444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US food additives market represents a dynamic and rapidly evolving sector within the American food industry, encompassing a comprehensive range of substances used to enhance food quality, safety, and consumer appeal. This market includes preservatives, flavor enhancers, colorants, emulsifiers, stabilizers, and nutritional additives that play crucial roles in modern food processing and manufacturing. Market dynamics indicate robust growth driven by increasing consumer demand for processed foods, extended shelf life requirements, and evolving dietary preferences across diverse demographic segments.

Industry transformation continues to accelerate as manufacturers respond to changing consumer behaviors, regulatory requirements, and technological innovations in food science. The market demonstrates significant expansion potential, with growth rates projected at 4.2% CAGR through the forecast period. Consumer preferences increasingly favor natural and organic additives, creating substantial opportunities for manufacturers specializing in clean-label solutions and plant-based alternatives.

Regional distribution shows concentrated activity across major food processing hubs, with California, Texas, Illinois, and New York leading in production capacity and innovation. The market benefits from advanced research and development infrastructure, sophisticated supply chain networks, and strong regulatory frameworks that ensure product safety and quality standards.

The US food additives market refers to the comprehensive ecosystem of chemical and natural substances intentionally added to food products during processing, packaging, or storage to achieve specific functional, nutritional, or sensory objectives. These additives serve multiple purposes including preservation, flavor enhancement, color improvement, texture modification, and nutritional fortification.

Food additives encompass both synthetic compounds developed through chemical processes and natural substances derived from plant, animal, or mineral sources. The market includes direct additives that become part of the food product and indirect additives that may contact food during processing or packaging. Regulatory oversight by the Food and Drug Administration ensures all additives meet stringent safety standards before approval for commercial use.

Market scope extends across numerous application areas including bakery products, beverages, dairy items, meat processing, confectionery, and convenience foods. The definition encompasses traditional preservatives like sodium benzoate alongside innovative solutions such as natural antioxidants, plant-based colorants, and functional ingredients that provide health benefits beyond basic nutrition.

Strategic analysis reveals the US food additives market experiencing unprecedented transformation driven by evolving consumer preferences, technological innovations, and regulatory developments. The market demonstrates resilient growth patterns with increasing adoption of natural and clean-label additives representing 38% of total market demand. Industry leaders continue investing heavily in research and development to create innovative solutions that meet both functional requirements and consumer expectations for healthier food options.

Market segmentation shows preservatives maintaining the largest share, followed by flavor enhancers and colorants. However, emerging categories including functional additives and natural alternatives exhibit the highest growth rates. The beverage sector leads in additive consumption, accounting for approximately 28% of total market volume, while bakery and confectionery applications show strong expansion potential.

Competitive landscape features established multinational corporations alongside innovative specialty manufacturers focusing on niche applications. Technology advancement drives market evolution with developments in microencapsulation, nanotechnology, and biotechnology creating new possibilities for additive functionality and application methods.

Market intelligence indicates several critical trends shaping the US food additives landscape. Consumer awareness regarding ingredient transparency continues driving demand for natural and recognizable additives, while regulatory pressures encourage manufacturers to develop safer, more sustainable solutions.

Primary growth drivers propelling the US food additives market include fundamental shifts in consumer lifestyle patterns, technological innovations, and evolving food industry requirements. Urbanization trends and busy lifestyles increase demand for processed and convenience foods, directly driving additive consumption across multiple categories.

Food safety requirements represent a critical driver as manufacturers seek effective preservation solutions to extend shelf life and prevent spoilage. The growing complexity of global supply chains necessitates robust additive systems that maintain product quality during extended transportation and storage periods. Regulatory compliance drives innovation as companies develop new formulations meeting updated safety standards while maintaining functional effectiveness.

Consumer health consciousness creates demand for functional additives that provide nutritional benefits beyond basic food enhancement. This includes vitamins, minerals, probiotics, and other bioactive compounds that support wellness objectives. Demographic changes including aging populations and diverse dietary preferences fuel demand for specialized additives addressing specific nutritional needs and cultural food preferences.

Technological advancement enables development of more effective, safer, and sustainable additive solutions. Innovations in biotechnology, nanotechnology, and green chemistry create opportunities for next-generation additives with enhanced functionality and reduced environmental impact.

Significant challenges facing the US food additives market include increasing consumer skepticism toward synthetic additives, stringent regulatory requirements, and rising raw material costs. Consumer perception issues create market resistance as health-conscious consumers increasingly scrutinize ingredient labels and prefer products with minimal artificial additives.

Regulatory complexity presents ongoing challenges as manufacturers navigate evolving FDA requirements, safety assessments, and approval processes for new additives. The lengthy and expensive regulatory pathway can delay product launches and increase development costs, particularly for innovative formulations. International trade restrictions and varying global standards complicate market access for companies seeking to expand beyond domestic markets.

Raw material volatility affects production costs and supply chain stability, particularly for natural additives dependent on agricultural inputs subject to weather variations and market fluctuations. Technical limitations in some natural alternatives may require higher usage levels or compromise product performance compared to synthetic counterparts.

Competition pressure from alternative preservation and enhancement methods, including advanced packaging technologies and novel processing techniques, challenges traditional additive applications. Environmental concerns regarding additive production and disposal create additional pressure for sustainable solutions and lifecycle management.

Emerging opportunities in the US food additives market center around natural and functional ingredient development, technological innovation, and expanding application areas. Clean-label trends create substantial opportunities for manufacturers developing natural alternatives to synthetic additives, with market potential extending across all food categories.

Plant-based food revolution opens new application areas as manufacturers require specialized additives to replicate traditional food textures, flavors, and nutritional profiles in alternative protein products. This emerging segment shows exceptional growth potential with increasing consumer adoption of plant-based diets and flexitarian eating patterns.

Personalized nutrition trends create opportunities for customized additive solutions addressing specific dietary requirements, health conditions, and lifestyle preferences. Functional food development enables integration of bioactive compounds that provide targeted health benefits while maintaining food quality and appeal.

Technology convergence offers opportunities for innovative delivery systems including microencapsulation, controlled release mechanisms, and smart additives that respond to environmental conditions. Sustainability initiatives drive demand for eco-friendly additives produced through renewable processes and biodegradable formulations.

Export potential exists for US manufacturers to leverage advanced technology and quality standards in international markets, particularly in developing regions with expanding processed food industries.

Complex market dynamics shape the US food additives landscape through interconnected factors including consumer behavior, regulatory environment, technological innovation, and competitive pressures. Supply and demand patterns reflect seasonal variations in food production, changing dietary trends, and economic conditions affecting consumer spending on processed foods.

Price dynamics demonstrate sensitivity to raw material costs, regulatory compliance expenses, and competitive positioning strategies. Natural additives typically command premium pricing due to higher production costs and limited supply sources, while synthetic alternatives compete primarily on cost-effectiveness and functional performance.

Innovation cycles drive market evolution as companies invest in research and development to create next-generation additives meeting emerging market needs. MarkWide Research analysis indicates that companies allocating more than 8% of revenue to R&D activities demonstrate superior market performance and growth rates.

Market consolidation trends show larger companies acquiring specialized manufacturers to expand product portfolios and technological capabilities. Strategic partnerships between additive manufacturers and food processors create integrated solutions addressing specific application requirements and market opportunities.

Comprehensive research methodology employed in analyzing the US food additives market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, technical experts, regulatory officials, and end-users across the food processing value chain.

Secondary research encompasses analysis of industry publications, regulatory filings, patent databases, trade statistics, and company financial reports. Market modeling utilizes advanced statistical techniques including regression analysis, time series forecasting, and scenario planning to project market trends and growth patterns.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification methods to ensure information accuracy and consistency. Segmentation analysis employs both top-down and bottom-up approaches to validate market size estimates and growth projections across different product categories and application areas.

Competitive intelligence gathering includes analysis of company strategies, product portfolios, pricing structures, and market positioning approaches. Regulatory analysis incorporates review of current and proposed regulations, safety assessments, and approval processes affecting market dynamics and product development strategies.

Regional market distribution across the United States shows distinct patterns reflecting local food processing concentrations, consumer preferences, and regulatory environments. West Coast markets including California demonstrate strong demand for natural and organic additives, driven by health-conscious consumer bases and innovative food companies. California accounts for approximately 22% of national market share due to its large food processing industry and early adoption of clean-label trends.

Midwest regions including Illinois, Ohio, and Michigan represent major manufacturing hubs with significant presence of large food processors and additive manufacturers. These areas benefit from central location advantages, established supply chains, and proximity to agricultural raw materials. Market concentration in the Midwest reflects the region’s role as America’s food processing center.

Southern states including Texas, Florida, and Georgia show growing market importance driven by expanding food processing facilities, favorable business climates, and increasing population growth. Texas demonstrates particular strength in beverage and snack food applications, while Florida leads in citrus-based natural additives.

Northeast corridor markets including New York, Pennsylvania, and New Jersey maintain significant market presence through established food companies, research institutions, and high-income consumer bases demanding premium additive solutions. The region shows above-average adoption rates for innovative and functional additives.

Competitive dynamics in the US food additives market feature a diverse mix of multinational corporations, specialized manufacturers, and emerging technology companies. Market leadership positions are held by companies with comprehensive product portfolios, strong research capabilities, and established customer relationships across multiple food industry segments.

Strategic positioning varies among competitors with some focusing on broad product portfolios while others specialize in specific additive categories or application areas. Innovation investment represents a key differentiator as companies develop next-generation additives meeting evolving market requirements.

Market segmentation analysis reveals distinct patterns across multiple classification criteria including product type, application area, source origin, and functional category. By product type, preservatives maintain the largest market share at approximately 31% of total volume, followed by flavor enhancers, colorants, and emulsifiers.

By Application:

By Source Origin:

Preservatives category demonstrates stable growth driven by food safety requirements and extended shelf life demands. Natural preservatives including rosemary extract, tocopherols, and citric acid show accelerating adoption rates as manufacturers seek clean-label alternatives to synthetic options. This segment benefits from consumer acceptance and regulatory support for natural preservation methods.

Flavor enhancers represent a dynamic category with significant innovation activity focused on natural and fermentation-derived options. Umami enhancers and plant-based flavor compounds gain market traction as food manufacturers develop more sophisticated taste profiles. The category shows particular strength in snack foods, processed meats, and convenience meal applications.

Colorants segment experiences transformation as manufacturers transition from synthetic to natural alternatives. Plant-based colorants including spirulina, beetroot, and turmeric extracts demonstrate growing market acceptance despite higher costs and technical challenges. The segment benefits from consumer demand for visually appealing foods without artificial coloring.

Functional additives emerge as a high-growth category encompassing probiotics, prebiotics, vitamins, and minerals that provide health benefits beyond basic nutrition. This segment aligns with wellness trends and shows exceptional expansion potential across multiple food categories.

Food manufacturers benefit from advanced additive solutions that enable product innovation, cost optimization, and quality enhancement. Functional improvements include extended shelf life, enhanced sensory appeal, and nutritional fortification capabilities that support brand differentiation and market positioning strategies.

Consumers gain access to safer, more nutritious, and appealing food products through innovative additive applications. Health benefits include improved food safety, enhanced nutritional content, and better sensory experiences that support dietary goals and lifestyle preferences.

Retailers benefit from improved product quality, reduced waste, and enhanced shelf appeal that drive sales performance and customer satisfaction. Supply chain advantages include extended product life cycles and reduced inventory management challenges.

Additive manufacturers experience expanding market opportunities, technological advancement possibilities, and partnership development potential with food industry participants. Innovation benefits include access to emerging application areas and premium market segments.

Regulatory agencies benefit from improved food safety standards, enhanced monitoring capabilities, and better consumer protection through advanced additive technologies and safety assessment methods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues reshaping the US food additives market as consumers increasingly demand transparent ingredient lists and recognizable components. This trend drives substantial investment in natural additive development and reformulation projects across the food industry. Manufacturers respond by developing plant-based alternatives and simplifying ingredient declarations.

Functional nutrition emerges as a dominant trend with growing consumer interest in foods that provide health benefits beyond basic nutrition. Bioactive additives including probiotics, omega-3 fatty acids, and antioxidants gain market traction as manufacturers develop products supporting specific health objectives and wellness goals.

Sustainability focus influences additive selection and production methods as companies seek environmentally responsible solutions. Green chemistry approaches and renewable raw materials become increasingly important in product development and market positioning strategies.

Technology integration accelerates with developments in microencapsulation, nanotechnology, and smart delivery systems creating new possibilities for additive functionality and effectiveness. Precision nutrition trends drive demand for targeted additive solutions addressing specific demographic and health requirements.

Regulatory evolution continues with updated safety assessments, labeling requirements, and approval processes affecting product development timelines and market strategies. MWR analysis indicates that regulatory compliance costs now represent approximately 12% of total product development expenses for new additive introductions.

Recent industry developments highlight significant investments in natural additive production facilities, strategic acquisitions, and technology partnerships shaping market evolution. Capacity expansion projects focus on natural preservatives, plant-based colorants, and functional ingredients meeting growing market demand.

Strategic acquisitions include major companies purchasing specialized natural additive manufacturers to expand product portfolios and technological capabilities. These transactions reflect industry consolidation trends and the strategic importance of natural ingredient expertise in competitive positioning.

Technology partnerships between additive manufacturers and biotechnology companies accelerate development of next-generation solutions including fermentation-derived ingredients and bioengineered alternatives. Innovation collaborations extend to food processors seeking customized additive solutions for specific applications.

Regulatory developments include FDA reviews of existing additives, updated safety assessments, and new approval pathways for innovative ingredients. Industry advocacy efforts focus on supporting science-based regulation and promoting understanding of additive safety and benefits.

Sustainability initiatives encompass renewable energy adoption in production facilities, sustainable sourcing programs, and lifecycle assessment implementations across major industry participants.

Strategic recommendations for US food additives market participants emphasize the critical importance of natural product development, technological innovation, and consumer education initiatives. Investment priorities should focus on research and development capabilities, particularly in biotechnology and green chemistry applications that enable natural additive production at commercial scale.

Market positioning strategies should emphasize transparency, safety, and functional benefits while addressing consumer concerns about synthetic additives. Brand communication efforts must effectively explain additive purposes, safety profiles, and quality benefits to build consumer confidence and market acceptance.

Partnership development represents a key success factor as companies seek to combine complementary capabilities in ingredient development, application expertise, and market access. Vertical integration opportunities exist in securing raw material supplies and developing specialized production capabilities.

Regulatory engagement remains essential for navigating evolving requirements and supporting science-based policy development. International expansion strategies should leverage US technology leadership and quality standards in emerging markets with growing processed food industries.

Sustainability integration should encompass entire value chains from raw material sourcing through production, packaging, and disposal considerations. Digital transformation opportunities include supply chain optimization, quality monitoring, and customer engagement platforms.

Future market prospects for the US food additives industry appear highly promising with sustained growth expected across multiple segments and application areas. MarkWide Research projections indicate the market will experience robust expansion driven by continued innovation, evolving consumer preferences, and expanding food processing activities.

Natural additives segment shows exceptional growth potential with market share expected to reach 45% of total volume within the next five years. This growth reflects sustained consumer preference for clean-label products and continued technological advancement in natural ingredient development and production methods.

Functional additives represent the fastest-growing category with applications expanding across traditional and emerging food segments. Personalized nutrition trends will drive demand for specialized additives addressing specific health conditions, age groups, and lifestyle preferences.

Technology evolution will enable development of more effective, sustainable, and cost-competitive additive solutions. Biotechnology applications including fermentation, enzymatic processes, and cellular agriculture will create new possibilities for additive production and functionality.

Market consolidation trends will continue as larger companies acquire specialized manufacturers and technology developers to strengthen competitive positions and expand capabilities. International expansion opportunities will grow as US companies leverage advanced technology and quality standards in global markets.

The US food additives market stands at a transformative juncture characterized by evolving consumer preferences, technological innovations, and expanding application opportunities. Market dynamics reflect the complex interplay between traditional additive functions and emerging demands for natural, functional, and sustainable solutions that align with contemporary food industry requirements.

Growth prospects remain robust across multiple segments with natural additives, functional ingredients, and specialized applications driving market expansion. The industry’s ability to adapt to changing consumer expectations while maintaining food safety, quality, and affordability standards positions it for continued success in the evolving food landscape.

Strategic success will depend on companies’ ability to innovate, invest in sustainable technologies, and build consumer trust through transparency and education initiatives. The market’s future trajectory will be shaped by continued technological advancement, regulatory evolution, and the industry’s response to emerging food trends and consumer health consciousness.

What is Food Additives?

Food additives are substances added to food to enhance its flavor, appearance, or preservation. They can include preservatives, colorants, flavor enhancers, and emulsifiers, among others.

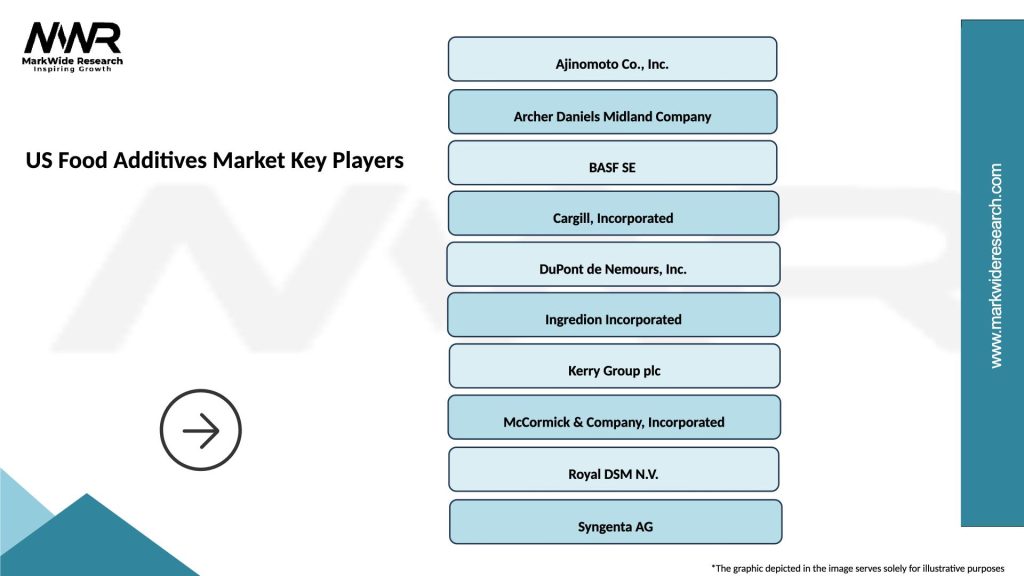

What are the key players in the US Food Additives Market?

Key players in the US Food Additives Market include companies like Archer Daniels Midland Company, Cargill, Inc., and DuPont de Nemours, Inc., among others.

What are the main drivers of the US Food Additives Market?

The main drivers of the US Food Additives Market include the growing demand for processed foods, increasing consumer awareness about food safety, and the trend towards clean label products.

What challenges does the US Food Additives Market face?

The US Food Additives Market faces challenges such as stringent regulations regarding food safety, consumer skepticism towards artificial additives, and the need for transparency in ingredient sourcing.

What opportunities exist in the US Food Additives Market?

Opportunities in the US Food Additives Market include the rising demand for natural and organic additives, innovations in food technology, and the expansion of plant-based food products.

What trends are shaping the US Food Additives Market?

Trends shaping the US Food Additives Market include the increasing use of clean label ingredients, the shift towards healthier food options, and advancements in food preservation technologies.

US Food Additives Market

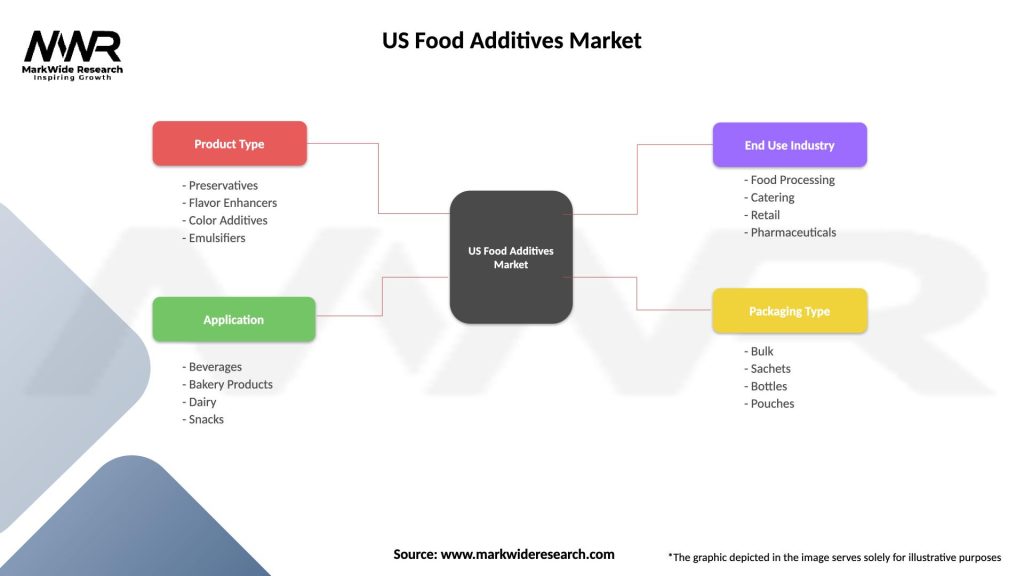

| Segmentation Details | Description |

|---|---|

| Product Type | Preservatives, Flavor Enhancers, Color Additives, Emulsifiers |

| Application | Beverages, Bakery Products, Dairy, Snacks |

| End Use Industry | Food Processing, Catering, Retail, Pharmaceuticals |

| Packaging Type | Bulk, Sachets, Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Food Additives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at