applications where harsh operating environments challenge traditional quartz-based solutions.

Atomic Clock Solutions serve specialized high-precision applications including telecommunications synchronization and scientific instrumentation. While representing a smaller market segment by volume, atomic clocks command premium pricing due to their exceptional accuracy and stability characteristics.

Timing Module Integration reflects market trends toward system-level solutions combining multiple timing functions. These products reduce design complexity and board space requirements while providing optimized performance for specific applications including 5G infrastructure and automotive electronics.

Frequency Synthesizer Applications expand in software-defined radio and test equipment markets where programmable frequency generation enables flexible system architectures. These devices support multiple communication standards and measurement requirements through software configuration rather than hardware changes.

Manufacturers benefit from expanding market opportunities driven by technology advancement and increasing precision requirements across multiple application sectors. The growing complexity of electronic systems creates demand for more sophisticated timing solutions, enabling premium pricing and improved profit margins for innovative products.

Technology developers gain access to substantial research and development opportunities supported by customer willingness to invest in advanced timing capabilities. Collaborative development programs with major customers provide funding and market validation for next-generation timing technologies.

End-users achieve improved system performance and reliability through access to advanced timing solutions tailored to specific application requirements. Integrated timing modules reduce design complexity and time-to-market while ensuring optimal performance characteristics for target applications.

Supply chain partners benefit from stable demand patterns and long-term customer relationships characteristic of the timing device market. The critical nature of timing components in electronic systems creates opportunities for value-added services including technical support and custom solution development.

Investors find attractive opportunities in a market segment demonstrating consistent growth driven by fundamental technology trends. The essential nature of timing devices across multiple industries provides defensive characteristics while emerging applications offer growth potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trends drive development of increasingly compact timing solutions suitable for space-constrained applications including wearable devices and IoT sensors. Advanced packaging technologies enable integration of multiple timing functions while reducing overall footprint and power consumption.

Integration advancement reflects customer preferences for system-level solutions combining timing generation, distribution, and control functions. These integrated approaches reduce design complexity and improve overall system performance while enabling cost optimization through reduced component count.

Performance enhancement continues across all timing device categories, with manufacturers developing solutions offering improved frequency stability, reduced phase noise, and enhanced environmental tolerance. These improvements support emerging applications with increasingly stringent timing requirements.

Power efficiency optimization becomes increasingly important as battery-powered applications proliferate. Low-power timing solutions enable extended operating life for portable devices while supporting always-on functionality in IoT applications.

Customization capabilities expand to address specific application requirements across diverse market segments. Manufacturers offer programmable timing solutions and application-specific variants to meet unique customer needs while maintaining cost-effective production volumes.

Supply chain localization gains importance as companies seek to reduce dependence on international suppliers and improve supply chain resilience. Domestic manufacturing capabilities become competitive advantages, particularly for defense and critical infrastructure applications.

Technology partnerships between timing device manufacturers and system companies accelerate development of application-specific solutions. These collaborations enable optimization of timing performance for specific use cases while reducing development time and costs for both parties.

Manufacturing investments in advanced production capabilities support increasing precision requirements and volume demands. Automated assembly systems and enhanced quality control processes enable production of high-performance timing devices at competitive costs.

Acquisition activities reshape the competitive landscape as major players seek to expand technological capabilities and market reach. Strategic acquisitions provide access to specialized technologies and customer relationships while consolidating market position.

Standards development activities influence product requirements across multiple application areas. Industry participation in standards organizations ensures timing device capabilities align with evolving system requirements and interoperability needs.

Research initiatives focus on next-generation timing technologies including quantum-based solutions and advanced MEMS devices. These long-term development programs position companies for future market opportunities while addressing fundamental performance limitations.

Investment priorities should focus on emerging application areas offering substantial growth potential, particularly 5G infrastructure, automotive electronics, and IoT devices. Companies developing specialized solutions for these markets can achieve premium positioning and strong customer relationships.

Technology development efforts should emphasize integration capabilities and system-level solutions addressing customer needs for simplified designs and improved performance. Collaborative development programs with key customers provide market validation and competitive differentiation.

Market expansion strategies should consider both horizontal diversification into new application areas and vertical integration of complementary technologies. Strategic partnerships and acquisitions can accelerate market entry while providing access to specialized capabilities.

Operational excellence initiatives should focus on manufacturing efficiency and quality improvements supporting competitive positioning in price-sensitive markets. Automation investments and process optimization enable cost reduction while maintaining performance standards.

Customer relationship management should emphasize technical support and collaborative development to strengthen competitive positioning. Long-term partnerships with key customers provide stability and growth opportunities while reducing competitive threats.

Market growth projections indicate continued expansion driven by technology advancement and increasing precision requirements across multiple application sectors. MarkWide Research analysis suggests the market will maintain robust growth momentum with projected compound annual growth rates exceeding 6% through 2030.

Technology evolution will emphasize integration capabilities, power efficiency, and enhanced performance characteristics supporting emerging applications. MEMS-based timing solutions are expected to gain significant market share, potentially reaching 25% of total market volume within the forecast period.

Application diversification will create new growth opportunities as timing devices find applications in previously untapped markets including renewable energy systems, smart infrastructure, and advanced manufacturing. These emerging applications may contribute 15-20% of market growth over the next decade.

Competitive dynamics will continue evolving through strategic partnerships, acquisitions, and technology licensing agreements. Market consolidation trends may result in fewer but stronger competitors with comprehensive product portfolios and global market reach.

Innovation focus will shift toward quantum timing technologies, advanced MEMS devices, and integrated system solutions addressing next-generation application requirements. These developments will enable new performance levels while supporting the continued evolution of electronic systems across all market segments.

The US frequency control and timing devices market demonstrates strong fundamentals and promising growth prospects driven by increasing precision requirements across diverse application sectors. Technology advancement in 5G communications, automotive electronics, and IoT devices creates substantial demand for innovative timing solutions exceeding current performance standards.

Market participants benefit from expanding opportunities while facing challenges including competitive pricing pressure and complex qualification requirements. Success factors include technological innovation, customer relationship management, and operational excellence supporting competitive positioning in evolving market conditions.

Strategic positioning requires focus on emerging applications offering premium pricing opportunities while maintaining competitiveness in established markets through cost optimization and performance enhancement. Companies developing integrated solutions and system-level capabilities are well-positioned for future growth.

Long-term outlook remains positive with continued market expansion supported by fundamental technology trends and increasing electronic system complexity. The essential nature of timing devices across multiple industries provides defensive characteristics while emerging applications offer substantial growth potential for innovative companies.

What is Frequency Control and Timing Devices?

Frequency Control and Timing Devices are essential components used to maintain the accuracy and stability of time and frequency in various electronic systems. They are widely utilized in telecommunications, aerospace, and consumer electronics applications.

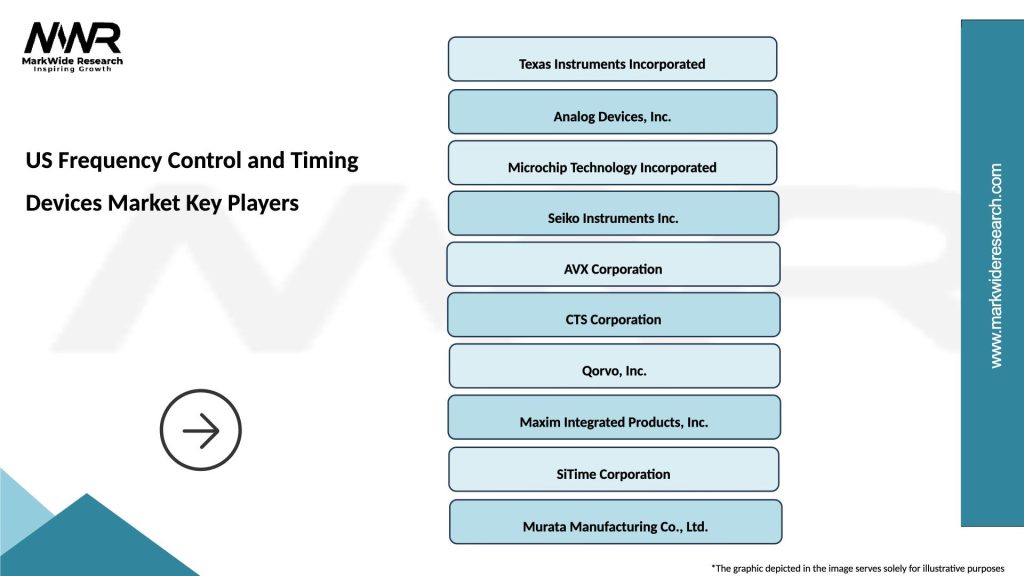

What are the key players in the US Frequency Control and Timing Devices Market?

Key players in the US Frequency Control and Timing Devices Market include Texas Instruments, Seiko Instruments, and Microchip Technology, among others. These companies are known for their innovative solutions and extensive product offerings in frequency control technologies.

What are the growth factors driving the US Frequency Control and Timing Devices Market?

The growth of the US Frequency Control and Timing Devices Market is driven by the increasing demand for high-precision timing solutions in telecommunications and the rise of IoT applications. Additionally, advancements in technology are enhancing the performance and reliability of these devices.

What challenges does the US Frequency Control and Timing Devices Market face?

The US Frequency Control and Timing Devices Market faces challenges such as the rapid pace of technological change and the need for continuous innovation. Additionally, competition from alternative technologies can impact market growth.

What opportunities exist in the US Frequency Control and Timing Devices Market?

Opportunities in the US Frequency Control and Timing Devices Market include the growing adoption of smart devices and the expansion of 5G networks. These trends are expected to create demand for advanced timing solutions that can support higher frequencies and improved accuracy.

What trends are shaping the US Frequency Control and Timing Devices Market?

Trends shaping the US Frequency Control and Timing Devices Market include the miniaturization of components and the integration of frequency control devices into more complex systems. Additionally, there is a growing focus on energy-efficient solutions to meet sustainability goals.

US Frequency Control and Timing Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Quartz Crystals, Oscillators, Frequency Synthesizers, Atomic Clocks |

| Technology | MEMS, SAW, TCXO, OCXO |

| End User | Aerospace, Telecommunications, Consumer Electronics, Industrial Automation |

| Application | Signal Processing, Timekeeping, Synchronization, Data Communication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Frequency Control and Timing Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at