444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US flat glass market represents a cornerstone of American manufacturing and construction industries, encompassing the production and distribution of flat glass products across diverse applications. This comprehensive market includes architectural glass, automotive glass, solar glass, and specialty flat glass products that serve critical functions in modern infrastructure and technology. The market demonstrates robust growth potential driven by increasing construction activities, automotive production, and renewable energy initiatives across the United States.

Market dynamics indicate sustained expansion with the industry experiencing a projected 4.2% CAGR through the forecast period. The architectural segment dominates market share, accounting for approximately 65% of total consumption, while automotive applications represent 25% of market demand. Solar glass applications are emerging as a high-growth segment, contributing 8% of market volume with accelerating adoption rates driven by renewable energy mandates and sustainability initiatives.

Regional distribution shows concentrated production facilities across the Midwest and Southeast, with major manufacturing hubs in Ohio, Pennsylvania, and Georgia. The market benefits from established supply chains, advanced manufacturing technologies, and proximity to key end-user industries including construction, automotive, and electronics manufacturing.

The US flat glass market refers to the comprehensive ecosystem encompassing the manufacturing, processing, and distribution of flat glass products within the United States. This market includes primary glass production through float glass processes, secondary processing operations such as tempering and laminating, and specialized coating applications for enhanced performance characteristics.

Flat glass products are manufactured through advanced float glass technology, creating uniform thickness sheets suitable for diverse applications. The market encompasses various glass types including clear float glass, tinted glass, reflective glass, low-emissivity coated glass, and specialty products designed for specific performance requirements. These products serve essential functions in architectural glazing, automotive safety systems, solar energy generation, and electronic display applications.

Market participants include primary manufacturers operating large-scale production facilities, secondary processors providing value-added services, distributors managing regional supply networks, and specialized fabricators serving niche applications. The integrated nature of this market creates complex value chains connecting raw material suppliers with end-user industries across construction, automotive, and renewable energy sectors.

Strategic analysis reveals the US flat glass market positioned for sustained growth driven by multiple demand catalysts across key application segments. The construction industry’s recovery and expansion, coupled with increasing emphasis on energy-efficient building designs, creates substantial opportunities for architectural glass products. Automotive sector modernization and electric vehicle adoption further strengthen market fundamentals through advanced glazing requirements.

Technology advancement plays a crucial role in market evolution, with manufacturers investing heavily in smart glass technologies, improved coating systems, and enhanced processing capabilities. These innovations enable superior product performance while addressing growing environmental regulations and energy efficiency standards. The integration of digital technologies in manufacturing processes improves quality control and operational efficiency.

Competitive landscape features established multinational corporations alongside specialized regional players, creating a dynamic market environment. Market leaders leverage economies of scale and technological expertise, while smaller companies focus on niche applications and customized solutions. The industry demonstrates 72% capacity utilization rates, indicating healthy demand-supply balance with room for expansion.

Future prospects remain positive with emerging applications in renewable energy, smart buildings, and advanced automotive systems driving incremental demand growth. Regulatory support for energy-efficient construction and renewable energy deployment provides additional market tailwinds, positioning the industry for continued expansion through the forecast period.

Market intelligence reveals several critical insights shaping the US flat glass industry’s trajectory and competitive dynamics:

According to MarkWide Research, these insights collectively indicate a market transitioning toward higher-value applications and advanced manufacturing capabilities, positioning industry participants for enhanced profitability and market expansion opportunities.

Construction industry expansion serves as the primary market driver, with residential and commercial building activities creating substantial demand for architectural glass products. The ongoing infrastructure modernization initiatives, coupled with urban development projects, sustain consistent market growth. Green building certifications and energy efficiency requirements further amplify demand for high-performance glazing systems.

Automotive sector transformation generates significant market opportunities through vehicle electrification trends and advanced safety system integration. Electric vehicles require specialized glazing solutions for thermal management and aerodynamic efficiency, while autonomous driving technologies demand enhanced visibility and sensor integration capabilities. The replacement market also provides steady demand through vehicle maintenance and repair activities.

Renewable energy deployment creates emerging demand for solar glass applications, supported by federal and state incentives for clean energy adoption. Utility-scale solar installations and distributed generation systems require high-quality glass substrates with superior light transmission and durability characteristics. Energy storage system integration further expands market opportunities.

Technology advancement drives market evolution through smart glass development, dynamic glazing systems, and enhanced coating technologies. These innovations enable new applications in commercial buildings, automotive systems, and consumer electronics while commanding premium pricing structures. Research and development investments continue expanding technological capabilities and market applications.

Raw material volatility presents significant challenges for flat glass manufacturers, with silica sand, soda ash, and limestone prices subject to supply chain disruptions and commodity market fluctuations. Energy costs, particularly natural gas pricing for furnace operations, directly impact production economics and profitability margins. These cost pressures require careful supply chain management and pricing strategies.

Environmental regulations impose compliance costs and operational constraints on manufacturing facilities, requiring investments in emission control systems and waste management infrastructure. Carbon emission reduction mandates may necessitate technology upgrades and process modifications, impacting capital expenditure requirements and operational flexibility.

Import competition from international manufacturers creates pricing pressure and market share challenges, particularly in commodity glass segments. Trade policies and tariff structures influence competitive dynamics, while currency fluctuations affect import costs and domestic market pricing. Quality standards and certification requirements provide some protection for domestic producers.

Cyclical demand patterns in construction and automotive industries create market volatility and capacity utilization challenges. Economic downturns can significantly impact demand levels, requiring flexible operational strategies and cost management capabilities. Seasonal variations in construction activities also influence quarterly performance patterns.

Smart building integration represents a transformative opportunity for flat glass manufacturers, with intelligent glazing systems enabling dynamic light control, thermal management, and energy optimization. The growing emphasis on building automation and occupant comfort creates substantial market potential for advanced glass products with integrated sensors and control systems.

Electric vehicle proliferation opens new market segments for specialized automotive glass applications, including lightweight glazing solutions, integrated heating systems, and heads-up display compatibility. The transition to electric powertrains requires enhanced thermal management capabilities, creating opportunities for innovative glass technologies and value-added processing services.

Solar energy expansion provides significant growth opportunities through utility-scale installations and distributed generation systems. Advanced solar glass products with anti-reflective coatings and enhanced durability characteristics command premium pricing while supporting renewable energy deployment objectives. Energy storage integration creates additional market applications.

Export market development offers expansion opportunities for US manufacturers, particularly in high-value specialty glass segments where technological expertise provides competitive advantages. Trade agreements and market access improvements can facilitate international growth while diversifying revenue streams and reducing domestic market dependence.

Supply-demand equilibrium in the US flat glass market reflects balanced production capacity with steady consumption growth across key application segments. Manufacturing facilities operate at optimal utilization rates, indicating healthy market conditions while maintaining flexibility for demand fluctuations. Regional supply chains provide efficient distribution networks connecting production centers with major consumption markets.

Technological evolution drives market transformation through advanced manufacturing processes, enhanced product performance, and new application development. Digital technologies improve production efficiency and quality control while reducing operational costs and environmental impact. Innovation cycles create competitive differentiation opportunities and premium pricing potential for technology leaders.

Competitive intensity varies across market segments, with commodity glass products experiencing price-based competition while specialty applications offer differentiation opportunities. Market leaders leverage scale advantages and technological capabilities, while regional players focus on service excellence and niche market segments. Strategic partnerships and vertical integration strategies reshape competitive dynamics.

Regulatory environment influences market development through building codes, energy efficiency standards, and environmental regulations. Policy support for renewable energy and sustainable construction practices creates favorable market conditions, while compliance requirements drive technology adoption and process improvements. Trade policies affect international competition and market access opportunities.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research includes extensive interviews with industry executives, manufacturing specialists, and key stakeholders across the flat glass value chain. Secondary research incorporates industry publications, government statistics, and trade association data to validate findings and identify market trends.

Data collection processes utilize both quantitative and qualitative research approaches, gathering production statistics, consumption patterns, pricing information, and competitive intelligence from diverse sources. Manufacturing facility surveys provide operational insights, while end-user interviews reveal application requirements and purchasing decisions. Market modeling incorporates historical data analysis and forward-looking projections based on identified growth drivers.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and regional market evaluation to provide comprehensive market understanding. Statistical analysis validates data accuracy and identifies correlation patterns, while scenario modeling evaluates potential market developments under different economic and regulatory conditions.

Quality assurance measures ensure research reliability through data triangulation, expert validation, and peer review processes. Continuous monitoring of market developments enables real-time updates and refinement of market projections, maintaining research relevance and accuracy throughout the analysis period.

Midwest region dominates US flat glass production with major manufacturing facilities concentrated in Ohio, Pennsylvania, and Illinois. This region benefits from proximity to raw material sources, established transportation infrastructure, and skilled workforce availability. The automotive industry concentration in Michigan and surrounding states creates substantial demand for automotive glass products, while construction activities support architectural glass consumption.

Southeast region represents a growing production hub with modern manufacturing facilities in Georgia, North Carolina, and Tennessee. Lower operating costs, favorable business climate, and proximity to growing construction markets drive regional expansion. The region’s strategic location enables efficient distribution to both domestic and export markets, supporting market share growth.

West Coast markets demonstrate strong demand for specialty glass products driven by technology industry requirements and stringent environmental regulations. California’s renewable energy mandates create substantial opportunities for solar glass applications, while commercial construction activities support architectural glass demand. The region commands premium pricing for high-performance glass products.

Northeast corridor maintains significant market presence through established distribution networks and proximity to major metropolitan construction markets. The region’s emphasis on energy-efficient building design creates demand for advanced glazing systems, while renovation and retrofit activities provide steady market opportunities. Import competition affects commodity glass segments in this region.

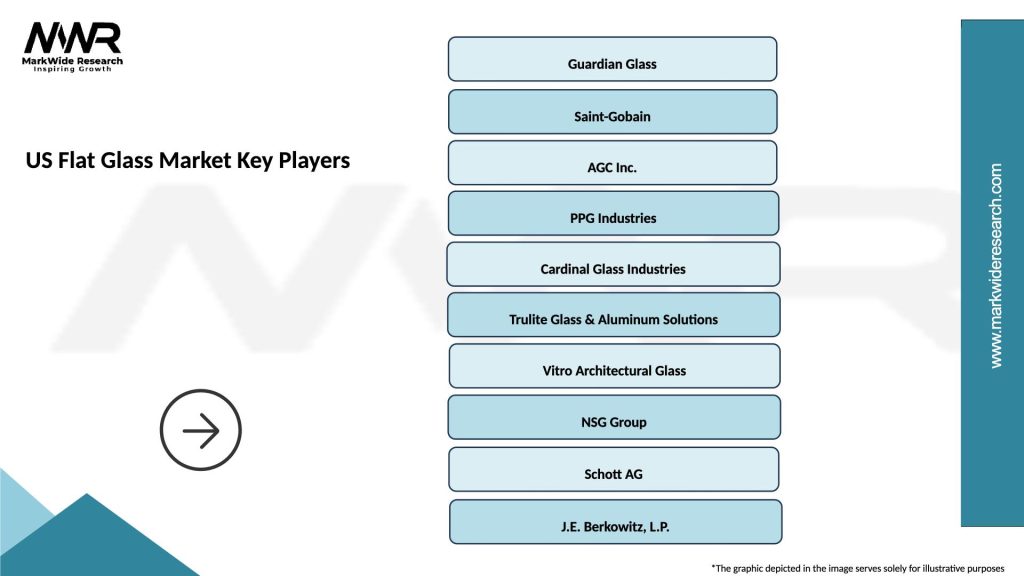

Market leadership is established by major multinational corporations with comprehensive product portfolios and extensive manufacturing capabilities:

Regional competitors maintain market presence through specialized product offerings and customer service excellence. These companies focus on niche applications, customized solutions, and regional market expertise to compete effectively against larger manufacturers. Strategic partnerships and acquisition activities continue reshaping the competitive landscape.

Technology innovation serves as a key competitive differentiator, with leading companies investing heavily in research and development activities. Smart glass technologies, advanced coatings, and enhanced processing capabilities create competitive advantages and premium pricing opportunities. Intellectual property protection and technology licensing arrangements influence competitive dynamics.

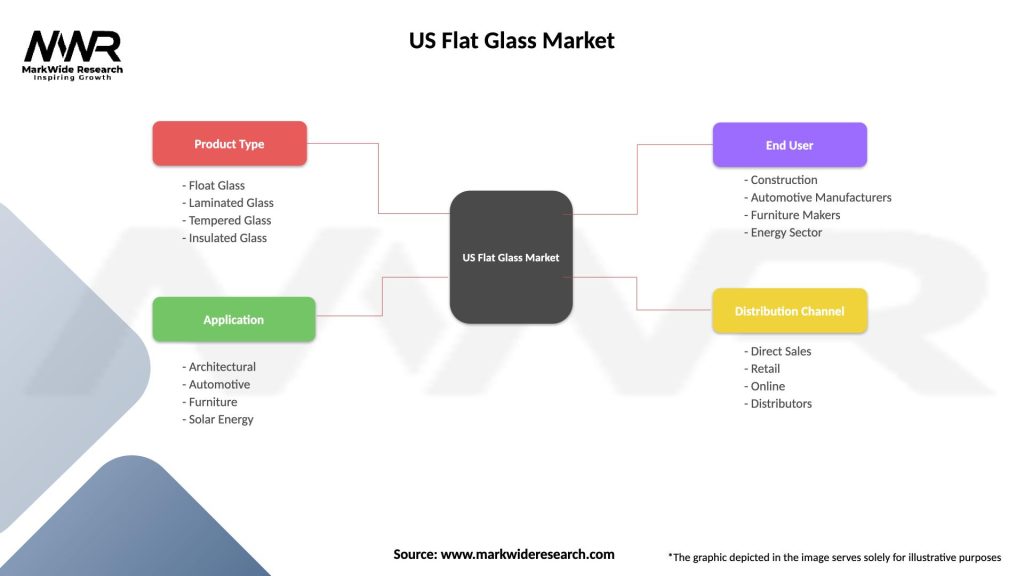

By Product Type:

By Application:

By End-User Industry:

Architectural glass segment maintains market dominance through consistent construction industry demand and increasing emphasis on energy-efficient building design. Low-emissivity coated glass products experience accelerated growth driven by building code requirements and green building certification programs. The segment benefits from renovation activities and commercial construction expansion, with premium products representing 35% of segment revenue.

Automotive glass applications demonstrate steady growth supported by vehicle production recovery and advanced safety system integration. Electric vehicle adoption creates opportunities for specialized glazing solutions with enhanced thermal management capabilities. The replacement market provides stable demand through vehicle maintenance requirements, while original equipment manufacturing drives innovation and technology advancement.

Solar glass category represents the fastest-growing market segment with utility-scale installations and distributed generation systems driving demand expansion. Anti-reflective coated glass products command premium pricing while supporting renewable energy deployment objectives. Technology advancement in photovoltaic systems creates opportunities for enhanced glass substrates with superior performance characteristics.

Specialty applications including electronics and consumer goods provide niche market opportunities with higher profit margins and customized product requirements. These segments benefit from technology innovation and product differentiation capabilities, enabling manufacturers to develop unique solutions for specific customer applications and performance requirements.

Manufacturers benefit from diverse market opportunities across multiple application segments, enabling revenue diversification and risk mitigation strategies. Advanced manufacturing technologies improve operational efficiency while reducing production costs and environmental impact. Technology leadership creates competitive advantages and premium pricing opportunities in high-value market segments.

Distributors and fabricators leverage regional market expertise and customer relationships to provide value-added services and customized solutions. Strategic partnerships with manufacturers enable access to innovative products and technical support capabilities. Market expansion opportunities exist through geographic diversification and new application development.

End-users gain access to advanced glass technologies that enhance building performance, vehicle safety, and energy efficiency. Product innovation provides solutions for evolving application requirements while supporting sustainability objectives and regulatory compliance. Competitive market dynamics ensure favorable pricing and product availability.

Investors and stakeholders benefit from market stability and growth potential across diverse application segments. The industry’s essential role in construction and automotive sectors provides defensive characteristics, while emerging applications offer growth opportunities. Technology advancement and market consolidation create value creation potential through operational improvements and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with manufacturers implementing circular economy principles and reducing environmental impact throughout the product lifecycle. Recycled content utilization increases while energy-efficient manufacturing processes reduce carbon emissions. Green building certification requirements drive demand for environmentally responsible glass products with enhanced performance characteristics.

Digital transformation revolutionizes manufacturing operations through Industry 4.0 technologies, predictive maintenance systems, and automated quality control processes. Smart manufacturing capabilities improve operational efficiency while reducing waste and enhancing product consistency. Digital customer engagement platforms streamline ordering processes and provide technical support services.

Smart glass adoption accelerates across commercial and residential applications, with electrochromic and thermochromic technologies enabling dynamic light control and energy management. Integration with building automation systems creates intelligent glazing solutions that optimize occupant comfort and energy consumption. Automotive applications expand through heads-up display integration and privacy glass systems.

Customization demand increases as end-users seek specialized solutions for unique application requirements and performance specifications. Manufacturers develop flexible production capabilities enabling small-batch customization while maintaining cost efficiency. Digital design tools and rapid prototyping capabilities accelerate product development and customer collaboration processes.

Technology advancement continues driving industry evolution through breakthrough innovations in glass composition, coating systems, and processing techniques. MWR analysis indicates significant investment in smart glass technologies and advanced manufacturing capabilities, positioning industry leaders for next-generation product development and market expansion opportunities.

Strategic partnerships reshape competitive dynamics as manufacturers collaborate with technology companies, construction firms, and automotive suppliers to develop integrated solutions. These alliances enable access to new markets while sharing development costs and technical expertise. Joint ventures facilitate international expansion and technology transfer initiatives.

Capacity expansion projects address growing demand across key market segments, with manufacturers investing in modern production facilities and enhanced processing capabilities. Regional expansion strategies focus on proximity to major consumption markets while optimizing logistics costs and delivery times. Automation investments improve operational efficiency and product quality consistency.

Regulatory developments influence market dynamics through updated building codes, energy efficiency standards, and environmental regulations. Policy support for renewable energy and sustainable construction practices creates favorable market conditions while driving technology adoption and innovation investments. Trade policy changes affect international competition and market access opportunities.

Strategic positioning recommendations emphasize technology leadership and market diversification to capitalize on emerging opportunities while mitigating cyclical risks. Companies should prioritize investment in smart glass technologies and advanced coating systems to capture premium market segments and differentiate from commodity competitors. Geographic expansion into high-growth regions provides additional revenue streams and market presence.

Operational excellence initiatives should focus on energy efficiency improvements and automation implementation to reduce production costs and enhance competitiveness. Supply chain optimization through strategic partnerships and vertical integration opportunities can improve cost structure while ensuring reliable raw material access. Quality management systems require continuous enhancement to meet evolving customer requirements and regulatory standards.

Innovation investment priorities should target smart glass technologies, sustainable manufacturing processes, and value-added processing capabilities. Research and development partnerships with universities and technology companies can accelerate innovation while sharing development costs. Intellectual property protection strategies ensure competitive advantages from technology investments and innovation activities.

Market expansion strategies should leverage technological expertise and product quality advantages to penetrate international markets and niche applications. Export development programs can diversify revenue sources while reducing domestic market dependence. Strategic acquisitions of complementary businesses provide access to new technologies, markets, and customer relationships.

Long-term prospects for the US flat glass market remain positive with sustained growth expected across key application segments through the forecast period. Construction industry expansion, automotive sector transformation, and renewable energy deployment provide multiple demand catalysts supporting market development. The industry’s projected 4.2% CAGR reflects balanced growth expectations with opportunities for acceleration through technology innovation and market expansion initiatives.

Technology evolution will continue driving market transformation through smart glass adoption, advanced coating systems, and enhanced manufacturing processes. Digital integration across the value chain improves operational efficiency while enabling new customer engagement models and service offerings. Sustainability initiatives become increasingly important for competitive positioning and regulatory compliance.

Market structure evolution through consolidation activities and strategic partnerships will create larger, more capable organizations with enhanced technological resources and market reach. Regional specialization and niche market focus provide opportunities for smaller companies to maintain competitive positions through service excellence and customized solutions.

Emerging applications in renewable energy, smart buildings, and advanced automotive systems offer significant growth potential beyond traditional market segments. These opportunities require continued investment in research and development capabilities while building partnerships with technology companies and end-user industries to capture market potential and drive innovation adoption.

The US flat glass market demonstrates strong fundamentals and positive growth trajectory supported by diverse application segments and technological advancement opportunities. Construction industry expansion, automotive sector transformation, and renewable energy deployment create multiple demand catalysts that position the market for sustained growth through the forecast period. The industry’s ability to innovate and adapt to evolving customer requirements ensures continued relevance and market expansion potential.

Strategic opportunities exist for market participants willing to invest in technology leadership, operational excellence, and market diversification initiatives. Smart glass technologies, sustainable manufacturing processes, and value-added processing capabilities represent key areas for competitive differentiation and premium pricing realization. Geographic expansion and niche market development provide additional growth avenues while reducing cyclical risk exposure.

Market challenges including raw material volatility, environmental regulations, and import competition require proactive management strategies and operational flexibility. However, the industry’s essential role in construction and automotive sectors provides defensive characteristics while emerging applications offer growth acceleration opportunities. Continued investment in innovation and operational excellence will determine competitive success and market leadership positions in this dynamic and evolving industry.

What is Flat Glass?

Flat glass refers to glass that is produced in flat sheets, commonly used in windows, doors, and facades. It is characterized by its smooth surface and clarity, making it ideal for various architectural and automotive applications.

What are the key players in the US Flat Glass Market?

Key players in the US Flat Glass Market include companies such as Guardian Industries, Saint-Gobain, and PPG Industries. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the US Flat Glass Market?

The US Flat Glass Market is driven by factors such as increasing construction activities, rising demand for energy-efficient buildings, and advancements in glass manufacturing technologies. Additionally, the growing trend of using glass in interior design is contributing to market growth.

What challenges does the US Flat Glass Market face?

The US Flat Glass Market faces challenges such as fluctuating raw material prices and stringent regulations regarding environmental impact. Additionally, competition from alternative materials can hinder market growth.

What opportunities exist in the US Flat Glass Market?

Opportunities in the US Flat Glass Market include the increasing demand for smart glass technologies and the expansion of the renewable energy sector. The growing focus on sustainable building practices also presents new avenues for growth.

What trends are shaping the US Flat Glass Market?

Trends in the US Flat Glass Market include the rise of energy-efficient glazing solutions and the integration of smart technologies in glass products. Additionally, there is a growing interest in decorative glass applications in residential and commercial spaces.

US Flat Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Float Glass, Laminated Glass, Tempered Glass, Insulated Glass |

| Application | Architectural, Automotive, Furniture, Solar Energy |

| End User | Construction, Automotive Manufacturers, Furniture Makers, Energy Sector |

| Distribution Channel | Direct Sales, Retail, Online, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Flat Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at