444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US food acidulants market represents a dynamic and rapidly expanding segment within the broader food additives industry, experiencing substantial growth driven by increasing consumer demand for processed foods, beverages, and convenience products. Food acidulants serve as essential ingredients that regulate pH levels, enhance flavor profiles, extend shelf life, and improve overall product quality across diverse food applications. The market encompasses various acidulant types including citric acid, phosphoric acid, acetic acid, lactic acid, and tartaric acid, each serving specific functional purposes in food manufacturing processes.

Market dynamics indicate robust expansion with the sector growing at a CAGR of 6.2% over the forecast period, reflecting strong demand from beverage manufacturers, bakery producers, and processed food companies. The increasing prevalence of convenience foods, coupled with rising consumer awareness regarding food preservation and quality, continues to drive market growth. Regional distribution shows concentrated activity in major food manufacturing hubs, with California accounting for 28% of national production capacity, followed by significant operations in Texas, Illinois, and New York.

Technology advancement in acidulant production methods has enhanced efficiency and reduced manufacturing costs, making these additives more accessible to small and medium-sized food processors. The market benefits from established supply chains, advanced research and development capabilities, and strong regulatory frameworks that ensure product safety and quality standards.

The US food acidulants market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of acidic compounds used as food additives to regulate pH levels, enhance preservation, and improve taste characteristics in various food and beverage products. These chemical compounds serve multiple functional purposes including flavor enhancement, antimicrobial preservation, texture modification, and color stabilization across diverse food manufacturing applications.

Food acidulants function as multifunctional ingredients that contribute to product safety by creating acidic environments that inhibit harmful bacterial growth while simultaneously enhancing sensory attributes such as tartness, freshness, and overall flavor complexity. The market encompasses both natural and synthetic acidulants, with applications spanning carbonated beverages, baked goods, dairy products, confectionery items, and processed foods.

Regulatory classification defines these substances as Generally Recognized as Safe (GRAS) ingredients under FDA guidelines, ensuring their widespread acceptance and utilization across the food industry. The market includes various acidulant categories based on chemical composition, source origin, and specific functional applications within food processing operations.

Market performance demonstrates exceptional growth trajectory with the US food acidulants sector establishing itself as a critical component of the nation’s food processing infrastructure. The industry benefits from strong domestic demand, advanced manufacturing capabilities, and robust distribution networks that serve diverse food and beverage manufacturers across multiple market segments.

Key growth drivers include the expanding processed food industry, increasing consumer preference for convenience products, and growing demand for natural preservation methods. The beverage sector represents the largest application segment, accounting for 42% of total acidulant consumption, driven primarily by carbonated soft drinks, fruit juices, and energy drinks. Citric acid dominates the market with approximately 35% market share, followed by phosphoric acid and acetic acid variants.

Competitive landscape features established multinational corporations alongside specialized regional producers, creating a balanced market structure that promotes innovation and competitive pricing. The industry demonstrates strong resilience to economic fluctuations due to the essential nature of food acidulants in maintaining product quality and safety standards.

Future prospects indicate continued expansion driven by emerging applications in functional foods, organic products, and clean-label formulations. The market is positioned for sustained growth with projected expansion into new product categories and enhanced manufacturing efficiency through technological advancement.

Strategic analysis reveals several critical insights that define the current market landscape and future development patterns:

Consumer behavior analysis indicates shifting preferences toward clean-label products, driving demand for recognizable and naturally-sourced acidulants. The market responds with increased focus on transparency, traceability, and sustainable sourcing practices that align with evolving consumer expectations.

Primary growth catalysts propelling the US food acidulants market include several interconnected factors that create sustained demand across multiple industry segments. The expanding processed food sector serves as the fundamental driver, with increasing consumer reliance on convenience foods, ready-to-eat meals, and packaged beverages creating consistent demand for acidulant ingredients.

Beverage industry expansion represents a significant growth driver, particularly in carbonated soft drinks, energy drinks, and functional beverages where acidulants provide essential pH regulation and flavor enhancement. The growing popularity of craft beverages and specialty drinks further amplifies demand for diverse acidulant types and formulations.

Food safety regulations increasingly emphasize natural preservation methods, positioning acidulants as preferred alternatives to synthetic preservatives. This regulatory environment encourages food manufacturers to adopt acidulant-based preservation systems that maintain product safety while meeting clean-label requirements.

Health consciousness trends drive demand for functional foods and beverages containing beneficial acidulants such as citric acid and lactic acid, which offer additional health benefits beyond their primary functional purposes. The growing awareness of gut health and probiotics particularly benefits lactic acid applications.

Technological advancement in food processing enables more sophisticated acidulant applications, allowing manufacturers to achieve precise pH control, enhanced flavor profiles, and improved product stability. These capabilities expand potential applications and increase overall market demand.

Cost volatility in raw material pricing presents ongoing challenges for acidulant manufacturers, particularly affecting citric acid production costs due to fluctuating prices of corn and other feedstock materials. These price variations can impact profit margins and create uncertainty in long-term supply contracts.

Regulatory complexity surrounding food additive approvals and labeling requirements creates barriers for new product development and market entry. The extensive documentation and testing required for regulatory compliance can delay product launches and increase development costs.

Consumer skepticism regarding food additives, despite their safety profiles, continues to influence purchasing decisions and may limit market expansion in certain consumer segments. The challenge of educating consumers about acidulant safety and benefits requires ongoing industry investment.

Supply chain disruptions can significantly impact acidulant availability and pricing, particularly for imported raw materials or specialized acidulant types. Global supply chain vulnerabilities exposed during recent years highlight the need for diversified sourcing strategies.

Environmental concerns related to acidulant production processes and waste management create pressure for sustainable manufacturing practices, potentially increasing operational costs and requiring significant capital investment in cleaner technologies.

Competition from alternatives including natural preservatives, fermentation-based solutions, and novel preservation technologies may limit market share growth in certain applications where acidulants traditionally dominated.

Emerging applications in functional foods and nutraceuticals present substantial growth opportunities as consumers increasingly seek products that provide health benefits beyond basic nutrition. Acidulants can serve dual purposes as functional ingredients and preservation agents in these premium product categories.

Clean-label movement creates opportunities for naturally-derived acidulants that meet consumer demands for recognizable ingredients. Companies developing organic and non-GMO acidulant variants can capture premium market segments willing to pay higher prices for clean-label products.

Export potential offers significant opportunities as US acidulant manufacturers can leverage advanced production capabilities and quality standards to serve international markets. Growing global demand for processed foods creates export opportunities for established US producers.

Technology innovation in encapsulation, controlled-release, and targeted delivery systems opens new application possibilities for acidulants in specialized food products. These advanced formulations can command premium pricing and serve niche market segments.

Plant-based food sector expansion creates demand for acidulants that enhance flavor profiles and extend shelf life of alternative protein products. The growing plant-based market represents an untapped opportunity for specialized acidulant applications.

Sustainability initiatives present opportunities for companies investing in environmentally-friendly production methods and renewable feedstock sources. Sustainable acidulant production can differentiate products and appeal to environmentally-conscious consumers and manufacturers.

Supply-demand equilibrium in the US food acidulants market demonstrates relative stability with periodic fluctuations driven by seasonal demand patterns and raw material availability. The market exhibits strong demand elasticity, responding effectively to price changes and supply constraints through alternative sourcing and product substitution.

Competitive intensity varies across acidulant types, with citric acid experiencing high competition due to multiple suppliers and standardized product characteristics, while specialty acidulants maintain higher margins through differentiation and limited competition. Market concentration shows moderate levels with the top five producers controlling approximately 58% of total market share.

Innovation cycles typically span 3-5 years for major product developments, with continuous improvement processes driving incremental enhancements in product quality, manufacturing efficiency, and application versatility. Research and development investment averages 4.3% of revenue across leading market participants.

Price dynamics reflect raw material costs, manufacturing efficiency, and competitive positioning, with premium products commanding 15-25% higher prices than commodity acidulants. The market demonstrates price stability over medium-term periods with gradual adjustments reflecting cost structure changes.

Distribution channels encompass direct sales to large food manufacturers, distributor networks serving medium-sized processors, and specialized suppliers for niche applications. Digital platforms increasingly facilitate smaller-volume transactions and provide market transparency.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. The research framework combines quantitative data analysis with qualitative industry expertise to provide holistic market understanding.

Primary research includes structured interviews with industry executives, food manufacturers, suppliers, and regulatory experts to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture quantitative data on consumption patterns, pricing trends, and future demand projections.

Secondary research encompasses analysis of industry reports, regulatory filings, trade publications, and academic studies to validate primary findings and provide historical context. Patent analysis and technology assessments inform innovation trend identification and competitive landscape evaluation.

Data validation processes include cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings to ensure accuracy and reliability. Market sizing methodologies employ bottom-up and top-down approaches to validate market estimates and projections.

Analytical frameworks utilize advanced statistical models, trend analysis, and scenario planning to develop robust market forecasts and identify key success factors. The methodology ensures comprehensive coverage of market segments, geographic regions, and application areas.

Geographic distribution of the US food acidulants market reveals concentrated activity in major food manufacturing regions, with distinct patterns reflecting local industry clusters and supply chain advantages. West Coast dominance led by California accounts for the largest regional market share, driven by extensive beverage production facilities and proximity to agricultural feedstock sources.

California market represents approximately 28% of national consumption, supported by major soft drink bottling operations, wine production facilities, and diverse food processing companies. The state’s advanced logistics infrastructure and port facilities facilitate both domestic distribution and export activities.

Midwest region demonstrates strong market presence with Illinois, Ohio, and Michigan serving as key production and consumption centers. The region benefits from abundant corn supplies for citric acid production and established food processing industries including dairy, baking, and confectionery sectors.

Southeast markets show rapid growth driven by expanding beverage production facilities and increasing food processing investments. Florida’s citrus industry creates natural synergies with acidulant applications, while Georgia and North Carolina host major food manufacturing operations.

Northeast corridor maintains significant market share through dense population centers and established food distribution networks. The region’s focus on premium and specialty food products creates demand for high-quality acidulant ingredients.

Regional growth patterns indicate shifting production capacity toward lower-cost areas while maintaining proximity to major consumption centers. This geographic optimization balances manufacturing efficiency with distribution costs and customer service requirements.

Market structure features a balanced competitive environment with established multinational corporations, specialized regional producers, and emerging innovative companies creating dynamic competition across different market segments and application areas.

Competitive strategies emphasize product differentiation, technical service capabilities, supply chain reliability, and sustainable production practices. Companies invest heavily in research and development to create specialized formulations that meet evolving customer requirements and regulatory standards.

Market positioning varies from cost leadership in commodity acidulants to premium positioning in specialty applications, allowing companies to serve diverse customer segments and maintain competitive advantages through different value propositions.

Product-based segmentation reveals distinct market categories based on acidulant type, each serving specific applications and customer requirements:

By Acidulant Type:

By Application:

By Source:

Citric acid category maintains market leadership through versatile applications and established supply chains, with fermentation-based production ensuring consistent quality and availability. The segment benefits from strong demand in beverage applications and expanding use in natural preservation systems.

Phosphoric acid segment demonstrates stability through concentrated usage in carbonated soft drinks, though faces challenges from health-conscious consumer trends favoring natural alternatives. The category maintains strong positioning in industrial applications requiring specific chemical properties.

Lactic acid category shows exceptional growth potential driven by probiotic food trends, clean-label preferences, and expanding applications in plant-based products. MarkWide Research analysis indicates this segment growing at 8.4% annually, outpacing overall market growth rates.

Acetic acid segment benefits from stable demand in traditional applications while exploring opportunities in organic and artisanal food products. The category’s association with fermentation processes aligns with consumer preferences for traditional food production methods.

Specialty acidulants including tartaric and malic acids serve niche applications with higher margins and specialized customer relationships. These categories demonstrate resilience through differentiated applications and limited competition.

Natural acidulant categories across all types experience premium pricing and growing demand, reflecting consumer willingness to pay higher prices for clean-label ingredients that meet sustainability and health criteria.

Food manufacturers benefit from acidulants’ multifunctional properties that simultaneously address preservation, flavor enhancement, and pH regulation requirements, reducing the need for multiple additives and simplifying formulations while maintaining product quality and safety standards.

Cost optimization opportunities arise through acidulants’ efficiency in small usage quantities, providing significant functional benefits at relatively low inclusion rates. This cost-effectiveness becomes particularly important in competitive food markets where margin pressures require ingredient optimization.

Regulatory compliance advantages include acidulants’ well-established safety profiles and GRAS status, facilitating product approvals and reducing regulatory risks associated with new ingredient introductions. This regulatory certainty enables faster product development cycles and market entry.

Supply chain benefits include acidulants’ stability during storage and transportation, reducing inventory risks and enabling efficient logistics management. The ingredients’ long shelf life and resistance to degradation provide operational flexibility for food manufacturers.

Consumer appeal advantages emerge from acidulants’ ability to enhance sensory attributes including taste, texture, and appearance while supporting clean-label positioning when naturally-derived variants are utilized. This dual functionality supports premium product positioning.

Innovation enablement through acidulants’ versatility allows food developers to create novel products and improve existing formulations, supporting differentiation strategies and competitive positioning in crowded market segments.

Sustainability benefits include acidulants’ role in reducing food waste through extended shelf life, supporting environmental goals while providing economic advantages through reduced product losses and improved supply chain efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient preference continues driving market evolution with consumers increasingly seeking recognizable, naturally-derived acidulants over synthetic alternatives. This trend supports premium pricing for organic and non-GMO acidulant variants while encouraging innovation in natural production methods.

Clean-label formulation requirements influence product development strategies as food manufacturers reformulate existing products to meet consumer expectations for simple, understandable ingredient lists. Acidulants benefit from their familiar names and established consumer recognition.

Functional food integration expands acidulant applications beyond traditional preservation and flavoring roles into health-promoting functions, particularly in probiotic foods, digestive health products, and immune-supporting formulations where specific acidulants provide additional benefits.

Sustainability focus drives adoption of environmentally-friendly production processes, renewable feedstock sources, and reduced packaging waste. Companies investing in sustainable practices gain competitive advantages and appeal to environmentally-conscious customers.

Technology advancement in encapsulation and controlled-release systems enables more sophisticated acidulant applications, allowing precise pH control, targeted delivery, and enhanced stability in challenging food matrices.

Plant-based product growth creates new application opportunities as alternative protein products require acidulants for flavor enhancement, texture modification, and shelf-life extension. This emerging segment offers growth potential for specialized formulations.

Personalization trends in food products drive demand for customizable acidulant solutions that enable manufacturers to create unique flavor profiles and functional benefits tailored to specific consumer preferences and dietary requirements.

Production capacity expansion initiatives by major manufacturers reflect growing market confidence and demand projections, with several companies announcing significant investments in new production facilities and technology upgrades to meet increasing market requirements.

Strategic partnerships between acidulant producers and food manufacturers create collaborative relationships focused on product innovation, supply chain optimization, and market development. These alliances strengthen competitive positions and accelerate new product introductions.

Sustainability certifications gain importance as companies pursue third-party validations of environmental practices, organic certifications, and sustainable sourcing credentials to meet customer requirements and differentiate their products in competitive markets.

Research and development investments focus on novel acidulant formulations, improved production efficiency, and expanded application possibilities. Innovation efforts target clean-label solutions, enhanced functionality, and cost-effective manufacturing processes.

Regulatory developments include updated guidelines for acidulant usage, labeling requirements, and safety assessments that influence market dynamics and product development strategies. Industry participants actively engage with regulatory agencies to ensure favorable outcomes.

Digital transformation initiatives encompass supply chain digitization, customer relationship management systems, and data analytics capabilities that improve operational efficiency and customer service while reducing costs and enhancing competitiveness.

Acquisition activity reflects industry consolidation trends as larger companies acquire specialized producers to expand product portfolios, geographic reach, and technical capabilities while achieving economies of scale and operational synergies.

Investment prioritization should focus on natural acidulant production capabilities and clean-label formulations to capitalize on consumer trends and premium pricing opportunities. Companies should evaluate organic certification and sustainable sourcing initiatives to differentiate their offerings.

Market expansion strategies should target emerging applications in functional foods, plant-based products, and specialty beverages where acidulants can provide unique value propositions and command higher margins than commodity applications.

Supply chain diversification becomes critical for managing raw material risks and ensuring consistent product availability. Companies should develop multiple sourcing options and consider vertical integration opportunities to reduce dependency on external suppliers.

Technology investment in advanced production methods, quality control systems, and product innovation capabilities will determine long-term competitive positioning. Focus should include automation, efficiency improvements, and sustainable manufacturing processes.

Customer relationship development through technical service capabilities, customized solutions, and collaborative innovation programs will strengthen competitive positions and create barriers to competitor entry in key accounts.

Regulatory engagement remains essential for influencing favorable policy outcomes and staying ahead of regulatory changes that could impact market access or product requirements. Proactive participation in industry associations and regulatory discussions provides strategic advantages.

Sustainability initiatives should encompass environmental impact reduction, renewable energy adoption, and circular economy principles to meet evolving customer expectations and regulatory requirements while potentially reducing operational costs.

Long-term growth prospects for the US food acidulants market remain highly favorable, supported by fundamental trends including processed food consumption growth, beverage industry expansion, and increasing focus on food safety and quality. MWR projections indicate sustained market expansion with growth rates exceeding 6% annually through the forecast period.

Innovation trajectories point toward more sophisticated acidulant applications including smart delivery systems, multifunctional formulations, and personalized nutrition solutions. These advanced applications will likely command premium pricing and drive market value growth beyond volume expansion.

Market evolution will likely favor companies that successfully balance traditional acidulant applications with emerging opportunities in functional foods, clean-label products, and sustainable solutions. The ability to serve both commodity and specialty market segments will become increasingly important for long-term success.

Regulatory landscape developments may create both opportunities and challenges, with potential benefits from streamlined approval processes for natural acidulants offset by possible restrictions on certain synthetic variants or new labeling requirements.

Competitive dynamics will likely intensify as market growth attracts new entrants while existing players expand capabilities through acquisitions and strategic partnerships. Success will depend on differentiation through quality, service, innovation, and sustainability rather than price competition alone.

Global integration opportunities may emerge as US producers leverage advanced capabilities and quality standards to serve international markets, potentially offsetting domestic market maturation with export growth and geographic diversification.

The US food acidulants market demonstrates robust fundamentals and promising growth prospects driven by expanding processed food consumption, beverage industry growth, and evolving consumer preferences for quality and safety. The market’s established infrastructure, regulatory clarity, and technological capabilities position it favorably for sustained expansion across diverse application segments.

Strategic opportunities abound for companies that can effectively navigate the transition toward natural ingredients, clean-label formulations, and sustainable production practices while maintaining cost competitiveness and operational efficiency. The market rewards innovation, customer service excellence, and adaptability to changing consumer demands.

Future success will depend on companies’ ability to balance traditional acidulant applications with emerging opportunities in functional foods, specialty beverages, and premium product categories. Investment in research and development, supply chain optimization, and sustainability initiatives will determine long-term competitive positioning and market leadership.

The US food acidulants market stands poised for continued growth and evolution, offering attractive opportunities for industry participants who can successfully align their strategies with market trends, consumer preferences, and regulatory developments while maintaining operational excellence and customer satisfaction.

What is Food Acidulants?

Food acidulants are substances used to impart a sour taste, enhance flavor, and preserve food products. They play a crucial role in various applications, including beverages, dairy products, and confectionery.

What are the key players in the US Food Acidulants Market?

Key players in the US Food Acidulants Market include Archer Daniels Midland Company, Tate & Lyle, and Cargill, among others. These companies are involved in the production and supply of various acidulants used in food processing.

What are the growth factors driving the US Food Acidulants Market?

The US Food Acidulants Market is driven by increasing consumer demand for processed foods, the rising popularity of sour flavors, and the need for food preservation. Additionally, the growth of the beverage industry contributes significantly to market expansion.

What challenges does the US Food Acidulants Market face?

The US Food Acidulants Market faces challenges such as regulatory compliance regarding food safety and potential health concerns related to excessive acid consumption. Additionally, competition from natural alternatives can impact market growth.

What opportunities exist in the US Food Acidulants Market?

Opportunities in the US Food Acidulants Market include the development of innovative acidulants that cater to health-conscious consumers and the expansion of applications in organic and clean-label products. The growing trend of plant-based foods also presents new avenues for growth.

What trends are shaping the US Food Acidulants Market?

Trends in the US Food Acidulants Market include a shift towards natural and organic acidulants, increased use of acidulants in functional foods, and the rising demand for flavor enhancement in culinary applications. These trends reflect changing consumer preferences and health considerations.

US Food Acidulants Market

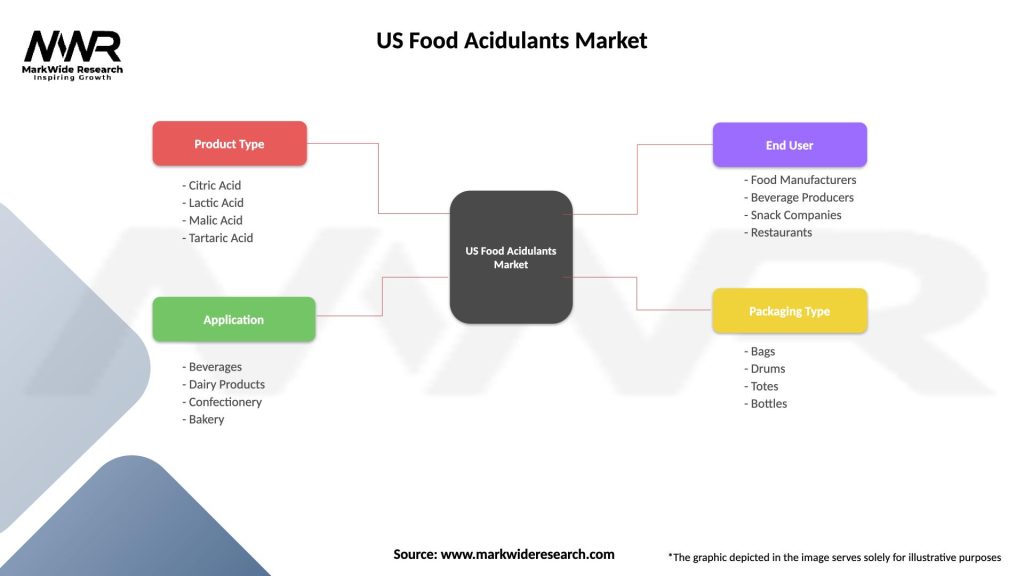

| Segmentation Details | Description |

|---|---|

| Product Type | Citric Acid, Lactic Acid, Malic Acid, Tartaric Acid |

| Application | Beverages, Dairy Products, Confectionery, Bakery |

| End User | Food Manufacturers, Beverage Producers, Snack Companies, Restaurants |

| Packaging Type | Bags, Drums, Totes, Bottles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Food Acidulants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at