444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US food spread market represents a dynamic and rapidly evolving segment of the American food industry, encompassing a diverse range of products from traditional peanut butter and jelly to innovative plant-based alternatives and gourmet artisanal spreads. Market dynamics indicate robust growth driven by changing consumer preferences, health consciousness, and the increasing demand for convenient, nutritious food options. The sector has experienced significant transformation over the past decade, with manufacturers adapting to meet evolving dietary requirements and lifestyle changes.

Consumer behavior patterns reveal a growing preference for premium, organic, and specialty spreads, with health-conscious Americans increasingly seeking products with clean labels, reduced sugar content, and enhanced nutritional profiles. The market demonstrates remarkable resilience and adaptability, with traditional players expanding their portfolios while new entrants introduce innovative formulations targeting specific dietary needs such as keto, paleo, and vegan lifestyles.

Distribution channels have evolved significantly, with e-commerce platforms gaining substantial market share alongside traditional retail outlets. The pandemic accelerated online purchasing behaviors, leading to a 35% increase in digital food spread sales. Major grocery chains continue to dominate the landscape, but specialty stores and direct-to-consumer brands are capturing increasing market attention through targeted marketing and unique product offerings.

The US food spread market refers to the comprehensive industry encompassing all spreadable food products consumed across American households, including nut butters, fruit preserves, chocolate spreads, savory spreads, and emerging plant-based alternatives designed for bread, crackers, and various food applications.

Product categories within this market span traditional offerings like peanut butter, which maintains the largest market share, to innovative alternatives including almond butter, sunflower seed spreads, and protein-enhanced formulations. The definition encompasses both mass-market products available in mainstream retail channels and premium artisanal spreads distributed through specialty outlets and online platforms.

Market scope includes various packaging formats from single-serve portions to family-size containers, addressing diverse consumer needs ranging from on-the-go convenience to bulk household consumption. The industry serves multiple demographic segments, from health-conscious millennials seeking organic options to families prioritizing affordability and taste preferences.

Strategic analysis of the US food spread market reveals a sector characterized by steady growth, innovation-driven product development, and increasing consumer sophistication. The market benefits from strong fundamentals including consistent demand, diverse product portfolios, and expanding distribution networks that collectively support sustained expansion across multiple consumer segments.

Key performance indicators demonstrate the market’s resilience, with organic and natural spreads experiencing particularly strong growth rates of 12.5% annually. Traditional categories maintain stability while premium segments drive value growth, reflecting consumers’ willingness to pay higher prices for perceived quality and health benefits. The sector’s adaptability to changing dietary trends positions it favorably for continued expansion.

Competitive landscape features a mix of established multinational corporations and emerging specialty brands, creating a dynamic environment that fosters innovation and consumer choice. Market leaders leverage extensive distribution networks and brand recognition, while smaller players differentiate through unique formulations, sustainable practices, and targeted marketing strategies.

Future projections indicate continued growth driven by product innovation, expanding health consciousness, and the ongoing trend toward premium food products. The integration of functional ingredients, sustainable packaging, and personalized nutrition concepts represents significant opportunities for market participants seeking to capture evolving consumer preferences.

Consumer preferences are increasingly shifting toward healthier, more natural food spread options, with clean-label products experiencing accelerated adoption rates. This trend reflects broader dietary awareness and the growing influence of health and wellness considerations on purchasing decisions across all demographic segments.

Health and wellness trends serve as the primary catalyst for market expansion, with consumers increasingly prioritizing nutritional value and ingredient transparency in their food choices. The growing awareness of the connection between diet and overall health drives demand for spreads offering functional benefits beyond basic nutrition, including protein enhancement, probiotic inclusion, and superfood integration.

Demographic shifts significantly influence market dynamics, particularly the preferences of millennials and Generation Z consumers who demonstrate strong affinity for premium, organic, and ethically sourced products. These demographic groups exhibit higher spending power and willingness to invest in quality food products that align with their values and lifestyle choices.

Convenience culture continues to shape product development and marketing strategies, with busy lifestyles driving demand for portable, ready-to-eat options that provide quick nutrition without compromising taste or health benefits. The rise of remote work and flexible schedules has created new consumption occasions and usage patterns that manufacturers are actively addressing through innovative product formats.

Innovation in food technology enables the development of novel formulations that address specific dietary requirements and preferences, including sugar reduction techniques, texture enhancement, and shelf-life extension without artificial preservatives. These technological advances allow manufacturers to create products that meet evolving consumer expectations while maintaining commercial viability.

Price sensitivity remains a significant challenge, particularly in economic uncertainty periods when consumers may prioritize affordability over premium features. The cost differential between conventional and organic or specialty spreads can limit market penetration among price-conscious demographic segments, requiring manufacturers to balance quality improvements with accessible pricing strategies.

Supply chain complexities present ongoing challenges, especially for products dependent on specific agricultural inputs like nuts and fruits that may experience price volatility due to weather conditions, crop yields, and global trade dynamics. These factors can impact product availability and pricing consistency, affecting both manufacturer margins and consumer accessibility.

Regulatory compliance requirements continue to evolve, particularly regarding labeling standards, nutritional claims, and allergen management. Manufacturers must navigate complex regulatory landscapes while ensuring product safety and accurate consumer communication, which can increase operational costs and development timelines.

Market saturation in traditional categories creates intense competition and pressure on profit margins, requiring companies to invest heavily in differentiation strategies, marketing, and innovation to maintain market share. The proliferation of product options can also lead to consumer confusion and decision fatigue, potentially slowing adoption of new products.

Emerging dietary trends create substantial opportunities for product innovation and market expansion, particularly in areas such as ketogenic-friendly spreads, plant-based protein alternatives, and functional food formulations that address specific health concerns. The growing interest in personalized nutrition opens avenues for customized product offerings tailored to individual dietary requirements and preferences.

E-commerce expansion presents significant growth potential, especially for specialty and artisanal brands that can leverage digital platforms to reach niche consumer segments and build direct relationships with customers. Online channels enable smaller manufacturers to compete effectively against established brands while providing consumers with access to unique products not available in traditional retail settings.

International flavor integration offers opportunities to introduce American consumers to global taste profiles and ingredients, capitalizing on increasing cultural diversity and culinary adventurousness. Products inspired by international cuisines can differentiate brands and create new consumption occasions while appealing to multicultural demographics.

Sustainable packaging innovation represents a growing opportunity as environmental consciousness influences purchasing decisions. Companies investing in eco-friendly packaging solutions and sustainable sourcing practices can capture environmentally aware consumers while potentially reducing long-term operational costs through improved efficiency and waste reduction.

Competitive intensity continues to escalate as established players face challenges from innovative startups and changing consumer preferences. Traditional market leaders are responding through acquisition strategies, product line extensions, and increased investment in research and development to maintain relevance and market position in an evolving landscape.

Consumer education plays an increasingly important role in market dynamics, with brands investing in content marketing and educational initiatives to help consumers understand product benefits and usage applications. This trend reflects the growing sophistication of food consumers who seek detailed information about ingredients, sourcing, and nutritional profiles before making purchasing decisions.

Retail partnership evolution demonstrates changing dynamics between manufacturers and distributors, with retailers increasingly seeking exclusive products and private label opportunities. These partnerships enable retailers to differentiate their offerings while providing manufacturers with guaranteed shelf space and promotional support in competitive market environments.

Technology integration transforms various aspects of the market, from production efficiency improvements to consumer engagement strategies. Digital technologies enable better supply chain management, personalized marketing approaches, and direct-to-consumer sales channels that reshape traditional business models and competitive advantages.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US food spread market. Primary research includes consumer surveys, focus groups, and in-depth interviews with industry stakeholders to capture current preferences, purchasing behaviors, and emerging trends that influence market development.

Secondary research incorporates analysis of industry reports, trade publications, regulatory filings, and company financial statements to establish market baselines and identify growth patterns. This approach provides historical context and enables trend analysis that supports forward-looking projections and strategic recommendations for market participants.

Data validation processes ensure research accuracy through cross-referencing multiple sources and employing statistical analysis techniques to identify and address potential biases or inconsistencies. The methodology includes regular updates to reflect changing market conditions and emerging factors that may influence future market development.

Expert consultation with industry professionals, including manufacturers, retailers, and food scientists, provides additional insights into market dynamics and validates research findings. This collaborative approach enhances the depth and reliability of market analysis while ensuring practical relevance for business decision-making purposes.

Northeast region demonstrates strong market performance driven by higher disposable incomes and sophisticated consumer preferences that favor premium and organic food spread options. Urban centers in this region show particularly high adoption rates for artisanal and specialty products, with 31% of consumers regularly purchasing premium spreads compared to national averages.

West Coast markets lead in health-conscious product adoption, with California consumers driving demand for organic, plant-based, and functional spreads. The region’s emphasis on wellness and sustainable living creates favorable conditions for innovative products, resulting in 26% higher penetration rates for alternative nut and seed-based spreads.

Southern states maintain strong traditional preferences while showing increasing openness to new products, particularly those offering familiar flavors with enhanced nutritional profiles. The region’s large family demographics support bulk purchasing patterns and value-oriented product positioning, with traditional peanut butter maintaining 68% market share in household penetration.

Midwest region represents a balanced market with steady growth across multiple product categories, reflecting diverse consumer preferences and strong retail infrastructure. The region’s agricultural heritage creates consumer awareness of ingredient quality and sourcing practices, supporting demand for locally produced and farm-to-table spread options.

Market leadership remains concentrated among several major players who leverage extensive distribution networks, brand recognition, and significant marketing resources to maintain competitive advantages. These established companies continue to invest in product innovation and strategic acquisitions to address evolving consumer preferences and emerging market segments.

Product type segmentation reveals distinct consumer preferences and growth patterns across various spread categories, with traditional nut butters maintaining the largest market share while alternative and specialty products demonstrate accelerated growth rates. This segmentation approach enables targeted marketing strategies and product development initiatives that address specific consumer needs and preferences.

By Product Type:

By Distribution Channel:

Traditional peanut butter continues to dominate the market through consistent quality, affordability, and broad consumer appeal across all demographic segments. Innovation within this category focuses on organic certification, reduced sodium formulations, and texture variations that maintain familiar taste profiles while addressing health-conscious consumer preferences.

Premium nut butters represent the fastest-growing category, driven by consumer willingness to pay higher prices for perceived quality benefits including organic ingredients, unique flavor combinations, and artisanal production methods. MarkWide Research analysis indicates this segment attracts health-conscious consumers seeking alternatives to traditional options without compromising taste satisfaction.

Fruit-based spreads experience steady demand with growth opportunities in reduced-sugar formulations and exotic fruit varieties that appeal to adventurous consumers. The category benefits from seasonal consumption patterns and gift-giving occasions that support premium pricing and specialty product positioning.

Chocolate spreads maintain strong appeal among younger demographics while expanding into health-conscious formulations that reduce sugar content and incorporate functional ingredients. The category’s indulgent positioning creates opportunities for premium products that justify higher price points through quality ingredients and unique flavor profiles.

Manufacturers benefit from diverse growth opportunities across multiple product categories and consumer segments, enabling portfolio diversification and risk mitigation strategies. The market’s resilience and consistent demand patterns provide stable revenue foundations while innovation opportunities support premium positioning and margin expansion.

Retailers gain from strong category performance and consumer loyalty that drives repeat purchases and basket building opportunities. Food spreads represent high-velocity products that generate consistent foot traffic and enable cross-merchandising strategies with complementary items like bread, crackers, and breakfast products.

Consumers enjoy expanding product choices that address diverse dietary requirements, taste preferences, and lifestyle needs. The market’s evolution toward healthier, more natural options provides access to nutritious, convenient food solutions that support busy lifestyles without compromising quality or satisfaction.

Supply chain partners benefit from stable demand patterns and long-term relationships with established manufacturers, creating predictable business volumes and investment opportunities. The industry’s growth supports agricultural producers, packaging suppliers, and logistics providers through consistent demand for raw materials and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to reshape product formulations and marketing strategies, with consumers increasingly demanding transparency in ingredient sourcing and processing methods. This trend drives manufacturers to simplify recipes, eliminate artificial additives, and communicate production practices that align with consumer values and health consciousness.

Protein enhancement represents a significant trend as consumers seek convenient ways to increase protein intake through familiar food products. Spread manufacturers are incorporating protein powders, nuts, and seeds to create products that serve dual purposes as taste enhancers and nutritional supplements, particularly appealing to fitness-conscious demographics.

Sustainable sourcing becomes increasingly important as environmental awareness influences purchasing decisions across all consumer segments. Companies investing in responsible sourcing practices, fair trade certification, and environmental impact reduction gain competitive advantages while supporting long-term business sustainability and brand reputation.

Personalization trends emerge through customizable products and targeted marketing approaches that address individual dietary requirements and taste preferences. Technology enables manufacturers to offer personalized nutrition solutions and direct-to-consumer products that create unique value propositions and stronger customer relationships.

Strategic acquisitions continue to reshape the competitive landscape as major players seek to expand their portfolios and access emerging market segments. Recent transactions focus on premium, organic, and specialty brands that offer growth potential and alignment with evolving consumer preferences toward health-conscious and sustainable products.

Technology investments in production efficiency and quality control enable manufacturers to improve margins while maintaining product consistency and safety standards. Advanced processing techniques allow for better texture control, extended shelf life, and reduced processing costs that support competitive pricing strategies.

Packaging innovations address consumer convenience needs and environmental concerns through improved functionality and sustainable materials. Developments include resealable containers, portion control packaging, and biodegradable materials that enhance user experience while reducing environmental impact and supporting brand differentiation strategies.

Retail partnerships evolve toward more collaborative relationships that include exclusive product development, co-marketing initiatives, and shared consumer insights. These partnerships enable manufacturers to better understand consumer preferences while providing retailers with differentiated products that drive traffic and loyalty.

Product innovation focus should prioritize health-conscious formulations that address specific dietary trends without compromising taste appeal. MWR recommends manufacturers invest in research and development capabilities that enable rapid response to emerging consumer preferences while maintaining cost-effective production processes.

Digital marketing strategies require increased investment to reach younger demographics and build brand awareness in competitive market environments. Companies should leverage social media platforms, influencer partnerships, and content marketing to create authentic connections with target consumers and drive trial of new products.

Supply chain optimization becomes critical for managing cost pressures and ensuring consistent product availability across all distribution channels. Manufacturers should evaluate vertical integration opportunities and strategic supplier partnerships that provide greater control over quality and costs while supporting sustainable sourcing initiatives.

Market expansion strategies should consider both geographic and demographic opportunities, particularly in underserved regions and emerging consumer segments. Companies can explore partnerships with regional distributors and targeted product development that addresses local preferences and cultural considerations.

Long-term growth prospects remain positive despite short-term challenges, with demographic trends and health consciousness supporting sustained demand for innovative spread products. The market’s evolution toward premium, functional, and sustainable options creates opportunities for companies that successfully adapt their strategies to changing consumer expectations and preferences.

Technology integration will increasingly influence product development, manufacturing efficiency, and consumer engagement strategies. Companies investing in advanced processing techniques, data analytics, and digital marketing capabilities position themselves advantageously for future growth and competitive differentiation in evolving market conditions.

Sustainability initiatives become essential for long-term success as environmental consciousness influences consumer choices and regulatory requirements. Manufacturers prioritizing sustainable sourcing, eco-friendly packaging, and carbon footprint reduction create competitive advantages while supporting broader industry transformation toward responsible business practices.

Market consolidation may accelerate as smaller players seek partnerships or acquisition opportunities to compete effectively against established brands with extensive resources and distribution networks. This trend could create opportunities for strategic investors while potentially reducing overall market competition and innovation diversity.

The US food spread market demonstrates remarkable resilience and adaptability, successfully navigating changing consumer preferences while maintaining steady growth across diverse product categories and demographic segments. The industry’s ability to innovate and respond to health consciousness trends positions it favorably for continued expansion and value creation.

Strategic opportunities abound for companies that effectively balance traditional consumer expectations with emerging demands for healthier, more sustainable, and convenient food options. Success requires investment in product innovation, digital marketing capabilities, and supply chain optimization that supports both growth objectives and operational efficiency requirements.

Future success will depend on manufacturers’ ability to anticipate and respond to evolving consumer preferences while maintaining cost competitiveness and operational excellence. The market’s fundamental strength and diverse growth drivers support optimistic long-term prospects for industry participants who embrace innovation and strategic adaptation to changing market dynamics.

What is Food Spread?

Food spread refers to a variety of products that are applied to bread, crackers, and other food items to enhance flavor and texture. Common types include butter, margarine, jams, jellies, and nut butters.

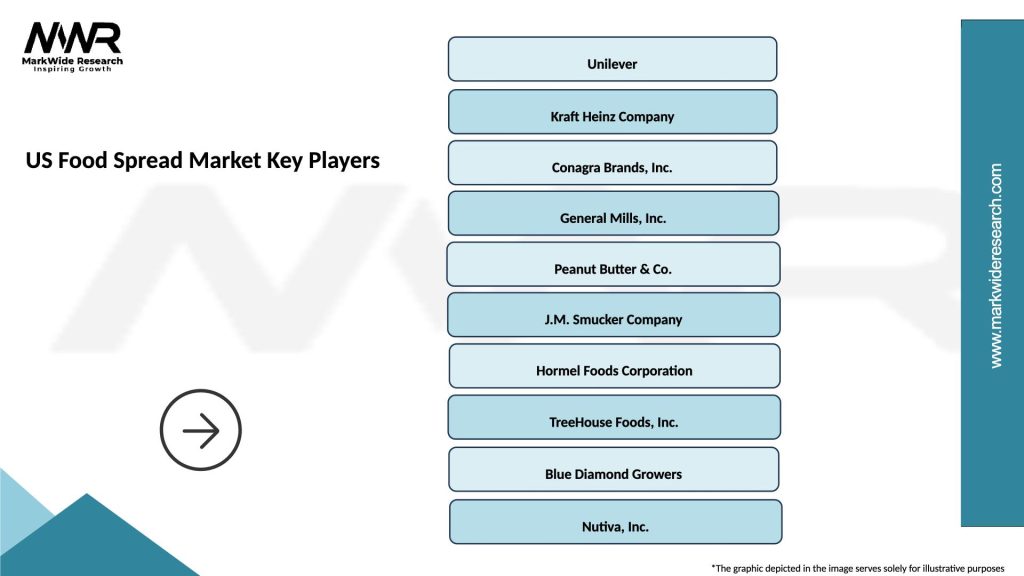

What are the key players in the US Food Spread Market?

Key players in the US Food Spread Market include brands like J.M. Smucker Company, Kraft Heinz, and Unilever, which offer a range of products from jams to margarine, among others.

What are the growth factors driving the US Food Spread Market?

The US Food Spread Market is driven by increasing consumer demand for convenient meal solutions, the popularity of healthy spreads like nut butters, and the rise of artisanal and gourmet products.

What challenges does the US Food Spread Market face?

Challenges in the US Food Spread Market include rising raw material costs, health concerns related to sugar and fat content, and intense competition among brands, which can impact pricing strategies.

What opportunities exist in the US Food Spread Market?

Opportunities in the US Food Spread Market include the growing trend towards organic and natural products, the expansion of online retail channels, and the potential for innovative flavors and health-focused formulations.

What trends are shaping the US Food Spread Market?

Trends in the US Food Spread Market include the increasing popularity of plant-based spreads, the demand for low-sugar and low-fat options, and the rise of sustainable packaging solutions.

US Food Spread Market

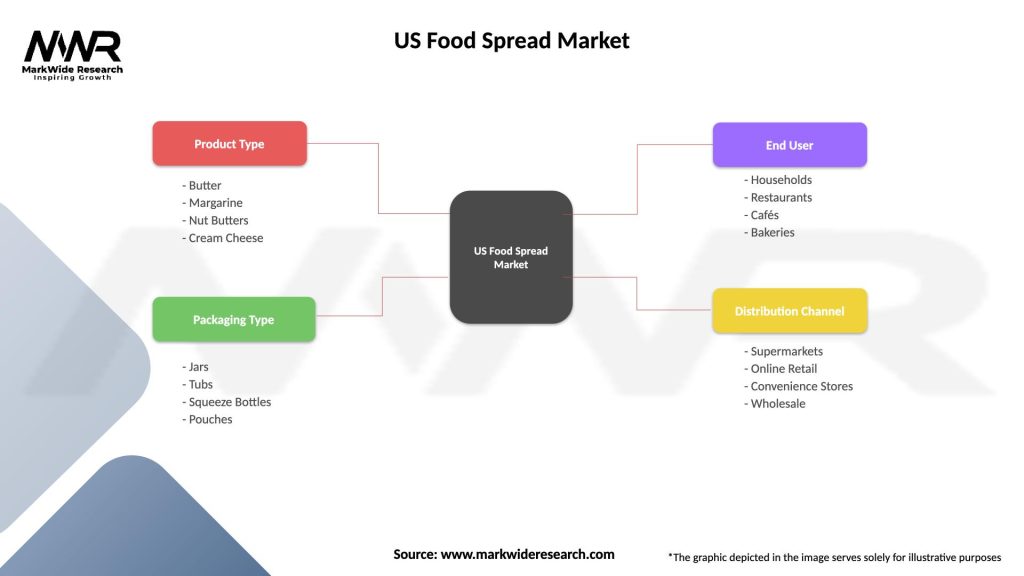

| Segmentation Details | Description |

|---|---|

| Product Type | Butter, Margarine, Nut Butters, Cream Cheese |

| Packaging Type | Jars, Tubs, Squeeze Bottles, Pouches |

| End User | Households, Restaurants, Cafés, Bakeries |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Food Spread Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at