444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Fourth-Party Logistics (4PL) market represents a transformative segment within the broader supply chain management industry, characterized by comprehensive integration and strategic oversight of multiple logistics service providers. Fourth-party logistics providers serve as supply chain integrators, managing and coordinating the activities of various third-party logistics providers while offering strategic planning and technology integration services. The market has experienced substantial growth driven by increasing complexity in global supply chains, rising demand for end-to-end visibility, and the need for cost optimization across logistics operations.

Market dynamics indicate robust expansion with the sector growing at a compound annual growth rate (CAGR) of 6.8%, reflecting strong adoption across manufacturing, retail, automotive, and healthcare industries. Digital transformation initiatives have accelerated 4PL adoption, with companies seeking integrated solutions that combine physical logistics management with advanced analytics, artificial intelligence, and real-time tracking capabilities. The market benefits from increasing outsourcing trends, with 72% of Fortune 500 companies now utilizing some form of fourth-party logistics services to enhance supply chain efficiency and reduce operational complexity.

Technology integration remains a cornerstone of 4PL services, with providers leveraging cloud-based platforms, Internet of Things (IoT) sensors, and machine learning algorithms to optimize supply chain performance. The market demonstrates strong regional concentration in major industrial hubs, with significant presence in the Northeast, Southeast, and West Coast regions where manufacturing and distribution activities are most concentrated.

The US Fourth-Party Logistics (4PL) market refers to the comprehensive ecosystem of service providers that act as supply chain integrators, managing and coordinating multiple third-party logistics providers while offering strategic planning, technology integration, and end-to-end supply chain optimization services. Fourth-party logistics represents an evolution beyond traditional logistics outsourcing, encompassing strategic partnership models where 4PL providers assume responsibility for designing, implementing, and managing entire supply chain networks on behalf of their clients.

Core characteristics of 4PL services include supply chain strategy development, vendor management, technology integration, performance monitoring, and continuous optimization. Unlike traditional logistics providers that focus on specific operational functions, 4PL providers offer holistic supply chain management solutions that span procurement, manufacturing, distribution, and customer fulfillment processes. The model emphasizes collaboration, transparency, and shared risk-reward structures that align provider incentives with client objectives.

Service delivery models within the 4PL market range from comprehensive supply chain takeover arrangements to specialized consulting and integration services. The market encompasses both asset-light providers that focus on management and coordination, as well as hybrid models that combine strategic oversight with selective asset ownership to ensure service quality and control.

The US Fourth-Party Logistics market demonstrates exceptional growth momentum driven by increasing supply chain complexity and the imperative for integrated logistics solutions. Market expansion is fueled by digital transformation initiatives, with 68% of enterprises reporting improved supply chain visibility and cost reduction through 4PL partnerships. The sector benefits from strong demand across multiple industries, particularly in manufacturing, retail, and healthcare sectors where supply chain optimization directly impacts competitive advantage.

Key market drivers include the growing complexity of global supply chains, increasing focus on core business competencies, and the need for advanced technology integration without significant capital investment. Fourth-party logistics providers offer compelling value propositions through their ability to leverage economies of scale, implement best practices across multiple clients, and provide access to cutting-edge logistics technologies. The market shows strong resilience and adaptability, with providers successfully navigating supply chain disruptions and evolving customer requirements.

Competitive dynamics feature a mix of established logistics giants, specialized 4PL providers, and technology-focused startups that bring innovative solutions to traditional supply chain challenges. Market consolidation trends are evident as larger providers acquire specialized capabilities and smaller firms seek scale advantages through strategic partnerships. The sector demonstrates strong growth potential with expanding service offerings and increasing penetration across industry verticals.

Strategic market insights reveal several critical trends shaping the US Fourth-Party Logistics landscape:

Market maturation is evident through the development of standardized service frameworks, performance metrics, and industry best practices. Client expectations continue to evolve toward more sophisticated solutions that combine operational excellence with strategic insights and continuous improvement capabilities.

Supply chain complexity represents the primary driver of 4PL market growth, as companies struggle to manage increasingly intricate global networks involving multiple suppliers, manufacturers, distributors, and customers. Globalization trends have created supply chains that span multiple continents, time zones, and regulatory environments, requiring sophisticated coordination and management capabilities that exceed most companies’ internal resources. The need for specialized expertise in managing these complex networks drives demand for comprehensive 4PL solutions.

Technology advancement serves as a significant market catalyst, with 4PL providers offering access to cutting-edge logistics technologies without requiring substantial client investment. Digital transformation initiatives across industries create demand for integrated technology platforms that can connect disparate systems, provide real-time visibility, and enable data-driven decision making. Companies recognize that partnering with 4PL providers offers faster access to advanced capabilities compared to internal development efforts.

Cost optimization pressures continue to drive 4PL adoption as companies seek to reduce logistics expenses while maintaining or improving service levels. Economic efficiency through economies of scale, shared resources, and optimized network design represents compelling value propositions for organizations facing margin pressure. The ability to convert fixed logistics costs into variable expenses through 4PL partnerships provides additional financial flexibility and risk mitigation.

Focus on core competencies motivates companies to outsource non-core logistics functions to specialized providers, allowing internal resources to concentrate on product development, marketing, and customer relationship management. Strategic resource allocation becomes more effective when logistics complexity is managed by dedicated experts who can deliver superior results while freeing internal capacity for value-creating activities.

Implementation complexity represents a significant barrier to 4PL adoption, as transitioning to comprehensive logistics outsourcing requires substantial organizational change, system integration, and process redesign. Change management challenges often create resistance within client organizations, particularly when existing internal logistics teams face displacement or role changes. The complexity of integrating multiple systems, processes, and stakeholders can create extended implementation timelines and increased project risks.

Control and visibility concerns persist among potential clients who worry about losing direct oversight of critical supply chain functions. Risk perception regarding dependency on external providers for essential business operations creates hesitation, particularly among companies with highly specialized or sensitive logistics requirements. Some organizations struggle with the cultural shift required to embrace collaborative partnership models rather than traditional vendor relationships.

Cost justification challenges can impede 4PL adoption when the comprehensive nature of services makes direct cost comparisons with internal operations difficult. Return on investment calculations become complex when benefits include intangible factors such as improved flexibility, risk mitigation, and strategic capabilities. Organizations may struggle to quantify the full value proposition, particularly during initial evaluation phases.

Service standardization limitations can restrict 4PL effectiveness for companies with highly unique or specialized logistics requirements. Customization constraints within standardized 4PL service models may not accommodate all client needs, creating gaps between expectations and delivered capabilities. Industry-specific requirements or regulatory compliance needs may exceed standard 4PL service offerings.

E-commerce expansion creates substantial opportunities for 4PL providers as online retailers require sophisticated fulfillment networks, omnichannel distribution capabilities, and rapid delivery options. Digital commerce growth demands integrated solutions that can manage complex inventory allocation, multi-channel order fulfillment, and last-mile delivery coordination. The increasing sophistication of consumer expectations regarding delivery speed and flexibility creates opportunities for 4PL providers to offer specialized e-commerce logistics solutions.

Sustainability initiatives present significant growth opportunities as companies seek to reduce environmental impact while maintaining operational efficiency. Green logistics solutions including carbon footprint optimization, sustainable packaging, and alternative transportation modes align with corporate sustainability goals and regulatory requirements. 4PL providers can differentiate through comprehensive sustainability programs that deliver measurable environmental improvements alongside operational benefits.

Healthcare sector expansion offers specialized opportunities given the industry’s unique requirements for temperature-controlled storage, regulatory compliance, and traceability. Pharmaceutical logistics demands sophisticated cold chain management, serialization capabilities, and regulatory expertise that create barriers to entry while offering premium pricing opportunities. The growing complexity of healthcare supply chains, including personalized medicine and direct-to-patient delivery models, requires specialized 4PL capabilities.

Technology integration services represent expanding opportunities as companies seek to modernize legacy logistics systems and implement advanced analytics capabilities. Digital transformation consulting combined with operational logistics management creates comprehensive value propositions that address both strategic and tactical client needs. The integration of artificial intelligence, machine learning, and IoT technologies into logistics operations creates opportunities for technology-forward 4PL providers.

Competitive intensity within the US 4PL market continues to increase as traditional logistics providers expand service offerings while specialized 4PL companies seek to defend market positions. Service differentiation becomes increasingly important as basic logistics capabilities become commoditized, driving providers to develop unique value propositions through technology, industry expertise, or specialized capabilities. The market demonstrates ongoing consolidation trends as larger providers acquire specialized capabilities and smaller firms seek scale advantages.

Client relationship evolution reflects a shift from transactional vendor arrangements toward strategic partnerships characterized by shared risk-reward structures, long-term commitments, and collaborative planning processes. Partnership models increasingly emphasize mutual investment in technology, process improvement, and capability development. This evolution creates higher barriers to switching while enabling deeper integration and more comprehensive service delivery.

Technology disruption continues to reshape market dynamics as artificial intelligence, machine learning, and automation technologies transform logistics operations. Innovation cycles accelerate the pace of change, requiring 4PL providers to continuously invest in new capabilities while helping clients navigate technological transitions. The democratization of advanced technologies through cloud-based platforms creates opportunities for smaller providers while intensifying competitive pressure on established players.

Regulatory environment influences market dynamics through evolving requirements for supply chain transparency, sustainability reporting, and security compliance. Compliance complexity creates opportunities for 4PL providers with specialized expertise while potentially creating barriers for companies considering insourcing alternatives. According to MarkWide Research analysis, regulatory compliance capabilities represent increasingly important selection criteria for 4PL partnerships.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of findings regarding the US Fourth-Party Logistics market. Primary research includes extensive interviews with industry executives, 4PL service providers, client companies, and technology vendors to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data regarding adoption rates, service preferences, and satisfaction levels across different industry segments and company sizes.

Secondary research incorporates analysis of industry reports, company financial statements, regulatory filings, and academic studies to provide comprehensive market context and validate primary research findings. Data triangulation techniques ensure reliability by comparing insights from multiple sources and methodologies. Industry databases, trade publications, and government statistics provide additional context and supporting data for market sizing and trend analysis.

Market modeling utilizes statistical analysis techniques to project future market trends, growth rates, and segment performance based on historical data and identified market drivers. Scenario analysis considers multiple potential future states to provide robust forecasting that accounts for uncertainty and variability in market conditions. Expert validation processes ensure that analytical conclusions align with industry expertise and practical market realities.

Quality assurance protocols include peer review processes, data verification procedures, and ongoing monitoring of market developments to ensure research accuracy and relevance. Continuous updating of research findings reflects the dynamic nature of the 4PL market and ensures that insights remain current and actionable for market participants and stakeholders.

Northeast region demonstrates the highest concentration of 4PL activity, accounting for approximately 35% of market share due to the presence of major manufacturing centers, ports, and corporate headquarters. New York and New Jersey serve as critical logistics hubs with extensive transportation infrastructure supporting complex supply chain operations. The region benefits from proximity to major consumer markets, international trade gateways, and established logistics service provider networks that facilitate 4PL implementation and operation.

Southeast region represents the fastest-growing market segment with annual growth rates exceeding 8.2%, driven by manufacturing expansion, automotive industry presence, and growing e-commerce fulfillment requirements. Georgia, North Carolina, and Florida serve as key distribution hubs with strategic locations for serving both domestic and international markets. The region’s business-friendly environment, lower operating costs, and improving infrastructure attract both 4PL providers and their clients.

West Coast markets maintain significant 4PL presence focused on international trade, technology sector logistics, and agricultural product distribution. California ports handle substantial import volumes requiring sophisticated logistics coordination and management services. The region’s emphasis on sustainability and environmental compliance creates opportunities for 4PL providers with specialized green logistics capabilities.

Midwest region benefits from central geographic location and strong manufacturing base, with Chicago serving as a major logistics hub connecting East and West Coast markets. The region’s agricultural and industrial diversity creates demand for specialized 4PL services across multiple industry segments. Transportation infrastructure advantages and lower operating costs support competitive 4PL service delivery.

Market leadership is distributed among several categories of providers, each bringing distinct capabilities and competitive advantages to the US 4PL market:

Competitive differentiation increasingly focuses on technology capabilities, industry expertise, and ability to deliver measurable business outcomes rather than traditional logistics metrics alone. Strategic partnerships and acquisition activities continue to reshape the competitive landscape as providers seek to expand capabilities and market reach. The market demonstrates ongoing evolution toward more specialized and technology-enabled service offerings that address specific industry requirements and client challenges.

By Service Type:

By Industry Vertical:

By Company Size:

Manufacturing sector represents the largest 4PL market segment, driven by complex supply chains involving multiple suppliers, production facilities, and distribution channels. Just-in-time manufacturing requirements create demand for precise coordination and real-time visibility across supply networks. The sector benefits from 4PL providers’ ability to manage supplier relationships, optimize inventory levels, and coordinate production scheduling with logistics operations.

Retail and e-commerce demonstrates the highest growth rates within the 4PL market, with omnichannel fulfillment requirements driving demand for sophisticated distribution network management. Consumer expectations for rapid delivery and flexible fulfillment options require integrated solutions that can coordinate inventory across multiple channels and locations. The segment benefits from 4PL providers’ expertise in managing seasonal demand fluctuations and scaling operations dynamically.

Healthcare and pharmaceuticals represent a specialized high-value segment requiring expertise in regulatory compliance, cold chain management, and product traceability. Pharmaceutical logistics demand stringent quality controls, temperature monitoring, and serialization capabilities that create barriers to entry while supporting premium pricing. The segment shows strong growth potential driven by aging demographics and increasing healthcare complexity.

Automotive industry utilizes 4PL services for managing complex supplier networks, coordinating just-in-time delivery, and supporting aftermarket parts distribution. Supply chain precision requirements in automotive manufacturing create demand for sophisticated coordination capabilities and real-time visibility. The segment benefits from 4PL providers’ ability to manage quality requirements and coordinate with multiple tier suppliers.

For Client Companies:

For 4PL Providers:

For Technology Vendors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a transformative trend with 4PL providers implementing machine learning algorithms for demand forecasting, route optimization, and predictive maintenance. AI-powered solutions enable more sophisticated decision-making, automated exception handling, and continuous optimization of supply chain performance. The trend toward intelligent logistics creates competitive advantages for providers with advanced analytical capabilities.

Sustainability and Carbon Reduction initiatives are becoming central to 4PL value propositions as clients seek to meet environmental goals and regulatory requirements. Green logistics solutions include carbon footprint optimization, sustainable packaging, alternative fuel vehicles, and renewable energy utilization. The trend creates opportunities for providers to differentiate through measurable environmental impact improvements.

Real-time Visibility and Transparency continue to evolve with IoT sensors, blockchain technology, and cloud-based platforms providing unprecedented supply chain transparency. End-to-end tracking capabilities enable proactive issue resolution, improved customer communication, and data-driven optimization. The trend toward complete visibility creates competitive pressure for comprehensive monitoring and reporting capabilities.

Omnichannel Fulfillment requirements drive 4PL providers to develop sophisticated inventory allocation and order management capabilities supporting multiple sales channels. Unified commerce strategies require integration across online, retail, and direct-to-consumer channels with flexible fulfillment options. The trend creates demand for advanced technology platforms and operational flexibility.

Supply Chain Resilience has gained prominence following recent disruptions, with 4PL providers developing risk management capabilities, diversified supplier networks, and contingency planning services. Business continuity planning and scenario modeling become essential service components. MarkWide Research data indicates that resilience capabilities are increasingly important selection criteria for 4PL partnerships.

Technology Partnerships between 4PL providers and software companies are accelerating innovation and expanding service capabilities. Strategic alliances enable access to cutting-edge technologies while sharing development costs and risks. Recent partnerships focus on artificial intelligence, robotics, and advanced analytics platforms that enhance operational efficiency and client value delivery.

Acquisition Activity continues to reshape the competitive landscape as larger providers acquire specialized capabilities and smaller firms seek scale advantages. Market consolidation trends focus on technology acquisition, geographic expansion, and industry specialization. Recent transactions demonstrate the premium valuations for companies with advanced technology capabilities and strong client relationships.

Sustainability Initiatives are expanding beyond basic environmental compliance toward comprehensive carbon reduction and circular economy programs. Industry collaboration on sustainability standards and measurement methodologies creates opportunities for differentiation and client value creation. Leading providers are investing in renewable energy, electric vehicle fleets, and sustainable facility operations.

Regulatory Compliance capabilities are expanding to address evolving requirements for supply chain transparency, product traceability, and security compliance. Investment in compliance technology and expertise creates competitive advantages while addressing client risk management needs. Recent developments focus on pharmaceutical serialization, food safety, and customs compliance automation.

Technology Investment should remain a priority for 4PL providers seeking to maintain competitive positioning and deliver superior client value. Artificial intelligence and machine learning capabilities represent essential investments for demand forecasting, optimization, and predictive analytics. Providers should focus on platforms that can integrate across multiple client systems and provide scalable solutions.

Industry Specialization offers opportunities for differentiation and premium pricing through deep expertise in specific sectors. Healthcare, automotive, and e-commerce represent attractive specialization targets with unique requirements and growth potential. Providers should consider developing specialized teams, processes, and technology solutions for target industries.

Partnership Strategies should emphasize long-term collaborative relationships rather than traditional vendor arrangements. Shared risk-reward models align provider and client incentives while creating higher barriers to switching. Successful partnerships require investment in relationship management, performance transparency, and continuous improvement capabilities.

Sustainability Leadership creates opportunities for differentiation and alignment with client corporate responsibility goals. Comprehensive environmental programs should include carbon footprint measurement, reduction initiatives, and reporting capabilities. Providers should consider sustainability as a core competency rather than an add-on service.

Geographic Expansion strategies should focus on regions with strong industrial growth and logistics infrastructure development. Southeast and Southwest regions offer attractive growth opportunities driven by manufacturing expansion and population growth. International expansion should consider markets with similar regulatory environments and business practices.

Market growth trajectory indicates continued expansion with the US 4PL market projected to maintain robust growth rates exceeding 6.5% annually through the next five years. Digital transformation initiatives across industries will drive demand for integrated technology and logistics solutions, creating opportunities for providers with advanced capabilities. The market evolution toward more strategic partnerships and comprehensive service offerings supports sustainable growth and profitability improvements.

Technology advancement will continue to reshape service delivery models with artificial intelligence, robotics, and IoT technologies becoming standard components of 4PL offerings. Automation capabilities will expand beyond warehousing to include transportation, planning, and customer service functions. According to MWR projections, technology-enabled efficiency improvements will drive 15-20% productivity gains across 4PL operations within the next three years.

Industry consolidation trends will accelerate as market leaders seek to expand capabilities and geographic reach through strategic acquisitions. Competitive dynamics will increasingly favor providers with comprehensive technology platforms, industry expertise, and global service capabilities. Smaller specialized providers will need to identify niche markets or consider partnership strategies to remain competitive.

Sustainability requirements will become increasingly important selection criteria as clients face regulatory pressure and stakeholder expectations for environmental responsibility. Carbon neutrality goals and circular economy initiatives will drive demand for specialized green logistics capabilities. Providers that develop leadership positions in sustainability will benefit from competitive differentiation and premium pricing opportunities.

Client expectations will continue to evolve toward more sophisticated solutions that combine operational excellence with strategic insights and continuous innovation. Value-based relationships will replace traditional cost-focused arrangements as clients seek partners that can contribute to business growth and competitive advantage. The future market will reward providers that can demonstrate measurable business impact beyond traditional logistics metrics.

The US Fourth-Party Logistics market represents a dynamic and rapidly evolving sector that plays an increasingly critical role in modern supply chain management. Market fundamentals remain strong with robust growth drivers including supply chain complexity, technology advancement, and the ongoing shift toward strategic outsourcing partnerships. The sector demonstrates resilience and adaptability in addressing evolving client needs while navigating economic uncertainty and technological disruption.

Competitive positioning will increasingly depend on technology capabilities, industry expertise, and the ability to deliver measurable business outcomes rather than traditional logistics metrics alone. Successful providers will be those that can combine operational excellence with strategic insights, advanced analytics, and continuous innovation. The market rewards companies that invest in long-term client relationships and develop comprehensive solutions addressing complex supply chain challenges.

Future success in the 4PL market will require continued investment in technology, sustainability capabilities, and industry specialization while maintaining focus on operational excellence and client value creation. Market opportunities remain substantial for providers that can navigate the evolving landscape and position themselves as strategic partners rather than traditional service vendors. The US Fourth-Party Logistics market is well-positioned for continued growth and evolution as supply chain complexity increases and companies seek more sophisticated logistics solutions.

What is Fourth-Party Logistics (4PL)?

Fourth-Party Logistics (4PL) refers to a logistics model where a company outsources its entire supply chain management to a single provider. This provider manages all aspects of the logistics process, including transportation, warehousing, and inventory management, often integrating technology and data analytics to optimize operations.

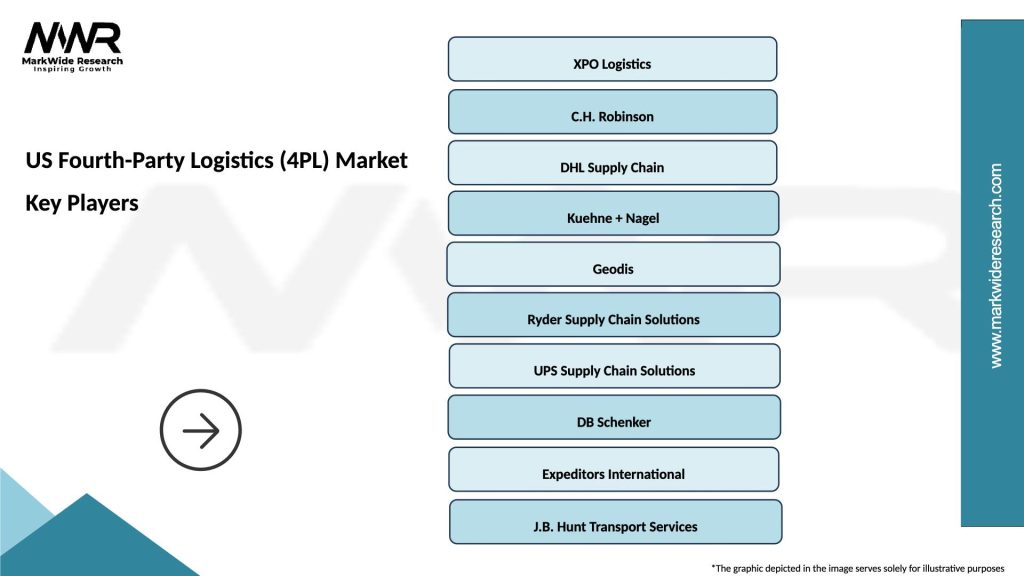

What are the key players in the US Fourth-Party Logistics (4PL) Market?

Key players in the US Fourth-Party Logistics (4PL) Market include companies like Accenture, XPO Logistics, and DHL Supply Chain, which offer comprehensive logistics solutions. These companies leverage advanced technology and strategic partnerships to enhance supply chain efficiency, among others.

What are the main drivers of growth in the US Fourth-Party Logistics (4PL) Market?

The main drivers of growth in the US Fourth-Party Logistics (4PL) Market include the increasing demand for supply chain efficiency, the rise of e-commerce, and the need for integrated logistics solutions. Companies are seeking to streamline operations and reduce costs, which 4PL providers can facilitate.

What challenges does the US Fourth-Party Logistics (4PL) Market face?

The US Fourth-Party Logistics (4PL) Market faces challenges such as the complexity of managing diverse supply chains, potential data security issues, and the need for continuous technological advancements. Additionally, competition among logistics providers can impact pricing and service quality.

What opportunities exist in the US Fourth-Party Logistics (4PL) Market?

Opportunities in the US Fourth-Party Logistics (4PL) Market include the growing trend of digital transformation in logistics, the expansion of e-commerce, and the increasing focus on sustainability. Companies are looking for innovative solutions to enhance their supply chain resilience and reduce their carbon footprint.

What trends are shaping the US Fourth-Party Logistics (4PL) Market?

Trends shaping the US Fourth-Party Logistics (4PL) Market include the adoption of artificial intelligence and machine learning for predictive analytics, the rise of automation in warehousing, and the emphasis on real-time data visibility. These trends are driving efficiency and responsiveness in supply chain operations.

US Fourth-Party Logistics (4PL) Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation Management, Inventory Management, Order Fulfillment, Freight Forwarding |

| End User | Retailers, Manufacturers, E-commerce, Wholesalers |

| Technology | Cloud Computing, IoT Solutions, AI Analytics, Automation Tools |

| Industry Vertical | Consumer Goods, Automotive Supply Chain, Healthcare Logistics, Aerospace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Fourth-Party Logistics (4PL) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at